DoorDash: The Value of Speed

Doordash in 1 minute

Pandemic-favorite DoorDash is slated to IPO at a $32 billion valuation. Best-known for its food delivery marketplace, DoorDash has scaled quickly since its official launch in 2013, only accelerating during the coronavirus outbreak.

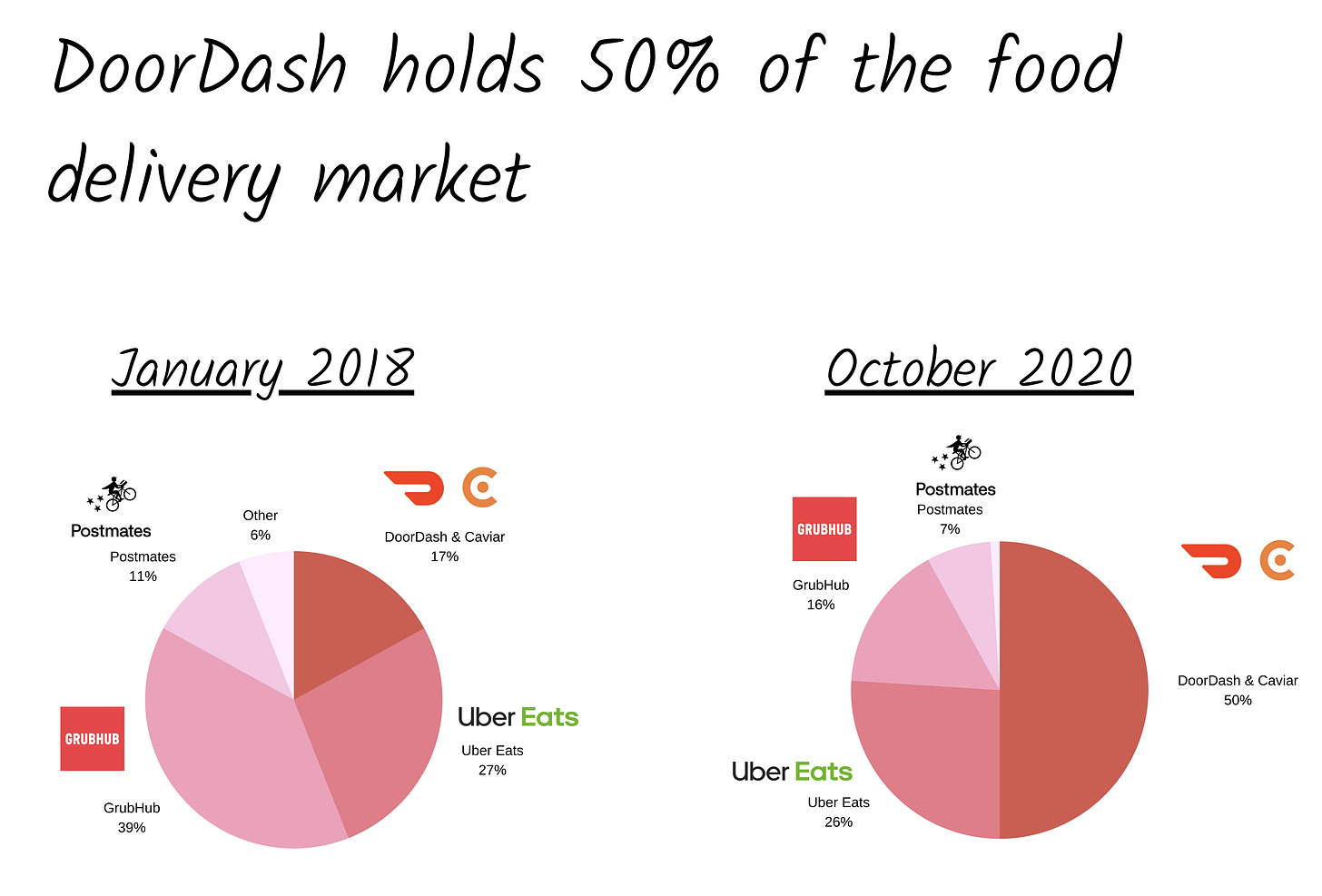

That velocity has taken DoorDash to the top of the food delivery space with 50% US market share. Revenues over the first nine months of 2020 reached $1.9 billion, an 226% increase year-over-year. While growth has been inarguably impressive, concerns over market size, competition, and regulation may leave some investors cold. DoorDash's IPO is, in some respects, a test of the share one puts in momentum, the value placed on speed.

The company's ascent has been aided by no little capital, with $2.5 billion raised. Sequoia and Softbank represent the largest external shareholders.

To learn about a historic pad thai, Tony Xu, and ghost kitchens, keep reading.

Analysts

Introduction

Has product/market fit ever arrived so swiftly?

Forty-five minutes after Palo Alto Delivery's website launched in 2013, it received its first order: pad thai to Alpine Road. The company's founders, Stanford students Tony Xu, Stanley Tang, Evan Moore, and Andy Fang, jumped in the car, swung by a local restaurant, and drove southwest.

"How do you hear about us? What do you do?" Tang asked the man that answered the door. He explained he was a scholar, passing the founders a business card. In an amusing idiosyncrasy, he reported he'd written Weed the People, a book reviewed in the New York Times about the battle to legalize cannabis domestically.

From that point on, Palo Alto Delivery never looked back. As co-founder Stanley told it:

And then yeah, the next day we got two more phone calls. The day after that we got five, then it became seven, and then it became ten. And then soon we began to gain traction on campus through PaloAltoDelivery.com which is pretty crazy, because think about it: This was just a landing page. You had to look up PDF menus to place your orders and then call in. This isn't exactly the most professional-looking site, yet we kept getting phone calls; we kept getting orders. And that's kind of when we knew that we were onto something. We knew we found a need people wanted when people were willing to put up with all of this.

Investment followed shortly afterward, with the company raising a $2.4 million seed from Khosla Ventures, CRV, SV Angel, and others. Even then, the founders had their eyes on a larger prize — the funding announcement expressed the newly-christened DoorDash’s plan to build “the local, on-demand FedEx."

Nearly eight years later, and while DoorDash has yet to fulfill that vision, it's hard to find fault with the company's growth. Despite launching almost a decade after competitor Grubhub, DoorDash has ascended to the US food-delivery space's prime position, reaching 50% market share as of October this year.

DoorDash's position has been met with a degree of skepticism by some, not unlike the suspicion an imperious Tour de France winner might receive from a motivated journalist. Yes, the execution is immaculate, these doubters assent, but by what means was it achieved? The performance-enhancing substance in DoorDash's case is clear: money. With $2.5 billion raised, much more than direct competitors like Postmates, skeptics will argue DoorDash is the beneficiary of financial doping with Masayoshi and others manning the drip.

Bill Gurley, a partner of Benchmark Capital, summarized the perspective, remarking, "It's super easy to take market share when you are allowed to lose way more money per order than your competition."

Raising significant amounts of capital does not break any rule, though, and bulls will point to the remarkable scale and growth the company has achieved. Beyond its number one spot, DoorDash has attracted over 18 million customers, 400K merchants, and more than 1 million couriers or "Dashers," as the company prefers. Aided by the pandemic, revenue grew over 226% year over year, reaching $1.9 billion over the first nine months of 2020. That revenue grew 204% from 2018 to 2019 indicates that such blistering speed is a habit, not happenstance.

That impressive run has given Xu and Co. the latitude to dream a little in the S-1 filing. The company casts its DashPass subscription product, which grants immunity from delivery fees, as a "membership program to the physical world.” There’s also a strong emphasis placed on DoorDash’s commitment to small business owners.

DoorDash exists today to empower those like my Mom who came here with a dream to make it on their own. Fighting for the underdog is part of who I am and what we stand for as a company...Helping brick-and-mortar businesses compete, succeed, and flourish in these rapidly changing times is the core problem we are trying to solve.

Cynics will argue that Xu's statement reads like the fox expressing a desire to "empower" the henhouse. Over the years, DoorDash has taken flack for its steep fees, unfriendly listing practices, and circuitous tipping policies. That result is a company that does not always appear allied with the little guy.

These dichotomies are what makes DoorDash so interesting. They also hint at the core question investors may wish to ask themselves: how far is the distance between rhetoric and reality? Is DoorDash a hypergrowth machine destined to dominate a massive market, or a money-furnace, immolating capital to win share that won't last? Is the company empowering the underdog, or feasting on smaller prey?

It's time to dig in.

Number of mentions in the S-1

Dasher: 626

Local: 299

Delivery: 274

Tony Xu: 111

Stanley Tang: 94

DashPass: 55

COVID-19: 70

Uber Eats: 13

Physical world: 6

DoorDash history

Arguably, DoorDash's seeds were sown long before 2012. As detailed in the S-1, Xu's parents immigrated from China to the US when he was five. His father had been accepted into the University of Illinois's Aeronautical Engineering doctoral program. To support the family, his mother, trained as a doctor, worked at a restaurant. That gave Xu a front-row seat of the day-to-day operations of running a food service business.

That understanding was further developed after college with Xu working at eBay in Corporate Development before heading to Stanford for business school. He would go on to intern at Square the summer before creating DoorDash.

As mentioned above, it was at Stanford that Xu teamed up with fellow MBA Moore and undergraduates Tang and Fang. As part of the popular course "Startup Garage," the quartet set about investigating markets and conducting customer interviews.

During a discussion with the owner of a local macaroon shop, Chloe, the founders stumbled upon the opportunity in local delivery. Having spent the better part of the meeting hearing about Chloe's difficulties and trying to map them to the ersatz app they'd created, it was only at the time of the departure that inspiration struck. This is Tang’s retelling:

Just as we were about to leave, Chloe bursted out [sic], "Well, there is one thing I wanted to show you." She took out a thick booklet. It was pages and pages of delivery orders. "This drives me crazy. I have no drivers to fulfill them and I'm the one doing all of it." And that was the lightbulb moment.

Three months after that initial revelation, in January 2013, the Palo Alto Delivery website launched, and that first pad thai was on its way.

Over the next two months, the founders studied by day and drove by night. Recounting that period in a 2014 speech, Tang paints a classic picture of cheery chaos, intense dedication, and ingenious hacks. In the film of DoorDash's ascent, this could only be shown in glorious montage: answering customer support calls in the middle of a lecture, keeping track of orders in a Google Doc, flyering University Avenue, and following drivers through Find My Friends. Palo Alto Delivery was pulling in so much cash that Square thought they might be money laundering and shut off their payment access. Thankfully, former intern Xu was able to make a call.

