No Shame: The Rocket Internet Story

The German company-builder is shameless. That might be a good thing.

Few emotions are quite so human as shame.

Simultaneously teacher and tyrant, shame is a corrective personally felt but collectively constructed. More than guilt, which separates person and deed, shame excoriates the individual not for what they’ve done, but for who they are, relative to the norms of their local context. There is a reason we hate to feel ashamed — it is a sign of a most intimate failure and of total isolation. Your culture rejects you; go the way of Brutus; fall upon your sword.

If this implies the benefit of shame — societal coherence — it comes at a cost. What good ideas have been stifled by the fear of indignity? What progress have we missed out on because we were afraid we might look silly?

Enough inspirational mugs and throw pillows have asked us: what would you do if you knew you couldn’t fail? That construction misleads. We do not fear failure so much as the dishonor that arrives with particular manifestations. Fitted for the modern entrepreneur, the more useful question might be: what would you build if you felt no shame?

In Rocket Internet, we have the answer. Since its founding in 2007, no company has demonstrated both the risks and riches of operating with no shame. Decried as a soulless copycat and defended as a catalyst for innovation, the Berlin-based startup incubation firm has been frequently covered but rarely understood. That’s perhaps because one’s position on Rocket feels less about the nuances of the company, more about who you are and how you see the world. To have an opinion on the Samwer brothers' creation communicates a certain aesthetics of work, answering questions like:

Is there such a thing as a novel idea?

Is innovation a singular act, or a process?

Does business have a code of honor?

Is mimicry simple, sensible pragmatism, or somehow...wrong?

These are the inquests an investigation into Rocket precipitates. An observer of the company can easily waver one way or another in the course of research, swayed by the anomalousness of it. This is a business simultaneously visionary and uncreative in the extreme, both artistically bankrupt and operationally brilliant.

Though that befuddling concoction proved potent for a decade, Rocket’s future looks uncertain. After delisting in 2020, the Samwers’s brainchild seems set for a quiet retirement or reinvention. Only time will tell which proves the truer path.

In today’s briefing, we’ll explore:

The brothers’ origins

Oli’s manifesto

Rocket’s playbook

Managing like a Replicant

The Rocket Mafia(s)

A checkered legacy

Lasst uns beginnen.

Origins

The Samwer lineage

“One ought to go too far, in order to know how far one can go.”

Anyone that knows him might guess those words came from Rocket’s famously intense chief, Oliver Samwer. In fact, they’re the work of Noble Prize-winning novelist, Henrich Böll, a client of the Samwer brothers’ father. Samwer pater led a distinguished career as an attorney, serving as counsel to Karl Carstens, who later became the President of Germany. That was but the continuation of a dignified family history — Oliver’s great-grandfather was the founder and director of a company that would become The Gothaer Group, an insurance company with revenues surpassing €4.5 billion in 2020. Oliver’s great-great-grandfather was Germany’s foreign minister.

All to say that in 1970, Marc, the eldest of die Brüder, was born into an affluent, intellectually rigorous environment. Two years later, Oliver arrived, and a year after that, Alexander followed.

From an early age, the brothers shared an interest in entrepreneurship, but as a harbinger of things to come, they were less concerned with ideation. As Marc once explained, "Our problem was we wanted to be entrepreneurs first, then had to find an idea." For a time, they fantasized about building a low-cost airline, considering Richard Branson and Ryanair founder Michael O’Leary among their idols. That idea wouldn’t stick, but the intense interest in business building was stoked in successive years.

That was particularly true of Oliver. He matriculated to WHU’s Otto Beisheim School of Management in 1994, and visited Silicon Valley the next year. That proved an eye-opening introduction to the world of entrepreneurship. Oliver followed suit with his own experiment, though of a decidedly less technical variety. In 1995, he founded “Ego International Trading,” a maker of shoes based in Bolivia. While that provided a crash course in scrappy operating, Oliver’s true education would come back at WHU in the form of a groundbreaking thesis.

The Samwer Manifesto

“America’s Most Successful Startups” is a remarkable document. Published by Oli and classmate Max Finger in September 1998, it is a distillation of the duo’s concerted study of US innovation, with particular emphasis on the tech sector. It is a terse, hortative text that outlines how companies can and should be built.

Samwer and Finger’s authoritative tone is mostly earned. The pair interviewed nearly 100 tech and venture luminaries including legends like Dick Kramlich and Mitch Kapor. What’s most exciting about the thesis though, is less the names rounded up or even the perspicacity it shows. Super angels and remote work are discussed. And long before it became accepted wisdom, the authors articulate the importance of customer interviews, the prioritization of execution over ideation, and the need to cut underperformers quickly. This is the Ur-“move fast and break things,” the proto-Lean Startup.

This hints at what is really striking about the work: it is an almost perfect playbook for the business Samwer would build close to a decade later. Among other things, the authors extoll the virtues of under-competed markets, emphasize the preference for aggressive execution, note the need to change company management at scale, and express a disregard for ideas.

On untapped markets:

You have to look at your chances of succeeding not based just on what you are doing, but on the competitive environment. You just cannot assume that you are going to be better than the other 19 companies. Because you are not necessarily always smarter, or better financed or more experienced. Just take Electronic Commerce for instance, everybody is doing Electronic Commerce, it must be literally a thousand companies, though you know that only 20 or 30 are ever going to make any money. You really need a pretty free field initially, that does not have a lot of competition.

On execution:

We should be very aggressive when it comes to marketing and product development. We should go right up to the edge and maybe you even fall over. But in terms of integrity we do not even go up to the edge. People can say they do not like where you went to school, or the way you look, but the one thing they can never take away from us is our integrity.

Elsewhere, the authors note, “You must be paranoid. Only the paranoid survive.”

On changing management:

Companies in Silicon Valley shoot for very rapid growth, usually doubling in size every year for at least five or six years. What you are talking about is going from 20 to 40 to 80 to 160 to 320 employees in a five year period of time. Ordinarily somebody who has never run a company with 500 employees reaches his or her limitation in that kind of time frame. So what the founders do is they cash out, exit and start another one. That one they can then maybe grow to a 1000 employees and then they cash out, and exit, and start another one again.

On ideas:

There are lots of ideas. The hard part is really executing on the ideas. Execution is taking the idea from an idea form and actually turning it into an executable plan that you are working against. Taking it to the point where it is meaningful, where people can see it, smell it, taste it, hold it. That is where many people fail. Many entrepreneurs have said, that the idea is only 10%, the rest is execution. The execution is actually making it happen.

The authors write, with classic Samwer bluntness, “Do not treat your idea like it is a gift from god, actually chances are that it is stupid.”

