S-1 Club | Vroom hits the gas

The S-1 Club is a community for those that want to be in the know before the opening bell. Once a month, we break down a business prepping for its public bow, sharing our analysis and thoughts from the community. Then we follow up, to unpack what happened after the fact.

Today we’re getting behind the wheel of automobile e-commerce company Vroom. You’ll learn what Hunter S. Thompson thought of car salespeople, the competitive advantage of car vending machines, and Thiel and Porter's battle for Vroom's soul. As always, nothing in this message should be construed as investment advice — this is a place for collaboration, not instruction. Thanks for joining us.

One final note: The S-1 Club is a joint from The Generalist. Sign up to read our private market analysis, investor and founder interviews, and take on all things tech.

Contributors

Jon Hale

Buckle up

We’ve spent the past few weeks popping the hood on Vroom, an e-commerce platform to buy and sell used automobiles. We were ready to drop this analysis, giving you plenty of time to review the information before Thursday's presumed listing. Then over the last 12 hours, reports emerged that Vroom was pulling listing forward two days, ringing the bell Tuesday morning. They're really testing our mettle to provide analysis before the opening bell. By our count, we've snuck it in, under the wire.

In many ways though, this is a fitting move for the company: moving fast, but not without a few bumps in the road.

As always, our goal is to provide the most interesting analysis of the companies that matter. To that end, Tom Guthrie of Onejob is back in action, bringing his unique insights to the table. We’ve also added some fresh blood. You may be familiar with Tanay Jaipuria’s (always insightful) market musings from Twitter or his own newsletter, while Jon Hale brings his CFA skills and equity research experience to the table. Beyond those two stellar signings, we’ve benefited from the help of a contributor that brings deep financial industry expertise, plus experience in equity research. Much like the Masked Singer, they are staying tantalizingly anonymous. Perhaps we’ll be able to unveil them down the line.

One final note before we hit the accelerator. If you haven’t done so yet, sign up for The S-1 Club directly by hitting the button below. Wherever you received this email, that’s the the best way to ensure you’ll keep receiving these briefings.

Brief

Vroom, a website to buy cars online, IPOs today

The company is raising $468MM, pricing at $18 - 20 a share

The US used car market totals $841B and is highly fragmented

Revenue in 2019 surpassed $1B, but gross profit is shrinking

Value-additive products like financing and insurance could help with margin

COVID-19 has forced pricing and operational changes

L Catterton, T Rowe Price, and General Catalyst stand to win big

Overview

Vroom, a daring NYC based e-commerce platform, is upending the used car buying experience. Led by CEO Paul Hennessy, the ex-head of Priceline.com, the 600-person company is leveraging a digital-first approach to connect used-car sellers with consumers. Think CarMax without the cumbersome real-estate. No more sprawling locations, no more expensive wasted space, and no more used car salesmen :). After raising a total of $721.3MM in venture funding over its seven-year lifespan, and generating over $1 billion in 2019 revenue, Vroom has set the stage for a big public offering in an otherwise muted summer IPO market.

However, despite continued top-line growth and strong platform adoption, Vroom's future is far from certain. The IPO comes only a few months after furloughing 1/3 of staff and reporting gross margin compression stemming from coronavirus-induced turbulence. As the IPO draws nearer, questions remain: has Vroom tapped out early-adopters? Is the rest of the market ready? Will consumers ditch the "try-before-you-buy" appeal of car dealerships? For early investors, the IPO could be a welcome liquidity event. For those about to jump in, the next few years could be a wild ride.

Market

Forget Tracy Chapman’s “Fast Car” or Wilson Pickett’s “Mustang Sally.” If the automobile industry were commissioning a theme song, they'd go to the Wu-Tang Clan for a C.R.E.A.M redux. It’s little exaggeration to say that Cars Rule Everything Around Me (and You).

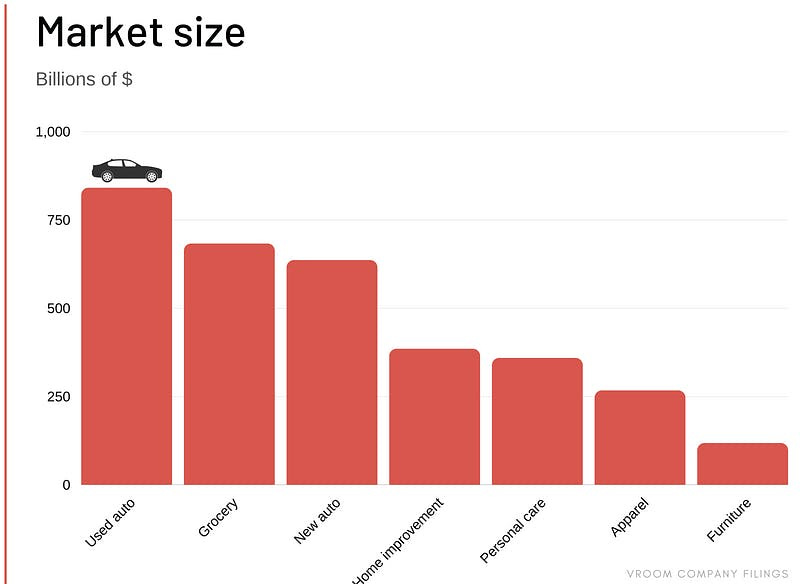

Not only are they the defining urban planning influence of the last century —as much as 1/2 of America’s cities are dedicated to roads, parking lots and the like — but they’re also the largest consumer product category. Specifically, used car purchasing, which totals $841B, eclipses grocery ($683B), new car purchases ($636B), and apparel ($267B). Motors maketh the man.

