Anduril: The Business of Defense

The weapons manufacturer has scaled revenue at record speeds, reaching a rumored valuation of more than $7 billion. It may be one of the most important companies of our era.

Actionable insights

If you only have a couple of minutes to spare, here's what investors, operators, and founders should know about Anduril.

A new prime. The “Big Five” prime contractors dominate the American defense industry. Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics have monopolized the industry for decades, hoovering up smaller businesses. Anduril seeks to be a true competitor to these giants.

Leading with software. The U.S. military has historically treated software like an afterthought, focusing on hardware. As the world and its wars change, that approach looks increasingly backward. Anduril is a defense business with software at its heart. It leverages artificial intelligence, machine learning, and computer vision to power its products.

Building to the mission. When the Pentagon wants to acquire a new product, it usually sets exhaustive specifications. Contractors make what they’re told to, rather than thinking about the problem from first principles. Anduril takes a different approach, building to the mission rather than the specs.

Bundling the best. In the last eighteen months, Anduril has acquired three companies, bundling their products into its suite. Thanks to its strong ties with global governments, it can sell these assets through established channels, layering on new sources of revenue.

Modern warfare. Future conflicts will likely rely heavily on AI, especially for coordinating large “swarms” of drones and other assets. Anduril seems one of the only companies with the technological power to handle these new kinds of warfare.

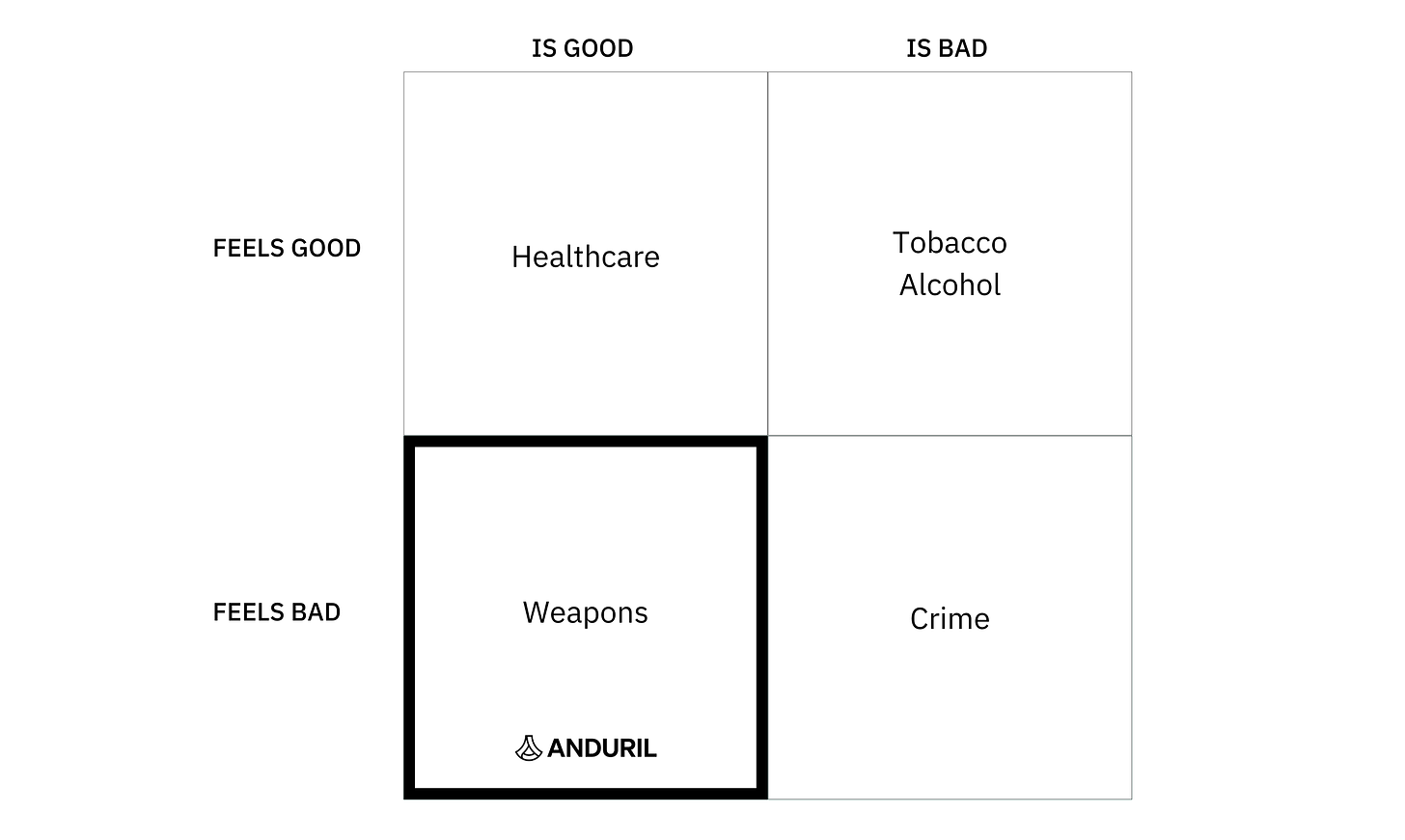

“There is a category of things that are a moral good but feel bad,” Trae Stephens said to me. Selling weapons to the United States and its allies may be one of them.

As Anduril’s cofounder and Executive Chairman explained, you can think of his business’s work as sitting in one quadrant of a two-by-two matrix. There are things that are good and feel good (like healthcare), things that are bad but feel good (tobacco), and things that feel bad and are bad (crime). It is easy to support the “double-good” camp and seductive to dabble in the “bad-good” quadrant of vice. The bad-bad camp is easy to ignore.

The final square evokes tension and disagreement. This fractious, unpopular zone is where Anduril lives.

Since its founding in 2017, Stephens’ business has endured condemnation and courted controversy in pursuit of building a business it believes to be a moral good. In that time, Anduril has rolled out a literal arsenal that includes drones, sentry towers, and submarines, knitted together with sophisticated software. Defense departments around the world have found considerable value in this suite, propelling the business to more than $150 million in revenue in five years. Reaching those figures in such a short time is no mean feat in the torpid world of defense.

Principled pacifists will find little redeeming value in Anduril’s work. Those that consider the U.S. military and executive branches unethical or incompetent will also have much to dislike. But anyone that believes well-armed liberal democracies are a force for good and crucial for maintaining global peace will see merit in Anduril’s mission. Russia’s invasion of Ukraine distressingly illustrates the importance of a dictatorial counterbalance.

