Consider the Eel

Inside the curious and potentially lucrative quest to grow eels in a laboratory.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about the quest to cultivate edible eels in labs.

The real eel. You have seen an eel or at least a picture of one, but there’s a good chance you don’t know the real eel. These are some of Earth’s strangest creatures, equipped with poisonous blood, multiple body transformations, metamorphosing digestive systems, and long lifespans. European eels are known to travel thousands of miles over land to reach freshwater lakes before returning to the ocean to spawn.

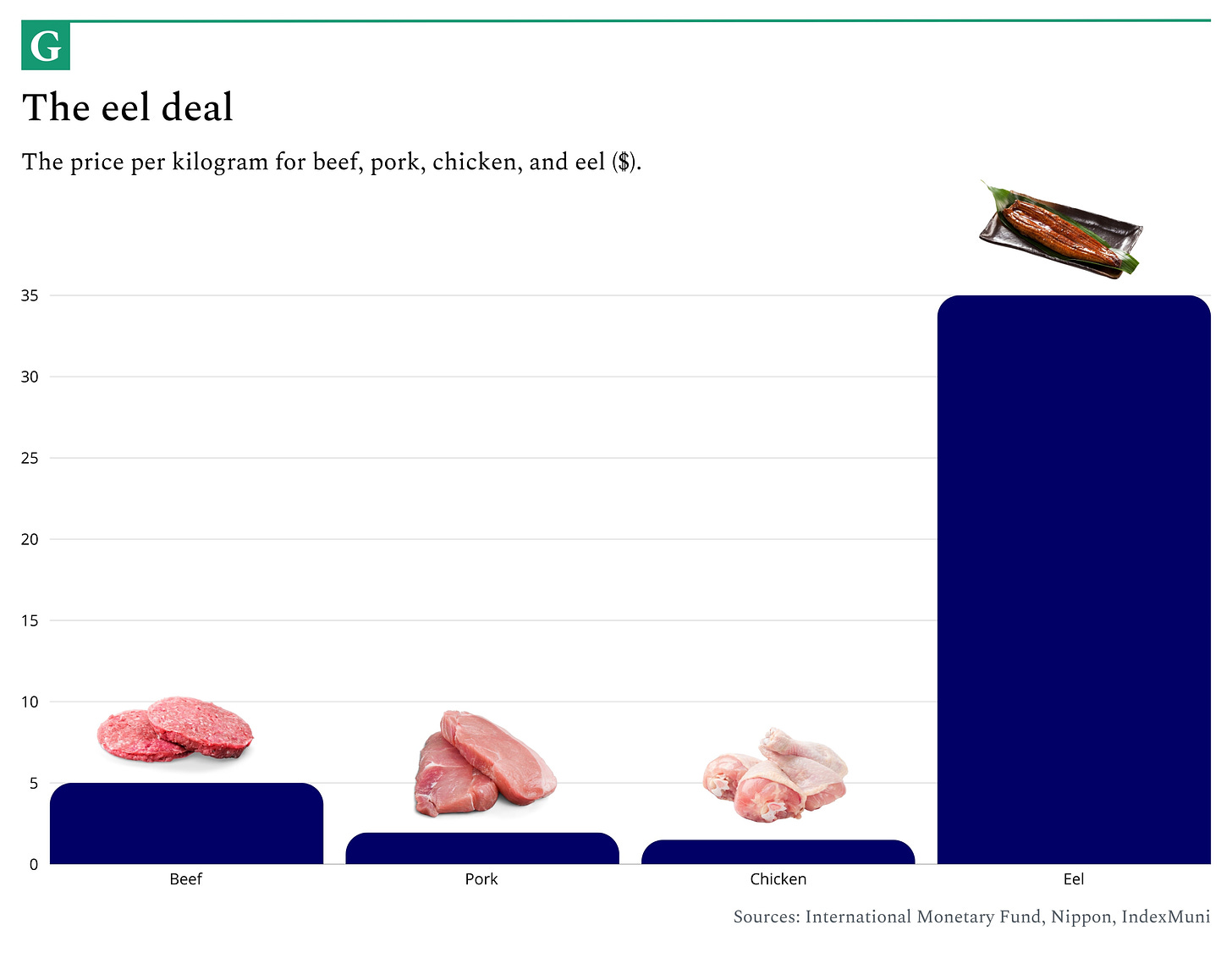

The price is right. The lab-grown meat industry has struggled to create products that are price-competitive with natural ones. Beef costs roughly $5 per kilogram, while chicken comes in at $1.50. Given the complexities of growing meat from stem cells, achieving parity has proven challenging. To give itself a shorter path to profitability, the Israeli startup Forsea Foods has chosen to focus on eel, a popular fish that sells at $35 per kilogram. It represents a differentiated approach to a challenging sector.

Growing appetites. Aficionados of Japanese cuisine will be familiar with eel’s many preparations. Unagi kabayaki, in which an eel is grilled and seasoned with sweet soy, is one of the country’s favorite dishes. The global eel market is worth $4.3 billion, with 70% of consumption occurring in Japan. It’s also growing, driven by increasing demand in China and South Korea.

Go fish. Demand for eels has gotten so high that a bustling smuggling trade has emerged. Narcotics gangs transport billions of dollars worth of baby glass eels across international borders, participating in the “largest wildlife crime on Earth.” Trafficking has been buoyed by the fact that it’s nearly impossible to farm eel, a significant difference from other popular species like salmon, tilapia, and trout.

Tastemakers. On June 4, Forsea Foods invited select guests to sample its lab-grown eel. The verdict? Pretty, pretty, pretty good. Though naturally, there’s significant room for improvement. For the company to truly take off, it will have to persuade picky eaters, many of whom are skeptical about cultivated meats. Approximately 30% of Japanese consumers—eel’s largest market—would be unwilling to try synthetic seafood.

50 game-changing startups – all in one place.

