I have a puzzle for you.

Imagine you are in a nondescript room, with the following items on a table in front of you:

A large wax candle

A cardboard box full of thumbtacks

A matchbook with working matches

Something like this:

Here’s your task: attach the candle to one of the walls and light it without dripping wax onto the floor. As a note, the walls can be punctured by tacks. They’re not stone.

Take a moment to devise your solution. Spoilers below.

…

…

…

…

...

In a canonical study, Gestalt psychologist Karl Duncker presented test subjects with a version of this quandary. Rather than asking them to imagine the scenario, though, participants were actually placed in a room with these materials.

The solutions varied. You might have considered many of them.

Some tried to tack the candle straight onto the wall. That didn’t work. Others used the matches to melt the bottom and side of the candle, using the wet wax as an adhesive. Not great, either.

Only a few completed the task in what looks like the simplest way with the benefit of hindsight: taking the cardboard box that held the tacks, using those tacks to attach it to the wall, and then placing the candle at its center. Like this:

The box both attaches the candle to the wall and prevents its wax from dripping onto the ground. Mission complete.

But why did so few subjects think of this solution? How come so many reasonable people pursue more convoluted fixes?

For Dunker, the answer came down to one main factor: “functional fixedness,” a cognitive bias that limits items’ usage to the context in which they’re presented. Because participants had seen the cardboard box as a “tack box” they found it hard to recast it as a candle box, or shelf.

The rigidity of functional fixedness can infect matters large and small. Yes, it might prevent us from parsimoniously solving a little brainteaser like Dunker’s, but just as easily, it can affect how we perceive ourselves, how we frame our work, and how organizations that employ or serve us conceptualize their capabilities.

Yes, JP Morgan is a bank. Could it also be an e-commerce player? Sure, Wells Fargo provides commercial loans. What if it was also the place you bought your next plane ticket?

It is reasonable to hear such suggestions and balk. But these are exactly the improbabilities that define Kaspi’s story. What began as a middling commercial bank in the 2000s, has transformed into a tech behemoth over the last decade. From its base in Kazakhstan, Kaspi has, without exaggeration, become one of the world’s most dominant and comprehensive super-apps with a lively platform that touches e-commerce, payments, travel, and fintech. Somehow, in a country of just 18.5 million people, Kaspi has succeeded in building a $21 billion business.

Above all, that success is borne from eschewing functional fixedness, and embracing fluidity; a triumph of shapeshifting. In today’s briefing, we’ll cover:

History. Kaspi’s circular origins as a bank serving a retailer, which became...a retailer with a bank.

Investors. How Baring Vostok, a Russian private equity firm, installed a new CEO and sparked a second act.

Dominance. Calling Kaspi Central Asia’s Mercado Libre or Alibaba is not an exaggeration. The company has the numbers to back it up.

Expansion and risks. Will Kaspi be able to capitalize on the opportunity in Ukraine and stave off competition at home?

Origins: Smart Money

The story begins in 1993 with a young Vyacheslav Kim living in Kazakhstan’s capital. Rather than seeking entrance to the corporate world, dominated by the petroleum industry, the Almaty State University graduate began a business at the age of 23. Planeta Eletroniki was, as you might have guessed, a purveyor of household electronics, a sort of Kazakhstani Best Buy.

That proved an appealing proposition. In less than a decade, Kim turned Planeta into the country’s largest retailer, with stores spanning Kazakhstan’s metropolises. Still, Kim wasn’t satisfied. He’d realized, alongside other retailers, that one of the largest impediments to consumer purchasing was a dearth of financing options. The dissolution of the Soviet Union had seen Kazakhstan’s population fall on hard times, with GDP per capita declining between 1990 and 2000. To address that problem, retailers took to M&A, acquiring banks with the goal of providing loans to buyers.

In 2002, Kim acquired a small local bank, Kaspiskiy. The commercial lender had only been privatized in recent years. The acquisition might have made sense on paper, but realizing the synergies was a struggle in practice. Kim described the issue:

It might have been a bit naive, but buying a bank was a big trend. Every successful entrepreneur was buying a bank, so we did too. But we didn’t really understand what we were buying or what a banking business was.

Unsure of how to leverage his new asset, Kim sought investment partners with expertise to bring to the table. It was in this process that he was introduced to a partner at Baring Vostok.

Founded in 1994 by American Michael Calvey, Baring Vostok began its life as a subsidiary of Baring Bank, which once counted Queen Elizabeth II among its clients. When one 28-year old derivatives trader tanked the business thanks to a series of speculative trades (what a story!), Calvey spun out but retained the Baring name.

In the succeeding years, the firm established itself as a major player in the Central and Eastern Asian investment world. Famously, Baring invested $5.3 million in Russian search engine Yandex in 2000. When the company reached the public markets eleven years later, the firm’s position was worth $2.9 billion, a casual 547x return. Baring would hold onto some of its stake through 2016.

That lengthy holding period was one of Baring’s differentiators, along with its hands-on approach, and the younger age of its staff. That helped create a closer relationship between fund investors and the entrepreneurs it backed.

Perhaps that was part of the reason Kim recognized the potential for a true partnership with the young Baring financier, Mikhail Lomtadze (Misha). Born and raised on the other side of the Caspian Sea in Georgia, Lomtadze had studied first in Tbilisi before building a local accounting firm, GCG Audit. GCG was later absorbed by Ernst & Young.

To further his education, Lomtadze headed to Harvard for business school. After finishing his MBA, he joined Baring Vostok. So keen was he to join the fund that he reportedly told Michael Calvey “I don't need any salary.” He got one anyway, going on to develop a specialization in the financial sector while at Baring. That expertise made him a valuable sounding board for Kaspiskiy’s befuddled owner.

The connection between the two men was effortless, according to Kim:

We got together for a dinner and there was immediate chemistry. I told Misha my aspirations for the business, and when Misha spoke, it was clear that he saw things the same way and shared the same values.

It proved the start of a remarkable journey. Though he had more lucrative offers, Kim plumped for Baring Vostok’s “smart money,” selling a 51% stake. Kaspiskiy was heading for a transformation.

Playbook: The reinvention of a middling bank

If the market had complied, Kim and Lomtadze’s renovation might have been of a more modest variety.

In the period leading up to the global financial crisis, emerging market banks were a hot commodity. Larger institutions that sought to expand their footprint in frontier markets happily paid premiums for well-run outfits. Kim and Lomtadze’s first plan was to ensure Kaspiskiy would be one of them. Among their first changes was rebranding the company, choosing the more direct, “Kaspi Bank” (Kaspi).