Stephens encapsulated the thorniness and significance of Anduril’s mission, “There’s all this moral ambiguity in building weapons systems. And yet, the best way to prevent war is by being prepared for war.”

In today’s piece, we’ll explore how Anduril seeks to deter war by arming liberal governments. We’ll cover:

Origins. If Palmer Luckey hadn’t donated to a “shitposting” organization, Anduril might not be around today. Its existence owes much to the perseverance of Trae Stephens, the good fortune of Luckey’s departure from Facebook, and the expertise of an impressive founding team.

Market. Starting in the early 1990s, the defense industry underwent a period of consolidation. That’s resulted in a dysfunctional market with high prices, low competition, and minimal innovation.

Product. Anduril has developed a comprehensive product suite in just five years. Powered by Lattice, an operating system for conflicts, the company can orchestrate assets across air, land, and sea.

Playbook. Anduril’s success stems from a nuanced understanding of selling to governments allied with the energy of a Silicon Valley startup.

Let’s get started.

Learn how the best businesses and investors win. The Generalist is designed to help you think better and capitalize on change. Join 61,000 subscribers today.

Origins: The reluctant founder

Anduril is a company that few in Silicon Valley thought needed to exist. Because of the foresight of Trae Stephens and Palmer Luckey, America and its allies have a software-first defense provider capable of impacting current conflicts.

Army of one

In 2014, Trae Stephens made a career change. From one vantage, his transition from startup operator to venture capitalist was not unusual. Many have made some version of the same journey, but such rough strokes obscure the more interesting details of the move. Though plenty of investors bring building experience to the table, few have spent time in the halls of government.

Before joining Palantir in 2008, Stephens had spent time at the offices of Ohio congressman Rob Portman and the Afghan embassy in Washington D.C. His public sector work seemed to skew towards the technical, with Stephens “building enterprise solutions to Arabic/Persian name matching” for the Intelligence community. Stephens used and bolstered this experience as part of his six-year stint at Palantir.

While venture capital rarely draws from defense backgrounds, there is an exception: Founders Fund. Established by Peter Thiel, Ken Howery, and Luke Nosek in 2005, Founders Fund holds a unique position at the nexus of Silicon Valley and Washington D.C, thanks to Thiel’s co-founding of Palantir and particular geopolitical worldview. The firm was early to back SpaceX (one of the few recent startups to secure meaningful governmental contracts), while Ken Howery went on to serve as ambassador to Sweden during Donald Trump’s presidency.

Stephens was a neat fit at Founders Fund, as was his mission to find the next great defense business. SpaceX and Palantir had made significant impacts, but they were the rarest of exceptions. By and large, venture-backed startups had failed to disrupt the established patterns of the public sector in general and military in particular. Stephens was hopeful a new generation of entrepreneurs would change that.

Despite his best efforts, Stephens came up empty-handed. “I didn’t find anything,” he said. With the benefit of hindsight, the investor noted there wasn’t a business he had overlooked: “There was nothing to miss. It turns out there wasn’t a next Palantir or SpaceX.”

Though Stephens didn’t find a ready-made defense startup during this period, he did meet a founder who would play a starring role in Anduril’s creation: Palmer Luckey.

Luckey breaks

A year before Stephens started his venture career, Luckey set out to raise a Series A for his virtual-reality startup, Oculus. He found a willing partner in Founders Fund, who became the company’s “first institutional investor,” per Stephens.

It took little time for that faith to pay off. By March the following year, Facebook announced it had acquired Oculus for approximately $2 billion in a mix of cash and stock. Barely twenty years old, Luckey was suddenly a wealthy man.

Around the time of that acquisition, Stephens and Luckey got to know one another, discovering themselves to be somewhat kindred spirits. “He was super interested in national security,” Stephens said of Luckey. That fascination pre-dated Luckey’s creation of Oculus. Indeed, while working at Bravemind, an organization that uses VR to treat veterans with PTSD, Luckey first created a prototype of his revolutionary headset.

For the next three years, Stephens and Luckey stayed in touch. By 2017, much had changed for them both. In March of that year, Facebook fired Luckey, a decision he claimed was politically motivated, catalyzed by a $10,000 donation he had made to pro-Trump “shitposting” organization, Nimble America.

Meanwhile, Stephens had reached an impasse in his search for a modern defense prime contractor (a “prime”). It was increasingly clear that if he wanted such an organization to emerge, he would have to build it himself. He made his pitch to Luckey, explaining the status quo as he saw it. In particular, Stephens saw two major shifts to which America’s military had failed to adapt:

The shift to software. Defense technology had traditionally been hardware first. Stephens was confident that future wars would be defined by software that worked in concert with intelligent devices and machinery.

The brain-drain. In previous eras, the military could reliably attract the best technical talent. Historic minds like John von Neumann lent their abilities to branches of the armed forces. That is no longer the case. Today, many of the best technologists work at companies like Google and Meta. “We’re not in a position where our best and brightest are working on national security,” Stephens said.

Luckey was impressed with Stephens’ diagnosis and proposed cure. “He was super excited about it,” the investor recalled. The two began work on the company that would come to be called “Anduril.” As with many Thiel-affiliated entities (see: Palantir, Valar, Mithril), the business took its moniker from Lord of the Rings. In Tolkien's books, “Andúril” is the name of a mythical sword which means “Flame of the West” in elven tongue.

Founders form

While Stephens and Luckey were a formidable team, they recognized they would need more executive talent to bring their mission to life. They set their sights on Brian Schimpf.

Like Stephens, Schimpf had spent much of his career at Palantir. Over the better part of a decade, Schimpf had risen through the ranks to become the firm’s Director of Engineering. That made him a tough get. “We always wanted Brian,” Stephens said, “But he was also running the engineering team at Palantir.”

In addition to circulating their vision among a small group of venture funds, Stephens and Luckey presented to Oculus, SpaceX, and Palantir’s leadership. That gave them a chance to share their grand vision with Schimpf and convince him to hop aboard. Stephens recalled texting Schimpf after Anduril’s founders had made their pitch. “I said we would really like him on the founding team.” A few days later, Schimpf agreed, signing on as Anduril’s CEO. Stephens’ business not only had a hardware genius in Luckey but an exceptional software developer.

