In this week’s BB, you’ll learn about…

🇺🇸 Zuckerberg’s last stand

⛓️ Opportunities in the American prison system

🛍️ E-commerce’s winged army

📵A phone-case made of ‘skin’

👑 The spend behind celebrity lookalike app Gradient

🍺Jobs for drinkers of beer, lovers of LEGO, and the immortal

🍎 Adam, a special apple, and autistic office workers,

🤷♂️A mea culpa

—

👉 If you’ve been digging the Briefing and would like to help, please share this email with someone you find thoughtful and good-looking.

🐰 Overheard

(Quotes from clever people)

A digital payments system is going to be important in the future. If America doesn’t lead on this, others will… There’s no guarantee that services which support democracy and fundamental rights around expression will win out.

‘Fear China’ was Zuckerberg’s primary line of argumentation to Congress this past Wednesday. In his opening statement, he cited the speed of Chinese innovation, referencing the country’s upcoming launch of a tokenized renminbi, which some commentators believe will be rolled out as part of the country’s transcontinental Belt and Road Initiative. What wasn’t clear from Zuckerberg’s testimony was why Facebook should steward the US’s rival effort, especially given that Libra is backed by several sovereign currencies (though Zuck was at pains to point out that reserves will be ‘mostly’ dollars).

It’s hard to imagine a significant upturn in Libra’s fortunes, but Zuckerberg’s conviction that the US is ceding ground to China is well made. Expect the Fed to follow the People’s Bank in the next 12-24 months, with a digitized dollar only a matter of time.

⛓️ Monitoring: Prison

(One space worth keeping an eye on)

The problem: we are shackling potential. The US has both the highest incarceration rate (716 prisoners per 100K citizens), and the largest population of prisoners, with 2.3MM currently locked up. Worse, the system doesn’t appear to work with high rates of recidivism. A study by the National Institute of Justice suggested that 83% of released prisoners were arrested within 9 years. Over that period, the average ratio of arrests per released prisoner was 5:1.

The solution: rehabilitation. Specifically, making time inside more productive and connected, and offering better support to those re-assimilating to civilian life. A handful of startups have taken on this formidable task.

Education. Inmates that take advantage of educational programs are 43% less likely to return to jail within 3 years. Edovo raised a $9MM Series A from Kapor Capital in 2018 to provide tablet-based education to prisoners. Traditional providers include GTL and JPay, both valued at over $1B, and reliant on predatory pricing models.

Employment. YC S17 graduate, 70 Million Jobs has raised $1.2MM to match the formerly incarcerated with ‘felony-friendly jobs.’ Employers include Skechers, Perdue, BNSF Railway, and the National Cannabis Industry Association. They’re joined by WhenPeopleWork, which provides a similar service. Others concerned with the space include R3 Score, provider of novel background checks for ex-cons, and Vainu. The latter is leveraging Finnish prison labor for data-tagging to train AI algorithms.

Social capital. Contact with family members reduces recidivism. Yet, traditional communication services are often prohibitively expensive (as much as $18 for a 15 minute call). Pigeonly has raised $5MM to provide inexpensive communication (by virtually localizing calls), and make it easier for prisoners to receive money from those on the outside. Acivilate, which raised a seed round last year, helps supervisory and parole officers talk to released prisoners, ensuring they receive the help they need to succeed outside.

What’s next? Given the demographics of most venture-backed founders, I expect this space to remain overlooked. But this is an underserved market, ruled by unscrupulous incumbents. If the national sentiment shifts towards outcome-based approaches, there are a number of tech playbooks that could be applied. A few ideas: an ISA-based coding school, a Noom-style nutritional program, a commissary providing healthier alternatives, a platform for remote work during incarceration, and virtual-reality based empathy training.

