Helium: The Network of Networks

Nova Labs’ Internet of Things network is now pursuing an even more audacious goal: to provide the infrastructure for 5G, WiFi, and VPN.

Brought to you by Stytch

Want to boost conversion and drive growth?

Stytch makes user authentication and onboarding seamless and secure. We offer customizable, out-of-the-box authentication with magic links, one tap social logins, biometrics, one-time passcodes, session management, and more. We’re your all-in-one platform for authentication.

With our API and SDKs, you can improve user conversion, retention, and security, while saving valuable engineering time. Current customers have seen a 60% increase in conversion after spending just one day on the integration.

Actionable insights

If you only have two minutes to spare, here's what investors, operators, and founders should know about Helium.

A pioneering use for crypto. Helium could be the counter-argument to the criticism that crypto serves no real purpose. The company has leveraged token incentives to deploy and operate the largest IoT network in the world.

A new revenue opportunity. Helium hotspots earn “HNT” tokens in exchange for contributing to the network. While rewards vary, some hotspots may have taken millions in earnings. Professional web3 implementation businesses have arisen to capitalize on the opportunity.

Leveraging unlicensed spectrum. Traditional broadcasters and telecommunication businesses rely on licensed spectrum. This is purchased from the FCC and promises an uninterrupted connection. Projects like Helium use noisier but cheaper unlicensed spectrum bands.

Growing opportunity and complexity. Though Helium’s network has a massive range, it is processing relatively little data. To bring more demand into the system, Helium is expanding beyond IoT. It hopes to provide infrastructure for 5G, WiFi, VPN, and other networks. While a considerable opportunity, each new network adds significant complexity.

“Cellular Summer” is about to begin in earnest. Helium’s quest to build a decentralized 5G network is expected to kick off later this month. Participating hotspots will earn a new token, MOBILE.

Even if you’ve never heard of it, there’s a chance you’ve interacted with Helium before. Founded in 2013, the decentralized wireless network has grown to become the “largest continuous wireless network in the world,” according to founder Amir Haleem. Focused on serving the Internet of Things (IoT), Helium has a presence in 65,000 cities and 170 countries. Close to a million Helium hotspots blanket the world, quietly connecting intelligent devices to the internet. The wearable around your wrist, the perky smart fridge that cajoles you to buy more eggs, and the doorbell that tells you UPS has arrived could all rely on a connection to Helium. So too soil sensors, air pollution systems, and dozens of other gadgets and apparatuses we interact with and depend upon.

Though Helium’s scale is remarkable in and of itself, its network is its defining characteristic. Haleem’s project is built on the blockchain and propelled by token rewards it gives to those who secure it. Owners of Helium’s hotspots not only contribute to decentralizing access to the internet, they earn “HNT” as their node in the network is used. It is a pioneering example of how crypto incentives can create new global infrastructure.

Helium’s revolutionary premise has catapulted the project to a fully diluted valuation of $2.2 billion, down from a 2021 high of approximately $12 billion. In February of this year, Andreessen Horowitz and Tiger Global co-led a $200 million investment into the firm.

Despite such strong validation, Helium’s best may be yet to come. Earlier this year, the company announced it was entering “Chapter 2” of its story. As part of this evolution, the firm will expand beyond IoT, starting with its 5G rollout this summer. In time, Helium hopes to support WiFi, VPNs, and other protocols. In that ambition, it seeks to be a true “Network of Networks,” orchestrating systems that will improve billions of lives worldwide and take power out of the hands of centralized incumbents.

It’s an audacious vision that brings real risks. Not all of Helium’s existing users have taken kindly to the introduction of 5G and the changes it brings to existing reward structures. Managing multiple economies and subDAOs sounds fiendishly difficult on a dozen different levels. And yet, with a global telecom market worth $1.6 trillion, the opportunity merits incurring such challenges.

Whatever the outcome, Helium has already had a startling impact, pioneering a new business model for building infrastructure and demonstrating the utility of cryptocurrencies. We’ll explore those ideas in today’s piece. We’ll also cover:

Origins. Founded by Amir Haleem and Shawn Fanning in 2013, Helium went through several pivots before landing on the version we see today. It is a story of entrepreneurial grit and ingenuity.

Product. Helium is a blend of hardware, software, blockchains, and decentralized governance. Managing such a myriad is no mean feat.

DeWi. Telecom is a massive market with a handful of major players. It’s also a sector with strong governmental ties. For these reasons, many believe “Decentralized Wireless” or DeWi is necessary.

A network of networks. After creating the largest IoT network in history, Helium has ambitions to support other networks, including WiFi, VPN, CDN, and 5G. Doing so has required a fundamental redesign.

Winning the 5G war. Helium’s next test is to roll out a decentralized 5G network. This time around, it faces competition from players like Pollen Mobile.

Let’s get to it.

Every Sunday, we unpack one of the most important companies in tech and crypto. Join 62,000 others today.

Origins: Crypto Pragmatism

Helium was not supposed to be a crypto company. Amir Haleem’s original vision involved no blockchains or tokens. Only after he and his team struggled to scale the network traditionally did they decide to experiment with crypto incentives. It is an example of true crypto pragmatism – leveraging the technology to achieve a specific end that could not be accomplished without it.

Different games

Amir Haleem grew up around computers, thanks to his father’s work at Commodore, an early PC manufacturer. At age seven, Haleem wrote his first lines of code in BASIC. “I was always around computers from a young age,” he said.

A passion for sporting competition accompanied Haleem’s interest in technology. Had an injury not derailed him, Haleem might have made his career as a professional soccer player, which he played at a “serious level.”

Online gaming allowed Haleem to combine his technological passion and competitive streak. As a student at the University of Manchester, where he studied artificial intelligence, he developed an obsession with Quake, a monster-slaying game. “It was the first game you could play on the internet,” Haleem said, “That was life-changing for me. I played hours upon hours of it.” As it turned out, Haleem had a gift for the game, rising through the ranks. In 1999, he won the Cyberathlete Professional League’s “FRAG 3” tournament, taking home a $10,000 purse. “I became, at certain points of time, the best in the world,” Haleem said.

