Introducing The Future 50

Meet 50 of the world’s highest-potential startups. Nominated by investors, selected by The Generalist.

Friends,

I am extremely excited to announce the launch of Future 50, a database of the world’s highest potential startups valued at or under $200 million at the time of nomination. It’s the product of a five-month process involving the wisdom of elite venture practitioners, access to confidential information, and detailed independent research.

When we first set out to create the Future 50, we asked ourselves a simple question: How can we ensure Generalist supporters know about the world's most promising startups before they become well-known? Our goal was to deliver genuine foresight. Simply hearing about a promising startup at the right moment can serve as an inflection point – for an investor seeking an outlier, a talented operator looking for their next challenge, or a founder seeking inspiration. We became obsessed with creating our version of an early detection system for great companies, driven by our editorial process.

The Future 50 is a benefit for premium subscribers. If you’re not a member yet and you work in tech or VC, this should justify joining. Just follow the link below.

About the awardees

If you want to learn more about the Future 50, here are a few key details. First, this is a list that spans continents and countries. In total, awardees are headquartered in 11 different countries, to be precise. Awardees are saving mothers’ lives in America, unlocking digital payments in South Africa, buying land for reforestation in Brazil, creating AI models in India, and leveling up brand marketing in New Zealand.

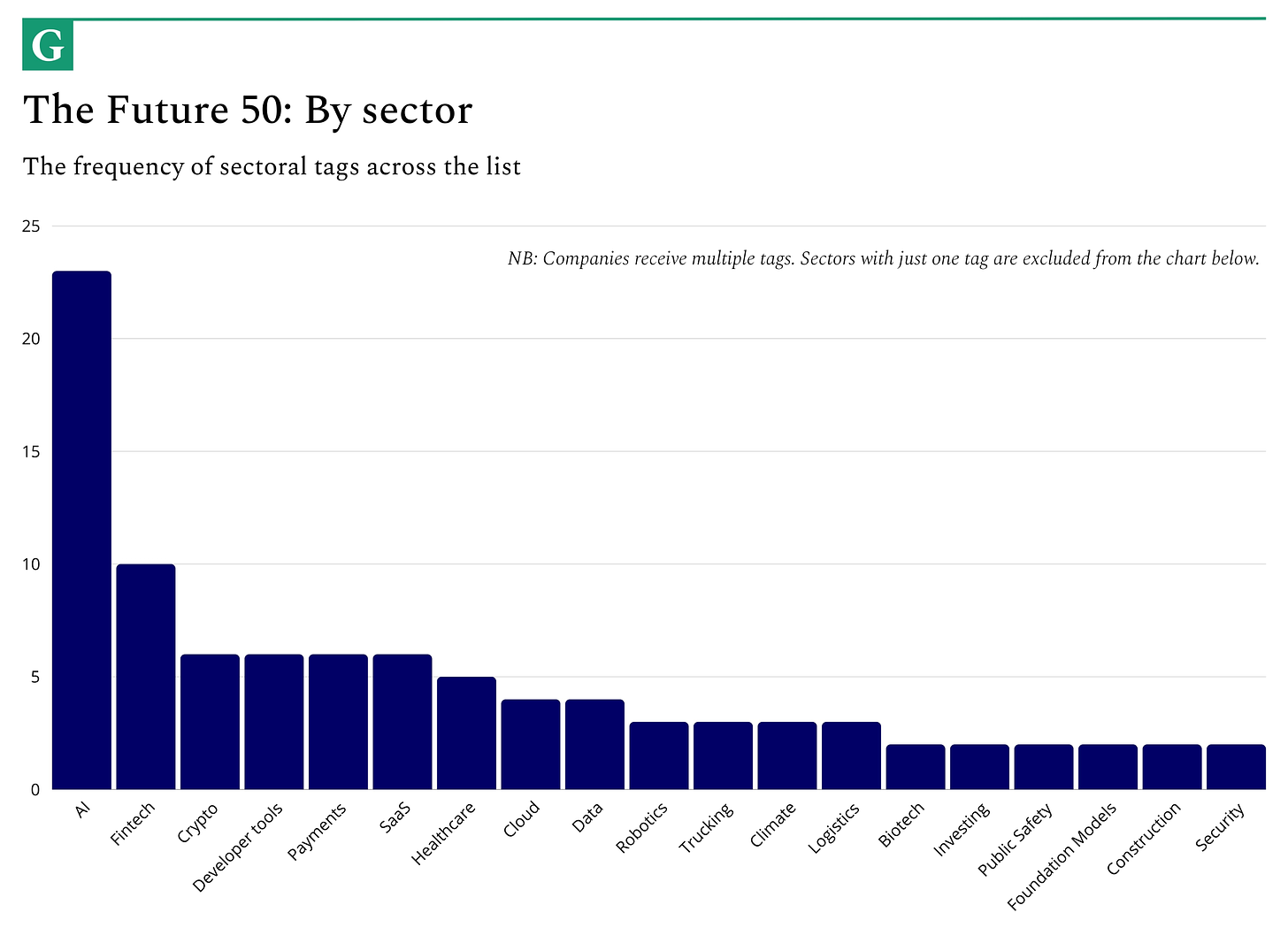

As those company descriptions suggest, the Future 50 also spans sectors. There are no prizes for guessing the most common sector: AI. Other popular sectors included fintech, SaaS, crypto, and healthcare.

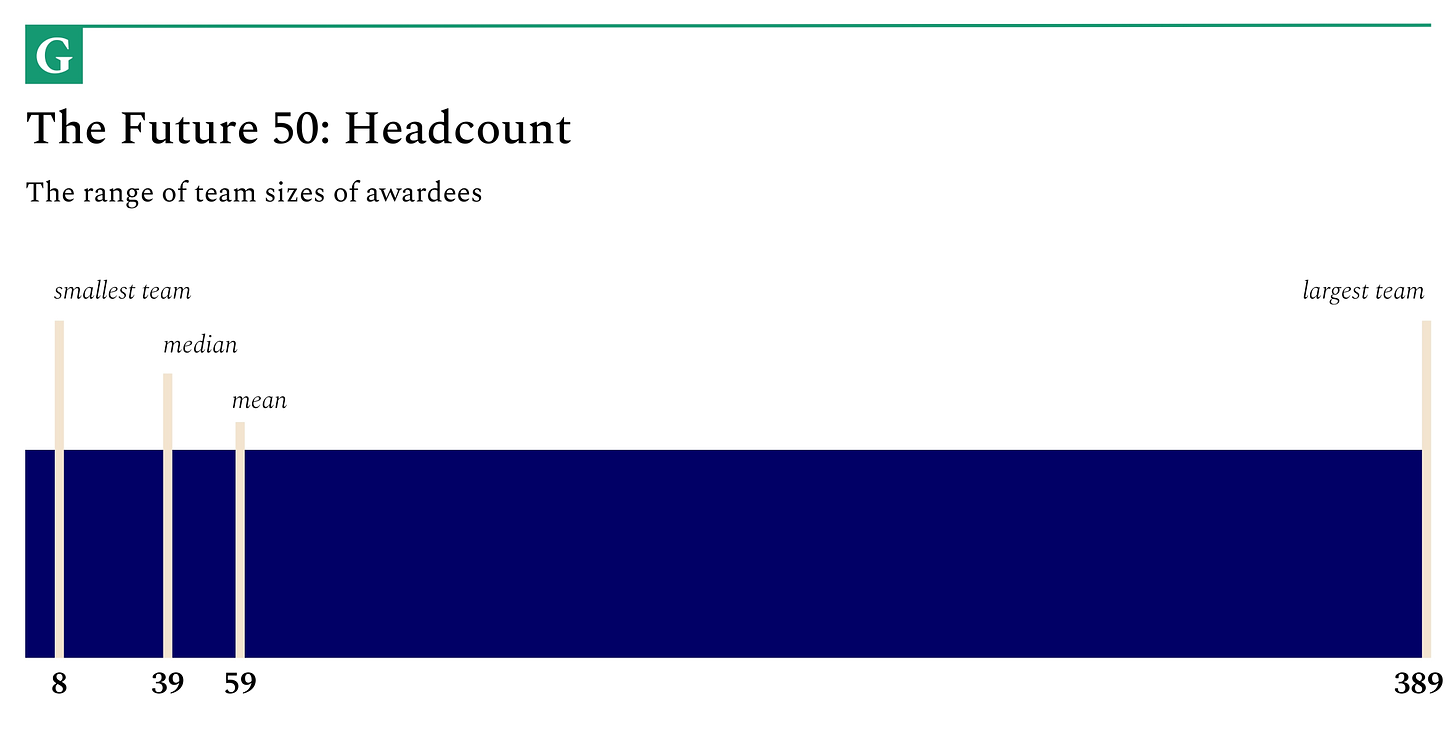

What size teams do the Future 50 awardees have? On average, 58.66. The smallest team recorded has 8 people; the largest, 389.

