Arthur Rock: Silicon Valley's Unmoved Mover

The life and lessons of a legendary venture investor.

Where does anything begin?

A sheet of newspaper dances across an empty sidewalk. What caused its motion?

The wind, we might say. The wind swept it forward and made it move.

But what caused the wind?

Well, the car, we might respond. By speeding past, it created the wind, which swept the paper.

And what moved the car?

The engine, we answer. The engine propelled the car, which made the wind, which sent the newspaper sailing over the stone.

We could play this game indefinitely, jumping from engine to driver, driver to body, body to muscles, muscles to atoms, digressing in any number of directions until we arrived at an inevitable conclusion: someone or something plays billiards with the universe; Saturn to side pocket, Mars kissed off the cushion, Earth banked into the far corner.

The Greek philosopher Aristotle referred to that first catalyst as the Unmoved Mover, the solitary galvanizer that depends on nothing and upon which all other actions rely. This being or force holds the cue in hand and plays the opening break shot that, billions of years later, sends a sheet of newspaper across your path.

If Silicon Valley has an Unmoved Mover, it is Arthur Rock. The man who began his career as an investment banker in New York provided the impetus for the tech industry to flourish in San Francisco Bay. As one of the first venture capitalists — he may be the author of the very term "venture capital" — Rock financed and guided some of the most impactful and influential technology businesses of the last century, including Intel, Scientific Data Systems, and Apple.

In doing so, he not only achieved remarkable returns but came to define a style of patient founder-focused investing.

In today's briefing, we'll discuss:

The "Traitorous Eight" and the makings of Silicon Valley

Davis & Rock, a historic venture firm

Recognizing genius at Intel

Mentoring Steve Jobs

Lessons from a legend

In the process, we'll uncover how contemporary founders and investors might apply the genius of venture capital's catalyst.

The Traitorous Eight

No one at Hayden, Stone & Company (HSC) was sure what to do with the letter.

It had arrived on the desk of one of the bank's managers, written by a client's son. Over a few pages, Eugene Kleiner, a scientist at Shockley Semiconductor, asked for help from his father's financiers. He made an unorthodox request:

This prospectus is to introduce a group of senior scientists and engineers that have been working together at Shockley Semiconductor Laboratory...A group feeling arose that rather than leave one by one, we believe we are much more valuable to an employer as a group.

Kleiner hoped that with HSC's help, he might secure a new place of employment for himself and his six colleagues.

Shockley Labs was a prestigious place to work in 1957, even if it was in the comparative research backwater of Palo Alto. A year earlier, Dr. Shockley had been awarded the Nobel Prize in Physics for his work on transistors. But while Shockley was widely regarded as a genius, he was far from an ideal boss, prone to erratic outbursts and fits of paranoia. Once, in a cloud of suspicion, the Nobel laureate tried to convince the entire office to undergo a lie detector test. Eugene Kleiner and his peers had had enough; one way or another, they were going to leave Shockley. Either HSC would find an employer to take them aboard, or they would go their separate ways.

Born in Rochester, New York, Arthur Rock had arrived at HSC after studying at Syracuse and Harvard Business School. As a young man, he'd worked in his parents' candy store upstate and sold magazines door-to-door. That salesmanship still hadn't made him much of a talker, though: with sharp, narrow features and a pointed style of speech, Rock cut an unusually stern figure, especially for someone just thirty years old.

He'd developed a reputation at HSC as an astute picker of technology stocks. In particular, he'd worked on General Transistor, a manufacturer of equipment used in hearing aids. Whereas other investors worried about the limitations of the technology, Rock saw enormous potential.

It was obvious to me that these things were going to be used for a lot more than hearing aids...They weren't used in computers at the time, but it was perfectly evident to anyone who studied the subject that it wouldn't be long before they would.

Though he was just a junior banker, that experience meant it was only a matter of time before Kleiner's letter landed on Arthur Rock's desk. Where others saw an inconvenience, Rock smelled opportunity.

He reviewed the details of the seven men, scanning the names.

Gordon Moore

C. Sheldon Roberts

Eugene Kleiner

Victor Grinich

Julius Blank

Jean Hoerni

Jay Last

Each was highly educated and experienced, having worked at SRI International, Dow Chemical, the Naval Research Lab, Western Electric, and the California Institute of Technology.

