Aave: The Crypto Conglomerate

With over $5.6 billion in total value locked, Aave is one of DeFi’s most dominant players. Its ambitions extend far beyond lending, with stablecoins and social media in its sights.

Brought to you by Masterworks

How are UHNW investors preparing for the “Decade of Lost Wealth?”

The near-zero interest rates and sub-two percent inflation that fueled the record bull market of the last ten years are gone. In their place, volatility and fear rule. How can you prepare?

Ultra-high-net-worth investors are increasing their exposure to an asset class that outpaced the S&P 500 by 164% over the last 25 years: blue-chip art. Because of this demand, Deloitte expects the asset class to grow nearly 60% in 3 years.

But investing in multi-million dollar art by names like Picasso and Banksy isn’t just an opportunity for the elite anymore.

Thanks to Masterworks, the award-winning art investment platform, 500,000 other members and I have already discovered the potential of this wealth-generating asset. In fact, since inception they’ve delivered a 29% average Net Realized Return to investors across six exits.

As a Generalist subscriber, you’re invited to skip the waitlist to join using this exclusive referral link.

See important Reg A and performance disclosures.

Actionable insights

If you only have a few minutes to spare, here's what investors, operators, and founders should know about Aave.

DeFi’s leading lender. Aave is the de-facto leader in decentralized lending. Its fully-diluted market cap is north of $1 billion, even after the crypto downturn. Aave has $5.6 billion in total value locked (TVL) and is on track to produce $147.6 million in annualized revenue.

Powered by community. One of Aave’s most noteworthy traits is its robust community. Founder Stani Kulechov has prioritized this since the beginning, investing considerable time in fostering grassroots support. This base has helped Aave distinguish itself from its rivals.

A relentless innovator. Aave is not a project that sits still. Since its founding in 2017, it has continually added new assets, ecosystems, and product lines. The result is a comprehensive financial platform with unparalleled range and flexibility.

Balancing expansion with focus. The organization’s biggest challenge in the coming years may be figuring out how to maintain focus. This year, Aave has announced two significant new initiatives in the social media and stablecoin spaces. While promising, they will be resource-intensive and invite new risks.

“Banking is necessary; banks are not,” Bill Gates once said. Stani Kulechov, founder of Aave, would likely agree. His financial protocol is perhaps crypto’s clearest expression of that sentiment. Since its founding in 2017, Aave has grown to support more than $5.6 billion in total value locked (TVL), a similar metric to assets under management. During last year’s bull run, TVL approached $20 billion, even without incorporating some of the parent organization’s newer projects. Aave has achieved such figures by architecting something akin to a bankless banking system, a financial empire built on protocols and animated by an enthusiastic community.

Aave’s ambitions have scaled with its assets. Over the past year, Kulechov’s team has outlined initiatives suggesting an expansive future beyond lending, including an overcollateralized stablecoin and decentralized social graph. These projects, and others that arise in the years to come, will live under the “Aave Companies” umbrella, alongside the liquidity protocol for which it is best known. Only time will tell whether such ventures prove a distraction or allow Aave to become something grander: a miniature Alphabet, a homespun crypto conglomerate.

In today’s piece, we’ll discuss:

Aave’s evolution. From the outside, Stani Kulechov looks like an unlikely entrepreneur. The former law student transformed a small peer-to-peer lender into one of DeFi’s blue chip projects.

Critical lessons. Aave’s success offers lessons about web3 entrepreneurship, the institutionalization of DeFi, and the power of an active community.

What the future holds. Aave is entering its second act. After addressing on-chain lending, Kulechov has set his sights on two of crypto’s biggest problems: establishing a reliable stablecoin and solving decentralized identity.

Learn what matters in tech and crypto.

Each week, we unpack one of the most important companies in tech and crypto. Join 63,000 others to make sure you don't miss our next briefing.

Try it now

Evolution: Aave’s ascent

For much of its life, Aave operated in relative obscurity. Its success owes much to Kulechov’s grit, the project’s innovative products, and an active supporter base.

Origins

In 2017, a Finnish law student decided to run an experiment. A few months earlier, while studying dispute resolution and contract law, Stani Kulechov had learned about Ethereum. When he discovered its potential to create self-executing and enforcing contracts, he was stunned by the implications. “It practically blew my mind,” Kulechov later recalled.

Intrigued by Ethereum’s possibilities, Kulechov decided to spin up a small side project focused on lending. The idea was that borrowers could put up cryptocurrency as collateral and then get matched with a lender. The peer-to-peer (P2P) process was built on Ethereum, leveraging its smart contracts. Kulechov called it ETHLend.