It wouldn’t matter, of course. Once the crisis shivered to life in 2007, Kaspi’s turnaround plan evaporated along with the bottom line of its potential buyers. To weather the storm, Lomtadze took the helm, becoming Kaspi Bank’s CEO, though Baring did not seem to think much of the business. One source remarked that the fund considered its investment in Kaspi as a “write-off” at the time.

Over the following decade, Lomtadze would prove such pessimism foolish, executing one of the great corporate turnarounds. With the benefit of hindsight, we can sketch a playbook from the steps he took:

Clean house.

Build a moat.

Befriend the ruling class.

Streamline the product.

Focus on the customer.

Layer.

Step 1: Clean house

“We basically fired everyone.”

That was how Lomtadze described one of his first acts, the expunging of Kaspi’s leadership. Suited for a different age and a different business, the new CEO felt these executives were ill-equipped to lead the revolution he sought.

Despite being purchased by Kim to serve customers of Planeta Elektroniki, Kaspi Bank had built its business serving commercial enterprises, primarily through loan products. But that was the past; Lomtadze knew the future lay elsewhere.

His new team reflected that shift, displaying a preference for young, more digitally-savvy MBAs:

Pavel Mironov joined as Head of Product, coming from Tieto, a Finnish digital consultancy.

Tengiz Mosidze, a fellow Georgian, joined from Ernst & Young as CFO. Prior to his time at E&Y, he served at the World Bank.

Yuri Didenko, had worked with Lomtadze at Baring Vostok, where he’d been a Director of Investments. He became Head of Capital Markets, handling treasury operations.

Together with Lomtadze, this quartet reinvented Kaspi and remains essential to this day, with all retaining leadership positions. It was a brutal way for the CEO to begin his tenure, but it’s proven to have been shrewd.

Step 2: Build a moat

With the right team in place, Lomtadze began to execute his master plan.

It didn’t look like a brilliant idea, at first blush: Lomtadze wanted Kaspi to shift from serving businesses to customers. That required forfeiting 95% of Kaspi’s balance sheet, to focus on just 5%.

Though the CEO recognized the pain such a move would cause, it seemed the obvious path to building an enduring moat:

We had a very clear goal to build our competitive advantage on speed of providing products and services, and constant disruption through innovation. You can achieve this only by being data-driven and technologically advanced. We felt that would be our biggest source of competitive advantage in the years to come.

Kaspi made the shift. To do so, the company reallocated resources to tech, altered its product suite, and expanded its physical footprint to better serve customers. That it managed to do so while riding out the financial crisis was a testament to leadership — reportedly, Baring Vostok advanced a $100 million loan to Kaspi during this period, but it went unspent.

Step 3: Befriend the ruling class

In researching Kaspi, I had the pleasure of speaking with several knowledgeable sources. That included Kiyan Zandiyeh, Chief Investment Officer of Sturgeon Capital, a fund focused on backing innovative businesses in frontier markets. Much of the firm’s work has focused on Central Asia.

Zandiyeh noted that the public sector has played an outsized role in industry, in these geographies. In Kazakhstan, for example, many of the companies Kaspi Bank competed with were government-sponsored. Kaspiskiy itself seems to have had affiliations with the Kazak state, prior to privatization.

That can, if not managed, set up an adversarial relationship between entrepreneurs and the government. After all, in many cases, these businesses are invading state functions, dislocating power in the process.

Whether by design or circumstance, Kaspi managed this potential friction masterfully. That owes much to Vyacheslav Kim. While Lomtadze focused on recalibrating the business, Kim increasingly busied himself in the political world, becoming a trusted consigliere of the country’s prime minister.

That seemed to give Kaspi a privileged position, further aided by the involvement of Kairat Satybaldy. The beloved nephew of president Nursultan Nazarbayev bought into Kaspi in 2015, selling prior to the IPO. With the ear and affection of Kazakhstan’s ruling class, Kaspi was permitted to grow unfettered.

Step 4: Streamline the product

Kaspi did not simply change its target market, it also radically pared its product suite. Rather than trying to tack on new features, it slimmed down, focusing on very few. That included deposits, consumer loans, and a credit card. With that skeleton, Kaspi was able to compete, winning over a considerable consumer base.

In part, that was thanks to the weak competition. In discussing the misconceptions of investing in emerging markets, Zandiyeh commented on this dimension, highlighting the traditional sloth and ineptitude of the kind of state-run outfits with which Kaspi vyed, “People think it's risk on risk, but it isn't.”

Five years after Lomtadze had become top dog, Kaspi had completed its first transformation, from commercial to retail bank. By 2012, the company had issued more than 1 million credit cards, making it the largest player in Kazakhstan, and a rising star in Central Asia.

Step 5: Focus on the customer

If Lomtadze had the chance to roll back the clocks to 2007, he might make one change: focus on the customer earlier.

Despite rising to the top of the domestic banking game, Kaspi failed to win consumers’ hearts. As the CEO described it, “we ended up in a situation where most financial services end up: with customers just hating us.”

Because of the weak competition mentioned earlier, Kaspi could, paradoxically, succeed while failing. It could be both used and despised, the best of bad options. That wasn’t a position the man that had sought to create a business with accumulating advantages considered satisfactory.

Having completed Kaspi’s first refresh, Lomtadze set off on the company’s second. This time, customer love would be at the heart of things. In particular, Kaspi developed an obsession with feedback and NPS.

This was far from lip service, defining how Kaspi defined success and what products it shipped. Revenue-based KPIs were sidelined in favor of NPS, with progress measured by how beloved a product became. That necessitated further hard decisions. After giving up 95% of the balance sheet to pivot from commercial loans to retail banking products, Lomtadze decided to shutter Kaspi’s credit card product — yup, the same one that had just hit 1 million users — after it received a negative net promoter score. Again, this meant forgoing real money: the division recorded $400 million, a third of total revenue. Lomtadze later recounted the decision dispassionately:

People hated different fees attached to credit cards and that they could not repay the debt over time, due to its revolving nature. A negative NPS meant for us that credit cards did not fulfil our mission. We called it unhealthy earnings. It took us 48 hours to kill the product.

In making this shift, Kaspi proved its ability to not only make successful products but popular ones. This allowed for the compounding that marked the years that followed.