By March, Palo Alto Delivery had been accepted by Y Combinator, picking up $120K in the process. It didn't take long for the company to shed its cumbersome name, rebranding as DoorDash. Later, the company's logo would take on a particularly dynamic edge, drawing inspiration from the shape of the Shinkansen, Japan's bullet trains.

That proved fitting inspiration. In the years that followed, DoorDash scaled almost as quickly as it raised money. By the time the company raised a $17.3 million Series A, led by Sequoia Capital, 1 in 6 households in the Bay Area were reported to have used the delivery service. New geographies followed: first LA, then Boston. And more money: a $40 million led by Kleiner Perkins. Soon enough, the firm moved into Canada, opening up in Toronto. A familiar cycle was established: investment begetting expansion begging investment. In total, it took $2.5 billion in equity financing to propel DoorDash to its status as the industry's biggest player. That funding permitted strategic acquisitions, too, most notably in the form of Caviar for $410 million. There's a pleasant symmetry in Xu buying from his old employer, Square.

That rise was not without collision. Starting in 2015, merchants began to chafe against DoorDash's practice of uploading their menus without permission. Often, items were listed at a higher price online than they were in-person or on other delivery platforms, putting restaurateurs in the position of justifying inconsistent charges. In-N-Out sued the platform that year, making similar complaints. The suit was dismissed, but it brought further attention to DoorDash's occasionally fractious relationship with local business.

Couriers were not always enthusiastic, either. Dashers brought a class-action lawsuit against the company for worker miscategorization, claiming they shouldn't be considered independent contractors. That effort resulted in DoorDash paying a $3.5 million settlement in 2017. An additional $1.5 million should be paid out once DoorDash goes public. As discussed in detail under the "Regulation" section, DoorDash has spent lavishly to avoid broader worker reclassification.

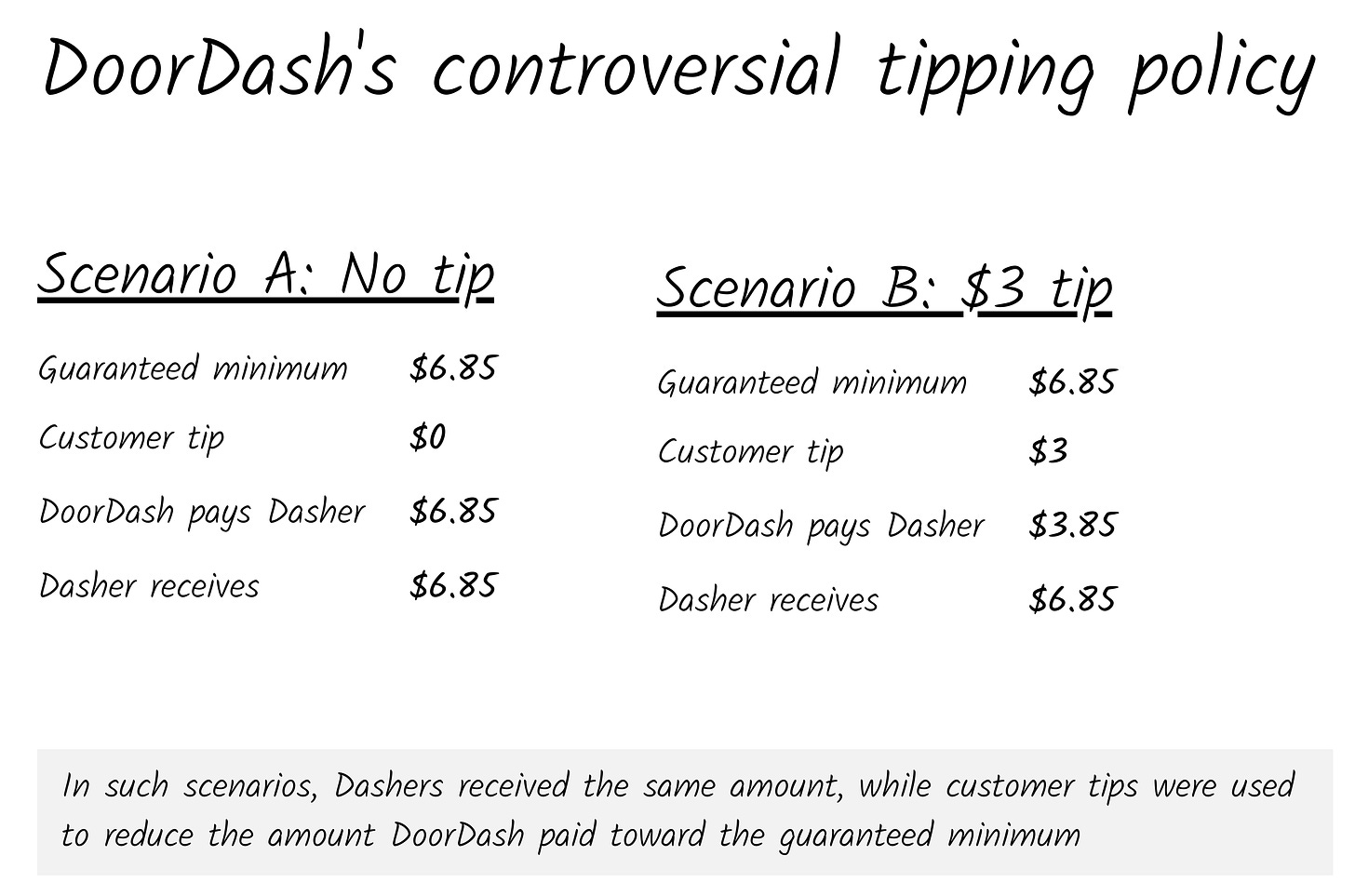

Dashers (and consumers) balked again in 2019 when details of DoorDash's tipping policy were brought to light. Rather than customer tips going directly to the courier, they went towards meeting a "guaranteed minimum." That meant that in many cases, a tip didn't result in more pay for a Dasher, though it did allow DoorDash to improve its margin structure. The company later reversed the practice.

The latest chapter in DoorDash's history may be its most significant. The outbreak of the coronavirus postponed the company's IPO but presented a gilded opportunity. Not only have total orders and gross order value (GOV) skyrocketed, but DoorDash has had the financial latitude and astute leadership to reframe themselves amidst the crisis. Restaurants with five or fewer locations saw commission fees cut by 50% in the pandemic’s darkest days, a move that impacted 180K locations. Over 270K complimentary meals were delivered to vulnerable community members. The result is a business that looks rather different than it did twelve months ago, a platform for "essential workers" rather than a blight on small business.

With a market-leading position established, few may wish to bet against Xu and the rest of the DoorDash team.

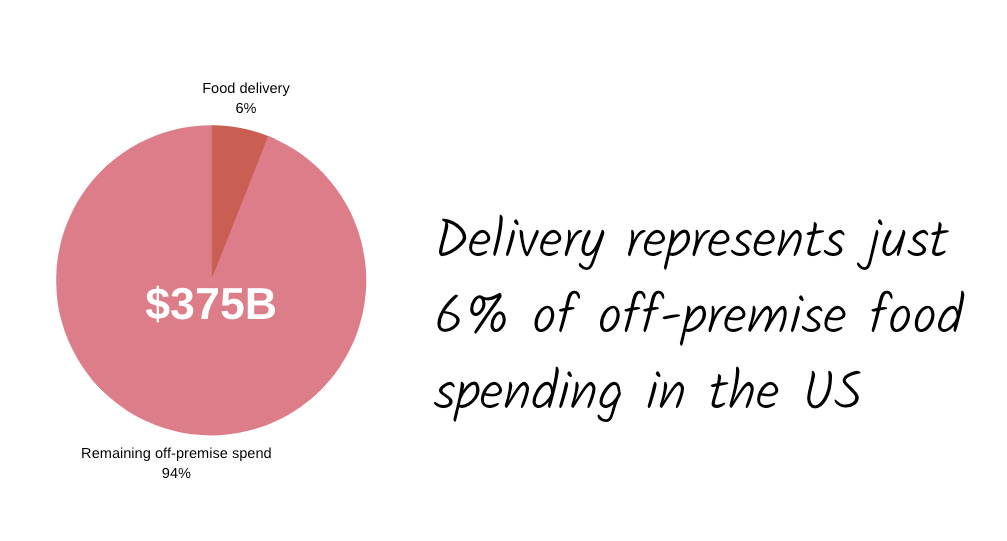

Market

DoorDash doesn't make a direct claim about the size of its total addressable market. Instead, the company references its penetration, noting that its customer base represents just 6% of the US population. The filing also notes that over $300 billion was spent "off-premise" in the food industry in the US in 2019. That total that includes restaurants, cafes, bars, and street stalls. A more recent report from Morgan Stanley estimates the figure to be closer to $375 billion. Food delivery, in particular, is presumed to be growing as much as 18% a year, with increasing penetration from 6% to 13% by 2025.

This implies the domestic market size for DoorDash's core product is $22.5 billion, potentially jumping to $60.7 billion in five years. DoorDash currently holds 50% market share — 58% in the suburbs — and is expected to IPO at a $32 billion valuation. If that pricing proves correct, it means DoorDash is valued significantly more highly than the total market in which it operates. While there is opportunity abroad, DoorDash is, for the time being, a predominantly US-focused business. These figures help explain why DoorDash has expanded its product offering to include “grocery and flowers" and generalized logistics services.

Within the food delivery market, DoorDash is attractively positioned in suburban and small metropolitan markets, where it has been able to acquire a leading market share. In addition to being underserved, these are valuable markets for food delivery as they tend to be family-centric, which usually means order values are higher. There is also less congestion, smoothing logistics. Direct delivery is also more common in these geographies, with companies like Dominos and Pizza Hut holding larger shares relative to metropolises, where the percentage of independents is higher.

Often overlooked, drive-through pickups play a hefty role in these markets, too. While city-dwellers are more familiar with delivery, drive-through is a considerably larger market, expanding rapidly during the pandemic. In March alone, drive-throughs brought in $8.3 billion in revenue, implying an annual spend of nearly $100 billion. Compared to delivery, drive-through is also more cost-efficient for restaurants. That's led to more merchants charging one price for on-premise purchases and a higher one for delivery. (There's some irony in that given merchants once criticized DoorDash for that practice.)

Why does this matter?

As DoorDash looks to defend its existing position and expand its offerings, it will increasingly encounter a different competitive set. While management has succeeded in outfoxing other delivery apps to reach the number one spot, they will need to steal share from drive-through operators and national chains that want to shift consumer demand to their own platforms. If DoorDash continues its foray into grocery, it will encounter specialized players like Instacart, which will limit its market opportunity.

The upshot is this: while DoorDash has an attractive position within the food delivery sector, particularly in suburban and small metropolitan markets, room for growth is relatively limited. The strength of drive-through, national chain platforms, and online grocery businesses may cut off avenues for further expansion.

