Phantom: The Quest to be Crypto’s Multichain Champion

The crypto wallet has won the Solana ecosystem. It’s now coming for Ethereum – and MetaMask’s throne.

Brought to you by Phantom

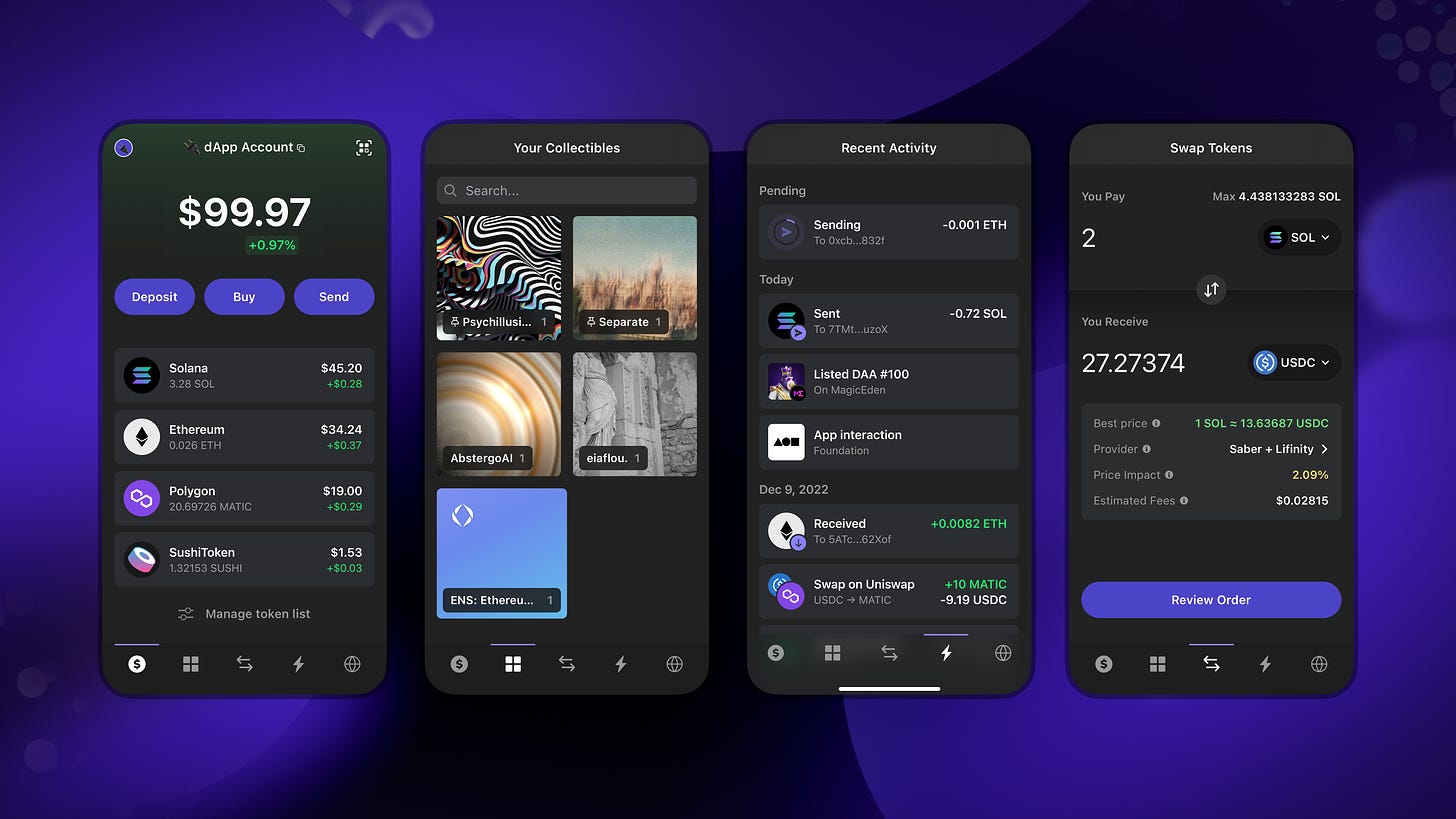

The first time I used Phantom’s crypto wallet, I was blown away. Founders Brandon Millman, Francesco Agosti, and Chris Kalani have built a beautiful, intuitive product with leading-edge safety features.