Though Haleem had ignored most of his schoolwork while he honed his gaming skills, it didn’t seem to matter much. After dropping out of university in 1999, he moved to Sweden to work at DICE, a game publisher responsible for the popular Battlefield franchise. In 2004, the firm was acquired by Electronic Arts, though by that point, Haleem had moved on, trading Scandinavian winters for Californian summers.

In Los Angeles, Haleem helped build the Global Gaming League, an American eSports organization. Around this period, he formed a friendship that would prove significant. The year after Haleem conquered Quake, Shawn Fanning graced the cover of Time magazine. Napster, the peer-to-peer music sharing platform Fanning had co-founded with Sean Parker, was nearing its peak in 2000, though it had already begun to attract legal trouble. By the time Haleem and Fanning became friends in the mid-2000s, Napster had closed its doors, and Fanning had moved on to his next venture.

The two engineers bonded over mutual interests in technology, gaming, and network systems. In the years that followed, both Fanning and Haleem embarked on entrepreneurial endeavors in gaming, giving them further reasons to interact. Fanning sold his business, Rupture, to Electronic Arts for $30 million in 2008, subsequently investing in Haleem’s social gaming startup Diversion a few years later. Perhaps the pair would have stayed on separate paths had it not been for the emergence of the Internet of Things (IoT) revolution.

The Internet of Things

Carnegie Mellon’s computer science faculty were sick of traipsing to the Coca-Cola vending machine only to find it was out of stock or that its contents had not had enough time to cool. To get around the problem, some enterprising caffeine addict installed a set of “micro-switches” which registered whether each of the machine’s slots was full – and for how long it had been filled. By connecting these switches to the ARPANET, a faculty member could run a quick status check and see whether there was Coke in stock and whether it had cooled for long enough. The year was 1982, and the connected Coke machine represented the first “Internet of Things” device.

What Carnegie Mellon computer scientists do on a lark takes decades to reach the mainstream. Indeed, it took until approximately 2010 before the IoT conversation gathered meaningful momentum in venture capital. Nest Labs opened its doors that year, with SmartThings and Ring following in 2012.

Among Haleem and Fanning’s friends, they noticed this uptick in interest. “It felt like everyone around us was building sensor applications all of a sudden,” Haleem said. Various acquaintances set to work on an intelligent doorbell project, a wearable for babies, and a people counting system. Though focused on different end customers, all leveraged connected hardware. Those founders ran into two fundamental problems:

Data costs. Connecting devices to existing networks was expensive, costing several dollars per device per month. Since IoT companies often sought broad scale and significant density, these costs limited the feasibility of many models.

Battery life limits. Traditional networks quickly drained the battery life of IoT devices. The need to frequently replenish or recharge products reduced their utility and appealed to consumers and enterprises.

As friends reported these problems to Haleem and Fanning, they began to ponder potential solutions. “Shawn and I started talking about whether we could build a sensor to help that kind of application,” Haleem said. The duo started to sketch out a potential solution: a distributed network of devices that offered connectivity for IoT devices at radically lower costs and with minimal battery strain. “We designed it to be a super long version of Bluetooth, basically,” Hallem said. “That was the start of Helium.”

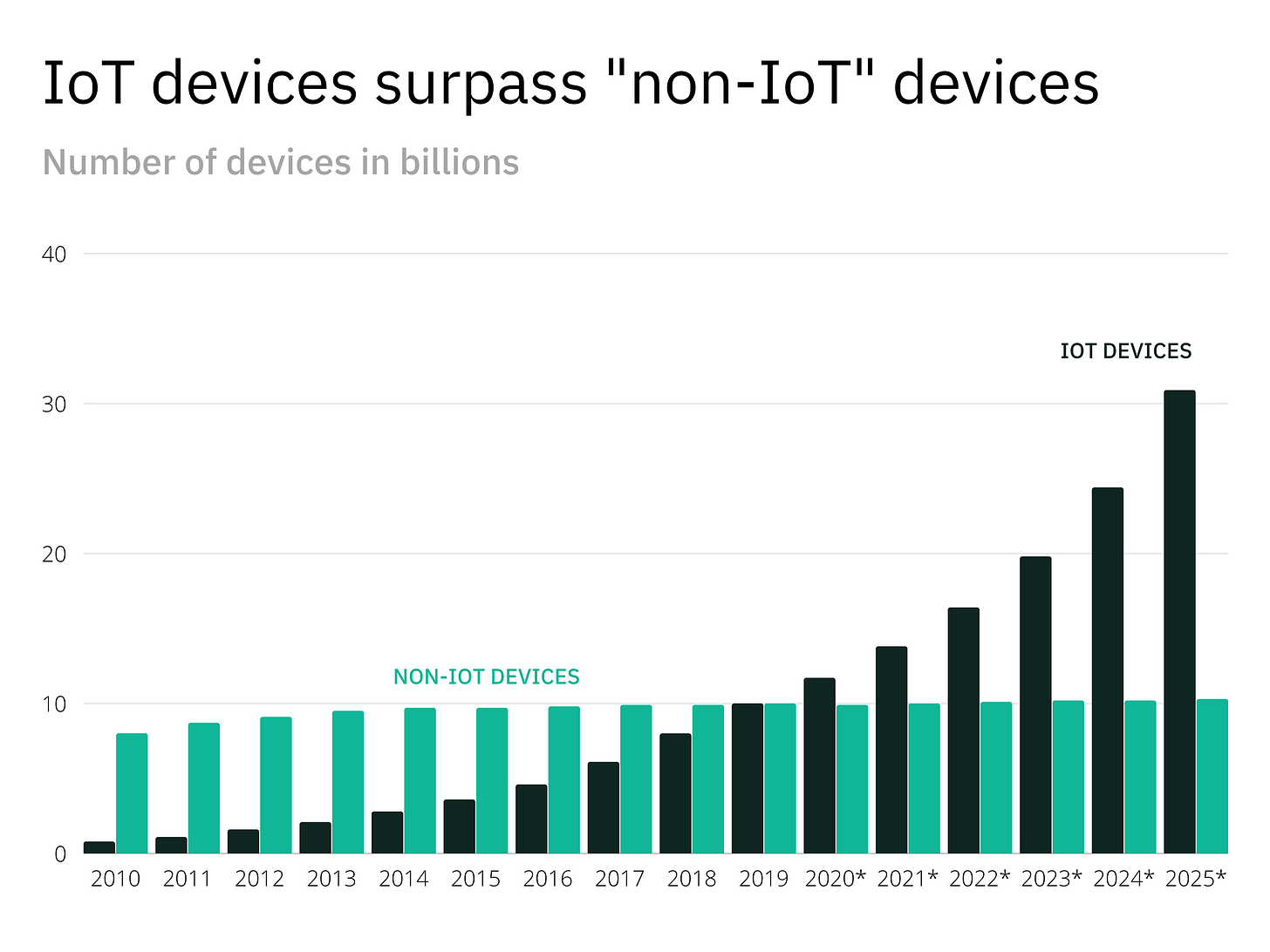

With the benefit of hindsight, Haleem and Fanning chose an apposite moment to launch their business. In 2013, the year of Helium’s founding, there were an estimated 2.1 billion IoT devices in the world. That was far fewer than the 9.5 billion “non-IoT” connected devices, including mobile phones, computers, and tablets.