🖼️ 1000 words

(Something to look at)

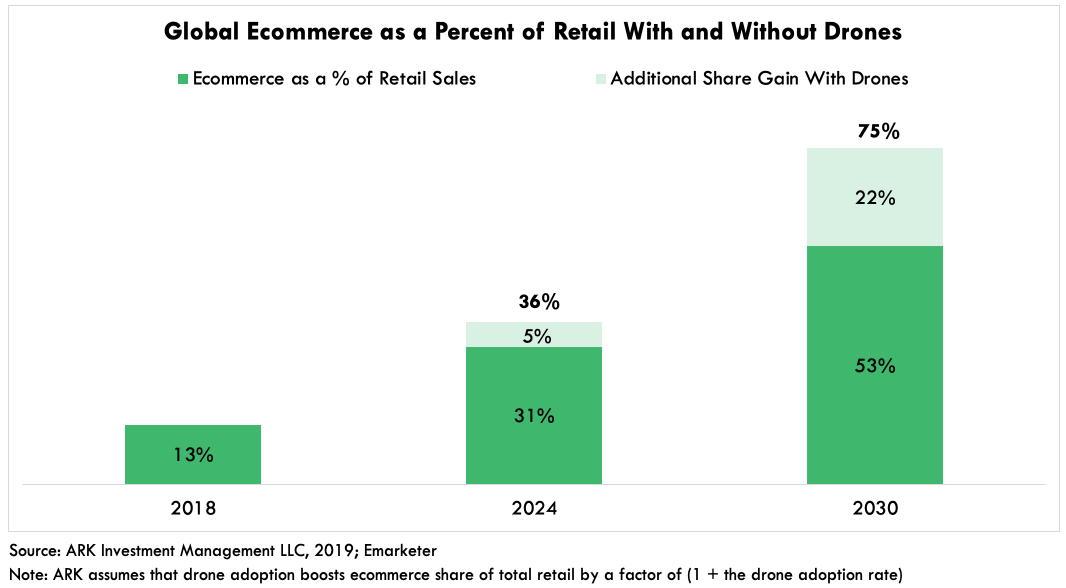

Drones will kill physical retail. As US regulators warm up to the idea of filling the sky with AVs, the parcel drone delivery market may be worth as much as $500B. That may bring E-commerce’s share of retail up to 75%. ARK Research believes Amazon is already capable of offering profitable drone delivery within 30 minutes.

😱 Signs of the apocalypse

(Look on my Works, ye Mighty, and despair!)

Make sure to smile. Over 100 employers, including behemoths like Unilever and Hilton, use HireVue’s AI to screen videos of potential candidates. The system judges an applicant’s suitability based on word choices, body language and facial expressions. While a system like this might reduce unconscious bias in theory, algorithmic hiring has shown itself to be vulnerable to unpredictable prejudices. (Free version here.)

‘We pledge allegiance til’ death’. ISIS has a new weapon in its arsenal: TikTok. The terrorist group has taken to the light-hearted platform to share jihadist songs and imagery as part of a recruitment push. Bytedance, TikTok’s owner, took the videos down but as the app gains in popularity its content moderation algorithms and manual reviewers will be increasingly tested. (Free version here.)

It puts the lotion on the phone. Some truly deranged minds at Telecom Paris have devised a phone case meant to mimic the feeling of human skin. By playing with the “ultra-realistic” case — through pinching and poking and tickling — you can control different aspects of your smartphone device.

🚢 Shipping news

(The most interesting product launch this week)

