This report is presented in collaboration with Masterworks…

Art is an under-appreciated asset class. Indeed, 84% of ultra-high-net-worth individuals invest in art and other collectives, per a 2019 Deloitte survey. That makes financial sense — contemporary art outperformed the S&P 500 by 174% from 1995 through 2020. Wild.

Unless you had a cool $10 million lying around to buy a Picasso, though, retail investors have been locked out of this asset class — until Masterworks came along. Founded in 2017, the company allows investors to buy fractional shares of masterpieces by geniuses like Basquiat and Banksy. After sending today's piece, I plan to buy a few shares myself. I have my eye on a Rothko. If you'd like to join me, Generalist readers can skip the waitlist via this private link.*

Team

One way to look at S-1 filings is as an invitation to a party.

The company is the eager host, keen to entice you, the investor, to join them. They will explain that they are extremely fun people who have long histories of throwing the biggest ragers with the prettiest people and that frankly, you are late, very late for this one, this party, which may be the best ever.

These are the contours of the argument, but each party differs in appeal and aesthetics. Unity’s S-1 is an invitation to candy flip in Joshua Tree, spending the weekend staring into the metaverse. Roblox’s is a summons to the birthday party of a precocious, terrifying thirteen-year-old. Bumble is a Paint N’ Sip for young female executives. Palantir’s is a LARP of the First Crusade — take up arms, repel the infidels!

Each has its own merits and is internally consistent. Its appeal depends on who you are and what you care about — these filings have a vibe, and if you share it, then perhaps you will come along.

Robinhood does not know what party they are throwing.

Read part of the S-1 and you might expect a symposium on the democratization of finance held in a hedge funder’s brownstone. Read another and you’d imagine a Davey Day Trader fan meeting, spilled pitchers lacquering the tables of a local watering hole. (Alight on a third and you’d anticipate a nerdy sleepover, all esoteric comic books, and wonkish, penetrating conversation.)

Depending on where you look, Robinhood is animated by contrasting energies, trying to convince you of the intelligence and nobility of its endeavor at the same time that it assures you of its playfulness.

This is clear even within the first few pages. One spread proclaims “Our mission is to democratize finance for all”; the next alludes to the Game Stop fiasco’s chief protagonist with a cheeky “ROAR” ticker. A similar juxtaposition plays out a moment later: right before Robinhood’s founders extoll their values — clear-minded and sober as they are — they wink again at Roaring Kitty with this paraphrase: “If you like these values, you may like the stock."

This is amusing, certainly. But it leaves the impression of a business unsure of whether it wants to be the most serious fun company or the most fun serious company. Does Robinhood want to be the Allegiance of Magicians from Arrested Development or Mean Girls’ “cool Mom”? Is this an addictive social app with an economic agenda, or a bank with a sense of humor?

The heart of this conflict seems to be that Robinhood isn’t quite sure what power source it’s appealing to. It seeks the affection of the YOLO’ing retail trader while it looks to garner the trust of the large financial institutions from which it makes its money.

This separation of users and revenue is not unique, of course, but Robinhood’s position is made fraught by the cultural battle in which financial markets are embroiled. The company not only has to appeal to two customer bases, it has to appeal to two customer bases that hate each other. The fact that the GameStop “degenerate” despises short-sellers like Melvin Capital, while such moneyed institutions condescend to the common man makes Robinhood’s “servant of two masters” gambit even trickier.

That the business finds itself in this position is, oddly, a symbol of its strength. No other company has played as significant a role in making investing a cultural phenomenon as Robinhood, and if it is pulled by competing forces, that is only because it is at the heart of profound shifts. This, along with the genuinely jaw-dropping numbers will be enough to persuade many.

Robinhood may not understand what party it’s throwing. Like the high-schooler organizing their first rager, the company seems keen to boost its attendance by saying one thing to the jocks, another to the emos, a third to the hipsters. That lack of definition may give pause, and yet, there’s no doubt Robinhood’s invitation has that ineffable quality of the best of bacchanals: you simply know you won’t want to miss it.

Mentions

Crypto: 318

Options: 203

Margin: 125

Vladimir Tenev: 109

Baiju Bhatt: 93

PFOF: 65

Dogecoin: 10

Gamestop: 5

Citadel Securities: 2

Confetti: 2

Meme stocks: 1

History: Occupiers of Wall Street

A trope of entrepreneurship is that it is the “beginner’s mind” that often unlocks step changes. Freed of preconceptions, the ingenue sees moves the grizzled veteran ruled out long ago.

If not quite beginners, Robinhood’s founders, Baiju Bhatt and Vlad Tenev, were certainly interlopers in the world of finance. Meeting as undergraduates at Stanford, the pair found they had a great deal in common. Bhatt once remarked on the similarities between him and his future co-founder:

We were both only children, we had both grown up in Virginia, we were both studying physics at Stanford, and we were both children of immigrants because our parents were studying PhDs.

It was that interest in physics that first brought Bhatt and Tenev together. In 2005, both attended a summer research program held at Stanford’s Palo Alto campus, and quickly hit it off. By senior year, Bhatt and Tenev were not only rooming together but planning their future.

Following in the footsteps of their parents, both first turned to academia, matriculating to graduate programs. Bhatt was the first to feel the pull of entrepreneurship, moving to New York City. Not long after, he persuaded Tenev to drop out of his PhD program and join him.

Like many other numerically gifted graduates, Bhatt and Tenev found themselves drawn to the gravity well of traditional finance, and in particular, to the exciting world of high frequency trading.

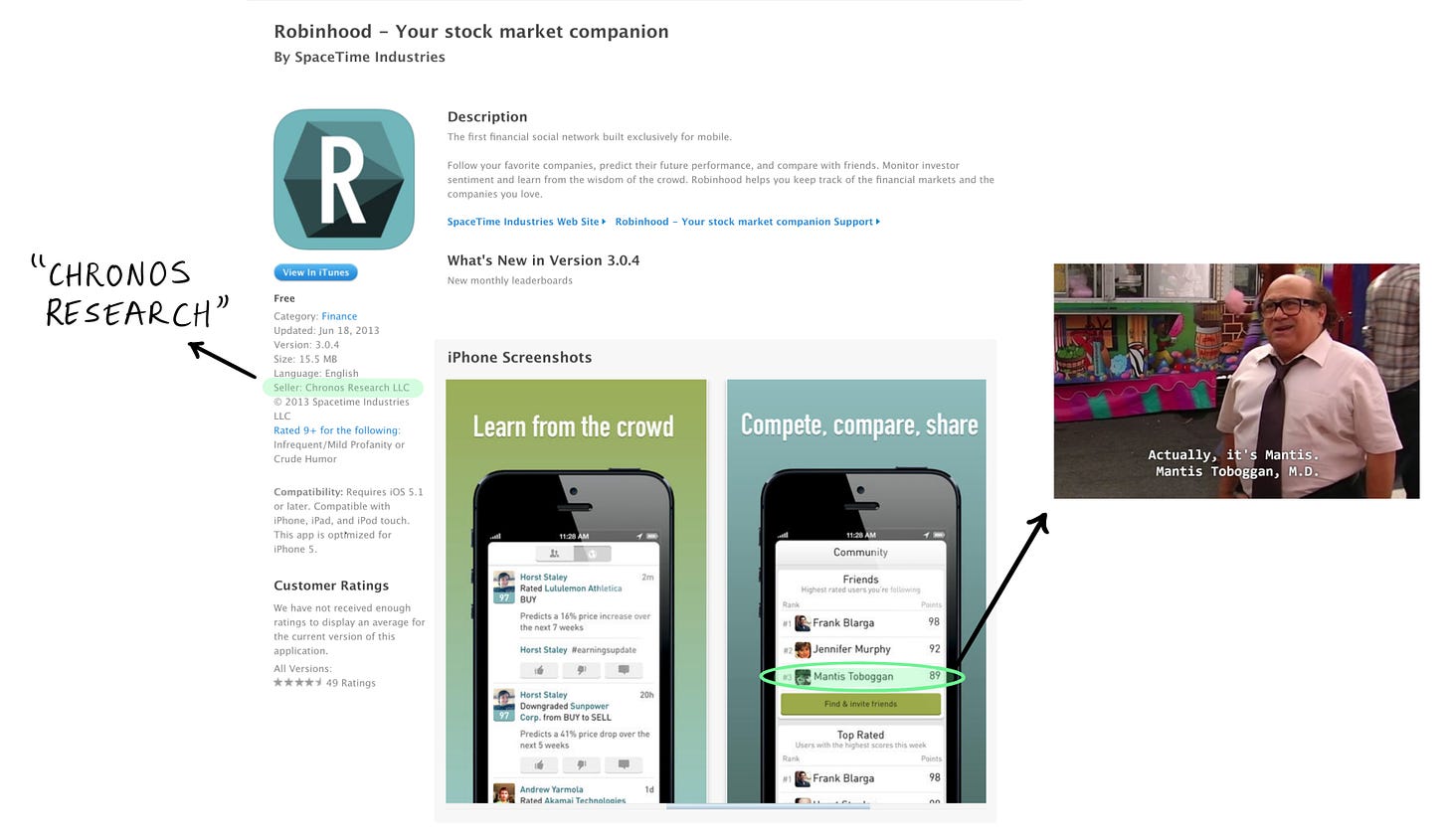

In 2011, Chronos Research was born from this newfound passion. The company made money by selling trading strategies to hedge funds and banks. This led the pair, who often worked from their Williamsburg apartment, to have a rude awakening when a certain movement took hold in 2011.