Those two categories switched places in 2020. That year, there were 11.7 billion IoT devices and 9.9 billion non-IoT devices. By 2025, projections imply the disparity will be much sharper, with 3x as many IoT devices. The IoT market is expected to be worth $677 billion by that point, surpassing the $1 trillion mark by 2030.

A few venture capitalists recognized the tailwinds propelling Haleem and Fanning’s creation. Matt Turck, Managing Director of FirstMark Capital, wrote Helium’s first check. Turck was convinced by the company’s approach as well as its CEO. “IoT needed a different kind of network to go from some crazy dream to reality,” he said, adding, “Amir is also a very special CEO.”

In particular, Turck was impressed by Haleem’s “intense intelligence” and ability to toggle between grand vision and the technical nitty-gritty. “He’s one of these high and low guys that’s very good at both things,” Turck said.

One trait that Turck may not have had a chance to see in those early days was Haleem’s grit. It would prove the Helium CEO’s defining feature.

Going enterprise

After raising a $2.8 million seed, Haleem set to work. He first attempted to build his budding network by partnering with real estate firms. As Turck shared, Haleem approached co-working spaces and large developers like Related, asking if the startup could place hotspots on the roof of various buildings. Though these businesses found Helium’s vision appealing, it was challenging to translate broad interest into concrete commitments without obvious incentives. “When it came down to it,” Turck said, “there was ultimately no real reason for companies to partner.”

With Helium struggling to bootstrap network density, the company executed its first pivot. Rather than trying to construct a broader service, Helium shifted to serve targeted enterprise needs. That revised vision was sufficient to raise a substantial Series A round, with Khosla Ventures leading a $16 million capital injection.

Helium worked with hospitals, factories, and other enterprises during this period. Turck outlined one such engagement in which Haleem’s business kitted out a hospital’s vaccine refrigerator with temperature monitoring sensors. The information from these devices was subsequently sent to Helium’s cloud. While less ambitious than the initial vision, this iteration gave Helium the space to refine its approach and work with paying customers. Though short of scalding product-market fit, Haleem was able to secure a Series B in 2016. Google Ventures led the round, perhaps especially intrigued after its parent company had acquired Nest two years earlier.

Helium entered 2017 with $20 million in new funding, brand name investors on their side, and a reasonable, if less audacious, plan of attack. Haleem soon threw it out the window.

Going crypto

Amir Haleem had little interest in crypto for the first four years of Helium’s life. Except for one of the startup’s employees who participated in the Ethereum ICO, no one on the team was particularly intrigued by its convoluted innovations. “I don’t think anyone in the company really took it seriously,” he said, “‘Blockchain’ was just a buzzword for us.”

In late 2017, that began to change. Haleem noted that Filecoin’s ICO was a turning point, showing a “serious team” with a “real idea.” Helium’s CEO began to wonder whether crypto might provide a solution to the incentivization problem his firm has struggled with when trying to win over real estate developers. Rather than relying on the goodwill of external parties, Helium could provide token rewards to those that secured the network. As Helium’s network grew and more IoT devices relied upon it, its value would increase. So too would associated tokens. The switch would create alignment across the company’s different stakeholders.

The problem was that Haleem’s team knew next to nothing about the space. “We didn’t even know where to start,” the CEO said.

In stumbling across “Understanding Token Velocity,” a blog post written by Kyle Samani of Multicoin Capital, Haleem found some direction. “It became this thing that I just kept reading over and over again,” he said. Haleem decided to reach out to Samani to talk. Serendipitously enough, the Austin-based investor was in San Francisco for a few days, giving the pair a chance to speak in person. Not long after, Haleem flew out to Austin to continue the conversation.

Along with partner Tushar Jain, Samani shared thoughts on how a Helium crypto network could work. With no high-throughput blockchains readily available, Haleem would need to build his own Layer 1 to handle Helium’s network. “There was no Solana or Avalanche,” Haleem noted.

While that represented a challenge, especially for a team new to crypto, both Multicoin and Helium became increasingly convinced of the idea's potential. In June 2019, Helium announced it had raised a $15 million Series C to pursue its crypto strategy, co-led by Multicoin Capital and Union Square Ventures.

After years of searching for the right direction, Helium moved quickly once it believed it had found it. Less than two months later, the company launched its network in Austin, with Multicoin helping to bootstrap early density. Neither Haleem nor Multicoin could have expected the speed at which their new network would grow.

Going global

Helium scaled solidly through 2019 and 2020 – but it was in 2021 that the network truly exploded. Over twelve months, the number of hotspots deployed rose from approximately 14,000 to 450,000 – an increase of 3,100%. More than 34,000 cities and 161 countries hosted a Helium hotspot by year-end. As COO Frank Mong noted, it was “the fastest rollout of a wireless network in history.” A secondary sale of $111 million brought in a16z and Tiger Global.

The approval of “Helium Improvement Process 19” (HIP 19) played a pivotal role in galvanizing such traction. Before HIP 19, all hotspots had been produced by the Helium team or a single third-party provider called RAK Wireless. While this may have allowed Helium to monitor hardware production more tightly, it limited supply. HIP 19 outlined a framework to approve new manufacturers. By the end of that year, twenty-five companies manufactured hotspots, helping to bring hundreds of thousands more onboard.