Product

Marketplace

DoorDash's core Marketplace product is comprised of four critical components:

A consumer app

A Dasher app

Merchant software and services

Backend logistics that orchestrates everything

Much of the core "product" work for DoorDash relies on the orchestration layer. Indeed, a genuinely excellent delivery product depends on two factors above all: scale and logistical optimization.

For consumers, those elements lead to a platform with a broad selection, capable of delivering accurate orders on-time. For merchants and Dashers, they drive incremental earnings. That scale is the primary driver of a great experience explains why Sales & Marketing (S&M) expenses dwarf Research & Development (R&D) spend (67% vs. 12% for FY 2019).

As noted, logistical optimization is the second most significant driver of product excellence. To deliver food fresh, DoorDash needs to answer questions like, "how do we ensure Dashers arrive just after the restaurant is done preparing an order?" The solution — send the order to the restaurant only when you know a Dasher's arrival time — is orchestrated through software. There are plenty of inputs to the system, like how long it takes to walk upstairs or traffic's real-time pace. These are challenging variables to consider; DoorDash has done the hard and expensive work of doing so. Some benefits of those investments accrue to the consumer, but many affect the Dasher, allowing them to earn more with better-optimized routing and order batching. DoorDash itself benefits, of course, by better handling higher volumes thanks to its improving algorithm.

The application interfaces are also important. After all, they are how DoorDash communicates the solutions to those hairy logistical challenges to users. One neat example of how this plays out: when picking up from a restaurant that frequently mistakes orders, the Dasher app nudges the Dasher to confirm items' accuracy. Beyond instantiating the logistics service, there are a couple of other application features worth calling out.

Consumer

In 2018, the company launched a membership product called DashPass, which costs $9.99/mo and earns you free delivery from qualifying partner merchants. DashPass had 5 million active subscribers as of September 2020, implying a $600 million run rate business. DashPass and other platform enhancements have enabled DoorDash to reduce consumer fees by 20% since 3Q 2017.

Dashers

The Dasher app allows couriers to track financial goals and gives full visibility into order details before accepting. It also highlights that Dashers do not need a car to deliver and that working for DoorDash is possible wherever the platform is live. Quotes from the S-1 and Reddit forum discussions suggest this geographical flexibility is a perk many Dashers value.

Merchants

Compared to other marketplaces, DoorDash's merchant tools feel lightweight. Etsy, for example, makes a quarter of its revenue from Seller Services, which includes ads, packaging and mailing, and a wholesale platform.

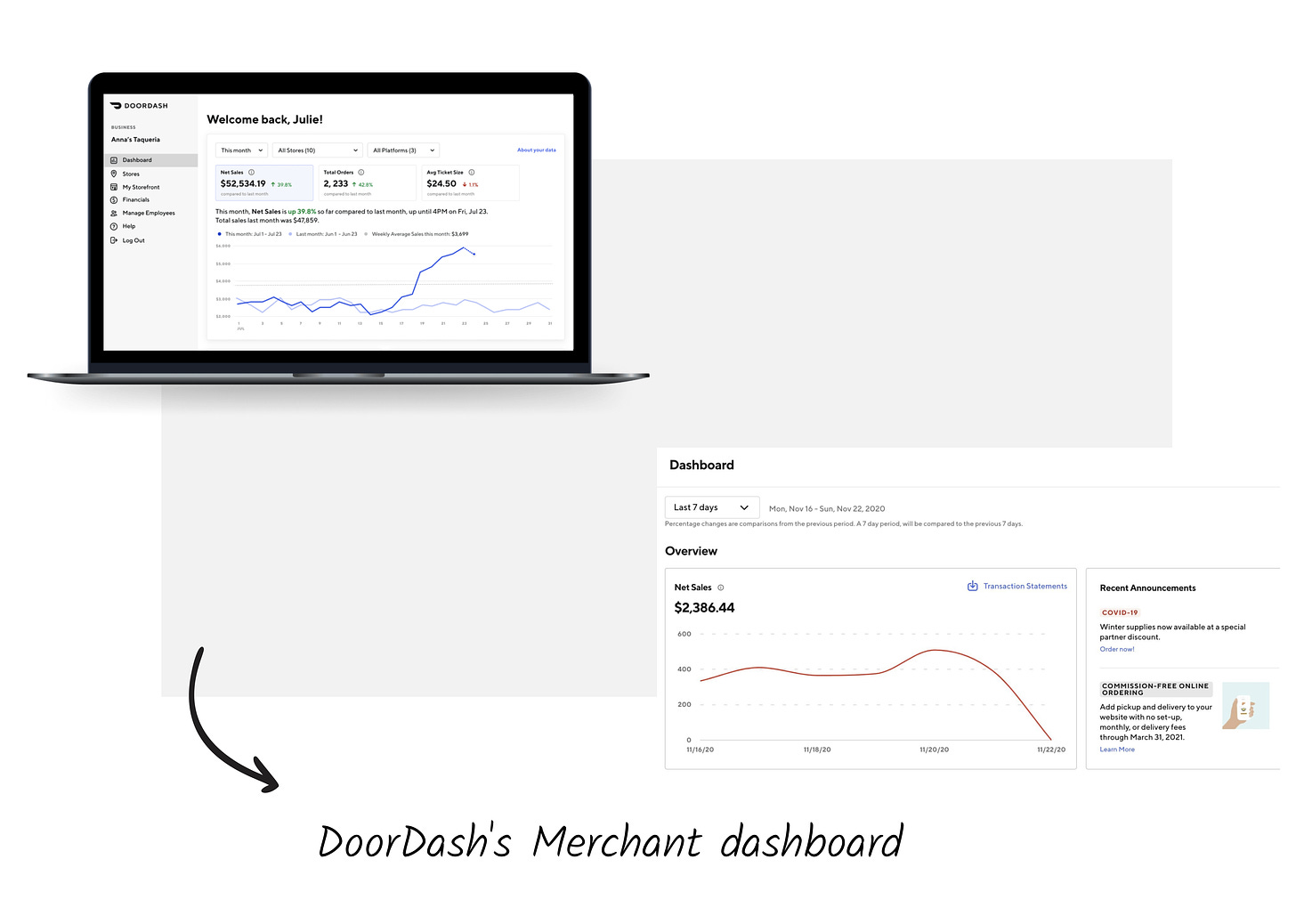

This might represent a long-term opportunity for DoorDash. Right now, the platform includes promotion planning, an analytics dashboard, customer support, payment processing, and consulting services. DoorDash case studies illustrate how platform insights have informed on-the-ground operational decisions: &pizza reportedly used DoorDash's tooling to identify a location for their mobile kitchens, for example. Despite that, it's hard to see anything that might be transformational for a small business. While DoorDash seems focused on broadening its market at the moment, deepening its support for merchants could prove lucrative. You could imagine the company taking a page from Etsy's book to offer wholesale foodservice distribution, a $280 billion industry as of 2017.

Conversely, it may be wise not to overinvest in such tools. Restaurants frequently list their menus across platforms to secure the broadest reach. That looks set to continue, presenting an opportunity for meta-players that simplify orchestration across channels. One early beneficiary of the trend? Ordermark, which has raised $150M, to do precisely that.

Other product lines

Drive

Beyond its core product, DoorDash offers a fulfillment-only product designed for large chains that own their ordering platforms.

In this model, a consumer orders directly from a chain like Chipotle, using the restaurant's app or website. Once placed, Chipotle passes off delivery to DoorDash. This is also how DoorDash collaborates with businesses that use white-label ordering solutions like ChowNow. In exchange for delivery, DoorDash charges a minimum of $7, with an extra $1 for each mile after the first.

The S-1 does not break down order volume between Drive and traditional Marketplace but reported that three customers accounted for 37% of accounts receivable. Major customers include Albertsons, Walmart, and Macy's. In October, the company announced a partnership with Sam's Club to provide same-day prescription fulfillment from 500 stores in 41 states via the retailer's website.

Storefront

Before covid-19, DoorDash found that 40% of its restaurant merchants lacked a direct ordering channel. These solutions allow restaurants to sell directly to their customers, maintaining a direct marketing relationship while avoiding high marketplace commissions. In July, the company responded to the growing threat of disintermediation by launching Storefront, its own white-label online ordering solution. Storefront charges a flat $2 delivery fee per order with no pickup fee. In exchange, restaurants pay a one-time $199 setup fee and monthly recurring $79 software fee, both of which are waived until March 31, 2021, along with the delivery fee. The product is currently used by a small yet diverse group of restaurants ranging from large steakhouse chains like Morton's and Del Frisco's down to local, single-unit mom-and-pop restaurants. DoorDash gives each brand a subdomain on its 'order.online' URL and allows it to display its logo instead of DoorDash's. With Storefront, the incremental cost of an average $30 order falls from the typical 20-30% marketplace commission down to ~7%. This is a compelling alternative for many merchants and directly competes with businesses like ChowNow.

Intriguingly, Storefront's recurring revenue model is in direct conflict with DoorDash's core marketplace business model, making this look like a defensive strategy rather than a real growth opportunity.

Convenience and Grocery

Since its early days, DoorDash has pitched itself as a logistics platform rather than a food delivery business. As mentioned, in announcing its initial seed funding, the company framed its ambitions as follows:

Ultimately, our vision is to build the local, on-demand FedEx. We are a logistics company more so than a food company. We help small businesses grow, we give underemployed people meaningful work, and we offer affordable convenience to consumers. We're tackling some of the most difficult logistical challenges that come with on-demand delivery — both in engineering and in operations.

This is a framing favored by many other delivery companies, primarily because delivery represents such a small portion of the +$300 billion off-premises food market. To that end, DoorDash is making plays in the convenience and grocery categories.

DoorDash is moving into the convenience category in conjunction with third-parties and with a vertically-integrated approach. In April, the company launched this new category in partnership with 7-Eleven, Walgreens, CVS, and Chevron. This new service spanned 2,500 stores across 1,100 cities nationwide. Two months later, DoorDash began rolling out its own convenience "dark stores," selling over 2,000 items deliverable in less than 30 minutes. Products include everything from frozen hot pockets to over-the-counter medicine to almond milk. According to its jobs page, the company currently operates 15 "DashMart" locations and is expanding to 18 new cities. The shift from aggregating towards operating its own convenience stores resembles the model of services like GoPuff and Amazon's Prime Now. In stocking a large supply of shelf-stable items closer to consumers, DoorDash has the opportunity to boost average order values (AOV) and improve profitability without significant inventory risk.