It requires no creativity to see the document’s impact on Rocket: a machine that capitalized on open markets, won through aggression, treated talent as interchangeable, and cared little for novelty.

There are differences, too, of course.

“America’s Most Successful Startups” suggests the best entrepreneurs are “people who have finished products,” usually between 30 and 40 years old; Rocket scaled by relying on young, eager ex-consultants. Among the key cultural values for a successful business, Samwer and Finger highlight “Respect” and “Integrity” as paramount — Rocket’s success here is questionable.

And, of course, one cannot help but find great irony in the author’s strident instruction for startups to protect their IP, or declamations like “Being an entrepreneur is not being a follower.” Or this passage, so prescient it hurts:

Do not burn bridges, do not steal ideas, do not use the resources of another company, and quit your job before you start working on the new thing. Otherwise you will cause problems for years down the road.

Alando

The allegation leveled most frequently against the Samwers is that they are makers of knockoffs. Rather than coming up with an idea of their own, they’re accused of stealing, profiting from the ingenuity of others.

Exhibit A: Alando.

In 1999, the Samwers teamed up with Oli’s co-author Max Finger to create “eBay for Germany.” The result was Alando, an online auction site that requires only a cursory glance to assess. In form and function, it is a direct, shameless rip-off.

If the Samwers’ had had their way, they never would have built it. As they later recounted, before founding Alando, they first emailed eBay, outlining the opportunity in Germany, and asking to run the company’s local division. When they received no response, they emphasized the viability of their idea another way. As Oli noted, “We took it into our own hands and didn't wait for the market to be founded."

To get the business started, the Samwers auctioned some of their childhood toys, including a train set, roller skates, and antique coins.

Alando took off, eBay took notice, and after just 100 days, the US firm bought the German startup for $43 million. Oli Samwer would later call it, “the biggest mistake of my career.” (May we all experience such blunders.)

The Samwers had their first big win.

Jamba

If you believe our souls are weighed after death, benevolence set against sin, the Samwers will need to defend their work at Jamba. In particular, the must answer for unleashing one of the most irritating songs on the world.

Archangel Michael: So...you sold ringtones?

Oli Samwer: Ja.

Archangel Michael: Ok. Not a great start, but I’m keeping an open mind. Let’s keep going. What kind of ringtones? Were they nice to listen to? You know, maybe a little Chopin Nocturne? Did you have Chopin?

Oli Samwer: No Chopin.

Archangel Michael: Hmmm. Bummer. OK. Well, forget about Chopin. What was the point of selling ringtones? Did you want to bring beautiful music into the world? To make even the most prosaic of moments come alive with melody? To punctuate everyday mundanity with a kind of spiritual joy, a reminder that no matter how bad things are, they can get better and that someone, something bigger than ourselves is looking out for us, providing a light amidst the darkness? Was that it, Oli? That was it, right?

Oli Samwer: No. We make our ringtones to be maximum annoying and we use a confusing subscription model, impossible to cancel.

Archangel Michael: Jesus, man! (*Waves away Jesus manifesting on a neighboring cirrus* — “sorry, yup, my bad. Old habits. I’ll stop saying it.”) Dang, Oli. Why did you do that? Did you know it was annoying people? You didn’t, right? You didn’t know, did you? I bet they weren’t all so bad. There had to be some nice ringtones in there. I bet there were some great ones! Right? What was the most popular one, Oli?

Oli Samwer: Crazy Frog.

Archangel Michael: ...

Oli Samwer: It made $400 million.

*Trap door in the clouds open*

Like Southern Europe’s sirocco, a wind that drives inhabitants mad with its heat, the Crazy Frog swept across the continent in 2004. It soon reached America, and it wasn’t long before almost every phone-carrying person in the world had been subjected to the fever dream of a spluttering, self-confident amphibian scratching through a melody that once heard, was impossible to forget. Even the phrase “Crazy Frog” may have sparked a “bing-badda-bing-bing-bing” in your head and for that, I apologize.

The Samwers won’t have minded much. Boosted by TV ads — a playbook to which they would return — Jamba grew quickly and secured another fast sale, this time to Verisign for $273 million.

It is a testament to the drive of the brothers that what followed dwarfed these successes. With more than $300 million returned, others might have chosen to do their time at the acquiring company, then sail off into decadent retirement. Instead, after leaving Verisign, the Samwers opened the doors on their biggest endeavor to date: Rocket Internet.

What is Rocket?

Like all fluid conglomerates (see: IAC and Constellation), trying to describe Rocket is, in some respects, an exercise in futility. Since its launch in 2007, the business has incubated hundreds of companies on almost every continent. It has relied on different strategies and playbooks and founders and investors.

In speaking with a dozen sources, I was struck by the different experiences employees had, depending on the country in which they operated and the timing of their involvement. Building a German e-commerce business in 2008, for example, is very different from founding an Iranian ride-hailing app in 2015. (These are illustrative examples, as many sources wished to remain anonymous.) Not only had the world changed, but as a consequence, so had Rocket’s approach to incubation.

Thankfully, there is some uniformity in Rocket’s approach. That doesn’t mean its product doesn’t require a multi-faceted reading. While we could refer to Rocket’s work as “incubation” and call it a day, we’d miss out on what the company unlocks with its approach. In particular, I think Rocket is best understood through three lenses:

As “inverted venture capital”

As an idea exporter

As a reallocator of founding risk

All three are connected but nevertheless offer different vantages.

“Inverted VC”

Rocket shares the same business model as venture capital firms — taking ownership positions in startups whose value they hope will appreciate — but this is where the similarities begin and end. For most of its life, Rocket operated antipodally to traditional private financiers, explaining why former founder Marek Zmyslowski refers to the model as “inverted VC.”

Rather than searching for founders already working on an idea, Rocket flips the process, deciding upon a fruitful idea internally, then staffing operators to execute. It operates, in this way, more like a consulting firm, assigning employees to a project. This is a profound change. Traditional VC is reactive, dependent on the deals a firm gains exposure to. Rocket’s methodology is proactive.

Rocket was also much more hands-on than a traditional VC. Because founders are essentially employees, they only partially set the direction of the business — major decisions come from above. Again, this is a departure from traditional VC, with firms typically providing passive capital and competing to be as “founder-friendly” as possible. As we’ll discuss in “Playbook,” Rocket provided a shared platform for its companies that assisted with marketing, IT, recruitment, and fundraising.

It’s worth mentioning at this point that Rocket also operates as a typical VC through subsidiaries. First, the Samwers operated European Founder Fund (EFF), a firm that was replaced by Global Founders Capital (GFC) in 2013. Last year, Rocket rolled out Flash Ventures, a pre-seed fund.