"These were, by their resumés, very superior people," Rock later recalled. "And I thought, 'Oh gee, maybe there's something here, something more valuable than just being an employee.'"

Maybe, Rock thought, he could encourage the men to start a company.

He flew out to the West Coast a few days later. Along with his senior colleague Bud Coyle, described as a "ruddy-faced Irishman," Rock met the seven Shockley deserters for breakfast in the august "Redwood Room." Rock might have been surprised when doling out handshakes to discover an eighth man had joined the cause; at the eleventh hour, Eugene Kleiner and his colleagues had persuaded their coworker Robert Noyce to join them.

Handsome with dark, thick hair and a penetrating gaze, Rock must have noticed the gravity Noyce carried, even among peers. It can only have encouraged Rock's belief in his idea.

At the end of the meal, Rock shared his proposition: the scientists should forget about finding a new job — it was time to build something of their own. It was a bold idea at the time, but all eight agreed. They would be able to do much more exciting work and run things the way they wanted to. Rock and Coyle suggested each researcher receive 10% of the new entity, with HSC taking 20%.

Fifty years later, Arthur Rock laughed about that moment.

"That's where the famous 80-20 began," he said, referring to venture capital's traditional carry. "For all you venture capitalists, if there are any in the room, you can thank me for your 20 percent."

Coyle pulled out ten 1-dollar bills to seal the commitment, suggesting each man signed all of them. With the ersatz contracts signed, Arthur Rock got to work.

Starting a tech company in those days was a tricky proposition. There was no formal risk capital asset class, with most venture-style funding conducted by the Rockefellers and other wealthy families on the East Coast. That meant that Rock was going to have to rely on the interest of corporations to forge the new laboratory.

Rock outlined a list of over 35 enterprises he thought might be willing to finance the venture in exchange for benefitting from the work of the cutting-edge researchers.

He scrawled the names on a sheet of yellow legal paper:

Ford

General Mills

Western Union

Motorola

General Dynamics

The list went on and on. Surely one of these companies would jump at the chance to bring the "California group," as they referred to themselves, under their auspices?

In an early example of portfolio support, Rock reached out to every single business. And each time, he was rebuffed. Yes, these were "superior people," but they were on the West Coast and wanted to stay there — that was little good to the majority of electronics companies out East. Even for those able to countenance the Eight's preference to remain in California, how should a deal be structured? Giving stock options to employees just didn't make sense, let alone to an unproven joint-venture. As Rock later told it:

All were interested, but no one knew how to incorporate the group without offending the existing employees in the company. No one was offering stock options at the time, except at the executive level and they didn't see how they could do it for some employees and not for others.

It must have been tempting to quit at this point and let Kleiner, Noyce, Moore, and Co. drift apart, each to their siloed laboratories. But Rock kept going, and finally, he found someone willing to talk to the men: Sherman Fairchild.

The son of a wealthy Republican congressman (Fairchild senior had financed the creation of IBM), Fairchild utilized his father's connections to win government contracts for his aerial photography equipment, leading to the creation of Fairchild Aerial Camera Corporation in 1920. In the years that followed, Fairchild built a technical empire, expanding into lunar photography — used by NASA on Apollo 15, 16, and 17 — airplane manufacturing and recording equipment.

By the summer of 1957, Fairchild was 61 years old and in the twilight of his career. But he still possessed a fascination with new technology and a willingness to take risks. He agreed to take a meeting.

Noyce handled the presentation. He explained the group's belief that silicon, not germanium, was the key to making commercially viable semiconductors. Fairchild would later admit that Noyce's passion and force proved the decisive factor.

A deal was struck: Fairchild would loan the group $1.38 million to start their laboratory, structured as a subsidiary of the existing business. In exchange, the parent company could buy the division outright for $3 million within eight years.

It didn't take nearly that long. With Noyce, Moore, Hoerni, Kleiner, and the rest of the group installed at Fairchild, progress was rapid. Within six months, Fairchild Semiconductor turned a profit, and within just two years, the parent company exercised its right to purchase the unit for $3 million. In 1959, led by Noyce, the group created the first commercially viable integrated circuit embedded in a silicon chip.

