DST Global: The Quiet Conqueror

DST has one of the craziest track records of all time. Somehow, it still slips under the radar.

In collaboration with Kalshi...

One of the most interesting startups I discovered in 2021

As part of writing The Generalist, I get the chance to learn about amazing companies being built. I make a mental note of the ones I find especially interesting.

Today’s sponsor, Kalshi, is one that stood out. Though they’ve been around since 2019, they popped onto my radar after raising a Series A from Sequoia. Here’s what I think’s fascinating about them:

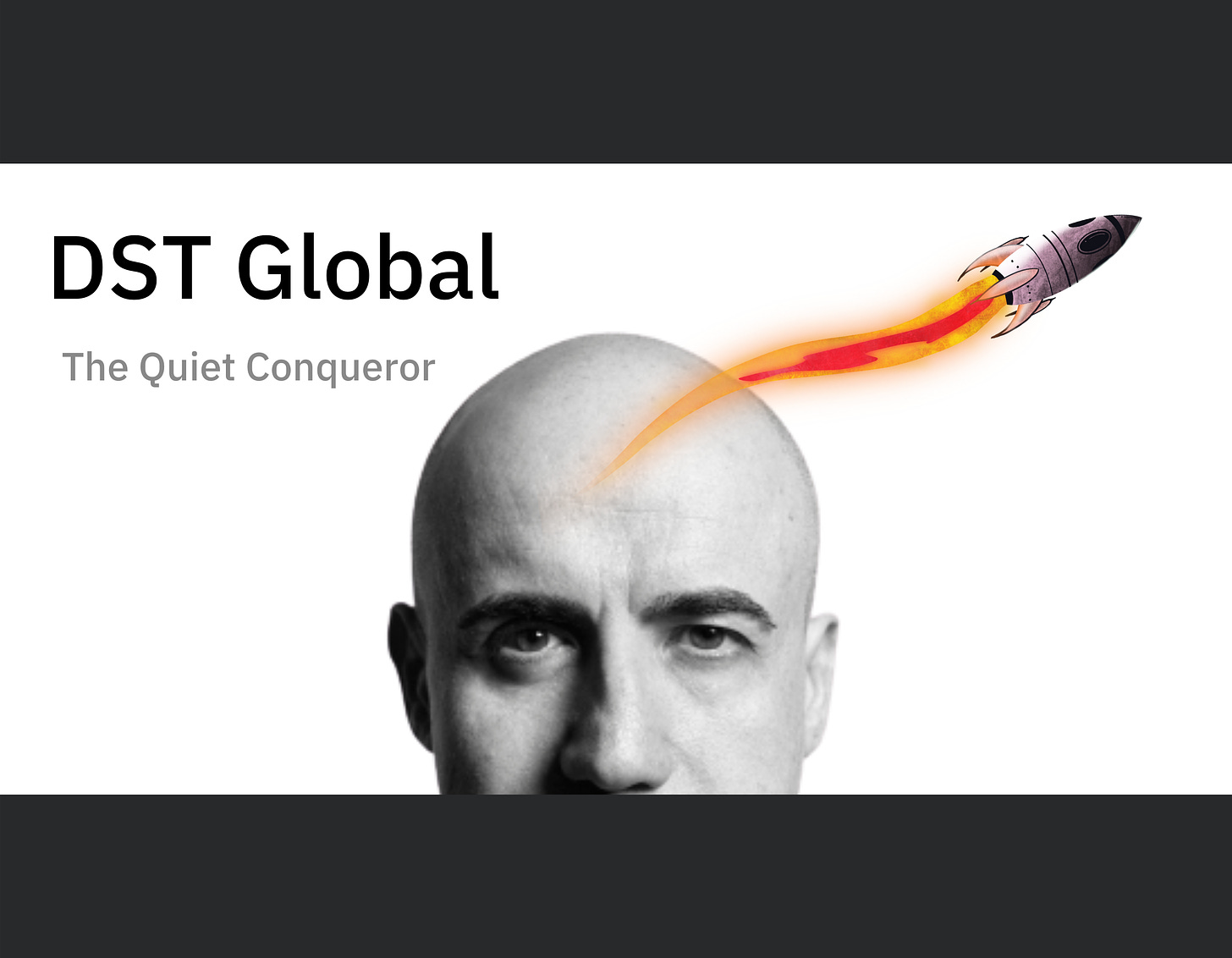

You can invest in opinions. Kalshi is an events exchange, allowing you to trade on what you think the future holds. Believe the debt ceiling is going up? Invest. Certain that Drake will have the album of the year? Buy in.

You’re not locked in. On Kalshi the price of an event market ranges from 1¢ to 99¢. The higher the price, the higher the probability. But you don’t have to wait for the deadline to exit. If you buy into a market for 5¢ and it moves to 15¢, you can sell and snag a 3x.

It’s regulated. Kalshi is the only exchange that’s regulated by the CFTC to offer event trading. The team really cares about protecting customers and have done the hard work.

I just bought a contract on real GDP growth in Q4 of 2021 this week. To join me on Kalshi, sign up here.

Actionable insights

If you only have a couple of minutes to spare, here's what investors, operators, and founders should know about DST Global.

DST is a surreptitious power broker. Many of today's founders may know little about DST Global. That hasn't stopped it from becoming one of the largest and most influential venture firms in the world, with an estimated $50 billion in assets under management (AUM).