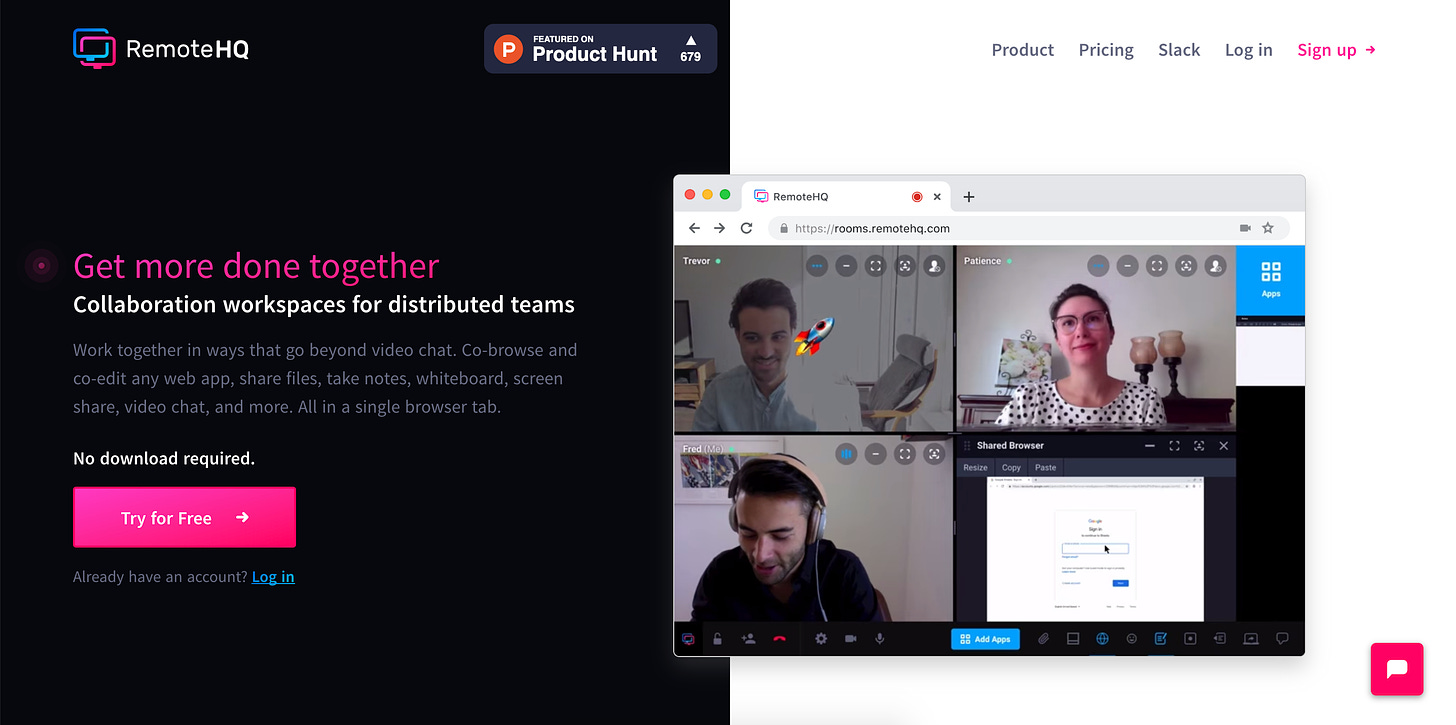

Enabling the Anywhere Economy. Remote work has increased 91% over the past 10 years, becoming a defining part of the DNA of companies like InVision, GitLab, Buffer and Automattic. While distributed teams have many strengths (lower costs through labor arbitrage, better time zone coverage, higher employee productivity), coordination can be tricky. RemoteHQ is looking to bridge that gap by providing simple tooling to screenshare, video chat, and collaborate on projects. Reminiscent of the mostly hotly contested startup from YC’s last batch: Tandem. The company secured a $7.5MM seed from a16z at a +$30MM valuation to simplify communication among remote teams.

📡 Signal

(One exploding Google Trend)