Two others joined what would become a five-person founding team. Joseph Chen, a former paratrooper and Oculus employee, added strength to the engineering team, while Matt Grimm joined as COO.

Grimm had deep ties to Anduril’s team. He had worked on an autonomous vehicle project with Brian Schimpf as a Cornell undergraduate before joining Palantir and then moving on to Thiel’s Mithril Capital. Stephens was certain no one else would be as effective at scaling a startup that sought hyper-growth. “He’s the best person I know at starting a company,” Stephens said. While Luckey has frequently contributed to Republican candidates, Grimm described himself as an “Obama fanboy.” While the political leanings of founding teams are not usually relevant in a work of business analysis, it is more salient when a company must survive changing administrations. Not only do Grimm’s affiliations add a potentially different perspective, they may augment Anduril’s non-partisan bonafides.

Narrative reversals

On June 6, 2017, Anduril’s founders officially set to work on its first product: a sentry tower that leverages artificial intelligence to monitor border crossings. “It was totally Palmer’s idea,” Stephens said, noting that Luckey had sketched prototypes before Anduril had gotten off the ground. It can take years for a defense contractor to ship a new product; Anduril had its sentry tower in the field within six months. While that was an impressive proof of concept from a technological and operational perspective, it came with baggage. Observing the Mexican border under Trump invited criticism. Anduril was subsumed by that narrative, according to Grimm. “The goal was not to set out and say, ‘We’re the border security company,’” he told Bloomberg, “Through the first year and a half…that was the narrative.”

Despite the unpopularity of its work, Anduril kept shipping. It followed the sentry tower with sensors, drones, and autonomous submarines. Though these products represented hardware innovations, the heartbeat of Anduril’s work was its orchestrating software system, Lattice.

As its product suite matured, Anduril continued to attract funding. Hundreds of millions of capital poured in between 2018 and 2021. Recent reports suggested the firm was raising a $1.2 billion Series E that would value the business at $7 billion pre-money. Anduril’s impressive traction has merited such injections. The company has secured major multi-year contracts, including a $99 million deal with the Defense Innovation Unit, a $250 million agreement with Customs & Border Patrol (CBP), and an approximately $1 billion agreement with Special Operations Command (SOCOM).

The events of this year have prompted a reappraisal of Anduril. Russia’s invasion of Ukraine laid bare the importance of a robust American military. Of the approximately $81 billion pledged in aid to Ukraine, more than $42 billion comes from the U.S. alone. Anduril has provided resources to the war effort. Luckey noted, “we have hardware, software and people in Ukraine.”

As the war rages on and tensions mount in Taiwan, Anduril looks more essential than ever. Luckey said earlier this year, “We've designed our technology to be specifically relevant to exactly these challenges…We've been putting all of our effort into things that are relevant to conflict or to preventing conflict with great powers like Russia and China.”

Market: Prime time

In 2019, the Department of Defense (DOD) shared big news: the nuclear arsenal no longer relied on floppy disks. That it took so long to achieve that evolution is emblematic of the flaws in the defense industry. Extreme consolidation has resulted in an inefficient market beset by low competition, high prices, and minimal innovation.

