The Future of Farcaster with Dan Romero

The founder of the disruptive social network talks about competing directly against Elon Musk, nerd sniping, prediction markets, and new business models.

It has been a tumultuous week at the top of the social media food chain. Yesterday, the US House of Representatives passed a bill to force Chinese giant ByteDance to sell short-form video platform and dopamine-casino TikTok. Though plenty must be done before that bill is enacted, it is another indication of the quixotic fragility among social media’s largest players – a trend we’ve been tracking at The Generalist for the past couple of years.

At the other end of the spectrum, new life is emerging. While some of the sector’s giants flail for a handhold, a set of nimble upstarts have begun to make their presence known.

Farcaster is among the most exciting of this cohort and a company worth paying attention to. Though beloved by a niche corner of the crypto world, the network has yet to reach the mainstream. The numbers alone suggest as much, with daily active users (DAU) peaking at 46,000 last month. Compared to the 171 million users TikTok’s lobbying team has been touting, Farcaster looks like a rounding error.

It is a tech truism to focus on slope rather than the y-intercept. Doing so with Farcaster reveals a remarkable trajectory. It may have crested at 46,000 DAUs, but it was humming along at a few thousand not long ago, spiking 20x in a matter of months. It is also a young organization, only emerging from a closed beta in October. While plenty more ups and downs should be expected, given consumers’ fickle whims (Farcaster has pulled back from that recent high), it may be blazing a breakout trajectory.

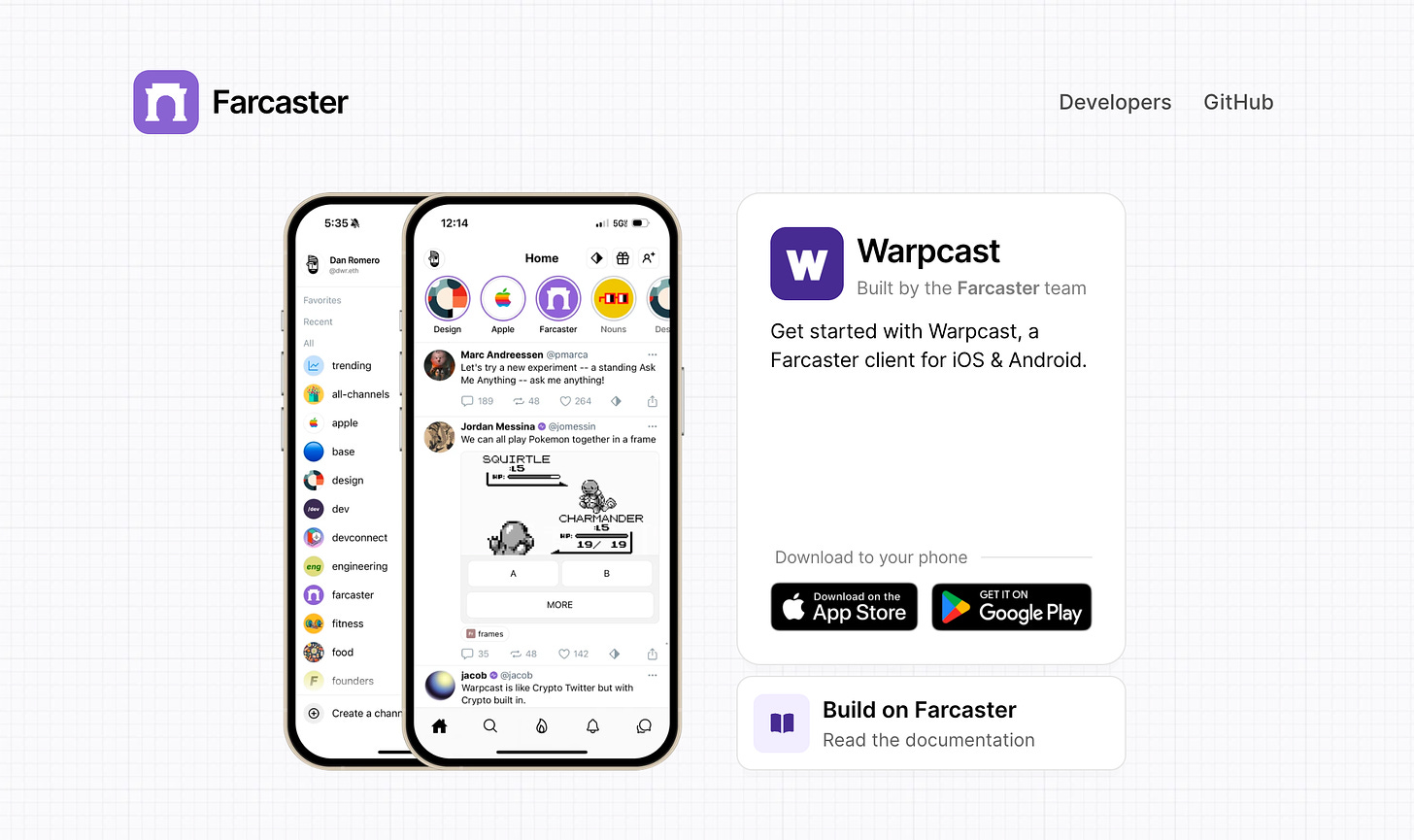

More interesting than Farcaster’s metrics or trajectory is the strategy behind it. After five years at Coinbase, Dan Romero set out to found a different kind of social network – one that wasn’t simply an application but a true protocol. The result is a piece of foundational social infrastructure that others can build upon, remix, and tweak. In essence, Farcaster is building a permissionless version of the skeleton that supports platforms like Twitter – then allowing the world’s developers to decide what it should look like and how it should act.