Though newer parts of the Rocket empire, and less relevant to its traditional playbook, these new vehicles could play a large role in the firm’s future.

Exporter of Ideas

The second way Rocket’s product can be understood is as an exporter of ideas. Especially in its early days, the company monitored the US and European markets for promising concept, then replicated them in new geographies.

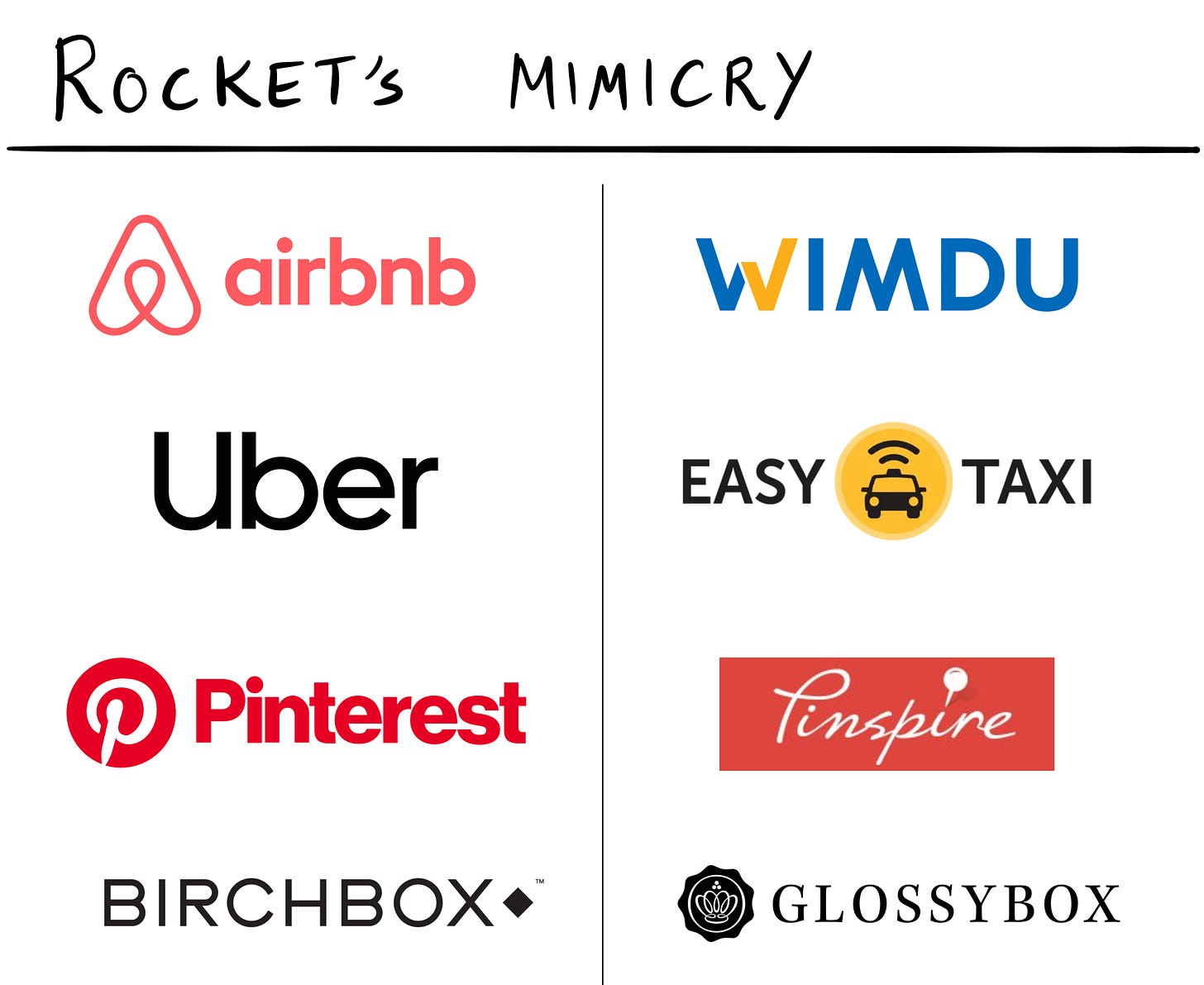

Just as Alando was a German copy of eBay, Zalando was a European facsimile of Zappos. While e-commerce was a particularly frequent source of inspiration, Rocket imitated models in home-sharing, ride-hailing, social media, and beyond.

(We’ll assess this approach in greater depth later.)

To begin with, Rocket focused on Europe. In the 2000s, the venture market was still incipient. That gave the Samwers the “free run” they favored. Over time, their ambition broadened to include Latin America, SEA, Africa, and MENA. This was partially a response to increased competition in Europe, as well as the recognition of the opportunity these markets posed. For their flaws, the Samwers were early to realize that the internet was a global catalyst and that Western models, if correctly tweaked, could prosper in frontier markets. Though uncreative elsewhere, Rocket’s approach was visionary in this regard.

Risk redistributor

For a startup to succeed, it must navigate many types of risk.

In a seminal essay, Marc Andreessen states that “The only thing that matters is getting to product/market fit.” The implied corollary is that a startup’s greatest risk is failing to find this fit.

Written the same year as Rocket was founded, it’s unclear whether the Samwers read the piece in formulating the business. Regardless, the incubator was specifically architected to reduce this risk — at a cost.

By copying models that had worked elsewhere, Rocket reduced the chances their products wouldn’t find sufficient demand. However, by relocating these products to new regions, they did take on market risk. Not all ideas are easily translated from one geography to another.

Rocket’s model incurred two other atypical types of risk: managerial and reputational.

Because Rocket copied ideas and relentlessly rolled them out at an extremely fast cadence, the firm required a large volume of “founder” talent. Rocket’s modus operandi of taking a majority share in the businesses it incubated made this search trickier. To solve the problem, Rocket effectively took on managerial risk, hiring young consultants with little to no entrepreneurial experience. The firm bet it could provide sufficient resources and training that would allow less competent founders to succeed.

Finally, Rocket’s approach brought reputational risk, the consequences of which the firm is still battling. While those outside the US tend to have a more favorable view of the incubator, the “copycat” moniker has stuck, leading to negative sentiment. (As we’ll discuss later, this has been exacerbated by Oli Samwer’s irascible management style and the company’s grim culture.) This impacts recruiting (both for founders and beyond), and according to some sources, has made it harder for GFC and Flash to win deals.

Different models

As an early Rocket founder tells it, Oli Samwer liked to conduct his interviews from the lobby of a swanky Munich hotel. On days when the Rocket founder was there, the place would fill with potential hires, large in number though light on variety.

As the founder noted, Rocket liked to hire “perfect substitutes” that even looked the same. The typical profile was a young business school graduate, fresh off of a two-year stint at McKinsey. Looking for greater responsibility, these “insecure overachievers” flocked to Rocket, enticed by the chance to have a project of their own and be a “founder.” (This title bloat was a common Rocket tactic — employees were encouraged to give themselves senior sounding positions, often out of kilter with the reality of their work. One source told the story of an intern being branded a portfolio company’s “Head of Marketing.”)

Recruiting this sort of individual was vital to Rocket’s model. Who else would go through the stressful lottery of startup building in exchange for just a few percentage points of equity?

In exchange for a viable idea and funding, Rocket traditionally took 80-90% of the business, with the remainder split among multiple founders.

As with other investors, Rocket’s returns came from these companies appreciating and exiting. Over the course of its life, Rocket seemed to move through two distinct approaches to achieving this outcome. We’ll discuss them both.

Phase 1: Fast flips

Perhaps influenced by their rapid sale to eBay, much of Rocket’s early work seemed to be focused on securing quick wins.

While Rocket always prioritized growth over profitability (like most in tech), this was especially acute at the outset, a period during which which the firm seemed to have little interest in creating enduring businesses.

The best example of this is CityDeal. Founded in 2009, the Groupon clone grew rapidly, scaling to 80 European cities. According to those with knowledge of the two companies, CityDeal appeared to be executing better than Groupon at the time, which prompted the American firm to acquire the Rocket spin-off for ~$100 million a year later. The reality was that CityDeal was burning cash, miles away from being a sustainable business. Though the Samwers took over a good portion of Groupon’s operations, in the end, the company had to close many of the markets CityDeal had “won.”

Rocket tried a similar approach with Wimdu, an Airbnb clone. However, as one entrepreneur with insight into the process noted, the Airbnb team was put off by the Rocket ethos, instead choosing to pick up Accoleo, another European player.

Even companies that eschewed acquisition and reached the public markets show signs of this frantic approach. An investor with knowledge of Jumia noted that the African e-commerce company required a complete overhaul after its IPO. Executives noted that the business had been constructed to grow rapidly with little thought toward durability. After accounting issues came to the fore, a rebuild was set in motion.

Phase 2: Building to last?

Over time, Rocket seemed to move toward a more sustainable approach, though it’s tricky to disambiguate between strategy and circumstance.

If the Samwers did make a concerted change, it was perhaps partly motivated by a common criticism of the brothers: they exit too fast. Just as Oli considers the sale of Alando to eBay as a “mistake,” others have suggested that some of the quick wins noted above cut winners short.

Rocket will be glad they did not flip businesses like Zalando and HelloFresh. Both firms have reached the public markets and achieved profitability with Zalando boasting a market cap of €26.35 billion and HelloFresh pegged at €14.31 billion.

Those figures far eclipse the size of outcomes achieved by the businesses they imitated: Amazon acquired Zappos for $1 billion, while Swedish firm Linas Matkasse — the inspiration for HelloFresh — remains private at a much lower valuation. BlueApron, an American mealkit contemporary, limps in the NYSE at a sub-$100 million market cap.

The playbook

“It’s as if McKinsey competed in the porn industry.”

That’s reportedly how Oliver Samwer described Rocket’s goals in the fashion industry to one of the firm’s early founders. The point he sought to make was that Rocket could win by out-analyzing its competitors. Industries like fashion were dominated by artists, not business people. As the internet altered buying habits, Rocket thought dedicated insurgents could steal share.

This anecdote gets to the heart of Rocket’s playbook: great companies are built analytically, systematically, from the top-down. One of the company’s mythologies is that its process was so finely tuned it launched businesses within 100 days. Whether this is true or not — sources I spoke to noted varying degrees of structure and speed — Rocket does have a paradigmatic playbook. At its best, it looks something like this:

Step 1: Identify an opportunity to amass market share

Step 2: Set up competing teams

Step 3: Out capitalize competitors

Step 4: Set clear KPIs and monitor closely

Step 5: Reduce cost and operational burden through shared services

Step 6: Consolidate

Let’s walk through it.

Step 1: Analytically identify opportunities

Rocket does not always copy and paste. Often, it’s incubations are the product of considerable research.

One investor recounted a trip he took with Rocket’s team in an emerging market.

As he described it, the primary mission for the Rocket employees was to analyze the local market to determine which model would allow the firm to amass the largest possible customer base, regardless of the cost. That could be ride-hailing, e-commerce, food delivery, or something else. The assessment is made based on deep research, as well as on-the-ground visits like the episode mentioned. The idea is that once a customer base has been acquired, different services can be layered on top.

You can see this approach play out with a business like Snapp. What began as an Iranian ride-hailing company has grown into a multi-pronged offering that includes food delivery, grocery delivery, and ticketing.

Step 2: Staff competing teams

Once an approach is settled on, Rocket staffs multiple teams to attack it. This creates competition on both sectoral and national lines.

For example, Southeast Asian e-commerce business Lazada was not only active in Indonesia but in Vietnam and Malaysia, too. Though part of the same parent business, each entity was staffed with “founders” given the latitude to run their business as they saw fit.

These units rarely collaborated; rather management pitted them against each other. As the founder of a Rocket subsidiary noted, “We all wanted to be the best country.”

Sometimes competition plays out nationally. For example, Rocket may spin up different businesses within the same country, as they did in Nigeria. The firm staffed a ride-hailing app, an ecommerce platform, and a travel booking platform, among other initiatives. Though perhaps less explicit, these businesses are also in a kind of competition, often compared to each other. As discussed in a moment, “winning” can impact the trajectory of competing businesses.

Step 3: Overcapitalize

With a team in place, Rocket looks to use its financial might to gain share, fast.

Again, the Berlin firm took this approach with Snapp. According to one investor, Rocket deployed over $200 million to grow the business, almost four times the capital collected by the company’s competitors. That proved a savvy move, ensuring Snapp secured the dominant position.

Of course, this approach has its downsides. Rocket is often profligate, squandering cash on unviable businesses. As the founder of one Rocket business in the food space noted:

We burned huge amounts of cash for close to zero return. It was insane to build a company that wasn’t e-commerce like this.

Marek Zmyslowski, founder of travel company Jovago, summarized Rocket’s approach to financing succinctly: “If it’s only a matter of time, then it’s just a matter of fundraising.” If the Samwers believe there is a market to be won, they will spend to make sure they do so.

Step 4: Set clear KPIs and track closely

Teams are expected to put that money to work immediately to hit ambitious KPIs. Some founders I spoke to had no recollection of a structured process here, while others described a nuanced set of steps.

One e-commerce entrepreneur talked about how at first Rocket provided benchmarks regarding the number of merchants on the platform. Then, once targets had been attained, the KPI switched to the number of orders. Once those metrics had been hit, the team was told to focus on growing basket size. (Zmyslowski noted that in the travel industry GMV was the critical metric — the “holy grail” was to achieve 20% month-over-month growth.)

These structured processes turned the abstract, amorphous task of a company building into discrete chunks, particularly valuable for first-time founders.

Metrics were communicated to HQ frequently, usually once a week. Every month, Oli Samwer hosts a conference call (which at one juncture lasted 20-hours) in which company leaders share progress.

Step 5: Provide shared services

Part of the sell Rocket made to public market investors is that its approach benefits fromunique synergies. By centralizing key functions like IT and marketing, Rocket believed it operated at a lower cost, and by sharing lessons across the portfolio, the firm contended it was able to improve performance.

This was somewhat borne out in discussions with former founders and operators. In addition to taking care of fundraising — either by deploying capital itself or looping in long-time associates like Scandinavian firm Kinnevik — Rocket provided IT systems and online marketing expertise.

These IT solutions were something of a mixed blessing. Managed by an office in Portugal (at least partially), IT was out of touch with the realities of the local market. Additionally, because the team was run with the same ruthlessness as the rest of Rocket turnover was high. The end result was a rather decrepit tech stack staffed by disgruntled outsiders.

That was sufficient for e-commerce businesses, but this weakness partially explains Rocket’s failure to win in product-heavy categories like social media. Of course, Shopify and its contemporaries entirely eroded this advantage in e-commerce, providing better tooling.

Marketing was a less complicated advantage. Rocket’s team was early to cracking internet advertising and successfully leveraged the playbook across businesses. They were reportedly exceptionally good at SEO and SEM, less so social media. This was aided by a shadowy network of blogs that pumped out content on companies’ behalf.

TV ads were another strength. One German founder recalled how Oli Samwer struck a sweetheart deal with the CEO of popular channel P7S1. Rather than pay for commercial time, Samwer persuaded the executive to give Rocket companies exposure in exchange for small amounts of equity.

This was apparently key to Zalando in the early days, giving the e-commerce store a brand awareness it could never have afforded.

Beyond these standard services, Rocket also provided training to employees. David Lobo, once employed by Mexican company Linio, described how he was given a one-month crash course in Spanish to get up to speed. Rocket also seems to have provided ongoing training in other areas. As with the services above, the goal is to provide an operational edge.

Step 6: Consolidate

Since Rocket has outsized ownership, it is able to reorganize its holdings without the permission of the founders. That often means combining smaller companies or allowing one of its “winners” to absorb secondary players.

For example, Rocket consolidated apparel companies Zalora, Zalia, Dafiti, Locale, Aere, and nearly a dozen others into the “Global Fashion Group.” It’s unclear whether this was a savvy move — one founder with knowledge of the situation mentioned it had increased overhead while diminishing the brand equity of the component parts — but it’s a playbook Rocket has employed with relative frequency.

Zmyslowski recalled how his business Jovago was absorbed by Jumia. In short order, he went from the founder of a business to the head of a division. Though ruthless, the maneuver seemed to have served Jumia, adding an attractive business line with higher average order prices.

Bruising culture

So much of Oli Samwer’s thesis was devoted to the culture it takes to build a great business; the author appears to have heeded almost none of it. Perhaps it was Samwer’s colleague Max Finger who wrote the section that outlined the need for “respect,” “integrity,” and an “egoless culture,” because on those dimensions, Rocket failed.

Though many founders I spoke to seemed to have enjoyed some of their time at the incubator, it was clearly a bruising place to work. Few stayed very long.

More than anything else that’s the consequence of the man, the ego, at the center of the operation, along with the values he imbued.

Oli Samwer

If you’ve heard anything about Oli Samwer’s intensity, it is probably the “blitzkrieg story.” In 2011, an email from the Rocket founder to employees leaked to the press. The strange machismo of the diatribe is well-summarized by these lines:

[T]here are only 3 areas in ecommerce to build billion dollar business: amazon, zappos and furniture. the only thing is that the time for the blitzkrieg must be chosen wisely, so each country tells me with blood when it is time. i am ready – anytime!

This is followed by another exhortation to “sign with blood,” a manipulation about not disappointing your grandchildren by failing to build the next Zappos, and this sign off, the Oli Samwer calling card: “I am the most aggressive guy on internet on the planet. I will die to win and i expect the same from you!”

That communique is in line with the rest of the middle-Samwer’s weltanschauung: business is a battle won with blood. Do what it takes to win, no matter the cost or consequence.

It also reveals an ironically critical aspect of the Samwer managerial style: shame. Though much of Rocket’s strength comes from its willingness to endure societal castigation, Samwer frequently manipulates situations to embarrass employees.

One founder recalled a meeting of Rocket’s founders in London. Over the course of a couple of days, Samwer called out teams he believed had created subpar TV commercials. Bringing them up on stage, he would play the spot and pick it apart. Executives were ridiculed in front of peers — “How do you come up with this kind of shit?”

Another founder remembered an Oli reflex. In meetings with him, he’d pepper founders with questions about their company’s numbers until they couldn’t answer. The exercise seemed to be less about the figures themselves and more about driving founders to a point of failure, keeping them off balance.

Distinct from other business ball-busting, there is little levity to Samwer’s methods. “I don’t recall ever seeing him smile. Or making a joke,” a source remarked.

Yet, many founders enjoyed his presence. “It’s fun to work with him,” one ex-employee noted. Another said they hoped they would collaborate with him in the future.

This is because, for his foibles, there is something alluringly direct about Samwer. No niceties, no bullshit, every email and comment, straight to the point. One founder recalled Samwer’s uncanny ability to enter a meeting after thirty minutes of disagreement, catch up in seconds, then push everyone to an immediate vote.

He also maintains a personal intensity that inspires. Zmyslowski recalled one of Samwer’s trips to Nigeria. Zmyslowski estimated his boss would reach the office at 8 am. After all, his flight landed at 5 am, and he would want to drop his bags off at the hotel and freshen up first. Right? To ensure a good impression, Zmyslowski arrived at 7 am. Samwer was already there, working in the dark. He’d come straight from the airport.

Perhaps the final defining Oli trait is his salesmanship. Despite his humorlessness, the Rocket chief is an expert dealmaker. “If Oli is prepared, there are not many people in Europe who can sell like him,” one source noted. That served Rocket well over the years, ensuring the firm always had capital to deploy, and that portfolio companies were supported with high-level business development.

If little has been said about Marc and Alexander Samwer, that’s because less is known about them. Few if any of the sources I spoke to had met the remaining brothers, though several had worked closely with Oli. They are believed to play important roles, with Alexander ostensibly vital to Zalando’s success. But Oliver is at the center of the Rocket universe.