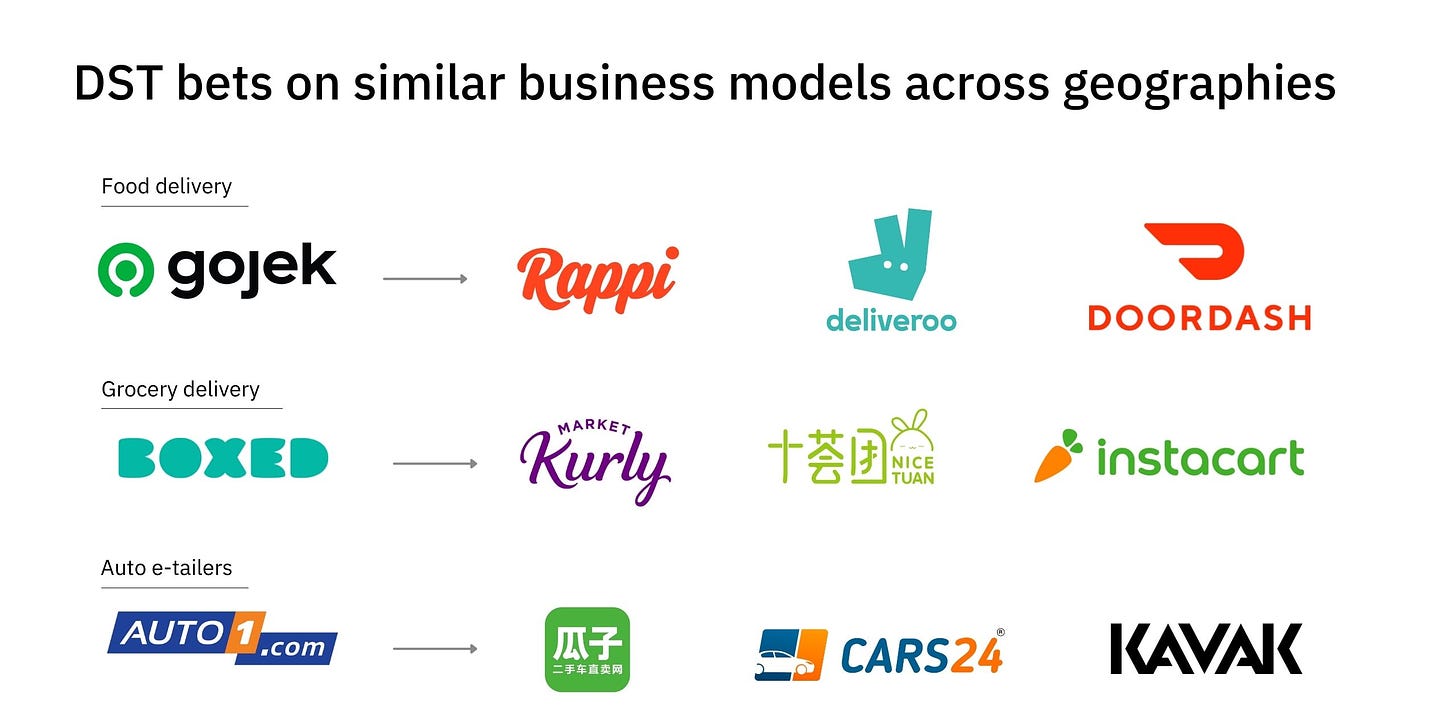

Geographical arbitrage has served it well. DST has a knack for identifying a powerful business model, then investing in winners in different countries. In this respect, its approach is not dissimilar to Tiger Global, though the firms differ in meaningful ways elsewhere.

That approach also allows it to rectify mistakes. One of the unrecognized benefits of investing worldwide is that you can compensate for gaffes. Miss out on Uber? At least you can invest in Didi and Ola. DST is a master of this move.

DST redefined what it meant to be "founder friendly." At the time of its 2009 investment in Facebook, it was considered absurd to invest hundreds of millions of dollars without receiving a board seat in return. Milner recognized that maintaining control was essential to Zuckerberg and struck a deal anyway. It changed the game.

Yuri Milner is no figurehead. Though DST's founder is in his seventh decade, he shows no signs of slowing down. A source close to the firm confirmed he remains a key part of the fund and still has "so much energy." Milner's work ethic sets the tone for a high-velocity team.

Learn how the best investors win. Every Sunday, we send a free email that explains the business world’s most important innovations and the stories behind them. It’s high quality business analysis, delivered at no cost to you.

There are two worlds, an investor told me. There is the world of loud investing and the world of quiet investing.

We know the loud world. It is the realm of Medium funding announcements, Twitter threads, and VC memes. It is podcasts and media-arms and YouTube shows and TikToks. It is logo shopping and #thoughtleadership and performative contrarianism and "I am thrilled to announce."

In spite of some of these less enjoyable elements, there is much to admire about the loud world. In an era in which attention is the rarest asset, loud world funds understand how to get it and turn it to their advantage. In the process, many bring information out into the open. The best inspire through storytelling, becoming masters of soft power.

Today, though, we are going somewhere else. We are going to a land in which footprints are muffled by snow and voices carry only a few feet. Where discussions take place behind closed doors and deals are struck in private. Where broadcasting too much of one's activities is not only unsavory but unwise. Welcome to the quiet world.

Among its denizens are dozens of funds whose names we may not know, along with a few simply too good to miss. Benchmark is a classic quiet world investor. Venture studios like Sutter Hill Ventures and Accretive fit the bill, too. Tiger Global would have fallen in this camp until its more recent investing detonations. It now shares its latest deals on LinkedIn.

If the quiet world has a conqueror, it is DST Global. After bursting onto the scene thanks to a 2009 investment in Facebook, the fund has evaded attention, especially in recent years. Such an understated presence belies both its size and track record. One source suggests that DST manages somewhere in the realm of $50 billion, making it larger than stalwarts like Sequoia and Insight Venture Partners. At the very least, it is certainly in their league.

That's not only the case when looking at assets under management; DST has a portfolio that would make almost any investor envious. Over twelve years, it has secured positions in Facebook, Twitter, Airbnb, Snap, WhatsApp, Spotify, Alibaba, Robinhood, Flipkart, DoorDash, Klarna, Bytedance, Slack, Wish, DraftKings, Meituan, Nubank, Gojek, Rappi, Flexport, Revolut, and many, many others. In the hits-driven world of venture capital, DST is the one firm that seems to never miss. It has done so while managing to stay almost entirely under the radar.

In today's piece, we'll unpack DST's playbook. In the process, we'll journey across continents and back in time, touching on:

Yuri Milner's path to the top. Before founding DST, Milner was a physicist, a would-be corporate raider, a Mary Meeker adherent, and a macaroni magnate.

How Mail.ru built Russia's internet. Though it started as a side-project, Mail.ru grew into one of its home country's most consequential internet businesses. Its history is intertwined with DST's.

Snagging Facebook. Why would Mark Zuckerberg want to meet with an unknown Russian entrepreneur? Milner had to fly to America and give his pitch at Starbucks to make a deal happen.

Being early and right. DST has a proven ability to correctly call internet trends. The fund was early to understand online monetization and has successfully caught multiple technological waves.

The generosity of Jan Koum. Look on Crunchbase, and you'll see no indication that DST invested in WhatsApp. But it happened.