Grocery represents another interest. In August, the company announced partnerships with retailers like Smart & Final, Meijer, Hy-Vee, and Gristedes/D'Agostino. Its pitch to consumers is to deliver over 10,000 grocery items in less than an hour, the gold standard established by Instacart. There are significant barriers to entry related to inventory management, advertising, and labor. Unlike delivering restaurant meals, additional work is required to collect a grocery order.

Business model

A fellow S-1 Club analyst once said, "it is a marvel that the US consumer gets a hamburger delivered direct to door and the order is profitable." That quote came from @Post_Market, who is deeply-versed in the food delivery industry. This brings us to the first question we must ask about DoorDash: is this true in their case? We need to understand if the company's model is one of subsidy — with venture dollars artificially attracting diners, Dashers, and merchants — or sustainability.

Let's first look at how DoorDash monetizes. The company's primary means of revenue generation comes from commissions paid by merchants (to list on their marketplace) and variable fees paid by diners (including delivery and services fees). We won't dive into DashPass or Drive's unit economics but suffice to say these are high margin products compared to the core marketplace business.

In the S-1, DoorDash illustrates a sample transaction.

For a ~$33 food order, DoorDash keeps ~$5 in revenue, a take rate of 15%. The remaining ~$28 is divided between merchants and the Dasher. The merchant receives ~$20 (an "effective" take rate of 61%), while the Dasher earns ~$8 (24%).

That "take rate," which usually describes what percentage of GMV a marketplace keeps, is a useful way to think about the different stakeholders in this model. A few critical questions for each of them.

Merchant. Can a merchant afford to deliver through DoorDash, given they lose ~40% of potential food sales? DoorDash would frame it differently, of course. As shown in the illustration, the merchant receives ~$20 in revenue from an order priced at ~$22, making DoorDash's effective take rate just 9%. Still, many restaurants have expressed their opinion that "fees are too high." As mentioned, merchants will often increase menu prices on DoorDash as a result.

Dasher. Can a Dasher make a livable income? Earning $8 is just above the national minimum wage but often below what's mandated by the states in which DoorDash operates. California's minimum wage is $12 an hour, for example. To help Dashers make additional income, DoorDash tries to enable multiple deliveries per hour. With three deliveries, a Dasher could earn as much as $24 an hour. However, this seems to be a rarity rather than the norm. A study conducted by #PayUp, a group campaigning for gig economy workers, suggested Dashers earn an average of just $1.45 an hour.

Consumer. How many diners exist who are willing to pay a 30-40% premium for food to arrive on their doorstep? As of today, 18 million diners use DoorDash. With 70 million US households making over $75K a year, the company may hit the ceiling of its addressable market. Arguably, the pandemic has already tested this upper limit — many consumers were willing to pay up in the circumstances. They could be less inclined once public health normalizes.

Beyond these core questions, it's worth understanding how the viability of DoorDash's business model might change in the future. Key considerations include (AOV), average order frequency (AOF), delivery efficiency, and supply-side pressure.

AOV. DoorDash's AOV is relatively low compared to other e-commerce categories, including online grocery. Mass market consumers tend to order fast food like pizza and burgers, which have relatively low order values.

AOF. We should expect AOF to decrease post-covid-19, given in-person dining will become tenable. The price premium also limits adoption, meaning that the average consumer may only order once a month rather than weekly.

Delivery efficiency. DoorDash's point-to-point model may hamstring them. The company averages 2-2.5 delivers per hour. To make this approach work, variable delivery costs are levied, which often results in significant mark-ups when combined with DoorDash's take rate. As alluded to above, this, in turn, limits TAM given that ordering becomes a luxury, discretionary service. Expanding into new verticals like grocery and pharmacy should help AOV (and theoretically AOF) but may suffer from similar problems given the point-to-point model.

Supply-side pressure. Independent restaurants are under severe pressure, with as many as a third predicted to go under in the coming months. Meanwhile, large fast-food chains are thriving. This combination may put DoorDash in a challenging situation. On the one hand, the company may wish to relax fees to keep small businesses alive (and avoid public backlash). On the other hand, fast food chains will feel they have sufficient leverage to reduce or eliminate the marketplace's take rate. The result may be a squeeze DoorDash from two types of supplier for different reasons.

In totality, these considerations don't make for reassuring reading. Growth seems likely to slow, and the current model may stifle further efficiency gains. The coronavirus was a distortion (a positive one, but a distortion no less), potentially setting the "high water mark" for adoption, at least in the near-term. As the pandemic subsides and unemployment increases, headwinds may be fiercer than tailwinds.

Management

DoorDash isn't an easy business to run. The company's product is entirely dynamic, adapting to stakeholder demands, local conditions, and perishable products. Diners are impatient, merchants want more orders, and Dashers want more work. It's a business that's part software, part logistics, and part customer service — a tricky combination that requires exceptional management. With that in mind, it's essential to understand how company leadership is incentivized to continue operating at a high level for the years to come.

It's hard to think of a better founder and CEO than Tony Xu. In many ways, he was made for the role he now fills, growing up inside his family's restaurant, before stints at merchant-focused companies like eBay and Square. He marries earned compassion for the small business owner with a former consultant's meticulousness.

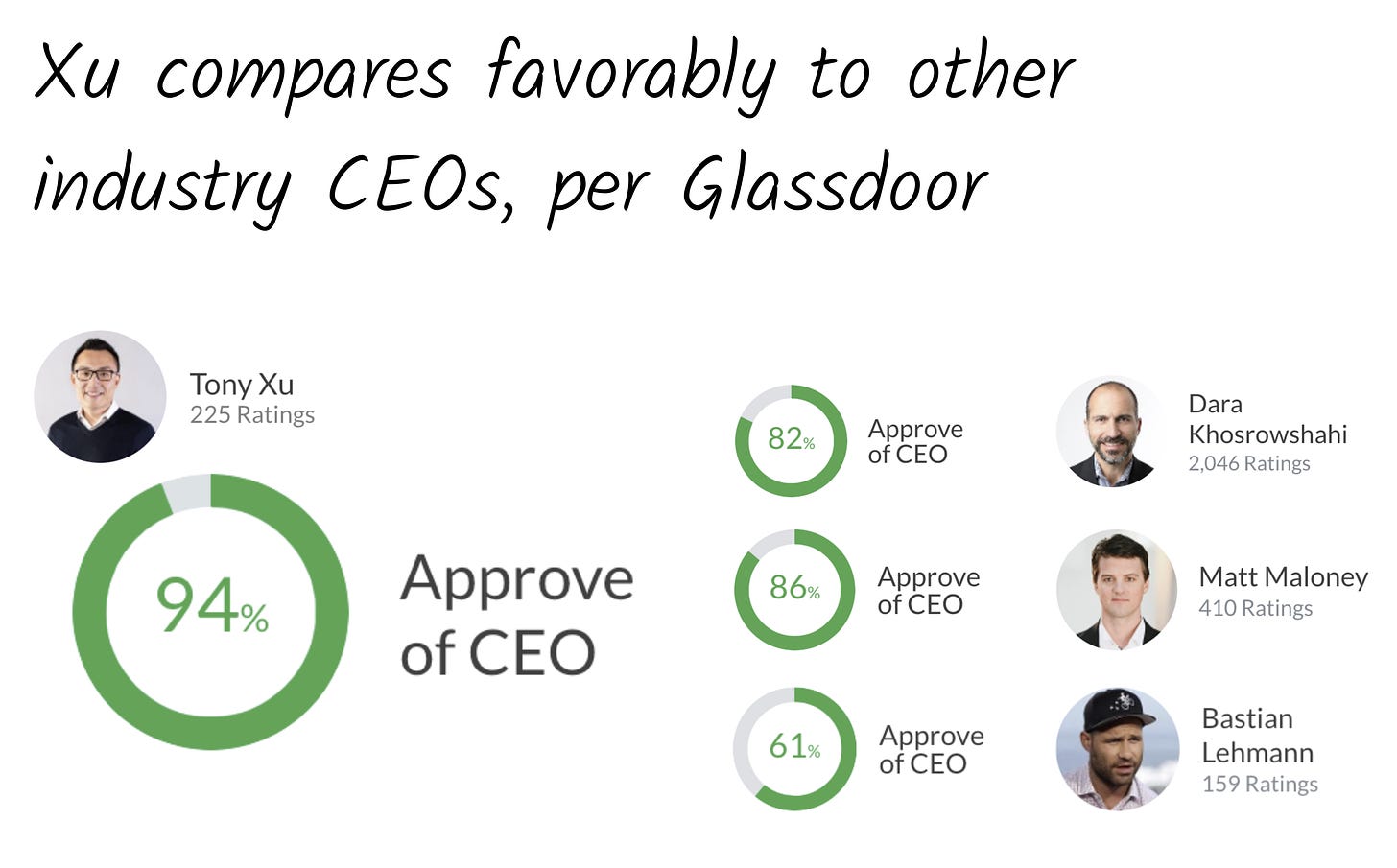

Time and again throughout DoorDash's rise, he's illustrated the grit and drive typical of great entrepreneurs. In the company's early days, Xu housed the first twenty employees in his 900-foot apartment to keep costs low and get the business off the ground. Today, the company employs ~3.3K at its SF HQ. Xu holds an approval rating of 93% from his team. That compares favorably to the CEOs of Grubhub, Uber, and Postmates.