A torrid uptick in the broader crypto market didn’t hurt either. Helium’s native token, HNT, began the year at $1.36 before surging to a high of $53. It ended 2021 priced just shy of $38. This upswing rewarded Helium’s early contributors, with one source noting they had heard of some hotspots racking up 250,000 HNT in rewards – a sum worth $12.5 million at HNT’s high. It also incentivized others to jump aboard, including some that built businesses to capitalize on the opportunity.

One such individual was Max Gold, founder of Hotspot Rescue. Gold received a hotspot in March 2021 as a promotion from a local company. Intrigued by the device, Gold installed it in his Houston apartment – which happened to be located on the 26th floor. He quickly realized that it earned a significant number of tokens, about 30 HNT a day. That became even more attractive as the price of HNT doubled to roughly $10 in its first couple of weeks of operation. Virtually overnight, Gold had gained possession of a money printing machine, generating $9,000 a month – more as HNT continued to rise.

Recognizing the revenue potential of the devices, Gold started taking friends’ devices and positioning them in good locations in exchange for a cut of earnings. After he exhausted that avenue, he reached out to an Internet Service Provider (ISP) in Kentucky to discuss positioning hotspots on their towers. After a weekend of experimentation, he and the ISP provider formalized their arrangement, setting up a business focused on “web3 implementation.” In partnership with a suite of ISPs, Hotspot Rescue has installed 750 devices, though not all remain operational. Gold estimates roughly 100 participants in the Helium community have professionalized installation in the same way as his firm. Along with consumers, these businesses contributed to Helium’s expansion.

Such hypergrowth naturally came with hiccups. Not all hotspot owners acted in the network's best interest, finding ways to take advantage of Helium’s “Proof of Coverage” algorithm to siphon underserved HNT. Bugs in the company’s codebase caused outages in November 2021, prompting changes to the network and validation process.

Though not ideal, such minor disruptions did little to dampen Helium’s extraordinary year.

Winter returns

Twenty-twenty-two has brought fresh opportunities and challenges for Helium. HNT has not escaped the hammering crypto has received, with the token’s price currently sitting at $9.20, more than 80% off the high. This decline has occurred even as Helium has expanded its network, surpassing 900,000 hotspots. At its current growth rate, it will hit 1 million devices in a matter of months.

Helium has also begun to roll out its newest project: a 5G network. We’ll discuss this initiative and the project’s broader growth strategy in more detail below. As it stands, approximately 1,600 5G hotspots have been activated, spanning close to 700 cities. In April of this year, Helium raised a further $200 million with a16z and Tiger co-leading and the venture arms of telecom giants like Deutsche Telekom, Nokia, and Liberty Global participating. As part of the announcement, Helium announced it was rebranding its corporate entity as “Nova Labs.”

Despite the project’s traction and capital injection, there is some unease within Helium’s consumer base. Some of that anxiety stems from softening incentives. Max Gold of Hotspot Rescue summarized the state of affairs: “The rewards are so bad right now.” Though still bullish about the network, he attributed declining rewards to rising hotspot competition, HNT selling pressure from professionalized bad actors, and concerns around the 5G rollout and other network changes.

This confluence of tremendous momentum and uncertain sentiment leaves Helium in an odd position. It is both an unprecedented success, having rolled out a network at record pace, and an organization embarking upon another massive evolution. Given Helium’s gritty, iterative, and audacious history, that is in keeping with the DNA of Haleem’s company.

Product: The IoT Network

Helium is easily understood in broad strokes – a network for IoT devices – but tricky when presented with greater detail. It is not so much a product as an ecosystem involving hardware, blockchains, tokens, and a native economy.

We must explore each of these components to understand where Helium is headed.