Where DST heads next. Looking at DST's geographical distribution and some of its recent deals, we can get a sense of where the fund sees opportunity today.

Tread lightly.

Yuri Milner: Made for moonshots

In less than two hours, the world had changed irrevocably. On April 12, 1961, a rocket rose from a patch of land in southern Kazakhstan, rounded the earth once, and finally floated to rest near the Volga River.

A 27-year old "cosmonaut had piloted the flight." At the time of take-off, he was Yuri, the son of a carpenter and dairy farmer and a Soviet pilot; when he landed, he was Yuri Gagarin, the first human to reach space. Though his training had lasted for months, the transformation itself, the conversion from mortal to legend, took just 108 minutes.

Almost exactly six months later, a baby boy was born in Moscow to two of the city's best educated. Boris Milner was a successful economist and professor specializing in American management practices. His wife, Betti, was a physician and worked at a national laboratory. With the optimism of new parents, they named their son after the nation's planetary hero. Yuri Milner entered the world.

It proved a fitting name. The young Yuri showed both an aptitude and appetite for science from an early age. While other children adorned their bedroom with posters of Lev Yashin and other great footballers of the day, Yuri's walls bore the faces of Albert Einstein, Stephen Hawking, and Soviet physicist Lev Landau. He dreamt of someday emulating their intellectual achievements.

Though bright, there were indications that Milner's ambition surpassed his talent as a scientist. In a Russian interview published in 2021, he recalled a high school teacher attempting to dissuade him from pursuing physics as a career, believing he did not have the skill to make much from it. "Rightfully cruel" was how Milner described it.

For a time, though, he could not be dissuaded. After finishing high school, Milner studied theoretical physics at Moscow State University, continuing to graduate school. Though intellectually stimulating, Milner's studies revealed the truth of that "cruel" teacher's assessment as classmates surpassed him with their gifts. Realizing that his future lay beyond physics, Milner received his PhD in 1989 but chose not to defend his thesis.

It was a consequential year for the Soviet Union. A series of revolutions radiated across its territories, rocking Poland, Hungary, Czechoslovakia, Bulgaria, and beyond. After decades under Soviet rule, each state recommenced a push for sovereignty. Symbolically, the movement culminated with the fall of the Berlin Wall on November 9.

Milner had always had an unusually global mindset for someone born during the Cold War. From the age of 6 or so, Milner's parents had enrolled him in English lessons, ensuring he achieved fluency. Other episodes contributed to a favorable view of the world beyond Moscow. In a commencement speech decades later, Milner remembered his father returning from a business trip to New York and Boston when he was about eight years old. In the middle of the living room, Boris opened his suitcase to reveal a collection of scented hotel soaps. No store in the Soviet Union had anything like the variety he'd amassed on a single trip.

As Milner later said, "Long before I saw America, I smelt it."

Lomonosov at Wharton

That was where the young man headed next – but not before a brief stint as a chauffeur. Though it paid much better than his PhD program, it frustrated his father, who considered it a poor use of his son's abilities. Boris pushed Milner to continue his studies; Yuri decided to try business.

Decades earlier, a family friend had immigrated to Philadelphia, earning a position as a Professor at the University of Pennsylvania's prestigious Wharton School. He provided an introduction to the admissions committee.

Milner described the decision to apply to Wharton as "perfect timing." Relationships between the Soviet Union and the United States had softened considerably, but that rapprochement was still in its early stages. That made Milner a rarity at a time when his citizenship was suddenly marketable. On his way to meet the admissions committee, he stumbled across an article in the newspaper that noted Harvard Business School had accepted three students from the USSR for the first time. He thought if his meeting didn't get off to a good start, he could leverage the rivalry between the schools to persuade Wharton they needed their very own Soviet transplant.

In the end, he needn't have worried. Despite answering an admissions officer's question of whether he had any extraordinary accomplishments with a flat "no," Wharton was nevertheless wooed. By Milner's reckoning, they seemed to think of him as a "present day Lomonosov," referring to the Russian polymath who left his homeland to continue his studies in Europe. A few years later, an interview confirmed that assessment, with Wharton's director of admissions noting he was "absolutely wowed" by the young physicist.

Two months after his visit to Philadelphia, Milner received a letter of acceptance, along with the promise of full tuition coverage and a $1000 per month living stipend. He returned to America and spent the next two years steeping himself in the world of business. Upon graduation, Milner concluded of his studies that "The concepts themselves are very simple. You don't have a very diverse mathematical derivation— it is broader than physics but less deep."

After a stint at the World Bank in Washington DC— where he focused on the re-christened "Russia's" banking system and rapid privatization— Milner decided to return home "to take advantage of the developing free markets." In a nod to the remarkable timing that would make his name in investing, he added, "My idea is to be in the most useful place in the proper time."

Michael Milken and The Chocolate Factory

Back in Russia, Milner accepted a job at Bank Menatep. From the outside, it must have seemed an enticing proposition, founded as it was by one of the Federation's rising business stars, Mikhail Khodorkovsky. Better yet, Milner's education was rewarded with a senior position: chief executive of Alliance-Menatep, the firm's investment arm.

In that role, he had a chance to emulate some of his business school heroes. In a Wired interview, Milner referred to corporate raiders like Henry Kravis and Michael Milken "as very romantic figures for me–and they are very American."

In the Red October Chocolate Factory, he saw a chance to apply the American way of hostile takeovers to the Russian market. It was an ambitious plan and an adventurous target. Red October was the country's largest candy manufacturer and a cultural reference point — not dissimilar to Hershey's in the United States or Cadbury's in England.

Though Menatep offered to buy out employee shares at a steep premium, the bid failed to gain momentum, as workers promised to "never sell." As a consolation, Menatep received a seat on Red October's board, though the company's president noted the bank had little impact on operations.

This period of Milner's life is rarely discussed in contemporary interviews, though Milner wrote a book about the Red October attempt years ago. There are good reasons for that gloss, which we'll mention momentarily, but the episode seems to have influenced the investor's later playbook. Rather than act hostile to founder interests or seek to exert control through formal governance, Milner's greatest successes would come by connecting with entrepreneurs and giving them total latitude to steer the ship.

For all the responsibility Milner was given, Menatep was not an ideal environment for a businessman at the beginning of his career. Not only was the bank rumored to have received funds from the KGB, in 1994, it was connected to an offshore subsidiary reportedly laundering money for "Russian organized crime groups." It is worth explicitly noting that no allegations have implicated Milner in these activities or suggested he knew of them.

Regardless, Menatep did not last long, collapsing in 1998. For the organization's founder, Mikhail Khodorkovsky, that was the start of a long period of pain. In 2003 he was arrested and spent the next ten years on trial or imprisoned. Today, he lives in exile and is known less as a businessman than one of Vladimir Putin's most vocal critics.

Why not us?

Freed from Menatep's wreckage, Milner dabbled in private equity, buying macaroni manufacturer Extra M, but increasingly, he found his thoughts drifting elsewhere. Milner studied equity research reports in his free time and was particularly enamored of those that dealt with the budding internet economy. One, in particular, stayed in his head, written by a Morgan Stanley analyst: Mary Meeker. The now-legendary investor described the rise of sites like eBay, Amazon, and Geocities, outlining the potential of this new sector to transform the US and Europe. For Milner, it was "truly revelatory."

It was time to capitalize. Rather than return to the West, though, Milner sensed plenty of opportunity at home. After all, why couldn't Russia have its own Amazon or eBay or Yahoo? Why couldn't Moscow create the next internet giant?

To bring his vision to life, Milner wanted a partner. Thankfully, he had just the man for the job: Grigory Finger. An investor at New Century Holdings (NCH) —one of the first Western investors to play in post-Soviet Russia — Finger had been introduced to Milner during the latter's stint at Menatep. The two men were kindred spirits, sharing a fascination with the internet. Both had also spent time in America. As Milner told Forbes years later, "We had chemistry."

In 1999, the pair set out to raise the first fund of "NetBridge," their new investment vehicle. NCH agreed to anchor with a $2.25 million check, providing both partners put in $750,000 of their own money. Some savvy public market investments meant Milner had the funds, as did Finger. NetBridge was in business.

Mail.ru: Many names, many masters

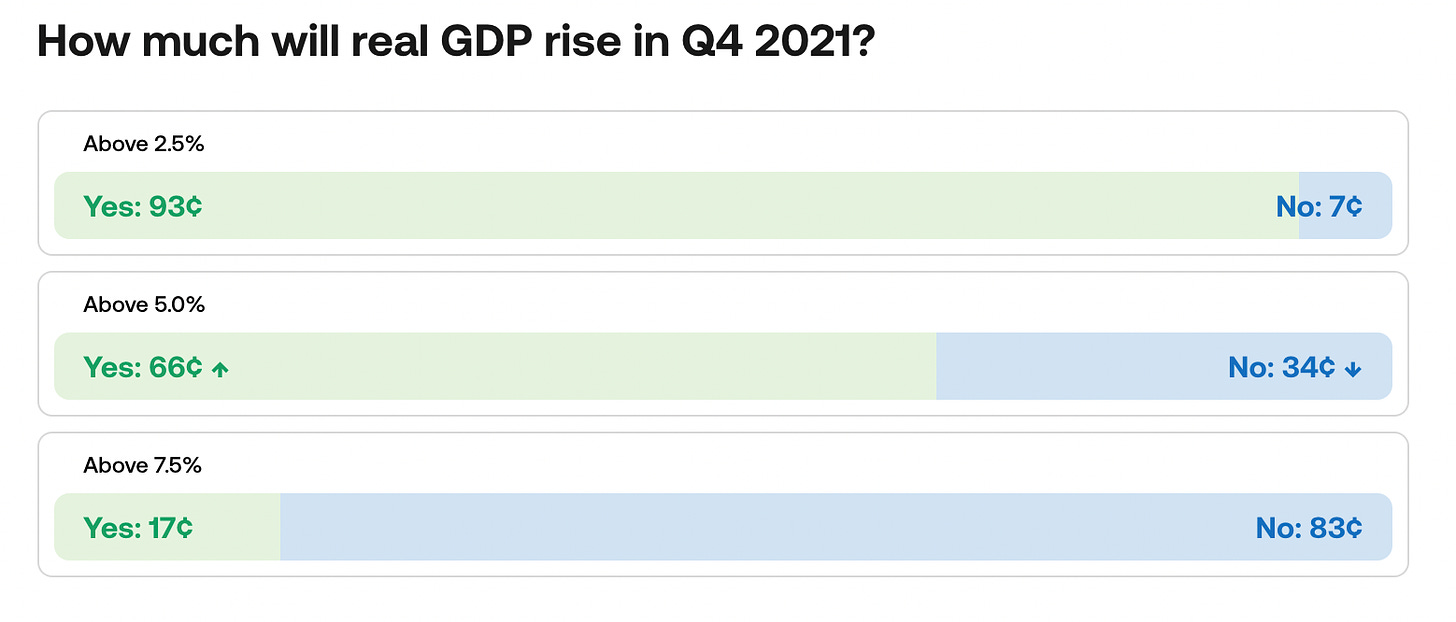

One of the most consequential companies in Russia's history began as the side project of a company founded in New York City.

Like Milner, Alexey Krivenkov entered the world of technology by way of physics and cars. After abandoning his scientific education, Krivenkov decided to move to America. He'd visited in the early 1990s and found the experience exhilarating, in part because of the friends he had made. Among them was Eugene Goland, a fellow Russian studying computer science at New York University.

With no job prospects, he resolved to move to New York City and wash cars for a living – at least until something better showed up. As it turned out, he didn't have to wait long. In New York, Krivenkov began living with Goland and working at the young man's newest company: DataArt.

While Goland had made money by selling computers previously, his newest venture was a software consulting company, a focus that suited Krivenkov's interests. During his stint at university, the erstwhile physicist had accessed the internet and recognized its potential. Krivenkov had a chance to put that interest into action from DataArt's Park Avenue office, working alongside Goland and other early employees.

Visa issues complicated Krivenkov's American dream. While Goland was able to stay and build DataArt in New York, Krivenkov was forced to return to St. Petersburg. It turned out to be a blessing in disguise. Not only did it allow Krivenkov to hire many of his talented friends, forming an outsourced development team, it revealed the opportunity for what would become Mail.ru.

On New Year's Eve of 1997, Microsoft announced the $500 million acquisition of Hotmail. Krivenkov remembers the news rippling across his crew of programmers:

Microsoft bought Hotmail for some huge amount of money, and of course, that inspired us. So at some point, we decided that we have an awesome service which provides free email for everybody... For us, that wasn't any kind of business at all — just a cool thing.