Step 6: Layer

Nearly twenty years after Kim founded Planet Electroniki, and seven after he partnered with Baring Vostok, Kaspi finally set forth on the path from which its current constellation can be cleanly traced.

Yes, it began as a business bank and became a consumer one. But neither formulation really bear a resemblance to the “ecosystem” Lomtadze went on to create.

It began with Kaspi rolling out a free online bill payment service. In a country in which most bills had to be settled at local bank branches which took a fee, Kaspi’s solution represented significant innovation. Notably, it reflected the company’s new priorities, leveraging a banking backend not to earn a profit, but to please customers. The product proved a hit, attracting a large, engaged userbase.

This was the key, according to Zandiyeh. As he describes it, one of the most effective playbooks for companies in emerging markets is to acquire customers as quickly as possible — sometimes at the sacrifice of immediate profitability — and once established, layer services on top. The company can then earn increasing revenue without additional customer acquisition cost. (We talked about this in the Rocket Internet piece, too.)

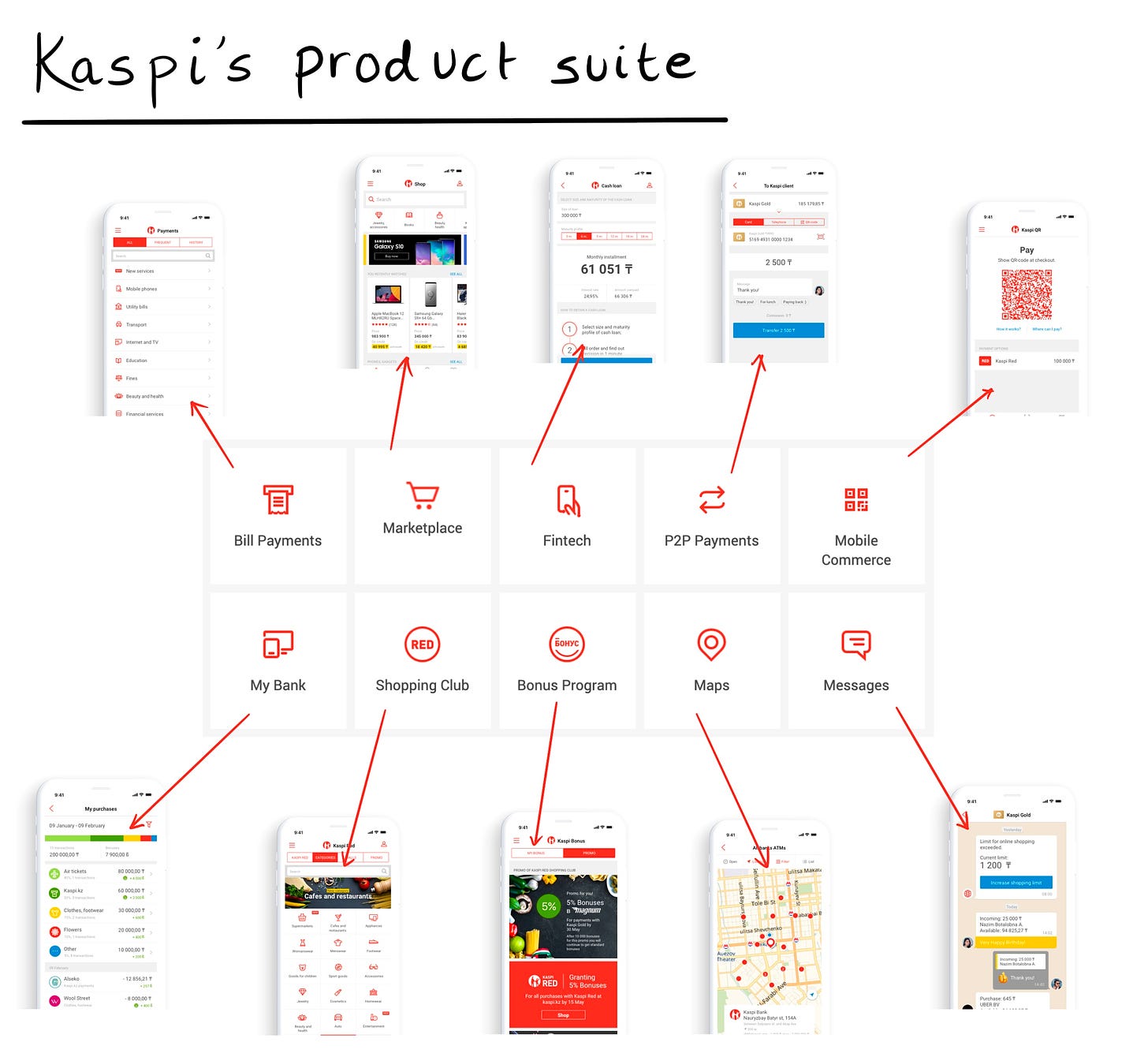

With online bill payment in place, Kaspi laminated on new products. In 2014, the company opened up an e-commerce platform, followed by consumer financial products, car loans (via a partnership), and in-home delivery. In 2017, Kaspi’s progress underwent yet another step-change thanks to the introduction of a mobile app, Kaspi.kz. That allowed Lomtadze to roll out a new wave of additions including maps, messaging, and P2P payments. In tandem with these consumer additions, Kaspi also built a suite of business products, making it easy for merchants to list their wares online and process payments.

After its period in the wilderness, Kaspi entered the millennium’s third decade as a multi-pronged, coherent super-app. After delaying its IPO by a year, Lomtadze delayed the company’s IPO in 2019 but received his reward the year following. In 2020, Kaspi listed on the London Stock Exchange, becoming Europe’s third-largest tech IPO.

Super-app: What is Kaspi, now?

If you want to push Mikhail Lomtadze’s buttons, call Kaspi a bank. Here’s a warning of the rejoinder you are likely to receive:

We are not a bank. Banks think in terms of the back office. We are at the front end of the relationship between the customer and our products and services. Are we a financial services company? Yes. Are we a payments company? Yes. Are we a marketplace and e-commerce company? Yes. But above all, we are a technology and a customer experience design company.

While Lomtadze’s rebuttal is useful, its power is mostly in its negation. We can agree about what Kaspi is not, but defining what it is, remains tricky. Yes, Kaspi is a “super-app,” but that in itself is not particularly decisive given the variety found within an umbrella term used to describe umbrella apps.

What do we mean in this context? How should we grasp Kaspi’s range of products?