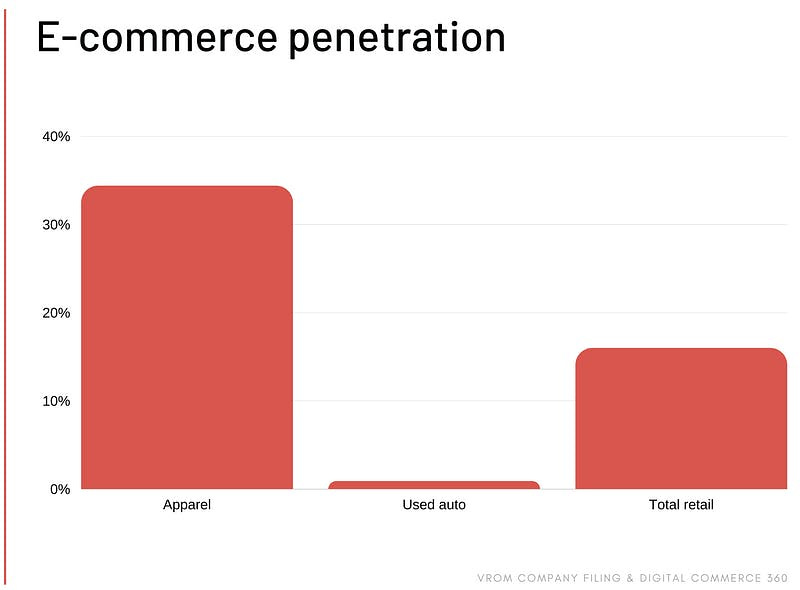

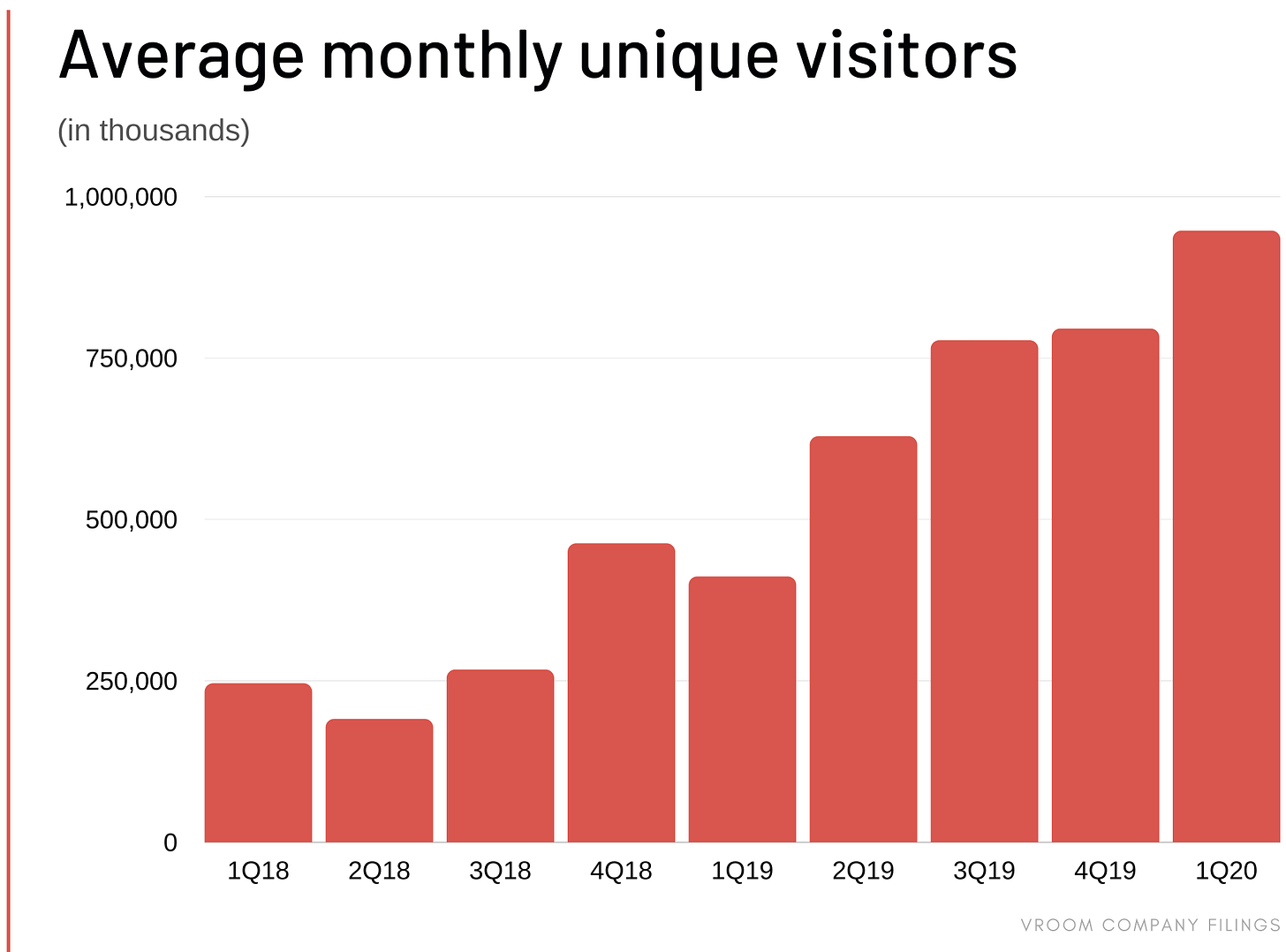

That alone provides plenty of open road for Vroom, but there are other attributes that create a favorable environment for the company. Despite the digitization of our lives, buying a used car remains an unpleasant, analog experience for most. Just 0.9% of used cars are bought online, compared to 34.4% of US apparel sales. Total e-commerce penetration stands at 16%, though that is sure to have surged during the coronavirus outbreak. Estimates suggest that by 2030, 50% of the used cars will be purchased online.

This antiquated process contributes to a subpar experience for buyers. One poll noted that 81% of purchasers are unhappy with the traditional buying process. That may be in no small part thanks to the villainy (real or perceived) of polished and pomaded salespeople. Hellraiser Hunter S. Thompson once referred to America as a “nation of 220 million used car salesmen with all the money we need to buy guns, and no qualms at all about killing anybody else in the world who tries to make us uncomfortable.” That he chose that profession to impugn will surprise few: just 9% of consumers trust car salespeople, per Gallup.

This dissatisfaction leaves plenty of room for improvement, and to Vroom’s benefit, there are few competitors with the market share to stand in their way. The largest used car dealer is CarMax, with ~1.8% of the market. The top 100 dealerships have just 8.6%, illustrating the fragmentation in the space. In total, there are 42K used car dealerships in the US.

Finally, it’s worth noting that just as consumers are increasingly keen to transact online, many are more willing to buy used with 64% of purchasers considering it in 2019, up from 61% in 2018. This fits broader buying patterns, particularly among Millennials and Gen Z. Younger buyers have transformed the apparel resale market in recent years, elevating what used to be a purchase confined to thrift shops. Vroom will be hoping those secular trends continue to lift their market as they look to capitalize on under-served, under-satisfied buyers.

Product

As you've probably gathered by this point, Vroom provides a managed marketplace around used vehicles where it guarantees quality, and handles operations and logistics. That's all to provide consumers a pleasant and reliable experience.

Relative to local dealers, it boasts a higher selection of inventory at more competitive prices, and relative to local peer-to-peer options, offers more trust, convenience, and quality.

Vroom’s operations consist of a few key elements:

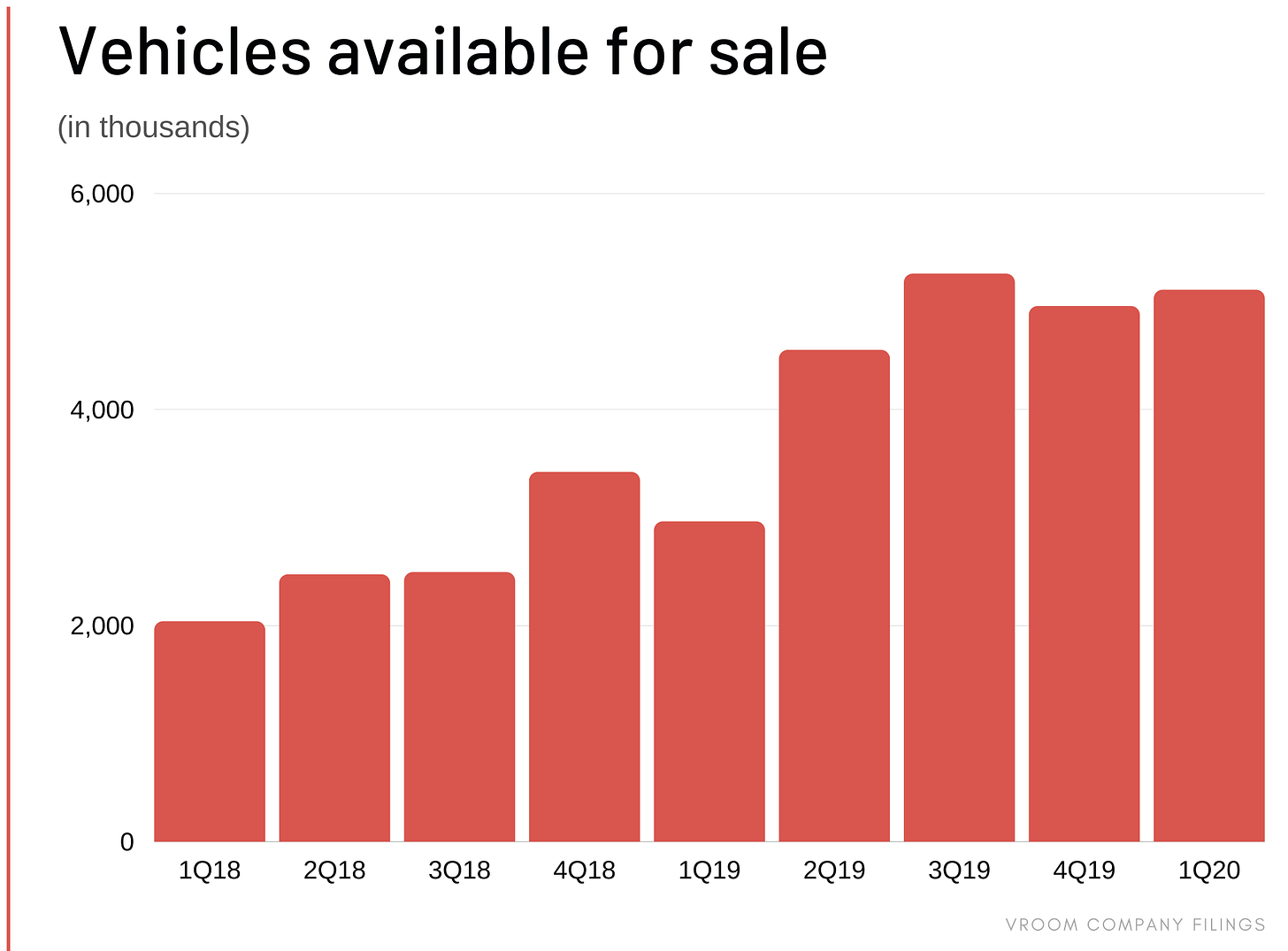

Inventory sourcing: Vroom sources its inventory from a mix of channels, including consumers using the platform, auctions, dealers, and rental car companies, with the first two accounting for 36% and 52% of inventory respectively, in 2019. Vroom hopes to continue to grow the share of its inventory sourced directly from consumers using the platform, which tends to be better priced than competitive auctions.

Vehicle reconditioning: Before a vehicle is listed for sale to consumers on the platform, it goes through reconditioning to meet Vroom’s retail criteria. Vroom employs a hybrid approach, owning one reconditioning center, and having partnerships with third parties. As of March 31, 2020, Vroom has the capacity to recondition 326 vehicles/day at its center and 186 vehicles/day through third parties.

Logistics network: Vroom has strategic partnerships with national haulers for its logistics operations, which allows it to deliver vehicles to customers anywhere in the US. As it expands, it may adopt a hybrid approach similar to the vehicle reconditioning approach above.

Selling vehicles: Vroom sells vehicles through its e-commerce platform, at wholesale auctions (typically for those vehicles that don’t meet the retail criteria), and through Texas Direct Auto (TDA), a retail location the company acquired in 2015. Its e-commerce platform made up ~50% of revenue in 2019 and 62% in 1Q20, and is expected to continue to contribute a growing majority of the revenue going forward. Vroom’s value proposition in e-commerce is that it streamlines the buying process for buyers by offering an enormous selection of high-quality vehicles with 90-day warranties and seven-day returns at competitive pricing, which can be delivered directly to your door.

Selling value-added products: Vroom generates additional revenue by offering value-added products such as insurance and financing to buyers. The revenue from these value-added products essentially has a 100% gross margin and contributed to more than 50% of the total gross profit per vehicle in the most recent quarter. Vroom entered into strategic agreements with lenders such as Chase and Santander in late 2019, and has seen its gross profit per unit increase and expects that to continue as they increase attachment rates and the breadth of products they offer.

Note that while Vroom says they take an “asset-light approach,” they are sourcing inventory themselves and keeping it on their balance sheet. The company does take a more asset-light approach to reconditioning, logistics, and vehicle financing where they maintain a network of third-party partners.

Vroom also talks up the use of data science, noting “Data science is at the core of everything we do.” They note that they leverage data science and proprietary algorithms to optimize their inventory sourcing, logistics, reconditioning, and to build a better and more personalized product experience and in performance marketing. Though a nice sell, it's hard to tell how much of that emphasis is sheen.

What do you think about Vroom? We'd love to hear your take. You'll get a chance to win a much-coveted "Golden Graham" in the process.

Management team

What pairs best with a glass of Hennessey? In Vroom's case, it's two veterans with a mix of auto and telecom experience. A quick look at the main players, below.

Paul Hennessey (CEO)

Paul, who succeeded co-founder Allon Bloch in the CEO seat in 2016, was previously the CEO of Priceline.com and the CMO of Booking.com. Pretty stellar pedigree in in transportation-based marketplaces. He’s making a base salary of $500K.

David K Jones (CFO)

David, or ‘Dave’ as he likes to be called, is top dog in the finance org, and previously served as EVP and CFO of Iconix Brand Group and CFO of Penske Automotive Group. He’s making a base salary of $500k.

Mark Rozkowski (CRO)

Mark is the man in charge of growing Vroom’s revenues, leading inventory acquisition, wholesale operations, consumer financing, and product sales. Before joining Vroom, he was the Head of Corporate Development at Verizon and AOL. For all the VC nerds out there, Rozkowski previously served on the board of Crunchbase for four years.

While there's not much to learn beyond the information above, there are a few things to keep an eye for going forward. Specifically, how the management team is incentivized. Top-line revenue? Earnings? Earnings per share? Companies usually share that information down-the-line. Given Vroom's hyper-growth trajectory to date, it will be interesting to see what KPIs the top brass are judged by going forward.

Investors

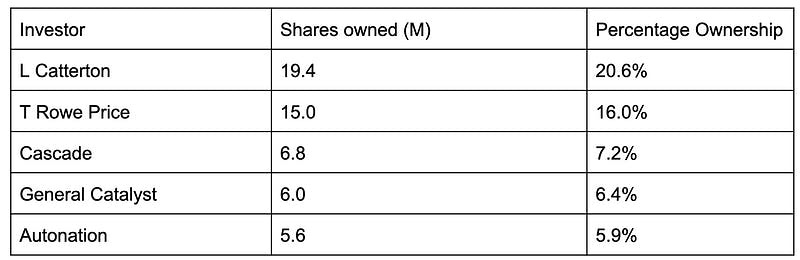

Vroom has raised a total of $721MM across eight funding rounds prior to IPO, with the most recent round — the Series H — valuing Vroom shares at $27.19 per share or approximately $1.3B valuation.

Vroom just enacted a forward 2-for-1 stock split and has ~94MM shares outstanding and is selling 18.75MM shares in the IPO, targeting a range of $18-20 per share.

The big winners will be some of the familiar growth-stage firms, with L Catterton and T Rowe Price Associates set to profit. Both own more than 15% each.