For the equivalent of $500, Krivenkov bought the mail.ru domain name from a friend, and along with a "genius programmer," set about building a Hotmail competitor for the Russian market.

Port.ru

Though Krivenkov's goal hadn't been to make money, Mail.ru's potential quickly became clear. With few available alternatives, Russia's early internet users flocked to the site, registering accounts. DataArt raised funding and funneled resources to Krivenkov's skunkworks division to support the site's growth. James Melcher, a venture capital pioneer and Olympic fencer, cut a $1 million check.

Boosted by Melcher's money, the project bloomed, expanding beyond email to touch music, chat, job boards, and auto listings. As a reflection of this broader ambition, Mail.ru became "Port.ru."

The more Port.ru grew, the more obvious it was that it was a fundamentally different business from DataArt. While the latter focused on providing software consulting for US clients, the former project dominated the incipient "Runet."

They were not its only players. With funding secured, Yuri Milner and Grigory Finger looked for "geographical arbitrage" opportunities. The first project they supported was Molotok.ru, an eBay competitor. An Amazon facsimile, 24x7.ru, followed, as did hosting sites and online review sites.

In different circumstances, perhaps Port.ru and NetBridge could have coexisted indefinitely, one as a leading internet platform, the other as an ecosystem's chief investor and incubator. As fate would have it, they converged. The dot-com bust of 2000 took its toll on the entire sector, putting small companies like Port.ru into jeopardy. Funding was far from plentiful, particularly for a project in Russia. It didn't help that Port.ru had once been valued as highly as $100 million, a figure that had seemed reasonable at the time but appeared ludicrous months later.

It also hampered NetBridge's portfolio. Though Molotok had done reasonably well, by and large, the firm's bets had not had the time or capital to truly pay off. In Port.ru, Milner saw real, tangible traction and huge potential.

Mail.ru (redux)

Milner pounced. With the help of financier Igor Linshits, he and Finger merged NetBridge and Port.ru, creating a mini-internet conglomerate. Across assembled properties, the re-christened "Mail.ru" owned a swathe of valuable digital territory. (Auction and bargain sites like Molotok.ru and Torg.ru were not included in the deal.)

Goland returned to building DataArt, which he would forge into a significant business in its own right, with reported revenues of $181 million in 2020. Krivenkov, 23-years old and newly wealthy, retired to Italy to make artisanal paper.

Over the succeeding few years, Milner transformed Mail.ru from a high-potential, zero-revenue startup into a real business. He reopened his private equity playbook, cutting staff by 80% and introducing an ad-based revenue model. He coupled that with successful experiments in online gaming, allowing Mail.ru to break even by 2006.

Of course, much of Mail.ru's success occurred with other team members managing day-to-day operations. Starting in 2003, Milner installed 25-year old Dmitry Grishin as the company's primary manager. Grishin had previously worked at NetBridge and helped operate Molotok.ru. Milner's shift away from hands-on management of the firm was in keeping with his uncurbed curiosity and an investor's habit of always looking for the next deal.

Digital Sky Technologies

In 2005, Milner and Finger raised a new investment firm to finance future bets: Digital Sky Technologies, or DST. With the internet sector on better footing, DST attracted a stable of impressive investors, including Naspers, Tencent, and oligarch Alisher Usmanov.

(The Uzbek-born businessman is a complicated figure. He spent six years in prison for fraud, for which he was later exonerated. Still, Kremlin-critics like Alexei Navalny have called for Usmanov to be sanctioned as recently as earlier this year.)

Mail.ru would also lure blue-chip financiers, receiving funding from Tiger Global and Goldman Sachs. Each of these relationships would prove influential in years to come.

Just as the merger between NetBridge and Port.ru had created a mini-conglomerate, DST and Mail.ru forged a larger one. Via DST, Milner accumulated shares of Mail.ru and purchased controlling positions in new social networks like Odnoklassniki, VKontakte, and Polish-player Nasza-Klasa.pl. Soon, the entity once called Mail.ru was renamed again, referred to as "DST."

Though Eastern Europe trailed the US when it came to adoption of many internet services, its social media scene was more mature in some respects. Because Russians came online later, many started on social media first, only later registering for an email account. That order of operations created a different dynamic than the US, which already had established methods of communication. Moreover, because of the sparser capital environment, Russian social media players had needed to learn to monetize much earlier in their lives. Milner and his team had a front-row seat, watching as players like Odnoklassniki layered on revenue through advertising and other services. They observed the efficiency these products had at turning attention into earnings.

That proved a multi-billion dollar insight.

Learn the playbooks of today's global giants. Join 64,000 others to get our next Sunday briefing.

Facebook: Anatomy of a deal

As the story goes, the Goldman guys alerted Milner to the opportunity. Facebook was considering raising a new round of funding.

By that point, in 2009, DST had built a tight relationship with the American investment bank. Not only had Goldman invested in Mail.ru, but Milner had hired two alums to join him at DST: Rahul Mehta and Alexander Tamas.

Despite DST's added support and influential friends, nothing suggested it could pull off an investment in Silicon Valley's hottest startup. For one thing, it was more of a holding company than a fund; it didn't have hundreds of millions of dollars sitting around, waiting to be deployed. Just as importantly, no one knew who they were outside of Russia. Sure, Milner might be a big player in his ecosystem, but in the Bay? His name meant nothing.

The meeting

Milner was undeterred, even as Facebook's team rebuffed his interest. On a call with finance head Gideon Yu, Milner explained how he and his team might add value, bringing their knowledge of social media monetization to Facebook. To continue the conversation, Milner suggested he fly to the company's offices in California for a longer discussion. Yu politely told him he didn't think it was worth Milner's time.

The brush-off didn't work: Milner showed up at Facebook's headquarters. Face to face with Yu, his pitch worked better. After a 15 minute session at a neighboring Starbucks, Yu agreed to set up a meeting with Zuckerberg.

Four men were in the room: Yuri Milner, Mark Zuckerberg, Alexander Tamas, and Vaughn Smith. In researching this piece, I had the chance to speak with Smith, Facebook's former VP of Corporate Development. He gave an insight into the company's frame of mind heading into the meeting with DST, "unknown in the West" at the time.