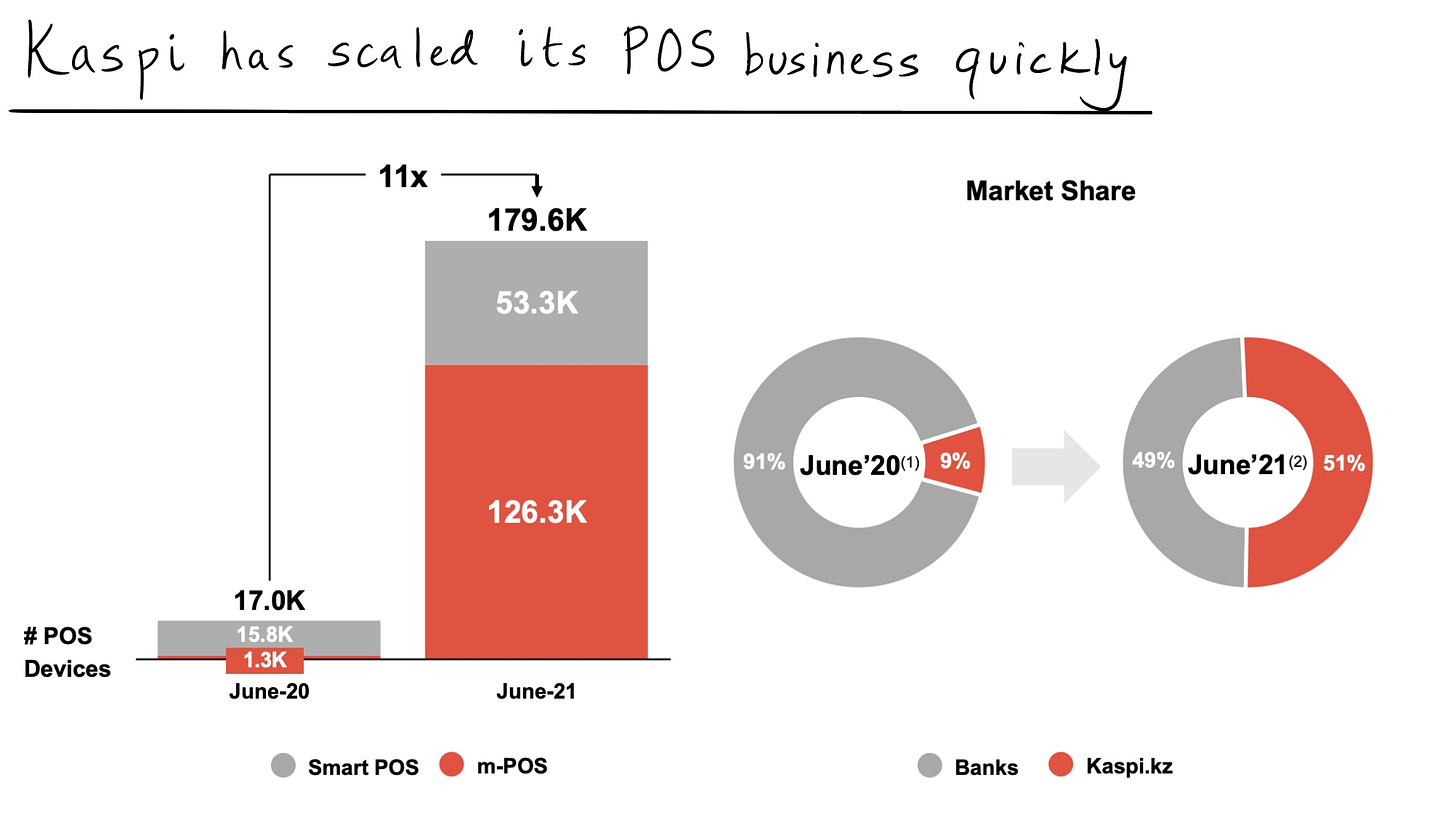

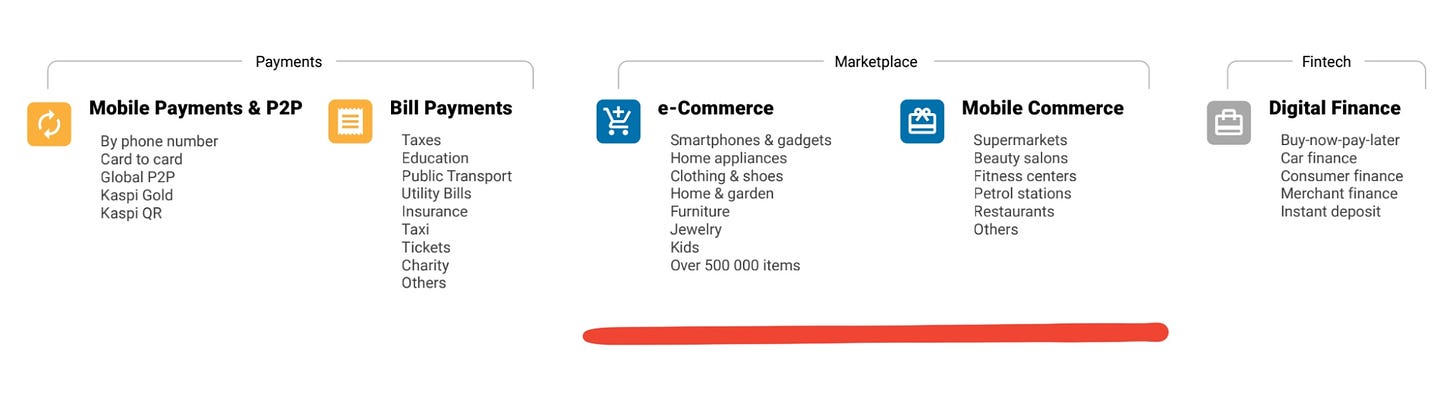

Kaspi is best understood as a business in triptych, part payments, part marketplace, part fintech. This is how the company defines itself, after all, and while each element feeds the other, they can be studied independently.

We’ll dig into each, outlining their size and relative importance to the business.

Payments

With a range of different offerings, “Payments” is Kaspi’s most mature unit. The most recent Annual Report calls out two subdivisions — "mobile payments" and "bill payments" — with 14 cascading products.

Here we see clear traces of Kaspi’s financial DNA and the hero product that set off its second wave: bill payment. It’s also notable how many of these features seem to unseat or intersect with governmental responsibilities including paying for public transport, education, and taxes.