It was not Kulechov’s first entrepreneurial effort. As a teenager, he displayed an admirably wonkish streak, building fintech apps in his spare time. The most notable was a revenue financing product for game makers. Instead of waiting 30 to 45 days to receive payouts from the App Store, developers could get paid instantly, allowing them to cover costs and grow their businesses. Though a promising concept, Kulechov allowed the project to fizzle out.

He expected ETHLend to follow a similar trajectory. “I never wanted it to be a startup, or anything like that,” he said, “I was still studying in university.”

Initially, it looked like Kulechov would get his wish. After sharing the idea on Reddit, Kulechov noted the “idea itself was completely killed.” Few saw the need for a service like the one he had proposed, nor the desire for it. Before too long, however, the tide began to change. Though ETHLend struggled to attract users to its service, it started to draw a community of enthusiasts. That was mainly due to Kulechov’s willingness to engage with crypto newcomers. “For some reason, I don’t know why but it became a bigger project,” he said. By the end of 2017, ETHLend underwent an Initial Coin Offering (ICO), receiving approximately $16.2 million in funding. With the benefit of hindsight, it was one of the few projects that emerged during the ICO frenzy that has shown real staying power.

ETHLend’s capital injection preceded meaningful traction. Matching lenders and borrowers through a P2P process was challenging, given the immaturity of crypto finance. One crypto investor summarized the state of affairs: “The biggest challenge was there were so few crypto users and DeFi users that it was really hard to solve that chicken-and-egg problem.” ETHLend wasn’t helped by a deepening crypto winter that froze interest in the space.

The bear market proved a boon to ETHLend. The project rebranded as Aave and shifted from a P2P model to a pooled approach. Rather than directly matching lenders and borrowers, they simply added or drew from a communal pot. Aave developed this strategy through 2018 and 2019, launching “V1” of this pooled strategy in early 2020.

It was around this time that Stani Kulechov contemplated a venture round. Though ETHLend had raised money via its ICO, the project took time to bring on formal partners. One investor recalled being impressed by Kulechov and the creativity of the organization he had created. “I had conviction in Stani as an entrepreneur,” they said, “and it was obvious they were innovating in really clear ways.”

Though Aave was just beginning to tap into Silicon Valley’s ecosystem, its closest rival had buttoned up some of its most prestigious names. In 2018, Robert Leshner, a former Postmates product manager, launched Compound. Like Aave, Leshner’s creation facilitated on-chain lending and borrowing. It attracted an $8.2 million seed in 2018 and a $25 million Series A the year after. Andreessen Horowitz participated in both rounds, with Polychain and Bain Capital Ventures contributing. One source described them as the “800-pound gorilla” in the space thanks to these connections.

In 2020, Aave developed its roster, bringing in Standard Crypto, Parafi, Framework, Blockchain Capital, and the ill-fated Three Arrows Capital. That was not the only good news Kulechov received that year: in December, Aave was added to Coinbase, contributing to momentum around the project.

In the years since, Aave has established itself as DeFi’s leading lending project by market capitalization. Its current market cap sits above $1 billion, though it neared $8 billion in 2021. For a project that Kulechov expected to be little more than an “experiment,” such figures represent a remarkable outcome.

Core product

At its most basic level, Aave is a simple product. Beneath a tangle of features and quirks, Aave offers an easy way to lend and borrow. Its service both mimics and subverts the traditional financial system.

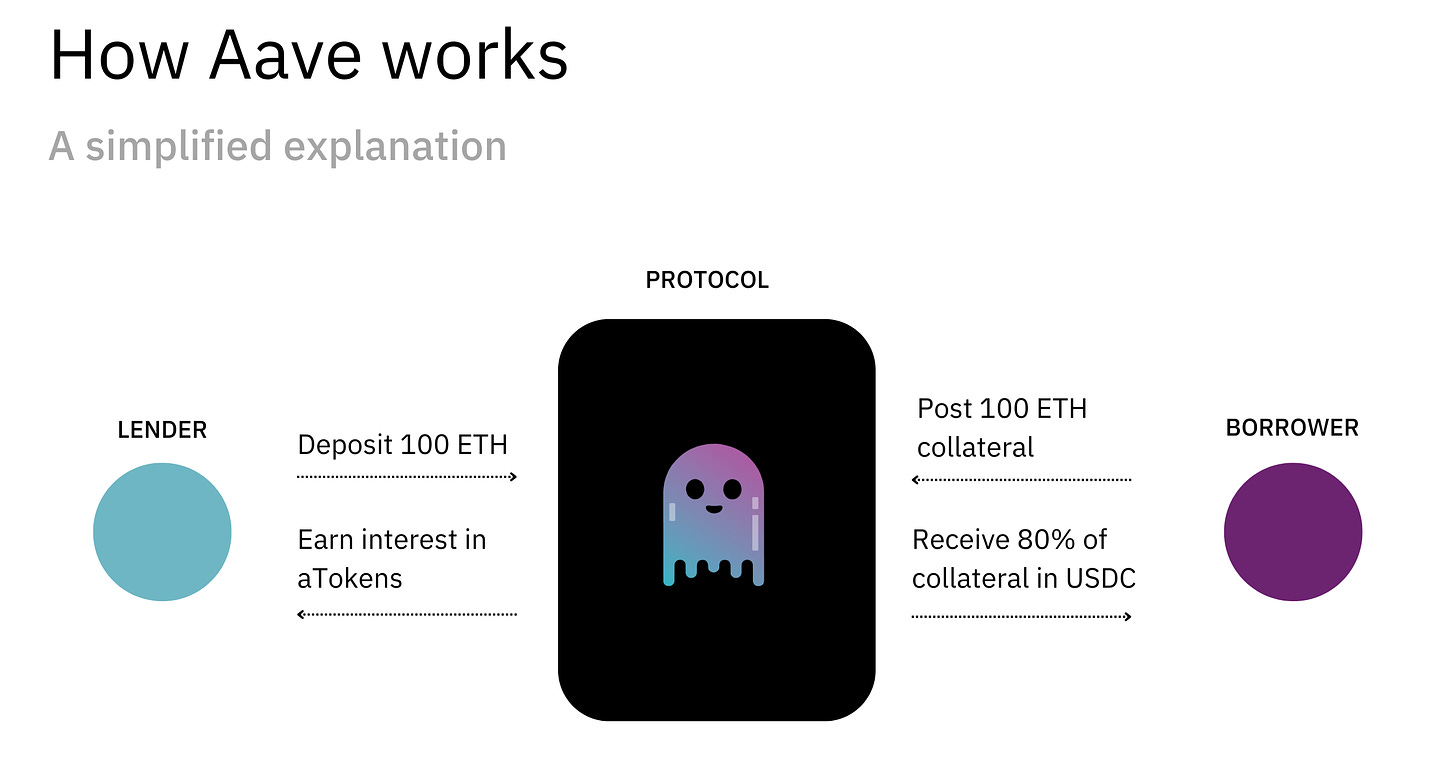

In basic terms, here is how it works. Imagine you’re lucky enough to have participated in Ethereum’s ICO and have 100 ETH at your disposal. Now, you could decide to leave these assets alone, hoping the price of ETH appreciates over time. Ideally, though, you’d earn interest on this ETH.

This is where Aave comes in. Instead of having your assets sit idly, you can deposit them on Kulechov’s platform and have them earn interest. Aave generates these earnings by lending out your ETH to borrowers. This interest is issued in “aTokens” – if you deposit ETH, you will earn aETH; if you deposit DAI, you will earn aDAI.

The borrower’s side of the equation is similarly straightforward. Imagine that you want to use your 100 ETH as collateral to borrow funds. Instead of putting it into Aave’s lending pool, you would put it forward as collateral. Once committed on the platform, you could subsequently withdraw 80% of the value of your collateral – the equivalent of 80 ETH in this case. You could use that ETH to buy a car, put a down payment on a home, or make an investment – all while keeping your original 100 ETH collateral intact and paying down the loan over time. Aave offers both fixed and variable rate loans with flexibility around repayment schedules.

You might wonder why someone would want to deposit more funds just to borrow a smaller amount. Why put up 100 ETH in collateral just to get the equivalent of 80 ETH in USDC? One reason is to preserve the upside of a growth asset. If you sell your ETH, you don’t benefit from any price appreciation. By lending against it, you can access short-term liquidity, but still benefit from the upside.