Occupy Wall Street swept into Zuccotti Park, its demand for greater economic parity capturing global attention. That shone a light onto the work Tenev and Bhatt were doing. At a party, Tenev was asked why retail investors couldn’t place trades at the same low cost as the institutional investors that Chronos served? After thinking about it for a few seconds, Tenev responded that he didn’t know.

After he left, Tenev couldn’t get the question off his mind. Though it was late, he called Bhatt to talk through the quandary. Bhatt would go on to stay up all night, intrigued by the questions Tenev posed. The first seeds of Robinhood had been planted.

It would take the duo two years to execute their first trade. Though that serendipitous conversation had sparked an obsession with the idea of offering commission-free trading, finding willing backers presented a considerable challenge. Some venture capitalists expressed skepticism that the company could make money without a fee structure, while others couldn’t understand why anyone would want to play the markets from the limited screen of a smartphone.

On the path to securing a $3 million seed round, Bhatt and Tenev’s fledgling business was rejected by 75 investors before meeting their first believer: Jan Hammer. The Index Ventures partner had previously worked at General Atlantic, a growth equity firm that had backed ETrade. Just as that business had popularized online retail investing, Hammer believed Robinhood could do the same for the mobile era. This was a platform shift and it presented a real opportunity. Google Ventures and Marc Andreessen shared Hammer’s conviction, completing the round.

That money gave Bhatt and Tenev the time to work, as well as the bank balance necessary to mollify regulators. As Tenev noted:

They don't want just a broker to come up with no capital and get a bunch of customers and then close up shop overnight. That's a really bad situation.

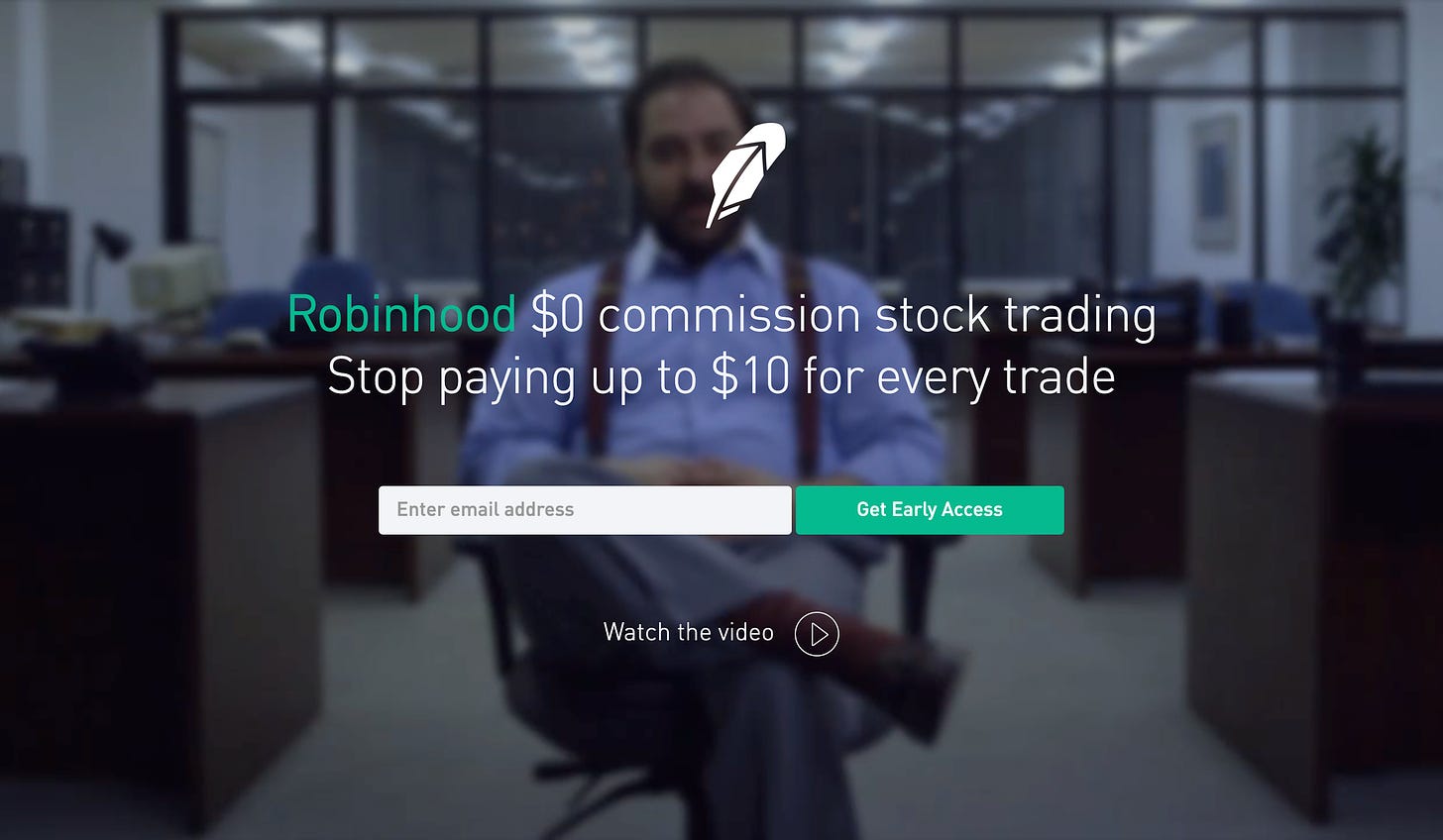

Showing admirable savvy for founders building in the consumer space for the first time, Robinhood’s founders built a strong pre-launch buzz. Inspired by once-beloved, now-defunct email provider Mailbox, Robinhood opened up a waitlist. Their simple landing page read, “Commission-free trading, stop paying up to $10 per trade.”

Within hours, Robinhood took flight.

I remember distinctly it was a Friday night...Everyone goes home, and I wake up Saturday morning, and I open up Google Analytics, and I see something like 600 concurrents on our site, which nobody knew about at that point. I was just like, "What's going on? This is not normal. Something must be wrong." Right?

And I'm looking at the analytics — I see a lot of traffic, or the majority of it, coming from Hacker News... And I open up Hacker News, and I see No. 1: "Chinese Land Spaceship on the Moon," No. 2: "Google acquires Boston Dynamics, the Robotics Company," and No. 3 was: "Robinhood: Free Stock Trading”...[Thirty five minutes later] we're at No.1.

The results were startling. Despite being caught so off guard, Robinhood had yet to configure its confirmation emails, the company landed 10,000 signups on day 1. Within a week, it had reached 50,000, and by the end of the year, still with no app, Robinhood had 1 million willing users.

Somehow, Robinhood had found incandescent product market fit with no product. If Bhatt and Tenev were relative ingenues to the world of finance, there was something fitting about the fact that two young physicists had constructed a rocket ship. A company founded off the back of a social movement was well on its way to becoming a cultural one, occupying Wall Street in a manner its founders could never have imagined.

(Aside: company mythologies are created post-hoc. In the years that follow great successes, the strange details and unusual digressions are often sanded down and lost. We think we may have found one of those under-discussed artifacts. In 2013, two years before an “official” launch, the company seems to have launched an app on Apple’s store. Could it be a different company? Possibly, but given the Seller name is listed as “Chronos Research,” we’re inclined to believe it’s Tenev and Bhatt’s work. Far from the slick product that came later, this iteration of Robinhood was a social trading app that allowed you to compare trades with other users and rated performance on a leaderboard. Was this product functional? What caused the pivot away from social? We don’t know for sure, but we hope to hear the story someday. The one thing we can deduce is that the pair are fans of the gloriously savage comedy It’s Always Sunny in Philadelphia — one of their stock usernames is listed as “Mantis Toboggan.” That’s doctor Mantis Toboggan to you, Vlad.)

GameStop: Anatomy of a stock block

The GameStop short squeeze was a financial opera that rivals the mayhem of the 1980’s leveraged buyout dramas. To understand what happened, we must first meet our players.

At the center of the scene is GameStop (GME), a mainstay of American malls that sells video games and related paraphernalia. Like Blockbuster before it, GME’s brick-and-mortar model has been buffeted by the increasing digitization of entertainment. Shop closures forced by the coronavirus turned what seemed to be an inexorable decline into an immediate, existential threat. From January 1, 2020 to April of the same year, the stock sank from above $6 to $3.12.

Expecting GME’s slump to worsen, hedge funds like Melvin Capital took short positions in the company. (They started doing so in 2014, in fact). Meanwhile, some value investors believed the stock had been oversold. Though “Big Short” celebrity Michael Burry had snaffled up a 3.3% stake in the business in 2019, it was Ryan Cohen’s involvement over a year later that raised the temperature. In November 2020, the Chewy founder revealed his firm had built up close to a 10% position in the business and intended to push for the company to focus on online sales.

Partially influenced by this activity, the stock began to generate interest on Reddit forum, r/wallstreetbets (WSB). As early as 2019, Keith Gill — who goes by “DeepFuckingValue” on Reddit and “Roaring Kitty” on YouTube — expressed his interest in the company, buying call options. Others began to follow suit.

(If you’re not sure what a call option is, don’t worry. “Calls” are an agreement in which the buyer purchases the right, but not the obligation to purchase a stock at a certain price. For this privilege, the buyer pays a “premium.”)

This activity hit hyperdrive at the turn of the year. On January 11, 2021, GME announced that Cohen and two his lieutenants had joined the company’s board of directors, with the aim of driving digital growth. The markets lost their minds.

Within three days, GME had risen 100%, within touching distance of $40 a share, and showing no signs of letting up. Even after Citron, a research firm with a history of identifying doomed businesses, raised its concerns, GME only accelerated. WSB was at the heart of a dizzying ascent that combined the diligent research of an institutional investor, the fervor of a religious sect, and the meme-savvy of a sassy teenager.