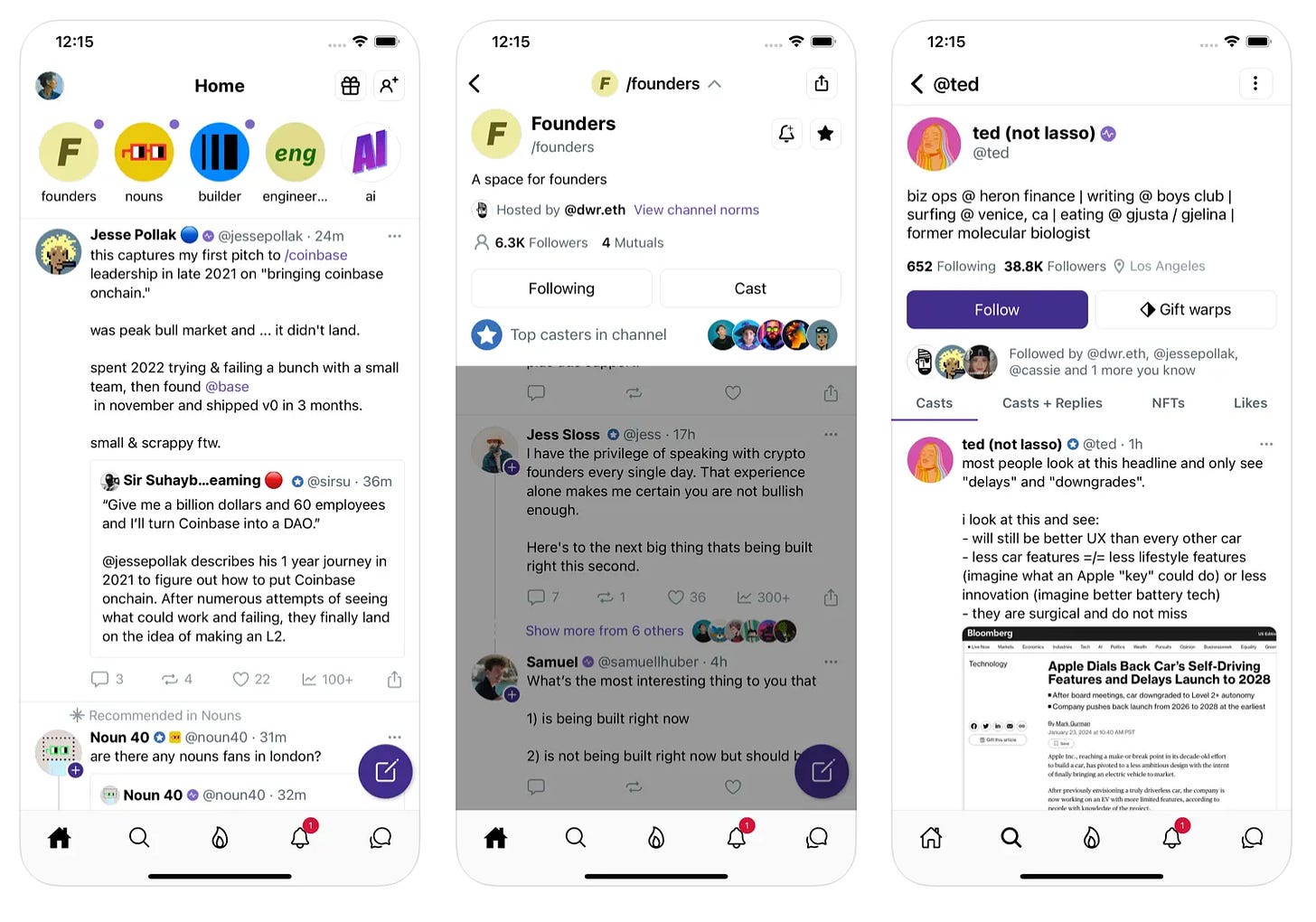

To galvanize that process, Romero’s team has built its own client on the protocol, Warpcast. What started as a Twitter facsimile, albeit with a radically different architecture, is slowly morphing into a space with distinct social norms and novel user behaviors. The best example is Farcaster “Frames,” mini-applications that live within the social app’s feed. These might be a poll, a game, or an NFT minting experience.

All of this terminology can get confusing, but the fundamental strategy is simple: Romero’s team is building both the protocol (Farcaster) and application (Warpcast). It’s the digital equivalent of laying down a cross-country railroad network and then building a steam locomotive to show the rest of the market how it works. Both the railroad and the train can make money, but in the long run, the organization behind it all hopes their train is not the only one on the tracks.

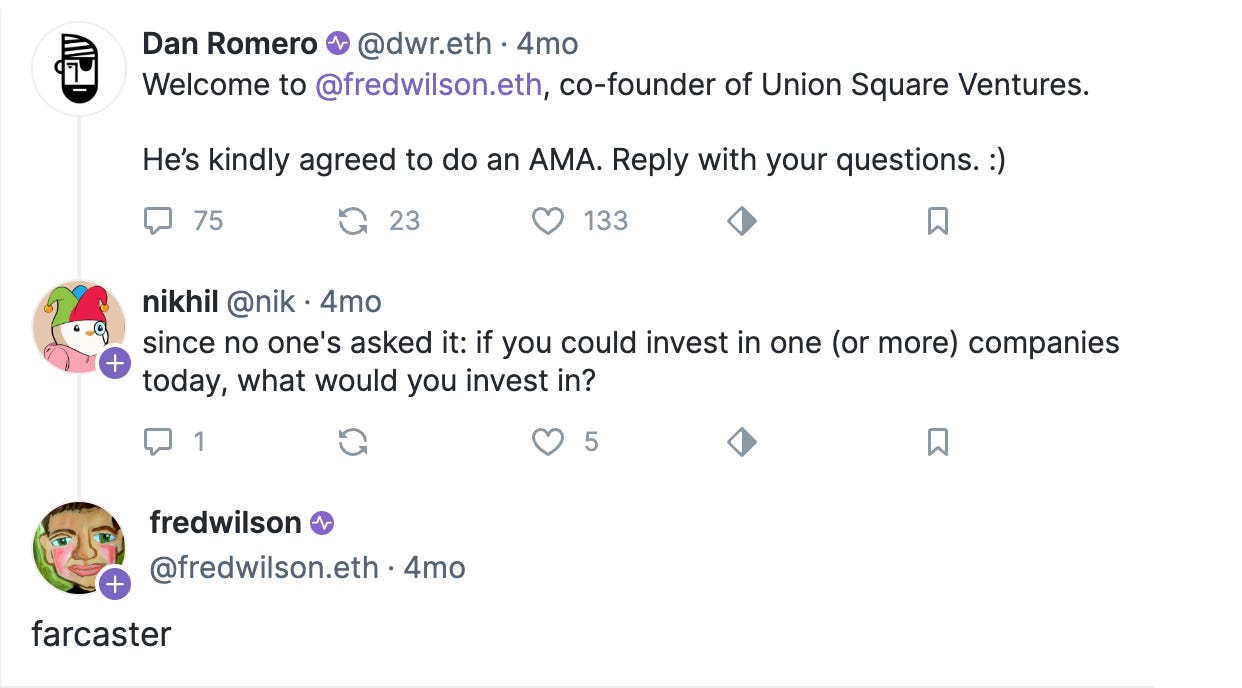

The fact that Romero’s company requires such an explanation illustrates the ingenuity of what he is building. When Union Square Ventures’ Fred Wilson was asked which startups he’d most want to invest more in, he responded with a simple answer:

I sat down with Romero, the company’s CEO and co-founder, to better understand what Farcaster is building and how it might shake up the social media firmament. Our conversation touched on his introduction to crypto, the idea maze that led to Farcaster, devising a unique business model, and the challenges of scaling a decentralized network.

Brought to you by Airwallex

Airwallex was built with a single purpose in mind – to create a world where all businesses can operate without borders and restrictions, and by doing so, propel the growth of the global digital economy.

With our proprietary infrastructure, we take the friction out of global payments and financial operations, empowering businesses of all sizes to unlock new opportunities and grow beyond borders.

Over 100,000 businesses globally including brands such as Brex, Rippling, Navan, Qantas, SHEIN, and many more use our software and APIs to manage everything from global payments, treasury, and spend management to embedded finance.

For more information on how Airwallex can help you simplify your global payments and financial operations, get in touch with our team today. Read The Generalist’s full deep dive on Airwallex here.

Actionable insights

If you only have a few minutes, here’s what investors, operators, and founders should know about social media disruptor Farcaster.

Different social norms. Farcaster CEO Dan Romero is building a different type of social network, starting with a permissionless protocol. That vision has earned his company $30 million in venture funding and attracted approximately 200,000 registrations. Though still operating from a small base, Farcaster’s trajectory and ingenuity are worth paying attention to.

In the ring with Elon. Though Romero hasn’t been challenged to a spin in the Octagon, he is competing head-to-head with Elon Musk in the social arena. As Romero tells it, despite the chaos of Musk’s reign over the once-blue bird, he’d much rather be competing against the old, slower-moving Twitter.