Two weeks ago we released the inaugural edition of Future 50, a database featuring the world’s highest-potential startups, supported by our friends at Mercury.

The Future 50 is the result of months of collecting nominations from leading VCs, researching different companies, and reviewing private data. You won’t want to miss it. Here’s a sneak peek of the startups you’ll hear about:

The AI company detecting wildfires faster

The “Saudi Aramco of carbon removal” reforesting the Amazon

The maternal healthcare provider that’s already impacted 3M lives

The tech-powered trucking company that’s surpassed $45M in revenue

…and 46 others. Each company is accompanied by a detailed description and clear rationale of why we think you should have it on your radar.

“Throughout the Middle Ages and in modern times, too, there was a veritable hunt for male eels,” wrote a young Sigmund Freud in 1876. As a twenty-year-old research student in Trieste, Italy, the future founder of psychoanalysis was part of that hunt, spending his days dissecting the bodies of the long, rippled anguilliformes.

If our cosmos has a creator, eels are an indication that they possess eccentric tastes. It begins with the name, an odd double vowel sliding across an ocean floor. A glance confirms the viewer’s suspicion that one is dealing with a curious predator, a floating comma with fins, a tilde with teeth. To watch them flash about a tank at your local aquarium or confront them on a scuba dive is to feel both interest and unease, drawn in by a dark magnetism.

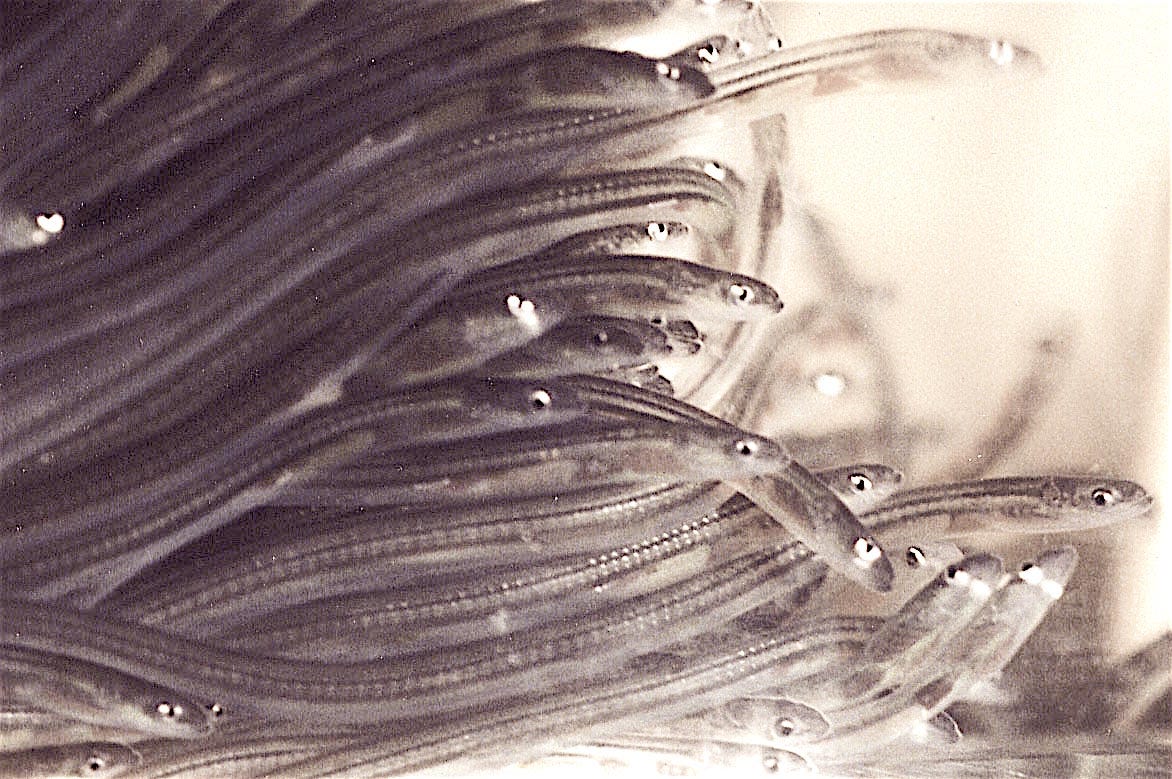

Neither name nor appearance truly captures the eel’s perplexing essence, though. These are magical fish that carve out enigmatic existences. Though eels begin their lives in saltwater, they migrate to freshwater, eventually returning to the ocean. Each of these trips necessitates a full transformation, which is why an eel takes so many forms: as thin, crystalline “glass eels,” opaque adolescents, and grim stone-colored adults. They live for fifty years or more, and though they appear to have the traction of a bar of wet soap, they have been known to climb dam walls in their astonishing, thousand-mile transits to our lakes and ponds. Oh, and their blood is toxic.

What brought Freud to Italy’s Far East was yet another of the eel’s mysteries: their genitals. Eels only develop sexual organs later in life, as they prepare to return to the ocean to breed, which makes determining their sex especially difficult. The young zoology student spent his days desperately searching for eel gonads as part of a research team’s quest to uncover its reproductive mysteries. In the evenings, Freud wandered the streets with “hands stained white and red with the blood of marine animals,” he later wrote. “Cell detritus swims before my eyes, which disturbs me even in my dreams, in my thoughts nothing but the great problems connected with the world of ducts, testicles, and ovaries.” What came next for Freud is, as they say, history.

Beyond their mysteriousness, eels possess another key trait: deliciousness. Though not to everyone’s taste, the slippery fish are prized in dishes around the world. England serves them cold and jellied in aspic, Spain sautees adolescent “elver” eels with oil and garlic, and Vietnam stir-fries them with bean sprouts and coriander. In terms of consumption volume, none of these countries compare to Japan, where unagi tops sushi rolls, sizzles on grills, and illuminates donburi.

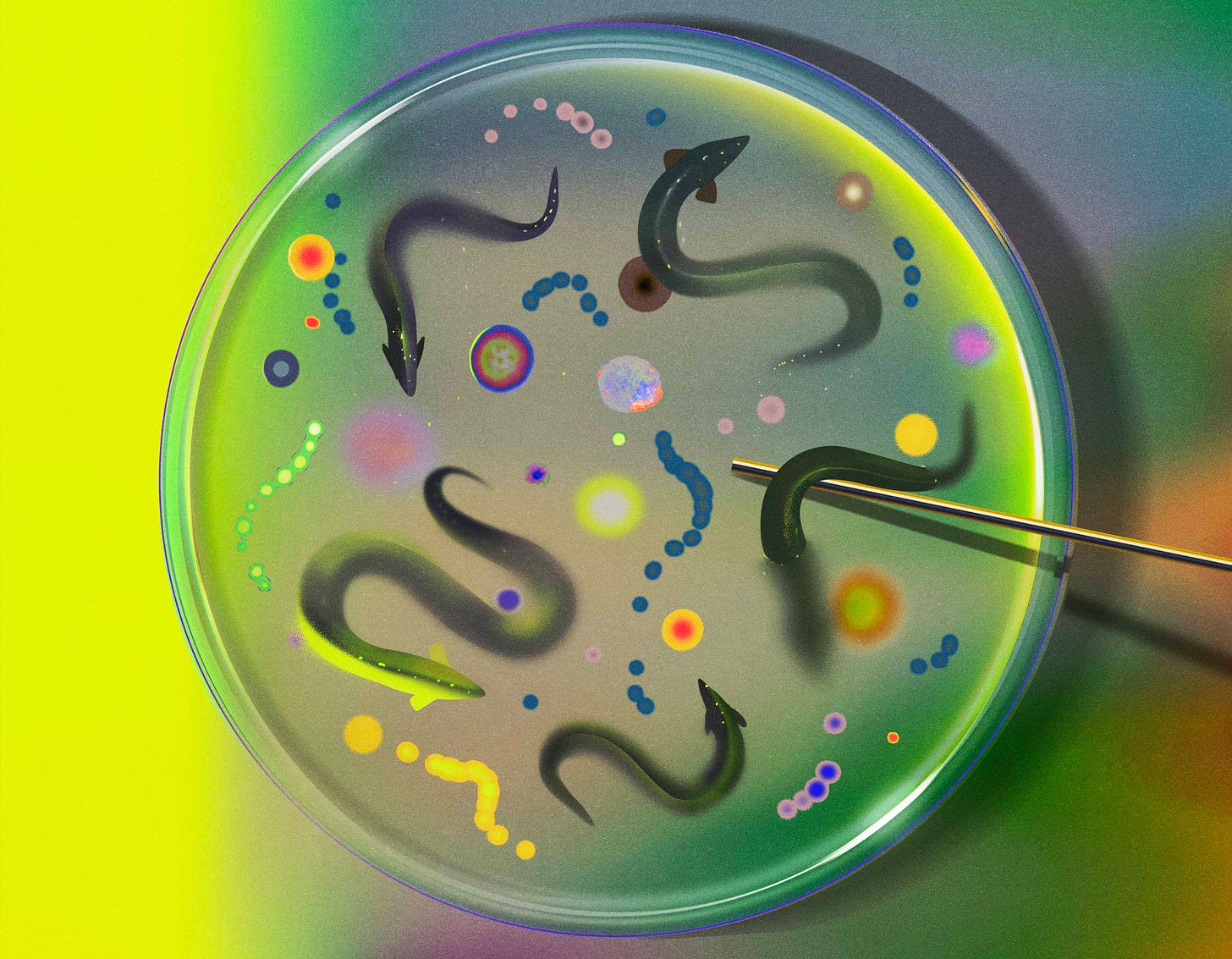

Given eel’s complexity in form and taste, the idea of growing them in a lab sounds far-fetched. How can you cultivate a changeling? What numinous petri dish permits the construction of a naturally poisonous, sexually complex dinner dish? Generating a passable facsimile of a hamburger – uniform in taste and texture – has proven a significant challenge for the cultured meat movement. What hope does the eel have?

Forsea Foods, an Israeli startup, is undaunted by the challenge. Though the Israeli startup’s research is markedly less bloody than Freud’s, it contains similar revolutionary potential to the psychoanalyst’s theories. In the three years since its founding, Forsea has carved an alternative path in the lab-grown meat landscape, eschewing popular products like beef and pork for eel. It has done so with minimal venture funding and has succeeded in constructing a promising prototype. Earlier this year, it invited a select group of diners to try its creation.

To explore this story, we spoke with an extensive list of sources, including Forsea’s leadership, cellular agriculture investors, global eel experts, and Indonesian fishery operators. In doing so, we’ve illuminated an unheralded, curious, and potentially lucrative corner of the cultivated meat market and the strange, cryptic world of the eel.

Golden grams

The Wright Brothers’ moment for lab-grown meat arrived in 2013 in the humble form of an 85-gram burger. Produced by Professor Mark Post and with the research funded by Sergey Brin of Google, the burger was a revolution on a plate. It also had a long way to go. Two food critics who tried it said that while Post’s patty was definitely meat, it possessed an odd flavor and lacked the fats and juiciness one associates with a burger. Had they been forced to foot the bill, the reviewers wouldn’t have found it value for money given that it cost $330,000 to make.

Post’s achievement catalyzed a sector and set off a frenzy. Lab-grown meat offered a solution to the massive environmental destruction and suffering caused by traditional animal agriculture. Meanwhile, investors drooled at the thought of disrupting a global meat industry valued at $1.4 trillion in 2023 and expected to grow as consumer wealth increases.

In the intervening eleven years, a slew of well-funded startups have come to market to attempt to capitalize on the industry. Upside Foods (formerly Memphis Meats) has ingested nearly $600 million to create synthetic chicken, while Mark Post’s own company, Mosa Meats, has consumed $138 million to scale up his innovation. (Beyond Meat, though traded publicly, is best known as a provider of plant-based “meats,” a different proposition.)