Couching their support of GME as a battle between internet rebels and anodyne money men, WSB’s community galvanized a short squeeze, which became a gamma squeeze.

This is wonkish stuff. A basic definition of a couple terms here:

Short squeeze. Investors that took a short position on GME did so because they thought the stock would go down. When it went up instead, these investors cap their losses by buying the stock, before it goes up even more. This has the effect of increasing the stock’s price.

Gamma squeeze. Remember what we said about calls? Ok, good. Well, when a buyer purchases a call, the “market maker” (firms like Citadel Securities that ensure there’s liquidity to buy and sell stocks) hedge their exposure by actually buying the stock. When the stock price goes up, market makers have to buy more, even as the number of call purchases increases. The result is an intensifying loop.

The result was that GME went stratospheric. The stock surpassed $480 and even hit $500 in pre-market trading one day. The equity had started the year at just $17. (Keith Gill reportedly turned a $53,000 options play into $48 million.)

Ordinarily, such frenzies are to Robinhood’s benefit. As we’ll discuss soon, the company’s revenue model is tied to usage and the GME mania saw frenetic trading activity. But that’s only true within limits.

Though the process of buying a stock on Robinhood looks frictionless, the reality is that a series of complex mechanisms and credit relationships occur behind the scenes. When a user buys a stock, it isn’t “settled” instantly, meaning the buyer doesn’t take charge of the equity and the seller doesn’t receive money right away. Instead, settlement occurs after two days, referred to as “T+2.”

That means brokers like Robinhood have to take credit risk: they’re guaranteeing money to the seller that has yet to be received. Clearing houses and organizations like The Depository Trust & Clearing Corporation (DTCC) police this relationship, ensuring that brokers have sufficient collateral to provide this credit.

In the middle of the night of January 27, Robinhood received word that GME’s volume meant it would have to post billions of dollars in collateral by the next morning, or face a trading blackout on the platform. The company had raised more than $2 billion over eight years, now it was being told it needed to eclipse that sum in a matter of hours.

Tenev and Bhatt moved quickly, reaching out to investors with the kind of ask rarely requested by a revenue-generating unicorn: send us as much money as you can. To expedite the process, Robinhood offered attractive terms with preferential clauses for those that acted first. The first class of investors capitalized a convertible note that offered a 30% discount to the IPO price, with an additional 15% in warrants.

Backers sprang into action. Ribbit, Sequoia, a16z, Index and others sank $3.4 billion into the business over the coming days. By the following Monday, Robinhood had received more money than it needed and those who dallied saw their funds either rejected, or put into a deal with a higher cap and no warrants attached.

That financing staved off a complete shutdown, but Robinhood had not escaped unscathed. Like many other trading platforms including Webull, Public, and M1, Robinhood halted trading on more than a dozen names, including GME. Though other players struggled with the same strictures, Robinhood’s cryptic messaging fed rumors that the company was in collusion with the traditional capital class. Many remarked on Robinhood’s relationship with Citadel Securities, given that the market maker is a major source of revenue.

Before Tenev had the chance to wrestle back the narrative (something he would fail to do repeatedly, demonstrating remarkable hamfistedness), the backlash had begun.

Portnoy’s complaint arrived early, with Barstool’s liver-cheeked CEO proclaiming “Robinhood is dead.” Others soon joined in: Ocasio-Cortez was furious, WSB was apoplectic, Twitter raged and burned. SPAC-smith extraordinaire, Chamath Palihapitiya referred to Robinhood as “corporatist scumbags” (whilst apparently forgetting his brief, lucrative stint torpedoing our collective neurochemistry).

Of course, customers had every right to be angry. While users could sell their shares in businesses like GME, buying had been shut off.

Customers and commentators were not the only ones to take issue with Robinhood. In mid-February, Tenev, Ken Griffin of Citadel Securities, Gabriel Plotkin of Melvin Capital, Steve Huffman of Reddit, Jennifer Schulp of the Cato Institute and Keith Gill testified before Congress. Though Tenev argued that the trading restrictions were put into place to meet the increased regulatory demands (aka: the billions of dollars in capital), lawmakers didn’t seem entirely convinced.

Whatever one’s position on Robinhood’s handling of the situation — and surely even Tenev himself would agree there is room for improvement — the company seems to have emerged better for the experience. The S-1 notes an increased investment in customer service, as well as hardier infrastructure designed to handle 30x the volume of 2020, and 3x the “highest load we’ve seen in the past.”

The saga isn’t over, of course. Though Robinhood did receive a $70 million FINRA penalty for unrelated outages in March 2020, and a $65 million fine for failing to disclose earning revenue via Payment for Order Flow, no such fines have been levied against the business for the GME debacle. Whatever Robinhood incurs, it will do so as a public company.

Market: The market of markets

Robinhood is the rare company that is not only capitalizing on large, existing markets, but expanding them through its activities.

Retail investing in the US alone represents a significant opportunity. Charles Schwab estimates retail traders have total assets of approximately $50 trillion. The involvement of individual investors has grown rapidly in recent years, with retail investors nearing 20% of total US equity volume, doubling from 2010. Mobile-first discount brokerages like Robinhood have undoubtedly contributed to that rise.

Retail trading’s share jumped from ~15% to ~20% from 2019 to 2020, indicating that is not the whole story. Much of this appreciation seems to have been driven by the changes wrought by the coronavirus, with volatility attracting speculators, lockdowns enticing the bored, and stimulus checks providing individual liquidity. Low interest rates and the prolonged bull market are other macro factors that emphasize we should not overly ascribe the “retail revolution” to Robinhood and its coevals.

Still, there’s no doubt Robinhood has created new investors. Between 2015 and 2021, more than half of its funded accounts came from first-timers. It has established itself as the default on-ramp, particularly with younger generations. This has not only impacted the complexion of markets, but of culture. The past year’s NFT mania can be traced back to the neobroker as investment and ownership become means of public self-expression.

There’s reason to believe in a market expansion story. A Pew Research survey found that just 35% of Americans held stocks, bonds, or mutual funds outside of those in IRA or 401(k) accounts in 2019. Robinhood will believe a significant portion of the remaining 65% can be converted to the retail game. Even without factoring in the international opportunity — significant but complicated — the company clearly has room to run.

Of course, Robinhood is not just a broker for traditional equities. In 2018, the firm rolled out cryptocurrency trading, now a meaningful part of the business. For the three months ending March 31, 2021, 17% of the company’s total revenue came from crypto transactions. This was up from 4% the previous quarter. Much of it arrived from meme-project Dogecoin.

Though the default in traditional retail trading, Robinhood is much less established in the crypto world. Coinbase, for example, dwarfs the firm when comparing either transaction-based revenue from crypto, or the crypto assets under custody — $223 billion versus $11 billion. Yet, it still feels like Robinhood can expect growth here. Only rigid non-believers will think crypto has reached its pinnacle, and as the market grows Robinhood will hope to maintain share, at the very least. As the lines between equities and cryptocurrencies blur, it's reasonable to think that businesses that offer all-in-one products, like Robinhood, may stand to benefit.

This is only half of the picture. Certainly, Robinhood can make a strong growth case based on market tailwinds. But what happens when the party stops?

Since its inception in 2011, Robinhood has surfed a bull run. That has enticed more individuals to trade — it’s a lot more fun to bet on your favorite companies when their value increases. It remains to be seen whether users stick around when prices plummet and, unlike 2021, take a while to bounce back.