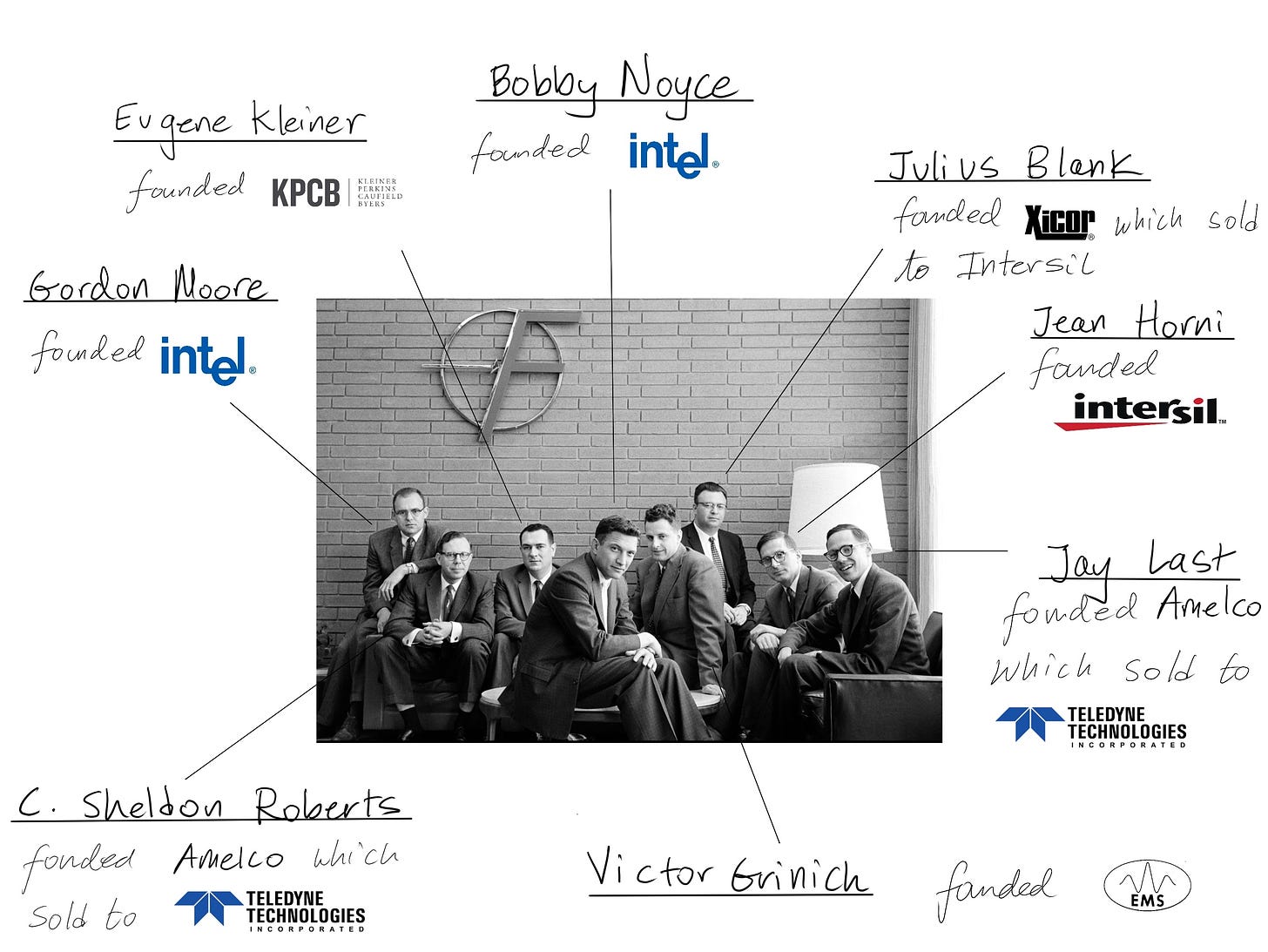

It's hard to overstate how influential Fairchild Semiconductor proved to be. Not only did it put the "silicon" in "Silicon Valley," but it served as the breeding ground for a crop of generational technologists and entrepreneurs. The "Traitorous Eight," as Shockley branded them, proved prolific, founding companies like Intel, Xicor, and Intersil.