Though Facebook had received funding at a $15 billion valuation two years earlier, the onset of the global financial crisis had encouraged a more conservative mindset. As Smith recalled it, the consensus at the time of the meeting was that Facebook's fair valuation was somewhere between $1-4 billion, a reflection of the fact that few saw a path to profitability.

Milner and Tamas capitalized on such weak conviction. They had seen the data back home and realized that Facebook's potential was wildly undervalued. "Yuri and Alexander had a conviction around the potential for social networks that almost no one other than us could see," Smith said.

Such confidence allowed DST to underwrite the investment at a higher price than other bidders, but it would be too simplistic to suggest an accord was struck on that basis alone.

Not only did Milner and Tamas walk through a spreadsheet showcasing analysis across their social properties, Milner made a personal connection with Zuckerberg. As Smith noted, "He's very good at connecting with founders of technology companies."

As Milner forged the relationship, Tamas hustled behind the scenes:

He worked his ass off to get the deal done…He was traveling all around the world, and he always seemed to be available and responsive.

Sweat and experience might have helped, but finding a suitable arrangement required DST's flexibility, too. At the time, any investment of the size DST was discussing came with provisions, most notably a seat on the board of directors. In a recent interview, Milner recalled that it was a no-go for Zuckerberg, who wanted to ensure he consolidated his grip on the company.

Perhaps influenced by his experience with Red October in which he won Menatep a board seat but failed to make a dent, Milner acceded to the request. DST would not take a board seat, and it would allow Zuckerberg to vote its shares. "You do not need a board seat to have influence," Milner later told Jason Calcanis.

Perhaps the final hurdle was for Milner to convince his board of directors. After all, the investment into Facebook would come straight from the company's balance sheet. As Milner recalled, every one of DST's owners advised him against it, save Alisher Usmanov.

Improbably, a deal was struck: DST would invest $200 million into Facebook at a $10 billion valuation. After that had cleared, the fund would purchase common stock from employees at $6.5 billion. (Per Smith: "The more we pushed the valuation, the more we had to find ways that would work for them.”)

From out of nowhere, DST was suddenly on the map. Often, it was as the butt of a joke, cast as the unsophisticated interloper flooding Silicon Valley with dumb money. Milner and Tamas didn't seem to care. With name recognition and Zuckerberg's stamp of approval, they no longer needed to cajole founders into taking a meeting. The day DST's investment in Facebook was announced, Tamas began conversations with Zynga CEO Mark Pincus at a conference.

Taking stock

Before DST could go all-in on global investing though, Milner needed to tidy things up back home. Before the Facebook "distraction," DST had been expected to go public on the London Stock Exchange. Mail.ru and associated properties were thriving, and it seemed an opportune moment to bring one of Russia's preeminent businesses to new investors.

What was DST, though? It had made sense as a Runet conglomerate, but it was less clear with Facebook (and soon Zynga) as part of the package. Just as importantly, if Milner wanted to keep investing, it made more sense to raise a fund rather than siphon from the balance sheet.

In yet another reconfiguration, DST was cleaved in two. "Mail.ru Group" (MRG) held DST's Russian entities (and a small portion of foreign holdings), while "DST Global" held on to other stakes.

In late 2010, MRG debuted on the London Stock Exchange, reaching a high of $8 billion. It was recognition of a remarkable journey for the company and its transformation from a side project to a global software behemoth. (Because it can't seem to help itself, MRG renamed itself again in 2021. It's now called VK Group, after one of its social networks.)

For Milner, it opened up a new beginning. With Tamas at his side and a growing team, he set his sights on taking the DST playbook global.

Playbook: DST Global

In the twelve years since its investment in Facebook, DST Global (DST, from here on) has established itself as one of venture capital's apex predators, albeit with an understated air. It manages tens of billions of dollars and has invested in hundreds of companies worldwide.

And yet, when asked about DST's portfolio, Milner noted that by his count, only two had lost money. Whether that is strictly true or not, it's undeniable that the fund has one of the most enviable track records of all time. For more than a decade, it has shown an ability to predict trends and pick winners.

Though many factors, luck among them, play a role in a fund's success, playbooks are nevertheless discernible. Spend any time studying DST, and it becomes clear that a coherent philosophy guides its investments. In particular, Milner and Co's genius can be distilled to four essential tactics:

Be early and right. Though it may sound facile, this is the heart of DST's approach. The fund has demonstrated great understanding of where the world is headed and which businesses are positioned to thrive.

Capitalize on geographical arbitrage. Once DST has conviction in a certain business model, it aggressively looks for analogous players across continents. This move allows it to profit many times from a single insight.

Make the "yes" easy. DST is a flexible capital partner. Once it has its eyes on a company, the fund is willing to adapt to get a deal across the line. That might involve higher valuations or unusual structures.

Support the founder. By accommodating Zuckerberg's desire for control, DST set a new standard in "founder friendliness." Today, many VCs take this approach. DST remains authentically aligned with builders.

Let's walk through these in greater detail.

Early and right

It is difficult to conjure the same sense of uncertainty with the benefit of hindsight. Yes, we know there was a time one could not socialize online. But are we, fifteen or so years later, capable of feeling the wildness of those that thought we would?

In that respect, the success of technological revolutions often seems to diminish them; we struggle to re-radicalize what is now mundane.

This should not curtail the impressiveness of DST's foresight. Like few other investors, it has identified large, foundational shifts and put money to work. Three, in particular, stand out:

The monetization potential of social networks.

The growth of global e-commerce.

The feasibility of the gig economy.

As we've noted already, DST had an unusually sophisticated perspective on how the internet would monetize attention long before incumbent venture firms. Not only did it allow the fund to build a large position in Facebook, it gave DST the conviction and credibility to invest in almost every significant social media player since inception. The firm's portfolio includes Twitter, Bytedance, WhatsApp, Snap, Momo, and Clubhouse, along with associated companies like Zynga.

(One of the few obvious omissions? Reddit, though Milner may still have exposure to it. After leaving DST to found Vy Capital, Alexander Tamas bought heavily into the purveyor of "organized lightning.”)

Just as DST was early to recognize the power of social media, it was quick to see e-commerce's disruptive potential. In a Bezos-esque moment, Milner recalled seeing the percentage of purchases made online and feeling certain it would multiply.

Groupon was arguably DST's first foray into the space, though the company famously focused on driving online customers to offline experiences. More successful bets quickly followed, and yet again, DST built an absurd constellation, including JD.com, Alibaba, Zalando, Flipkart, Boxed, Wish, Meituan, and others.