A new Frame of mind. The introduction of Farcaster “Frames” proved an inflection point. Frames are mini-applications within the social application’s feed, offering unique interactive experiences. It’s the clearest example of the net-new social behavior that Romero and his team hope to enable.

Multiple models. Farcaster has numerous ways to monetize. At the protocol level, it’s started by charging every user $3 per year. Not only is that a way to earn revenue, it’s also an attempt to prevent spam. On the client side, Romero is open to advertising, subscription, and transaction-based models.

Scaling to 1 billion. Farcaster is building with a fundamentally different decentralized architecture. Can that scale to reach the size of other consumer behemoths? It’s not entirely clear yet. Though Farcaster’s current infrastructure can scale to 10 million daily active users, according to Romero, growing beyond that will require larger change.

Dan, it’s great to be talking. I think you’re building one of the most exciting startups in the world at the moment, and I’d like to talk about your journey to this point. How did you first become interested in tech broadly and crypto in particular?

I moved out to Silicon Valley in 2013 after graduating from Duke. My friend and former college roommate Fred Ehrsam was building Coinbase at the time. He and Brian (Armstrong) had just raised a Series A from Fred Wilson at USV.

It was just the two of them – they were looking to hire their first person. I remember Fred saying, “Hey, would you be interested in this generalist customer support role?” I looked at him like he had four eyes and was like, “Why would I want to work on magic internet money, on Ponzi-scheme type of stuff?” It was a classic example of not taking the time to be intellectually curious enough to understand it.

It took me about a year to realize I’d made a mistake. Part of it was moving to Silicon Valley and meeting new people there. During that period, people were excited about Bitcoin and what could be done with it. It felt like we were at the beginning of this new app platform. Mobile was five, six years old at that point – very much on the S-Curve but not the hot new thing anymore. Meanwhile, Bitcoin was one of maybe three categories that had real excitement around it. The other ones were drones and virtual reality. Those were hot.

I got excited about the idea that Bitcoin would become this new consumer app platform, a popular thesis at the time. People could do stuff with money and value in a way that didn’t require you to input a credit card.

Ultimately, the thing that really nerd sniped me was a white paper written by Jerry Brito. Today, Jerry is the Executive Director of the Coin Center, but he was at George Mason’s Mercatus Center at the time. He published this piece on the use of Bitcoin in prediction markets. That was always a topic that had interested me. I was in eighth grade when 9/11 happened – I remember reading a story in the Wall Street Journal or something in the aftermath talking about how the Pentagon was interested in setting up a market to try and understand where future terrorist attacks would happen. That idea had so much moral complexity, but it was this fascinating concept: if you allow people to make money from information, you can sometimes suss out the truth. That was what got me excited about Bitcoin – I was like, “Oh, I can see where this could go.”

Prediction markets seem to be a topic that nerd snipes a lot of interesting people.

Interestingly, they didn’t work on Bitcoin because it didn’t have smart contract capabilities. One of the earliest projects on Ethereum was the prediction market Augur, which didn’t quite play out. Now, we’re in the next generation of this. This election cycle, you’ve seen a massive amount of money wagered on platforms like Polymarket – it’s permissionless and can happen anywhere in the world. There’s also a regulated, non-crypto option called Kalshi.

As I’ve gone through the noise of America’s primary election cycle, for example, I’ll just go to Polymarket or Kalshi and see the likeliest outcome of a given race. So far, it’s been totally on the money. Of course, there are instances where it’s wrong – that’s the point of the market.

Anyway, this was something I had been fascinated with for a long time, and it really sparked my interest in crypto and brought me back to Brian and Fred at Coinbase.

Prediction markets brought me into the space, but they aren’t what has kept me in it for a decade. There are a lot of really interesting things you can do with crypto, but I would say it’s very much in its infrastructure phase. It is not a consumer app platform yet. I think we’re only finally getting to a place where the infrastructure is sufficient so that you can build halfway decent consumer experiences.

I’m excited to dig into the state of crypto today and what’s changed to allow something like Farcaster to emerge. Before we get there, I’m curious to hear about joining Coinbase in 2014. What was that conversation like with Fred and Brian? And what did Coinbase look like when you joined?

I went to them and said I was wrong and that I was really excited about the space. I think I was employee twenty.

It was an interesting time to join. The company was focused on Bitcoin payments, which ended up not working for various reasons. In Q1 of that year, Coinbase hit a million users, so it felt like an inflection point. In reality, we had hit a local maximum – I joined, and the company experienced a slow and steady decline in usage for the next two years. Man, it was a brutal introduction.

For some set of reasons, mostly stubbornness, I stuck it out. Then, in 2016, we added Ethereum to the platform which created a bit of a tailwind. Then, in 2017, we had a breakout: 100x growth, from $10 million in revenue to roughly $1 billion in revenue in one year. It was a textbook example of Marc Andreessen’s essay, “The only thing that matters,” about how important the right market is. We were doing the same thing as the year before, but the market just turned, and we were in the right place at the right time.