It makes interacting with web3 – whether you’re sending tokens, staking SOL, or buying an NFT – 100x less stressful and more enjoyable. There’s a reason the company has racked up millions of users in less than two years.

After becoming the standard in the Solana ecosystem, Phantom is taking its next big step, expanding to Ethereum and Polygon. This is big news with the potential to positively impact mainstream crypto adoption.

To get started with Phantom’s one wallet for everything, sign up here.

Actionable Insights

If you only have a few minutes to spare, here's what investors, operators, and founders should know about Phantom.

Phantom is going multichain. The wallet company shared major news last month: it’s coming to Ethereum and Polygon. Not only will this radically expand the size of Phantom’s opportunity, it will also put the company head-to-head with crypto’s biggest wallet: MetaMask.

A buttery product. Since launching in 2021, Phantom has grown at an extraordinary clip. The company’s exceptionally smooth product has been essential to that uptick. Use the elegant wallet, and you’ll see why it’s such a “buttery” experience.

A knack for making the right decisions. CEO Brandon Millman has cultivated a culture of intention and intuition. Phantom isn’t afraid to go with its gut, but only after carefully thinking through the different options. This balance has helped the startup make consistently good non-consensus decisions.

Crypto’s turning point. Every crypto company right now is asking itself a question: where are we? How far along the adoption curve is our industry? Using Carlota Perez’s framework for analyzing the maturation of great technologies, crypto appears to be at a turning point. The industry will need to act savvily to usher in a “golden age.”

The power of wallets. Though used by millions, we still don’t really know what crypto wallets will become. What will they look like? What functionality will they absorb? At present, they hold a position of power in the ecosystem, with numerous expansion opportunities.

This piece was written as part of The Generalist's partner program. You can read about the ethical guidelines I adhere to in the link above. I always note partnerships transparently, only share my genuine opinion, and commit to working with organizations I consider exceptional. Phantom is one of them.

Few startups had a better 2021 than Phantom. After launching in the spring of 2021, the crypto wallet went on the kind of tear that demonstrates what true, scalding product-market fit looks like, amassing millions of customers, $118 million in capital from firms like Paradigm and Andreessen Horowitz (a16z), and a unicorn valuation. For a company younger than most parmesans, this was a genuine annus mirabilis.

While 2021 might have been more eye-catching, I suspect 2022 will prove more important in Phantom’s story. (For what it’s worth, I am betting it will be a long story – I angel invested in the company’s last round.) As the crypto markets have cooled dramatically, founders Brandon Millman, Chris Kalani, and Francesco Agosti have continued to ship substantial improvements and set new benchmarks for how a consumer wallet should function and what it should feel like. It is both an elegant, intuitive product and one packed with security features designed to protect customers better. I suspect many of these safeguards will become standard in time, as ubiquitous as a spam filter.

These are not incremental improvements, yet Phantom’s latest announcement dwarfs them: it is coming to Ethereum and Polygon. Anyone that has used both Phantom and ecosystem standard MetaMask will recognize the improvement this represents. Though the crypto community should be grateful for MetaMask’s service these past few years, many believe it is yesterday’s wallet. To attract and retain mainstream usage, crypto needs a consumer-grade wallet that travels across ecosystems, supporting on-chain activity. It requires a crypto pocketbook, a digital, bottomless backpack carrying identity, information, and property across the internet.

This is Phantom’s ultimate goal: to become an inventory for everything. Such supremacy never comes easily, but it is definitely in play. Few wallets offer such a smooth product; fewer still boast the deep ecosystem partnerships Phantom has cultivated; none carry those advantages across multiple ecosystems.

Origins: The right stuff

Many founders dream of capturing lightning in a bottle like Phantom. How did they go from zero to millions of active users in less than a year? How did an insurgent wallet provider come to dominate an ecosystem?

Answering such questions is never straightforward. Too many little decisions, hidden factors, and unrecognized moments make subtle but meaningful differences. But let’s accept the challenge. If we had to distill Phantom’s breakout trajectory, we might say it was the inevitable result of the right people building the right product in the right ecosystem at the right time.

First, the people. After spending time with Phantom’s founders, perhaps the most notable takeaway is that this is a team you would bet on to build many other products – a marketplace, SaaS platform, or super-app. Indeed, before founding Phantom, Chief Product Officer Chris Kalani raised funding for design startup Wake – eventually purchased by InVision. A common knock against crypto founders is that they tend toward the idealistic and lack a strong commercial sense. That’s not the case with Millman, Kalani, and Agosti. Though believers in crypto’s potential, they are pragmatic, possessing the savvy it takes to build a substantive business.

Critically, they blend this strategic sense with expertise. The trio met while working at 0x, an established crypto infrastructure player focused on decentralized exchanges (DEXs). During their stint at 0x, Millman and company learned to build at different parts of the stack, from the protocol layer up to consumer-facing products. For example, Millman helped ship Matcha, a popular DEX aggregator that makes it easy for consumers to find the best pricing across exchanges.

“The strength of the team stood out,” investor Arianna Simpson remarked. “Typically, we don’t see that level of product thinking among founders just starting out,” the a16z GP added. Other sources echoed Simpson’s take, commenting on leadership’s technical bonafides, executional skill, and product sensibilities.

It was during their time at 0x that Phantom’s founders recognized the need for a better wallet. We started to see where the pain points were both as developers and users,” Kalani said. “And as we built Matcha, we kept feeling held back by the available wallets. At that time, it was MetaMask.” No matter how much effort Kalani put into making Matcha a beautiful, seamless experience, as soon as consumers had to enter an unintuitive wallet, there was a sharp drop-off. Rather than an isolated issue, it became increasingly apparent this was an industry-wide phenomenon. As long as wallets remained convoluted, customer adoption would be hamstrung. “It became clear there was a big need,” Kalani said.

Others had recognized the need, too. Before Phantom emerged in 2021, a wave of wallet startups had come to market intending to ease onboarding and displace MetaMask. Few had truly broken out. Simpson described the wallet space as a “graveyard” with many solid offerings struggling to expand beyond thousands or tens of thousands of users. Many struggled to figure out distribution or offer sufficient differentiation. If Millman, Kalani, and Agosti were to compete, they would need to craft a thoughtful product with the right distribution model.

As we’ll discuss in greater detail, product has proven to be one of Phantom’s core strengths. The company has constructed a beautiful, intuitive wallet with deceptive power. It may feel simple, but its safety and privacy features put it ahead of the competition.

Critically, Phantom avoided product traps in its early days. For example, the company started by building a web extension rather than a mobile app. Though an app could provide a fuller experience, Millman’s team recognized that it was too early for that approach to thrive. Web3 was dominated by advanced financial transactions or developer activity – neither of which was well suited to mobile. The slow speed and high cost of transactions on the Ethereum network also favored a desktop environment. That wasn’t an obvious decision at the time. “A lot of people saw MetaMask and thought building a Chrome extension was not it,” Millman said, “Many went straight to mobile.”

As high-speed blockchains like Solana have grown in popularity and web3 expanded into NFTs and other more consumer-focused applications, Phantom launched a mobile experience. But starting in-browser was clearly the right decision for the company.

However, Phantom’s best decision was to build in the right ecosystem at the right time: Solana in early 2021. It was an idiosyncratic bet to make and one the team thought through carefully. “We didn’t want to compete head-on with MetaMask, coming out of the gate with fewer features,” Kalani said, “We wanted to dominate, figure out what we were doing, and then grow from there.”

That ruled out Ethereum, but rather than narrowing the possibilities, it expanded them. Before settling on Solana, Millman considered Bitcoin (“we wrote that off pretty early because we want to enable dapps”), Cosmos, NEAR, and Polkadot.

A few factors pushed the team towards Solana.

First, there was surprising stablecoin liquidity on the chain. When Millman dug in, he discovered that the second largest deployment of USDC was on Solana, second only to Ethereum. At 0x, he’d learned that stablecoin liquidity was the “lifeblood” of DeFi activity. Solana’s strength gave it a better chance of generating usage and momentum.

Second, the Solana team had a differentiated view of the crypto market and a willingness to support the upstart wallet. In those days, the Layer 1 was still small, priced at a couple of bucks. (Since then, it has gone through an enormous hype cycle, much like the rest of the crypto sector, but ultimately remains a much more prominent ecosystem player than it was twenty-four months ago.) Its relatively small size made it easier to discuss what a true partnership between Phantom and Solana might look like. “They had a different take on the ecosystem,” Millman said, “it was very BD-oriented. They wanted to drive it from the beginning.”

Finally, Phantom was swayed by the technology itself. Solana was fast. Not only did that seem like a value proposition that could win over users, but it also impacted the product Phantom could build. “The UX starts with the blockchain you build on,” Kalani said. “What we loved about Solana was that it was incredibly fast and incredibly cheap. We thought, ‘this is how crypto should feel. This is how software should feel.’”

Not all shared Phantom’s conviction. “A lot of investors were like, ‘This Solana is cute, but when are you moving to Ethereum,’” Millman remembered. Even Simpson, one of Phantom’s first backers, wasn’t sold. “I wasn’t totally sure,” she said, “If you pick the wrong chain, you can have a great product, and no one will use it.”

In the end, Phantom couldn’t have timed its decision better. Solana grew exponentially in 2021, with its token appreciating 14,875% to a high of $239.60. Even less speculative metrics grew meaningfully, albeit at more modest numbers. Weekly active developers expanded from 26 in December 2020 to more than 2,000 a year later. Protocol revenue rose from $1,800 per week to $787,000.

Even before its product was out in the wild, Millman sensed growing energy. The response was rabid whenever Phantom posted screenshots or videos of their work. “It almost felt like we skipped the phase of discovering product-market fit,” he said. “People were really excited about just mock-ups.”

In March of 2021, Phantom launched its beta; by the time it fully opened its doors in July, it already had 200,000 users. Then the fun really began. Over the next few months, Phantom picked up tens of thousands of new users every week – sometimes more than 100,000. One important catalyst was the mint of Degenerate Ape Academy. The attention the NFT project received pulled many into the Solana ecosystem and, inevitably, to Phantom. In short order, Solana became what Millman described as “the second-most robust ecosystem behind Ethereum.”

Phantom succeeded in becoming the standard of this expanding ecosystem. Millman noted that many Solana stans seemed “proud” that their community had a product that surpassed the best of what Ethereum and other chains had to offer.

Like Solana, Phantom’s team showed a savvy for picking up partnerships that sharpened their trajectory and fortified their position. One team-up was with NFT marketplace Magic Eden, run by old friends from the crypto industry. Indeed, Magic Eden co-founder Zedd Yin noted that he was partially inspired to build on Solana because of the Phantom founders’ interest. “When I saw them building on Solana I thought, ‘Oh shit, we should pay attention.’” Magic Eden now presents Phantom as a user’s first choice, while Phantom provides rich NFT functionality and strong links to Magic Eden. For example, customers can list NFTs directly onto the marketplace without leaving the Phantom wallet.

Though Phantom owes much of its 2021 growth to Solana, the reverse may also be true. “I think you could make the argument that Phantom had a lot to do with Solana’s growth,” Jesse Walden, co-founder of Variant and Phantom investor, said. “The Solana ecosystem was very easy to onboard to. There’s a symbiotic relationship between Solana and Phantom where one fueled the other and visa-versa.” Magic Eden’s Yin agreed: “It was a turning point for the Solana ecosystem to have these very legitimate, Ethereum-native developers building in the ecosystem.”

Though Phantom had raised a $9 million round out of the gate just a few months earlier, Phantom’s summer ascent invited strong venture interest. It didn’t hurt that the wallet had also started generating revenue, lightly monetizing in-app token swaps. “Every major investor reached out and wanted to chat,” Millman recalled.

Paradigm was among those inquirers. Though traditionally associated with Ethereum, the fund noted they were bullish about the Solana ecosystem in general and Phantom in particular. The opportunity to work with Coinbase co-founder Fred Ehrsam was a strong draw for Millman. “There’s no better partner to bring on,” Millman noted, “He’s one of the foremost experts on building crypto for the mainstream.” Paradigm led a $109 million Series B, valuing the company at $1.2 billion – not bad for a business that hadn’t existed a year earlier.

Every Sunday, we unpack the business world’s most important innovations and the stories behind them. Join 64,000 others today.

Product: Crypto butter

The highest compliment you can give Phantom’s product is that it works as you’d want it to. That’s no small feat in web3. More often than not, wallets are confusing, convoluted products that take a long time to master. Something as simple as sending tokens, purchasing an NFT, or swapping between currencies can seem baffling, especially to newcomers. I still remember interacting with a wallet for the first time and coming across a dropdown menu with names like “Ropsten,” “Rinkeby,” and “Goerli,” and feeling as if I must have gone wrong somewhere; if only I could figure it out.

For many consumers, using a wallet is not only bewildering but scary. The sheer volume of crypto fraud makes every transaction feel like a gamble. That’s especially true, given that transaction confirmations, which are a string of letters and numbers, are not human-readable. Will this be the time your funds are wiped? Is this the moment your NFT is stolen?

As readers will know, one of the funds I most admire is Union Square Ventures. The firm has succeeded in delivering extraordinary returns for nearly two decades, showing impressive selection and timing in the process. One of the firm’s “unwritten” filters for investment is “The Butter Thesis.” GP Nick Grossman explains it by saying that “‘Butter’ is the term we use to describe interactions & experiences that are just so smooth. Rich, easy, delicious. Hard to define formally, but you know it when you see it / feel it.” Grossman's examples include Stripe’s API, Splice’s software, and Airtable’s database.

Phantom is crypto butter. The team has created a rich, thoughtful, intuitive, and silky-smooth wallet. You can easily tab between your tokens, NFTs (organized by collections), a swapper, and an intelligent notification list. “We’ve explicitly designed for the average person,” Chris Kalani remarked, “We purposefully don’t expose every raw component.” The result is a polished experience – as simple to navigate as a well-made mobile app. Kalani’s experience building design startup Wake shows in these moments. Transacting on Solana, with its fast time to finality, adds to a smooth experience. (For the avoidance of doubt, USV is not an investor in Phantom – this is my own parallel.)

Very honestly, this was one of the primary reasons I was so excited by the company and keen to invest. From the first time I used it, Phantom felt like a huge step forward from what I was used to. Crypto products often feel excessively wonkish, under-designed, or difficult to use. Phantom is none of those things. It’s a joy, a demonstration that exploring web3 doesn’t have to feel arduous.

More critical than Phantom’s elegant design and UX is its commitment to security. Though no crypto wallet should be seen as unbreachable, Phantom’s team has demonstrated a desire to make it the most trustworthy on the market. To date, that’s helped it avoid the hacks that have plagued others.

So, what has Phantom done? For one thing, Phantom’s entire codebase has been audited by top firms like Kudelski Security. That company’s 2021 report is available for everyone to read. In addition, Phantom runs a bug bounty program designed to surface vulnerabilities before they become a problem, with rewards up to $50,000.

You might be familiar with the term “phishing.” In the web2 world, it usually refers to the practice of coaxing internet users to reveal personal information like the password to your email account, name of your childhood pet, or PIN to your credit card. Web3 phishing is a little different. Instead of going after personal information, crypto fraudsters are usually trying to snaffle your wallet’s secret recovery phrase or trick you into approving a damaging transaction.

Phantom’s first defense against phishing is a comprehensive “blocklist” it is constantly updating. Essentially, this is a record of sites engaged in phishing. Often these websites are designed to look like brands you trust – Coinbase, for example – with a slight variation in the URL as the only obvious differentiator. When Phantom adds a site to its blocklist, it improve the safety of the entire customer base, ensuring that no one else gets tricked by “Coinface.com,” for example. Tthe blocklist currently includes more than 2,000 addresses and counting. Phantom has also helped take down 1,000 fraudulent websites and 250 spam social media accounts engaged in phishing.

Another line of defense is Phantom’s NFT “burning” feature. Bad actors sometimes send customers a “free” NFT to mint, which can only be claimed by visiting a website. Once there, users have their money stolen. Customers can simply destroy unwanted spam NFTs within the Phantom app to avoid that risk. Since launching in August of this year, users have burned more 600,000 NFTs – decluttering their wallets and saving them from getting scammed.

Recently, Phantom helped incubate Blowfish, a crypto security startup that transforms a transaction preview into readable language. Effectively, it turns indecipherable, jumbled text and numbers into a message that explains what the consumer is about to do, issuing a warning if it detects a risk.

So far, Blowfish has scanned more than 85 million transactions and prevented 18,000 “wallet-draining transactions.” That means that 18,000 times, Blowfish’s technology has saved someone from having their funds wiped out. Phantom is currently the largest wallet that integrates Blowfish’s functionality and is best positioned to benefit from its increasing sophistication. “Where they’re incredibly far ahead of everyone is user protection,” Austin Federa, Head of Communications at the Solana Foundation, noted.

If customers ever do have a problem, they can contact Phantom’s support team. The startup offers 24/7 help with a resolution time of just 14.8 hours. Anyone that’s had to ask a crypto company for assistance before will know that such availability and speed is unusual. Phantom’s 7-person team has resolved more than 30,000 tickets. To keep users even safer over time, Phantom passes on lessons to Blowfish, helping to train its proprietary detection engine.

Phantom also prioritizes privacy. It doesn’t have access to funds or private keys, with the latter encrypted on customers’ devices. It also hides user IP addresses from external parties, such as RPC providers, by routing all requests through a privacy proxy.

This became a hot topic after ConsenSys, owner of MetaMask and Infura, revealed it collected user data. MetaMask gathers user identification information, including contact details. When interacting with Infura via MetaMask, ConsenSys collects wallet and IP addresses. In response to the backlash, ConsenSys is planning to update its policy.

Ultimately, Phantom’s product strength boils down to a commitment to make the best possible wallet – and to do what it takes to make that happen at every level of the stack. From the blockchain it is built on to the features it introduces, Phantom has created a rarity in the crypto world: a product as smooth as butter.

Expansion: Going multichain

Phantom doesn’t just want to be the biggest wallet in the Solana ecosystem. It wants to be the most significant wallet in crypto, full-stop. A couple of weeks ago, the team announced it was taking the natural next step toward becoming a true multichain champion. In a blog post titled “One Wallet for Everything,” Phantom noted it was adding support for Ethereum and Polygon.

It represents a huge move, radically expanding Phantom’s market size and competitive set. Though Solana is now a major ecosystem, Ethereum is still much larger. It has a $148 billion market cap at the time of writing, compared to Solana’s $285 million; total value locked is $24 billion compared to $296 million; and weekly active developers total 2,357, compared to 343. Ethereum also boasts a supermajority of NFT trading volume. Factor in an L2 like Polygon, and these figures increase.

This is not a knock against Solana. Ethereum has had many more years to establish itself, and Solana’s ascent over the past two years has been extremely impressive. That it bests Ethereum on number of daily transactions (approximately 16 million vs. 950,000), and occasionally, daily active wallets show the value of its high throughput offering. Instead, Ethereum’s size demonstrates the scale of the challenge and opportunity in front of Phantom. It is now fighting for supremacy in arguably crypto’s most influential community.

Phantom’s growth will not go uncontested. Jesse Walden noted that Millman was shrewd to start with Solana since all Ethereum users “at least had some solution.” Phantom will now need to best these solutions, namely MetaMask. It will believe that its buttery product, robust safety features, and cross-chain functionality give it every chance of taking share.

Of course, it does not need to win share to thrive. If you believe crypto is likely to grow and that Ethereum and Polygon will help power its ascent, Phantom can succeed without convincing users to switch. Instead, it can focus on winning net-new users, those who may not want or need to learn what Rinkelby is, prefer an intuitive experience, and find it valuable to transact via browser and mobile app. Phantom seems ideally situated to pick up these newcomers; in practice, I suspect it will also convert a meaningful number of existing users.

Phantom has taken a typically systematic approach to its expansion. Though we are still short of an official release, the team has taken considerable time to ensure it can maintain its product experience.

As part of its push, Phantom has also partnered up with Polygon. “For us, it was natural to approach them,” Ryan Wyatt, CEO of Polygon Studios, noted. “Wallet friction is a really big hurdle, and Phantom is a really high-caliber team.” As Polygon seeks to win web3 use cases, it recognizes the value of a world-class wallet experience.

While details are light, Phantom and Polygon noted their eagerness to push toward a deep partnership. “We have a pretty ambitious roadmap,” Wyatt said. Given Polygon’s exceptional business development track record – it has brokered partnerships with Starbucks, Instagram, Stripe, Disney, and others – a link-up could take eye-catching forms.