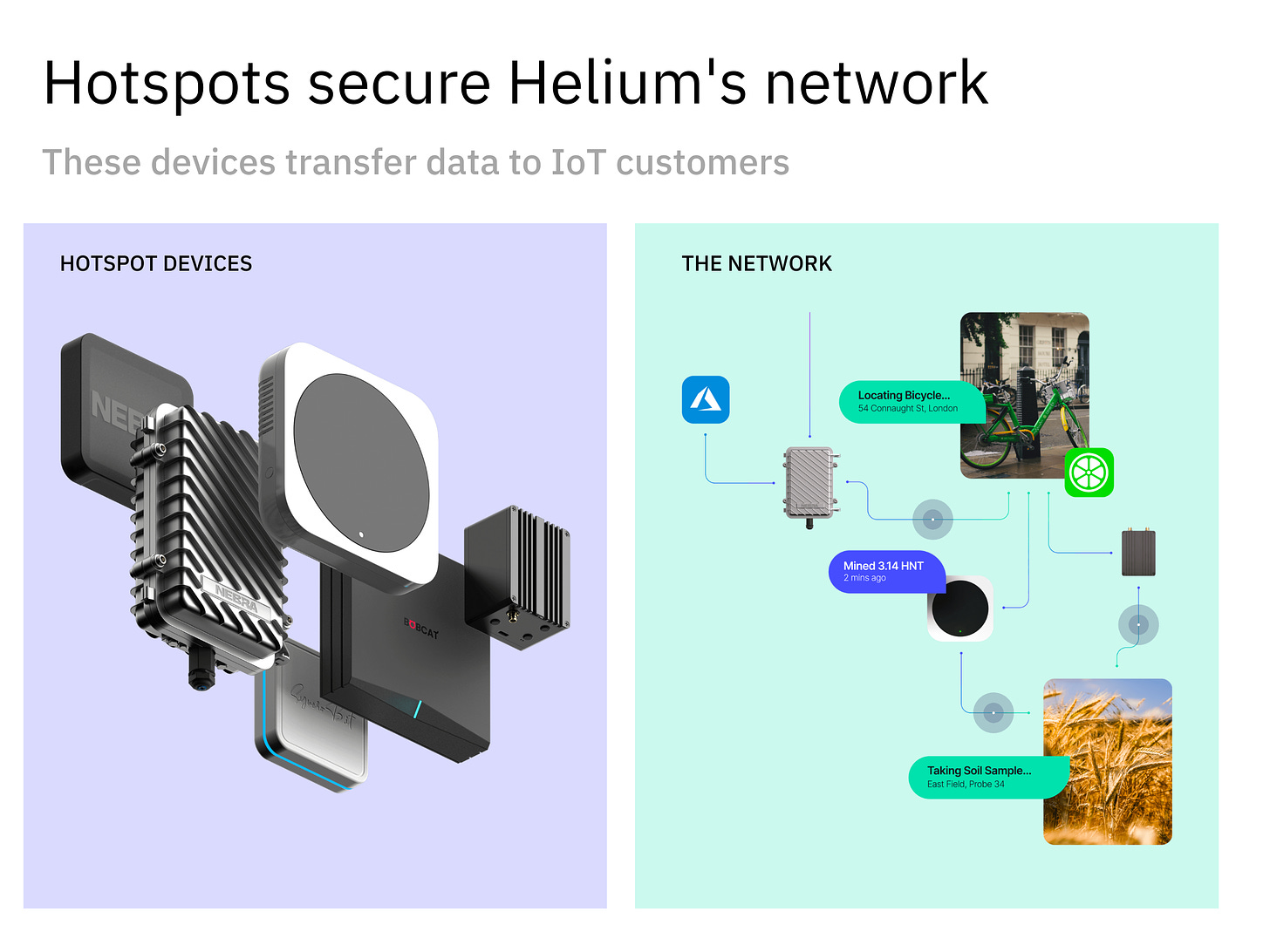

Hotspots

The simplest place to start is with Helium’s hotspot. While Helium and RAK Wireless initially made these devices, there are now twenty-six approved manufacturers. The most popular maker is Bobcat, which offers three models, including a new 5G-ready edition. Manufacturers also provide their own smartphone applications to manage devices – a recent shift. Initially, Helium offered an application to manage hotspots across manufacturers.

At HNT’s peak, these unobtrusive hotspots operated like money printing machines. Simply by sitting on a windowsill or table in a productive location, a device was capable of generating thousands of dollars in earnings each month.

LongFi

Hotspots provide coverage using a Helium-created network dubbed “LongFi” that combines the characteristics of LoRaWAN (Long Range Wide Area Network) with the company’s blockchain. LongFi draws minimal battery power and stretches 200x further than WiFi. Because LongFi uses “unlicensed” frequency bands, it is also much cheaper than traditional data plans. This is a critical distinction to understand as it also impacts Helium’s 5G strategy.

The Federal Communications Commission (FCC) licenses spectrum to companies – both radio and higher-band spectrums – in exchange for a fee. Television broadcasters and telecom operators are happy to purchase the license for this spectrum as it promises uninterrupted access. However, not all bands within a spectrum are licensed. Unlicensed segments can be used without paying a fee or receiving permission from the FCC. The downside is that these bands tend to have more interference. By leveraging unlicensed spectrum, Helium provides IoT connectivity at a fraction of the cost.

The second critical element of LongFi is Helium’s blockchain. Each customer is affixed with a unique identifier registered on the blockchain. When a customer’s devices are used, they can be traced back to this ID. Critically, no centralized entity has to greenlight sending data or adding new devices to the network.

Proof of coverage

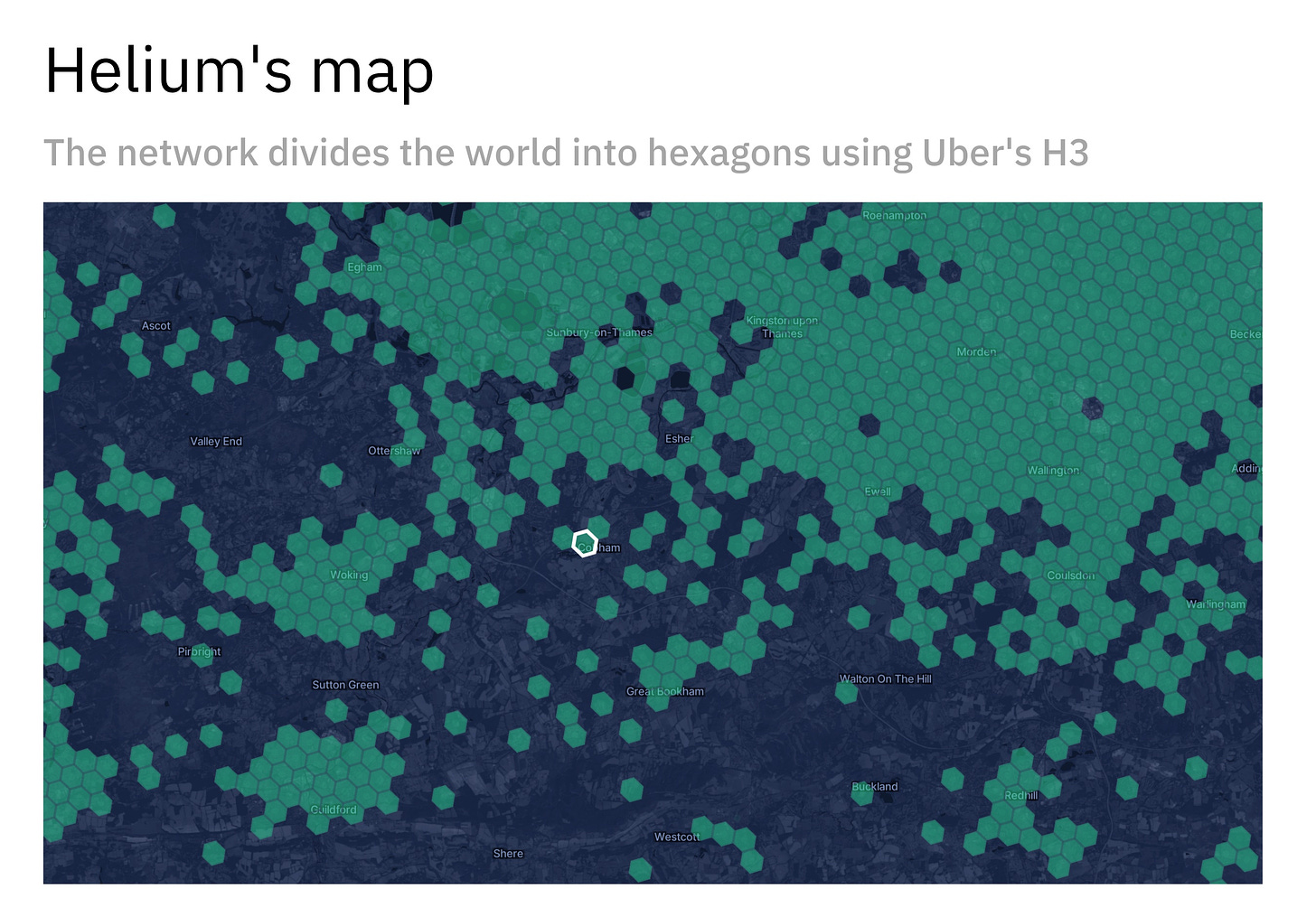

To Uber, the world is a honeycomb. You might have noticed this when using the app. The ride-sharing business divides territories into a series of hexagons, a grid used to visualize and identify different locations and better understand supply and demand. This cohesive system can be implemented across territories and metropolises of different sizes and complexions.