Despite the talent and capital deployed, creating a product that is delicious, scalable, and price competitive remains elusive. “Unfortunately, there’s been no major success stories, certainly not from a financial perspective,” says Andrew Chow, co-founder of Agronomics, one of the largest investors in the foodtech space.

Only four companies have received regulatory approval to sell cultivated meat in any jurisdiction, and sales have been limited to a few curious or discerning customers. In recent years, funding for startups in the field has also dried up. Global interest rate hikes are part of the story, but so is disillusionment among investors who had hoped for faster results only to see companies that once raked in funds fail to deliver. In 2023, funding for cultivated meat declined by 78%.

The cost has proven to be the most significant barrier. The industry consensus is that for cultivated meat to be consumed on a mass scale, it needs to achieve price parity with a traditional product from a slaughtered animal. So far, no one has managed to do that.

“We knew it was challenging, we knew it was going to take a lot of research and development efforts,” said Amir Zaidman, founder and chief business officer for The Kitchen Hub, an Israeli foodtech incubator that invested in Forsea. “But I think, though we knew it would take several years, we didn’t anticipate the full depth of research that was required.”

The Tesla strategy

Forsea is betting that eel presents a potential solution to the cost conundrum. Given the sheer volume of R&D spending the sector still requires, CEO Roee Nir believes starting with a premium offering makes the most sense rather than targeting popular low-cost products like hamburger patties or sausage links. In that respect, Forsea’s approach emulates Tesla’s, settling for a smaller beachhead market size to put profitability in sight.

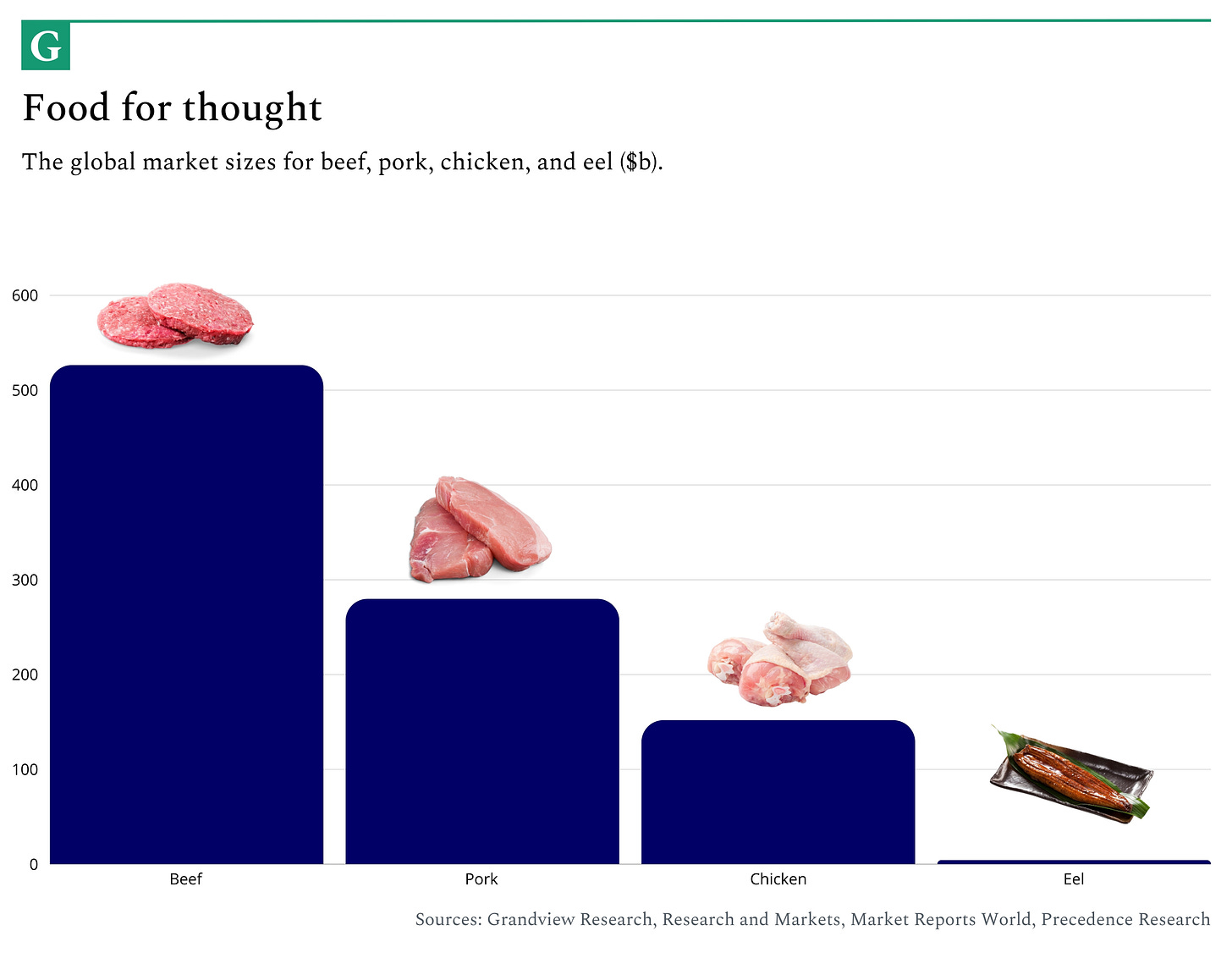

In 2022, the value of the global eel market stood at $4.3 billion, a fraction of the size of beef ($526.5 billion), chicken ($151.9 billion), or pork ($279.90 billion).

However, whereas chicken’s price usually hovers around $1.50 per kilogram and beef sells at around $5 per kilogram, eel sells at around $35 per kilogram in Japan. That makes reaching price parity with a cultured product much less daunting.