Though not mentioned by Milner, his firm also deserves credit for recognizing the feasibility of the sharing economy. Not only did bets in Airbnb run counter to the conventional wisdom of many, it marked an understanding of changing labor dynamics. Many of DST's other investments relied on the trend, including Didi, Alto Pharmacy, Swiggy, and Ofo.

Global arbitrage

While there are advantages of focusing on a particular geography, DST's playbook is defined by going global. Not only does that increase the number of opportunities, it allows the fund to leverage its early insights to the maximum. Once it has the conviction that a certain business model works, it will actively look for similar businesses across major markets. (In this respect, it seems to have learned a thing or two from Mail.ru investor Tiger Global.)

For example, once DST decided on-demand food delivery was a viable model, it didn't stop its search once it had invested in Indonesia's Gojek. Instead, it went on to back Rappi in Colombia, Deliveroo in Europe, and DoorDash in the US.

A similar pattern played out after the fund led the Series B for grocery company Boxed. With a play in the US, DST turned to South Korea to fund Market Kurly, France for Jow and Gorillas, and China for Nice Tuan. It also circled back to America to snag Instacart and Weee!

DST uses this approach repeatedly, going from Nubank to Revolut, Robinhood to Ajaib. An added benefit of this model is that the fund becomes an expert in a subject matter in a way that almost no other investor can rival. (Tiger is an exception.) Just as Milner wooed Zuckerberg with his remarkable grasp of social media players across Eastern Europe, today, DST's team can impress the next online car retailer with lessons gleaned from AUTO1 Group (Germany), Chehaoduo (China), Cars24 (India), and Kavak (Mexico).

Such expansiveness also allows DST to correct mistakes. When asked about his investing regrets, Milner cited the firm's failure to fund Uber and Pinduoduo. For most venture capitalists, that would be the end of the story; for DST, it was an opportunity. The firm compensated for failing to recognize the brusque brilliance of Travis Kalanick by funding his company's most plausible global rivals. Didi, Ola, and Ofo are all part of DST's portfolio. As for Pinduoduo, DST responded to missing the social buying platform by securing a stake in Super, an Indonesian approximation.

The impact of DST's global approach here is meaningful. Not only does this model allow DST to compound expertise faster, it gives it a failsafe against venture capitalist firms' greatest fear: missing a runway winner.

Make it easy

As shown by the Facebook investment, DST is willing to be creative to get a deal across the line. In that case, Milner accepted a higher valuation and fewer controls in exchange for the chance to pick up secondary shares.

In the years following, DST would reprise this approach. Though not as flexible on valuation as Tiger, DST is willing to pay up. It also takes secondary opportunities when available, which many other funds forswear.

Milner has also been willing to experiment in pursuit of seamless dealmaking. In 2011, he launched Start Fund, a spin-off investment vehicle formed with SV Angel. The premise was radical but revolutionary: invest $150,000 in every company accepted into Y Combinator. No picking and choosing, just automatic funding. For early-stage founders, it was a godsend. Entrepreneurs accepted into YC went from having $20,000 to play with to a reasonable pre-seed round.

It seems to have worked. Though it only ran for two years, Start Fund invested in dozens of high-potential startups. More importantly for Milner, at a cost of ~$10 million – a rounding error to an investor with his asset base – he created an index of the world's most effective accelerator. At the same time, he set his team up to capitalize on breakout winners and fortified his reputation as a power broker.

Start Fund's portfolio includes Goat ($492 million raised), LendUp ($361 million raised), SingleStore ($318 million raised), GoCardless ($217 million raised), Sift ($156 million raised), ClassDojo ($66 million raised), Clever (acquired for $500 million), Fivestars (acquired for $317 million), SmartThings (acquired by Samsung for $200 million), and Parse (acquired for $85 million by Facebook).

This is an impressive and almost certainly lucrative collection; it's also an indication of the lengths DST will go to make consummating a deal as easy as possible.

Support the founder

Yuri Milner does not immediately seem like a master of charisma. Interviews portray him as a taciturn, deadpan character, a depiction bolstered by other accounts. But with tech founders, he has a kind of magic. His forthrightness and his operating experience give him the credibility to offer advice. Moreover, he makes it clear that DST is on the founder's side and that it trusts them to chart the path ahead.

This was pivotal in the persuasion of Zuckerberg and became part of DST's calling card. While Sequoia has a reputation of being an astute active manager, pushing out founders when it feels they no longer serve the business's best interests, DST promises not to meddle.

Such an assurance doesn't mean the fund won't advise founders. Unlike Tiger Global, which effectively seeks to outsource portfolio support, DST's partners do look to build long-term relationships with entrepreneurs — making themselves available in good times and bad. One source familiar with the fund's investors commented that Tom Stafford, one of DST's partners, had probably spent more time with Deliveroo than any other investor, despite it being a comparatively less lucrative position for the firm. (Aside: when the "bottom half" of your portfolio still makes it to an IPO, you know you're doing something right.)

Building that rapport starts in early conversations. One investor familiar with DST's approach remarked on the team's tendency to focus only on a business's truly salient points. Rather than pepper a founder with low impact questions, DST focuses on what it would take to reach extraordinary scale. "Entrepreneurs really like it," the source noted.

Perhaps the clearest indication that DST wins over founder trust comes from Facebook's acquisition of Whatsapp. As Milner tells it, his fund had tried to invest nearly a dozen times in the chat app, being rebuffed each time. Then, in early 2014, CEO Jan Koum changed his tune. In a meeting at Milner's California house, he tentatively agreed to take investment from the firm.

Milner's jubilation didn't last long. Two to three days later, his old friend Mark Zuckerberg called Koum and extended an acquisition offer. Though Milner was disappointed, he recognized what a good deal it was for Koum. When the Ukrainian called Milner for advice, he counseled him to accept Facebook's bid. Two weeks later, the deal was closed: Facebook would buy WhatsApp for $19 billion.

But rather than closing the door to DST's investment, it opened it. In recognition of Milner's sincere advice, Koum and Zuckerberg agreed to let the fund invest at a valuation 3x lower than Facebook paid for the business. Milner said he was "overwhelmed with emotion."