One interesting call out is that Autonation, a national car dealer, has a 5.9% ownership in Vroom. Autonation was a reconditioning vendor for Vroom in 2019 and early 2020, but that vendor agreement has since been terminated. Vroom calls out Autonation as a potential competitor as it expands into omnichannel offerings. As they say, keep your friends close and your enemies closer.

Model

In some senses, Vroom’s business model is fairly simple: buy used cars from people and sell them to other people for more (on the internet). But, as with everything, there's a little more to it.

First, how does Vroom source vehicles? As we mentioned, it’s not just from consumers (although that’s part of their approach), they also buy through auctions, rental car companies - hello Hertz! - and dealers. The quality, make, and model of vehicles differs across channels, which impacts their revenue and profit per unit. Vroom says that they intend to start listing third party inventory on their site, which would move them towards a more asset-light model.

Before Vroom sells the vehicles they source, they recondition the vehicles at either their own Vehicle Reconditioning Center (snappy name) or at centers owned by third parties across the country. They also move vehicles around the country, mostly through third-party logistics networks.

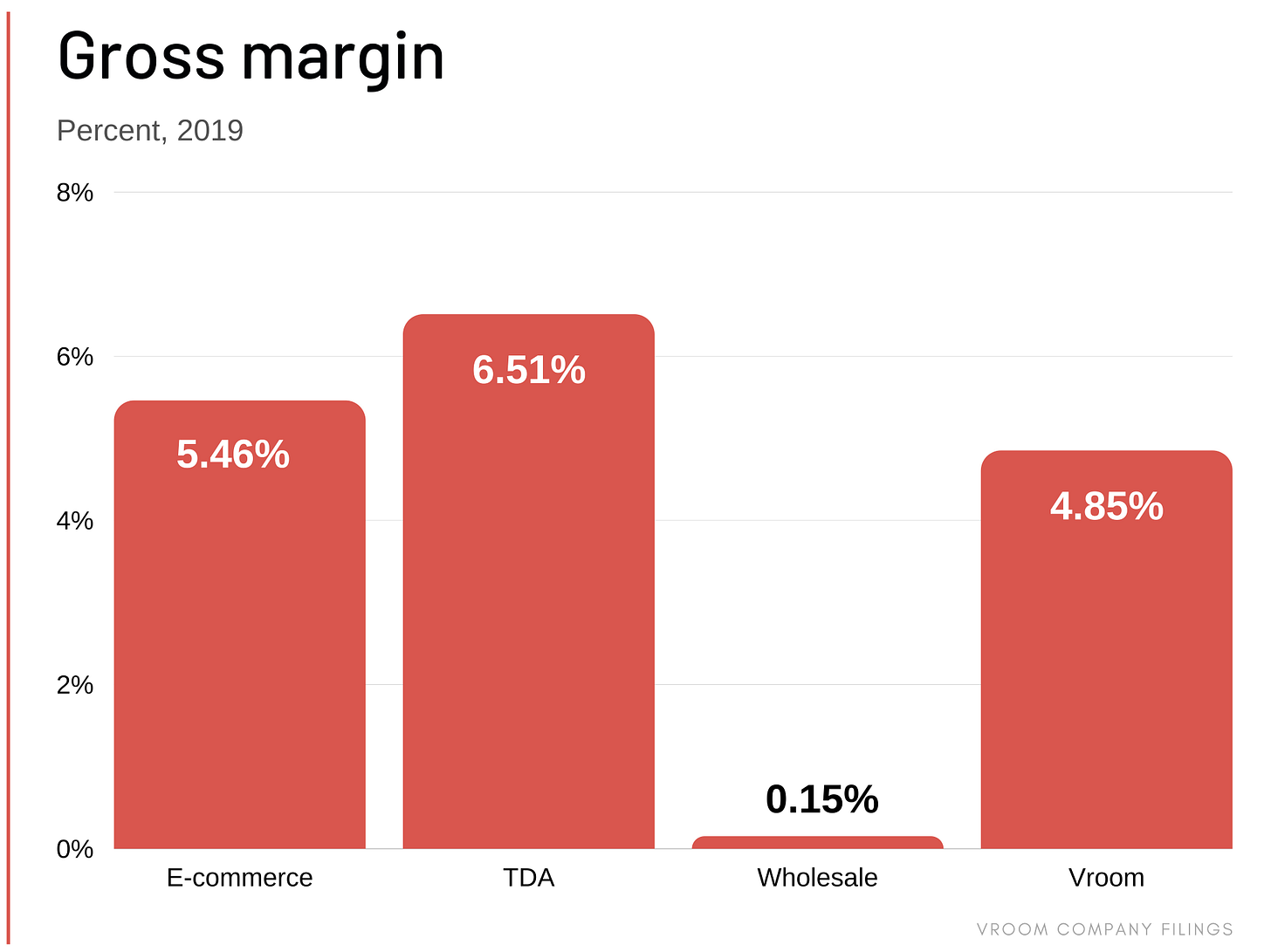

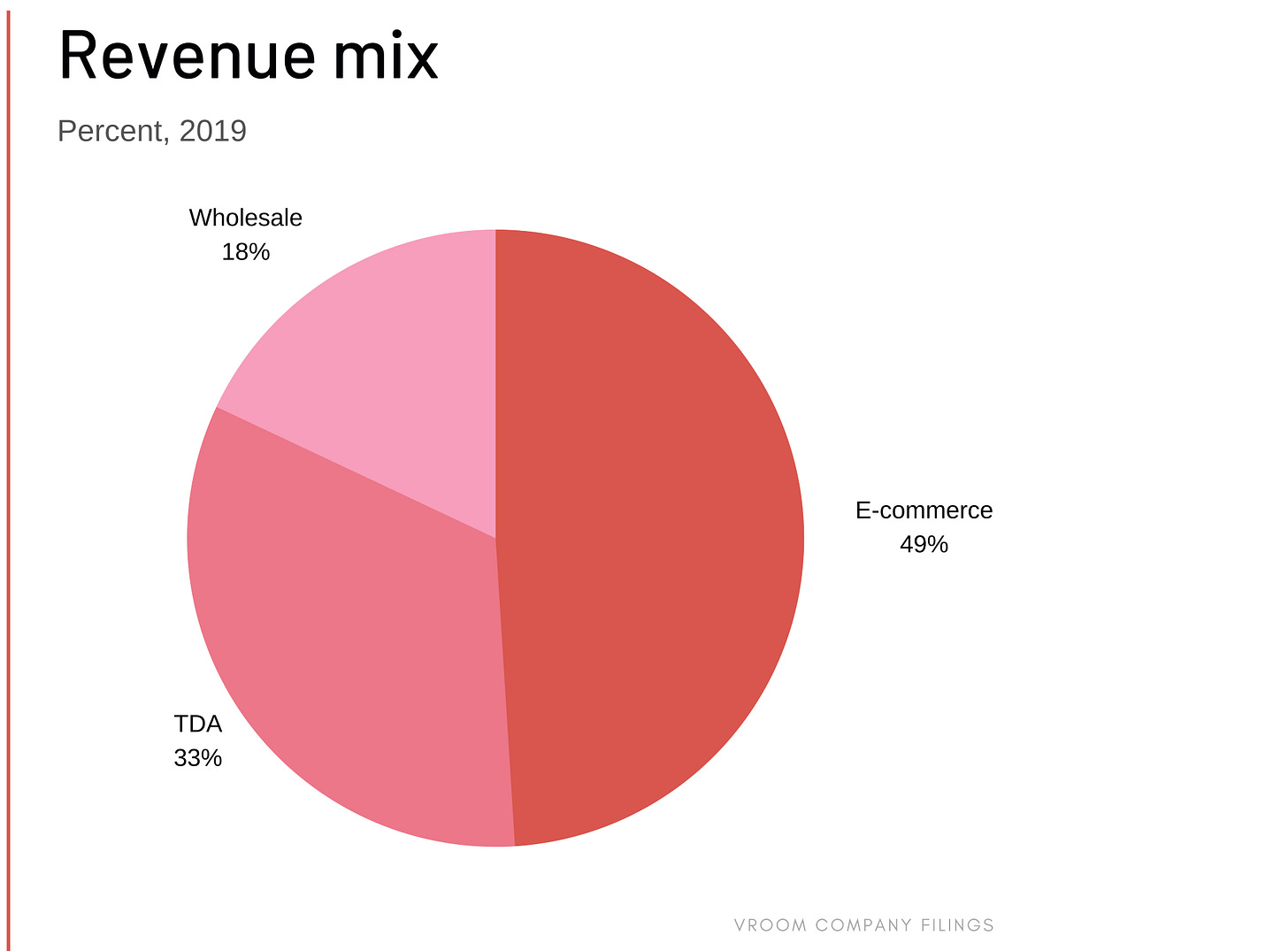

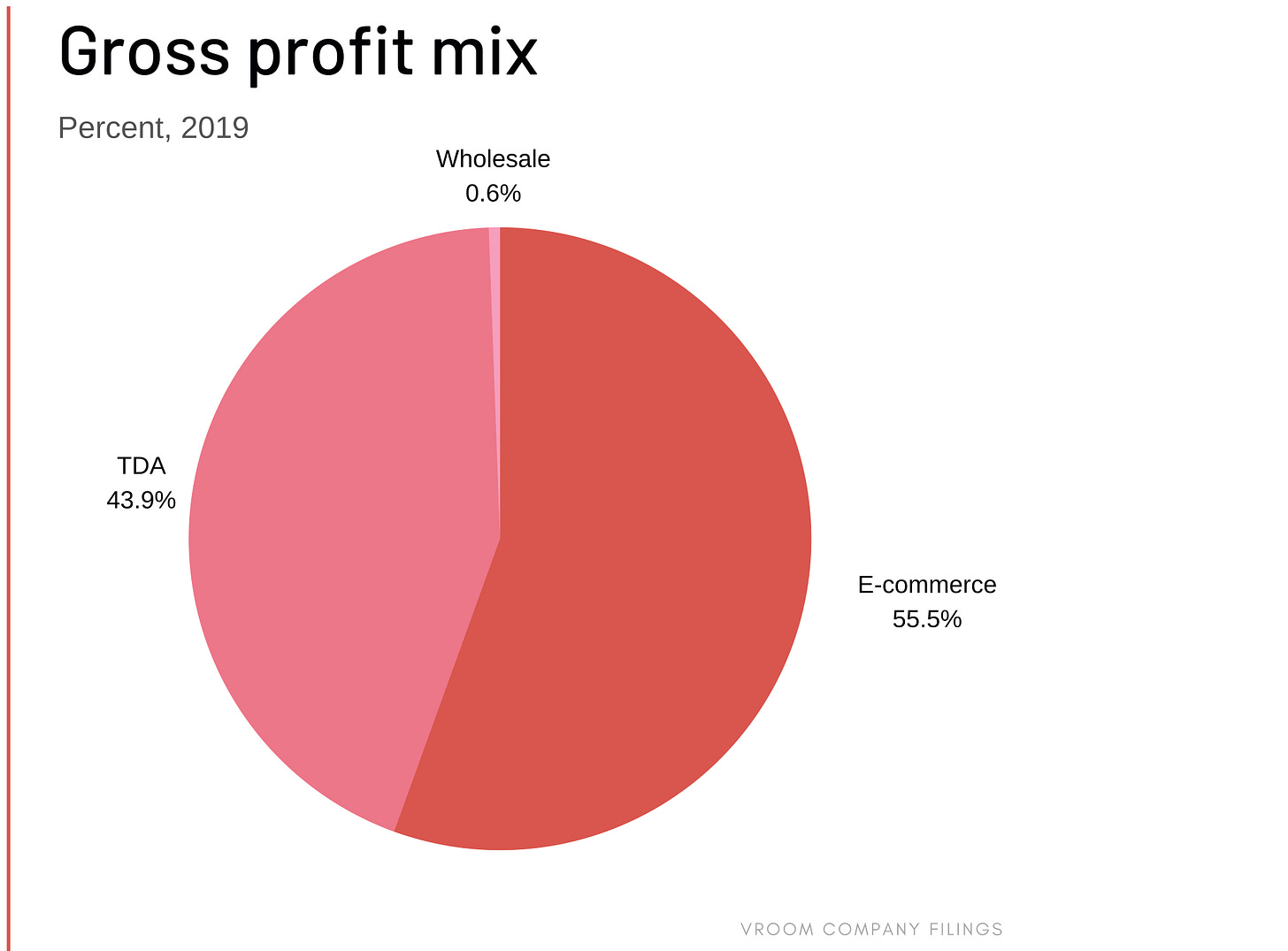

Finally, how do they sell the vehicles? There are three main segments. First, e-commerce, which makes up the majority of their revenue. Second, TDA, which represents the Texas Direct Auto acquisition that Vroom made in 2015. Finally, their wholesale segment, which represents less than 20% of their overall revenue.

If you read the S-1, you’ll see the magic phrase ‘asset-light’ sprinkled throughout the document like fairy dust. There may be some truth to this, but Vroom is not asset-light in the same way as Uber and Airbnb are. They hold significant amounts of inventory and operate some physical locations, after all. However, if you compare them to a traditional used car retailer, their assets are positively airy — other than TDA they operate no physical retail locations, which means no hefty real estate assets.