That represented the start of a larger movement. As of 2014, an estimated 92 companies trace their roots back to Fairchild Semiconductor founders and employees (some suggest the number is closer to 400), with $2 trillion in value created. That includes Apple, Advanced Micro Devices, and Applied Materials, as well as venture firms like KPCB and Sequoia.

It may never have happened were it not for Arthur Rock's intervention and stroke of inspiration: talented engineers should be incentivized to build.

Davis & Rock

Despite his success orchestrating Fairchild Semiconductor's formation, Rock didn't relocate to the West Coast until 1961. In New York, he further burnished his reputation at HSC as a shrewd stock-picker, advocating for a basket of science and technology companies that rose 457% between 1958 and 1961. That included companies like Hewlett-Packard and Teledyne. The latter company would play a significant role in Rock's future.

Rock's success was, in part, down to his exceptional understanding of the right vectors upon which to analyze these businesses. Reflecting on that skill, Rock highlighted the kind of thinking that would come to dominate the venture capital industry with its focus on the future rather than the present state:

Most fellows were approaching electronics stocks the wrong way. They wanted to know a company's revenues and earnings this year. That's crazy. The industry is in its infancy. Knowing where past earnings or present ones are coming from is no help.

Perhaps realizing that he was one of the few financiers on the East Coast that thought about businesses in this way, Rock decided to cross the country in 1961. He'd noticed, increasingly, that the best scientists were coalescing around Stanford University, where Fred Terman, head of the engineering school, had fanned the flames of technical entrepreneurship:

Fred Terman did two things. He allowed doctoral students and professors to start companies while they were still at Stanford, and he convinced Stanford to lease some of its land to individuals to start companies.

Rock wanted to be near those kinds of people — the kind of men he'd gotten to know as part of the Fairchild deal. He packed up his life in New York City and, with acquaintance Thomas Davis, founded a West Coast investment firm focused on funding new companies.

Davis & Rock raised $5 million, with Rock putting in $175K of his own money. The rest primarily came from Rock's East Coast network, including Harvard Business School classmate Fayez Sarofim (the second-largest shareholder in Kinder Morgan) and Teledyne founder Henry Singleton. It didn't take the new entity long to invest in one of its LPs:

I raised the initial money for Teledyne a few months before I moved to California. And then when Davis and Rock was formed, we made a follow-on investment. In fact, I knew I was going to do that when I set the thing up, and I was on their board for 34 years.

That marked the beginning of a remarkable run. Over the following seven years, Davis & Rock would invest just $3 million of the $5 million raised into only 15 companies. It returned $100 million to investors.

Portfolio companies included:

Scientific Data Systems, a maker of scientific computers. 300-380x.

Teledyne, a conglomerate of scientific businesses. That included Amelco, founded by members of the Traitorous Eight. 233x.

Astrodata, an Epsco spin-off focused on "data processing equipment." 7.4x.

Anadex Instruments, a manufacturer of electronics. +2x.

SAGIMO, a real estate company focused on the French market. +2x.

General Capacitor. Bankrupt.

International Holding Corp, an insurance fund started by Davis & Rock, that subsequently acquired General Corp. Unknown.

Benrus, a watch manufacturer. Unknown.

Intersil, a manufacturer of integrated circuits for watches developed by Traitorous Eight member, Jean Hoerni. Unknown.

As illustrated, the bulk of the 33x fund return came from Teledyne and Scientific Data Systems (SDS).

The latter company was founded by Max Pavelsky, a Packard Bell engineer with a management style that made an impression on Arthur Rock.

I was convinced Palevsky was going to make money. Very few people turn me on the way he did...Max was and is a very interesting man... He was a very, very good manager. But his style was different than most people's style. His was an easy going, slap you on the back, put your feet up on the table [type of person]. I think he was the first executive I ever came across who didn't wear a tie.

In Pavelsky, Rock saw a reaffirmation of the lesson he'd taken from the Fairchild transaction — remarkable people, not ideas, were the secret to great investments. According to Rock, Davis & Rock invested $257,000 into Pavelsky's venture, a decision that would return as much as 380x.