It also tells you a little about how Kaspi thinks through product expansion. Like Amazon, Kaspi has made a virtue of turning its costs into revenue, recognizing that it needn’t shell out for payment processors and instead could build (and charge) for its own.

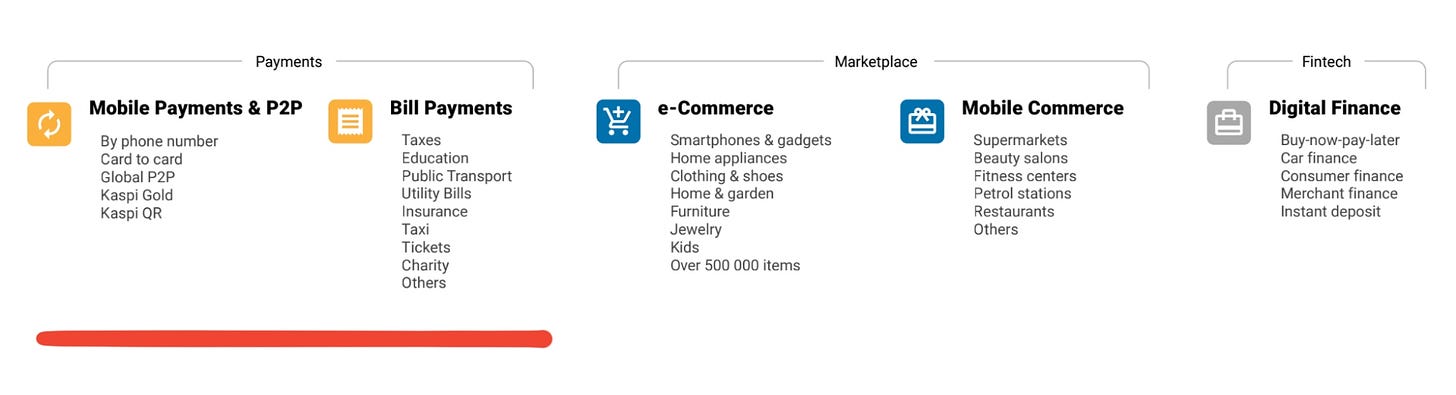

As suggested by the list above, Kaspi has succeeded in onboarding both consumers and merchants. Indeed, it has become the de facto point of sale (POS) solution in the country. It’s startling to see how fast Kaspi has secured the lead spot here: in June of 2020, the company had just 9% market share, with a total of 17K units deployed. A year later, Kaspi had 51% with 180,000 POS devices in the wild.

This is not the first time Lomtadze and co. have pulled off such a feat. In June of 2019, Kaspi had 2% of the P2P payments space, dominated by Visa and Mastercard. Twelve months later and it had vaulted to 66%. This is a team operating at the peak of its powers.

The POS blitz of 2020 was part of a larger narrative — the company’s most recent quarterly report notes that the number of merchants actively using Kaspi’s payments solutions has risen nearly 450% year over year (YoY) to 135,000. Active customers have risen just 34% in that time to 8.8 million. This makes sense given Kaspi’s strategy — as we noted, it has prioritized capturing a large customer base and then layering new services on top.

Payment volume has grown rapidly YoY, up 155% from the second quarter of 2020 (2Q20). In its most recent quarter, Kaspi reported reaching $28 billion in total payments processed, with a 1.2% take rate. The majority of volume came from P2P payments, totaling 77%.

Only a quarter of Kaspi’s payment volume is revenue-generating, emphasizing the firm’s desire to create more value than it captures. Still, revenue rose 92% and net income grew 121%, with the former hitting a $480 million run rate, and the latter at a $280 million run rate.

Marketplace

Kaspi’s “Marketplace” division encapsulates purchasing in both the digital and physical worlds. Traditional e-commerce is coupled with “m-commerce” or mobile commerce. This captures purchases made at brick-and-mortar stores via Kaspi’s app.

Already Kazakhstan’s largest online marketplace, Kaspi continues to grow this business unit impressively. Over the past year, the number of active merchants on the platform has increased 130% to just below 60,000, while the number of active customers reached 3.7 million, a jump of 35%.

Though smartphones and gadgets make up a third of the marketplace, the “home, garden, and furniture” category was fastest-growing, a reflection of a shift in habits wrought by the coronavirus, as well as a boon for Kaspi given the higher ticket prices. Tires and automobile accessories grew second fastest from a SKU count perspective.

Indicating its ability to extract greater value from its existing base, Kaspi’s GMV grew 253% during this period, with take rates growing too.

In total, this division increased revenue 343% YoY, reaching a revenue run rate of $320 million, and net income of $216 million, up 267%.

Fintech

Kaspi was an early innovator in consumer lending. The company’s secret sauce can be boiled down to two improvements: speed and segmentations.

Kaspi pays out loans fast, with the company’s “time to money” capped at 5 minutes. It also lends to a much larger portion of users thanks to its segmentation. While some banks treat customer applications as undifferentiated, Kaspi uses different criteria for different groupings. Some merit longer repayment periods, or lower interest rates, for example. This more bespoke approach was an early competitive advantage, though others have since caught up.

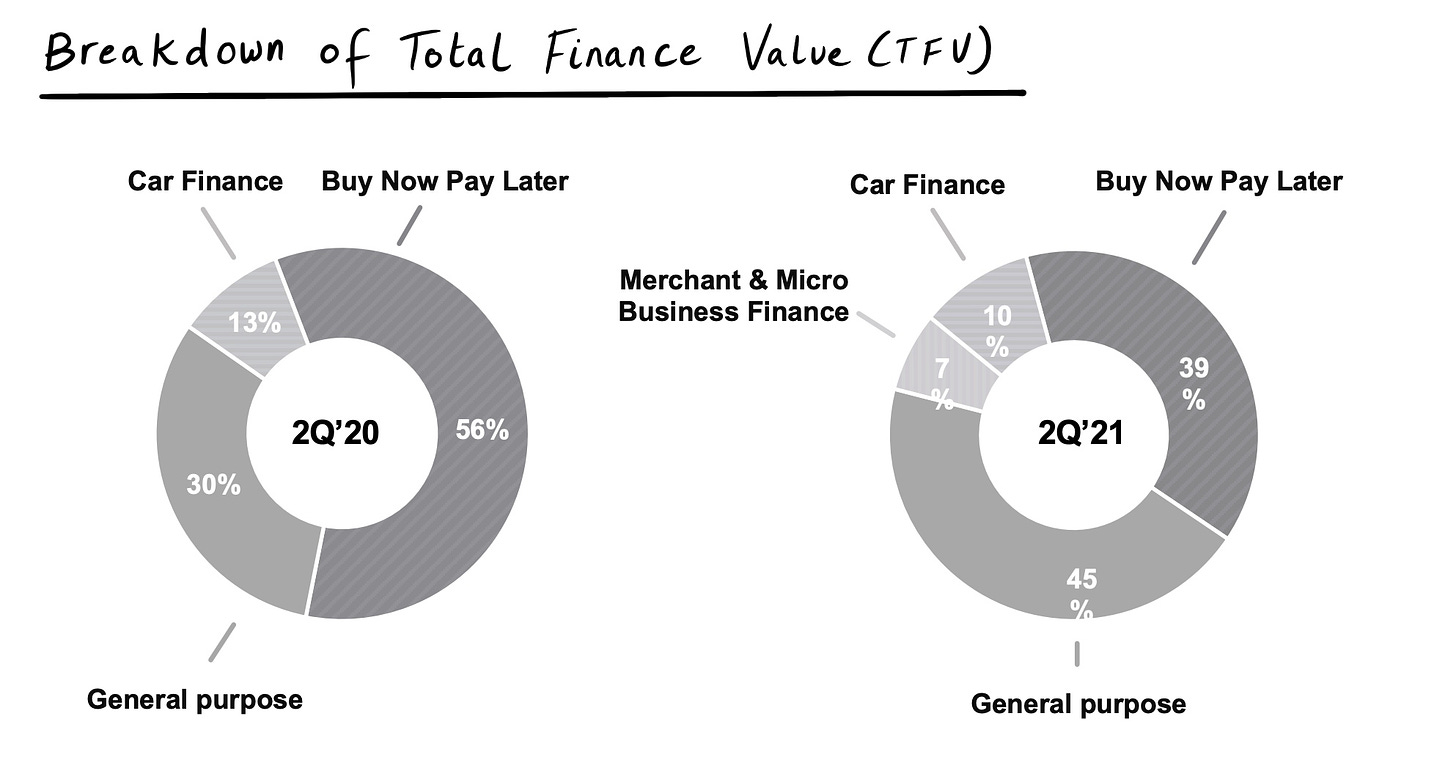

Consumer lending remains part of Kaspi’s fintech platform, along with B2B loans, and BNPL.

There’s something rather pleasing in reviewing this part of Kaspi’s business in that it illustrates a return to the origin. Kim bought Kaspiskiy to finance consumer purchases, Kaspi does exactly that albeit with a much more intuitive, accessible product.

Origination has increased rapidly YoY with total finance value (TFV) spiking 456% to $2.3 billion in 2Q21. The company’s conversion rate has actually increased in that time, while delinquency and loss rates seem to be dropping over time. The upshot is that Kaspi is increasing the amount it lends, converting more of its base, and yet losing less money. This is a sign of the company’s technological moat in action with data across its ecosystem informing financing.

Revenue from the fintech division reached a $1.2 billion run rate last quarter, an increase of 23%. Net income grew 37% to $440 million. That makes the segment the greatest contributor to Kaspi’s top and bottom line.

It’s easy to imagine how Kaspi might grow this function even further over time. As it stands, commercial loans make up just 7% of TFV, with car financing coming in at 10%.

Both could become significant business lines, without even contemplating untouched markets such as home financing.

Other

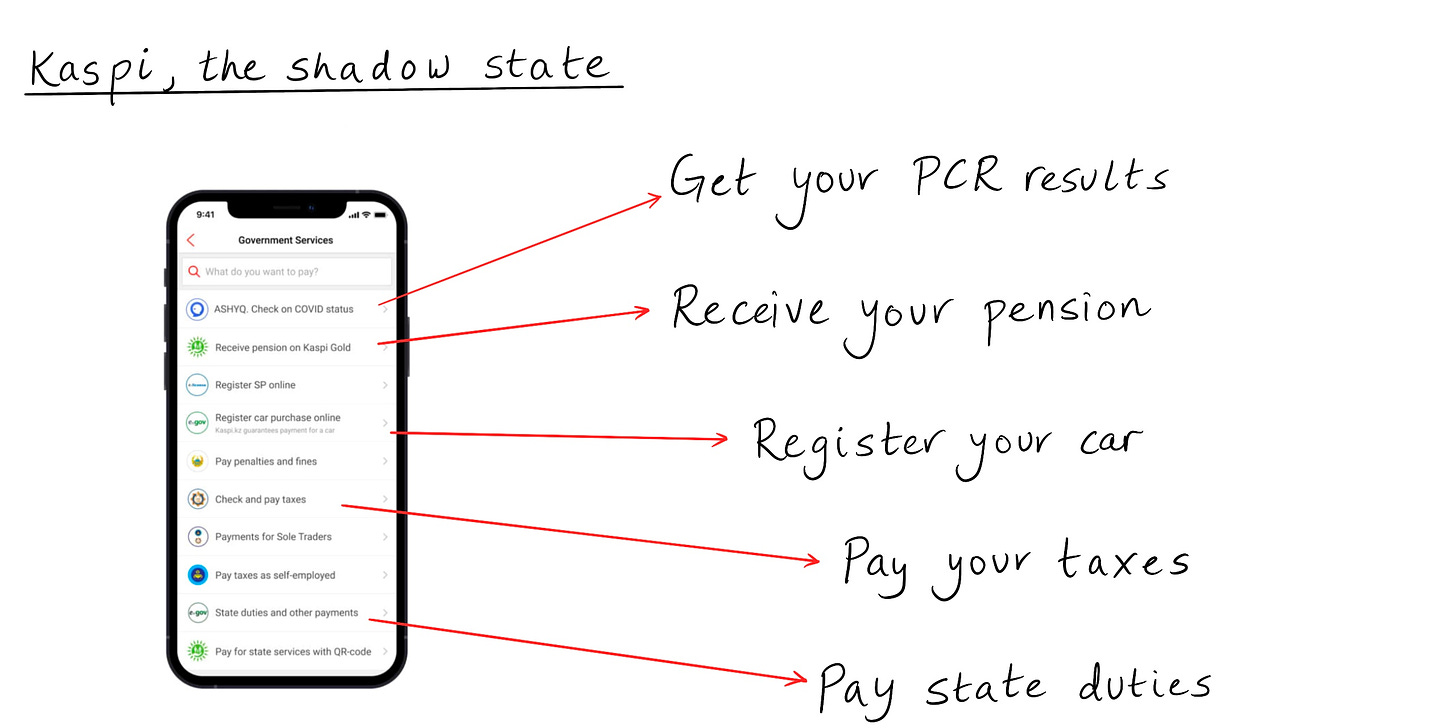

It is the space between neat divisions that often seems to make super-apps unique. As a company grows, it can viably serve an increasing number of edge cases, adding to its penumbra.

Kaspi is no exception. It has shown a particular appetite in fulfilling further governmental services, handling logistics, and offering travel booking.

It is genuinely wild to see how prominent a role Kaspi plays when it comes to the public sector. We’ve touched on this already, but looking at an app screen brings it to life.

Covid tracking. Pensions. Penalties. State services.

Can you imagine a similar interface in the US? The closest equivalent would be if you logged into Square’s Cash App and used it to submit your taxes, pay your latest parking ticket, and get the results of your PCR test. To Kazaks, Kaspi is so much more than just an app — it’s a national OS. It may even eclipse Tata’s primacy in India, which we previously covered.

In total, Kaspi recorded 3.4 million monthly active users (MAUs) for its governmental services, a 390% increase from the year prior.

More common is Kaspi’s logistics platform. Like Mercado Libre and Tokopedia, Kaspi has bolstered its e-commerce position by creating the means to deliver the products sold on-platform.

Kaspi takes the role of coordinator, connecting couriers across delivery routes to good effect. Delivery is free for 98% of customers, with 54% of items dropped off in less than two days. There’s room for improvement here, but there’s no doubt the company is leading the way.

Among Kaspi’s most recent innovations is its push into travel. Just as with POS and P2P, the new line has gotten the warp-drive treatment. Perhaps an indication of what’s to come, Kaspi entered the sector via acquisition, picking up Santufei, a Kazak player in the space. After completing that purchase in August of 2020, Kaspi succeeded in rolling out its new offering in December. By March, the company had sniped 20% of airline ticket market share, rising to 26% by June. In 2Q21, Kaspi sold 505,000 airline fares.

Train tickets launched the same month, with 55,000 bought in three weeks.

Though early days, there’s reason to think this could be a significant addition. As we mentioned when discussing Jumia, the African super-app, the integration of a travel product significantly increased average revenue per user (ARPU) given the basket size for plane tickets, hotels, and other related expenses.

Total usage

Much of Kaspi’s magic is in the interplay between the segments noted above. Super-app alchemy comes from turning episodic users of a single division into serial users of the full suite.

Already, Kaspi is doing well in this regard, but has room to run. The annual report noted that the ratio DAUs and MAUs had increased over the prior twelve months, reaching 54%, a jump from 33% the year prior. That compares favorably with other super-apps and pseudo-super-apps, with Kaspi outperforming Alipay, Allegro, Tinkoff, and others, on this metric. (Aside: look at the engagement on WeChat! Absolutely insane.)

This ratio improved over the succeeding two quarters, reaching 59%. While impressive, it also shows that Kaspi can still more effectively activate nearly half of its 10.2 million total users.

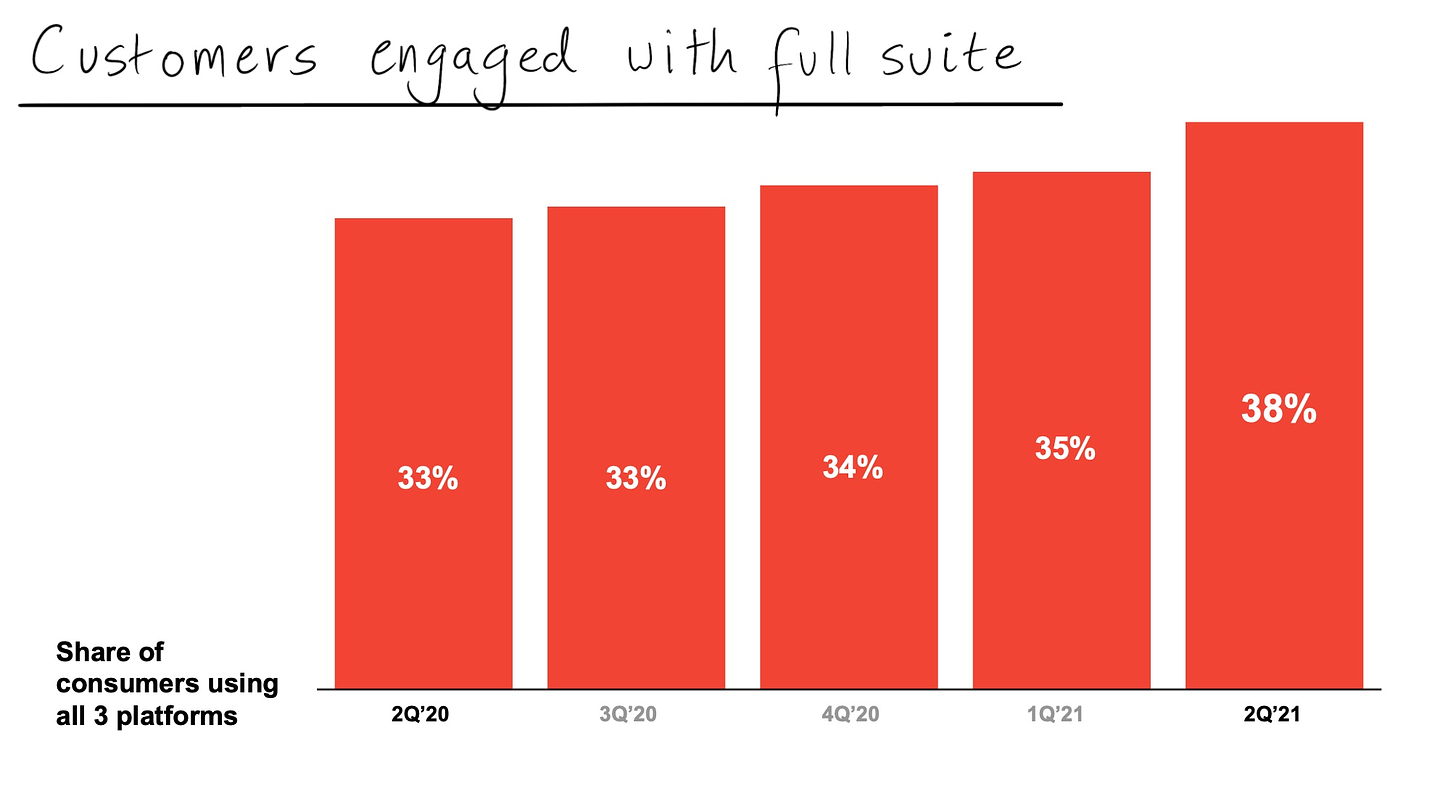

Another sign of Kaspi’s headroom is the siloed nature of its userbase. Just 38% of customers interact with the three core “Payments” “Marketplace,” and “Fintech” divisions.