Forsea’s decision to focus on eel is no accident, but rather the result of a considered process. When Nir founded the company in 2021, he knew he wanted to specialize in seafood. In part, that was inspired by the competitive dynamics in the sector. As mentioned, well-funded companies had emerged to produce cellular chicken and beef, but few were taking on fish. Human’s natural seafood consumption habits also helped, with dozens of different species consumed. That left room for multiple winners. For example, BlueNalu has made substantial progress in culturing the fatty belly of bluefin tuna, but this poses no direct threat to Forsea.

Once settled on seafood, Nir narrowed his options further, filtering by three dimensions. The CEO specifically looked for fish with high price points, market sizes of $1 billion or more, and endangered populations. “Eel really stood out in this area in terms of the amazing potential that it has without any ability to supply it,” Nir said.

Not only is eel meat already expensive, but its price looks set to rise. Consumers continue to tuck in, but the global population is cratering, threatened by climate change, overfishing, and fierce smuggling. Since 1980, for example, the European eel population has fallen by 98%. Supply has declined so rapidly that some environmental scientists have called for it to be removed from menus.

Forsea plans to launch a cultivated eel product commercially by 2026, just five years after its founding, an unusually quick rollout. It will start in Japan, where it is already seeking regulatory approval. The country accounts for a large share of eel consumption, with citizens eating 50,000 tons a year, by some estimates. Older benchmarks suggest that it accounts for as much as 70% of global consumption. Eel is embedded in Japanese cultural events, such as the “day of the ox,” a celebration in which millions feast on unagi kabayaki – a classic dish where eel is butterflied, doused in sweet soy, and grilled.

According to Nir, the only hurdles in Forsea’s path are obtaining regulatory approval and the capital to scale up the product. How can the startup CEO be so confident, given the sluggish pace of innovation in the sector? The answer lies with Forsea’s cutting-edge technology.

The organoid revolution

On paper, the process of growing cultivated meat sounds simple. First, stem cells – cells that can turn into any other type of cell – are extracted from an animal. The cells are then “immortalized,” modified so they can multiply forever instead of aging and ceasing to replicate over time. These immortalized cells are then placed in huge sterile steel bioreactors, which allow for careful control of the environment. There, they sit suspended in a medium. This soup of hormones, proteins, and nutrients prompts the stem cells to develop into muscle, fat, or skin, as desired and provides them with the food they need to develop. Once you have enough cells, harvest them, cook them, and voilá! Bon appétit.

Until the last decade, cell cultivation has mainly been the domain of the pharmaceutical sector, used for cancer research, vaccine production, and gene therapy. This type of stem cell work has four distinctive traits that separate it from lab-grown meat.

Low volume. The pharmaceutical applications outlined typically require a small number of cells to work. There’s no need for these companies to scale processing into the tons.

High fixed costs. Production relies on highly specialized tools and expensive raw materials, both of which contribute to a capital-intensive process.

High operational costs. The smallest contamination can compromise a pharmaceutical product, further driving up costs and increasing complexity.

Extreme pricing power. Consumers often have no alternatives to a medicinal product, meaning that pharma companies can sell at elevated prices. This essentially offsets the difficulties incurred by the first three traits.

In short, pharma cell cultivation is low volume, high cost, and high margin.

Cultivated meat has very different requirements. The food industry is extremely high volume, with low costs, and low margins. For consumers in the developed world, cheap meat is sitting on every supermarket shelf. And, since prices are low, profit comes from selling lots of it. Each year, the world produces over 350 million tons of meat. Even eel production runs into the hundreds of thousands of tons – with production and consumption concentrated in East Asia. This is mass production in the most extreme sense of the word.

Some researchers, looking at these challenges, have declared it impossible to make cultivated meat commercially viable. Naturally, members of the industry don’t share such pessimism and have some evidence to justify their bullishness. Andrew Chow of Agronomics claims that several of the companies he’s invested in have already “blasted through” the price assumptions of techno-skeptics. Reducing the costs of raw materials (especially mediums) and operating at “food-grade” rather than “pharma-grade” standards have delivered key early wins.

Roee Nir believes that Forsea’s biggest advantage is its approach to cell cultivation, which he argues is significantly more efficient. “What we’re doing is we’re building organoids, mini-tissues that spontaneously differentiate into edible cells,” Nir said. This is the technology Forsea was founded on.

To understand Forsea’s innovation here, a little background is required. All cultured meat startups rely on something called “directed differentiation.” This process relies on using chemical prompts to instruct the stem cells on what they should turn into. A stem cell in a petri dish is a bit like an actor standing on stage, waiting for tuition; “directed differentiation” delivers both the director and the script.

Forsea’s organoid process treads an alternative path, using technology previously limited to pharmaceutical applications. The stem cells require much less prompting, dividing, differentiating, and coalescing into three-dimensional clumps. This is the equivalent of a cellular improv troupe, taking the odd suggestion from the audience but otherwise following its own instincts. It’s not quite like spawning a disembodied filet of fish, but it’s perhaps closer than anyone else has got.

For some, the mention of organoids invites skepticism. Chow, while emphasizing he knows little about Forsea as a company, expressed worries about the technical challenges. “It’s hard enough just to grow single cells and enough biomass in an efficient manner at a price point that is competitive,” he explains. “So, if you’re asking them to do that and form muscle fibers, I don’t think you’ve got a chance in hell. I think they’re probably 10, 15, or 20 years ahead of their time.”

Nir, however, insists that organoid technology is not only viable but saves on costs. Since organoid technology allows the cells to largely guide their own development, the company does not need to add nearly as many expensive “growth factors,” complex proteins that guide cell development.

Organoid technology allows Forsea to grow different types of cells—muscles and fats, for example—in a single bioreactor. Many other companies typically use separate reactors for different types of cells, which they then combine at a later stage, adding to the cost.

Because the cells form three-dimensional clumps on their own, you also don’t need to use “scaffolds” – biological materials used to shape the cultured meat. All Forsea uses are some molds to get the tissue in the right shape. Again, this cuts down on both production time and costs.