I ended up staying at Coinbase for five years. I worked most closely on two things. One, I built all the financial infrastructure that knits together the different payment systems in the US and Europe. By virtue of being early and getting assigned that problem to solve, I developed expertise in that space. The plumbing Coinbase uses to process the hundreds of billions in fiat they’ve moved at this point is still largely what I initially set up.

The second was the consumer product – I shifted to that in my last couple of years. That gave me a bird’s eye view of usability problems, especially from an onboarding perspective. Coinbase is obviously best-in-class here; they’ve onboarded 100 million KYC accounts to crypto. But I think there’s still room to improve, and that experience informed a lot of the stuff I’ve done with Farcaster.

You met your Farcaster co-founder, Varun Srinivasan, while you were at Coinbase. I always love hearing how people find their startup partner and what they were looking for. What was it about Varun and your relationship that made you think you’d make a good team?

Working with someone closely through hard times is a great pressure test – especially outside of actually founding a company. Varun and I had those experiences together. For example, 2017 was a super stressful year at Coinbase. The site was down all the time because of the growth we were seeing; we had huge customer support issues. We worked together closely on some pretty challenging stuff with high stakes, right? Because you’re moving a lot of money around. The ability to handle pressure calmly and logically is a strength of Varun’s and stood out to me.

When we reconnected in 2020, we were also in a similar place. We’d both had some success with the Coinbase IPO – or we were expecting to – and were thinking about what to do next. The time-value of money was still important to us, but less so. We had the willingness to build on a longer time horizon.

What I’ve noticed about a lot of the founders that have joined crypto over the last couple of cycles is that they tend to be younger. They join at the peak, raise, and then the market falls apart. And the classic line is like, “You’re in crypto pivot to AI.” That happens because they haven’t had that breakthrough success and think, “Well, I don’t want to stick around a market that’s slow-moving. I want to be in one that’s fast-moving.” It’s quite logical.

The complicated thing is that being in a fast-moving market means you’ll have a lot more competition. If you’re smart about spend, a crypto bear market is the best time to build: all the people competing with you leave and the true believers stay. You can make a lot of progress during that period. It’s hard: you have to motivate the team, and recruiting is harder. But if you can stick around when the market picks back up, you can be well-positioned.

Varun had gone through multiple cycles, too, and was thinking about it the same way. When we started building Farcaster in 2020, we knew we weren’t going to catch this cycle. We were building for the next cycle.

You talked a bit about the usability issues you saw at Coinbase, but ultimately, it’s not a company with a big social surface area. I’m curious to hear how you and Varun found your way to building a new social network. What was the idea maze that got you there?

In 2009, Paul Graham wrote an essay called “Why Twitter Is a Big Deal.” It’s really short; you could fit it into a screenshot on Twitter. It makes this very basic observation that Twitter should be a core internet protocol – it offers short, pushed-based text updates – but somehow, it ended up inside this weird company. Twitter had this very open API at the time, so it was like, “Oh, maybe it’s going to be this weird type of company built around this protocol.” It did not play out like that. And, you know, as much as people want to talk about the death of Twitter, I think the company is fine and as relevant as ever. But from a developer perspective, it’s no longer a thing people experiment with.

I was an early API developer during that period. With a couple of college friends, I helped make a polling app called StrawPoll, built on top of Twitter. I also remember using Tweety and Tweetbot and all these innovative mobile apps. For example, “pull to refresh” was invented by an independent developer, Loren Brichter. When I moved to Silicon Valley, that ethos was something I was excited about – the concept of open APIs and developers having the ability to take the same dataset and user base and create totally different experiences.

RSS is kind of this parallel universe to Twitter. It’s this relatively simple, open, and decentralized protocol that you can use to disseminate different types of information. It’s never had the same breakout consumer success, but it is widely used for podcasts. That was always interesting to me – that this huge ecosystem was built on these simple protocols that don’t require centralized API access. And that the UI of individual clients can be very different.

The idea we started Farcaster with was: how can we make RSS competitive with Twitter? Now, one of our beliefs when we were starting out was that Twitter was this slow-moving company without much innovation.

Elon coming in was a bit of a curveball – just a black swan event. There are many people on the sidelines commenting on a variety of different things about him, but very few have directly competed against Elon. Being in the same space…it’s not great, right? Is he going to make every decision perfectly? No. But Twitter’s velocity and ability to make dramatic changes on a short timeline has never been higher. It’s forced us to innovate and develop something that’s not just a decentralized Twitter clone, which is how we started. We have to play a different game. Anyone trying to build “Twitter but decentralized” will not beat Twitter – you have to offer consumers, developers, and creators a completely new thing.

You genuinely would have preferred to compete against pre-Elon Twitter? As one of those people on the sidelines, it feels like the last two years have undercut the platform’s strength.

Oh yeah, that was easy. There was no catalyst to get people to Mastodon, Bluesky was going to be something that was a part of Twitter, Threads wouldn’t exist.