This system, dubbed “H3,” is a crucial base layer for Helium’s “Proof of Coverage” algorithm. Look at Helium’s hotspot map, and you’ll see how this manifests.

Proof of Coverage (PoC) is Helium’s way of verifying the dimensions of its network. Specifically, it's used to test if hotspots are where they say they are. Given that HNT rewards vary based on location, this is important. One of Helium’s most potent levers is its ability to financially incentivize network growth in areas that need it. If coverage cannot be reliably tracked, expansion becomes near impossible.

PoC works via a “challenge” model. This is essentially a Shakespearean technological drama in miniature with three major players: the Validator, the Beacon, and the Witness.

The Validator’s role in the drama is to issue a challenge. They scream across the world to a specific hotspot and say: prove you are where you say you are. To avoid disgrace, the challenged hotspot, better known as The Beacon, shouts back in return: here I am! Anyone that hears my voice can attest to my whereabouts. A nearby hotspot is drafted into the drama to serve as a Witness. This hotspot reports back to the Validator, saying: I have heard the Beacon and confirm he has told no lie. As with any reputable production, each of these characters is paid for their part, compensated in HNT.

While a simplification, it is not far off. A technological explanation adds a little more color. A validator – a node that has staked 10,000 HNT – issues a challenge to a beacon after a certain number of blocks. The beacon transmits data packets to be observed by neighboring witnesses (usually more than one). Witnesses report the existence of this data, submitting a receipt to the validator.

Though PoC has mostly worked, some have gamed it. In April 2022, Deeper Network – a web3 infrastructure business – was banned from using the Helium network for at least a year. The company was believed to have been involved in faking the location of its hotspots, using its own surrounding hotspots to bear false witness. Deeper Network argued that a manufacturing partner conducted this without their knowledge.

According to Max Gold, gaming PoC is not uncommon. Those that spoof the network effectively often sell the HNT they earn as soon as possible, putting downward pressure on the price of HNT. Gold noted that Helium’s core team had been cracking down on scamming of this kind. “It’s starting to get better,” he said.

Though any system that offers financial reward is likely to be gamed in some respect, Helium has constructed a novel and largely effective way of securing its network.

The economy

As John Robert Reed of Multicoin Capital said, “Helium builds economies.” At the project's center is a market for IoT data, through which Helium and its stakeholders transact.

To use Helium’s IoT network, customers burn HNT in exchange for Data Credits (DC). This has a deflationary effect on the price of HNT. Data credits maintain a steady value of 1 DC equalling $0.00001. Companies spend Data Credits by transferring data via LongFi and making transactions on the Helium blockchain.

Helium’s economy looks moderate or small, depending on how you parse the numbers. According to Token Terminal, Helium’s revenue in June totaled $2.6 million. That’s down from the April high of $5.5 million but a 73% improvement over the same period a year earlier. In 2020, Helium’s June revenue was below $200,000. Eddy Lazzarin, the head of protocol design at a16z, noted that when his firm first invested in Helium, “the last ninety days had something like $600.” It has come a long way since then.

However, this is only part of the picture. Data Credits are used when onboarding a hotspot, asserting a location, and processing a payment. Onboarding hotspots, in particular, is intensive from a Data Credit perspective. Since Helium is onboarding so many new hotspots, this skews results, suggesting greater customer activity than is actually present. Data from The Decentralized Wireless Alliance removes these three uses, demonstrating the size of the Helium economy’s customer demand. By this measure, DC usage was just $6,561 in June.

In either case, it’s clear Helium’s network has room to grow. Indeed, it needs to. While it has done an exceptional job scaling the supply side of the project, nearing 1 million hotspots, more demand is necessary. Embracing 5G could send that side of the market through the roof.

Future: The Network of Networks

Helium isn’t content to simply be the largest IoT network in the world. It wants to be the infrastructural layer for a range of communication networks, fundamentally disrupting traditional telecommunications and bringing connectivity to those that need it.

The DeWi opportunity

Without a grasp of the telecom industry, it’s hard to comprehend just how large a prize Helium is chasing. The global telecom market was pegged at $1.6 trillion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% between 2021 and 2028.

Beyond its size, the telecom space has several intriguing quirks that make it ripe for disruption. For one thing, competition is minimal. In the United States, there are three major players when it comes to wireless operators; Verizon, AT&T, and T-Mobile control an estimated 98.9% of the market. AT&T, the largest telecom company in the world, earned $169 billion in revenue in 2021.

Salvador Gala, co-founder of Escape Velocity, a fund dedicated to investing in decentralized wireless networks, noted that telecom operators traditionally have strong ties to the government. Based on internal research, Gala suggested that much of the industry remained directly or indirectly beholden to national policy. “Twenty-five percent of the entire telecom industry globally is government-owned, and the other 75% is extremely heavily regulated, he said, “After money printing, its the number one thing that governments care about maintaining sovereignty over.” Gala pointed to Congress’s directive to telecom providers to remove hardware from Chinese manufacturers like Huawei and ZTE as an example of how national bodies exert control over the sector.

This is far from the most extreme example. Other governments not only influence implementation but shut communication networks down during moments of turmoil. The Carnegie Endowment for International Peace recorded hundreds of such incidents over the past few years. During its invasion of Ukraine in March, Russia’s internet regulatory body closed off access to Facebook and Twitter. News outlets like the BBC, Voice of America, and Radio Free Europe were subsequently banned.