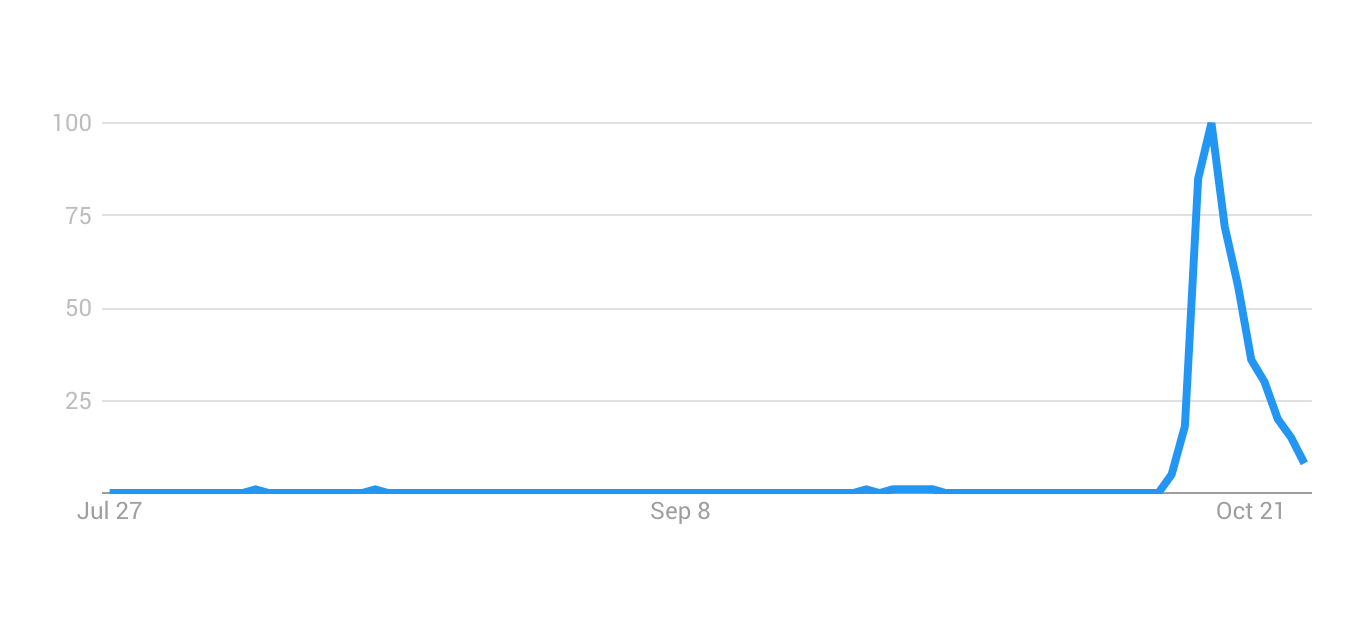

Anatomy of a craze. Celebrity lookalike app Gradient was trending on Google over the past week, racking up over 200K searches in a single day. Interestingly, the app launched in September but only went parabolic once promoted by members of the Kardashian clan. Since then, Gradient has been downloaded over 8MM times, earning 10K reviews, and $1.1MM in revenue.

That might sound impressive, but it’s worth remembering how dear the Kardashian stamp of approval comes with Kim regularly earning $300-500K for a post, and Kyle earning $1.2MM. Given that Gradient was promoted by Kim, Kourtney, Khloe, Kylie and Scott Disick it’s not unreasonable to imagine an outlay of ~$2.2MM resulting in a LTV:CAC of 1:2. Perhaps some schadenfreude in that given the shadowy backers behind it, and unclear data rights in the company’s privacy policy.

But I am willing to sacrifice my data for the sake of this parish. So, in case you’re wondering, my celebrity lookalike was, of course, Belgian regent, Maria José of Savoy. Uncanny.

📈 Jobs for interesting people

(Openings at companies and funds building something cool)

Strategy & Growth - Hilma (NY). Take natural remedies mainstream.

VC Associate - Anthemis Group (NY). Fintech is having a moment.

VC Analyst - Rosecliff Ventures (NY). Under-the-radar fund with a great D2C portfolio.

VC Internship - AngelList (SF). A paying VC internship that will give you a plenty of reps.

VC Analyst - Packard Foundation (SF). Allocate money towards things that matter, including reproductive rights and improving the lives of children.

VC Manager - LEGO Ventures (SF). Sounds fun, right?

VC Associate - Longevity Fund (SF). Do we have to die?

Head of Product Design (NY). Great subway ads and incredible product.

Global Director of Craft Beer - ZX Ventures (NY). Be the person who knows about the newest brews by working at AB InBev’s venture arm.

Go to Market Manager - WeWork. Feeling brave?

🐒 Long tail

(Best of the rest)

Trump still dominates the social media game. Democrats aren’t getting close to the President when it comes to money raised via ‘the Fifth Estate’. Biden is increasingly shifting resources to TV.