Do I think any of those things are that competitive with Farcaster today? No, but it just makes it harder. There was this very clear narrative in my mind if Twitter remained in status-quo mode: we would be this fundamentally new, exciting thing that is a protocol and decentralized. Now, we’re one of a few different things – the story is a bit more muddled.

It’s further reinforcing that we have to be something different, something new. The more differentiated what we’re building with Farcaster feels, the better our chance of succeeding.

Isn’t the reason we’ve seen so many apps like Mastodon and Threads emerge and gain traction because users are more willing to try out new platforms post-Elon? Isn’t that to Farcaster’s benefit?

I don’t know how many users have left Twitter. I think the departures you have seen have been more politically motivated. If you look at the three years before Elon took over, I think there was a very clear shift to the left from a content moderation perspective. That was during the Trump era when things got a lot more politicized.

When people complained about that, they responded, “Oh well, if you don’t like Twitter’s moderation policies, go build your own network.” That’s how you got Gab, Parler, and Truth Social, right? Those never took off because they’re filled with one set of political people, and what makes Twitter great is that it’s a public square. You have both sides, and their fighting is part of the product.

Fast-forward to Elon’s era and you see a similar thing happening. You have a bunch of people who are politically protesting and are moving over to Mastodon, Bluesky, or Threads. It turns out that if you take all the people who are anti-Elon and put them in a social network, that’s also not sufficient. I don’t know anyone who’s centrist on those platforms on a real basis. You might have some: the indie Mac developers seem to have congregated on Mastodon. On Threads, I think you have some other subcommunities. But for the most part, people have stuck around on Twitter.

You can’t have a public square founded on an “anti” vision. I fundamentally believe you have to have a positive vision for the world. This might be a subtle difference, but the network’s ethos has to be deeply rooted in something new rather than against something else.

You mentioned that Farcaster began as a Twitter clone. Given that you were starting from scratch, why was that the right design decision? Why choose to make it so skeuomorphic to Twitter?

There are two parts to this. One, there’s a basic sort of functionality that you just need. If you look at Instagram and Twitter and squint a bit, there’s a lot of similar functionality on the page. The core elements of social are probably 80 - 85% the same. It turns out you need those because that’s what people expect. We’re not in 2012, where you can have one new feature and use it to grow like Snapchat or something.

Twitter is the cheapest in terms of getting to parity. It’s naturally the easiest entry point. It’s also where our target market of crypto people – specifically people in the Ethereum ecosystem – spends time. When I first started in crypto, it was Reddit. Then there was a big migration to Twitter in 2017 and 2018. “Crypto Twitter” is a thing now – even Elon was part of it during the last cycle with Doge.

My view was that modality was the right way to start. We could have been more aggressive earlier by creating new things that weren’t the same as Twitter. But you need the baseline functionality first.