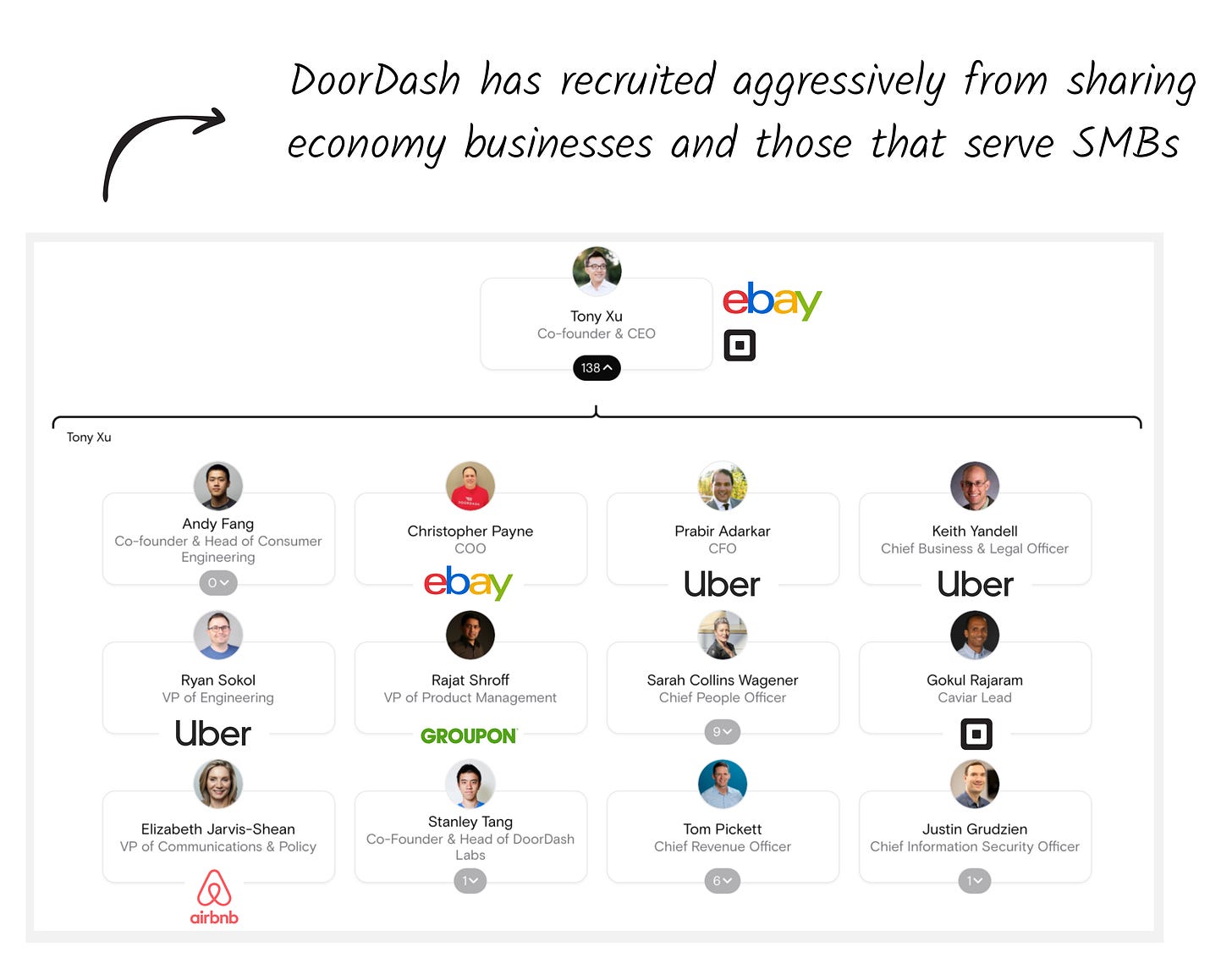

As CEO, Xu oversees a direct executive team of twelve, spanning engineering, finance, product management, HR, communications, and information security.

Many of these direct reports come from high growth companies and, most notably, large marketplaces that serve SMBs.

Christopher Payne, COO. Before serving as CEO of Tinder, Payne held multiple executive positions at eBay, including SVP of North America.

Prabir Adarkar, CFO. After stints at McKinsey and Goldman Sachs, Adarkar worked as Head of Strategic Finance at Uber.

Gokul Rajaram, Caviar Lead. Rajaram worked as Caviar Lead during six years at Square, a role he has continued to fulfill at DoorDash.

As evidenced by this org chart, Xu is a masterful recruiter, drawing impressive individuals from his old haunts. He's also a remarkable storyteller (see how he opened the S-1 telling his own story of growing up in a Chinese food restaurant), an essential ability for a business like DoorDash that relies on the narrative of empowering SMBs.

Xu's incentive plan is somewhat unique, driven by the board of directors and tied to the company's long-term performance. With an annual salary of $300K, a modest sum compared to many other tech company CEOs, Xu has a lot riding on DoorDash's continued success. Should he lead the company to great heights, he can earn orders of magnitude more.

How much exactly?

The S-1 is hazy on the details. Xu's vesting is broken into nine tranches, defined by the stock price, but it's unclear what each hurdle will be.

From the S-1:

The CEO Performance Award is divided into nine tranches that are eligible to vest based on the achievement of stock price goals, each, a Company Stock Price Target, measured based on an average of our stock price over a consecutive 180-day trading period during the performance period as set forth below. This measurement period was designed to reward Mr. Xu only if we achieved sustained growth in our stock price.

We'll have to wait and see how the stock performs once listed. But if demand is as hot as it has been in the private markets, Xu is set to become one of highest-paid "restaurant workers" of all time.

Investors

Doordash has raised a colossal $2.5B to date, the most recent of which was a Series H earlier this year. That round, led by Durable Capital, was said to value the company at $16 billion.

Along the way, DoorDash has brought in numerous notable investors but inevitably diluted early backers. From the beginning, the company garnered interest from top firms. After graduating Y Combinator in 2013, DoorDash raised a seed round led by Keith Rabois, then of Khosla Ventures, with participation from Charles River Ventures, Kleiner Perkins, and angels. None are listed in DoorDash's cap table after seeing holdings diluted below the 5% ownership hurdle. That said, given DoorDash's projected valuation, none will mind too much.

So who owns this company?

Only three investors cleared the 5% threshold: Sequoia Capital, Softbank Vision Fund, and Greenview Investment Partners.

The paths to those respective stakes look quite different. Sequoia acquired a large portion of equity by leading DoorDash's Series A, doubling down by leading the Series C, too. The firm continued to invest in later years, even as the valuation skyrocketed. In total, Sequoia is rumored to have invested $217 million to secure its stake. Softbank Vision Fund and GIC both invested at the Series D, at which point DoorDash was already a unicorn. Naturally, accumulating their respective stakes has cost considerably more.

Given that DoorDash competes with well-capitalized competitors, many of who had a considerable head start, raising this kind of money makes some sense. It's also an indication of the scale of financing certain startups need to succeed, requiring investors to allocate increasing amounts of capital to protect ownership in their respective "winners."

Financial highlights

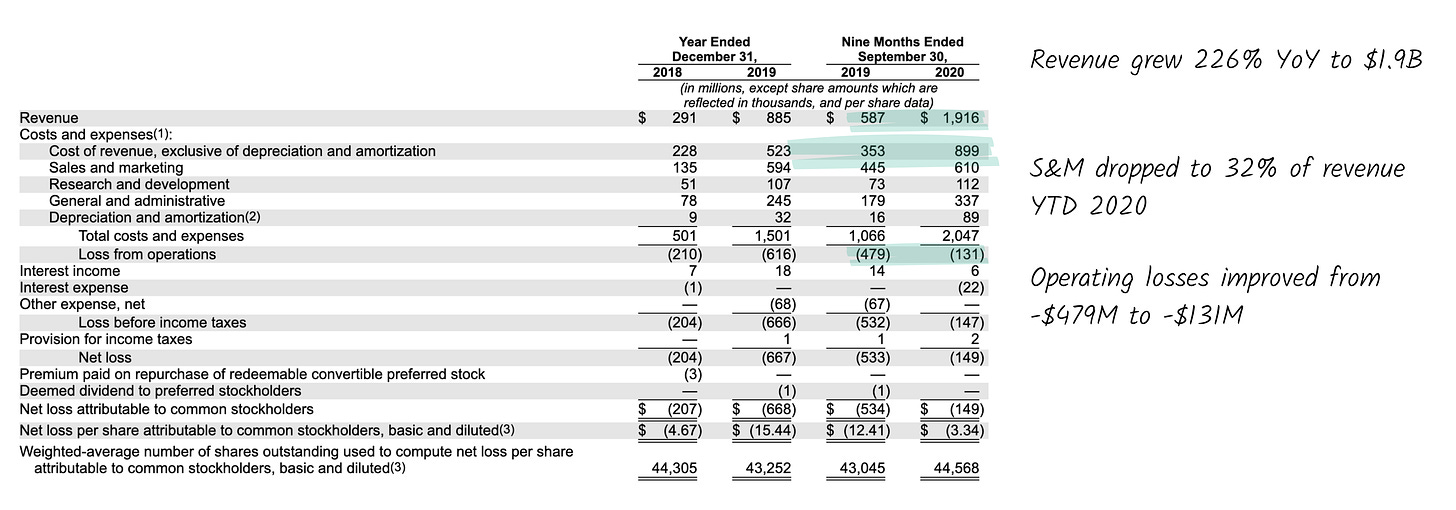

DoorDash has been serving up mouthwatering revenue growth for years. The company earned $291 million in 2018, rising to $885 million in 2019. Over the first nine months of 2020, DoorDash brought in $1.9 billion in revenue. The filing notes that over that period, revenue increased more quickly than Marketplace GOV. DoorDash attributes this difference as follows:

Revenue increased at a faster rate than Marketplace GOV, primarily due to increased Dasher efficiency, lower refunds and credits as a percentage of Marketplace GOV, and increased merchant fees from our Marketplace as well as Drive.

As expected, Sales & Marketing (S&M) and Cost of Revenue, which includes Dasher payment, represent the largest cost centers. Relative to revenue, S&M spend declined significantly from the first nine months of 2019 to the same period in 2020, dropping from 75% of revenue to 32%. Meanwhile, Cost of Revenue dropped from 60% in 2019 to 47% in 2020, a change facilitated by "product and operational improvements."

These are promising signs for DoorDash, suggesting the company has had success reducing costs by improving its logistical efficiency. The stark decrease in operating losses, which dropped from $479 million in 2019 to $131 in 2020, points to the same conclusion.