For these reasons, Gala believes that “Decentralized Wireless” (DeWi) projects like Helium are essential. “Wireless is one of the few things in crypto that needs to be decentralized,” he argued.

Beyond the societal value of having an uncensorable network, DeWi projects have the potential to increase connectivity faster and more economically. Haleem remarked that installing a traditional cell tower might cost as much as $150,000. Helium’s Chief Product Officer Abhay Kumar added that even reaching that stage may take a while and involve numerous parties. “Traditional networks are highly centralized infrastructures that require a lot of planning and capital expenditure. This ultimately leads to a multitude of intermediaries involved.” In this process, telecom companies overlook communities that do not offer commercial value. Kumar remarked that “vulnerable communities” are often left with little or low-quality connectivity.

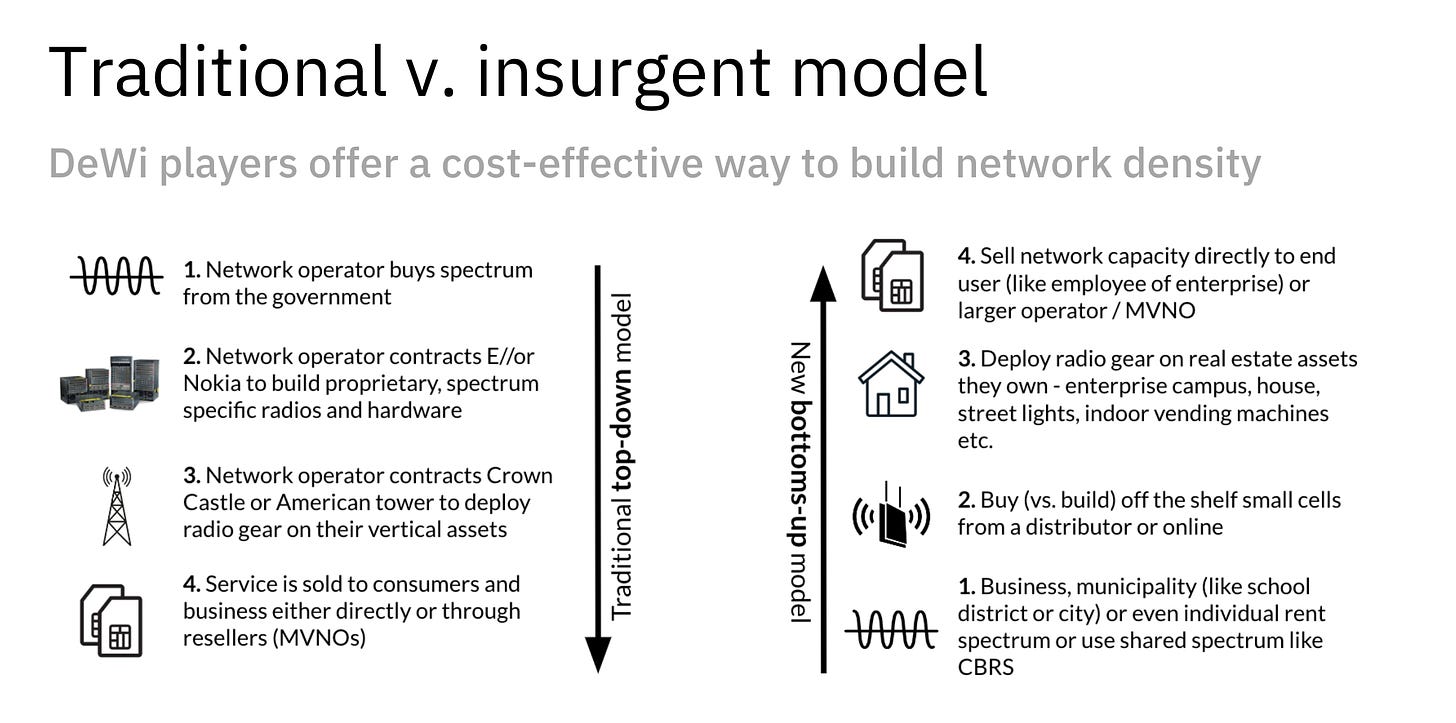

DeWi projects flip this script. Rather than buying an expensive spectrum, contracting proprietary equipment, and engaging in costly installations, DeWi initiatives work bottom-up. They leverage spectrum bands, use off-the-shelf components, and rely on citizens to install devices in their homes. Boris Renski, founder of FreedomFi, shared a diagram that outlines how traditional and DeWi processes differ:

FreedomFi is a provider of DeWi infrastructure and a partner in Helium’s 5G push. Renski added that traditional providers and DeWi need not be enemies. Indeed, the best solution for all parties, including consumers, would be for incumbents and insurgents to work harmoniously. This is partly because DeWi networks offer density that big telecom businesses cannot.

“Most traditional operators that build networks top-down are not well positioned to build very dense, small cell networks,” Renski said, “They can build a few towers in a city. They can't put a small cell in every coffee shop.” According to Renski, such density will be necessary as higher frequency bands are utilized, as these parts of the spectrum don’t travel well through walls and other impediments. Critically, these DeWi implementations can occur in communities overlooked by incumbents, bringing more people online. Partnerships between DeWi and incumbent providers offer a chance to create robust, widespread connectivity.

Helium hopes it will be essential infrastructure in bringing this to fruition. Indeed, it hopes to become the backbone for a suite of networks beyond IoT.

Beyond IoT

To roll out a 5G network, Helium has had to rethink its structure from the ground up, conceiving of new devices, incentives, and governance entities. This new architecture has been designed to serve future networks, too. Helium hopes to support WiFi, VPN, and CDN eventually. As mentioned earlier, Helium needs to do this – the level of demand on the network is not sustainable at current levels.

Supporting 5G requires a new kind of hotspot. So far, six launch partners offer indoor and outdoor devices built for this network. These are much more expensive than Helium’s IoT products – costing several thousand dollars each. While indoor devices are easier to install, as they can sit on a windowsill or table like the original miners, outdoor products require a more involved implementation. The upside is that these external devices will likely earn more of Helium’s new token, MOBILE.