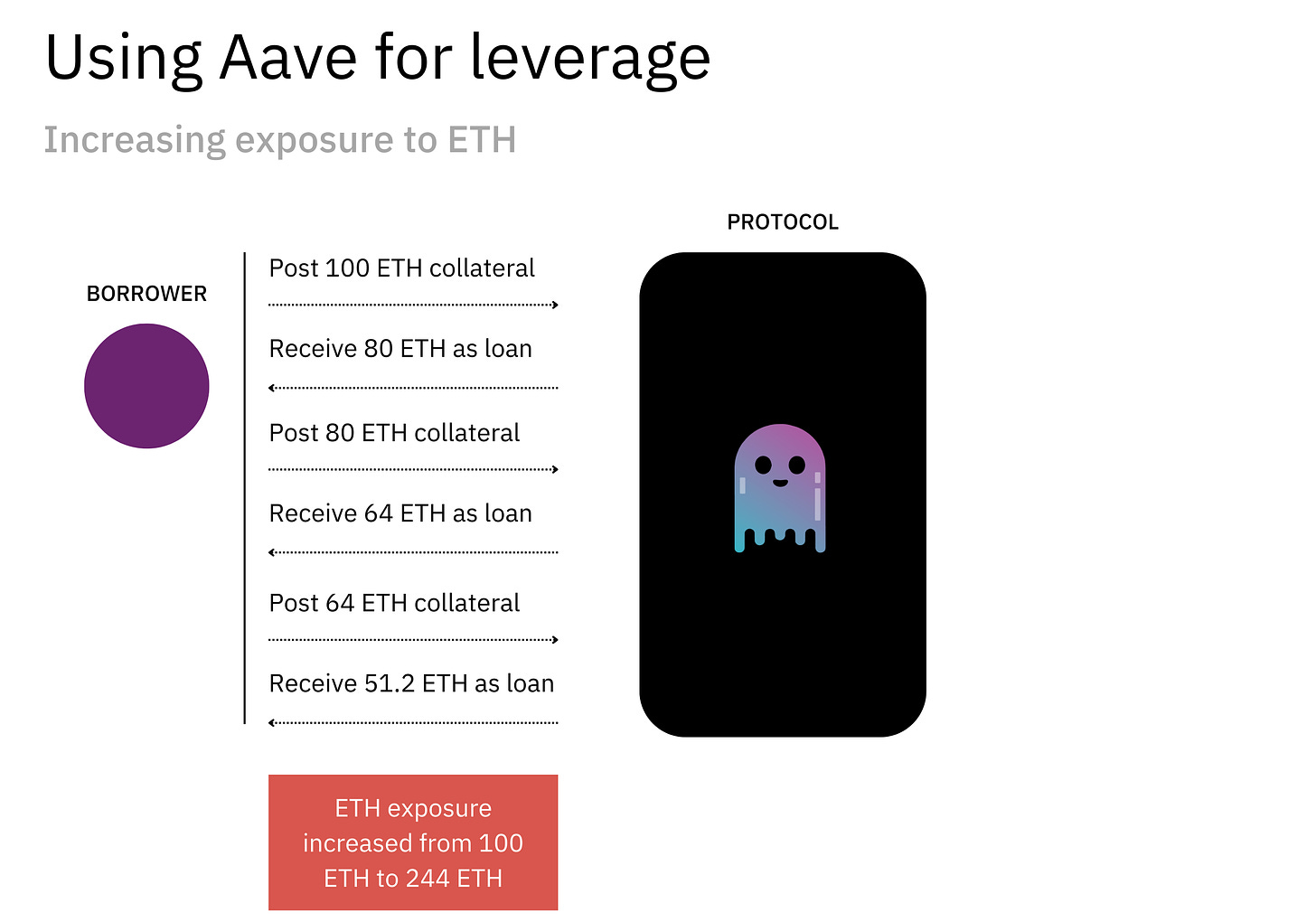

Another reason to use a service like Aave is to increase one’s leverage. An investor could deposit 100 ETH in collateral, receive 80 ETH, deposit 80 ETH in collateral, receive 64 ETH, deposit 64 ETH in collateral…and so on. The result would be a hyper-leveraged bet on ETH’s price. In the case of a surge, the investor would see a handsome return, but a drop would cause severe pain.

Trying to undertake any of these interactions with a traditional financial institution would be difficult, if not impossible. Many are not equipped to accept crypto assets as collateral; the few that are would demand much more information upfront and offer a more rigid loan product. Aave gives anyone with assets the ability to lend and borrow, near-instantly, around the world.

Innovations

Aave has grown to become DeFi lending’s leader, in large part thanks to its inventiveness. Several sources highlighted this as one of the project’s defining traits and a key reason it has been able to separate itself from competitors. “Aave outcompeted Compound by shipping faster,” Étienne Brunet, a crypto investor, noted, highlighting the project’s innovations.

Reviewing Aave’s work, it becomes clear it has succeeded by bringing existing solutions to new domains and developing net-new products. Today, Aave accepts 30 assets across seven ecosystems, including Fantom, Optimism, and Avalanche. Beyond typical tokens, Aave offers pools tied to “Real World Assets” (RWA). Developed in tandem with Centrifuge, a player that links DeFi to traditional economies, Aave’s RWA Market offers lending pools for real estate, freight forwarding, consumer loans, inventory financing, and beyond.