User experience

While none of your loyal correspondents have had to buy or sell a car recently (and though we love you all, we aren’t ready to shell out the big bucks just for this), we wanted to gain some perspective on the user experience of Vroom in comparison to some of its competitors. While we don’t want to focus overly much on single reviews, some, such as this one from “Clunker_Tripod” on Reddit, criticize Vroom for their slow payment after picking up the customer’s car.

More quantitatively, it seems that either Carvana has a strong customer review strategy, or they’re more popular than a prom king pulling up to the dance in a red corvette. On the App Store, Carvana has more than 7,500 reviews with an average of 4 stars while Vroom has a comparatively measly 51 reviews with an average of 4 stars. Maybe it’s just an App Store thing? Turns out...no. On Yelp, for instance, Vroom has 310 reviews, while Carvana has 423 reviews for their Atlanta location alone.

That said, the experiences themselves don’t seem to differ terribly much — you buy (or sell) the car on their website, complete the necessary paperwork, and then a truck comes to either take your clunker away or bring you a new one.

Financial highlights

Your view of Vroom’s traction might depend on which of these two quotes with which you agree most.

“If your goal is anything but profitability — if it's to be big, or to grow fast, or to become a technology leader — you'll hit problems.” — Michael Porter

“Wall Street is always too biased toward short-term profitability and biased against long-term growth.” — Peter Thiel

Porter or Thiel? Growth or profitability? In many respects, Vroom is a member of the class of venture-backed startups encouraged to grow at all costs. Below, we’ll dig into the company’s consolidated financials, before zooming into its three operating segments: (1) e-commerce, 2) TDA, and 3) Wholesale.