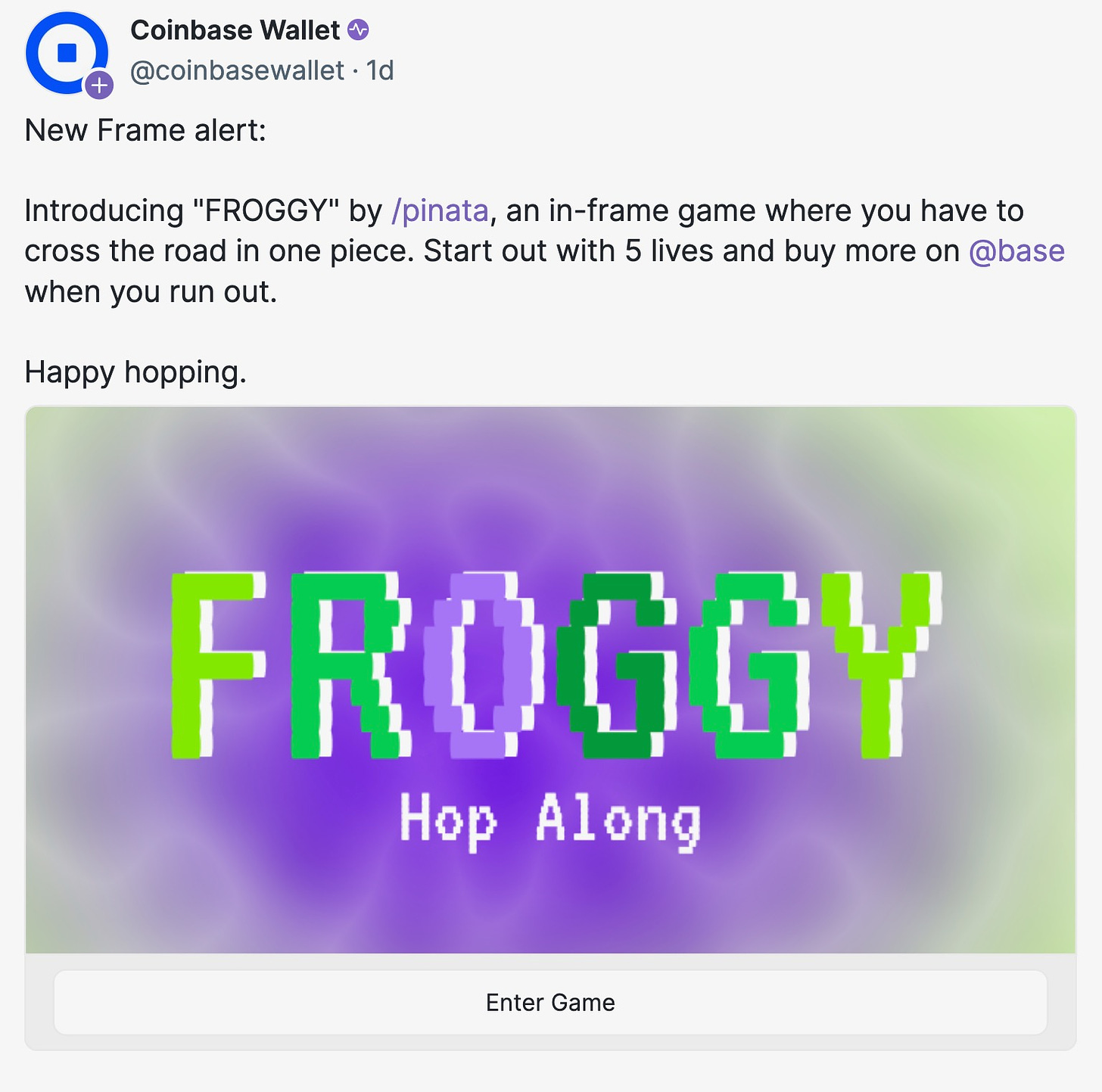

Speaking of original functionality, introducing Frames (interactive mini-apps) as a new social media primitive has been a game changer for Farcaster. Why do you think Frames captured people’s imaginations so fully?

We had sufficient conditions. The network was finally permissionless; for the first 10,000 or so users, it was like, “DM me on Twitter to get an invite.” In October of last year, we also got to a place where anyone could go and build their own competing Farcaster client. That didn’t drive growth, but it built trust with developers, which is a critical component of what made Frames successful. The other thing is that we spent three years building up a user base. It was still small – on the order of 5,000 daily, but that’s still more than, say, 500. The important part is that those users tended to be crypto-native, so they were very interested in experimenting with stuff involving the blockchain, particularly Ethereum.

It was also a very developer-heavy group, which was originally a critique we got. A lot of people said, “Hey, you have a network of people who are crypto-native devs, that’s not going to scale into the mainstream.” But when you launch a new developer primitive, which is what Frames is, that’s perfect.

Frames is very simple: you take a link, and instead of just adding a title and an image like you would on Twitter, we allow you to add a couple of buttons, and then when you click on those buttons, it can communicate with another server and create an interactive experience within the feed.

Also, it’s worth explaining that Farcaster respects links. We think links are great. One of the things that made Twitter so magical in an earlier era was that it was the best place to find and share the most interesting links on the internet. Because of Instagram and TikTok, Twitter seems to have decided that optimizing for time spent in the app is the best way to drive growth. That may be the right decision, but it opens up a huge gap in the market.

Taken together, a Frame is something you can quickly prototype and build. It can be shared in a feed and go viral through likes and re-casts. And because every user on the network has a crypto wallet underneath and all of our APIs are open, developers have come up with these really creative experiences where, even though it’s not initiating a transaction, they can drop a crypto asset in a wallet. It’s almost like having a mailbox and being able to drop something in it. We have transactions coming soon, by the way, so that will be a whole new primitive to play with. (Editor’s note: Transactions officially launched last week!)

After a two-year bear market, I think there was so much pent-up demand, especially among crypto developers. People were desperate to figure out how to go to market. That became an even bigger issue when Twitter doesn’t allow you to use a link – it’s so hard to get the engine going. Meanwhile, on Farcaster, even though the total number of users is small, the fact that they’re all crypto-native and that links can go viral in a meaningful way means it created this flywheel where developers were building Frames and users found them interesting, which attracted new users.

As you said, developers have already built really creative Frames. Are there any new use cases you hope someone develops in the coming months?

Transactions will give developers full creative freedom to launch users into some new experience, using a blockchain. You can do that seamlessly so that the user does not even have to have set up a third-party wallet. They can just use the Farcaster app they’re already using.

For example, Frames become an amazing place to initiate an NFT transaction. I don’t love the term “NFT” because it has so much baggage, but the idea that you can have a digital object that you value and is yours to own is one I find really powerful. I am very bullish on it over a five to ten year period. I think younger people will ask, “Why would you ever want to collect physical objects when you can have something in a digital realm that is relevant to the time you spend within a screen or with a headset on?”

Here’s the other area I’m very excited about: when you click a frame, you have a lot of information on that user. It’s a signed action cryptographically, so you know who it is that’s clicking. As a result, you can offer this amazing onboarding experience. Rather than signing in with Apple or Google or whatever, you click a button in a feed, it opens up the app, and the user has already been onboarded. It can pull in your profile photo and all the users you’ve interacted with on this public network. It’s true one-click onboarding.