Besides increasing the scope of the assets and ecosystems it serves, Aave has also created innovative lending products. “Flash loans” are perhaps the best example. With this product, users can borrow millions of dollars in assets, providing they pay it back in the same Ethereum transaction – in a matter of seconds. This might sound like a disastrous proposal for both customers and providers, offering catastrophe in record time, but it has practical uses. Some rely on flash loans to capitalize on token price differences between exchanges.

Others leverage the ability to trade collateral and debt in a single transaction to avoid a financial fallout or improve loan terms. For example, imagine a user deposits ETH and withdraws Tether. If ETH’s price begins to plummet, their position would be at risk of liquidation. Using a flash loan, they could swap their collateral into DAI and avoid further fallout. Similarly, if Tether’s interest rates increased, users could switch their debt to DAI to avoid paying more. Aave both pioneered this product and has become the de-facto destination for interactions of this kind.

Aave Arc is a newer initiative that offers “permissioned” liquidity pools for institutional clients. Unlike Aave’s trademark service, Arc’s pools adhere to AML and KYC rules, making them viable capital destinations for larger organizations. When Arc was announced earlier this year, Aave shared that it already supported thirty funds, including Bluefire Capital, CoinShares, GSR, Hidden Road, and Ribbit Capital.

As we’ll discuss shortly, the project’s recent innovations have extended beyond the financial realm and show a glimpse of what “Aave Companies” may become.

Traction

Aave does not only boast a high market cap. Kulechov and company have built a project that has attracted capital and users.

As mentioned, Aave’s Total Locked Value is pegged at $5.6 billion, down from earlier highs but still large enough to make it DeFi’s fourth-largest project by that metric. Only Maker, Lido, and Curve boast more assets in their smart contracts.

Despite a decline in TVL in recent months, Aave has continued to scale active users. The protocol hit an all-time high of 36,000 in August – a 360% increase yearly. By web2 standards, these are small figures; plenty of tech-enabled lenders count customers in the millions. For crypto, however, it’s indicative of a tangible user base. For comparison, Lido – which has more assets under management – topped out at 11,400 users over the last year. Aave’s number of tokenholders has also steadily climbed, approaching 120,000 in August. A year earlier, it stood a little over 90,000.

Aave earns money by taking a fee on loans, with preferential terms given to those using the project’s own token. This business model produces significant revenue. In October 2021, Aave generated $59.4 million in revenue, with the protocol taking $6.2 million of that sum. Total revenue includes the interest paid by borrowers, while protocol revenue reflects the amount that redounds to holders of the AAVE token. As trading volume has declined through this crypto winter, these figures have fallen considerably. In August, Aave recorded $12.3 million in total revenue and $1.4 million in protocol revenue, a decline of 62.5% and 57.5% year over year. Such figures are unsurprising in the context of the broader market.

Judging Aave’s valuation in the context of these figures is tricky. Do you focus on the project’s torrid initial growth and remarkable peak? Or do you look at its more recent figures? A $1.23 billion fully diluted market cap looks appealing for a project that grew total revenue by more than 2,600% between January and October 2021, hitting $712.8 million in annualized revenue. It sounds much more expensive for one that’s declined steeply and is now tracking at $147.6 million in total annual revenue.

The truth lies somewhere between these two depictions, and whatever one’s ultimate appraisal, it’s clear that Aave is a product that sees real use and has the capacity to generate mid-eight-figure revenue.

Lessons: Aave’s significance

Aave’s impact illustrates interesting dynamics in the crypto ecosystem. In particular, it shows the different ways entrepreneurs can win in the space, the superpower of a strong community, and the appeal of DeFi to consumers and enterprises.

Different ways to win

In 2020, few would have bet on Aave becoming DeFi’s leading lender. Compound was seen as the front-runner, boasting a more traditional tech leader at the helm and a roster of high-profile investors. By comparison, Aave was founded by a European team with a much less conventional background and few links to Sand Hill Road.

This juxtaposition of profiles is repeated across the crypto ecosystem. Often, for every anointed Silicon Valley player, there is a scrappy, community-driven outsider. Compound and Aave are just two examples of how this binary plays out. Uniswap and Sushiswap easily fall into these roles, too.

Aave shows us that both can work. Access to Silicon Valley is not a prerequisite for success, even when faced with a competitor with such connections. While this reflects the super-trend of technology taking over the world, it also reveals something about crypto’s dynamics. By opening up investment to retail and providing a path to participate in growth and governance, projects outside of tech’s power center can generate grassroots momentum.