Vroom Consolidated

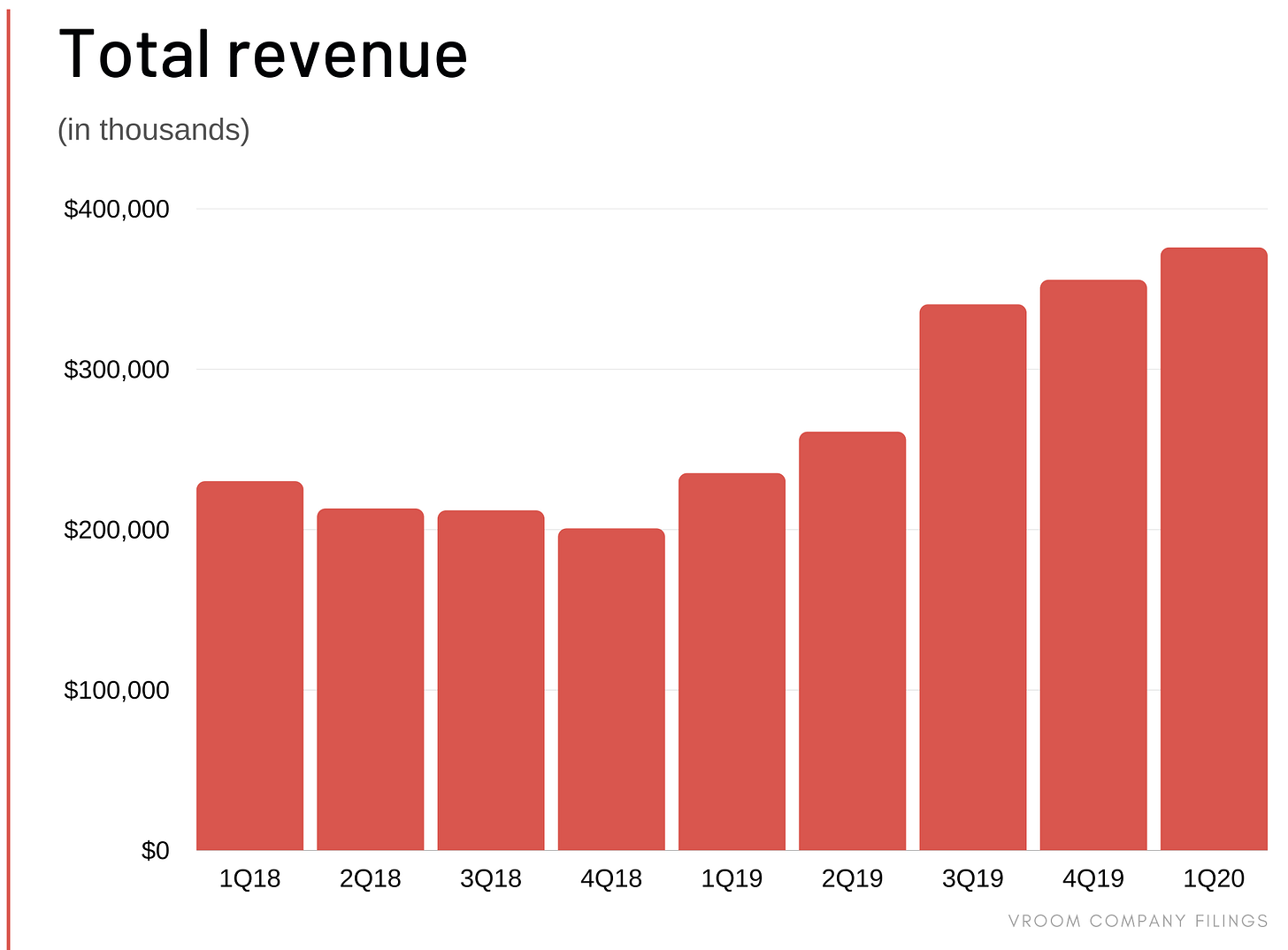

On a consolidated basis, Vroom grew 39% YoY in 2019 to nearly $1.2B in revenue, up from ~$850MM in 2018. In its most recently reported fiscal quarter (the three months ending 3/31/20), the company posted even stronger top-line growth — 60% YoY when compared to 1Q19. Vroom’s significant growth in fiscal 2019, and in the first quarter of 2020, have been driven by a concerted focus to scale nationally. To that end, Vroom boosted marketing, inventory, and recondition capabilities.

Despite the strong top-line growth, under the hood, financial performance around profitability is considerably rockier. Gross margin is in the single digits, with 2019 at 5%, down ~200bps from the prior year. Worse, the company had a negative operating margin in 2019 and 1Q20 periods. It may not surprise you to learn that since inception, Vroom has yet to reach profitability.

Declining gross profit, coupled with robust SG&A expense growth of 38% YoY (in no small part thanks to boosted marketing expenses), resulted in deepening operating losses for the company in 2019. Vroom’s operating loss was $133MM in 2019, a 67% increase from its operating loss in 2018 of nearly $80MM. Similarly, in Vroom’s most recent fiscal quarter, continued low gross profit contribution and growing SG&A expenses led to increased operating losses totalling ~$41MM, up from $26MM in 1Q19.