In addition to delivering absurd returns, together, Davis & Rock's partners solidified a style of venture investing and talent spotting that has influenced every successor to some degree or another. Davis best articulated this approach in a 1966 speech to the Western Electronic Manufacturers Association. During his address, he noted a focus on six founder characteristics.

Integrity. "The guts to take responsibility, admit mistakes, face the facts."

Motivation. "This is the key criterion...The motivation of the man I want to back is to build a large, important company. To him, the products and product fields are not objects of affection or evidences of his brilliance, but merely the means to achieve his goal as a builder/manager. And he intends to keep sweating and sweating and sweating to attain this goal."

Market-oriented (the desire to sell). "The man I like to back...has interest only in things that people are going to buy, buy soon and buy in quantity...He knows that everything has to be sold. He's quite different from many engineers I have seen whose reaction to every slump in sales is to run back into the laboratory to invent something they hope will sell itself."

Skills and experience. "The man to back in starting a company must have the technical capability to create in his chosen fields...he should have had experience in actually managing operations of substantial size.

Accounting ability (understanding of financial levers). "A real manager has a deep appreciation of the role inspired accounting can play in his company. Without accurate information on costs, the really astute manager knows he cannot price his product appropriately, or bid on contracts with any assurance. And he cannot tell where to place his efforts in cost reduction."

Leadership. "I won't try to describe this quality."

He also identified the attributes the pair looked for in businesses.

Manufacturing over services. "I like manufacturing because you sell your design repetitively, and the more you sell, the more profitably you can produce, either by breaking the production down into less and less skilled activities or through employment of machines."

Sophisticated products. "It is a lot easier to prove superiority in such products than in, for instance, alphabet soup, cigarettes, light bulbs, and printed circuit boards."

Existing, growing markets. "I like to back a man who wants to operate in fields which already have markets of around $100 million and which are still growing rapidly... say, 15 percent to 20 percent or more a year."

The polar opposite of Davis personality-wise, Rock usually opted for fewer words. When asked about his approach, Rock noted:

Well, it's all about the people...Good ideas and good products are a dime a dozen….good people are rare.

Rock exercised that ethos for the rest of his career.

45,000x

In 1968, Davis & Rock's partnership expired. While there was no bad blood between the two men, they decided to go their separate ways, in part because of byzantine securities laws that would have required Rock to step down from SDS's board.

Arguably, the best was yet to come for both. Tommy Davis went on to found Mayfield, a celebrated fund in its own right. Meanwhile, Arthur Rock was about to play a pivotal role in the founding of another historic business.

Passed over for promotion, Bobby Noyce decided it was time to leave Fairchild Semiconductor. The Traitorous Eight had created game-changing technology, but there was little incentive to stay now the unit was wholly owned by Fairchild. By 1968, only Noyce and Gordon Moore remained. And once they had an idea for a new business — focused on using silicon for computer memory — they knew who to call.

[N]oyce called me and said, 'Gee, I think maybe Gordon and I do want to leave Fairchild Semiconductor and go into business for ourselves.' And so we talked about it for a while and I asked him how much money they needed and he said two and a half million dollars. And I said, 'Well, how much money are you guys willing to put up?' He thought about it for a while and said, 'Well, we'll each put up a quarter of a million dollars,' which represented a fairly good portion of their net worth at the time."

Rock did not doubt the capabilities of the founding pair. Later in life, he would remark that he was "never 100 percent sure that a company would make it, except for Intel [the company they founded]. Of that, I was absolutely sure."

It wasn't called Intel at that point, of course, referred to instead as "NM Electronics," borrowing from the founders' initials.

Once again, Rock sprung into action, making the play that set the rest in motion. He wrote a two and a half-page business plan for NM Electronics "devised to say nothing." In an afternoon, he raised a $2.5 million seed round from 15 investors for 50% of the business. Reflecting on his work, Rock remarked:

It was easy. Noyce and Moore were extremely well known and had a proven record. They had done fantastic things at Fairchild Semiconductor, and there was no real competition at the time, so it wasn't a difficult call. The financing was so sought after that people were calling Moore's wife to try to get into it.