Speaking about the three of them, Zmyslowski highlighted the sheer amount of enterprise value the Samwers created, making the case that they are among the equal of elite entrepreneurs: “I would put them next to guys like Bezos.”

That value was built with a culture of intensive work, interchangeable talent, and winning at all costs.

Intense work

To build anything worthwhile, hard work is required.

Former employees described long days and weekend work. That, in and of itself is perhaps worthy of praise — if employees are motivated by the mission, additional work can feel less like a tax, and more of an opportunity. But in its tenor, Rocket’s practices led to unrest.

Like everything else, punching the clock seems to have been wrapped in the Oli Samwer mentality, making hard work seem like a matter of life and death. In that respect, Rocket’s vibe was closer to that of a frenzied investment bank, dogged by performative masochism. One ex-Rocket source remembered a company CEO growing furious with an underling for leaving the office at 7 pm.

High churn was the inevitable result. Even company founders often left after just months running the business — the combination of long hours, manufactured urgency, and minimal upside convincing them they might be better off elsewhere. One source recalled realizing that after just six months he was the second or third most tenured person within an entire national market.

Interchangeable people

Rocket’s model compensated for this perennial defection.

It was a running joke: if you were a young consultant or investment banker in Europe, chances were you received a LinkedIn message from one of the Samwers’ lieutenants, extolling the virtues of working at Rocket. That was the first step in a masterful recruiting operation that ensured that the incubator's leaky bucket was constantly refilled.

This approach only works, of course, when talent is interchangeable. It was not a bug of Rocket’s system that they chased the same profile of employee over and over again — it was a feature.

That bred a certain disregard for the human impact of company-level decisions. A source recalled how Rocket closed it’s 400-person Istanbul office with little warning. Employees had relocated to a new country and were suddenly out of a job.

Founders faced equivalent rapid changes. Similar to Zmyslowski, who went through a merger with Jumia, a different founder recalled being told his e-commerce business had been combined with another portfolio company. Suddenly, they had co-founders they’d never worked with, and new directives.

Winning at all costs

“So many people get screwed.”

The speaker described how the founders of a Rocket portfolio company were cut out of an acquisition at the eleventh hour. Because the incubator uses a complex corporate structure — a single company will often have national, regional, and global entities — it has the flexibility to strike terms that benefit it most.

As with other Rocket decisions, this may be mere pragmatism, rather than malevolence. Several sources noted that Rocket is coldly rational, calculating risk and reward, then acting in its best interest; a Replicant with a balance sheet.

This approach often meant Rocket operated in ethical and regulatory grey zones. An employee noted that the incubator skirted immigration laws in countries like Malaysia. Since most staff came from overseas, Rocket allegedly classified them as “consultants,” meaning they could only work in conference rooms rather than from dedicated desks.

In another instance, local employees informed the police that many of their colleagues were working in the country illegally. Rocket’s two-class system, with expats running the show and receiving generous salaries while domestic talent receive lower pay and responsibility, created this tension. To avoid deportation by Malaysian authorities, the expats hid in the bathroom. (Unsuccessfully as it turns out — several members of staff were kicked out of the country.) To impede future raids, the business positioned security cameras out front so they would know who was at the door, and built a wall to slow down unwanted visitors.

These bizarre, extreme tactics are par for the course at Rocket. Though undoubtedly crucial to the business’s success, they contributed to the firm’s decline.

Fall and future

In September of 2020, Rocket declared its intention to delist from the Frankfurt stock exchange. It did so in typical Samwer fashion, using company cash to buy back its shares. A Bloomberg piece explained the shadiness of the approach with an analogy:

Imagine you and I own half each of a $100,000 sports car that has another $50,000 locked in the trunk. The problem is that I have the car keys, so you can neither drive it nor access that money. I offer to buy you out for about $50,000. Fair deal?

Rocket bought out shareholders at €18.57; the company went public at €42.50. An investors’ rights activist summarized the Samwers’ latest move, calling it “totally legal and totally immoral.”

It represented an undignified end to an undignified era. As the prices above suggest, Rocket struggled as a public company, even as investments like Zalando, HelloFresh, and DeliveryHero flourished. (Home24 is another publicly-traded Rocket investment, though it’s stint has been rather less successful.)

But Rocket’s slump may have less to do with the exigencies of public reporting, more so the changes in the tech and venture capital landscape, many of which have eroded the business’s advantages.

The fall

There’s an irony in that the world the Samwers expedited has handicapped them. In seeking to attract capital to Europe and beyond, in bringing more talent into entrepreneurship, and in demonstrating how infrastructure can simplify company building, the brothers paved the path to their own irrelevance.

In particular, five changes have diminished Rocket’s power:

Capital availability

Maturation of talent

Shifts in online marketing

Emergence of infrastructure for startup creation

Enduring reputation damage

First and foremost, there is much more capital available than back in 2007. At the time Rocket opened its doors, just $55 billion was allocated to startups, with $25 billion coming from outside the United States. In just the first half of 2021, global venture investing surpassed $288 billion. At that pace, capital deployed will have increased more than 10x since the Berlin business’s debut.

That has resulted in increased competition, making it much harder and more expensive for Rocket to accumulate the controlling positions it favors. Today, founders, not investors often hold negotiating power.

Second, tech talent has matured. In part thanks to Rocket, global founders now have more experience under their belts, having run businesses in the past, or served as key contributors. These seasoned operators understand their value and don’t want to work in a paradigm in which they give up control and a significant part of the upside, as Rocket’s model traditionally required.

Third, Rocket’s USP has diminished. The company was once truly great at performance marketing, but the space has moved on. Winning over customers today requires a different playbook than the SEO/SEM-focused script Rocket followed. As one source noted, “I’m not sure they’re the company that could crack the TikTok code.”

Fourth, and related to the point above, Rocket’s technical infrastructure has become unnecessary. Never particularly technically adept, the incubator’s “platform” has been surpassed by dedicated offerings like Shopify and BigCommerce. It used to be difficult to spin up an ecommerce business; now it can be done in an afternoon.

Finally, Rocket’s reputation has been cast in stark relief in the current environment. As social issues seep into work life, employees are especially wary of businesses with environments that many might consider toxic or abusive.

Meanwhile, the rest of the venture capital class is falling over itself to serve founders, competing to offer better terms with fewer demands. The cache of being a founder has only risen, and despite VCs attempts to ingratiate themselves, there’s a simmering distrust of investors. These factors emphasize how off-market Rocket’s original model has become. “Stealing” ideas from entrepreneurs, taking 90% of the imitation, and reorganizing entities at will fails modern expectations on multiple dimensions.