The decision to focus on eels has brought complexities, admits Nir, but also opportunities. While there is a long history of research on cultivating mammalian and even chicken cell lines for reasons of pharmacological research, there has been little reason to do the same for fish. In working out how to immortalize, differentiate, and proliferate eel cells, Forsea had to almost start from scratch.

As it turned out, that didn’t prove to be a significant issue. Forsea’s research discovered a number of advantages in cultivating fish cells compared to mammalian or avian ones. Eel cells, in particular, are robust and able to tolerate lower temperatures, a wider pH range, and less oxygen, all of which favorably impact Forsea’s bottom line. The mini-tissues produced by organoids also suit seafood particularly well. Seafood cuts are usually fairly uniform, lacking the long muscle fibers or marbling you find in beef or steak.

While technically persuasive and intriguing, Forsea’s real challenge may not arrive in the laboratory but in the kitchen. Though scientists and tech analysts may find the prospect of a disembodied fish filet fascinating, winning over diners is another matter.

Dinner is served

On June 4, at a Japanese restaurant in Tel Aviv, Forsea stepped up to the plate. Guests, including investors and members of the Japanese embassy, were invited to sample Forsea’s eel served three ways: a fish katsu sandwich, a fish kebab, and unagi kabayaki. Yuval Ben Neriah, owner of Taizo restaurant group and one of Israel’s most-renowned chefs, was impressed by the product he was given to work with. “I’d say it’s 60-70% of the way to something like the real thing,” Neriah said. He has been working with Forsea since early 2024, developing prototypes.

“I think most people were surprised by how good it tastes,” Neriah added, though admitted that work is still needed. The consensus among diners was that while the cultured eel was delicious in its own right, its taste didn’t yet perfectly match “real” eel.

Industry insiders often consider emulating the texture of real meat to be harder than capturing its taste. Yet, Neriah believes that Forsea has nearly completely cracked it on this dimension. “If you look from not very close, you would think it’s an eel. Some of my cooks didn’t understand what this was until we told them,” he said.

Peer closer, however, and you begin to see some of the tricks that are still needed to recreate the look and feel of the original. Forsea can’t yet grow organoids with skin, so instead, a gelatin made of nori seaweed is used on the outside, delivering an extra punch of umami.

Other diners we spoke to concurred in their assessments, professing to be impressed, even if they felt there was room for improvement. For Dana Bublil, an investment manager at the technology investment firm Target Global, which is backing Forsea, the most impressive part was how quickly the company reached this point. “We rarely see companies taking commercial steps like this so early.”

Getting Forsea’s katsu sandwiches onto more plates will rely on receiving regulatory approval and winning over consumer palates. Nir admits that Japanese bureaucratic processes can be a little slow. Thankfully, Japan’s Prime Minister Fumio Kishida announced his support for the industry last year, paving the way for Forsea’s rollout. As a result, Nir expects the regulatory approval process to go as smoothly as one might hope for a novel technology.

Within Japan, Forsea plans to target the country’s large restaurant sector. The first location will likely be Tokyo vegan restaurant Saido, whose world-famous chef Katsumi Kusumoto is already advising Forsea. In the long term, the company aims to target Japan’s ubiquitous cheaper eateries. Nir also cited the interest of the country’s major food suppliers as an encouraging sign, though he declined to name them.

“Relatively speaking, Japanese eat a lot at restaurants, especially fish. So, food service is the most important way to consume fish in Japan,” Nir said. While the classic way of serving eel involves chefs stunning live animals before killing, butterflying, and grilling them fresh for customers, nowadays, many eateries buy eel pre-filleted and even pre-sauced. Forsea’s product, Nir hopes, could slip seamlessly into the supply chain.

The friendly diners that assembled on June 4 enjoyed Forsea’s offering. But will others swallow it? Can Forsea close the 30-40% taste gap chef Neriah cited? Perhaps nothing is more sensitive or more susceptible to yuck factors than what people eat.

The Kitchen Hub’s Zaidman is optimistic. Unlike plant-based food, he hopes cultivated meat can sate picky palates. Vegetarian simulacrums have struggled in this regard, as have insect-based alternatives.

The evidence so far is mixed. A survey released earlier this year by the Asia-Pacific Society for Cellular Agriculture found that while 42% of Japanese consumers would try cultivated meat or seafood assuming it was safe, 30% would be unwilling to do so. Though not disastrous, such figures are not sterling either, particularly from an industry press release potentially predisposed to optimism.

Proponents of cultivated meat can take heart from the fact that most consumers simply don’t yet know what cultivated meat is. Increased awareness does not necessarily mean increased acceptance, though, as the fate of genetically modified food shows. Decades on, consumer suspicion about the “unnaturalness” of such products remains widespread. Japan is among the least GMO-skeptical countries in the world, and yet 32% of its consumers consider modified foods to be hazardous. Just 14% consider it safe; the rest aren’t sure. Indeed, many cultivated meat companies, including Forsea, have deliberately avoided genetic modification because of the regulatory and perception burdens this brings.

Cultivated meat may have an easier time gaining consumer trust, but there are signs a backlash is emerging, galvanized by entrenched agricultural groups and culture-warring politicians. In May of this year, Florida banned the production or sale of cultivated meat. Governor Ron DeSantis declared, “Florida is fighting back against the global elite’s plan to force the world to eat meat grown in a petri dish or bugs.” Alabama followed suit not long after.

Solving scale

While Forsea’s team is still working to improve the product, Nir is keen to start moving towards mass production as soon as possible. “The challenge that we as a company now face is how to scale what we achieved into a commercial scale.” This will require capital, with insiders suggesting Forsea is looking at another funding round in the next 6-12 months.

So far, Forsea has operated on a slender budget. It raised just $5.2 million in seed funding in 2022, though sources indicate that investment since means total capital received has crept up to the $10-15 million mark. Compared to the sums thrown at some investor darlings, this is peanuts.