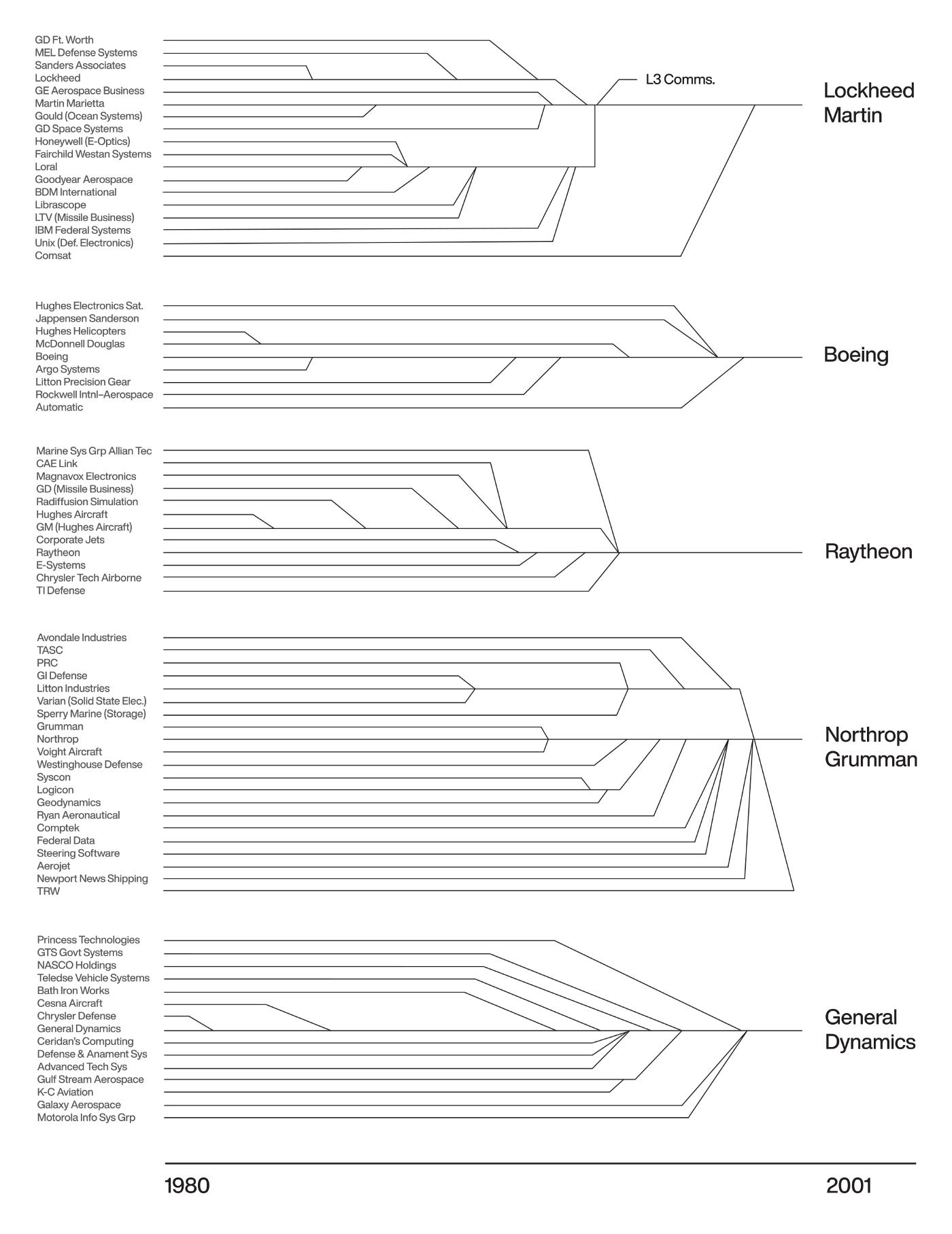

Extreme consolidation

Uncle Sam orders from a set menu. Five defense contractors dominate the industry: Lockheed Martin, Boeing, Raytheon, Northrop Grumman, and General Dynamics. Notably, these businesses trace their roots back to the early 20th century. General Dynamics began life as the Electric Boat Company in 1899. Northrop Grumman is the “Big Five’s” equivalent of a scrappy up-and-comer: one of its original entities started in the relative modernity of 1930 – the same year a cartoon mouse named “Mickey” made his debut in a comic strip.

This state of affairs is no accident but the result of concerted governmental effort. In 1993, Deputy Secretary of Defense Bill Perry convened the CEOs of the industry’s largest businesses in a meeting referred to as “the Last Supper.” Perry informed them that military spending was set to decrease. With the threat of war with Russia waning, fewer and smaller contracts would be available. Contractors were left with a choice: consolidate or die.

It was no choice at all: fifty-one aerospace and electronics businesses shrunk to five.

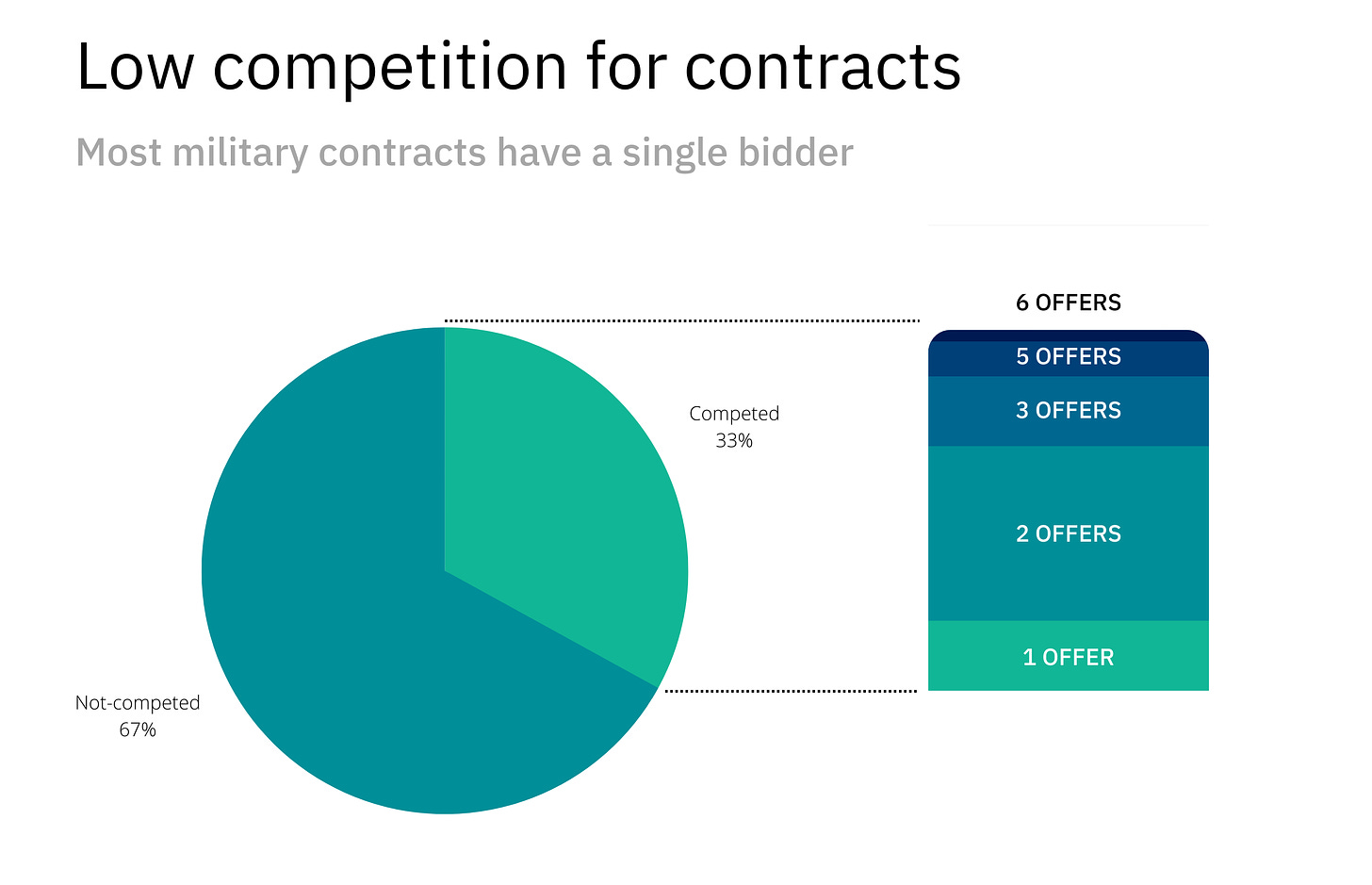

Low competition

Perry sought to mitigate the impact of this shift by introducing policies that favored newcomers. By and large, they didn’t work. As of 2016, 86% of aerospace and defense revenue was concentrated in the hands of just ten companies. According to The American Economic Liberties Project (AELP), two-thirds of major DOD weapons contracts had just one bidder. Of those that do receive competition, less than 10% received three or more offers. Across all DOD contracts between 2008 and 2017, competition fell from 62.6% to 55.4%. Nearly half of all contracts went to one of the Big Five.

The result is an industry with inadequate competition for crucial contracts. In 2018, for example, Boeing stopped producing intercontinental ballistic missiles (ICBMs), suggesting that Northrop Grumman had an unfair advantage after acquiring a smaller business. In doing so, it concentrated America’s nuclear triad, considered the country's “defense backbone” by the DOD, in the hands of one company. For one of the most significant deterrents in the world to have no failsafe regarding production is a remarkable market failure. It’s almost akin to a sole contractor being tasked with producing the world’s car brakes – accidents are made many times more possible in the absence of rivals.