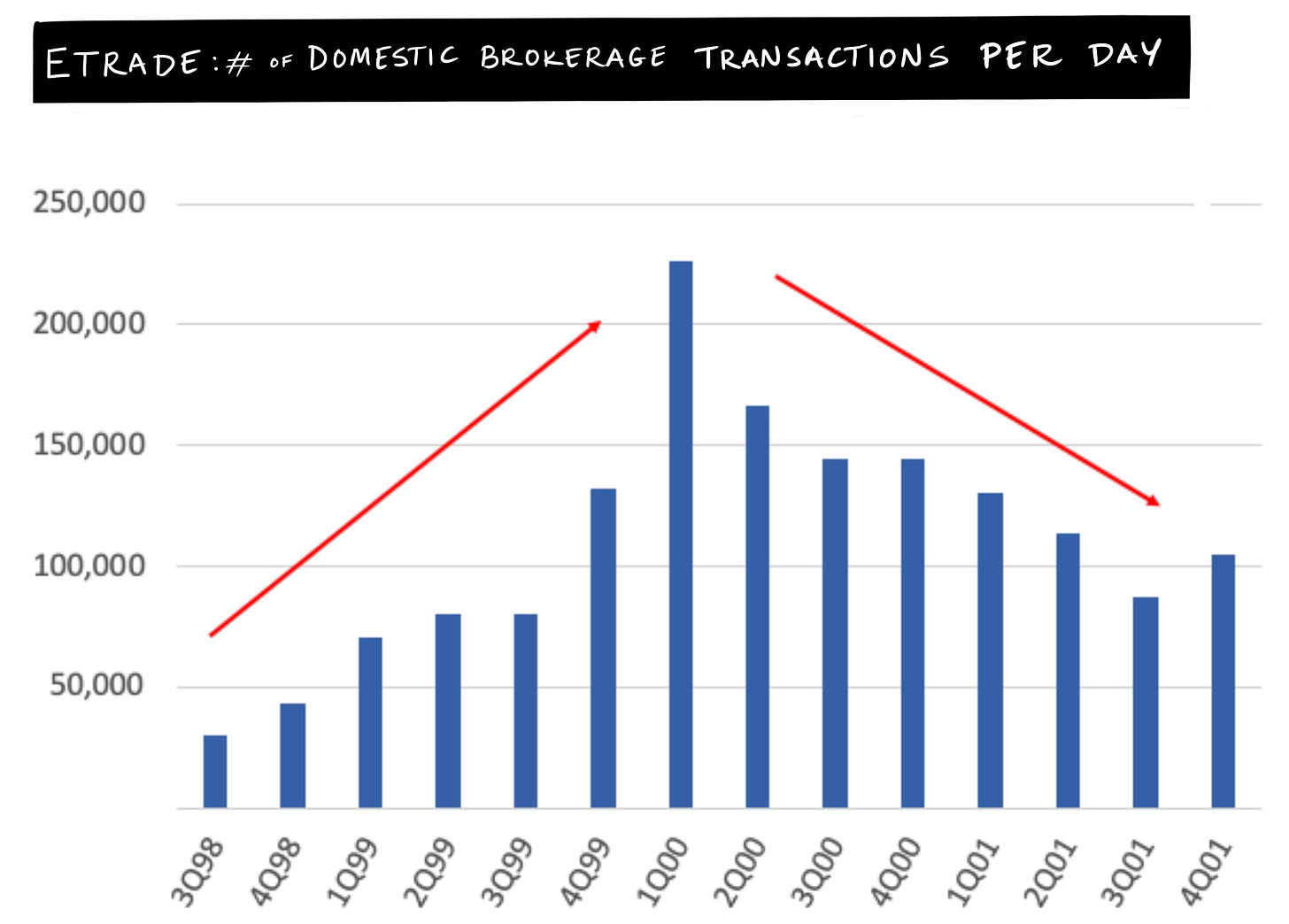

History paints a bleak portrait. Marc Rubinstein at Net Interest looked at ETrade activity from the dotcom bubble. The number of trades per day peaked in 2000 — then trailed off radically as the market fell. Within the next five quarters, it halved. Retail trading took years to recover, enthusiasm dampened by the downturn.

Would Robinhood suffer a similar fate?

Possibly. First of all, most of the company’s revenue is tied — if consumers retreated, topline would decline. More than that though, is the fact that Robinhood’s revenue is disproportionately tied to options trading.

In 1Q21, Robinhood made $198 million from options versus $133 million from straight equities. This is despite the fact that in his congressional testimony, Tenev noted that just 13% of customers trade options on a monthly basis. Though smaller in number, these risk-loving traders are really where the money comes from, with Robinhood earning $2.90 per options trade versus $0.40 for an equities trade.

Would these speculative players disproportionately flee a bear market? Will there be appetite for riskier trades in a slump?

A long-term bet on Robinhood is either a bet on the behavior of retail investors across market cycles, or a gamble on Tenev's ability to build alternative business lines before the music stops. The company’s cash management hints at broader ambitions, but only time will tell how a business built in fair weather withstands a sustained storm.

Product: Frictionless finance

Robinhood is a business with a clear headline product: commission-free trading. Around that center orbit a number of secondary units designed to either drive revenue in their own right or bolster the core. Let’s dig into each.

Brokerage

Funnily enough, Robinhood was not the first $0 brokerage. Five years before the company was founded, Zecco opened its doors. The firm raised $35 million before selling to TradeKing.

Regardless, Robinhood is now synonymous with this model. That is in no small part down to the stellar product the team has built. From its earliest days, the company demonstrated an obsession with beautiful design and intuitive functionality, with much of that drive coming from the more artistic of the two co-founders: Baiju Bhatt. Even little things, like removing the need to fill out ten screens of information to sign up and get trading, contributed to a smoother experience.

Today, Robinhood is arguably the most enjoyable, frictionless place to trade stocks. You can buy and sell shares in your favorite companies with just a few touches of your fingers. A number of additional features add to the experience:

Fractional shares. To make ownership more accessible, Robinhood allows users to purchase fractions of shares. Rather than buying a single $3,500 stake in Amazon, you can put $50 to work.

Recurring purchases. Consumers that want to “dollar cost average” their way into a security can do so by setting up recurring purchases.

IPO access. Rather than wait for a company to start trading on the NYSE or Nasdaq, users can buy shares of a new company at its IPO price. This is usually reserved for high-net worth individuals and can have a meaningful impact. For instance, if you had wanted to buy Affirm at the IPO rather than waiting for it to start trading, you would have gotten in at $49 vs the $90 at which it opened.

Options trading. As we’ve mentioned, users can trade options, an offering that has been lucrative for Robinhood.

This suite has proven popular, with 18 million cumulative funded accounts on the platform. The company’s user engagement puts them on par with leading consumer social networks: 98.3% of all funded accounts on Robinhood use the product monthly. And their DAU to MAU ratio is 47%, a similar ratio as leading social platforms.

(It should be said that the way Robinhood defines some of these terms is a bit hazy. For example, the company counts anyone that “loads a page in a web browser” as a MAU, which is rather liberal. Nevertheless, it’s clear the company’s core product is winning.)

This makes it worth wondering whether this level of activity is...good? Is the ability to trade options in a matter of seconds something that should be promoted? Do we want social media dynamics paired with the emotional drama of gambling?

Robinhood rejects this moralizing. Rather than telling us what users can or can’t do, the company orients around providing access. In that dimension, the company’s brokerage is an undeniable success.

Crypto

Robinhood first promoted its crypto product with the depressing campaign slogan: “Don’t Sleep.” It was a pun on the team essentially working at all hours to launch the new feature within weeks, with the rallying cry plastered across its offices. While traditional markets close at the end of the day and deign to take a day or two off, crypto trading is constant. That serves to bring users into the app during off-hours, and allows the company to monetize different investor interests.

Currently, Robinhood supports seven cryptocurrencies: Bitcoin, Bitcoin Cash, Bitcoin SV, Dogecoin, Ethereum, Ethereum Classic and Litecoin. Market data is available for 10 more.

Gold

As one former Robinhood employee noted, Tenev and Bhatt went a long time before settling on a revenue model. You can see the implications of that with Robinhood Gold, a subscription offering for premium users.

For a $5 monthly fee, subscribers receive the following benefits:

Instant deposit access. Gold members get access to $5,000 to $50,000 as soon as a deposit is made.

Professional research. Thanks to an arrangement with Morningstar, subscribers can access research on “approximately 1,000” stocks.

Market data. Nasdaq Level II market data is supplied, giving greater visibility into the depth of orders.

Investing on margin. If approved, users can borrow funds to make investments. Any funds borrowed above $1,000 incur a 2.5% annual interest rate.

Currently, 1.4 million use the service.

Cash Management

Robinhood’s first foray into other banking services was something of a fiasco.

In 2018, the company attempted to launch a checking and savings account that offered a 3% interest rate and no fees. Unfortunately for Tenev and Bhatt, the Securities Investor Protection Corporation refused to insure the company’s accounts.

It took a full year for the business to retool the product, releasing Cash Management in late 2019. The product allows Robinhood customers to earn interest on their cash holdings. A branded debit card is also provided. Most importantly, accounts are insured by the FDIC.

Despite that snafu, the product uptake is passable, with 3.4 million using the service. That's better than some anticipated, but still far cry from the +8 million that Chime has racked up.

Snacks

Robinhood’s first acquisition was a media company: MarketSnacks. For an undisclosed sum, the neobroker snapped up the audience and talent of the newsletter and podcast, rebranding it to “Robinhood Snacks.”

That now looks like a rather savvy move. The S-1 reports that Snacks has amassed 32 million subscribers, with the daily podcast downloaded close to 40 million times in 2020. This gives the firm a clear advantage in the battle to stay top of mind, reminiscent of Bloomberg’s playbook, revamped for the 21st century.

Learn

One of the most frequent arguments leveled against Robinhood is that the company enables and encourages speculative trading in an audience ill-equipped to gauge its risks. As a countermove, the firm has devoted time to its “Learn” feature, a “library of financial literacy resources.”

Whether this is sufficient is debatable, and it's unclear how we should parse the numbers Robinhood provides us with in the filing. Per the S-1, seven million cumulative views had been logged on Learn, which at first blush feels rather low.

Skeptics may hope the company finds ways to tie this financial education more closely to the core product.

Business Model: PF-OFF

Though Robinhood does earn some money from Gold subscriptions, 75% comes from transaction-based revenue. That means the firm earns when consumers trade equities, options, and crypto currencies.

At the center of this revenue is a controversial practice: Payment for Order Flow or PFOF. As we noted earlier, Robinhood has disguised this revenue source in the past, but in the wake of GME, it has come under increased scrutiny.

We’ll do our best to unpack both sides of the argument at a high-level, and delve into its implications on Robinhood’s model.

What is PFOF?

PFOF is a practice in which brokers receive money for sending orders to a third-party, usually a market-maker.

When you buy $100 of Apple, for example, Robinhood (the broker) has the choice of directing your trade somewhere. While it could send your order straight to a stock exchange, market makers are usually able to offer a better price.

Instead of costing $150 per share, for example, Citadel Securities (the market maker) might be able to get it for you for $149. (The difference is usually fractions of a penny, but this is easier to keep track of.)

The result is a $1 savings. Robinhood keeps some of that, while passing on a portion to you, the user, in the form of “price improvement.” Robinhood has effectively earned money from sending your trade to Citadel Securities.

What are PFOF’s benefits?

In many respects, PFOF looks like a win/win/win.

Customers get a better price than they would have ordinarily, brokers make money by providing this price improvement, and market makers profit from the spread of “internalizing” the brokers orders.