One possibility is that the duo collaborates to create gaming-specific wallet functionality – an area of focus for Polygon. “We’re seeing the next generation of web3 games on the horizon,” Wyatt remarked, “We want to make that a seamless experience.”

Team: Intention and intuition

Phantom’s team is a primary reason why I’m a believer in the company. As we’ve discussed, the startup’s founders have the expertise, executional ability, and strategic sense to build a category leader. Much of this seems to come from the balance in the team and the way this has translated to the broader company.

Though effective individually, Phantom’s founders are especially effective as a trio. “I really like having three co-founders,” Millman said. “There’s always a natural tie-breaker, and if one person needs to recuperate, there are still two of us that can shoulder the burden.”

Millman also noted that Phantom’s setup makes it easy to divide and conquer, with each founder handling discrete functions. CTO Agosti manages engineering, ensuring the reliability of a product used by millions. Kalani takes care of product, design, and marketing – functions in which he has “incredible intuition,” according to Millman. Indeed, Millman credited Kalani for seeing the NFT wave coming and quickly adapting the product to capitalize. As for Phantom’s CEO, he focuses on “making sure Chris and Francesco don’t have to focus on anything else.” That includes operations, finance, fundraising, and recruiting. Millman appears particularly good at adding elite talent to his team and giving them the space to thrive.

As well as focusing on different functions, Phantom’s founders have distinct but complementary personalities. “We balance each other out,” Kalani said. The CPO tends to be more aggressive, pushing the company to go further, faster. Agosti airs on the conservative side, minded toward risk. Millman sits in the middle, mediating Kalani’s desire for speed with Agosti’s meticulousness.

Phantom seems to be an expression of these differing perspectives, blending fast-twitch intuition with methodical intent. The result is a business that makes correct, non-consensus decisions with impressive frequency. Sure, there was some luck in Phantom choosing to go all-in on Solana in 2021, but there was also thoughtful analysis. Of course, the wallet benefited from last year’s NFT craze, but it was no accident that the company was positioned to capture it. It sounds simple, but this is what great companies are made of: the ability to make good decisions over and over again.

Beyond its leadership, Phantom has a strong team. Earlier this year, for example, Millman brought aboard Kevin Jacobs as General Counsel – a critical role. Jacobs previously led regulatory functions for Robinhood Crypto. Ron McKown was also cited as a key addition. The Head of Security has served in similar functions across the industry at companies like Casa, Voyager, and BitGo. Other hires have come from ConsenSys, Coinbase, and Ledger, along with web2 giants like Facebook and Lyft. “It’s helpful to have people that come from web2,” Millman said, “It makes sure we’re building something for a mainstream audience.”

Maintaining a high-quality bar is important to the company, as is prioritizing self-starters with low ego. “We really like people that hack and tinker,” Kalani said, “People that just want to build great things.” Frequent “show and tell” sessions give team members a chance to display their work and get feedback. “Shipping is a social currency at Phantom,” Kalani remarked.

Perhaps the final vital aspect of Phantom’s culture is its desire to eschew zero-sum games and “grow the pie,” per Millman. When I asked Kalani what ambitions he had for Phantom in the long term, he spoke of wanting to push crypto beyond its tribalism. “There’s so much of that,” he said. “We hope we can be a leader in bringing different web3 ecosystems together. We want a product that makes it such that you don’t have to choose sides.” Creating one wallet for everything would go a long way toward thwarting crypto’s infighting.

Risks: Where are we?

In her book Technological Revolutions and Financial Capital, Carlota Perez outlines the cycle of great technologies.

First comes the “Installation Period,” during which exuberance over the advent of a new technology attracts attention and capital, resulting in financial gains and the creation of an asset bubble.

As enthusiasm grows, the nascent industry reaches a “turning point,” in which it must decide to mature or risk dissolution. Regulation is often part of this phase, curbing excesses and laying the groundwork for broader adoption.

If this is managed successfully, the “Deployment Period” is reached. Though less exciting than the Installation Phase, this era sees the technology fulfill its promise and achieve adoption, ushering in a “golden age.”

Where is crypto along this curve? We may have reached a turning point. The first decade and a half have been marked by remarkable growth and rampant speculation. Though crypto bubbles have bloomed and burst several times over, the current collapse, sparked by FTX’s demise, seems likely to force critical decisions. The kind that determines whether a turning point is well-managed, whether Installation becomes Deployment.

Above all, this seems like Phantom’s greatest risk, best summed up in a few questions: Will we grow up? Will crypto become more than a promising technology hyped into heatstroke? Will tens or hundreds of millions use it for more than just speculation? This is a risk not just for Phantom but for every company in the space.

Indeed, one of the reasons I like Phantom so much is because it is focused on these core questions. The explicit mission of the business is to allow more people to use this technology to push us closer to deployment. If we are to reach a golden age of blockchain, we need our best builders focused on these fundamental matters.

Though the uncertain future of crypto is Phantom’s biggest risk, there are others. Wallets represent a new internet primitive – a mash-up between a bank account, online identity, and a browser. Such capaciousness means that different product interpretations are possible, and our current frameworks could prove wrong. It’s possible, for example, that browsers absorb wallet functionality or that providers verticalize around different use cases. Rather than having one general-purpose wallet made to travel with you across the internet, we may have a dozen made for music NFTs, gaming, DeFi, and more. “You might end up seeing wallets that are more specialized by application,” Jesse Walden noted.

While meaningful shifts almost always open the door for upstarts, Phantom looks more than capable of weathering volatility. It is well-capitalized, an attentive product builder, strategic about its partnerships, and genuinely interested in pleasing consumers.

Future: Everything Everywhere All at Once

“The design space we play in is as big as web3 itself,” Millman said. When I think about Phantom, this is what makes me most excited. While the nascency of wallets as a category poses some risk, it offers remarkable possibilities. What might wallets become? What uses will they serve? How important will they be?

For now, wallets are in an extraordinary position of power, sitting at the nexus of consumers and developers. Such positioning affords many opportunities. Swapping, staking, lending, buying, auctioning, flexing – all are consumer behaviors Phantom can lean into if it sees an opportunity. “Any verb that people like to do already is an opportunity for us to build something directly into the wallet,” he said. That might involve creating a beautiful media player for music NFTs or a social network built on top of wallet addresses.

Gaming is expected to be a particular focus over the next year. Both Solana and Polygon are investing in gaming use cases, and despite the troubles players like Axie Infinity have had in 2022, there are many that believe the space will be vital in taking web3 mainstream. Phantom’s close ties to relevant ecosystems, partnerships with NFT marketplaces, and strong support for digital collectibles position it to catch future tailwinds.

There are similarly numerous opportunities on the developer side. For example, Phantom could allow dapp builders to better engage with its users, with consumers toggling on a button to receive an email from the project.

More intriguing is the potential to serve as a source of discovery and distribution. In the future, consumers may find and engage with new dapps through Phantom’s interface. Instead of turning to Google when looking for a staking provider or crypto game, you might use a Phantom app store or search console that makes it easier to get up and running, perhaps even factoring in your existing transactions and balances. As Phantom expands across networks, such interactions may become increasingly seamless, without even a need for the user to know whether they’re using Solana or Polygon or NEAR or something else. “It’s probably a ways a way,” Chris Kalani conceded, “but our vision is that a wallet should work with every network, switching between them just like your phone automatically switches between 5G and LTE.”

In time, Phantom may make this a reality. It may become crypto’s multichain champion, an application that can do everything you need in web3, anywhere you want. But, they will not rush. Though aware of market trends – and willing to capitalize on them – this is not a company searching for shiny objects. “We don’t want to be a multichain wallet that integrates a flavor of the month blockchain for no reason,” Millman said. “We want to take highly convicted bets and work closely with that ecosystem to build special features.”

Novelist John Forsythe once said, “Idealism increases in direct proportion to one's distance from the problem.”

What is most impressive about Phantom is that it breaks this law. Despite their considerable experience building at every altitude in the crypto stack, Millman, Kalani, and Agosti have retained a belief in what is possible without losing themselves amidst euphoria. They balance idealism with pragmatism, ambitious vision with commercial sense. They are true builders, addressing a significant problem from the ground up and taking care of the details.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.