High pricing

The lack of competition has inflated pricing. Between 2008 and 2018, the inflation-adjusted cost of Pentagon weapons systems grew by 13%. With no rivals, defense contractors are often emboldened to charge more than they meet in an efficient market. For example, in 2019, Transdigm, a large, publicly-traded contractor, was found to be marking up its products by as much as 9,400%. Transdigm charged $4,361 for a half-inch “drive pin” estimated to cost $46. The company eventually agreed to repay $16 million after a governmental investigation.

While Transdigm is just one example, it is emblematic of the pricing power contractors have been allowed to have. Another contributor to high prices is the “cost-plus-fixed-fee” (CPFF) model the defense industry often uses. In this approach, contractors are not paid a fixed, pre-agreed fee. Instead, they bill the government for their work, receiving a percentage on top of the total cost, usually between 6-8%.

Some argue that CPFF pricing has its benefits – namely, that it allows contractors to share the risk of a new, more speculative contract with the government. Imagine you’re a relatively small contractor tasked with building a drone that relies on untested technology. Estimating a cost for such a task may be difficult, and the risk of losing money may either dissuade bidders or result in significant overbids. Of course, the downside of CPFF pricing is that it incentivizes contractors to bill as much as possible, increasing the time and cost of projects. Though there have been efforts to curb CPFF engagements over the years, they still make up 38% of DOD contracts. Ultimately, this model seems to have contributed to a broken pricing structure, particularly in a quasi-monopolistic market.

Minimal innovation

Perhaps companies whose founding occurred closer to the American Civil War than our current year should not be expected to be exemplars of innovation. Contractors ship products slowly and invest little in experimentation.

Boeing spends roughly the same amount on R&D as it did in 2001. Its total investment in 2021 totaled $2.2 billion, approximately 3.5% of its revenue. Northrop Grumman spent a similar percentage. Compare that to a company like Alphabet. The Google parent organization spent $31.5 billion or more than 12% of total revenue on R&D. Meta spent even more on a relative basis, investing $24.6 billion or 21% of revenue. While these businesses have very different products and available capital, the difference is striking. Such low R&D sums make it appear less likely the Big Five and others will keep pace with the changing nature of war, particularly as it leverages software.

The state of the defense industry left room for a company like Anduril to emerge. Its desire to build cost-effectively, move quickly, innovate on product, and prioritize software represents a critical addition to the market.

Product: Brain and brawn

Anduril has built more than a series of devices or a piece of software. It has constructed a system that works in concert and plays nicely with external providers. Indeed, it seems to act almost like an organism, leveraging an advanced brain and considerable brawn.

The brain

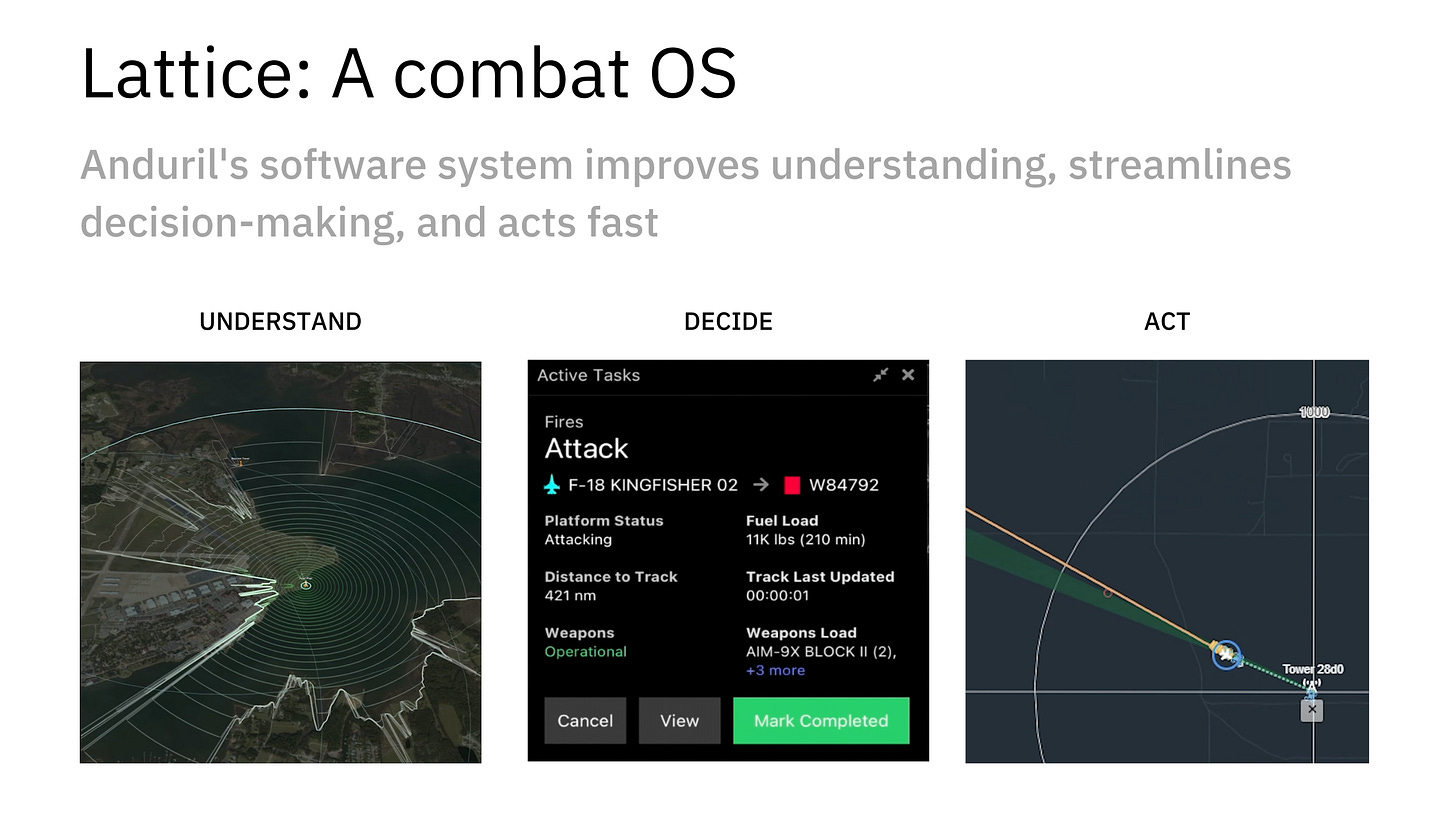

Lattice is at the center of Anduril’s product. The software system acts as a command hub, pulling in information from sensors, drones, and other field assets. Using artificial intelligence and computer vision, Lattice constructs a live, detailed view of a battlefield, accessible via computer, tablet, or VR headset. Critically, Lattice is built such that it can sync with assets made by other companies. It is an open system that seeks to play nicely with third parties.