This isn’t to say that a more traditional approach can’t work, Uniswap is crypto’s leading decentralized exchange, and though Compound trails Aave by market cap and TVL, it is an undoubted success. Its current fully-diluted market cap stands at $625 million with $2.25 billion in TVL. Total annualized revenue is pegged at $23 million. In April 2021, its high, Compound brought in $46.8 million or $561.6 million annualized. Though it has not kept pace with Aave, it is a project capable of putting up big numbers and boasts its own strengths. For example, one source highlighted that Aave could learn from Compound’s UX. Moreover, though Aave has more active users, Compound has a greater number of tokenholders, beating out Aave 197,000 to 120,000.

Both Kulechov and Leshner have created impressive projects that should serve vital roles in DeFi’s evolution. Their projects have taken different paths to reach that point.

The power of community

We have spoken about how Aave’s strength derives from its community, at least in part. But how has it developed this power?

It seems to stem from Kulechov’s personality and priorities to some extent. In our interaction, Kulechov described himself as “passionate about gathering people who want to build products that will create a positive impact on our society.” Aave’s strong community seems to stem from this interest. In a prior interview, Kulechov noted that he engages with the community constantly. “I spend countless hours on a daily basis talking to people,” he said. In Aave’s early years, he would walk users through the basics of crypto, explaining what a wallet was and how to buy ETH.

These accumulated interactions have helped create an unusually engaged and enthusiastic movement. Aave’s approach to governance has aided that. Holders of the AAVE token have the power to submit and vote on proposals, tangibly contributing to the project’s development.

One of Aave’s most fun community initiatives is Raave – a series of dance parties that pop up around the world. One month, Raavers might assemble in Bogotá; the next, they’ll be in Berlin. Many describe them as some of the most impressively produced and enjoyable bacchanals they’ve ever been to. If a tech company were to spend so lavishly on entertainment, it might seem wasteful. However, for a project that relies on community involvement, there’s a logic in investing in moments of effervescence.

Beyond the direct advantages of having an engaged community, Aave has also benefited indirectly, especially when it comes to hiring. Brunet described Kulechov as a “true visionary capable of hiring missionary employees.” He added that Aave has “been able to hire and retain top female talent – which is rare in crypto.” Such devotion and diversity would be harder to achieve for a project with a less ardent following and a smaller footprint.

Like no other space, crypto projects must seed, develop, and continually engage a community. When done well, it can become a compounding competitive advantage.

DeFi’s appeal and development

Though DeFi is often associated with unsustainable yield farming schemes and other financial shenanigans, Aave illustrates its benefits. Consumers with crypto assets can earn interest and borrow money from anywhere with an internet connection.

Lending is an essential ingredient in a financial system. For consumers and enterprises, access to loans allows many to take on productive risks, or make important purchases they might not have been able to otherwise. For investors, Aave has created an attractive product that offers high yields and digestible risks. Compared to traditional financial services, Aave is faster, less arduous, and more flexible.

The advent and growth of Aave Arc and RWA Markets indicate where DeFi’s step change may come from. Giving institutional investors the safeguards they need to delegate meaningful resources to the ecosystem could unlock a wave of capital and allow more conservative market participants to grow comfortable with crypto. This opportunity will not go uncontested, of course. Compound has a good roster of whales and institutions, while newer offerings like Maple Finance have snowballed by focusing on this customer base. As with traditional finance, this is a market with room for multiple mega-winners, but Aave will need to ensure it maintains its shipping speed to avoid falling behind.

Looping in “Real World Assets” like freight financing offers another massive avenue of growth. Many of these lending opportunities are difficult to access, dominated by sleepy incumbent providers, and financially attractive. Aave’s moves here illustrate where the industry may be headed and how crypto is imbricating itself into web2 industries.

If Aave can own these evolutions – at least in significant part – there’s every reason to believe the lender can become orders of magnitude larger than its last peak.

Try it now

Future: A conglomerate forms

Stani Kulechov is not content with simply building the best lending platform in the world. His recent moves reveal an appetite to address crypto’s most significant problems and solve them one by one. Doing so is changing the fundamental complexion of Aave, transforming it from a focused suite of lending products into something closer to a conglomerate. Indeed, when I asked Kulechov what outsiders often failed to understand about Aave, he pointed to the scope of his work:

People often don't know there is a difference between Aave Companies – the technology company that develops software products for web3 – and Aave Protocol, which is now decentralized and governed and maintained by the Aave DAO.

Increasingly, it looks like “Aave Companies” will be the parent for several different initiatives. Kulechov’s team has already picked two new initiatives to tackle: a web3 social graph and a stablecoin.

Lens Protocol

In February of this year, a new account called Lens Protocol tweeted a message: “Something is blooming….”

Aave Companies' had called its next big swing: a decentralized social graph. It might sound like a surprising move for a lending business, but those who followed Kulechov’s interests were not shocked. For some time, the Aave founder has expressed an interest in social media. Earlier this year, Kulechov was banned from Twitter for tweeting a joke claiming to be its new interim CEO. The fact that many in crypto found it funny was down to the fact that it didn’t seem too far-fetched.

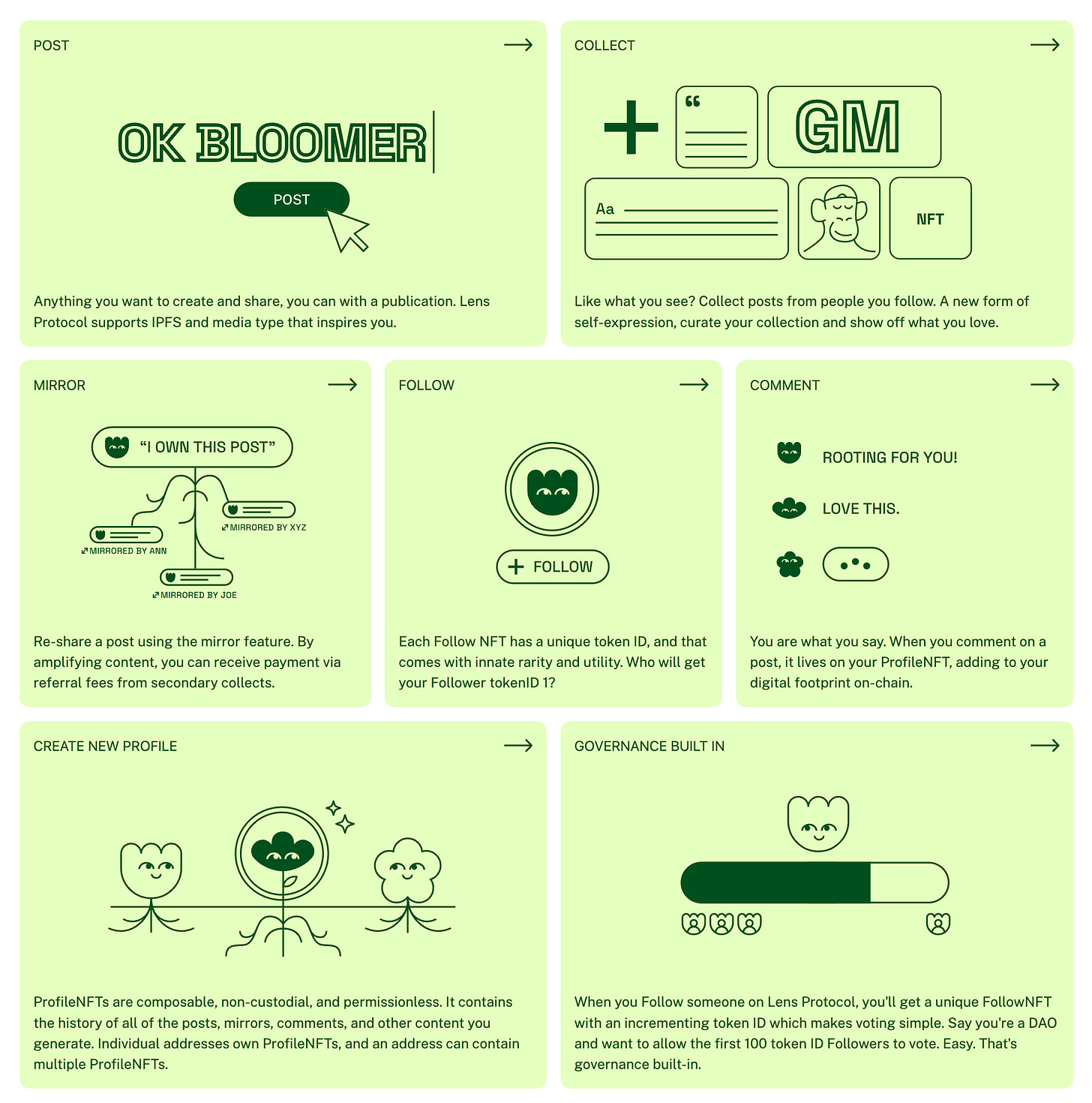

Though other players have tried to build a decentralized social graph, Lens is the most compelling. It replicates existing traditional social media primitives and behaviors in a crypto-native framework. In doing so, new behaviors are unlocked.