Rocket has not helped themselves in this regard. In perusing the company’s 2019 Annual Report — published last year — readers will alight on multiple passages that suggest dubious practices. For example, here is what the company says about its venture firm, GFC:

Besides founding new companies ourselves, we also provide operational support and invest strategically in complementary existing companies in order to expand the global network of Internet companies, find new business ideas for foundings and benefit from economies of scale, cooperations as well as know-how advantages for our own foundings.

The suggestion here is that Rocket uses GFC to identify promising ideas for it to imitate. The tension is obvious: founders receive investment from a firm that may decide to compete with them.

Do entrepreneurs know this? After asking that question on Twitter, I received a response from a member of GFC’s team. The investor reported that Rocket has not incubated companies in several years. (They did not note whether Rocket had ever taken a concept from its GFC portfolio.)

Of course, this raises another question: why is it in there? In multiple places?

As we’ll see, shedding this slippery reputation will be critical to a Rocket renaissance.

The future

So, where does Rocket go from here? What will a return to private life portend?

We can see the contours of a new firm emerging, even if it appears provisional — Rocket 1.5, rather than a true 2.0.

The firm’s plan seems to be to construct a full-stack investment vehicle composed of focused subsidiaries.

Flash Ventures is a pre-seed incubation practice. The firm develops ideas with founders, and invests $500,000 for 20-25% equity.

GFC is a venture fund. The firm usually invests in early rounds, though it has participated in growth financing. (Notably, Alexander Samwer is also involved with Picus Capital, a firm that invests from pre-seed through Series A.)

Global Growth Capital is a debt fund. The firm provides “fintech lending,” “venture debt,” and “growth lending.”

Global Realty Capital is a real estate investment vehicle.

Search the websites for any of these firms, and you will find no mention of Rocket. No sign of an affiliation.

Why is this?

Rocket is abstracting away its brand, in the hopes of diluting the negative connotations it carries. According to the sources I spoke to, this may not have borne fruit yet.

As a founder said of GFC:

There are important VCs in Europe that say I won’t co-invest with GFC...Compared to others, it has a deal flow problem.

Another source told the story of a company pursued by one of Rocket’s investment vehicles. Because of the firm’s history of exercising outsized control, the founders considered taking the firm's money a last resort.

(It should be noted that while Rocket’s VC arms may struggle, they have still made plenty of investments, often into buzzy rounds. Crunchbase counts 528 fundsings for GFC.)

Where is Rocket in all of this?

The firm seems to be almost disappearing, dissolving into these sub-entities. Though the GFC employee I spoke to said Rocket had not taken a majority stake in an incubated company in several years, another source offering a conflicting view, noting that the firm had tried to secure a 30-60% share in an incubation within the last quarter or so. The company has also dabbled in SPACs, raising $250 million for its “Rocket Internet Growth Opportunities” vehicle.

Is this the future of Rocket? An opportunist catching the edge cases that its other vehicles miss?

Maybe. But something about that doesn’t sit right with what we know about the Samwers. Unable to sit still, Oli in particular seems an awkward fit with this more muted millieu. Perhaps, in time, Rocket will return with a new approach, or maybe firms like Flash will scale in a manner reminiscent of the parent company.

Whatever the future holds, Rocket has left an enduring legacy.

A mixed legacy

More than almost any other company, Rocket dares us to make a moral judgement about its work. The brazenness of its approach and the scope of its ambitions provoke us to say, either, "this is wrong” or, “this is business.”

It's time to settle these conflicting urges. Let us return to the mindset of the Archangel Michael and try the case.

The prosecution

The charges, your honor.

Charge 1: Rocket copied other people’s ideas and did so in a way distinct from other businesses.

Charge 2: Rocket acted ruthlessly and unethically.

Charge 3: Rocket was a net-negative on the tech ecosystem.

Did Rocket copy other’s ideas? We can take all of ten seconds on this part of Charge 1.

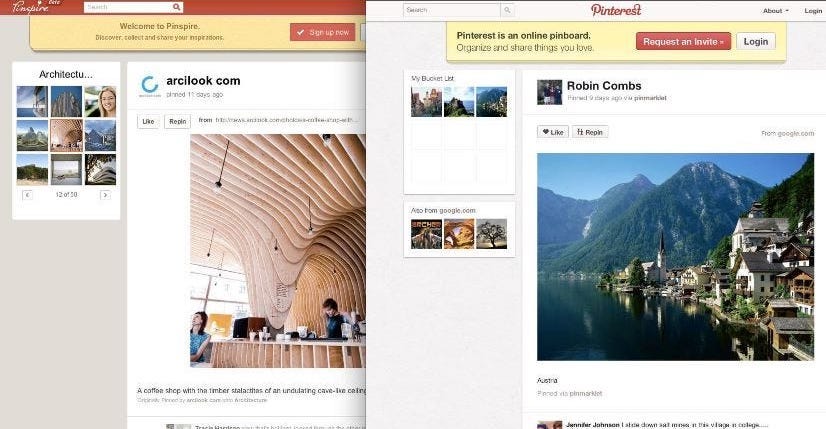

Case in point: Pinspire.

I think that settles it. Right?

Now we turn into thornier territory. Did Rocket copy in a way that’s different from other businesses?

In 2012, Wired asked then-investor Jerry Colonna for his thoughts on the firm. Colonna offered a defense:

Give me a break, OK. Whose idea isn't derivative? Whether we're talking about art, music, culture, software, technology: come on, what isn't derivative?

The main thrust is that there are no new ideas, that everything is a copy of a copy of a copy, and that to expect anything more is not only unreasonable but naive, a luxury of the impotent idealist.

We can borrow Jerry’s words for a rebuttal: Give me a break.

Yes, everything is a remix. Yes, every artistic or entrepreneurial endeavor owes something to both predecessors and contemporaries. But it is not asking too much of ourselves as technologists and thinkers to delineate between inspiration and imitation. Just because the boundary is muddy does not mean it doesn’t exist.

Not every Rocket business was like this. But in the meticulousness of its mimicry — one former employee talked about copying Amazon down to the pixel — and its recidivism, Rocket was unique.

On to Charge 2: Rocket acted ruthlessly and unethically. There can be no question that Rocket was ruthless — but this is true of almost every successful business, to some extent. Was it unethical?

If the stories and implications mentioned above are to be believed, I would submit that we have a clear answer. Rocket treated people as expendable resources, badgered them relentlessly, and then snipped their profits. (Our boundaries may differ.)

And so, we land on Charge 3, the true question: was Rocket a net-negative on the tech ecosystem?