In addition to intuitively presenting important information, Lattice streamlines decision-making. It does so by offering potential next moves. For example, if a field sensor identifies an enemy drone, it will show up on Lattice along with a prompt to intercept it. In the push of a button, an operative can decide to send an asset to meet and disable it.

Once a decision has been made, Lattice turns it into action. Orders are routed to assets in seconds. The result is a system that allows for rapid, fine-tuned “command and control” of a military operation.

The body

Trae Stephens described Anduril’s product strategy as a “Trojan horse.” Buyers used to purchasing hardware are sated by the company’s physical goods, while software system Lattice is slipped in relatively sub-rosa.

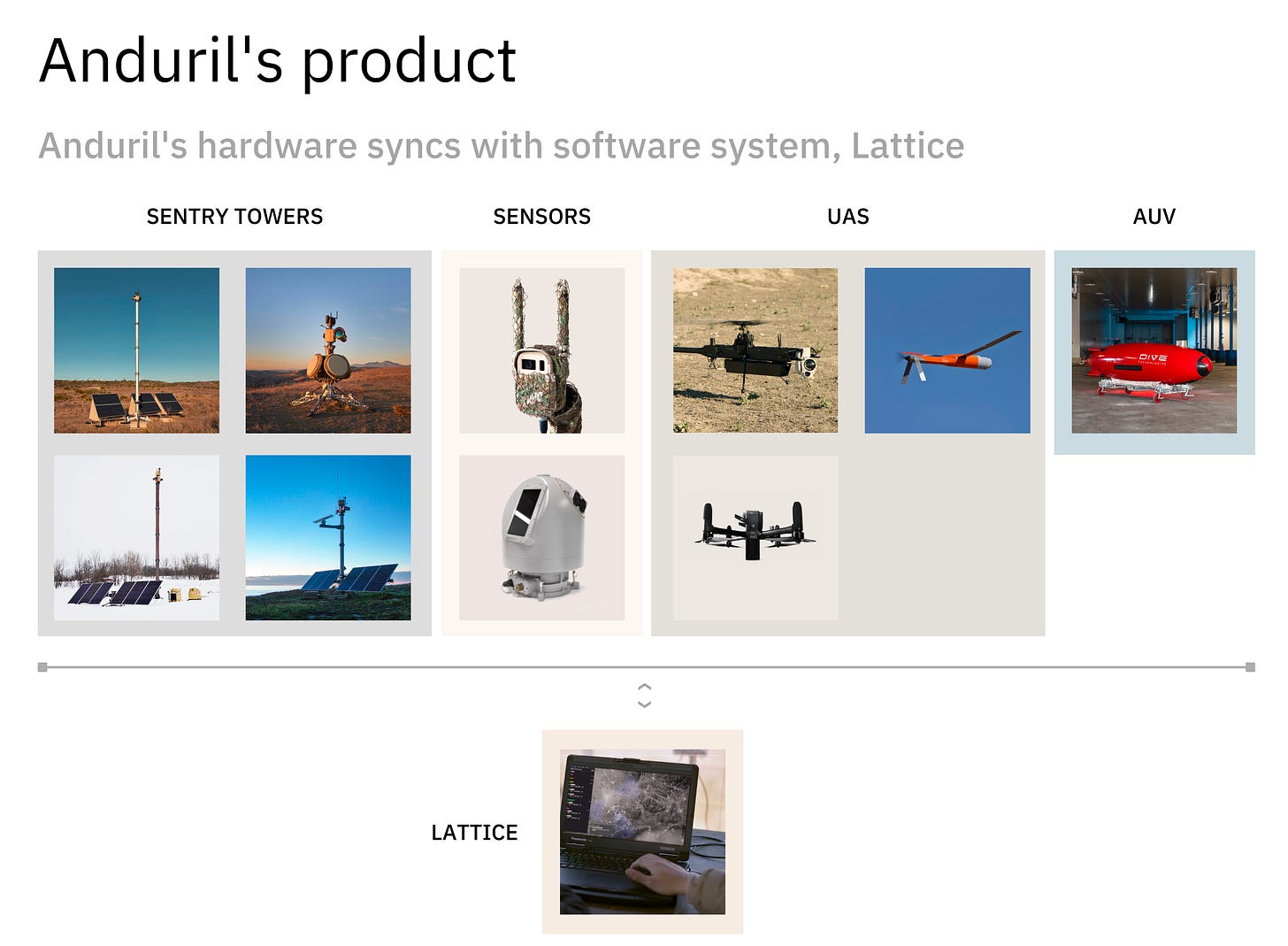

So, what are the hardware assets Anduril sells to its military buyers? We can better understand their selection by dividing it into four categories: sentry towers, sensors, unmanned aerial systems (UAS), and autonomous underwater vehicles (AUV).

As mentioned earlier, Anduril’s first product was its sentry tower, which was positioned along the US-Mexico border and has since been deployed along the US-Canada border. In the intervening years, Anduril has further developed its sentry suite to serve slightly different purposes and survive in different environments. In total, it has four sentry towers: one standard offering, one focused on long-range detection, one suitable for cold weather (camera lenses can freeze over in low temperatures), and one for maritime services. The last of that quartet uses a special radar “designed to detect boats, jet skis, and other water-borne objects.”

Anduril has developed other sensors to augment its surveillance capabilities. Dust is one such device. Weighing just four pounds with a battery life of more than two months (and a solar panel for longer operations), Dust unobtrusively extends surveillance operations. The conical WISP device is another option, offering 360-degree “situational awareness.” WISP can be placed on ships, sentry towers, tactical vehicles, or on the ground.

Anduril has three unmanned aerial systems (UAS): Ghost, Altius, and Anvil. Ghost is a drone that a single person can assemble in just three minutes. It can fly for sixty minutes and does so nearly silently, making it ideal for covert surveillance. Operators can easily manage a suite of Ghost drones simultaneously. Altius is a drone that launches from a T-shirt cannon-like tube. Its four different models can be positioned on helicopters, tactical vehicles, and ships, and boast impressive reach. The furthest-ranging drone, Altius-900, can fly for more than 15 hours and travel 620 miles. Anvil is the most distinct of the bunch in that it is not designed for surveillance so much as defense. Deployed from what looks like a big suitcase, Anvil is designed to knock enemy drones out of the sky.

Finally, Anduril has a hardware system designed for subsea environments. Dive-LD is an autonomous underwater vehicle (AUV) capable of conducting surveys that may last weeks, reaching depths of 6,000 meters. Because of its endurance, Dive-LD can launch from a pier, make its way out into the deep ocean, then return. This “pier-to-pier” model eliminates the need for costly off-shore launch vessels.

In just five years, Anduril has accumulated a range of products capable of making a difference on land, air, and sea.

The solutions

The genius of what Anduril has built is best understood by viewing how its products work in concert. Leveraging Lattice as the brain, Anduril combines its hardware capabilities to solve specific problems. It has created CounterUAS, Counter Intrusion, and Maritime Counter Intrusion offerings.

CounterUAS does what you expect: detecting and stopping enemy aerial campaigns. To do that, Anduril pulls together four products: Lattice, a long-range sentry tower, WISP, and Anvil. You can imagine how this all works together. The sentry tower scans the skies for threats, aided by WISP’s 360-degree vision. The data they collect is routed into Lattice for observation and decision-making. Once a threat is detected, an operative decides what to do via Lattice. If the best decision is to disable it, Anvil is launched to knock it down.

Counter Intrusion is designed to protect against land attacks. It relies on a slightly different bundle, using Lattice, a standard sentry tower, WISP, Dust, and Ghost. The sentry tower and WISP can surveil a large area, while Dust can be easily moved as needs change. Ghost handles aerial patrol.

Finally, the Maritime Counter Intrusion solution monitors the sea. Anduril’s maritime sentry tower can detect vessels 20 kilometers from the shore and runs special AI and computer vision models. WISP and Ghost are used to extend the range and improve fidelity. All devices once again route back to Lattice’s operating system.

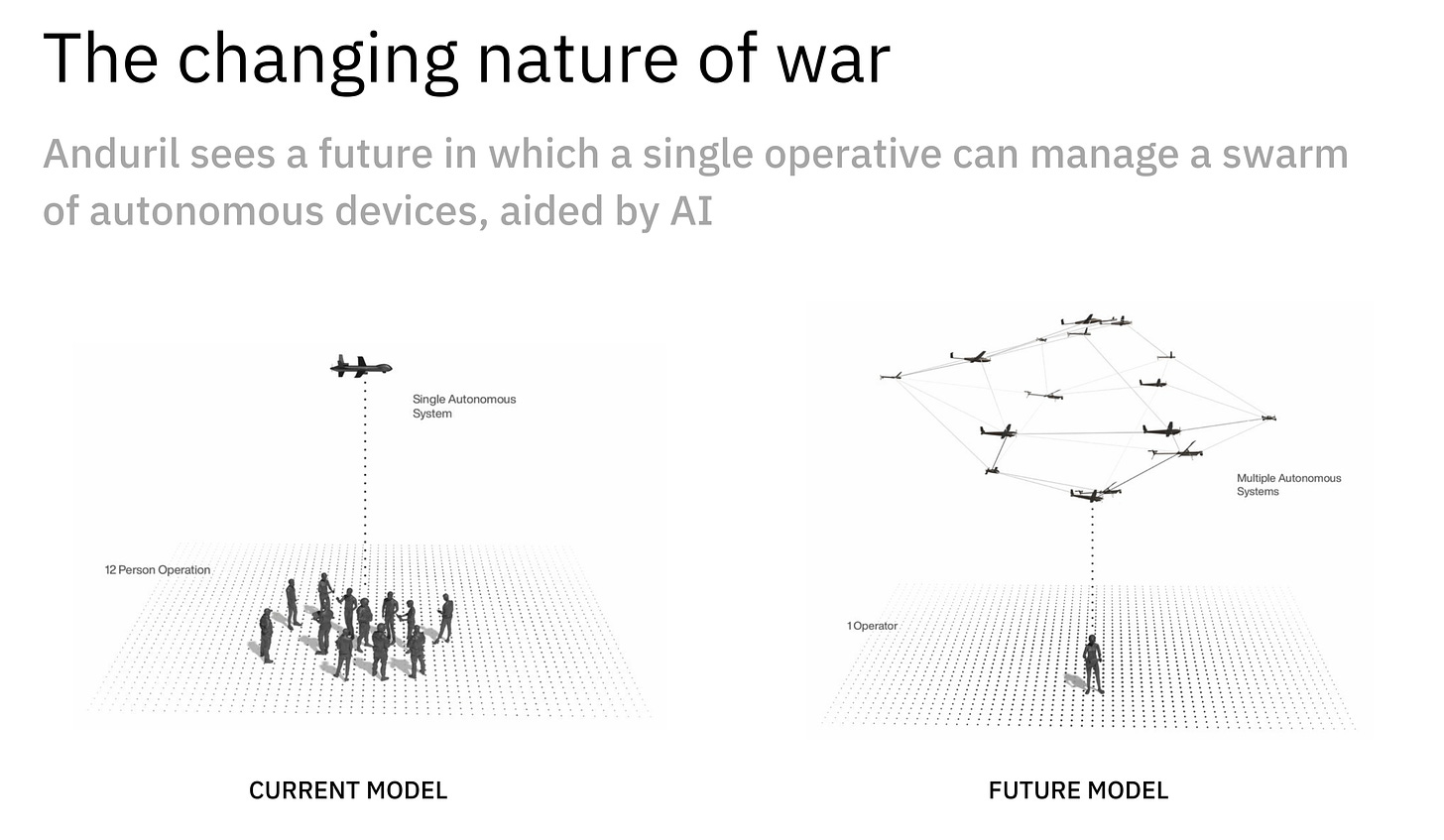

While Anduril’s products are useful in modern conflicts, they’re also well-suited for the wars of tomorrow. For several years, militaries have noted the potential and peril of “swarm” technologies. Instead of a single drone intercepting an enemy asset, a UAS swarm might descend on a target and disable it. There are clear advantages to a swarm, notably that it is much harder to fight multiple targets at once and that there’s a much higher degree of redundancy. A swarm can still be extremely effective even if several drones get taken out.