In exchange for his help (and personal investment), Rock received 10% of Noyce and Moore's company. Over the following decades, Rock was ever-present at Intel, an active member of the board, even serving as chairman. By the time he stepped down in 1999, Intel was worth $225 billion, a 45,000x markup from the initial $5 million at which the firm was valued.

The opera of Apple

By 1977, Arthur Rock was flying solo. After Davis & Rock had expired, he'd formed Arthur Rock & Associates, bringing in Richard Kramlich as a junior partner. Kramlich would go on to found New Enterprise Associates, another leading venture firm. While Arthur Rock & Associates performed well, it didn't match Davis & Rock's numbers. Using a structure reminiscent of today's "solocapitalists," Rock reverted to a leaner operation, forming Arthur Rock & Co. The new firm had just two members, Rock, and his secretary.

It was thanks to an old friend that Rock found his next win.

Mike Markkula had worked as a marketing manager, first at Fairchild and later at Intel. After retiring at the age of 32, he'd been coaxed back into action by a strange, lank-haired young founder: Steve Jobs. Markkula joined the upstart's new venture, Apple, bringing $250,000 with him, most of which came in the form of a personal loan.

As the Apple co-founder with most business acumen — both Jobs and Wozniak were predominantly technical — Markkula was tasked with leading its fundraising efforts. Of course, he reached out to Fairchild's facilitator to see if he was willing to meet with Apple's young founders. Rock was not impressed.

I met with Steve Jobs and Steve Wozniak. They kind of turned me off as people. Steve had a beard and goatee, didn't wear shoes, wore terrible clothes, hair down to his collar, and probably hadn't had a haircut in twenty years...He looked as if he had just come back from seeing that guru he had in India, and he kind of smelled that way too.

Thankfully for him, Markkula persuaded Rock to attend the Homebrew Computer Show, located in San Jose. After the Two Steves had failed to make a positive personal impression, Markkula hoped the technology would do the talking. When Rock showed up to the large auditorium, filled with budding technological projects, he noticed that one table proved the biggest draw:

I walked over to the Apple booth, and I couldn't get close to it. People were piled up behind the booth. I began to figure maybe there was something to this.

Convinced by popular opinion as well as Markkula's involvement, Rock invested $57,400. After jumping aboard, Rock would develop a meaningful relationship with Steve Jobs, who described him as "like a father." In addition to his business mentorship, Rock took Jobs to his first opera, Tosca, hosted him at his ski lodge in Aspen, and shared his other passions. Jobs later recounted an exemplary episode of Rock's holistic tutelage:

I remember driving into San Francisco one time, and I said to him, 'God, that Bank of America building is ugly,' and he said, 'No, it's the best,' and he proceeded to lecture me, and he was right of course.

The trust that Rock and Jobs built complicated matters when it came time for Apple's board to pick between the company's founder and professional CEO, John Sculley. Rock sided with the latter, a decision that pained Jobs.

He chose Sculley over me. That really threw me for a loop. I never thought he would abandon me.

By the time Jobs returned, Rock had left the company's board, stepping down after Apple began to directly compete with Intel. At the 1980 IPO, Rock's Apple holdings were reportedly valued at $14 million, a return of 244x. Today, those shares would be worth over $21 billion.

Lessons

Have you heard of Hikaru Nakamura?

Though even passing chess fans will recognize the name and grumpily ponderous face of Magnus Carlsen, many fewer may have heard of Nakamura. And yet, both men are world number ones: Carlsen, the king of the men's game, and one of the all-time greats, Nakamura, the champion of "blitz chess."

In all ways but one, blitz chess is the same as the traditional game. The difference is speed: blitz requires players to make their moves within 10 minutes or less. By altering that parameter, different talents are amplified — players rely less on calculation and more on instinct. That favors players like Nakamura, only ranked #18 in traditional chess, while disadvantaging those like Fabiano Caruana. Though world number two in the classical game, Caruana slumps to #38 in blitz, his slower style wilting under time pressure.

(Carlsen, the cognitive freak, sees his relative skill dip only marginally; he is #2 in blitz chess.)