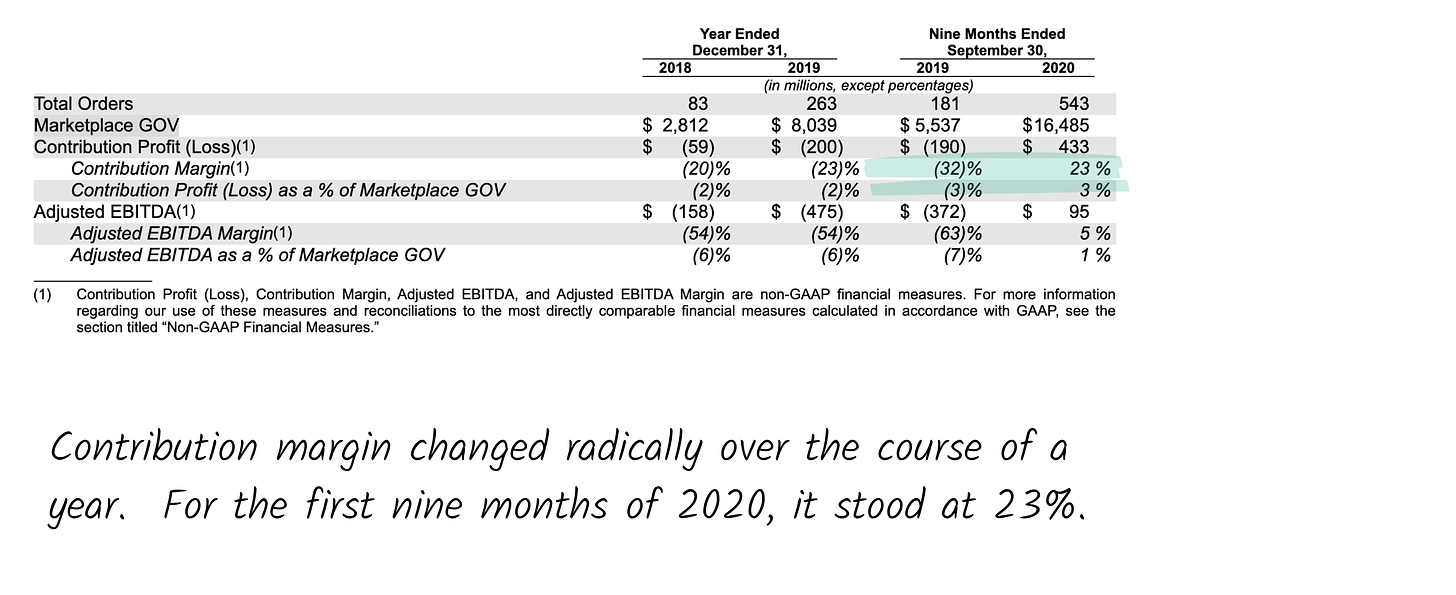

DoorDash's margin structure has improved, too. The contribution margin, which hovered steadily around -20% in 2018 and 2019, shifted to 23% in the first nine months of 2020.

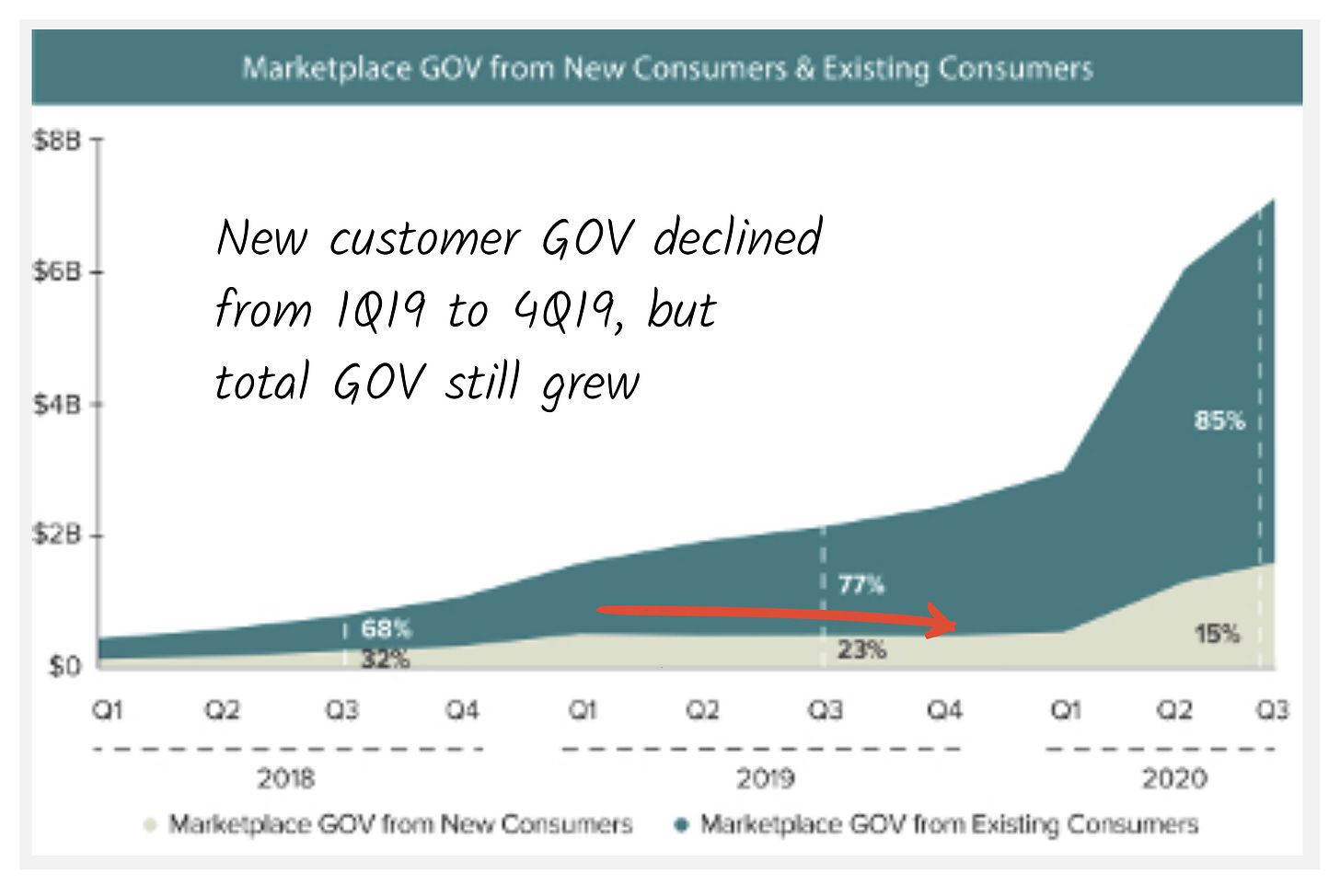

That was helped by gross order value (GOV) nearly doubling to reach $16.49 billion. In reviewing other private research sources, the S-1 Club found that this trajectory is consistent with DoorDash's historical data. GOV more than doubled each year in 2016, 2017, and 2018 before growing another 250% in Q1 2019. While this growth fell to "only" ~100% by Q1 2020, it got a second wind in the most recent two quarters because of coronavirus-induced tailwinds, taking growth back up above 200% again, as noted.

A review of GOV reveals an interesting tidbit: pre-COVID, DoorDash's growth was earned primarily by expanding repeat business from existing customers rather than through new customer acquisition. In fact, Marketplace GOV from new customers was 3% lower in 4Q19 than it was in 1Q19.

If it wasn't for the coronavirus, Q1 2019 might have been the customer acquisition peak for DoorDash. It's a real testament to the business that it could double revenue while new customer acquisition fell. That likely means we're still a long way away from peak revenue.

A final note on the graph above. There’s been some discussion that it may contain a key error. We’ve made the assumption that the numbers are correct, even if there’s some controversy over the visualization.

Unit economics

How valuable is a DoorDash customer?

What do the company's unit economics look like, and what does that mean for customer lifetime value (CLV)?

Using a series of statistical models for acquisition, retention, ordering, and spend, trained on all of their disclosures (most commonly known as "customer-based corporate valuation"), we triangulated their likely unit economics.

(For more on the approach, check out this article in the Harvard Business Review and this analysis of Lyft by Theta Equity Partners. If you have a high pain tolerance, you might like reviewing one of the academic papers undergirding the approach.)

Here's the simple math for a customer from the January 2019 cohort, after normalizing out the impact of COVID-19 to measure for post-pandemic economics:

DoorDash spends on the order of $6 in S&M to acquire a new customer. That's their customer acquisition cost (CAC).

Customers spend about $30 each time they place an order.

DoorDash keeps a growing proportion of that $30 as gross profit – around 2% in year one, growing to approximately 12% by the end of year three.

DoorDash spends another 2.3% or so on sales and marketing for each repeat order, implying a contribution margin on repeat orders that grows from 0% or less in early years to about 10% in year three.

Order frequency grows over time. The average customer places ~1.6 repeat orders in year one, ~3.5 orders in year two, and more in subsequent years. Customers place an average of +20 orders in their first five years.

All told, when we forecast future revenues, deducting COGS and S&M, DoorDash earns an incremental ~$60 over the next five years on each new customer after acquisition. That's about ten times the $6 that DoorDash spent in CAC to acquire the customer, implying a mouthwatering 5-year return on marketing spend of ~900% (even higher over a longer horizon if they can keep it up).

However, because of the back-end-loaded nature of orders, gross profitability, and S&M efficiency, it takes about 16 months to break even on that initial customer investment. For those interested in a closer look at this analysis, check out this detailed companion article.

In this sense, DoorDash's unit economics almost look like a B2B SaaS firm. There's a relatively significant investment upfront, a lengthy payback period, but significantly improving monetization over time, resulting in great ROI. That analogy only stretches so far, of course, given DoorDash's margin profile is much thinner than that of a software business. Indeed, small percentage point changes in their margins have an outsized impact on CLV. The small absolute dollar amount of their CLV makes them sensitive to TAM/customer acquisition concerns, which we've discussed under the "Market" and "Business Model" sections.

So, where do we go from here?

On the one hand, each newly acquired customer will probably be more income constrained, holding down their order frequency, in the manner we described previously. On the other, expanding the platform with consumers, Dashers, and restaurants should boost lock-in with all of these stakeholders. Given their investment in infrastructure and technology, DoorDash is well-positioned to identify new areas for operational efficiency, which should improve margin structure. Moving into groceries and other related verticals will also probably help their order frequency.

Where all this nets out is hard to say, but while TAM remains an issue, a cohort analysis of the customer base gives reason for optimism.

Competition

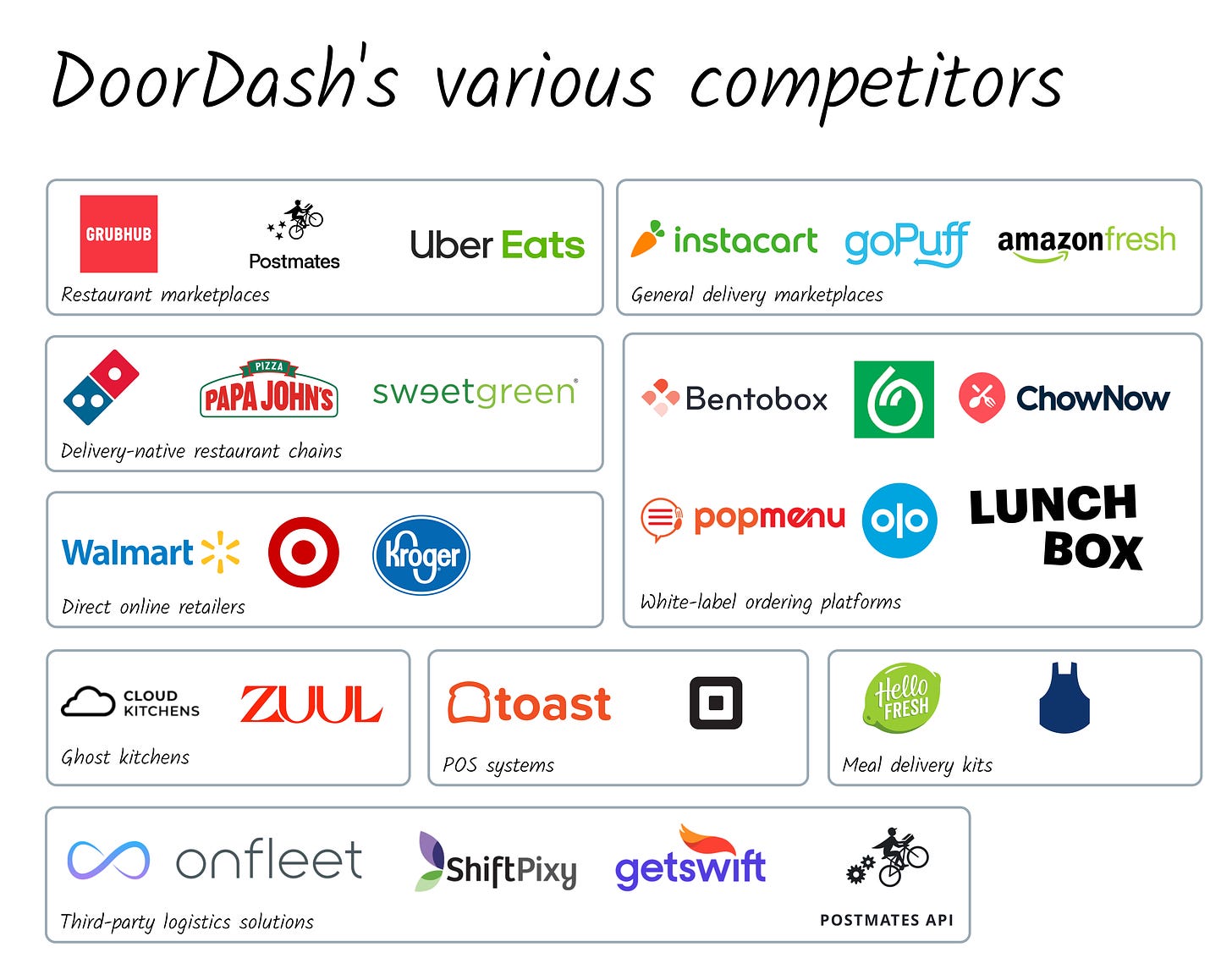

In its quest to dominate delivery in food and beyond, DoorDash jockeys with a variety of competitors. In the sense that DoorDash seeks to win an increasing slice of food spending, the company vies with other marketplace apps, grocery delivery services, meal kits, ghost kitchens, and vertically-integrated restaurant chains. In so much as DoorDash looks to empower SMBs and expand its logistical operations, it competes with white-label ordering platforms, POS systems, third-party logistics providers, and direct online retailers.

Our analysis focuses on those competitors who offer the most direct challenge to DoorDash: delivery marketplaces, white-label platforms, and ghost kitchens.

Delivery marketplaces

DoorDash's most direct competitors are Uber Eats, Grubhub, and Postmates.

It's worth noting that one of these is not like the other. Unlike its three rivals, Grubhub began as a pure marketplace, aggregating demand and leaving merchants to manage the actual delivery. Over time, the company introduced a last-mile logistics service. Just Eat Takeaway, Grubhub's new owner, started similarly, dipping its toe into delivery only when faced with increased competition from Deliveroo and Uber Eats. CEO Jitse Groen has publicly said that he is skeptical of the profitability of offering such services at scale.

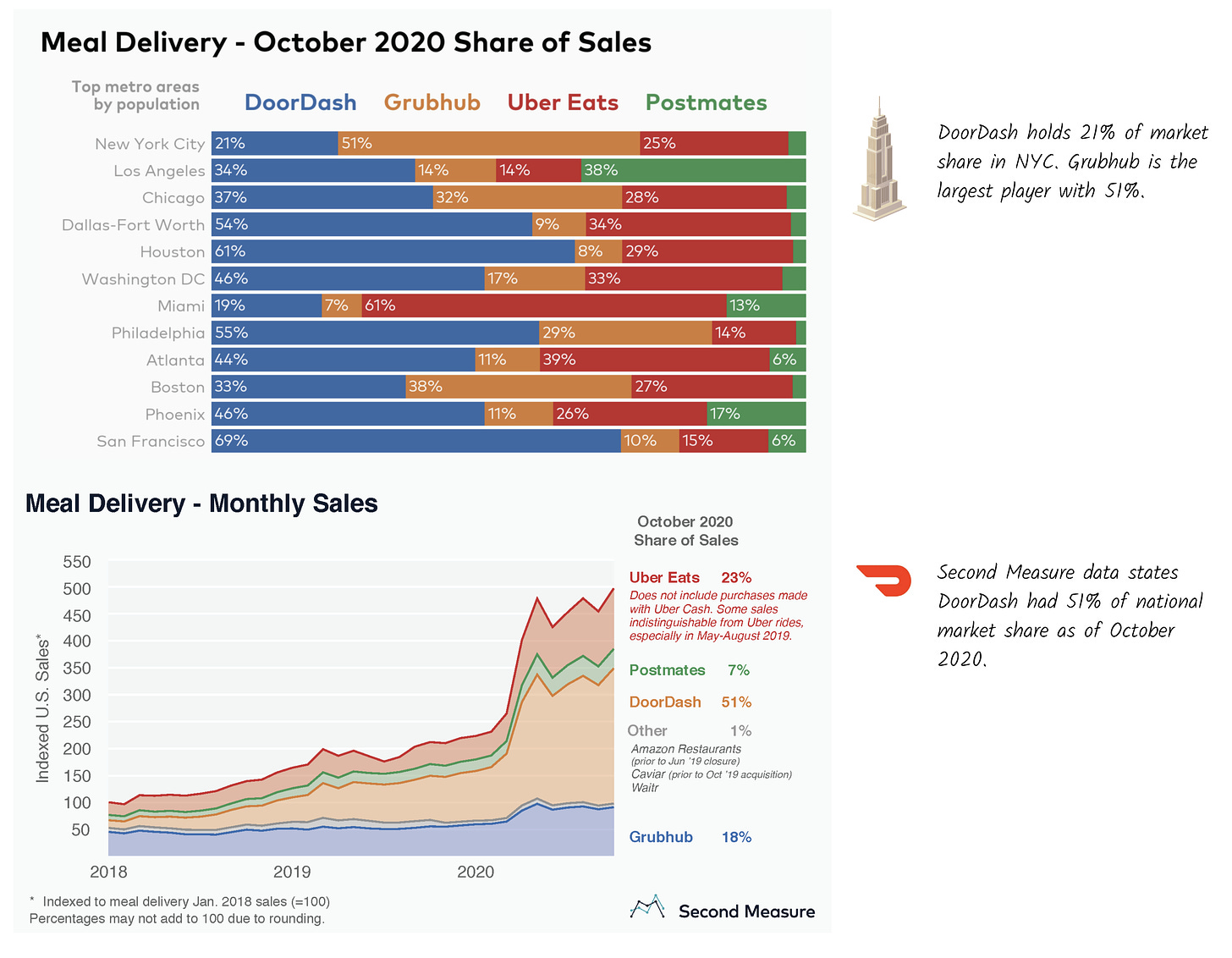

DoorDash currently stacks up well against the competition. As noted, DoorDash cites its US market share at 50%, with greater penetration in suburban markets. Data from Second Measure broadly confirms this assertion, suggesting that DoorDash held 51% of the market as of October 2020. Uber Eats and Grubhub held 23% and 18%, respectively. Uber is expected to acquire Postmates and their 7% market share by the end of the year.

These aggregate numbers don't paint the full picture, though. Like most marketplaces with physical logistics, geographies are won locally, with considerable variation between cities. Such differences are usually explained by the different time and investment companies devote to particular markets. Local partnerships also make a difference. DoorDash, for example, isn't the leader in either NYC or LA, the two largest metro areas.

DoorDash's share is impressive, but it may be difficult to tighten the stranglehold. Both restaurants and consumers tend to be promiscuous users, either listing or ordering across platforms. That leaves room for multiple winners.

Marketplaces have tried to steady their footing by signing exclusive deals with large chains and tying customers to subscriptions. Uber Eats, for example, earned sole access to deliver Starbucks products, while DoorDash boasts a partnership with Wingstop. The DashPass attempts to lock down the consumer, similar to Uber's Eat Pass, Postmates Unlimited, and Grubhub+. In DoorDash's case, it appears to be working, accounting for 20% of customers.

These partnerships and subscriptions may end up playing meaningful roles as delivery marketplaces hope to dominate individual geographies.

White-label platforms

The sentiment around the value of DoorDash to restaurants depends on who you ask. Some restaurants view it as a way to access more customers and grow revenues without expanding their retail footprint. However, others may feel that it is cannibalizing their revenue and hurting margins. The same can be said for many marketplace businesses that aggregate supply and own the customer relationship. That, in turn, often leads space for a "picks-and-shovel" business that allows the merchant to regain control of their customers.

To put another way: if DoorDash becomes the Amazon of restaurant delivery, who will be Shopify?

There's a handful of companies that are enabling restaurants to build digital experiences, including Bentobox, ChowNow, Lunchbox, and Popmenu. There are also companies like OnFleet that provide last-mile delivery as a service. The strategic complement to these marketplace business models will be platforms that enable restaurants to build and own their customer experience.

Ghost kitchens

One of the greatest threats to the one-to-one restaurant/marketplace model is ghost kitchens.

Businesses like Travis Kalanick's CloudKitchens aggregate supply from +100 restaurants and CPG brands under a single roof, allowing for delivery within minutes at no additional cost to the consumer. By co-locating 30-40 kitchens per facility, CloudKitchens changes the logistical dynamic from one-to-one to many-to-one. The company has alluded to its goal of creating a "virtual food court," allowing families to order from multiple restaurants, adding additional items like ice cream, liquor, or household essentials. This should yield a higher AOV, enabling more generous delivery subsidies. HNGRY, a media company founded by one of the S-1 Club's analysts, uncovered ~50 domestic properties owned by CloudKitchens, in addition to acquisitions and investments in South Korea, China, India, United Kingdom, and Mexico. Kalanick's company has raised $700 million in equity and $200 million in credit, with a recent $5.3 billion valuation.

Other competitors exist outside of CloudKitchens. Regional ghost kitchen operators like Zuul in New York City have already tested the model, offering end-to-end delivery services for restaurants on-site. Zuul Market is a fully-integrated marketplace of its tenants that also takes the step of aggregating demand from commercial and residential landlords, incentivizing batched ordering. Within that framework, many-to-one becomes many-to-many. Ultimately, multi-tenant ordering combined with batched delivery to densely populated office and residential buildings could bring the cost of delivery down to as low as $1/order in urban markets like Manhattan.

Regulation

The DoorDash S-1 has:

90 mentions of the word "regulatory"

122 mentions of the word "regulation"

5 mentions of the exact phrase "If Dashers are reclassified as employees"

Underlying the positive DoorDash S-1 numbers is a significant risk: the threat of regulatory and policymaking action at the local, state, and federal levels. The two most prominent regulatory risks are a reclassification of Dashers as employees (from independent contractors) and the imposition of commission caps that cities have begun to impose. Are these regulatory risks, outlined in typically anodyne legalese, of equal importance as the others listed, or do they represent a greater threat?

Worker reclassification

The DoorDash business model only works if Dashers remain independent contractors. The S-1 lays out a host of problems that would arise if Dashers were reclassified, the most obvious being "claims for employee benefits, social security, workers' compensation, and unemployment." Subtler issues include the necessity to pay back taxes potentially. DoorDash has historically lost money, and while the margins have improved, a reclassification would make an already improbable business model untenable. The numbers just wouldn't work. From the S-1:

[I]f Dashers are determined to be employees in other states or under federal law, this could result in even higher increases to our costs related to Dashers, which would likely lead us to increase fees and commissions even more and may result in further lower order volumes.

The existential nature of the threat was reflected in the money DoorDash spent pushing for the passage of Proposition 22 in California, legislation that allowed businesses like DoorDash's to keep treating their on-demand workforce as contractors. Gig economy companies Uber, Lyft, DoorDash, and others spent a combined $224 million to maintain the status quo. That doesn't mark the end of DoorDash's troubles, though. These battles will continue to play out throughout the country, and it's worth noting the "official" Biden administration position as presented during the campaign:

Ensure workers in the "gig economy" and beyond receive the legal benefits and protections they deserve. Employer misclassification of "gig economy" workers as independent contractors deprives these workers of legally mandated benefits and protections.

The page continues:

States like California have already paved the way by adopting a clearer, simpler, and stronger three-prong "ABC test" to distinguish employees from independent contractors. The ABC test will mean many more workers will get the legal protections and benefits they rightfully should receive. As president, Biden will work with Congress to establish a federal standard modeled on the ABC test for all labor, employment, and tax laws.

The ABC Test is a term to remember as the reclassification debate evolves. The framework was established during a 2018 court case involving Dynamex, a same-day delivery company. The A, B, and C are:

(A) that the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact; and

(B) that the worker performs work that is outside the usual course of the hiring entity's business;

(C) that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

The DoorDash S-1 recognizes the reclassification risk numerous times, and it's one that faces the entire gig economy. That the Biden administration suggested a "federal standard modeled on the ABC test" will undoubtedly keep DoorDash's corporate affairs team up at night.

Commission caps

The other immediate regulatory risk is the commission caps being imposed by cities across the country. As noted in the S-1:

With the continued duration of COVID-19, we expect these existing commission caps to persist in the near term and for additional jurisdictions where we operate to implement similar caps. If any of these events occur, or if commission caps are retained after the COVID-19 pandemic subsides, our business, financial condition, and results of operations could be further adversely affected.

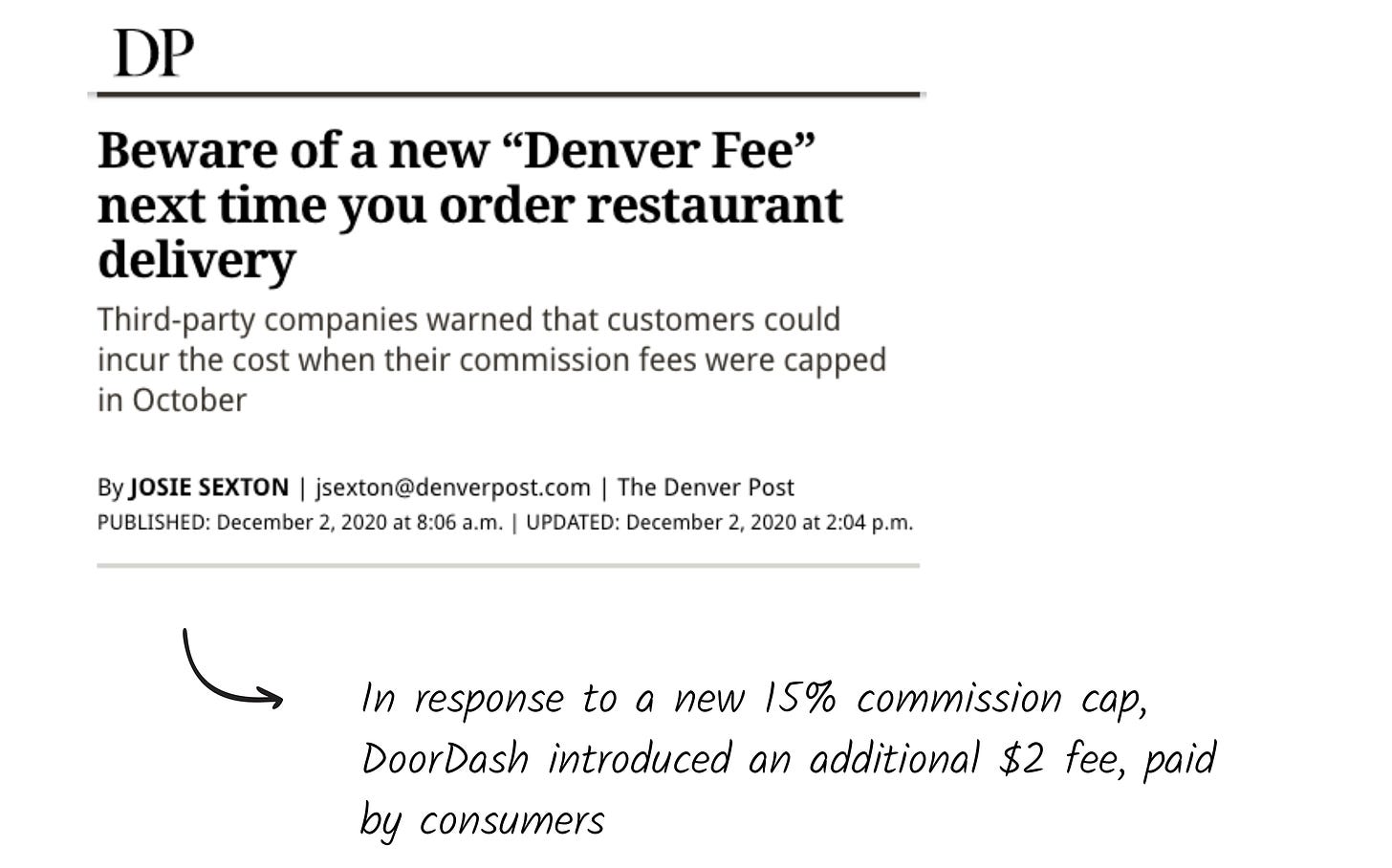

Denver, for example, has imposed a 15% cap on fees charged to restaurants. In response, DoorDash began charging customers a $2 "Denver fee," added whatever the order size. The cap went into effect on October 7 and is slated to run through February 9.

Will these caps remain in place after the COVID-19 pandemic has subsided?

DoorDash's steep fees can make sense for a typical restaurant if the delivery volume is supplemental to a regular dining operation. It seldom will when delivery makes up the majority of the business.

Just as critically, will implementing add-ons like the "Denver fee" cause economic and reputational damage?

Higher prices should lower demand (attenuated during the pandemic) and may frustrate customers. At several points in the S-1, DoorDash notes the importance of maintaining a positive reputation to retain and attract both merchants and customers. While consumers may blame policymakers, the decision may cast a pall over DoorDash, too.

Covid-19

As alluded to above, the coronavirus had a significant effect on DoorDash. Despite changes in consumer behavior, DoorDash saw a steep upturn in orders and moved quickly to keep its workforce safe.

According to the USDA, grocery spend has historically dominated "food away from home" until around 2007. Over the last twelve years, consumers spent more on food prepared from restaurants and other food service establishments. The pandemic changed all of that. When initial stay-at-home orders were announced in March, restaurant sales plummeted 28% YoY while groceries surged by 29%. These numbers have normalized to a 19% YoY restaurant decline and a 12% YoY increase on grocery spend in October, according to the US Census Monthly Retail Trade Report.

Meanwhile, restaurants have become wholly reliant on marketplaces and ordering platforms to sustain themselves through online pickup and delivery, driving DoorDash's bumper year. According to e-Marketer, the pandemic generated a 25% increase in new smartphone delivery app users in 2020. Indeed, as mentioned, 15% of DoorDash's Marketplace GOV came from new consumers over the first nine months of 2020. Naturally, DoorDash uses the S-1 to state that it expects order growth to decline going forward. Interestingly, AOV did not appear to increase during the pandemic, remaining steady at ~$30. These numbers may be skewed as DoorDash does not disaggregate Drive and Marketplace orders.

DoorDash took steps to assist its merchants and drivers at the early onset of the pandemic. It provided PPE for its Dashers and was a first-mover establishing contactless delivery as a default option. It announced a 50% reduction in rates for ~180,000 local DoorDash/Caviar partner restaurants with fewer than five locations in April. This amendment ran through the end of May.

Why now?

DoorDash doesn't need to go public. With $1.6 billion in cash, cash equivalents, and marketable securities on the balance sheet, they're in a stable financial position. But, of course, conditions have aligned in DoorDash's favor like few other businesses.

Firstly, the pandemic has not only altered DoorDash's figures but its perception, transforming the company from a "nice to have" to an essential service. With the coronavirus surging and a long winter ahead, DoorDash should be able to post some stellar early numbers.

Secondly, competitors like Uber and Grubhub have fared well, recently. After a rocky start to public life, Uber's stock has hit new highs, with the market seemingly viewing the acquisition of Postmates positively. Similar sentiments may color Just Eat gobbling GrubHub.

Thirdly, the passage of Proposition 22 has significantly de-risked DoorDash's third-rail. California tends to serve as the vanguard for this kind of legislation, so while other cases may emerge, it represents encouraging validation for the company's model.

Finally, DoorDash believes their story is just beginning. With ambitions to power all manner of local deliveries and continue growing at breakneck pace, new capital will be needed.

Disclosures

A few notes about this edition's analysts.

One was threatened with legal action by Durable Capital, an investor in DoorDash.

Another worked at DoorDash for several years.

A third is an investor in ChowNow.

A fourth works for a grocery delivery business.

A fifth was Tony Xu. (Kidding).