Rocket has had an undeniable impact on the startup world. It has not necessarily been for the better. One can argue that the firm has propagated a certain cold-blooded, unartistic strain visible in subsequent endeavors. A Berliner I spoke to lamented Rocket’s influence on the city. Though the city is renowned for its creativity and delightful weirdness, its tech scene is populated by “business dudes.” These former consultants are either ex-Rocket or share the mentality that has become a kind of default. The result is the creation of a dominant allele in Berlin’s DNA — building a company requires brash machismo rather than vision and invention.

That approach may bleed down into the management of people. Those that have endured humiliation at the hands of bosses may consider the approach acceptable when running their own business. Should that occur, the end result would be a diaspora of despair — hundreds of little empires run by grim Napoleons.

If that is not a negative impact, your honor, I don’t know what is. The prosecution rests.

The defense

My first act as Rocket’s imaginary defense attorney is to plead guilty on points 1 and 2. But I intend to fight like hell on the final charge.

Yes, Rocket is artistically brain dead and culturally unpalatable. But net-negative on the ecosystem?

One can argue that few organizations have had as positive an impact on tech as Rocket. Powered by the Oli Samwer topspin, Rocket deployed billions of dollars into the startup world at a time when few others were doing so. Even more vitally, it did so in markets that might not have received funding for years, if not decades.

“If I was the mayor of Berlin,” a founder remarked, “Oli Samwer would still be the person I thank every morning.”

Beyond Europe, Rocket arguably had an even bigger impact.

How many people were investing in Iran in 2014? Which major venture firms were active in Nigeria in 2012?

Rocket went where others feared to tread, and built businesses that employed local workers and provided benefits to the local population. That has had a lasting impact.

Let’s look at Lazada. To operate in Vietnam, Rocket had to not only offer a website, but create a method to receive payment in cash (long before Amazon offered this option), and build a national logistics network. Today, that same infrastructure is used to deliver all manner of goods to consumers.

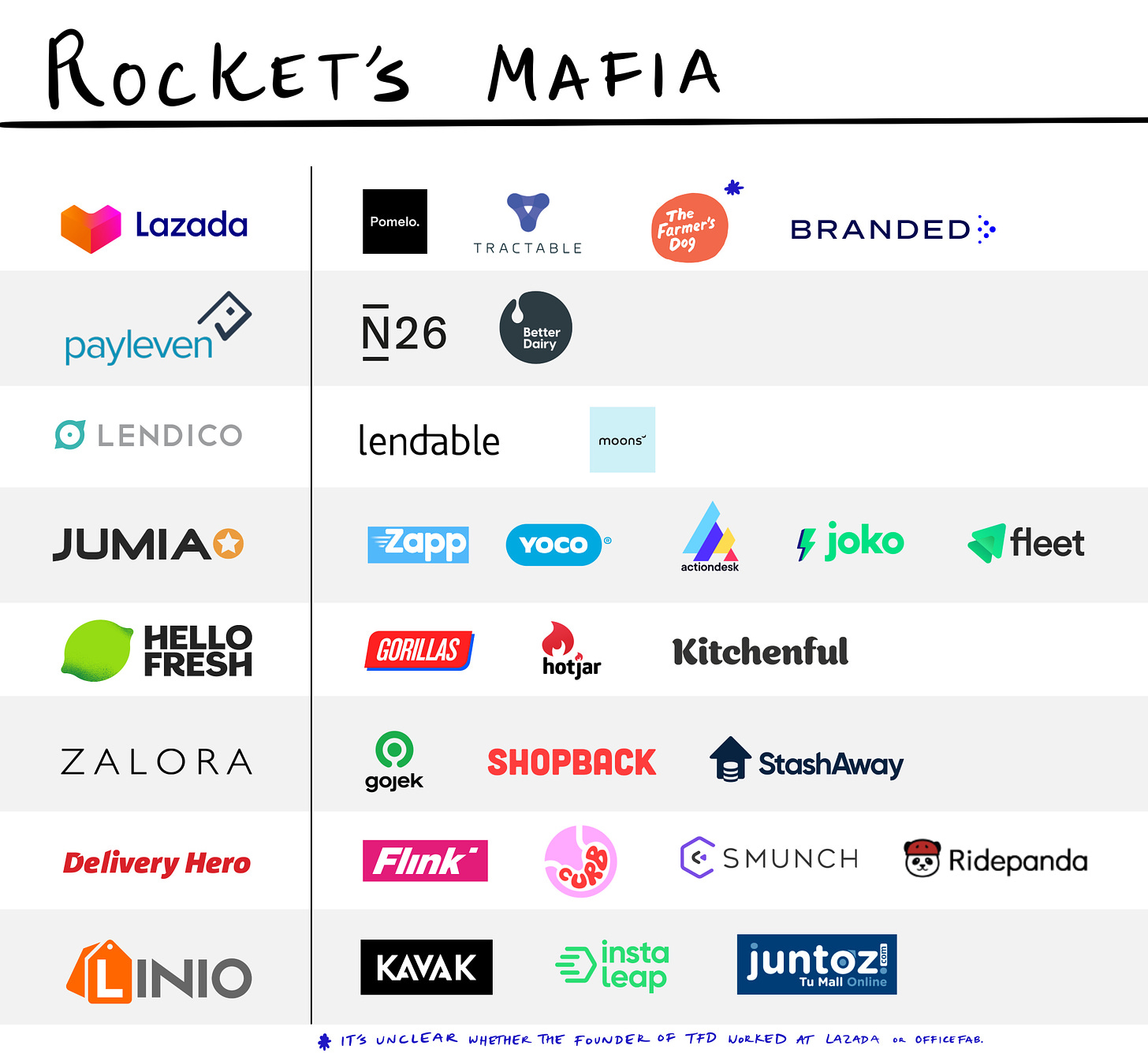

Beyond elevating frontier markets, Rocket aided the startup scene by radically increasing the supply of entrepreneurs. Though we can argue with the uniformity of the company’s recruitment, we must be pleased that it succeeded in drawing capable people away from consulting and banking and into tech.

Not only did Rocket draw these people in, it trained them, giving them the tangible skills and experience needed to build businesses. You can see the impact this has had by looking at a selection of businesses founded by the “Rocket Mafia.”

There are hundreds of others. The defense rests.

Mark Twain wrote, “Man is the only animal that blushes. Or needs to.”

Shame is a deterrent without which society might decay. But we must decide what sort of shame we will listen to, what embarrassment we are willing to feel. The founder of any new venture must reckon with the possibility of appearing ridiculous, frivolous, somehow worthy of society’s condescension, and persevere.

For all the shame they deserve, for all the shame they deploy in Rocket’s inner circus, we should be more than a little glad the Samwers seem to feel none of it.

Because, in the end, the man that blushes, builds nothing.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.