We must take a moment to recognize how bananas this is. Two of the world's sharpest entrepreneurs gifted a billionaire VC tens of millions of dollars at no-risk for being a solid guy. As an act of generosity, it surpasses even the sweetheart $500 million valuation Instagram's Kevin Systrom gave investors days before he completed the app's $1 billion acquisition, also from Facebook.

There are two lessons here. The first is that if your friend is in M&A discussions with Facebook – be nice to them, for goodness sake. The second is that few are likely to outstrip DST when it comes to wooing founders.

Other factors

Beyond the tactics outlined above, other factors contribute to DST's success. For one thing, the firm seems to have a work ethic closer to Tiger Global than traditional venture funds. Despite his wealth, Milner remains in the thick of things. One source said that "to a large extent, he is the firm…he will take this to the grave." They added, "He wants to meet the next Zuckberg and he still has the same energy at 60." DST's drive begins at the top.

Dedication of this kind does not go unrewarded. "DST comp stupidly well, better than anyone else," according to a fellow investor. With seven funds under its belt and recent vintages reportedly sitting at or above $10 billion, DST certainly has sufficient management fees to share the wealth. Such benevolence is surely part of the reason why Milner has so effectively retained partners, with Alexander Tamas the only high-profile departure since DST's founding. Current managers Rahul Mehta, Tom Stafford, John Lindfors, and Saurabh Gupta have all been with the firm for over a decade.

Perhaps because of its dramatic entrance onto the VC scene, DST has never seemed to struggle to raise financing. Relationships with Usmanov, Goldman Sachs, Naspers, and other global entities have undoubtedly helped. DST has been criticized in the past for taking funds from entities with connections to the Kremlin and for associations with Jared Kushner. Perhaps partially because of that, the firm has not raised money from Russian investors since 2013 and mostly invests Milner's personal wealth. One source noted that both GIC, Singapore's sovereign wealth fund, and Goldman Sachs remain investors, with the latter offering clients access.

Learn how the best businesses and investors win. Every Sunday, we send a free email that explains the business world’s most important innovations and the stories behind them. It’s high quality business analysis, delivered at no cost to you.

Catching the next wave

When DST invested in Facebook, it changed the game. Other funds had to adapt to match the fund's flexible, founder-friendly approach, among other considerations. Since that entrance, the venture landscape has continued to evolve. Will DST be able to keep up with it?

It certainly shows no signs of slowing. In 2021, DST made 73 investments, up from 22. Those predictably occurred across geographies in the US, Latin America, China, India, and Europe. And while DST once seemed to constrain itself to consumer internet — at least partially— it is now a familiar name on B2B cap-tables, particularly for businesses touching fintech. (It still seems to eschew pure-play enterprise SaaS).

Those with knowledge of DST's operations suggest there have been subtle changes, as well as a continuation of the fund's determination to catch the next technological wave.

To do so, DST seems to be building something close to an in-house research team. Many of the firm's recent additions come from equity research backgrounds, a talent pool venture funds infrequently tap. The suggestion from one source was that DST recognizes it is already good enough at closing deals, but it may need assistance widening its aperture. These analysts do "some of the stuff that Tiger outsources to Bain," giving DST coverage of emerging trends and markets.

DST's senior investors are also empowered to spend time on less proven ideas. Though the fund's check sizes are typically around $200 million, partners can write personal checks into early-stage businesses. Often, other employees will join in, creating an internal syndicate. As with Start Fund, these investments give DST an insight into new markets and allow the fund to pounce should one of these more speculative plays pick up traction. For example, Rahul Mehta participated in the seed round for Zolve, a cross-border fintech company, before DST participated in the Series A. In total, DST's partners appear to have committed to 16 personal investments in 2021.

So, where does DST think the next wave is coming from? We can get a sense from looking at the partner's distribution and the firm's recent investments. Like Milner, Saurabh Gupta is based in San Francisco Bay, though he seems to be tasked with covering Latin America if his presence at a regional panel is anything to go by. Given his time in India, he may also add support in that market. Rahul Mehta perhaps takes the lead here, given his relative proximity from his UAE base. Both Tom Stafford and John Lindfors are based in Hong Kong. For Stafford, that seems to be a change, after many years operating out of London. Could that signal increased interest in Chinese tech companies at a time when many other investors are retreating? So far, in 2021, DST has invested in six companies in either Hong Kong or China. Other frequent markets include the US, India, Brazil, and Indonesia.

Like many other investors, DST seems to be accelerating its interest in crypto. The fund has not invested in any major exchanges — misses that Milner may wish to add to his list. The first web3 company the firm invested in was in 2019. To rectify the matter, DST has picked up the pace; in 2021, it backed BlockFi, Cobo, Bitwise, Matrixport, and Blockchain.com. As Milner and his team improve their understanding of the sector, that cadence may increase.

Beyond crypto, DST shows steadfast conviction in the power of delivery. While that started with its bets in e-commerce, it has invested up and down the stack, funding e-tailers and logistics providers around the world.

Recent bets in Gorillas and Manna imply it believes there are still plenty of improvements to be made. Gorillas is a hyper-grocery business, promising to deliver staples in 10 minutes. In pursuit of that goal, the company has raised — and seems to be quickly chewing through — $1.3 billion in just 18 months. It faces many of the same criticisms once leveled at Facebook (overvalued with no path to profitability), and DST will believe it can defy skeptics yet again.

Manna makes Gorillas look positively slow. Leveraging a fleet of drones, the startup can deliver goods from local stores in 3 minutes. Though that may sound like a pipe dream, the service is already live and used in Ireland, floating dinners and grocery orders across the countryside.

Time will tell exactly which of DST's bets pay off, of course. But if any investor has proven an ability to predict the future over the last decade, it is the fund that began its life in Moscow.

Can DST stay quiet forever?

Though the firm's investments made it legendary with a certain vintage of entrepreneur, new generations of builders may never have heard the name DST. Many of these founders may have learned about the industry through podcasts, videos, and articles written by the very loud world firms with which DST is competing. Will its muted approach thrive over the next decade?

The question misleads. What is really being asked is: are there multiple ways to win in the game of investing?

Of course, there are. Some win through speed while others rely on their size; some take a surgical approach while rivals reach for a shotgun; some build personal relationships while coevals distill it down to a transaction, as detached as buying a couch on Craigslist. Some thrive in noise, and some, like DST, need the quiet. There are many ways to win, and the best run counter to consensus. For DST, at least, silence is golden.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.