Helium’s new economy is both complex and elegant. To use the organization’s networks – including 5G – clients will still need to burn HNT in exchange for Data Credits. However, instead of earning HNT, miners will generate tokens specific to the network in question. Devices supporting IoT will earn a new token called IOT, while 5G hardware will generate MOBILE. Each of these currencies can be swapped for HNT, but the reverse is not possible: you can’t take your existing HNT bags and flip them into MOBILE, for example.

Critically, each of these economies will be managed by subDAOs with authority to define their own Proof of Coverage, mining rewards, and pricing. As CPO Abhay Kumar explained, this structure keeps Helium’s core mechanism in place:

We’re seeing this opportunity as a “rising tide that lifts all boats” situation. All subDAOs need to settle traffic payments with Data Credits, and Data Credits exist by burning HNT. This maintains the Helium Flywheel and ensures there is a strong affinity of each subDAO to the Helium network, and thus other subDAOs as well.

In the future, Kumar hopes that consumers will use multiple subDAOs:

For their phone, for example, they’ll use a carrier on the MOBILE subDAO in order to make and receive calls but may use the WiFi subDAO in order to access a WiFi network in a train station while they’re waiting. All of their data may transit over a securely tunneled connection to a particular end node that exists at the VPN subDAO, or some of their traffic may be served through nodes on the CDN subDAO.

Though Helium has not announced a partnership, Solana may play a vital role in making this a reality. It is rumored that Helium is considering moving its Layer 1 to Solana. Though that might cause a temporary disruption, it could also radically reduce the technical burden on Helium’s team. In our conversation, Haleem remarked that if a company wanted to compete with their network, using Solana, “you could build a clone of Helium with a thousandth of the engineering work.” Given the early stage of The People’s Network, Haleem may be tempted to make such a trade.

Solana has shown a growing interest in telecom that is unlikely to be accidental. Last month, the protocol debuted Saga, an upcoming smartphone built to be web3 native. Within a year, it feels entirely possible that consumers may use their Saga to connect with Helium’s network and mine a suite of tokens. First, Helium will need to win the “Cellular Summer” battle.

Try it now

Don't miss our next briefing. Our work is designed to help you understand the most important trends shaping the future, and to capitalize on change. Join 62,000 others today.

Cellular Summer

Right now, there are approximately 1,600 5G hotspots in the wild. Helium will hope that by the time autumn comes around, that figure is many multiples larger. It’s worth noting that this roll-out is concentrated in the United States. The lack of unlicensed bandwidth in other geographies makes this playbook a non-starter for the time being.

Later this month, Helium will push its 5G initiative into its “Genesis” phase. For the first time, hotspots will begin to earn MOBILE, with 100 million tokens issued per day. There is also a pre-mine for those that have bootstrapped the network thus far.

The company’s entry into 5G arrives not a moment too soon. Over the past year, competitors have emerged, using Helium’s success as a template. For believers in DeWi, this is good news. Different players are learning from each other, improving their offerings through rivalry.

The most notable challenger is Pollen Mobile. A subsidiary of Pronto AI, Pollen relies on a system of “Flowers” (static hotspots), “Bumblebees” (mobile hotspots), and “Hummingbirds” (smartphones using Pollen’s eSIM) to create a 5G network that promises to be “privacy-first.”

There is more than a little irony in that claim. Pollen’s founder is Anthony Levandowski, who completed a rare hat-trick of grifts before his newest venture. As documented in Mike Isaac’s Super Pumped, at Google, Levandowski started a side business that provided services to his employer without disclosing his ownership of the entity. He then sold this company to Google at a price that ensured he didn’t have to share profits with employees. Upon departing Google, Levandowski famously downloaded 14,000 confidential files associated with the firm’s self-driving program, which he then used to launch his own self-driving startup. He swiftly sold the business to Uber. Levandowski was charged with the theft of trade secrets for this final breach and sentenced to 18 months in prison. A pardon from Donald Trump arrived before he served any time. The venture market punished Levandowski’s behavior with a seed round.

While Pollen may be cryptographically secure, we have seen many early-stage crypto projects manipulated by unethical founding teams. Funds can be diverted and incentives skewed. Pollen may be a true paragon of integrity, but trusting Anthony Levandowski's network with your data feels like relying on a crypto custodian built by Razzlekhan.

And yet, Pollen is a viable competitor. Lucrative “Pollen Coin” (PCN) rewards may convince even the most skeptical consumer to take a shot and plant a Flower. Helium has a headstart over Pollen – but not much of one. Helium may have 900,000 IoT hotspots, but as mentioned, it has just 1,600 equipped for 5G. Pollen has 525 Flowers in its network, up 16% from a month earlier. It also has 466 Bumblebees. While Helium’s established community and strong record should help propel a fast implementation, success is by no means assured. Some Helium community members have already started deploying Pollen devices, partially motivated by falling HNT rewards.

Helium must move fast to protect its position. An effective strategy would be to lean into its strength and Pollen’s weakness: reputation. As a market leader without ethical baggage, Helium should be able to cement more significant partnerships. So far, that appears to be true. In October 2021, Helium announced a partnership with DISH Network. DISH will use Helium’s coverage to fill in connectivity gaps as part of the collaboration. Other major players are likely to follow. “We’ve seen incredible traction and interest from traditional telcos this year who are interested in learning about and joining our mission,” Haleem said. It may not be long before Helium reels in one of telecom’s giants.

Helium is undertaking yet another wildly ambitious task. Indeed, winning the 5G war could set it on the path to becoming one of the world’s most valuable entities.

And yet, despite that uncertainty, there is much to learn from Amir Haleem’s business already. As John Robert Reed of Multicoin noted, Helium created a “new business model for deploying infrastructure.” The startup that struggled to win over landlords and dabbled with micro-enterprise IoT pioneered how networks can be built and crypto effectively used. Eddy Lazzarin of a16z elaborated on this second point, remarking that “when you roll out a token, there needs to be a purpose.” Though many different “X to Earn” models have toyed with using tokens as subsidies, Helium has demonstrated such rewards work best when they add more tangible value. “It’s much smarter if the network subsidy actually contributes to the growth of the network and makes it better for the next consumer,” Lazzarin noted.

What infrastructure could the world build following Helium’s model? What new networks could crypto create?

The French-Romanian playwright Eugène Ionesco once said, “It is not the answer that enlightens, but the question.” More than almost any project, Helium prompts such valuable interrogation, raising questions that illuminate.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.