To scale its production, Forsea will need to build a first-of-its-kind facility. That is unlikely to come cheaply. Agronomics is a backer of BlueNalu, the purveyor of synthetic tuna described earlier. Investor Andrew Chow estimated that a production facility for that startup might cost $100-200 million. Though Nir believes that Forsea’s organoid technology will help keep costs under $100 million, it remains a significant expense.

For Forsea to secure the necessary capital, investors will need an appetite for risk as well as eel. Scaling up by orders of magnitude is an inherently unpredictable process. As Amir Zaidman of The Kitchen Hub pithily put it, “If you don’t have a 1000-liter tank, you don’t know how much you can manufacture from a 1000-liter tank.”

Cultured meat startups face a much cooler market than a few years ago. “I think that all of the big US companies actually did bad for the industry because of the very high valuations and IPOs and all the shiny events,” said Dana Bublil. “But at the end of the day, they were not tech companies; they were consumer companies.”

Several of these early foodtech darlings have hit hard times. In 2023, Bloomberg reported that plant-based food company Impossible Foods slashed the value of the shares it offers to employees by 89%. Meanwhile, Eat Just, which raised around $850 million by promising to develop a wide range of products, including cultured meat, has struggled financially and faces lawsuits from suppliers and investors.

Still, Nir seems undaunted, citing venture capital, government grants, major food distributors, and major Japanese banks as potential sources of funding. A concrete example of this diverse interest arrived in March of this year. Forsea received undisclosed funding from the venture arm of Oisix Ra Daichi, an online Japanese grocer with a market cap of around $45 billion.

Crime waves

Though an ecological disaster, the depressed eel population works in Forsea’s favor. Consumers who want a taste of the fish have increasingly few options, opening a pathway for synthetic alternatives. As noted earlier, the European eel stock has nose-dived over the past four decades. The American eel population underwent a similar decline. It has since stabilized at a historic low.

Other geographies paint a similarly bleak picture, albeit from patchy data. Statistics jointly released by Japan, China, South Korea, and Taiwan – the industry’s main centers – show eel production increasing over the past decade, even as wild populations have come under extreme pressure, a sign of overfishing. Supply is struggling to keep up with demand, with consumption spiking in China and South Korea.

The phenomenon extends further afield, too. Yudhi Winarsono Basuki, the head of a small fish processing business in Sukabumi, Indonesia, highlighted the growing demand. While some local fisheries sell eel to buyers from Japan, China, or South Korea, Yudhi is focused on the domestic market. Locals have long steamed eel in banana leaves, but Japanese restaurants across Indonesia are driving recent demand. To meet their needs, Yudhi’s company now produces its own kabayaki for these eateries and eel onigiri for local supermarkets.

Unfortunately, the evidence suggests that Indonesia’s eel population is in steep decline, too. According to Sri Padmoko, the head of a local government fisheries office, the catch of glass eels—juvenile eels who get their name from their transparent bodies—is extremely low this year. He attributes this slide to a local five-year cycle in which the population peaks and dips, with 2024 sitting at the bottom of the dip.

Still, Sri notes that this trough is much deeper than usual. Efforts to boost the local eel population – including introducing fishways for dams and restocking rivers – are underway, but Sri expects it will be some time before results are visible.

The growing appetite for eel has driven unsustainable fishing practices in Indonesia and beyond. According to Willems Dekker, a leading global expert on the fish, overfishing is responsible for approximately 50% of the decline in eel stocks. Environmental changes—such as dried-out wetlands and construction projects that block migration paths—account for the other half.

Policies designed to restrict the catch of eels have had the unhappy side-effect of incentivizing smuggling. The trafficking of glass eels has been called the “largest wildlife crime on Earth,” with stock worth billions of dollars moving across international borders. The work is done by existing narcotics criminal gangs that adopted eel as a new, lucrative business line. Recipients tend to be aquaculture farms in East Asia, eager to meet consumer demand.

Sri Padmoko, the fisheries official, noted that, in Indonesia at least, the problem had subsided after serious police crackdowns. It doesn’t hurt that running lobster fry is now the more profitable enterprise.