There’s much more to learn about every awardee. Discover the AI logistics firm clocking $45 million in annual revenue, the public safety startup using drones as first responders, and the next “AWS for biology” by following the link and becoming a member.

Our process

There are an infinite number of ways you might try and create a list like this one. You could collate it based on perceived status, hard metrics, personal opinion, or the opinion of ceremonial judges. We took a different approach, with a few key characteristics:

Create a valuation threshold. We started by setting a valuation threshold of $200 million, post-money, at the time of nomination. (Naturally, some companies have raised in the five months since.) It is hard enough to compare a biotech firm to a social media app – it only becomes more so when one is a seed company and the other a Series D scale-up. The $200 million threshold prioritizes companies with real traction and strong products in market, but that still have plenty of room to run, should they succeed in becoming breakout businesses.

Focus on nominator quality, not quantity. We chose an outbound approach, believing it allowed us to create the highest quality list. We contacted many of the world’s best-regarded investors and asked them to nominate companies they consider the highest potential. We started with those we know and consider exceptional pickers. In turn, we asked them to nominate other investors they consider impressive. Finally, we reached out to select practitioners that have global reputations. We only considered nominations from partner-level investors. Overall, investors from nearly every Tier 1 fund participated.

Push to the edges. We believe many of the most impactful companies will be built outside the United States. To ensure global coverage, we proactively sought elite venture investors from Latin America, Africa, Europe, Oceania, and Asia. As you’ll discover, the list includes many stellar organizations from beyond Silicon Valley.

Force stack ranking to avoid over-nominating. As noted, we asked every investor to nominate the two companies they considered particularly high potential with an explanation for each. (Some investors ended up sharing a few more, which we considered.) Ultimately, our goal was not to solicit as many nominations as possible but to encourage nominators to make difficult choices, selecting those they consider the very best of the best. As a note, Generalist Capital is an investor in some of the companies nominated. I did not nominate any companies myself, but have noted any investment in the interest of transparency.

Personally study each company. After receiving an extremely strong cadre of nominations, I personally reviewed each one. This involved reading the investors’ rationales and studying the company directly via its website and associated press. We used this to filter the list down to a select few finalists.

Request exclusive, confirmatory information. We reached out to the finalists directly and asked them to share data confirming their valuation at the time of the nomination, cumulative capital raised, and revenue run rate. We also asked them to outline their primary sources of differentiation and highlight other traction they consider notable. Companies have allowed some of this data to be shared publicly; the rest remains confidential but was invaluable in our assessments.

Make final judgments. We used the information gleaned from companies to choose our final 50. This relied on me personally reviewing all additional data supplied by the companies. In making our choice, we factored in metrics but also recognized that great companies have different commercial maturation rates.

Provide detailed descriptions and clear rationales. One of our frustrations with lists is that they are often light on detail. For each awardee of the Future 50, you will find a strong synopsis of the business and why it matters. You will also find a bullet-pointed rationale explaining its inclusion: what we liked about it and why.

No process is perfect, and there are certainly trade-offs to our approach, but it’s enabled us to create something unique: a global, detailed, actionable list of potentially legendary companies – many of which I had never heard of before.

What you can expect

By joining as a member and unlocking the full Future 50, here’s what you can expect:

An incredible list. Fifty high-potential startups, nominated by elite investors, supported by exclusive data, and curated by The Generalist.

Easy-to-grasp descriptions. We explain what each company does and why it matters in clear language. You don’t need to be a sectoral expert to understand their potential.

A point-by-point rationale. We give four reasons why we chose every awardee, giving you a deeper understanding of each business.

Traction details. We include information on key customers, ARR, and other signs of traction whenever possible. You’ll get a sense for just how far along they are.

Links to leadership. We’ve added LinkedIn URLs that make it easy to review the people behind the businesses.

Headcount information. Virtually every awardee shared up-to-date headcount information, helping you gauge the size of their operations.