While this can be viewed as a weakness — and the improvement over the last year is modest compared to many other numbers — it does illustrate the company’s whitespace.

Future: Transcontinental giant

After a long journey to its current state, it's tempting to look at Kaspi as finished, its end state reached. But Lomtadze has demonstrated a desire to constantly reinvent. That suggests in five years, Kaspi may look like a meaningfully different company than it does today. In particular, we can expect the business to expand its product offerings and broaden its horizons. To do so, it will have to navigate governmental risk and enhanced competition.

Opportunities

To maintain its growth, Kaspi will need to expand both functionally and geographically.

Already, we see the contours of this functional excursion with initiatives like Kaspi Travel. The company recognized the opportunity in the space and effectively layered a new service on top of its existing base. That playbook has served it well, and there’s no reason it cannot be continued.

To ponder where Kaspi might go, one only has to look at the suite of more mature super-apps like Tencent and Alibaba. Should Kaspi offer music streaming or gaming? What about ride-hailing or grocery delivery?

Recent developments may have opened the door to the latter two. Both services have been traditionally dominated by Yandex, the rival conglomerate based in Russia that Baring once invested in. A recent suit levied by a nearly-defunct Kazak company has paused its progress. G-Taxi claimed that Yandex’s operations in the country were in violation of its patent for an “automated taxi ordering system.” Surprisingly, The Economic Court of Almaty validated that claim.

This may give Kaspi a chance to pounce, although it seems unlikely given the company would need to beat out well-backed foreign players including Citymobil (owned by Mail.ru) and Didi Chuxing.

A better move might be for Kaspi to expand its portfolio of financial products. While Kazakhstan’s GDP has taken a hit in the last year, it is still a country with real wealth and a middle class that expanded rapidly during the first decades of the 2000s. Kaspi could leverage its position to build out a suite of investment tools to help this group more easily access the financial markets, such as stock trading.

While intriguing, Kaspi seems less keen on such a maneuver, and more intent on growing its geographic footprint. Indeed, Kaspi has noted that “international expansion is now a top priority.”

Starting in 2020, Kaspi began to build a presence in nearby Azerbaijan. The Central Asian country has about half the GDP per capita as Kazakhstan ($4,214 versus $9,055) and a smaller population (10 million to 18.5 million). That makes it seem like a kind of testing ground for broader ambitions.

At first blush, it appears to have been useful. Kaspi actually inverted its traditional approach in entering Azerbaijan: beginning with e-commerce, then adding fintech, rather than the other way around. It bolstered key categories such as automobile and real estate listings with acquisitions. That might be a script that can be followed going forward.

So, where should Kaspi expand next?

The company seems to want to focus on ex-Soviet states given the linguistic, cultural, and business similarities between them, and the weak competitive dynamics discussed earlier. Uzbekistan and Ukraine are clearly in the cross-hairs — Kaspi purchased an automobile classifieds player in the former and called out the latter in a recent quarterly report. In that document, leadership revealed it had bought a Ukrainian bank, Portmone Group. The acquisition gives Kaspi a Ukrainian payments license, as well as an established customer base. If approved by regulators, the deal will close in 4Q21.

In a few years’ time, calling Kaspi a Kazakhstani company may seem rather provincial. Rather, it seeks to be a true transcontinental giant, touching both Europe and Asia.

Risks

Part of the reason Kaspi is so set on growing internationally may be because it fears governmental benevolence has reached its limit. The president’s nephew, Kairat Satybaldy, is no longer involved with the company, meaning Kaspi has lost a layer of protection.

Could regulators curb its influence? The recent Yandex kerfuffle shows a willingness by the legal system to thwart tech giants, though it's notable that the target, in this case, is an interloper. Lashing out at a national darling winning global acclaim seems less likely. Nevertheless, Kaspi’s spread is a sensible derisking.

It may also be, in part, due to increased competitive pressure. Having watched Kaspi’s success, coevals have gotten their act together. Both Alfa-Bank and ForteBank have stepped up their game in recent years, undergoing digital transformations that would make Lomtadze proud (and perhaps concerned). Forte has been particularly aggressive in copying the Kaspi playbook, opening up e-commerce and travel arms to complement its financial business.

Can either challenge Kaspi’s supremacy? Both have a long way to go to catch Kaspi, though they may be able to grab a greater share of customers opening bank accounts for the first time.

Beyond Kazakhstan, Kaspi will fend off new threats. Moving into Ukraine represents a step closer to skirmishing with Yandex, while by dabbling in Uzbekistan, Kaspi will vie with Zood, operator of ZoodMarket and ZoodPay.

The latter’s offering reveals a chink in Kaspi’s armor — namely that its ecosystem is so closed off. For example, to use Kaspi’s BNPL service, a customer has to go through the Kaspi checkout. ZoodPay provides an alternative — allowing customers to leverage its BNPL outside of its ecosystem. Though focused on Uzbekistan, Zood does serve some Kazak customers.

Management will want to keep an eye on these developments, but for now, Kaspi can afford to focus on itself.

In 2012, a research fellow named Anthony McCaffey published a paper titled, “Innovation relies on the obscure: A key to overcoming the classic functional fixedness problem.”

In it, McCaffrey unpacked how that pesky cognitive bias might be avoided, or mitigated. Referencing Dunker’s study, he argued that the goal was to strip items into their “generic parts,” listing their functionality discrete from form. A wax candle, for example, might first be subdivided into wax and wick. Wick, in turn, might be generalized as string, then as strands of many strings. What could those be used for? To McCaffrey, this was the meat of creativity, “unconcealing” the features of an object.

Kaspi is a testament to the potential of this approach. Lesser executives might have seen Kaspi as a commercial bank, but in Lomtadze, the company found a CEO with the ability to look past form, avoid functional fixedness, and think of how a business’s constituent parts might be repurposed. In doing so, he enabled the creation of a truly unique business, both focused and flexible, a ferocious shapeshifter. It may not be done transforming.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.