Lens’ operations revolve around NFTs. When you sign up, you can create a Profile NFT. Each wallet address can own several, in fact, with the ability to give management of a profile over to a group. That’s particularly handy for DAOs.

Following someone also produces an NFT. Since each of these is unique, they carry information of when you followed someone, opening up the potential for profiles to reward early supporters or modulate content visibility by this dimension.

Lens supports posting rich media, including articles, photos, and videos. Users can buy this content, adding it to a “collection” showcases their interests. For creators, this represents a new revenue stream. It remains to be seen just how popular this form of patronage and self-expression becomes.

Lens’ version of the retweet is the “mirror.” This amplifies content and gives the amplifying account exposure to its upside. Those that re-share a post from another account earn a percentage of the fees when those posts are purchased.

Finally, since Lens is decentralized, users can port their social graphs from one application to another. Users genuinely own their social network, rather than borrowing it from platforms that might, one day, ban them or decline in popularity.

So far, Lens seems to be off to a good start. One web3 contact remarked that it is one of the most widely used protocols at hackathons, acting as the de-facto choice for any product requiring a social graph. New applications have emerged, including Lenster, Refract, Phaver, and Alps Finance. A recent post notes that 65,000 profiles and 300,000 posts have been made using Lens.

Lens has also developed from a governance perspective. Earlier this week, Kulechov announced the creation of CultivatorDAO, a collective focused on trust and user safety. The DAO aims to act transparently and conditionally. Users and developers can decide whether they want the curation and moderation of Cultivator turned “on.” The idea is that activating Cultivator improves your social experience, removing bots and spam. It can be forked by other communities and tailored to its needs.

While an intriguing addition, CultivatorDAO reminds us of how big a challenge Aave Companies is taking on. Not only is Kulechov looking to create a novel technical framework for social media, he and his team are building the human infrastructure, too. How will they manage to execute at full capacity on both fronts?

Investor Étienne Brunet cited this as one of Aave’s risks. “There’s a ton of stuff to build,” he noted, “and it’s a bit difficult to see the link between Aave and Lens.” Kulechov will need to ensure that moonshots like Lens do not distract from the opportunity Aave’s core protocol offers.

GHO Stablecoin

GHO’s connection to Aave’s lending services is immediately apparent. Proposed in July of this year, GHO is an overcollateralized stablecoin pegged to USD that operates within the confines of the Aave protocol.

Once implemented, users will be able to mint GHO by depositing collateral. As with Aave’s other loans, the amount of GHO minted will be a fraction of the posted assets’ value. When a user recalls their collateral or is liquidated, their GHO holdings are burned.

Wading into the stablecoin world is a risky proposition. The collapse of Terra has attracted considerable regulatory scrutiny, which Aave will want to avoid. It has also prompted healthy skepticism over these assets' design decisions, which may take time to untangle. As with Lens, GHO could represent a distraction, leading Aave away from more straightforward growth.

It seems a bet worth taking. For all their turmoil, stablecoins represent a massive category with considerable upside. As Aave intends to direct all interest earned from borrowing GHO to its DAO Treasury, it also provides a new revenue stream. There’s also reason to think it’s an elegant fit. After all, Aave has already built an enormous collateral base and distribution. In that respect, GHO feels like a natural extension of Aave’s earned power. Gaining meaningful share here could propel Kulechov’s budding conglomerate into the stratosphere.

What will Aave look like in ten or twenty years? One source suggested that Stani Kulechov’s ultimate goal may be to build something no less vast than crypto’s version of Alphabet.

It’s a comparison that makes little sense at first but starts to come into focus the more you think about it. Aave and Alphabet share nothing from a product perspective. They operate not only in different spaces but different paradigms. Revisiting Alphabet’s S-1 filing, however, reveals more fundamental similarities.

“Google is not a conventional company,” Larry Page and Sergey Brin wrote in their introductory letter. “We do not intend to become one.” Later on, they add, “Do not be surprised if we place smaller bets in areas that seem very speculative or even strange when compared to our current businesses.”

One can imagine Stani Kulechov making the same proclamation. Initiatives like Lens Protocol may not perfectly line up with its core business, but the willingness to experiment, take risks, and fail is the sign of a generative organization.

For now, Aave Companies is a long way from Alphabet’s heights. And yet it shows many promising traits that suggest it could be a long-term compounder. Aave is not a conventional lender. It does not intend to become one.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.