In 2020, investors received roughly $3.7 billion thanks to PFOF-driven price improvement. Not bad, right?

PFOF apologists will also note that the practice is widely used both in traditional financial markets and beyond. The only large exchanges that don’t monetize through PFOF are Fidelity and Public, with the latter firm making it a core part of its differentiation. Crypto liquidity pools leverage the approach to build decentralized trading venues.

Why do people dislike it?

The knocks against PFOF are that it’s uncompetitively run, unevenly shared, and ultimately more expensive.

First, PFOF is not a truly competitive process. There is no auction process for different orders, meaning there’s no guarantee that customers are truly getting the best price. Instead, brokers are free to negotiate terms that benefit them, rather than their customers, providing they are providing execution in line with domestic standards set by the National Best Bid and Offer (NBBO). The lack of competition on price, skeptics suggest, is bad for the consumer. (It's worth noting that because market makers now receive so much trading volume, the NBBO's pricing is arguably untrustworthy and out-of-kilter with reality.)

Second, PFOF heretics believe its implementation is often unevenly shared. There are no rules around what percentage of payments brokers like Robinhood are permitted to take. An SEC investigation indicated that Robinhood traditionally took 80% share, with just 20% of the remaining payment passed down as price improvement. Some will argue then that rather than giving customers a better deal, PFOF ensures they’re paying a premium on what could be procured.

Finally, despite appearing to save users money, PFOF may be more expensive than alternatives. Again, the SEC provided insight here:

For most orders of more than 100 shares, the analysis concluded that Robinhood customers would be better off trading at another broker-dealer because the additional price improvement that such orders would receive at other broker-dealers would likely exceed the approximately $5 per-order commission costs that those broker-dealers were then charging.

The analysis further determined that the larger the order, the more significant the price improvement losses for Robinhood customers—for orders over 500 shares, the average Robinhood customer order lost over $15 in price improvement compared to Robinhood’s competitors, with that comparative loss rising to more than $23 per order for orders over 2,000 shares.

The upshot is that PFOF — at least when practiced by Robinhood — costs consumers money, particularly with larger orders.

What behavior does it incentivize?

The value of the PFOF inventory Robinhood offers is a function of two things: the number of active users and the average “noise” of their trades.

Noise is a function of both volume (number of trades) and style of trading. In general, Robinhood wants as many aggressive, high volume traders who are trading in basically random patterns as it can get.

Why? Because these types of traders are likely to get good, cheap execution from a PFOF model like Robinhood’s, but are also unlikely to be motivated by the factors that we traditionally think of as motivating investors. Like those that play fast and loose in the crypto markets or study sports books, these day traders are attracted to skew.

This raises an awkward question: is Robinhood’s model built on high-risk investors? Is this a gambling app disguised as an investment brokerage?

Robinhood has come under fire in the past for gamifying risky behavior, with its use of confetti and “scratch card” games. The S-1 seems to be at pains to emphasize this is not the market the company likes to think of itself as serving. The confetti is gone, replaced by “new visual experiences,” while elsewhere Robinhood notes that “our platform is enabling our customers to become long-term investors.”

Is that true?

Account growth and ARPU numbers cut through the spin. In late-2019, DAUs showed little growth, while by mid-2020, they had doubled. With the pandemic shuttering traditional outlets, skew-seekers flocked to brokerages like Robinhood to sate their risk-taking activities. ARPU rose 65% from Q4 2019 to Q4 2020.

At least over the past two years, Robinhood’s business does seem particularly tied to those seeking a specific kind of high-payoff risk. With that in mind, the business starts to look a little different, with future growth in ARPU and EBIT levered to attracting this kind of customer.

Of course, that doesn’t have to be the end state of the company. Gold’s subscription offering may continue to grow, and expanded neobank offerings may pave the way to earn net interest income.

Management: Vlad the App-scaler

In the course of researching this piece, we had the chance to speak to sources with first-hand knowledge of Robinhood’s management team and inner workings. We’ll cover the senior leadership, Tenev and Bhatt’s leadership styles, and cultural challenges.

Senior leadership

Robinhood’s current management team reflects its identity as part financial firm and part tech startup. Wall Street and Silicon Valley horsepower is in place to lead its next phase of growth.

Key personnel include:

Aparna Chennapragada, Chief Product Officer since April 2021. Prior to joining Robinhood, Chennapragada spent 12 years at Google leading product, engineering and design teams.

Daniel Gallagher, Chief Legal Officer since May 2020. Before joining Robinhood, Gallagher was a Partner and the Deputy Chair of the Securities Department at Wilmer Cutler Pickering Hale and Dorr LLP from 2019 to 2020. In addition, he served as a Commissioner of the SEC from 2011 to 2015.

Gretchen Howard joined as Vice President of Operations from January 2019 and was promoted to Chief Operating Officer six months later in June 2019. Before joining Robinhood, Howard was a Partner with CapitalG, Alphabet’s Growth Equity fund from 2014 to 2019 and held several positions at Google prior to that role.

Christina Smedley, Chief Marketing and Communications Officer since September 2020. Before joining Robinhood, Smedley was most recently Vice President at Facebook from 2015 to 2020, where she worked with the Messenger, Diem (previously known as Libra) and Novi teams. Smedley joined Facebook from PayPal where she was Vice President of Brand and Communications from 2012 to 2015.

Jason Warnick, Chief Financial Officer since December 2018. Prior to joining Robinhood, Warnick spent 20 years at Amazon where he held a variety of finance, strategy and compliance leadership positions including VP of finance and chief of staff to Amazon’s CFO.

Vlad and Baiju

For most of Robinhood’s life, Vlad Tenev and Baiju Bhatt have served as co-CEOs. However, the company has relied on the pair differently, at different phases of maturity.

According to a former employee, Bhatt was the “major” CEO early in Robinhood’s life. As his current title of Chief Creative Officer suggests, he has a keen aesthetic sense, which can be seen in Robinhood’s elegant product. While well-suited to building in “0 to 1” environments, Bhatt’s step back can be seen as recognition that he may be less well-suited to running a mature business. (Incidentally, he is apparently a true trading obsessive, mentioning to one of our analysts that he dislikes ETFs, and couldn’t understand why someone wouldn't choose to buy specific securities.)

Scaling may be where Tenev shines. The ex-Robinhood employee described Tenev as both detail-oriented and visionary. He is apparently excellent at driving effective product and engineering development while keeping an eye on the bigger picture opportunities. Since stepping into the driver’s seat twelve months ago, he’s managed to reduce downtime despite extraordinary growth.

That does not mean he, and the team, are not without weaknesses. As you might guess from the GME farrago, communication is not a strong point. That’s said to be true both externally and internally. Furthermore, the former employee suggested Tenev can dither when it comes to driving the executive team to a decision.

Finally, the team has shown a questionable ability to see around corners. Should Robinhood have been better prepared for the kind of meltdown it endured in January? On one hand, what unfolded seemed like a true tail-end event. On the other, Robinhood has grappled with outages and unforced communication errors in the past. It perhaps should have been better attuned to potential risks and had a clearer playbook.

Cultural challenges

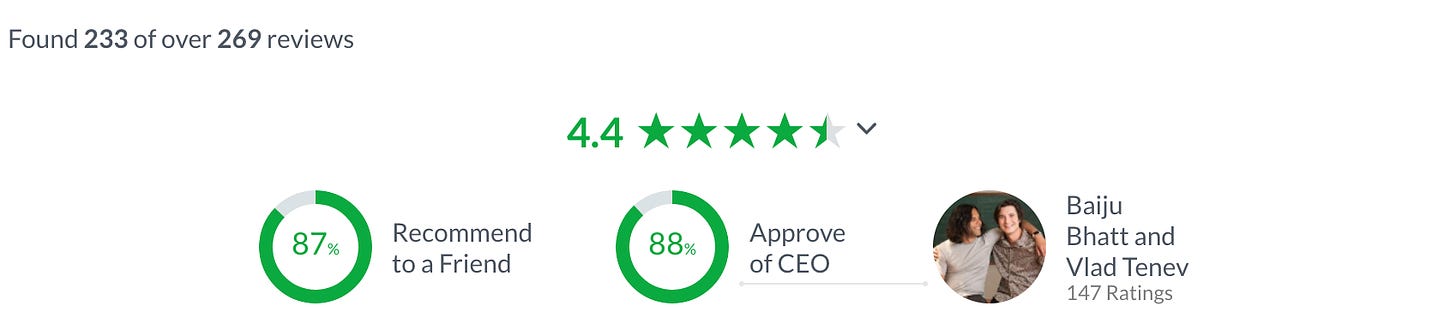

By and large, Robinhood seems to be a place people like to work. The company received 4.4 stars on Glassdoor and Bhatt and Tenev secured an 88% approval rating.

Yet, Robinhood faces cultural challenges by dint of its public perception.

Though Robinhood began as the scrappy outsider, it now feels almost like an incumbent. In 2019, Bhatt noted that one of the original motivating factors was to bring in “disenfranchised” millennials that were “frustrated ... with the way that the system worked.” Does that sell still work? Rather than breaking down the system, increasingly, Robinhood is the system.

Being upbraided in front of congress may only fortify some employee misgivings, at a time when the company not only needs to retain its top talent but recruit. So far, Robinhood does not seem to have suffered from a mass exodus; as they expand into new product lines, they will need to keep hiring.

Investors: Snoop scoop

Over the course of Robinhood’s multiple funding rounds and ~$5.74 billion in total equity raised to-date they’ve attracted many of the most storied names in venture to their cap table, including Andreesen Horowitz, Sequoia, Kleiner Perkins and Google Ventures.

You’ll also find more surprising names like Snoop Dogg, Jared Leto and Nas as early investors as well. As the story goes, Box CEO Aaron Levie introduced Jared Leto to Tenev, who subsequently brought Snoop along for the ride.

Per the S-1, the investors with the largest ownership are DST Global, Index, NEA, and Ribbit Capital, who are all listed as > 5% stakeholders.

Something particularly unique about this offering, but aligned with their mission of “democratizing finance for all,” is that Robinhood is reserving 20-35% of the shares for its customers at the IPO price. This looks like a brilliant marketing move. Not only should it drive new sign-ups and reactive dormant accounts, but it allows the company’s users to profit from a pop.

Financial highlights: On a tear

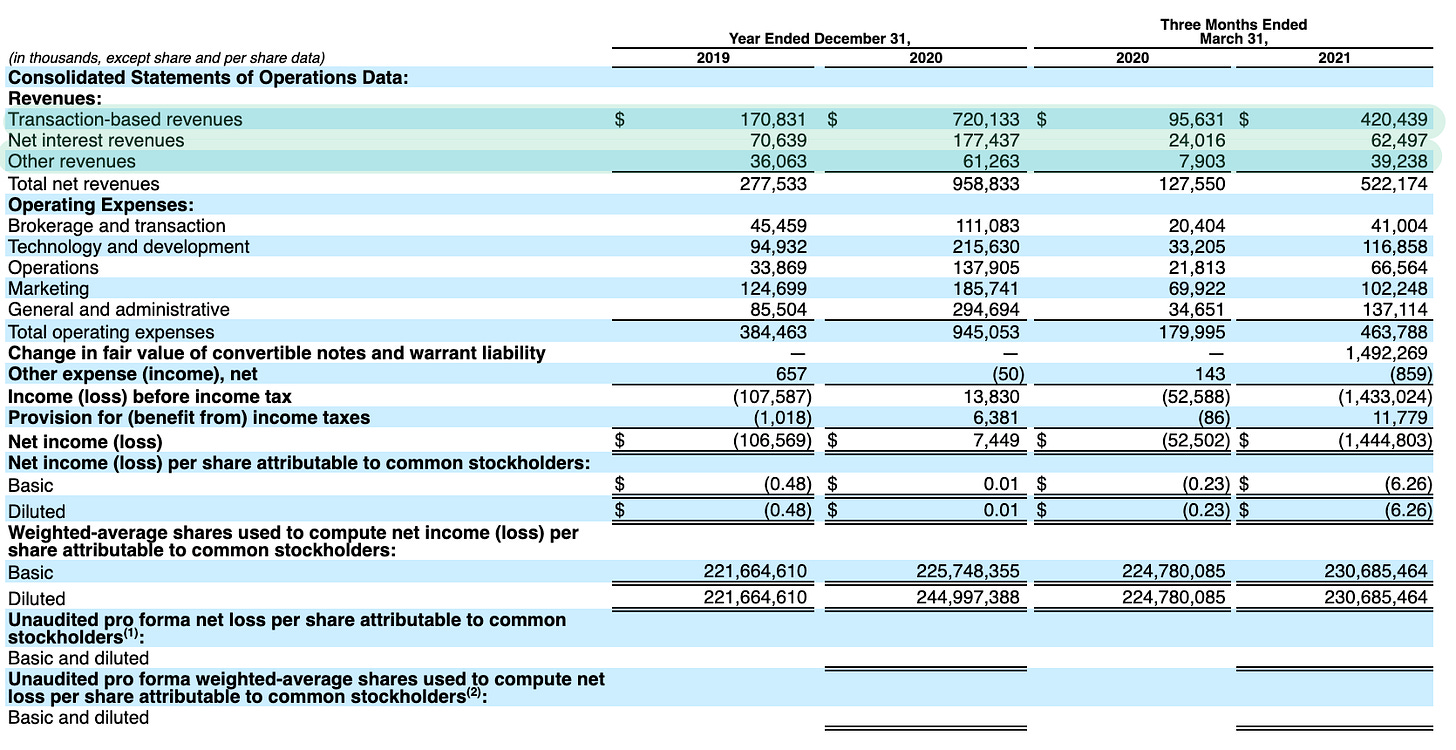

Whatever one’s position on Robinhood’s controversies, it’s financial results are undoubtedly impressive. A few high-level figures from 2020:

Revenue. The company earned $959 million, up 245% year-over-year (YoY).

Users. Net cumulative funded accounts reached 12.5 million, up 145% YoY.

That torrid pace has only accelerated. Let’s look under the $HOOD.

Revenue

As noted earlier, the majority of Robinhood’s revenue comes via transactions, across equity, options, and crypto trading. This brought in $720 million in 2020, while net interest revenue supplied $177 million. “Other revenues,” which mainly consists of Robinhood Gold subscriptions, brought in $61 million.

Revenue has continued to grow in recent quarters. Indeed, Robinhood reported $522 million in the three months ending March 31, up 309% YoY. Over time, revenue mix has shifted towards transaction-based, with this line driving 80% of revenue last quarter. Across this transaction-based revenue, the majority is generated via options, an admittedly controversial yet highly lucrative revenue stream across the brokerage landscape.

Crypto has also been a meaningful contributor in recent months. Robinhood had 9.5 million users trading crypto in 1Q21, driving $81 million. This represented 17% of revenue. Interestingly, Robinhood is not making nearly as much from crypto trading as Coinbase. Despite boasting over 3.4 million more monthly transacting users, Robinhood manages just 10% of Coinbase’s take rate on crypto transactions.

It’s worth wondering whether this is sustainable. Thirty four percent of Q1’s crypto revenue came from Dogecoin, equating to a whopping 6% of total revenues. Should Robinhood bank on unsophisticated YOLO-trading going forward? For the time being, the company is unlikely to mind.

Users

Given the company’s dependence on an actively engaged audience to generate transaction-based revenue, net funded accounts is an especially consequential KPIs.

For the three months ended March 31, 2021, Robinhood claimed 18 million Net Cumulative Funded Accounts, compared to 7.2 million a year earlier. That represented a 151% growth rate.

Where is this growth coming from?

Today, the majority of new customers arrive organically or through the Robinhood Referral Program. Related organic channels were responsible for over 80% of new Funded Accounts in 2020 and Q1 2021. This has depressed Robinhood’s CAC and payback period. The latter dropped from 13 months in 2019 to less than 5 months in 2020. Such a substantial improvement speaks to the company’s marketing efficiency and brand momentum.

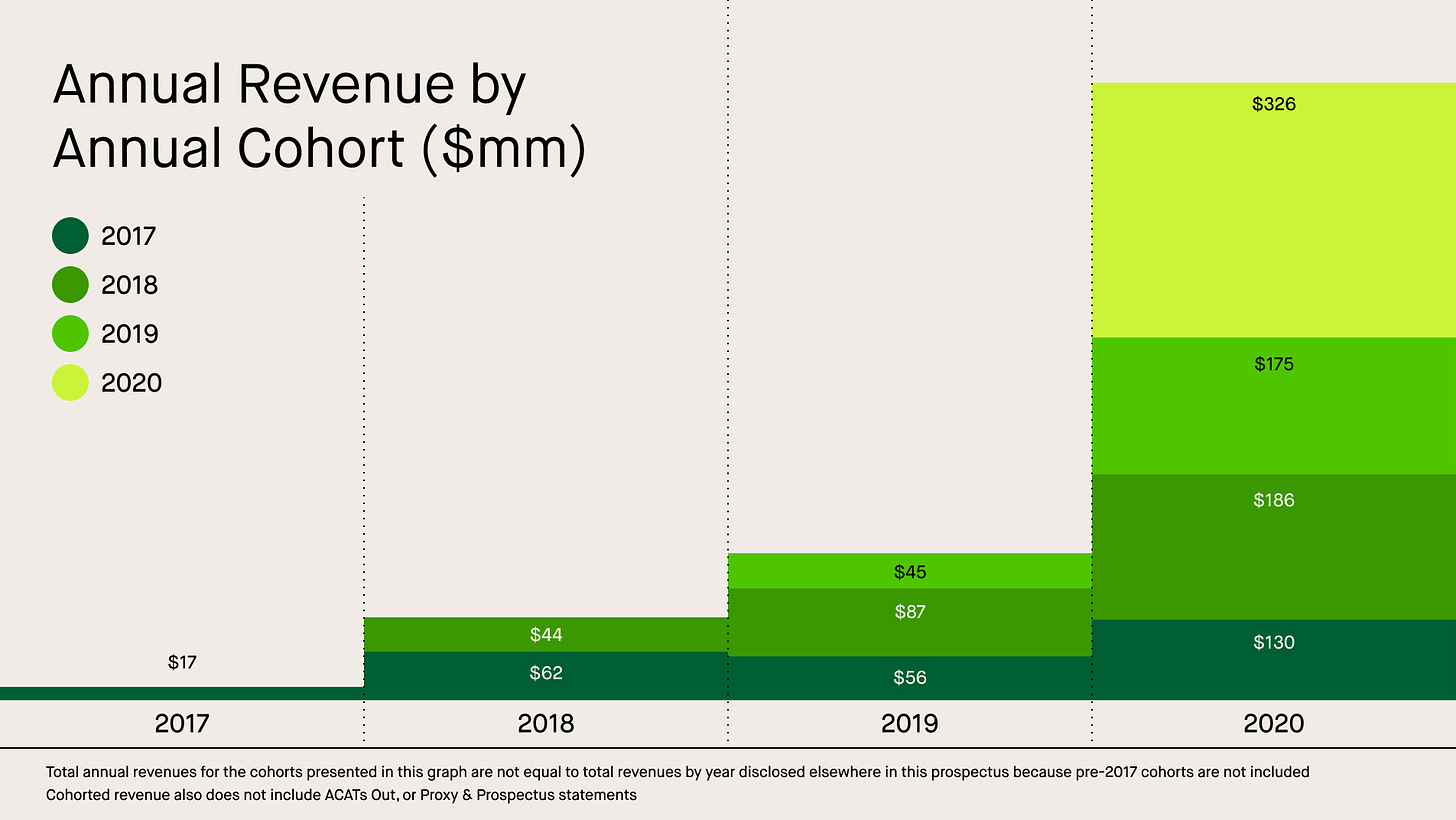

Expanding cohorts

Looking beyond growth in new accounts, Robinhood has grown revenue by increasing net deposits per cohort and its suite of products. As the chart below illustrates, Robinhood’s annual cohorts expand over time.

That’s led to impressive net revenue expansion on a user basis, generating $137 in ARPU. That makes Robinhood 3x more lucrative than Facebook per user.

That’s contributed to an impressive amount of assets under custody (AUC). Today, Robinhood commands $81 billion in AUC, 3x the GDP of Iceland.

Gross margins

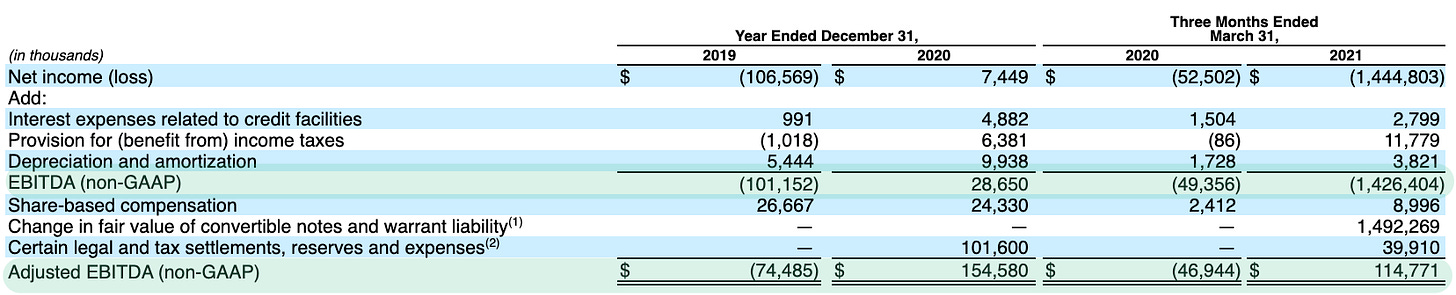

Robinhood is an efficient business at scale. On an adjusted basis, they are an 85-90% gross margin business, with the main costs coming from clearing and executing trades. Due to increased transaction volume, Robinhood hit $155M of EBITDA for the full year 2020 and achieved $115M of Adjusted EBITDA in 1Q21. If retail investor participation continues to stay strong, then Robinhood should be able to continue to hit strong profitability and margin numbers.

It’s worth mentioning that Robinhood did have a $1.4B loss in 1Q21. This came from a one-time charge related to the emergency convertible notes raised to cover the capital shortfall from the GME mess.

Competition: Trading places

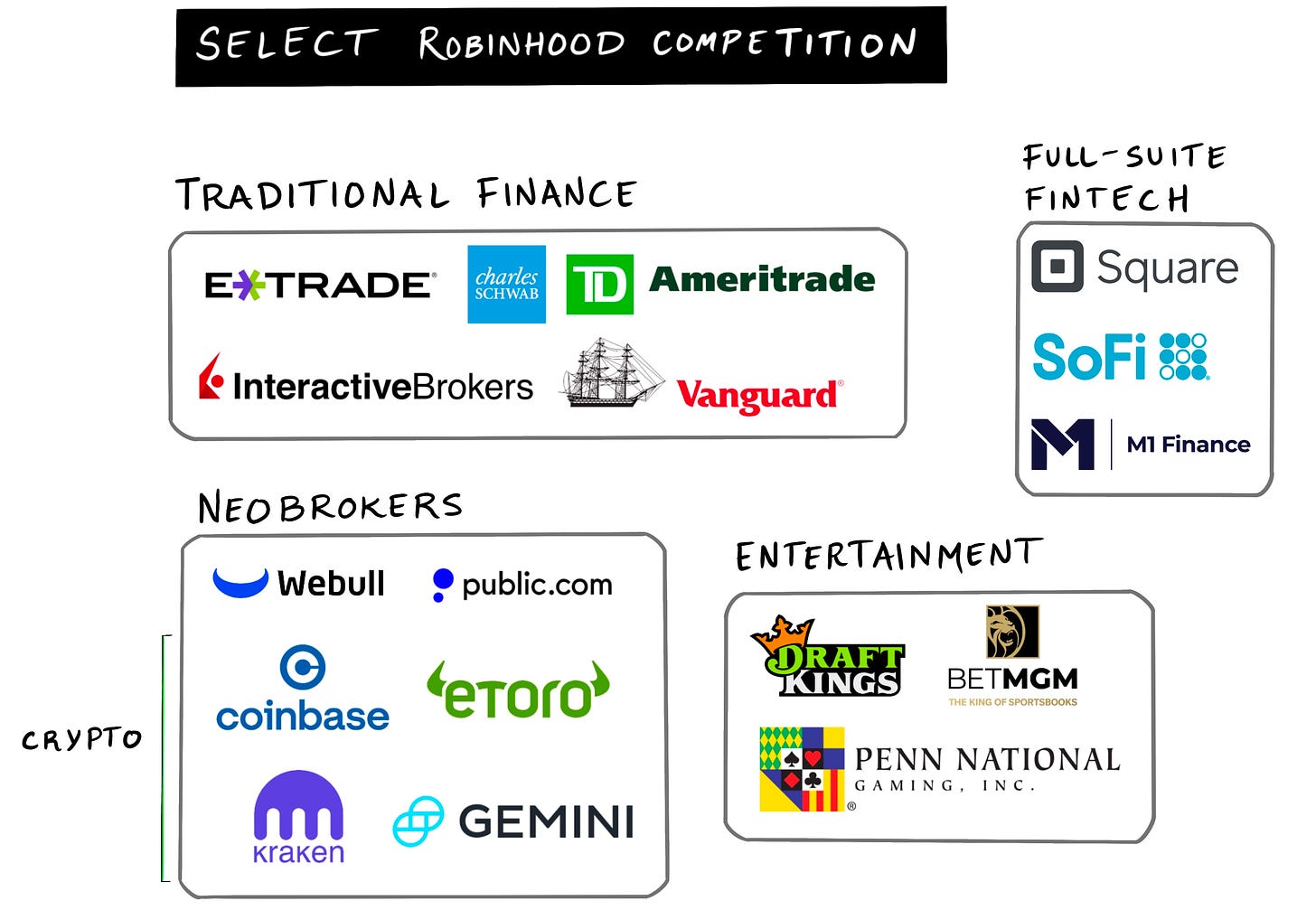

As with most disruptive businesses, Robinhood faces competitive threats from above, below, and beyond their sight lines. If the company is to justify its value and appreciate, it will need to fend off the advances of traditional brokers, neobrokers, full-suite fintechs, and entertainment offerings.

Traditional finance

The old guard will not go down without a fight. Companies like Schwab, Vanguard, Interactive Brokers, and ETrade represent the incumbency, and it's possible that they act in such a manner that Robinhood’s growth is curtailed. Recent years have seen attempts with institutions like Schwab changing their model to offer commission-free trading.

While that allowed Schwab to eat TD Ameritrade’s lunch, and then acquire them, it hasn’t seemed to hamper Robinhood at all. Though providing commission parity, these older businesses have a long way to go before they match Robinhood’s design or intuitive functionality.

Neobrokers

Energized by Robinhood’s success, a generation of insurgents have taken to the market over recent years. This includes neobrokers like Webull and Public. The former has raised $238 million, while the latter has pulled in $308.5 million.

Each offers a different spin on the retail investing phenomenon. Webull orients itself towards sophisticated traders, providing more complex charting, among other features. Public, meanwhile, leans into social functionality, allows investors to follow favorite personalities and converse with others.

Public may be a particular threat for this reason. While it’s easy to imagine Robinhood adding more functionality for power-uses, tacking on a social graph would be no easy feat, requiring a product revamp and expansive moderation system. Over time, Public’s social network effects may provide a defensibility Robinhood lacks.

Beyond these neobrokers, Robinhood competes with crypto exchanges. Though a secondary business line, companies like Coinbase, EToro, Kraken, Gemini, and many others will hope to snipe Robinhood’s users in the long run.

Full-suite fintech

Perhaps the biggest threat to Robinhood? Square’s Cash App.

Leveraging its position as a popular peer-to-peer payment service, Cash has rolled out zero-commission stock trading as well as bitcoin purchases. Jack Dorsey’s company will hope that it can effectively front-run Robinhood’s user acquisition, drawing consumers in with payments, then converting them into investors.

Other fintech companies are taking a similar approach, bundling trading into a fuller suite product. This includes players like SoFi and M1 Finance. Robinhood will hope it can move into its counter-parties’ territory faster than it is encroached upon.

Entertainment

Robinhood doesn’t just compete with financial businesses. As noted earlier, the company’s growth is dependent on how many risk-seekers it can attract. It competes for those users across verticals, battling sports gambling and other games of chance.

During the pandemic, millions of people jumped into the app because they had lost access to other “risky” activities: sports gambling shut down with professional leagues and casinos closed. It’s no coincidence that lockdown brought Robinhood’s strongest period of account growth.

Will growth continue when craps tables have blossomed anew? Will Robinhood maintain its pace when you can bet on ol’ Glory Vase down at the tracks?

The number of people who have a very strong risk appetite (and the means to exercise it) is finite, especially if Robinhood doesn’t expand geographically. Given the company has racked up 18 million accounts, it’s unlikely they’ve tapped out just yet.

Still, more than Charles Schwab, Robinhood may find itself threatened in the long run by companies like DraftKings, MGM (via IAC), and Penn National Gaming.

Growth path: Stretching boundaries

What will Robinhood look like in five years time? Will we still think of it primarily as a brokerage? Or will it have taken on the definition of a financial super app?

Though the company has its hands full at the moment, leadership is certainly planning its future. Reports suggest product and engineering is firing on all cylinders, giving the business the confidence to look further afield (and avoid the snafus of Cash Management’s roll-out).

Three directions Robinhood could expand:

Geographically

Functionally

Internally

First off, Robinhood could choose to expand beyond the US. This would be far from a trivial task, given each market poses its own regulatory challenges. The UK, for example, doesn’t allow PFOF. That might force Robinhood to do away with a commission-free model.

That appears to have proven effective for companies like Trade Republic. The “Robinhood of Europe” has raised more than $900 million and is valued at $5.3 billion, and charges €1 per trade.

If Robinhood wants to avoid international complications, it might choose to expand its functionality. Just as neobanks like Nubank have succeeded by starting with one high-usage product, then layering on higher-margin business lines, Robinhood may choose to do the same. Though it feels like a product challenge given current customer usage, in time, Robinhood may provide lending, insurance, and credit products. This feels like a sound move as Cash Management has seen solid uptake, with roughly ~20% of users taking advantage of the product.

Finally, Robinhood may choose to build inwards. Specifically, Robinhood could, over time, take on the role of market makers, internalizing orders. Though certainly a functional expansion, the customer experience would remain largely unchanged, though a great deal would have shifted behind-the-scenes.

Valuation: Built for a breakout?

It’s not unusual for companies to view IPOs as important marketing events. It is unusual for a company to use its public market debut as a marketing campaign to the extent Robinhood has.

As mentioned, Robinhood is offering users direct access to its IPO. This all but guarantees significant press coverage and increased traffic. It also establishes unique incentives for Robinhood to underprice the IPO and generate a big pop.

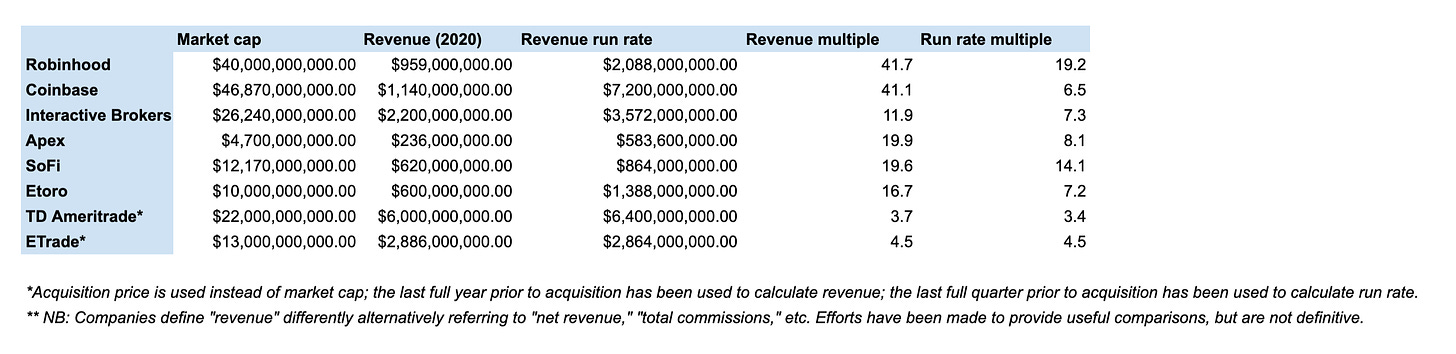

Mechanics aside, the IPO is expected to price at around $40 billion, valuing the company at ~19x it’s 1Q run rate revenue and ~41x 2020 revenue. This would also mark a 3.5x step-up in valuation from Robinhood’s last priced round of financing (a $668 million Series G at an $11.2 billion post-money back in October 2020). Though, as we know, the company raised a boatload of cash via a structured convertible note in January in the midst of its GME meltdown.

Is this cheap, or expensive? We can get a better sense by referring to similar businesses. In particular Coinbase, Interactive Brokers, and SoFi represent valuable public comps. Though yet to hit the public markets, EToro and Apex Clearing are preparing to list, and represent useful benchmarks. Finally, two critical acquisitions give us some useful figures: Charles Schwab finalized a $22 billion acquisition of TD Ameritrade in 2020, while Morgan Stanley picked up ETrade for the same year.

Let’s look at revenue multiples across these companies:

Though not far off of Coinbase’s 2020 revenue multiple, Robinhood stands out everywhere else. That may be in part justified by the company’s growth rate. As noted, its most recent quarter saw it post results up more than 300% from the year prior. That’s not quite Coinbase level (3x QoQ), but certainly puts it in a very elite company.

Furthermore, Robinhood is operating much more profitably than most hypergrowth businesses. In 2020, the company’s Adjusted EBITDA, which excludes one-time costs like legal settlements and convertible notes, stood at $155 million. Last quarter, Adjusted EBITDA reached $115 million, a run rate of $460 million.

It’s not often you see a business posting these kinds of numbers, and though the valuation may look a little rich, we wouldn’t bet against a pop to somewhere close to $70 billion.

Regulation: Meme collateral

Arguably, the only space more regulated than financial services is consumer financial services. People care about their wallets and so do their elected representatives. That means that by default, Robinhood attracts scrutiny.

Even so, the company had not exactly done a great job of staying under the radar. It’s starring role in the GME shenanigans and broad cultural power has only sharpened regulators’ focus. That’s part of the reason why a broker that doesn’t get close to cracking the top ten by AUC has been dragged in front of Congress, had its CEO’s phone seized by federal prosecutors, and been hit with the biggest ever FINRA fine, all within the best six months of its history. This is the collateral damage that comes with being the home of meme finance.

What does any of this actually mean for the company and its shareholders? A rundown of Robinhood’s potential issues suggest not much.

Fines. These are essentially immaterial. Seventy million dollars is a rounding error to a company of Robinhood’s scale.

Capital requirements. Higher capital requirements (like those imposed on Wells Fargo) will have little impact now that Robinhood is a public company with functionally unlimited access to capital.

Bad press. Though it might affect the company’s recruiting to a certain extent, added attention is likely to drive sign-ups. Robinhood’s account numbers certainly didn’t seem hampered by recent dalliances with legislators.

PFOF. Robinhood’s PFOF counter-parties are already paying a premium to execute the company’s trades; scrutiny and hearings is likely to do little to quell their interest. That position is bolstered by the knowledge that major regulatory action against PFOF is probably impossible because of the potential ripple effects throughout the capital markets. Even proposals to tax financial transactions would only hurt Robinhood insofar as they are counter-parties for high frequency traders.

This all begs the question, where is RH actually weak or vulnerable?

The biggest standouts here are KYC/AML (Know Your Customer and Anti-Money Laundering laws) and Robinhood’s fiduciary duty. Robinhood is currently under investigation on multiple fronts, including from the Secret Service for allegedly allowing criminals to open accounts with fraudulent credentials (like dead peoples’ SSNs) as part of money laundering schemes. If Robinhood isn’t properly vetting new account openings, it could quickly drown in alphabet soup. The OCC, FinCEN, and others have the power to levy massive fines and impose business-killing restrictions. For that to happen, Robinhood would have to be unwittingly serving as a bank for terrorists or drug traffickers — a farfetched sounding proposition, at the moment.

Secondarily, slow-moving actions are coming together in a few states (most notably MA) which would bar Robinhood from operating on the grounds that it fails to serve the best interests of its customers. Though these look unlikely to succeed at the moment, triumphs here would have profound impacts on Robinhood, forcing the company to pursue a different model.

If these scenarios sound implausible, that’s because they probably are. There’s enough momentum and capital behind the company that it will almost certainly settle-without-admitting-guilt their way out of its troubles for years to come and without major changes to Robinhood’s business or operations. But the simple fact that multiple federal and state prosecutors and regulators are investigating the company simultaneously with no signs of slowing down is worrying on its own. Even if users are still signing up, investigations and litigation will inevitably take a toll if only in the form of distracting management.

Why now?

The timing of Robinhood’s IPO is a reflection of recent successes and failures.

As we’ve noted, covid proved a blessing for brokerages, with Robinhood a particular beneficiary. The company’s growth has been extraordinary. Low interest rates, an up-and-to-the-right market environment, and a wave of stimulus capital haven’t hurt either.

The year’s turmoil has also influenced the company’s timeline. For much of 2021, Robinhood had its hands full, first dealing with wild swings in traffic, then handling the GME fallout. With Tenev’s hearing behind them, and the rage burned off somewhat, the company clearly feels confident about making this next step.

What will come next? Despite reopening acting as a retardant, we expect 2Q21 numbers to be impressive. Beyond that, who knows. Robinhood’s party seems like it's just getting started.

___

*See important disclaimer

** The goal of The Generalist’s “multiplayer” pieces like this one is to bring different ideas into discussion. In that spirit, please note that some analysts have invested in Robinhood. Others may have invested or supported competitors. As always, nothing written should be construed as investment advice.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.