So much of what Farcaster is doing is structurally new. What’s the right business model for what you’re building? I can imagine Frames being a really interesting part of the equation.

It’s important to separate the protocol and the client.

For the protocol, my vision is that we charge a small fee to everyone on the network. We actually started doing that last October when we exited our closed beta. Of the 200,000 people that have signed up to Farcaster, 180,000 have come in since then – all of them have been paid. We started at $12 per user per year and have moved our price down to $3, trying to find the Pareto optimal point. If it’s too cheap, you get spam, and if it’s too expensive, you don’t have as much growth. I think of it almost like a domain name.

We have a big unknown because we haven’t had any users reach a full year of their subscription. Later this year, we will see how many people churn and how many people think it’s worth $3 a year to sign up again.

Choosing to have a fee will be a big make-or-break for the network. If it doesn’t work, we’ll have to iterate, but if it does, maybe it becomes a fundamentally new model. It’s one that hasn’t really existed at consumer scale before. Looking at a company like Netflix makes me optimistic – they haven’t had an ad-based tier for most of their growth and have relied on subscriptions. Even Twitter is moving toward a paid approach. I think that if we can deliver on the core value proposition, in terms of content quality on the network and interesting apps built on top of the protocol, people will think $3 a year is really cheap.

One of the reasons we have people pay for the network is as a spam prevention mechanism. The architecture of Farcaster is such that your account lives outside of any server. It’s just like an Ethereum wallet. That has some nice properties; for example, it means you can use two different Farcaster apps or clients at the same time, just like you can use two different Ethereum wallets simultaneously. That’s an amazing check on bad behavior on the client side – if they do something you don’t like, you can migrate to a different one.

At the client level, monetization is relatively straightforward. Any time you have people’s attention, there’s a variety of different ways to monetize. You can do ads – that’s the most basic. I’m not a huge fan of ads, but many people in the world say, “Hey, I’d rather have free with ads.” I love the idea of subscriptions – I think Elon’s subscription push at Twitter has been great. I subscribe to the max level and don’t see any ads on my feed anymore. I wish it had existed a long time ago.

Frames is a third area. There’s a natural hook for commerce and economic transactions that happen as a result of browsing your feed. Taking a cut of transactions is an internet-native business model – think of Stripe, Coinbase, or Airbnb. You’ll have a natural check on monopolistic pricing because of the competition between different clients. Airbnb is basically a monopoly within its own network effect – its pricing is very high. Compare that to Stripe, which offers a really solid service but is fundamentally a commodity. They have to have a much lower take rate. In a world where Farcaster has many different clients, that take rate will be lower, but there’s probably a natural clearing price.

At the beginning of our conversation, you mentioned that crypto has matured sufficiently to support semi-decent consumer applications. What infrastructure needs to be built to support Farcaster’s future growth? What will it take for Farcaster to support a billion-plus users?

There’s still work to do in terms of scaling – you’re always going to have that – but our current architecture can scale to 10 million active users. After that point, we have to shift the architecture. The simple way to describe it is when you run a Farcaster hub right now – essentially the node on the network – you run a full copy of the entire network. To use a Twitter analogy, that would be like an individual or developer having access to a copy of Twitter’s entire database.

If you do the back-of-the-envelope math, you cap out with a single machine handling about 10 million active users. After that point, you probably need to move to something where you shard it, which introduces a bunch of other architectural things you have to solve. Internally, we view it as, “When we have a million daily active users on the protocol, that’s probably a good time to start worrying about this.”

To go from 10 million to 1 billion – there are a lot of unsolved problems there. But I’m reasonably confident you can get to a system that works. I think the model you move to is: the entire network’s data will be available, but very few people will have a full copy of it in an easy to access way. But, in theory, if someone was motivated enough, they could go and get a copy.

I don’t claim we have it all mapped out. We just know where things break and will take it from there.

How will Farcaster look different in a few years if everything goes well?

Today, the client we built, Warpcast, accounts for a disproportionate amount of the overall network activity. It’s more than 90%. In a few years, I would love for us to be 30% of the network – and for that to happen in a world where we didn’t just fumble the experience. If you hold our execution constant, or even increase it a little, and Warpcast loses market share? That means we’re doing something correctly. The network became so compelling for other people that they decided to come in and build great new experiences on top of it.

The second thing is that I hope new social primitives are Farcaster-first. When people use the network today, it still feels very much like Twitter. Yes, we have Frames and topic-specific channels. But I think that over a sufficiently long time horizon, there will be effectively an infinite number of social primitives, and I want the net-new behavior they create to happen on Farcaster. Once that starts to happen, I think you know, “OK, this is going to be around for a while.” If we stay as just a decentralized Twitter with some other features, then it will be more of a curiosity or science experiment versus something that is a meaningful foundational internet protocol.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.