E-commerce Segment

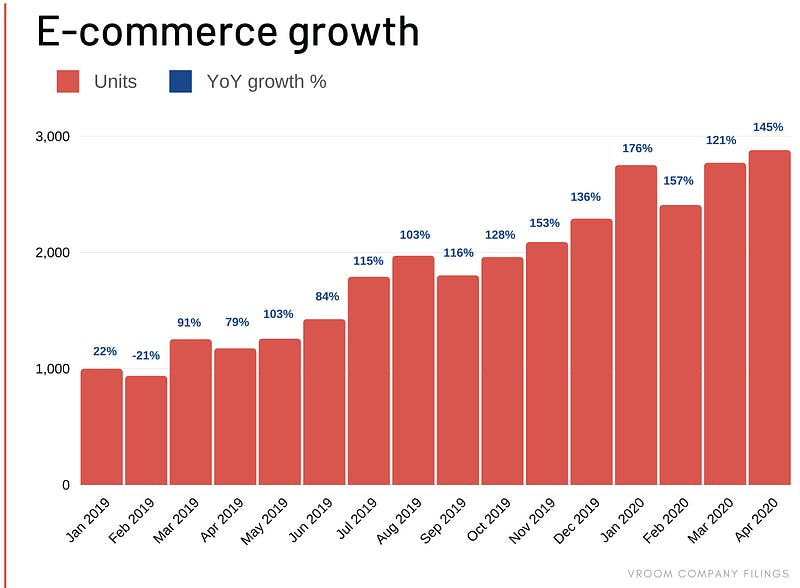

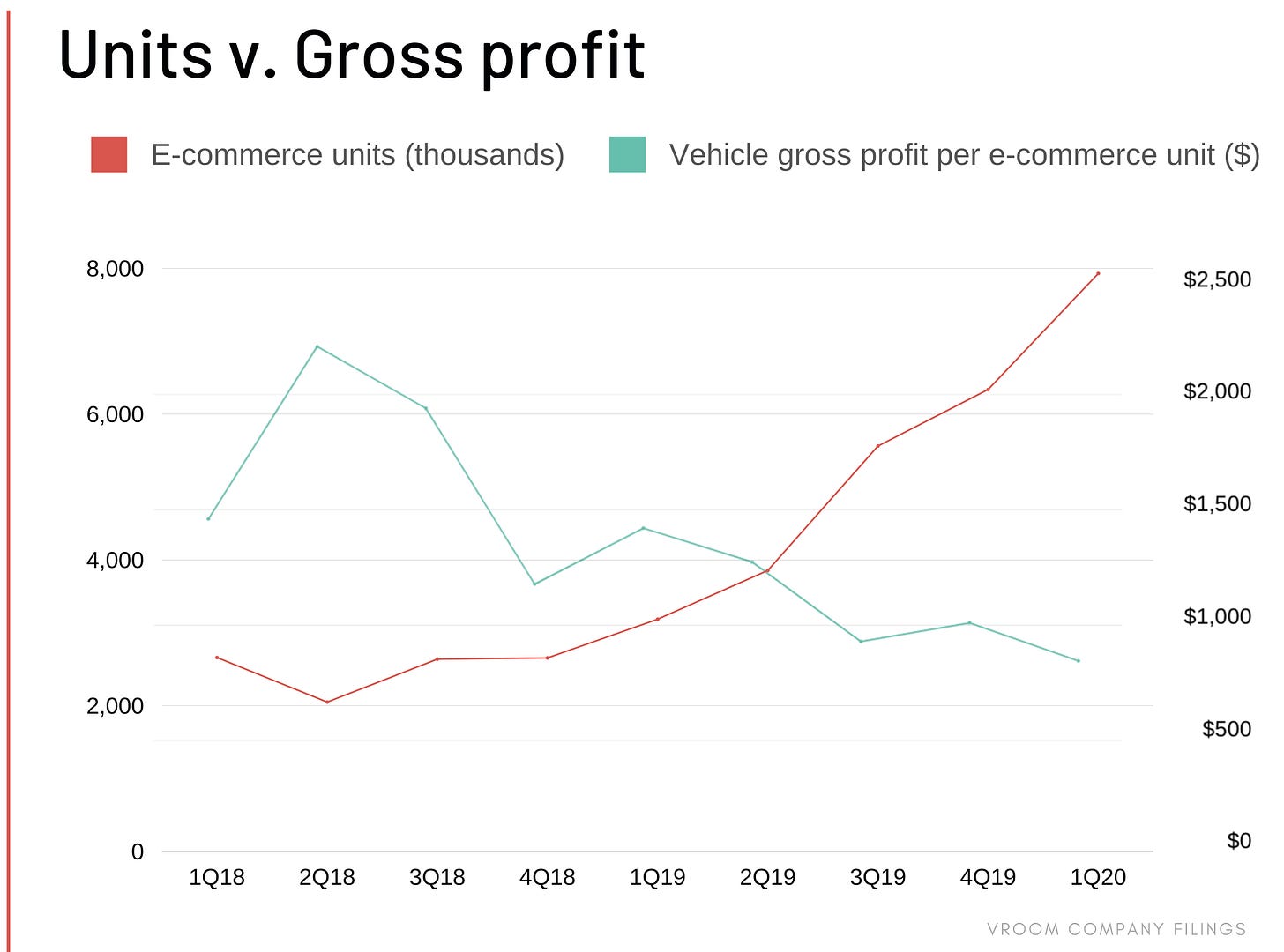

E-commerce is the money maker. The segment accounted for $588MM of revenue in 2019 and was up 95% YoY when compared to 2018. Vehicle revenue, which accounted for 98% of e-commerce segment revenue in 2019, similarly increased 95% YoY, with growth driven by a small increase in average selling price per unit and an 89% increase in units sold. While product revenue (aka financing and insurance) only accounted for about 2% of e-commerce revenue in fiscal 2019, it too increased similarly to 2018.

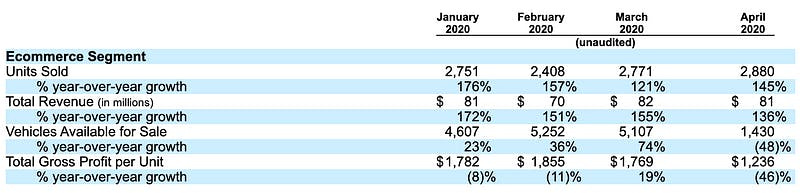

For 1Q20, overall e-commerce segment revenue rose 159% YoY to $233MM, driven by 155% YoY growth in vehicle revenue and 518% YoY growth in product revenue. For the vehicle revenue, the growth was driven almost entirely by unit sales, with average selling prices up slightly on a YoY basis. As outlined in the chart below, e-commerce units sold have increased meaningfully during 2019 and 2020 as the company has focused on growth.

Despite the significant uptick in overall revenue and unit growth, gross vehicle profit per unit has generally moved in the opposite direction. In 2019, gross vehicle profit per unit declined 33% YoY, driven in part by the focus on growth and a stronger depreciation cycle impacting the back half of the year, according to the company. For 2019, this led to gross vehicle margin of just under 4%.

In 1Q20, gross vehicle profit per unit declined 41% YoY. To be fair, some of this was driven by the company’s decision to reduce inventory levels in light of COVID-19, which led to depressed profitability in March 2020. In 1Q20, the lower unit economics on vehicles sold were offset by a substantial rise in gross product profit, helping keep overall e-commerce segment gross margin relatively flat at 6% in 1Q20 when compared to 1Q19.

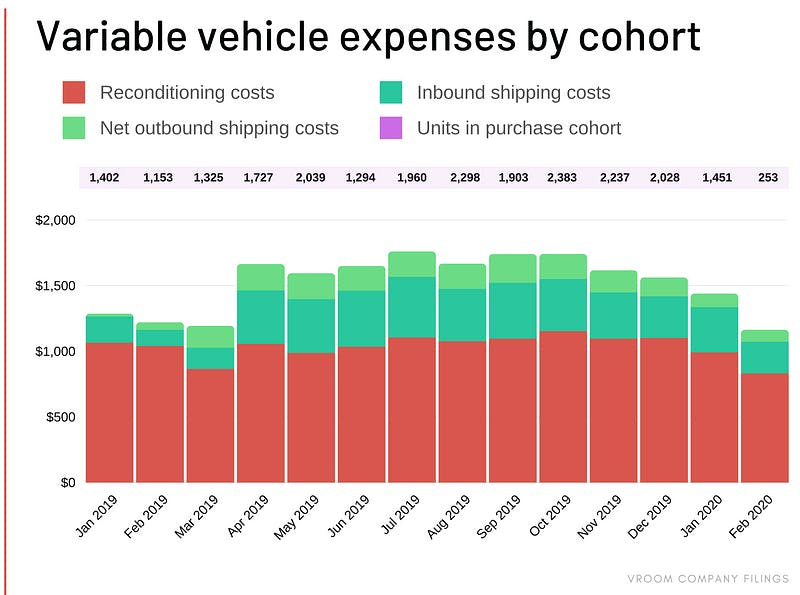

To their credit, Vroom appears to be focused on improving its unit economics. Part of the "data science is at the core of everything" narrative is centered around the improvements that can be driven by buying more cheaply and reduce logistical costs. Whether the company has the chops to make the most of data analysis is another question. Below, you'll find Vroom's variable expenses by cohort.

TDA Segment

Texas Direct Auto (remember TDA?), which was acquired by Vroom in December 2015, encompasses the company’s Houston retail location, its owned vehicle reconditioning center (VRC), and Vroom’s Sell Us Your Car Centers. The company’s TDA segment accounted for about 1/3 of total company revenue in 2019. For fiscal 2019, overall TDA segment revenue grew 3% YoY, with vehicle revenue growing 4%, partially offset by declines in product and other revenue. The 4% YoY growth in vehicles was driven by a 5% increase in the average selling price per unit, offset by a 1% decline in units sold. Gross profit for the segment declined 28% YoY in 2019, driven largely by lower profitability on vehicle sales. With the owned reconditioning center handling most of the TDA inventory sold, coupled with the growth in e-commerce, this created inefficiencies at the VRC and led to reduced profitability. The company noted that infrastructure investments, coupled with a better distribution of VRCs and cost reductions, should lead to improved TDA gross profit per unit.

For 1Q20, TDA segment revenue fell 7% YoY, led by a decline in vehicle revenue and partially offset by higher product-related revenue. Vehicle revenue fell 8% YoY in 1Q20, as units sold declined by 10%, partially offset by a modest increase in the average selling price. The company noted that decreased demand for vehicles as consumers quarantined at home in light of COVID-19 impacted units sold in March. Overall TDA segment gross profit declined 11% YoY in 1Q20, with vehicle profitability impacted more, but off-set by improved product gross profit.

Wholesale Segment

The Wholesale segment, representing sales at auction, is the baby brother of Vroom's revenue streams. Making up 18% of revenue and less than 1% of gross profit. Wholesale revenue did grow 22% YoY in 2019, driven by a 12% rise in average selling price and a 10% increase in units.

Competition

If philosopher Bertrand Russell is to be believed, “Life is nothing but a competition to be the criminal rather than the victim.” Vroom will be hoping to become the John Dillinger of the used car market over the next few years, pilfering profits from more established platforms like CarMax and Carvana in the process.

As mentioned previously, CarMax is the front-runner in the space, though because of the complexion of the market, that only translates into 1.8% market share. Founded in 1991 by Circuit City execs that used the codenames "Project X", and "Honest Rick's Used Cars," CarMax has gone on to become a member of the Fortune 500. CarMax provides a slick online service for buying cars, in addition to operating 225 physical locations across the country. In that respect, the company operates more of a true-hybrid model than Vroom.

In 2019, CarMax pulled in $20.32B in revenue with $812.38MM in EBITDA. While hedge fund positions in KMX, traded on the NYSE, have declined in recent months, as recently as June 1, JP Morgan gave the company an “Overweight” rating, proposing a December 2020 price target of $110, up from the current price of $95.

Serendipitously enough, Carvana was also a spin-out. Dubbed the “Amazon of Auto” by the Houston Chronicle, CVNA, is the product of DriveTime, a buying and financing platform for automobiles. In the years since its 2012 inception, Ernest Garcia III and his co-founders have scaled the company across more than 100 markets, bringing in $4.28B in revenue with -$239.04MM in EBITDA. Since listing in 2017, the stock has surged from a price of $13.50 to its current position of ~$115. While that’s made the company something of a darling, Carvana remains best known for one of its publicity stunts, the car vending machine. At 24 locations, buyers can insert a token, and see their car emerge from a giant glass tower. Very cool.

Though both CarMax and Carvana are impressive in their own right, whether Vroom should fear them represents a more complicated question. With 99.1% of the market still offline, the bigger enemy seems to be established consumer behavior, local social ties, and the natural desire to assess significant purchases in person. In that respect, both KMX and CVNA may be better described as co-conspirators rather than competition: if they are able to bring more purchasing online, all three have the chance to benefit.

COVID-19

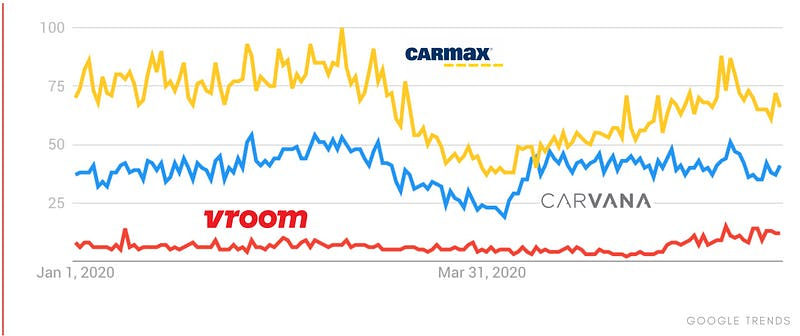

The advent of Covid-19 spooked the used car industry, as it did many other sectors. The call of the open road is harder to heed when the country is in lockdown. Both Carvana and CarMax saw the value of their shares stall out in late February before recovering. Search traffic for both companies fell over a similar period.

As unpacked above, Vroom’s business was far from immune, though a decline in search is harder to parse.

That said, the coronavirus may yet be a blessing for Vroom. The prospect of entering a crowded subway car or breath-stained bus is unlikely to tempt those that can afford alternative means of transportation. Used car purchases may rise as a result. Interestingly, the industry fared well during the last recession. The average used vehicle gross profit margin rose from 8.9% in 2007 to 9.4% in 2009. New vehicle gross profit margins fell over the same period.

Why now?

When is the best time to IPO? Arguably not during a global pandemic and looming economic recession. So why the rush to market?

Answer number 1 is relatively straight-forward. Like any company raising money, Vroom needs the cash. At the end of 2019, Vroom reported cash and equivalents of $217MM on the balance sheet. While sizeable, the company also reported cash outflow from operations of $215MM for the year. That's net of cash inflow from revenue. Yikes. So, at the time of registering the S-1, we can assume the company had a forecast runway of just 1 year. This assumes stable revenue and cash generation, which of course is never guaranteed. Despite needing funds, after already having raised $721MM, the private markets may be tapped out and closed to Vroom. Plus, after seven-years of operations and reaching $1B in annual revenue existing shareholders are likely eager for a liquidity event. An IPO is the next logical step in the business lifecycle.

Answer 2 is slightly more subtle and a bit more interesting. Although Vroom's IPO date is this summer, the company registered the S-1 in secret before the close of 2019 and, importantly, just before reporting +$1B in annual revenue. Why is this interesting? Well, the JOBS act allows any company with reported revenue below $1B to register an S-1 as an "emerging growth company". These companies enjoy limited disclosures requirements and more lax accounting standards during the IPO process. Even though Vroom is technically no longer an emerging growth company, management can still benefit from this classification, given the carefully timed filing date. Though cash inevitably drives a fundraising decision, it's possible that the simpler reporting and disclosure requirements gifted from a 2019 registration date may have factored in the IPO decision process.

Net/net

Vroom is a fast-growing company winning share in a massive, analog market. That's often a recipe for success. But as with many of 2019's public bows, that growth has come at a cost: profitability. Though data analytics go some way to helping optimize operations, more fundamental changes may be necessary. And with an "asset-light" competitor in Carvana stealing the limelight, will the markets be willing to back an upstart?

We'd love to hear your thoughts. Is Vroom set to speed out of the starting grid? Or will the company hit the skids? Share your takes by hitting the button below. The winner of the 1-month pricing challenge will be awarded "The Golden Graham," the S-1 Club's deeply prestigious (and very serious) trophy. Light it up.

The S-1 Club is a joint from The Generalist. If you'd like to read our private market analysis, investor and founder interviews, and takes on all things tech, subscribe below.