Anduril is one of the few businesses that appears capable of bringing such a vision to life. While you need hardware for a swarm, the software matters most. In addition to a refined autonomy stack, you need an AI engine that simplifies coordination. Even a team of people could not effectively orchestrate a swarm that might number in the hundreds without machine assistance.

Lattice already handles some of this functionality, but it may enable entirely new forms of warfare in time.

Sign up

Playbook: The country is the customer

According to Trae Stephens, it took SpaceX five years to hit $10 million in revenue. Such timelines are not uncommon in the defense industry – indeed, many other businesses have likely taken longer to reach that landmark. “It was really hard at Palantir and SpaceX,” Stephens said of accumulating revenue, “Like ridiculously hard.”

Anduril managed to reach the same figure in twenty-two months. Within four years, it hit $100 million. Last year, it was mooted to have taken in $150 million in revenue. How has the company managed to log such wild numbers so quickly?

“It’s not that we’re smarter than them,” Stephens said of Palantir and SpaceX, “We were able to compress the timeline by standing on the shoulders of giants.”

Anduril’s success owes much to the founding team’s ability to combine deep sectoral experience with the wisdom of Silicon Valley. Perhaps more than any other business in the space, Anduril is running a “lean startup” methodology retrofitted for the world of war.

Build to the mission

When the military wants to purchase something new, it typically puts together a set of specifications. It is effectively an extremely detailed recipe of what it wants and expects to get built.

From one vantage, this is extremely helpful. The customer is outlining precisely how a company can fulfill a stated task. But in doing so, the military inhibits creativity and product vision. As Anduril notes in Rebooting the Arsenal, the great businesses of our time like Amazon and Apple could not have shipped such revolutionary products had they been confined to a set of specs.

Anduril looks to operate differently than other defense contractors. Rather than focusing on the spec, it “builds to the mission.” It focuses on the buyer’s problem and searches for effective, efficient ways to solve it.

Looking at Anduril’s products, you can see this sensibility. Anvil might have been designed according to instructions, but it feels unlikely. Rather than coming up with a convoluted way to disable enemy drones – hacking into the flight systems or sending a small missile to shoot them down – Anduril landed on a design that feels deceptively simple, akin to a flying brick.

Designing from first principles allows Anduril to create novel defense systems.

Move fast

Legacy primes are extremely slow product developers. This was not always the case. Before the 1970s, contractors could build new aircraft in less than five years. But starting around 1975, budgets and timelines swelled. Planes like the V-22 took twenty-five years to reach operational capacity. It is conceivable that an engineer could have spent nearly their entire career working on that one aircraft.

By attracting some of Silicon Valley’s sharpest developers and operators, Anduril has drastically reduced new product development timelines. Much of this relies on the genius of Palmer Luckey. “The first version of everything we build is very Palmer,” Stephens said, “All of these seedlings start with him.”

None of Anduril’s products have endured development hell. Stephens shared that it takes the company nine to twelve months at the “far edge” to build a product capable of a “minimal viable demonstration.” That’s an opportunity to show the Pentagon the product’s capability and ensure interest and alignment. After that, Stephens says it typically takes between one and three years for full deployment. Anduril shows the urgency of Silicon Valley, shipping complex products quickly.

Bundle

Anduril is an active acquirer of other defense startups. Over the past eighteen months, the company has purchased three businesses: Area-I, Copious Imaging, and Dive Technologies. Each of these pick-ups added to Anduril’s product suite. Area-I makes the Altius UAS, Copious Imaging developed WISP, and Dive Technologies built the Dive-LD AUV.

Because of its existing relationships with government buyers, Anduril can maximize the revenue potential of these technologies. For example, before the acquisition, Dive Technologies had revenue of less than $1 million per year. After the acquisition, Anduril leveraged its connections to secure a $100 million contract for Dive with the Australian Ministry of Defense. “We don’t want to just acquire your company and shut it down,” Stephens said, “We want to take the best ideas and technologies and use our business development strategy and pour jet fuel on it.”

We should expect Anduril to acquire more companies in the years ahead, using them to layer on additional revenue streams. A modern satellite manufacturer might make an attractive target. Anduril has a wide range of surveillance systems but nothing that gathers information from space.

Invest in innovation

Stephens wants to ensure that Anduril remains an innovative defense business. He expects to experiment with a few new ideas each year to ensure it retains a steady pipeline of fresh products. From a revenue perspective, Stephens expects Anduril’s money to come from three tranches he refers to as “trees,” “saplings,” and “seeds.”

“Trees” are mature products that have secured large contracts. Anduril’s sentry towers would likely fall into the category, as would the drone defense system that secured a $1 billion contract with SOCOM. According to Stephens, roughly 50% of revenue will come from this segment each year.

“Saplings” are systems that are “scaling into production.” They have not yet secured large, multi-year contracts but are trending in that direction. Twenty-five percent of revenue will come from this group.

The final 25% will come from “seeds.” Stephens explains, “if you’re not planting seeds, you don’t grow trees.” These are the new bets that Anduril will seek to cultivate over time, knowing it takes up to three years for a product to be deployment-ready. Not all of Anduril’s bets will pay off, Stephens knows. “Right now, it’s kind of crazy, we’re hitting 100% home runs,” he said, “There’s no way that will be the case going forward.”

As well as bundling in excellent products through acquisition, Anduril will continue to build its own innovative solutions.

No sane person wants war. And yet, to paraphrase Plato, only the dead have seen the end of it. Violent competition for resources and power has marked every phase of human history, and there are no signs of it ceasing. Recognizing that may be the end of idealism, but it is the beginning of a solution.

Anduril is a business founded in this spirit. It recognizes that building weapons feels bad in some fundamental sense – but it perseveres, sure of its mission’s morality. Pacifism is no way to protect the world; violence is deterred by the presence of force, not its absence.

Taken together, Anduril is a rare, paradoxical creation: a defense contractor that moves like a startup, a software business disguised as a seller of hardware, and a weapons manufacturer, in pursuit of peace.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.