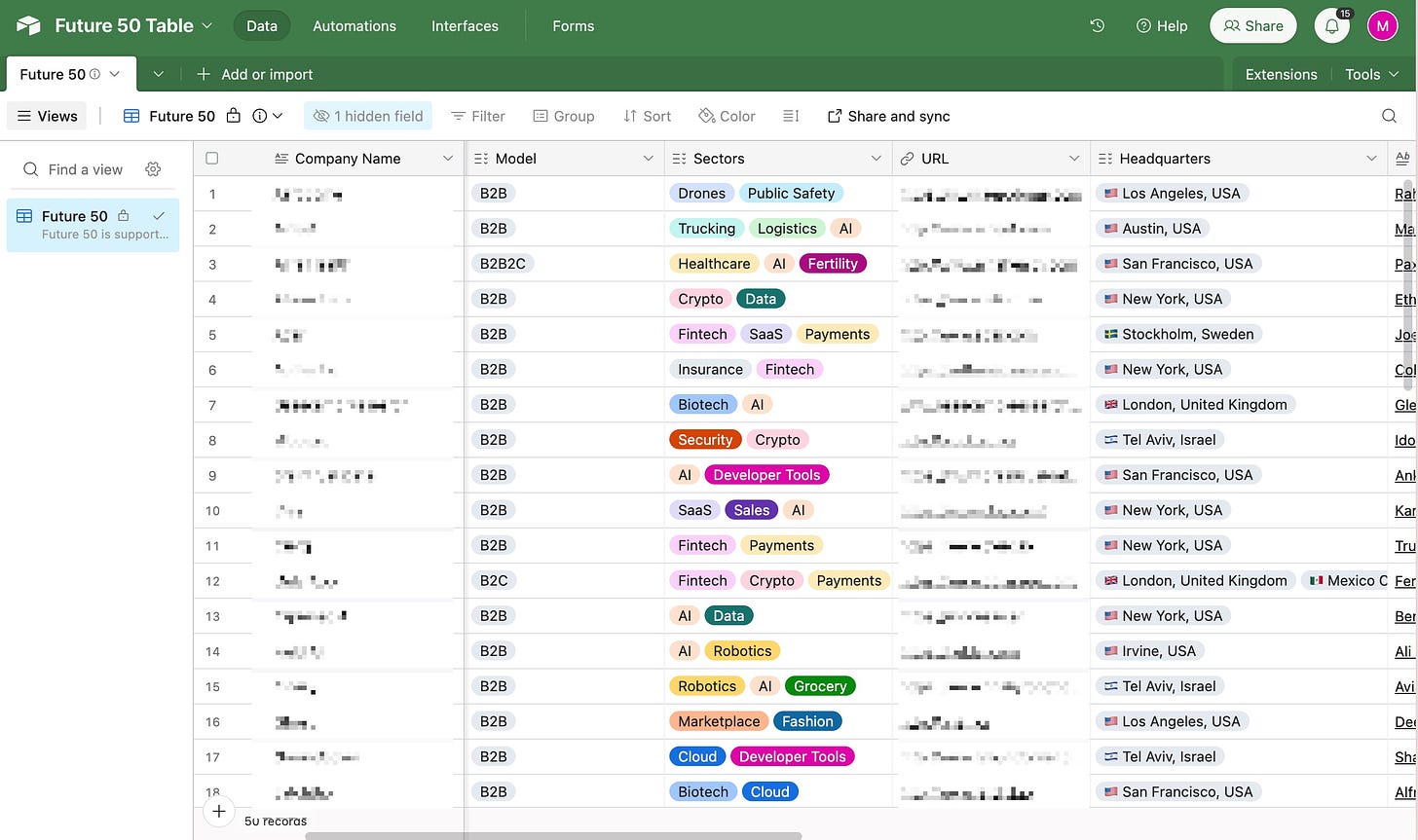

An embedded database. If you want a fast way to scan the list or filter by location or sector, you can use the Airtable we’ve created. It’s included in the Future 50 piece. Here’s a hint of what it looks like:

Join us now to unlock the full database and learn about 50 of the world’s highest-potential startups.

Brought to you by Mercury

If Jony Ive built a banking* experience…

It would look a lot like Mercury. The Generalist has been a Mercury customer for years, and I’m constantly awed by the platform’s beauty, thoughtfulness, and power. It’s become a core part of how we run our business and is probably the only banking product I find a genuine pleasure to use.

Mercury’s banking experience isn’t just loved by The Generalist. Some of the world’s most prominent and promising startups – like those named in the Future 50 – trust Mercury to simplify their finances and power essential workflows, like paying bills or sending invoices. By using Mercury, customers save time, get granular visibility into their finances, and have finer-toothed control over money movement.

Apply in minutes today at mercury.com to simplify your finances and perform at your best.

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust®; Members FDIC.

The Future 50

Meet 50 of the world’s highest-potential startups. Nominated by investors, selected by The Generalist.