The biggest Apple launch since iPhone X. The Cosmic Crisp is a new varietal expected to the take the fruit aisle by storm. It’s backed by $10.5MM in marketing spend.

Cloak and dagger goes mobile. Provider of encrypted smartphones, MPC, is linked to the assassination of a blogger.

Surveilling the American high-schooler. As shootings increase, more schools are using software providers like Bark and Gaggle to monitor student emails and messages.

The most baller IPO of the year. Spencer Dinwiddie isn’t giving up. After initial setbacks, the point-guard expects to offer a fractionalized version of his 2021-22 earnings before the end of the year. This on the same week Metta World Peace launched his AirBnB for basketball courts.

The problem with generics. The brandless pills are becoming cheaper. While that’s good for the consumer’s pocket, it’s resulting in fewer safety checks and diminishing incentives for providers. Shortages may inevitable.

The kids are alright. The Guardian brought Gen Z’ers face to face with old technology. Adorable results, and a testament to the timelessness of the OG GameBoy.

Actors may live forever. More and more performers are being digitally scanned to preserve their likenesses. As an aside, I’m very intrigued to see the laws that emerge to protect our digital likenesses after death. We may need a “Right to Remain Dead,” similar to the Right to be Forgotten.

An autistic workforce. Ultranauts is one of a few companies committed to building a ‘neurodiverse’ culture, leveraging the unique talents of those on the spectrum.

Thinking about going solo? This HN thread shares the stories of successful one-person businesses, including an app that brings in $400K a year with about ~20 hours work per week.

The definitive WeWork downfall story. So many tasty tidbits including Neumann pushing Nasdaq and NYSE Presidents to ban meat at their companies, and the presence of both a sauna and ice-bath in the WeWork impresario’s office.

📜 Revisionist history

(Mea culpas and responses to readers)

One of the great pleasures of this newsletter is hearing from those that read it, especially when it results in an interesting conversation and refinement of thinking. In October 13th’s edition of BB, we discussed the concentration of emissions among energy firms like Chevron, BP and Shell. I urged for fund managers to divest from the sector. In response, reader SEV shared his thoughts, summarized below:

The data lacks nuance. Saying petroleum firms have produced most emissions is rather like saying beef producers kill most cattle. Of course. A more interesting graph would show the emissions created through actual production. I.e.: doing the necessary drilling, and extraction to bring petroleum to buyers.

Mass divestment could backfire. If you targeted the major producers, which tend to have more buttoned-up processes, smaller, less safety conscious operators might fill the gap. For example, the latter do not have “flare reduction metrics” — the process of burning less-valuable gas to facilitate oil extraction without interruption — while majors do. (Ed: There may be significant underreporting of flaring, however, and even the majors may be increasing this practice with Exxon’s levels skyrocketing.)

Major firms do not support climate change deniers anymore. Exxon, for example, used to support the Heartland Institute, but disassociated themselves after 2008. Better late than never? (Ed: These organizations still spend ~$200MM a year to push for increased fossil fuel production, and stymie carbon tax proposals.)

The industry has done a great deal of good. Few products have raised the domestic standard of living as drastically and ubiquitously. For example, modern fertilizers that have catalyzed agricultural bounty are derived from natural gas. Environmentalists may push for total divestment, but often fail to look at the matter comprehensively.

I don’t agree with all of SEV’s arguments (and I expect further pushback), but he has added much needed nuance to my thinking. Thank you to him, and may this be an invitation to you all to send me excoriating emails.

🧩 Puzzler

(A question, conundrum, or riddle to mull over)

A man approaches an exclusive club that has a bouncer at the door, and requires a password to get in. The bouncer says to the first patron “12” to which the patron replies “6”. He is let in. To the next patron, the bouncer says “6”, to which the patron replies, “3”. She is let in. Believing he has understood the password, the man approaches the bouncer. The bouncer tells the man “10” to which the man replies “5.” He is turned away. What should he have said?

Congratulations to JCV for providing the answer to last week’s riddle both quickly and correctly: leaves. Fall really is upon us. Honorable mention to Arnie G. for getting close.

Thank you for reading, and sending you warm wishes for a wind-down Sunday. 💙