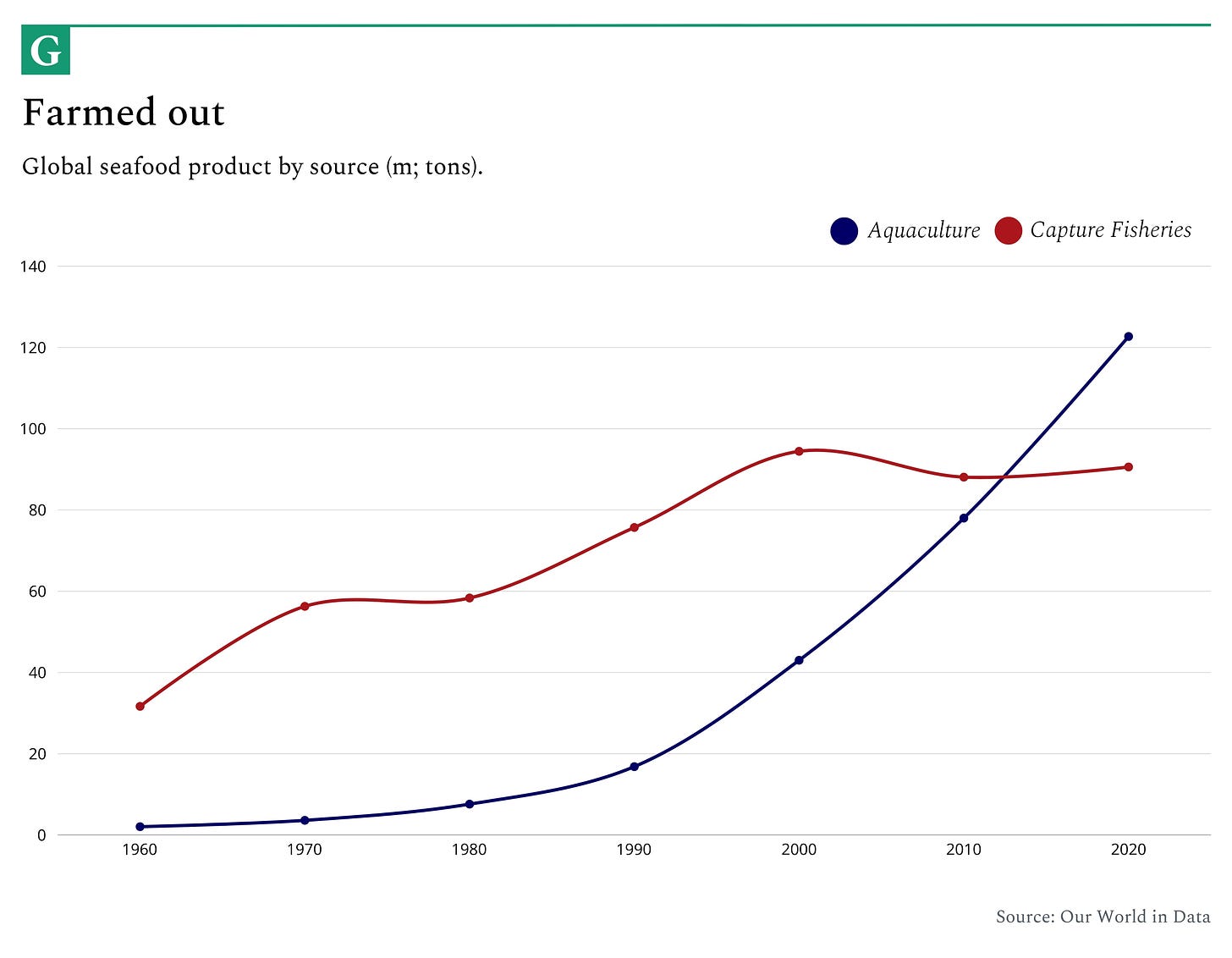

Such illicit measures would not be necessary if eel were not quite so idiosyncratic. Salmon, tilapia, trout, and many other species are bred in captivity, allowing for greater control of stock. In 2012, the volume of seafood from fish farms surpassed wild-caught. As of 2021, aquaculture delivered 126 billion tons of fish, compared to just 92 million from the wild.

Eels are unlikely to contribute to aquaculture’s lead any time soon. Eel reproduction – which Freud was enlisted to help solve – remains one of biology’s enduring mysteries, stymying attempts to farm them in captivity.

Scientists have achieved moderate success by pumping eels full of hormones to induce spawning, but they are still far from commercialization. In 2023, a Japanese university broke ground by rearing mature eels from eggs, but the process remains costly and complex. The complexities of eel reproduction may make it easier to cultivate the fish than breed them, according to Professor Kenzo Kaifu, a specialist from Chuo University.

That Forsea might do some good for marine conservation is a happy thought for Nir. “I’m a big ocean lover. Surfing is a very important part of my life,” he explained. If the company succeeds in creating a commercially viable eel alternative, it will have gone some way toward protecting one of the ocean’s denizens. In the long term, Nir hopes Forsea will cultivate facsimiles of other fish being eaten to the brink of extinction.

Out in the vastness of the Atlantic Ocean sits the Sargasso Sea. It stands alone among such water bodies, the only sea to be bounded by currents, not land. Gulf streams and equatorial currents close around it from all sides, creating a gyre of deep, spinning water streaked by the tan sargassum seaweed that gave the Sargasso its name. So dense is the macroalgae that when Christopher Columbus encountered it on his journey to the New World, he worried that it hid shallow waters liable to ground his ship.

It is fitting that the Sargasso’s currents spin clockwise because it is here that eels begin and end their lives. No matter how far they travel from the Sargasso, slithering thousands of kilometers across the land to freshwater, they always return to the same patch of ocean to spawn.

Remarkably, the elvers seem to be born with hereditary knowledge, following their ancestors’ path back to the lakes and streams they journeyed from. It is a recursive migration, with each generation beginning in the same place, tracing the path of their forebears across land and over dams, and then returning to spawn and die. On the final leg of their journey back to the golden expanse of the Sargasso, eels dissolve their stomachs, internally devouring their own bodies for survival.

So covert is the eel’s journey, so improbable, that it confounded scientists for centuries. Perplexed by their provenance, the philosopher Aristotle decided they arose spontaneously from the mud. It was only after the Danish biologist Johannes Schmidt painstakingly tracked eel migration in 1923, tracing younger and younger specimens across the ocean, that we found their breeding ground.

Still, Schmidt’s discovery is just a theory. While scientists have witnessed Japanese eels spawn in the Philippine Sea and used satellite tags to track a few eels to the Sargasso, to this day, no one has seen a single European eel spawn in the wild.

“It is very strange that men should deny a Creator and yet attribute to themselves the power of creating eels,” Voltaire once wrote, offered as a riposte to the German atheist Baron d’Holbach.

A belief in the divine is not required to share the sentiment of the French writer’s remark. The eel is an impossibility, a baffling stack of quirks and impracticalities compressed into a smear of ink. It has poison in its blood, ancestral secrets in its cells, and three transformations coded into its DNA.

“[T]o see the running of the old eels and the young shad to the sea, is to have knowledge of things that are as nearly eternal as any earthly life can be,” American marine biologist Rachel Carson once wrote. In its quest to construct an eel out of stem cells, Forsea is not only attacking a compelling market segment nor attempting to solve an ecological catastrophe in motion; it is peering into one of marine life’s most enduring mysteries.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Super interesting piece. Thanks so much for pulling this together. I knew practically nothing about this area so it was a great deep dive. Such an interesting example of "finding the right hill to climb". Pick a market where the costs of goods is high and there is no alternative to production! Love it