Nubank: Finding Brilliance in Brokenness

The world's largest digital bank is a feat of ingenuity.

"You always have to use a soccer analogy in Latin America." — David Vélez, CEO of Nubank

"Don't forget, the first ball goes to Garrincha."

Huddled in the bowels of Gothenburg's Ullevi Arena, Vicente Feola stood in the dressing room and barked his instructions. As the coach of Brazil's international team, the squat manager with a neat side-part had been tasked with one of the most difficult jobs in sport: winning the World Cup for his country for the first time.

Despite a decade of sustained brilliance, somehow, the Seleção had failed to secure football's most illustrious prize. Four years earlier, in 1954, the team had stumbled at the quarter-finals. Four years before that, Brazil had endured the ignominy of losing the final to Uruguay. So scarring had that defeat been, it produced a word of its own: Maracanaço, or "the agony of the Maracanã stadium," the scene of that spiritual crime.

Like those other tournaments, the 1958 edition had gotten off to a decent start. Now, Feola's side would face its first real test: the USSR.

If Brazil's team was defined by artistry and improvisation, the Soviet Union's success had been built on physical stamina and a "scientific" obsession for scripting play. Rumors swirled that the USSR's players could run for 180 minutes, the length of two matches, without tiring. And in Lev Yashin, dubbed "the black panther" for his feline reflexes, they had not only the best goalkeeper in the world but an embodiment of their cool, unfussed efficiency.

Playing against such disciplined opposition would require a different approach, Feola knew. He needed to unsettle the Soviets' defenders, to shake things up. He needed Garrincha.

That Garrincha was there at all was a miracle. Born to a poor family near Rio de Janeiro, Manuel Francisco dos Santos, his given name, had a congenital defect that skewed both legs. His right was not only more than 2 inches longer than his left, it bent inward, while its complement slanted outward. Doctors classified the young boy as "crippled," recommending leg braces that Garrincha's parents couldn't afford. Small of size but high-spirited as a child, Manuel earned the nickname "Garrincha" from his sister, which meant "little bird."

Proof that God has a keen sense of irony, with a ball at his feet, "crippled" Garrincha was magical. Though archival footage is limited, the clips that endure portray a player of impish gifts, a Loki-style trickster that disappears behind a veil and emerges on the other side of a defender as if he has traveled through a rip in the fabric of space. Like no other player, Garrincha manages to play football without the ball, shimmying left and right and showing a defender to the ground without touching the orb in front of him.

Despite those skills, many didn't want Garrincha to play on that June day. Though talented, some coaches on the team worried the right-winger didn't have the requisite temperament for high-pressure situations (a concern they also had about a young striker named Pelé).

Feola disagreed: Garrincha would start. And not only that, as soon as Brazil won possession, he wanted the ball to go to the Little Bird.

The whistle sounded in the Ullevi Arena. What followed is described by some as the most beautiful three minutes of football in history.

Within twenty seconds, Garrincha has the ball, just as Feola wanted. The dour Russian defender, Boris Kuznetzov, blocks his path, but a barricade for Garrincha is just an opportunity to dance. He breezes past the Russian, then doubles back and does it again. And again. And again. The fifth time he tortures Kuznetsov, he asks him to bring a few friends. The Brazilian skips past three Soviets, and as they tumble behind him, the stadium bursts into laughter. Garrincha crashes a shot against the post, and even the imperturbable Lev Yashin looks worried.

A moment later, Garrincha has the ball again. Once more, he asks Kuznetzov to sit down, and the Russian obliges. Garrincha moves the ball to midfield, and a pass is floated over the top to Pele, who hits the bar. A minute later, Brazil would finally have the goal they deserved. As described by a writer at the time:

The pace is mind-boggling. As is Garrincha's rhythm...The wave of attacks continues. Time after time, Garrincha decimates the Russians. There is hysteria in the stadium. And an explosion when Vavá scores after exactly three minutes.

Brazil won the match 2-0 and would go on to become world champions, securing the team's place in sporting history.

When thinking about Nubank, the Brazilian fintech company, those three minutes come to mind. Not only was Garrincha's brilliance a triumph of the gifted underdog, football's "bent-legged angel" besting the USSR's physical specimens, but an example of one of the most virtuosic opening salvos across disciplines.

In an interview last year, Nubank's CEO David Vélez noted, "We're in the first second of the first minute of the first half of the soccer game."

The oligopolistic dynamics of Brazil's banking system meant that Nubank entered as the sector's ultimate underdog, a player with both absurd disadvantages and mesmeric gifts. Since launching in 2013, Nubank has attracted 40 million users, reached a valuation of $25 billion, and altered the financial landscape in Latin America. It may be just the beginning — the "first second" in Vélez's parlance — but what a beginning it has been.

Still, Vélez is right to counsel caution. The second-most valuable fintech in the world has become a dominant force in its home country, but it can't necessarily rely on the same serendipity as it spreads beyond Brazil.

In today's briefing, we'll explore…

Brazilian banking's perfect brokenness

The making of Vélez

Nubank, an accidental hit

The product secrets of the fintech's feijoada

Competition from above and below

The tricky alchemy of winning new markets

Brazilian Banking and Kintsugi

In its symbolism, I have always found the Japanese art of "kintsugi" particularly appealing. The point of the practice is to reform broken pottery by annealing fragments with gold or silver joinery. The resulting piece evokes a resilient beauty, in which scars and fissures are not hidden but highlighted, not marks of shame but stunning, gilded rivulets.

Kintsugi suggests that not only can things be broken, they can be perfectly broken. Something can be fractured in such a way that its flaws only increase the beauty of the piece.

Anyone who looked at Brazil's banking system in the past ten years saw it was broken; only David Vélez — an entrepreneur with the craft of an artisan — saw it was perfectly broken.

Brazilian banking was, and is, an oligarchy. Even today, 81% of the country's assets are controlled by a Big Five of Itaú, Caixa Economica, Banco do Brasil, Bradesco, and Banco Santander. They also hold 85% of the country's loans.

In relative terms, these are massive businesses. According to the Fortune 2000, three of the top five Brazilian companies are banks. The size and positioning of these organizations have not only granted substantial political and social power but permitted a hostile consumer culture to flourish. With little competitive pressure to improve, the Big Five traditionally treated customers poorly. Opening a bank account could take multiple visits to a local branch, phone support was subpar, and online service, non-existent.

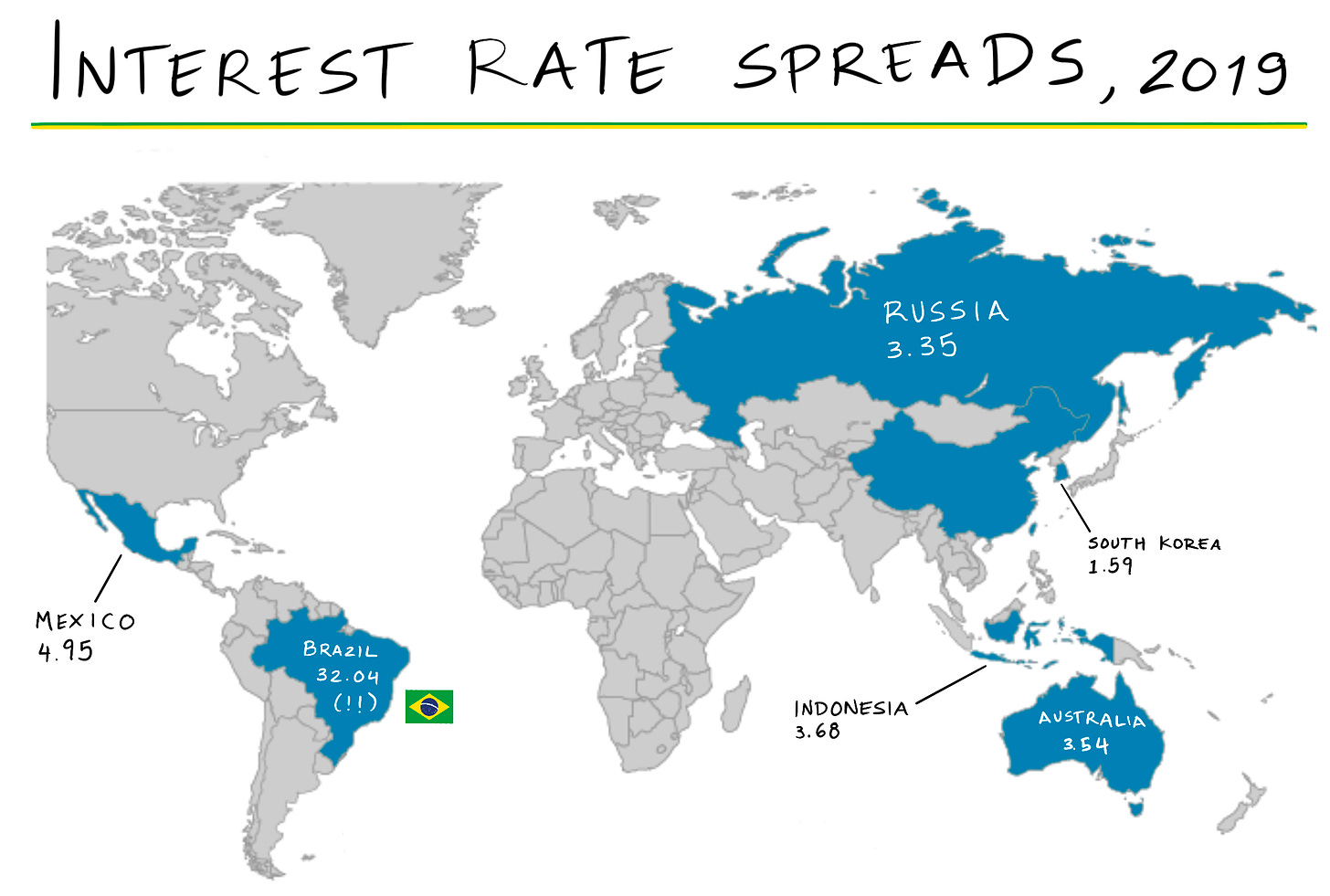

At the same, these banks levied extraordinarily high interest rates, with some consumers paying 450% a year. The country's monetary policy committee recently decided to cap interest rates at 150% with average rates above 306%, illustrating the problem remains unsolved. A map of interest rate spreads — the difference a bank receives from loans and the rate it pays on deposits — demonstrates how far of an outlier Brazil is, with a spread of 32.04% compared to 3.35% in Russia and 2.85% in China.

Brutal fees further padded bankers' pockets. Want to receive text message updates? Pay up. Looking for fraud protection? That'll cost you. Needing to withdraw cash? Here's the bill.

One JP Morgan study suggested that Brazilian banks earned 40% of their revenue through fees in 2019, far outstripping the 15-20% standard in Mexico, Argentina, Chile, and Peru.

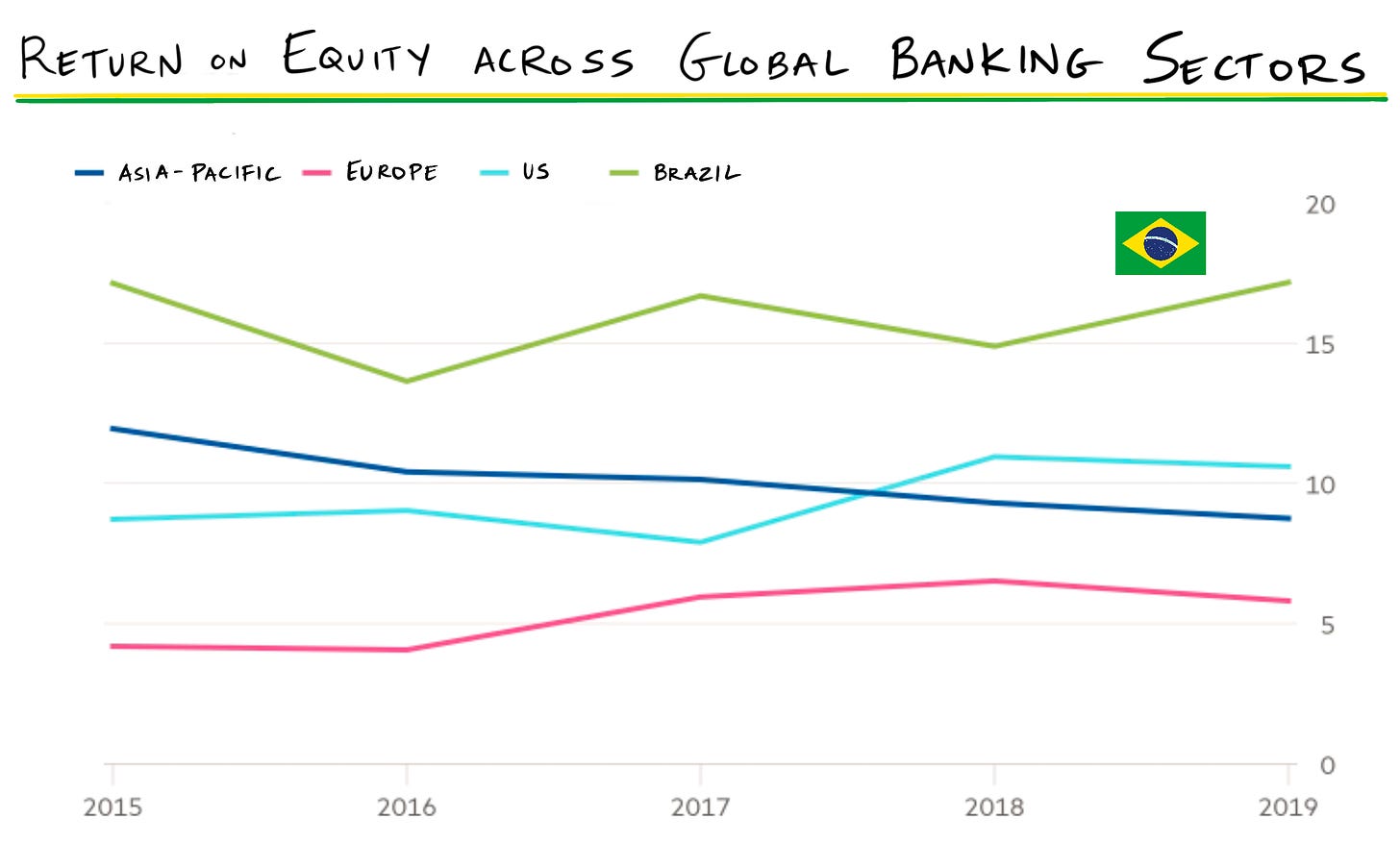

These factors created a uniquely profitable banking sector, with Brazil's return on equity (17.2%) easily outstripping the US (10.6%), Asia-Pacific (8.8%), and Europe (5.8%).

It is unsurprising then that much of Brazil's population has gone without basic financial services. Poor service and high costs deterred even many qualified customers. Today, 55 million, a quarter of the country's population, are considered unbanked.

In a myriad of ways, banking in South America's largest economy was broken. But David Vélez saw gold running through its rifts: lazy incumbents, unhappy consumers, extortive financial models, and unfilled demand.

In retrospect, it seems obvious the Big Five were ripe for disruption. But at the time, confronting the most powerful and profitable sector of Brazilian business looked like an act of lunacy, the mission of a madman or a fool.

David Vélez, Nigel Morris, and Interpreting Scarcity

Vélez was neither.

Born in Medellin, Vélez came from a family of entrepreneurs. Even as a boy, he shared that enterprise, saving money from birthdays and summer jobs to buy a cow. Over time he amassed six heifers. When it came time to attend college in the United States, Vélez sold his herd, partially subsidizing his Stanford education.

Though Vélez tried to find a startup idea in those tender Palo Alto years, he failed to find one he considered viable, instead matriculating to Morgan Stanley before moving on to growth equity firm, General Atlantic (GA).

It was during this stint that the young Vélez intersected with Nigel Morris, founder of Capital One. The British businessman served as an advisor to one of GA's Brazilian businesses, and through that engagement, Vélez learned from the banking tycoon. In large part, Capital One's success had been built on a sales-focused playbook Morris implemented. Using customer data, Capital One successfully matched users with the right credit card product, doing so more effectively than the competition. Years later, when Vélez was starting his own financial company, these lessons would influence his thinking.

First, though, Vélez returned to Stanford for business school. As the story goes, it was during this period that Vélez overlapped with someone close to Douglas Leone. The legendary Sequoia investor was looking to set up an investing presence in Latin America, and Vélez's connected classmate recommended him, citing his impressive intellect, Colombian heritage, and experience investing in Brazil.

In his second year at the GSB, Vélez started working for Sequoia, traveling back forth between São Paulo and Palo Alto. Though he and Leone spoke to plenty of companies, they invested in just one: Scanntech, a grocery management platform in Uruguay. Over nearly three years, it became clear that the region was too immature for Sequoia to devote its resources, with a paucity of great entrepreneurs, uninspired business ideas, and a shortage of engineers. Vélez would later note that one pitch, in particular, sounded the death knell: a Brazilian founder mentioned that just 42 Computer Science students graduated from the prestigious Universidade de São Paulo every year. Leone decided: that wasn't enough technical talent to build an ecosystem around. Sequoia was pulling out of Brazil. Vélez heard the news the day before his birthday.

While others might have taken the retreat of venture's most august firm as a suggestion to look elsewhere, Vélez interpreted scarcity differently:

You want to position yourself on the side of the market where there's scarcity. In the US, there's an oversupply of good entrepreneurs. Somebody with my experience and background is a commodity. In Latin America, there was significant scarcity.

Remembering the dreadful experience he had endured as a consumer trying to open an account in Brazil, Vélez wondered whether banking could be disrupted. After studying the market and its oppressive idiosyncracies, he became more convinced. No one he spoke to seemed to share his enthusiasm:

At the end of 2012, I talked to 30 industry experts in Brazil about using a smartphone to build a new bank. They all told me I was crazy, that this was impossible — that because I wasn't Brazilian, I had no idea what I was talking about. The big banks will kill you. The regulators will kill you. Customers will never trust a new brand. Customers will never do this online. They gave 100 arguments for why this was a dumb idea.

He persevered. Not long after he had been made redundant, he returned to Sequoia to pitch his digital bank, EOS. Though not a unanimous decision, Sequoia agreed to invest on the condition Vélez secured funding from a Latin American firm. Kaszek, founded by Mercado Libre's former CFO and COO, agreed to co-lead the round with each fund investing $1 million.

Going Viral on California Street

Two of Sequoia's early pieces of advice?

Change the name and find some co-founders. Though Vélez had shifted from EOS to EO2 after finding the best domains taken, Leone suggested he rethink the moniker entirely. It was too nerdy, he said. Vélez should find something more dynamic.

Roelof Botha, one of Sequoia's other partners, pushed for Vélez to bring someone with some real banking experience aboard. Sure, Vélez was a smart guy, but did he really know what he was getting himself into? He needed someone with an inside track on the organizations he sought to surpass.

In Cris Junqueira, Vélez found his answer. As the head of a credit card joint-venture between Itaú and Magazine Luiza, Junqueira understood the industry and its flaws; when Vélez proposed teaming up, she needed little persuasion. Edward Wible, an engineer Vélez remembered from his Sequoia days, filled out the founding squad.

Vélez would have to rely on outside help to solve the company's naming issue. In conjunction with a branding agency, the team settled on "Nubank." Not only did "nu" mean "naked" in Portuguese, emphasizing the transparency with which the business would operate, it sounded like the English word, "new," suggesting change.

With Sequoia's concerns addressed, it was time to get to work. While other founders might have sought to spend their blue-chip funding on an ostentatious office, Vélez wanted to imbue his business with the scrappiness of the Silicon Valley hacker houses he'd seen in his Stanford and VC days. On São Paulo's Rua Califórnia, he found the perfect headquarters — a modest home with enough space for Wible to live upstairs.

Inspired by the wisdom of Nigel Morris, Vélez initially sought to make Nubank a sales-driven organization in the mold of Capital One. Those interactions had convinced him that a sophisticated customer acquisition motion was the most effective way to sell financial products to consumers. That was particularly true of credit cards, the first product Nubank would offer. While regulatory approval was required to open a checking account, credit cards needed no such authorization.

To run the Morris playbook, Vélez hired a team of marketers. As it turned out, he didn't need them.

Offering a no-fee, eye-catching purple credit card procurable entirely via one's mobile phone, Nubank struck a chord with the misserved Brazilian populace. With enmity toward traditional finance congealed over decades of high fees and poor service, Nubank's arrival felt like salvation. Hundreds of thousands joined the company's waitlist, and soon millions would wield the neobank's memorable cards.

Vélez had constructed his company to drive steady growth; it had gone viral instead.

Central Bank Beneficence and Consumer Outrage

In the years that followed, Nubank would maintain and better its startling opening pace, reaching 40 million users to become the largest digital bank in the world. Though Vélez had initially worried about regulatory interference, reportedly worrying more about that than competition from the Big Five, Nubank was actually helped by authorities.

Another illustration of Brazil's perfect brokenness is that though most of the country's institutions tend toward inefficiency and bloat, its Central Bank (CBB) is best in class. Unlike other areas of government, the CBB attracts savvy, top-tier talent willing to aid innovation. (One illustration of the institution's global regard: Timothy Geithner suggested former CBB president and dual-citizen Arminio Fraga as Chairman of the Fed.)

Recognizing that previous regulators had prioritized stability over competition, leading to the consolidation of the Big Five, Nubank's emergence coincided with a new class of bureaucrats seeking to redress those issues.

This proved particularly helpful in 2016.

Historically, Brazil's credit system gave issuers like Nubank thirty days to pay a merchant for a consumer purchase. This is very different from the United States, where merchants receive funds in just two days. This dynamic served Nubank well — the average consumer paid Nubank back in 26 days, meaning the company had a positive cash flow cycle, with four days of float.

In 2016, two years after Nubank first came to market, banking's Big Five aggressively lobbied to shift to a two-day deadline, arguing it was friendlier to merchants. While true, it also represented an attempt to cut Nubank off at the knees. Unlike the gargantuan institutions with which it competed, Nubank didn't have the balance sheet to pay merchants 24 days before receiving repayment from consumers. Junqueira was frank in outlining the effect such a move would have on Nubank:

Reducing the deadline to two days would be apocalyptic for us. We've already done some simulations. With two days, we have to turn off the lights and close the door. [Even] with 15 days, we would need almost R $1 billion in additional capital overnight.

Rather than an enemy, Nubank found an ally in the CBB. Recognizing that the move would crush competition, the Central Bank retained the 30-day deadline, giving Nubank room to breathe. It didn't hurt that consumers responded full-throatedly to the prospect of Nubank's demise, taking to social media to express their support for the company with the "cartão roxinho."

Wedges, Channels, and Product Savvy

That Nubank began with credit was no accident. While it represented the simplest option from a regulatory perspective, it also proved the right wedge. That was for several reasons:

Untapped population. More than 60% of the Brazilian population didn't have a credit card. By starting with small limits and leveraging social and digital data to underwrite, Nubank could provide credit to those without prior histories.

Limited adverse selection. Usually, giving under-banked consumers access to credit suffers from adverse selection, with the least qualified customers often those without access. But because credit cards were not widely used in Brazil, a comparatively large portion of creditworthy customers was untapped, reducing this effect. The risk profile of Nubank's customer base is only marginally above the Big Five.

Poor customer experience from incumbents. As noted earlier, securing a credit card was a Kafkaesque hassle. Nubank could differentiate without changing the product but simply by offering a better procurement method (via mobile).

High frequency of usage. Compared to financial products like insurance, credit cards are high usage, giving Nubank the chance to establish a close relationship with the customer.

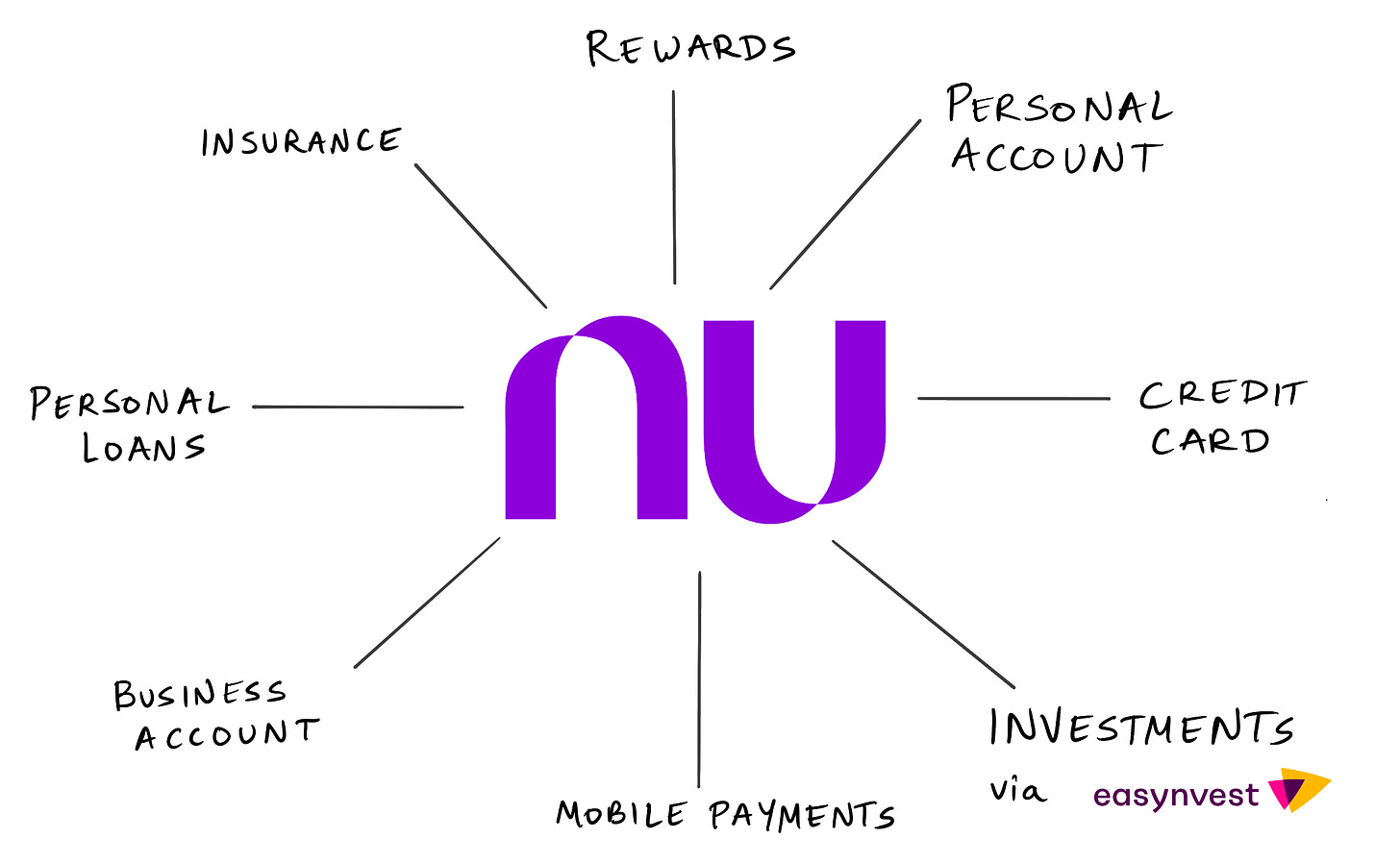

This final point has proven key. By beginning with credit cards, Nubank laid the groundwork to turn a wedge into a channel. Credit users check their accounts frequently, making it relatively simple to launch a new product: Nubank just has to present it in the app, provide easy access, and watch the customers roll in.

Over time, Nubank has rolled out products across what it calls the "Five Financial Seasons: Spending, saving, investing, lending, and insuring." One of the guiding factors behind Nubank product's expansion seems to be adding higher-margin products over time, then cross-selling. This effectively increases average revenue per user (ARPU), increases LTV, and favorably slants LTV: CAC.

In late 2020, for example, Nubank launched "Nubank Vida," a life insurance product associated with Chubb. This product was promoted via Nubank's existing channel, its app. This proved remarkably effective. Sources with knowledge of the industry claim Vida is the fastest-growing Brazilian life insurance product of all time.

Referring back to Nubank's strategy, it's evident how initiatives like Vida advantageously alter unit economics: customers that buy an insurance policy significantly increase their LTV but require no additional customer acquisition spend.

Nubank has reported a $9 CAC with an LTV topping $305, a ratio of 34x.

Today, Nubank's product seems full-featured and mature. If much of the fintech revolution has been powered by the unbundling of financial institutions into component business lines, Nubank has led the way in rebundling elements under one banner. It offers checking accounts, mobile payments, rewards, personal loans, and insurance. Via acquisition, the company addressed a missing area: investing. In September 2020, Nubank snatched up digital broker, EasyInvest, opening up the path to equity trading. As Nubank continues to rebundle, investors may wish to keep an eye out for further bolt-ons.

Though Nubank primarily targets consumers, it has forayed into B2B services. This is particularly relevant in emerging markets where the lines between consumers and SMBs frequently blur. To address that need, Nubank offers bank accounts and card services for SMBs. This may prove a vector of further expansion and competition, particularly as Nubank butts against Mercardo Libre's Pago division.

Viewed as a whole, Nubank's product strategy has undoubtedly worked. In 2020, revenue approached $1 billion, an increase of 79% YoY. At the same time, net losses narrowed by more than 25% to $43 million. Nubank is adding more than 1.5 million new customers a month and is projected to surpass $1.5 billion in gross revenue in 2021, growth of more than 100% year over year. Credit card transactions rose close to 50%, and the company loaned nearly $200 million. As an IPO beckons, Nubank is clearly firing on all cylinders across product lines.

The Philosopher, the Drill Sergeant, and the Architect

Like the great Garrincha with the ball at this feet, Nubank's management seems finely balanced. Each member of leadership brings something to the table dispositionally, contributing to a high-performance, modern culture.

At the head of the organization is Vélez. While we've already spoken of his experience and the boldness he demonstrated in starting Nubank, we have yet to touch on his particular skills. Those with knowledge of the CEO describe him as a structured, disciplined person and a cerebral one. Most of Nubank's long-term thinking still seems to originate from the man who spends free time reading novels. Especially for a first-time founder, the completeness and sophistication of Vélez's vision are said to set him apart.

That farsightedness manifests in a ruthless desire to ensure Nubank is well-positioned for the future. One source cited Nubank's recent CFO upheaval as an example. Though many felt Gabriel Silva had performed solidly in the role since joining in 2016, Vélez believed the company needed more experience in the run-up to IPO. In 2020, he brought aboard Marcelo Kopel, former CFO of Citibank and Credicard. Over the past year, Kopel positioned Nubank for its public future before stepping down for personal reasons. Silva moved into a VP of Finance position, with insider Guilherme Lago filling Kopel's shoes.

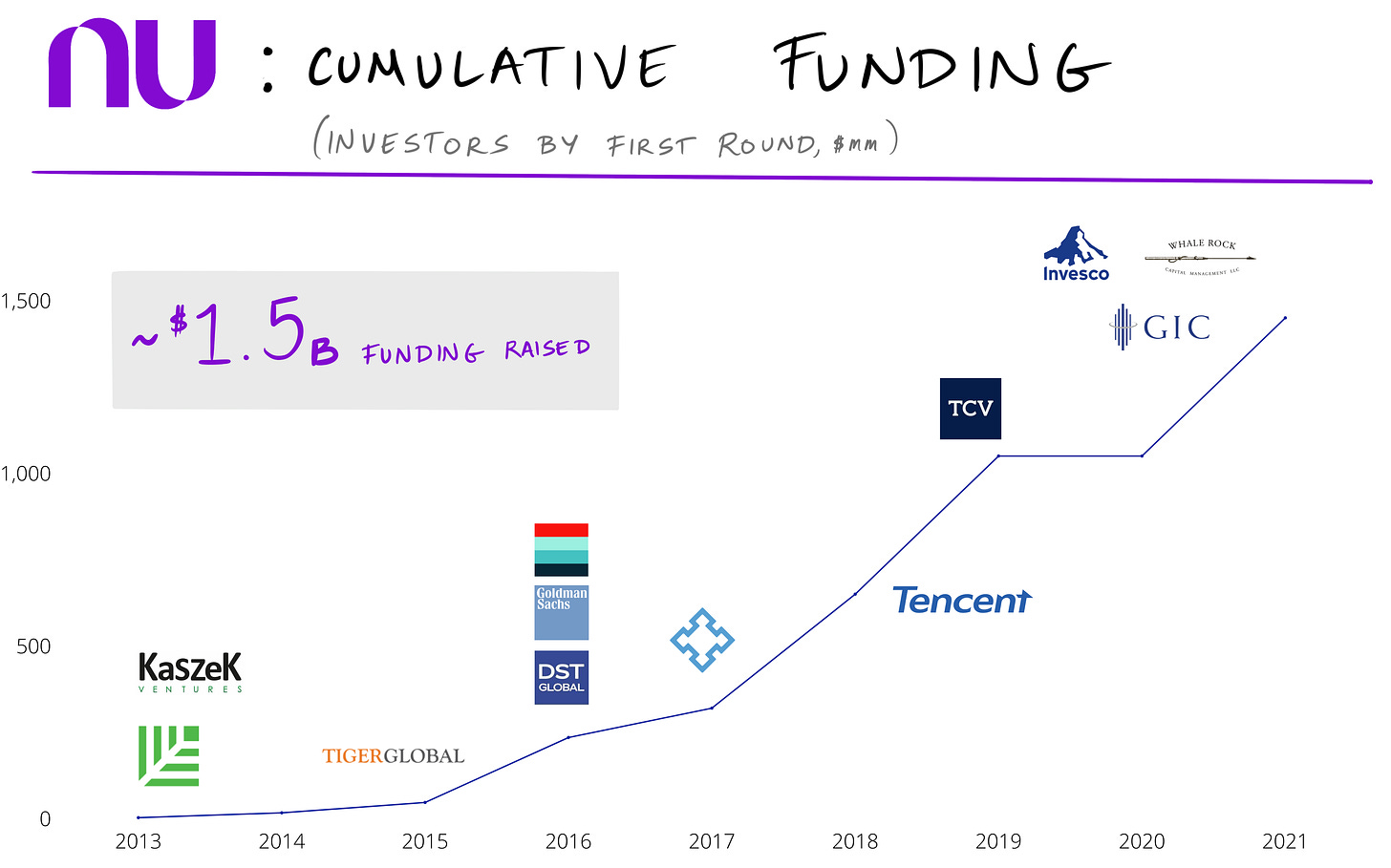

Beyond his role as corporate philosopher and keeper-of-the-vision, Vélez is reportedly an exceptional fundraiser. That partially explains the $1.5 billion the company has pulled in from global megafunds like GIC, TCV, Whale Rock, DST, Tiger, and others. Nubank's last round, announced in January of 2021, valued the company at $25 billion, making it the second-most valuable private fintech company, behind only Stripe.

If Vélez is an even-keeled, calming presence, Cristina Junqueira is all action. Described as something of a drill sergeant, the former banker is said to be the one galvanizing troops and enforcing deadlines. That outspokenness has occasionally gotten the company into trouble. In October of last year, Junqueira noted that Nubank could not "lower its standards" to increase the number of Black managers at the company. That prompted a sharp backlash which Nubank has been at pains to soothe in the ensuing months, funding education initiatives for people of color and championing recent efforts to improve diversity.

Though a quieter presence than either, Edward Wible is arguably Nubank's most operationally critical leader. Those I spoke with described Nubank as a fundamentally tech-driven company, different than the sales-driven organization Vélez had initially expected to build. Corporate hires report being surprised by the degree to which engineering determines the prioritization of new products. Technical debt is said to be a total non-issue, with Nubank consistently renovating and improving its stack, a significant difference from the legacy infrastructure duct-taping together the Big Five.

Taken together, Nubank boasts a management team held in exceptionally high regard, noted for their boldness. Perhaps that's to be expected given the ostensible lunacy of challenging the status quo.

Banks Battle Back

Nubank knows the battle has not been won. As Vélez's "first second" metaphor indicates, the team recognizes the game is not over.

Galvanized by Nubank, the Big Five have stepped up their tech game in recent years, closing the gap on service and functionality. This has been managed through internal initiatives, venture investments, and outright acquisitions.

Banco do Brasil and Bradesco partnered to create "Digio," a digital banking platform designed to challenge Nubank directly. Though Digio partnered with Uber to offer loans to drivers in Brazil, the platform lags far behind Nubank with 1.6 million users as of late 2020.

Bradesco also launched a more fully-featured fintech product, "Next." Offering payments, a debit card, loans, and insurance, Next has attracted 4.4 million users and was spun out by Bradesco into a standalone business. That has given the subsidiary more latitude to compete with tech insurgents ahead of a potential IPO.

Other Big Five members have their own initiatives — Caixa has pushed digital micro-insurance while Itaú has expanded its third-party offerings online — but it's not clear whether it will matter much to Nubank.

That's for two reasons.

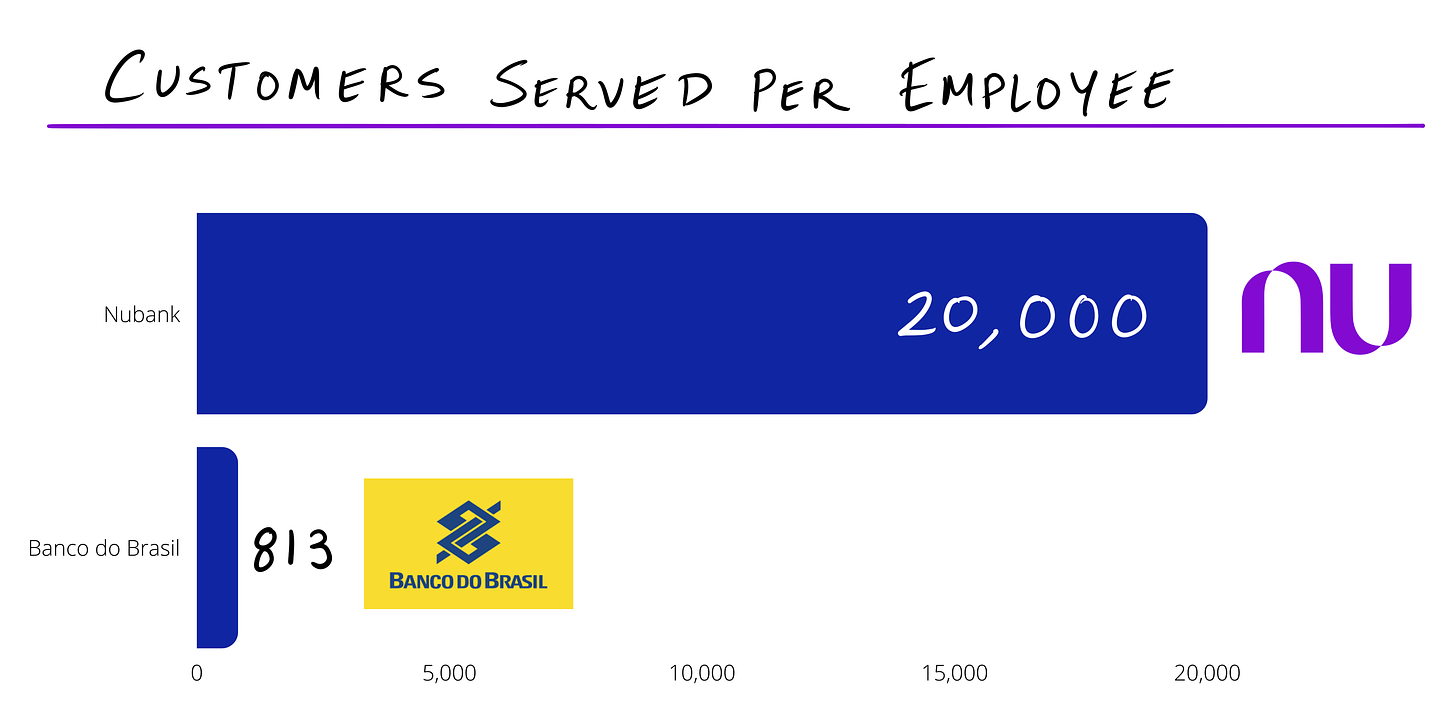

Firstly, Nubank operates with a fundamentally different structure. Being digital by default has allowed the company to excise real estate and staffing costs. Compare the newcomer to one of the old guard: Nubank serves 40 million with 2,000 employees; Banco do Brasil (BB) serves 74 million with 91,000 employees. That means for each employee, Nubank can support 20,000 customers; BB can manage just 813. Just as critically, Nubank has 0 branch locations; BB has 4,368.

While BB has advantages, including a richer product suite and more assets under management, the composition of Nubank gives them far more margin to play with while also making expansion more asset-light. In sum, Nubank has ~95% lower opex than traditional players.

Secondly, competition from traditional banking might not matter simply because of the size of the opportunity. As noted earlier, 55 million Brazilians are believed to be unbanked, with nearly 200 million across Latin America. The banking sector in Nubank's home country tops $280 billion. This gives plenty of room for existing players to grow alongside Nubank. Though they may find relative share decline, they can still profit and prosper.

Nubank will believe it can capture an outsized portion of the offline market while simultaneously chipping away at the Big Five. Again, regulators may aid that effort.

Both Caixa and BB are state-owned institutions. As Brazil's Central Bank continues its efforts to reform the economy, it is likely to push these organizations to operate less as arms of the state and more as private companies. Today, both Caixa and BB can make non-economic lending decisions thanks to the government's support; that won't fly when operating solo. That may lead to a scenario in which two of the three biggest banks by deposits serve as permanent "share donors," shedding stakes over time.

Tech Tug-of-War

Nubank will need to worry about more than the lumbering of the Big Five. Vélez was not the only one to recognize the opportunity in Latin American fintech.

As dissected in last week's piece, Mercado Libre is a prominent player in the space via its Pago division. Historically, Pago has focused on businesses rather than consumers; it seems to be only a matter of time before it more directly encroaches on Nubank's turf. Whereas traditional banks suffer from tech-lag and staid management, Meli can boast robust IT architecture, a relative abundance of engineering talent, and top-tier leadership. Critically, Pago already operates across Latin America, with a presence in Argentina, Brazil, Chile, Colombia, Mexico, and Venezuela. Nubank is only just beginning to poke its head out beyond Brazil.

Pago also benefits from having rich customer data with access to merchant platform revenue. Though Nubank's business account should provide similar information in time, the scale of Pago's operations and Meli's user base may give the company an edge.

Moving in the opposite direction of Meli (and Magalu) is Banco Inter. With 6 million users in 2020, the company announced it was expanding beyond fintech into e-commerce, launching Inter Shop. The company has been explicit in its goal to build a super app (it literally calls its app... "Super App") bundling in ticket purchasing, parking payment, and food delivery. Nubank seems, reasonably, laser-focused on fintech and will likely be pleased to see a digital banking competitor look elsewhere in search of opportunity.

Stone presents a different challenge, though it may have similar data advantages as Mercado Pago — helpful in offering credit. The "Square of Latam," Stone can rely on data from the network of merchants that use its POS and financial management services. As Nubank builds out its B2B offering, it may find itself competing with these products. Equally, Stone may mimic Square and move into P2P payments, using that as a wedge to provide broader consumer services, like investing. For now, Stone looks more like a standalone business — albeit one with a $19.5 billion market cap — rather than a true multi-dimensional Nubank challenger.

Totvs's expansive product suite makes it a strange beast. The leading ERP platform in Brazil, the company put down a stake in fintech starting in 2019. That has manifested in an increasingly robust credit product, bolstered through acquisition. With access to a business's full P&L, Totvs has information even Pago doesn't. That's enabled the company to engage in unusual lending practices, including offering salary advances to the workers of the companies that use its system.

If most of the insurgents mentioned above compete on the business side, XP represents a direct consumer threat. Founded in 2001, XP has assembled a constellation of assets in the investing space. Through XP's businesses, consumers can access stocks, bonds, fixed income, real estate, and other opportunities. Unlike traditional financial players, XP has a high NPS score and is growing exponentially. With a market cap of $23 billion, XP is also at a similar scale to Nubank.

Today, Nubank and XP operate from different bases, with the former dominating banking and the latter focused on investing. Neither is content. Recent acquisition EasyInvest gives Nubank a play in the investing space, while XP is experimenting with banking products. In July of last year, the investment firm launched an international credit card.

Each has advantages. XP has won over a smaller (3 million) but more affluent clientele. Nubank has lured a larger (40 million) but less creditworthy and prosperous base. It remains to be seen which provides a better foundation for the long-term.

Beyond those listed, Nubank should expect a steady bubble of insurgents in the years to come. The Central Bank's support of startups, once such a boon, may become a nuisance. Beginning in 2019, the CBB began advancing an "open banking" framework, making it easier for tech companies to access user financial data with the consumer's permission. This allows challengers to build credit products and other fintech offerings more easily, smoothing the path to more bottoms-up competition.

The Little Bird Flies

Though Vélez will undoubtedly keep his eye on the rearview mirror, much of Nubank's recent rhetoric is forward-focused.

In 2019, the company opened its doors in Mexico; in 2020, it commenced operations in Colombia. We are yet to see the wisdom of either move.

Though companies like Meli have made regional expansion look easy, extending beyond Brazil is far from a simple maneuver. Differences in language, culture, and regulation require different approaches. Traditional banks like Itaú have flourished in Brazil but floundered elsewhere in the region.

No one will want to bet against Vélez, though. Outside of Meli, Nubank's leadership is said to be Latam's most thoughtful when it comes to international expansion. And it doesn't hurt that Vélez is not Brazilian, but Colombian. That allows the company to spin a broader pan-regional narrative rather than appearing as an interloper among hispanophones.

In time, Nubank may even have ambitions beyond Latam. In a 2019 interview, Vélez dropped the following hint:

For the next five years, we're focused on Latin America, but over a very long-term horizon, we think emerging markets are very interesting — when you look at Nigeria, Indonesia, Vietnam, India, you find the same oligopoly structure.

And yet, to become a $100 billion-dollar company, Nubank may not ever have to leave Brazil.

When you read about the rest of Garrincha's life, marked by alcoholism and personal problems, you get the sense he wished he could live in those three minutes. Against the USSR, the boy from Pau Grande delivered one hundred and eight seconds of pure poetry, pure play, dance disguised as competition. It was a feat of brilliance born out of brokenness.

In its finessing of Brazil's debilitated banking system, Nubank's triumph shares something fundamental with the "People's Joy." Against all odds, Vélez's company upended powerful incumbents and became the world's largest digital bank. Though only in its "first second," Nubank has executed memorably. We can only hope the rest of the match is just as thrilling.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.