Mullet Capitalists

To survive venture’s “extinction event,” emerging managers should adopt a new style

🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor, founder, and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Become a member today.

Friends,

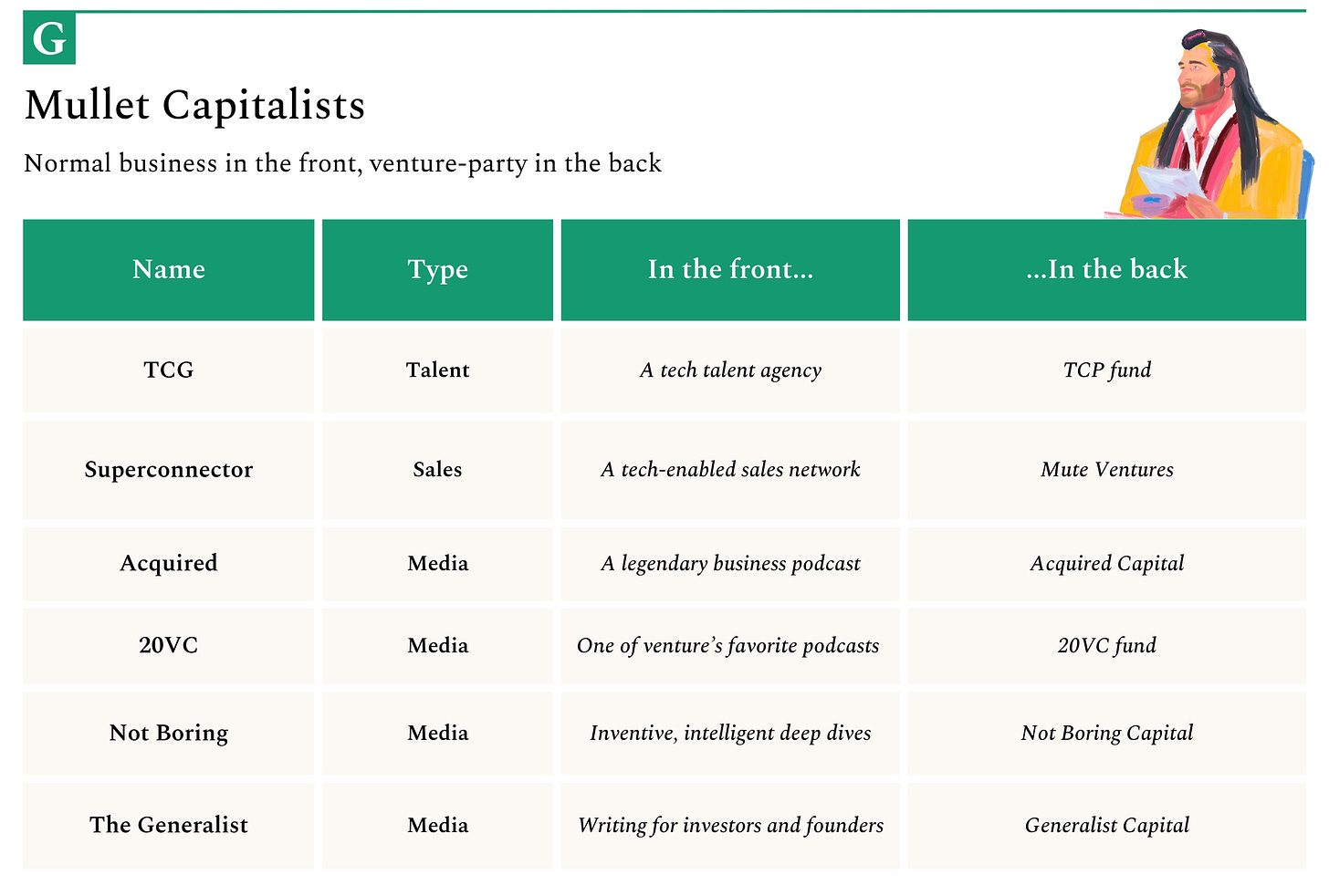

Today’s piece discusses a growing trend I’m seeing in the venture capital world: Mullet Capitalism.

Mullet Capitalists are a new wave of firms with a traditional “boring” business in the front and a venture bonanza in the back. They represent an intriguing rebundling of the VC product at a time when the broader asset class reckons with a potential “extinction event” that may cull more than 50% of managers.

Whether Mullet Capitalism outperforms classical emerging managers will take a decade or more to discover. But in the meantime, I think we’ll see many new versions of it crop up and subtly change the venture landscape. It also serves as a viable alternative model for insurgent managers to consider.

To unlock all of The Generalist’s tactical guides, expert interviews, and private startup databases, become a premium member. You’ll get exclusive access to the secrets and strategies of many of the world’s best investors and founders. Invest in yourself by clicking the button below.

P.S. - A very happy Thanksgiving to American readers! I hope you have a lovely, unvexing time with family and friends that doesn’t devolve into a series of political recriminations.

Simplify compliance + build customer trust: join Vanta’s live product demo

Whether you’re starting or scaling your company's security program, demonstrating top-notch security practices and establishing trust is more important than ever.

Vanta automates compliance for SOC 2, ISO 27001, HIPAA, and more, saving you time and money — while helping you build customer trust.

See it in action: join Vanta’s live product demo on December 5 at 10am PT to learn how Vanta automates the work for security and privacy frameworks and helps you move towards a state of continuous compliance.

Mullet Capitalists

If Earth could write her own history rather than depend on the unreliable memories and shoddy investigations of her higher primates, she would spend a chapter, at least, on the Chicxulub crater. She would spend a page on us – a page on the great apes and the Great Wall, on Hernan Cortés and Exxon Valdez, on the Pythagorean theorem and the balloon boy hoax, on cowrie shells and bit-coins, on the cross, the star, the crescent, the Om, on language and agriculture and mathematics and the Categorial Imperative – and she would spend a chapter on Chicxulub. Look at this! No one seems to ask but just look?