Modern venture capital looks a lot like a "blitz chess" version of the original. The influx of capital and proliferation of funds have created a competitive dynamic in which speed is one of the most crucial vectors of differentiation. That's forced modern investors to adopt a more proactive stance, meeting companies where they are and front-running deals by building an audience. It makes drawing lessons from Arthur Rock's success somewhat difficult, equivalent to studying Capablanca or Spassky's moves to improve one's rapid game.

Rock himself seemed to recognize venture had changed since his heyday, noting a shift beginning at the turn of the millennium:

I get my kicks out of building companies. [Early VCs] were all company builders. And people entering the business in the late 1990s were promoters. They're always promoting their companies and promoting their deals.

Of course, every great chess player does study the work of early masters, even if they wish to apply themselves within the confines of a compressed game. And so, though there are undoubted differences in the manner of play, lessons remain. In particular, Arthur Rock's work exemplifies four rules, some of which run counter to common venture practice.

Stubborn on the person, flexible on the structure.

Find a mafia.

Dare to manage.

Advocate, not friend.

Stubborn on the person, flexible on the structure

Rock's style was defined by a focus on the person. That, more than anything else, was the true non-negotiable.

The key is faith, faith in people...When people want backing, I look at their personal philosophies and judge whether they are limited people. Some guys want to play the game safe, not take any chances and keep small.

As described in our telling of the Davis & Rock story, Rock favored high-integrity, mission-driven founders. He would spend extensive time with builders before choosing to back them. More than vetting the technology or business model, Rock wanted to understand what made people tick. In particular, he was keen to separate the self-interested from the true, driven builder.

I don't like businessmen who are too promotional. I like a man who has a dream, who wants money to do something with, not just to have. If a guy has a good idea, I can figure out how much money I can make on it. I want him working on the idea.

While Rock was stubborn about who he worked with, he was flexible on the structures of the arrangement. With no set way of operating, Rock showed a willingness to trial different models, dependent on the circumstances, showing formal creativity.

We see this from the very beginning. Rather than simply shipping the Traitorous Eight off to another employer, Rock devised a way for the group to stay together and work on their research. He recognized that starting a company from scratch was not realistic, and so secured a corporate sponsor that provided the founders and his investment firm access to upside.

At Davis & Rock, he formed an insurance fund to conduct a buyout, and later, he engaged with Noyce and Moore in an almost incubatory capacity. Rock started his relationship with Intel on the ground floor, raising money and helping to drive strategy.

Today, though many investors would not wish to admit it, Rock's preferences have traded places. The formalization of the asset class means that structural creativity is rare — deals are conducted within set parameters. While this increases the speed of transaction (and, to some extent, protects against abusive terms), it represents a limitation.

Meanwhile, the compressed cycle of modern investing has forced more flexibility when it comes to the founder. Investors must be willing to provide financing with less information and more uncertainty over the individual's motivations and abilities. (To those that argue they can deduce such information in a single thirty-minute meeting: I do not believe you.)

Where possible, Rockian investors will find ways to bring deliberation to the process — particularly when it comes to the person at the helm — while developing a creative, flexible mindset elsewhere.

Find a mafia

Arthur Rock recognized that serendipity played a role in his success:

You've got to be lucky. Everybody's going to be lucky at some time or another. The thing I'd say is that I was lucky enough to be lucky early.

He was referring, of course, to his connection to the Traitorous Eight and his subsequent involvement in founding Fairchild Semiconductor. Fortune indeed favored Rock in delivering that letter to his desk (though many others couldn't see its value), but what separated him was his ability to turn one stroke of luck into ten.

While other investment bankers might have felt their work was finished after closing the transaction, Rock developed a genuine relationship with the eight scientists. That would serve as the bedrock for future success, with Rock capitalizing on the emergence of a "Fairchild Mafia." Investments in Intel, Apple, and Intersil all arose from connections to the semiconductor unit.

Establishing a position within a powerful Mafia is an almost singularly valuable foothold. High-performance businesses tend to have a large number of high-performance people. The shared characteristic among this group is professional competence — precisely the dimension upon which VCs evaluate investments. This is fundamentally different from other communities (affinity groups, for example), in which the shared characteristic may be irrelevant to an investor (a love of Japanese cinema). Alumni groups have the shared characteristic of relative academic ability, but this translates less directly to startup success, and ties tend to weaken over time. Ultimately, owning the right Mafia can deliver a steady stream of vetted deal flow.

Modern investors have found success emulating that approach and can continue to do so. While PayPal boasts the most storied contemporary Mafia, recent companies have developed strong diasporas, including Uber and Airbnb. While early investors in those businesses (and others like them) will have a natural head start, there is room for outsiders to create a niche, particularly among less mature companies.

For example, if an investor believes Figma — on track to be a generational company — will produce a crop of promising entrepreneurs, they may be able to establish a reputation as a design-friendly capitalist. In concert, they may court mid-level and senior executives entering their last year of an earnout. Over time, such efforts might compound into a genuine competitive advantage: recognition as the first port-of-call for talent leaving the business.

The success of such efforts is likely to be idiosyncratic and highly dependent on the investor's abilities. But should they find a hit, the characteristics of a Mafia make it much easier to find successors.

Dare to manage

If contemporary venture capital can be damned by a single phrase, it is this one: "Let me know how I can be helpful."

Those words have become synonymous with a certain type of well-intentioned but vacuous venture investor. The implication is that VCs are effectively useless, banal moneymen at pains to appear rather than be helpful.

This portrayal has risen in correlation to another stereotype: founder as genius. As deals have become more competitive, firms have jockeyed to position themselves as increasingly "founder-friendly." Often, this manifests in a stance of obsequiousness in which the venture firm depicts themselves as lowly capitalists in service of a numinous ability beyond questioning. The not-so-hidden message of many funds' websites is this: you're brilliant, we're sorry, we'll get out of the way.

Arthur Rock would have had absolutely none of this.

Though he believed in listening more than speaking, Rock recognized that he possessed a business acumen that many founders might not have developed. Of course, Jobs was a genius, but Rock realized he was not beyond coaching or advice. And while an interlocutor might note the age and experience gap between the two men, Rock was willing to share an opinion from the beginning of his investment career. He did so even among entrepreneurs who undoubtedly understood their technology far better than he did. In the process, he demonstrated that founders were not mythical creatures but fallible humans.

Fundamentally, Rock saw himself as an active force in a company's life, not a passive one. He noted that the venture industry seemed to have moved away from this positioning:

There's a huge difference in a lot of venture capital firms. I think maybe Kleiner Perkins and a couple of the other older ones still try to give some management help. There's so much money around that they're fighting to get into deals, and decisions are being made over the telephone. People are calling up saying, I've got to be in this deal, without ever knowing anything about it.

In capitulating to the "cult of the founder," investors do themselves and their portfolio companies a disservice. As one CEO remarked of Rock, "his individual contribution has been the difference between success and failure for us."

Advocate, not friend

Arthur Rock did not seek to become friends with founders. Some described his style as "detached and clinical," while others noted being scared of him. Instead, he sought to act as an honest broker — highlighting issues, pushing weak thinking, and inspiring through his commitment to the cause. As one entrepreneur noted:

Arthur could provide capital and guidance. But he also had a third role, by showing commitment – devoting yourself to success, disciplining yourself for success, to make the right decisions to be successful. That helped him build great companies.

Related to the previous lesson, Rock maintained a professional relationship with his portfolio company founders. This seems to have enabled him to more easily offer constructive criticism, something that may be made difficult by a more casual friendship.

The motivation behind the "let me know how I can be helpful" mantra is the modern VC's desire to be friends with everyone. Increased competition means that anything other than full-throated approbation carries a risk — getting branded as "unfriendly to founders," even fleetingly, can impact one's deal flow. As alluded to above, that's created a class of VC cheerleaders. While that may insulate investors from passing castigation, it limits candid discussion. As investors onboard new portfolio founders, they may consider maintaining a more Rockian distance.

Many in Silicon Valley may not know Arthur Rock's name. He wouldn't mind, of course; he once said that he'd "rather be known as a skier." But the cradle of technological advancement could not have existed without him.

Viewed through a particular lens, the flourishing of today's tech and venture market can be traced back, movement by movement, action by action, to an investment banker, sitting at a desk, reading a letter.

____

My thanks to Ho Nam, Sajith Pai, and Neckar Capital.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Coming in two years after that fact here, but this was fantastic