It is an indication of our anthropocentrism that the name Chicxulub means nothing to most of us. It sounds big and old and Mayan, which is true, but doesn't mean much. It is at this spot, 66 million years ago, that our planet was shot. An asteroid, nine miles wide, barreling at 27,000 miles an hour, collided with a chunk of land and water that would later (much, much later) come to be called the Yucatán Peninsula and appreciated by American tourists for its opal cenotes and favorable exchange rate.

It was a big deal, if you happened to be there. The Earth has taken worse blows (she still smarts from Vredefort Dome 2 billion years earlier), but none more destructive. Dust and ash blotted out the sun, froze the ground, acidified the oceans, and killed off an estimated 75% of plant and animal life. (Chuckling in their stream water, crocodyliforms thrived on detritus.)

Earlier this year, the venture community began to discuss its own “extinction event.” In August, Lux Capital’s Josh Wolfe published his firm’s Q2 LP Letter on X. Among other observations, Wolfe predicted that LP capital would consolidate into a smaller number of “prestige” venture firms, culling 30-50% of shops in the process. Roughly a week later, Rick Zullo of Equal Ventures suggested the death rate may be even higher. Though not on the order of acid rain and sunless impact winters, these bleak prognostications precipitated a cool sweat under the Loro Piana vicuña crewnecks of long-time managers and the sleek activewear of their younger rivals.

Emerging managers appeared most vulnerable in this assessment. In his blog post, Zullo cited spine-tingling data from Sapphire Partners’ Beezer Clarkson: historically, just 17% of fund founders reached their fourth fund. LPs’ preference for experienced stewards with established track records makes those odds even slimmer.

Alongside the destruction and debris, the Chicxulub asteroid created what is cheerily termed an “ecological opportunity.” To weather the new environment, now devoid of its major predators, species rapidly diversified. This process, known as “adaptive radiation,” resulted in the genesis of many of the Ur-mammals we know today.

Trump’s win may briefly thaw the bitter winter chasing emerging managers, but a new wave of adaptive radiation has already begun. Namely, the establishment of standalone businesses that use an advantaged position to create additional upside through venture investing. These are what I would call “Mullet Capitalists.” At the front rests a reliable, straightforward business; in the back, a party of risk and upside.

At first glance, Mullet Capitalists may sound like corporate venture capitalists (CVCs) or, perhaps, a celebrity-led venture practice.

Though it can have a flavor of both, it is a little different. For one thing, CVCs sit behind much larger businesses — small players in a much vaster constellation. They are less the roguish back of a mullet than a single kinked wisp among an otherwise straight mane. And though there are excellent managers of CVCs, they’re often not judged on economic terms but on how well their investments serve the mothership.

Celebrity funds also differ. Though someone with star power – say, Messi – has a natural advantage over a boring old normie, they do not usually run businesses that sell to startups or have direct contact with them. This proximity and engagement is a key part of the Mullet Capitalists equation. To better understand what Mullet Capitalists are (and are not), here are a few examples:

Recruiting firm in the front, venture in the back. You’re the founder of a recruiting firm specializing in tech. Startup CEOs pay you to identify candidates that will power their growth. In the course of your work, you naturally get to know a startup’s founders, how quickly they’re growing (you need to be able to convince talented candidates to take a call), and where their greatest needs lie. It becomes only natural to try to invest in the most promising opportunities you come across.

Outsourced sales in the front, venture in the back. You coordinate a network of sales development reps equipped to help startups acquire customers. In the process, you help solve a pressing problem for founders and get to see which products have the strongest market pull. You can directly quantify your ROI in a way that other investors can’t (and might be afraid of if they could).

Media in the front, venture in the back. You study technology and interview founders, earning revenue through subscriptions and sponsorships. Some of those sponsorships might involve deep collaborations with startups that allow you to get to know founders personally and understand the competitive dynamics of their space at a granular level. As with the previous examples, you demonstrate differentiated value and earn trust, laying the groundwork for a potential investment.

As you might have realized, several firms are already executing versions of these strategies. The Cannon Project (TCP) is a career agency that works with elite startups interested in recruiting outstanding college graduates. In addition to serving companies like Rippling, Airtable, Modern Treasury, Traba, and many others, TCP invests out of a $20 million venture fund.

Superconnector is an outsourced SDR network founded by Mute Ventures’ Chris Quinn. Initially, Quinn built Superconnector to supercharge his portfolio support before realizing its value as a standalone product. Superconnector recently raised a venture round of its own to serve more startups.

Acquired, Not Boring, and 20VC are all media businesses that cater to an audience of tech founders, operators, and investors. Each operates a venture arm as well. (The Generalist is another example here, though I’ll try to avoid talking about myself as the trend is most significant.)

You can imagine dozens of other flavors of this theme: dev shops, design agencies, copywriting firms, branding experts, strategic finance gurus, differentiated tax advisors, and customer support experts all have the ability to win a share of equity with the right approach. (If you’ve heard of interesting versions here, I’d love to know!)

This practice is not entirely new. Design agencies and recruiting firms have taken stakes in startups in the past, using their information and access to increase their upside. But these precursors have not typically raised standalone funds, nor made investing as large a part of their organization’s focus. Mullet Capitalists make venture a much bigger part of their masterplan rather than an occasional dalliance.

In an unfriendly LP environment, Mullet Capitalism may be one of the more promising pathways for emerging managers. It benefits from a a few distinct advantages versus an average new seed firm: