Social’s Next Wave

How paid subscriptions, political polarization, and AI are changing the social media landscape.

Brought to you by Sardine

Scams and fraud are a tax on revenue in a time where every dollar matters.

Last year the losses to scams and fraud increased by 70%. Businesses don’t realize they have a fraud problem until they see users they thought were “verified” scamming them.

Like any skill, getting better at detecting fraud can take a decade or more of experience and requires significant training data. And it’s a problem that is constantly evolving.

Another option? Use Sardine.

It’s like having the best fraud team in the world, available as an API. Sardine uses machine-learning, extensive transaction data, and intelligent rules to stop fraud before it happens. Companies like Brex, MetaMask, AtoB, and Blockchain trust Sardine to reduce fraud by as much as 7x. Better yet, thanks to its superior risk modeling, Sardine also improves conversion rates, increasing the number of good customers buying from you. Thanks to Sardine, Blockchain.com’s conversion rate improved by 10% (and it’s still going up).

Take control of your survival and scale without the scams by implementing Sardine today.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about social media’s next wave.

Winning close friends. Social media’s largest companies may have started with the intention of connecting close friends, but they are largely no longer used for that purpose. As TikTok and Instagram focus on acting as modern broadcasters, there’s space for startups that connect close ties.

Fragmentation along political and ethical lines. Increasing polarization has created opportunities for insurgents that seek to be the “good” version of an established platform. Of course, good means different things to different people, spawning right-wing and left-leaning upstarts.

New business models gain traction. The last generation of companies relied on advertising above all else. Startups increasingly ignore that money spigot in favor of subscriptions, in-app payments, or e-commerce. On a small scale, several of these experiments look promising.

We may not need each other in the future. Already, we see small pockets resort to synthetic personalities for companionship and romantic connection. In ten years, speaking to AI friends at least as often as to human ones may be normal. That could reduce our desire to use social networks to find online kinship.

“The price of anything is the amount of life you exchange for it,” philosopher Henry David Thoreau said. By that measure, social media is among the world’s most expensive products. Over the last two decades, consumers lavished extraordinary sums of time on platforms like Facebook, Instagram, Twitter, Snap, and TikTok, allowing them to monetize through advertisements.

These empires of attention are beginning to show signs of decline. As outlined in last week’s piece, industry incumbents face business model uncertainty, fiercer competitive dynamics, mounting political pressure, and managerial instability. Suddenly, disrupting these giants seems merely difficult rather than impossible.

A new wave is emerging to meet this opportunity. Upstarts like BeReal, Poparazzi, Mastodon, Post News, and others seek to win by promising a better use of our most valuable resource: time. These companies don’t aim to dominate every second of our day or every one of our relationships. They position themselves as productive alternatives to the controversy and chaos of old platforms, escapes from the fiefdoms of Zuckerberg and Musk.

For now, these companies are still in growth mode – their investors will not judge their current success or failure on revenue. In time, though, some trade-offs will need to be made. Either these startups will play the same game as the last generation, looking for the most efficient way to gobble up time and monetize it through advertising, or they will embrace alternatives. That might involve subscriptions, payments, e-commerce, or other approaches. Better uses of our life may require spending money.

In Part 2 of our investigation into the social media landscape, we’ll assess the most promising startups and their tactics. We’ll also discuss how the sector may change in the years to come, especially as AI, VR, and AR mature.

Now: Four strategies

Beyond the shadow of its whales, social media teems with smaller players. Spend a little time in your phone’s app store, and you’ll discover a vibrant ecosystem of sub-scale apps riffing on established use cases and experimenting with new ones.

More interesting than the individual applications are the strategies startups are attempting. Often these approaches work in concert, but they are discrete enough to be isolated. Four, in particular, are worth highlighting:

Focusing on close friends.

Counterpositioning on ethical or political grounds.

Moving beyond advertising.

Winning the next great use case.

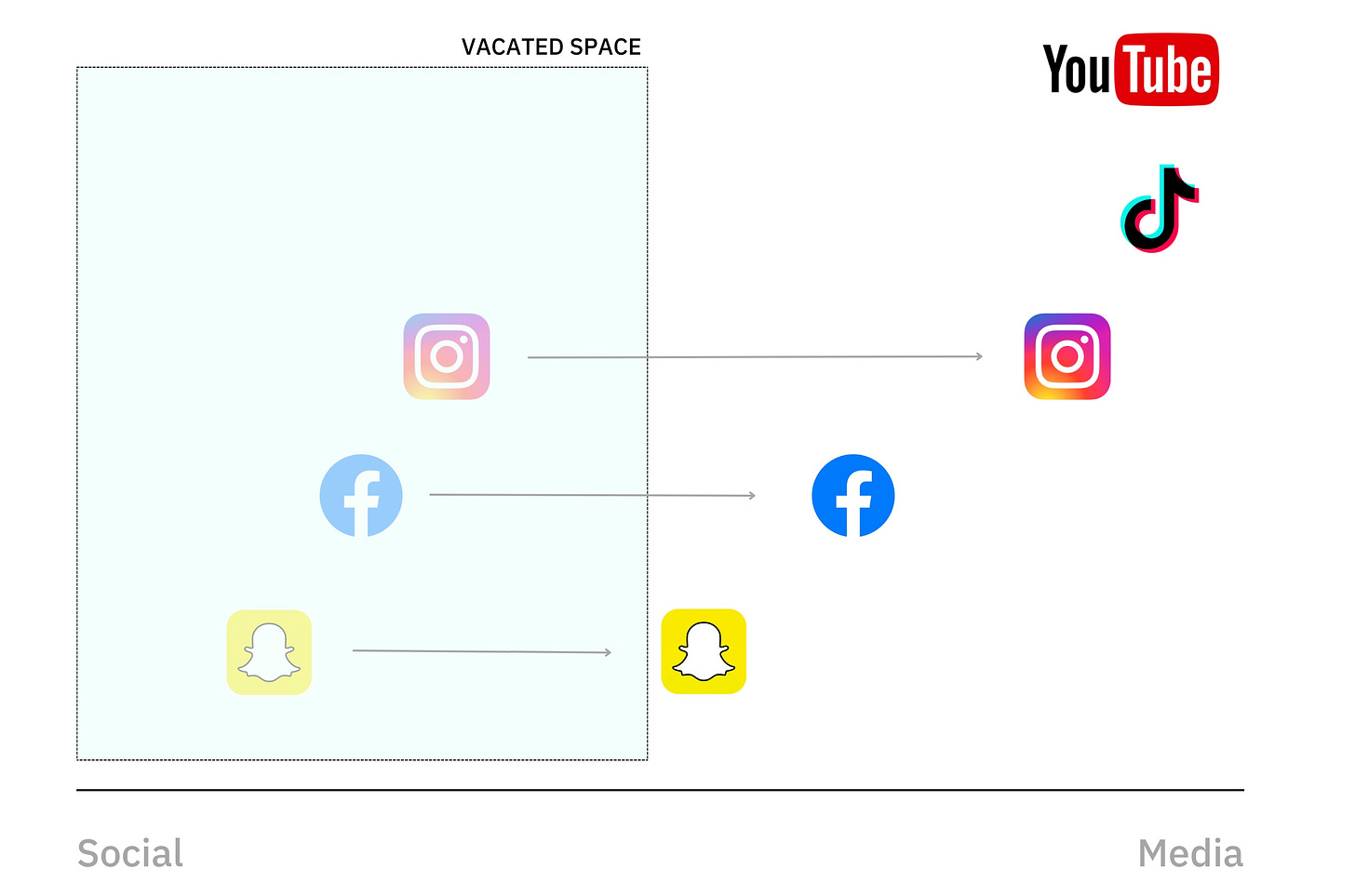

As discussed in last week’s piece, it is more accurate to refer to TikTok as a media company than a social network. It surfaces compelling content without needing to know who your friends are. As it has risen to prominence, others have followed suit. Facebook, Instagram, YouTube, and Snapchat rolled out equivalent features to keep attention on-site. If you think of social media as a spectrum – from social to media – all of these companies are shifting toward the latter end.

Startups like BeReal, Poparazzi, Locket, Gas, Slay, and others are moving into the vacated space. These companies don’t try to monopolize every moment of your attention; they want to give you a better way of staying in touch with your close friends. The mechanics of each of these platforms make this focus clear.

BeReal, Poparazzi, and Locket are photo-sharing networks that constrain the content users post. On BeReal, you’re only permitted to post one photo a day at a specific time. On Locket, users push an image directly to a friend’s home screen, which appears in a widget. On Poparazzi, you’re only allowed to post photos of your friends, not yourself. Neither app offers filters or other ways to improve the quality of your post; the goal is to be genuine rather than polished. As Alex Ma, CEO of Poparazzi, said in our conversation, “You can’t fake it. It’s this much more authentic version of who you are.”

Though all three are early in their lives and appear far from cracking monetization, they represent the vanguard of this new movement. BeReal has an estimated 73.5 million monthly active users (MAUs); a Series B raised in October 2022 valued the network at approximately $600 million. Locket has logged at least 20 million downloads and $12.5 million in funding. It pulled in a $10 million Series A from Sam Altman last summer.

Poparazzi is a little smaller. “We’re close to 8 million downloads and 100 million photos shared,” Ma said. Still, the platform has attracted significant attention from venture capitalists. Benchmark, the firm that backed Instagram and Snap, led the firm’s $15 million Series A in 2021. The app was reportedly valued at $135 million.

Gas, acquired by Discord earlier this week, takes a different approach in pursuing a similar goal. Though Gas aims to give friends new ways to interact, it does so via polls. Users are asked questions like who they secretly admire, who should DJ at every party and whose smile makes their heart melt. Since its launch in late 2022, Gas has rapidly attracted teens. Slay offers similar functionality for the European market. Other riffs on the “compliments app” include Sendit, NGL, and nocapp.

Though these apps – and others like them – play with different mechanics, they are united by the fact they only work with a social graph. The focus is not on building a media machine but on a network for close ties.

The second core strategy insurgents are leveraging is counterpositioning on ethical grounds. To some degree, virtually every social media startup does this, trying to cast their offering in a favorable light compared to the attention-thieving monoliths that came before them. Some do this by eschewing an ad model, while others highlight perceived moral failings or political biases.

We can see this approach play out most clearly with Twitter. Though Musk’s ownership may work out in the long term, it has undoubtedly opened the door for competition. Alternatives like Mastodon and Post News have benefited from the controversy surrounding Twitter’s CEO, attracting new users and capital. Mastodon reportedly poached more than 2 million from Twitter, though the company has chosen to forgo investment to retain non-profit status. Meanwhile, Post raised venture funding from Andreessen Horowitz (a16z). Though these platforms (and others like them) offer tweaks to the bluebird’s functionality, their fundamental virtue in the eyes of incoming users is that they are not Twitter.

Platforms like Gab, Truth Social, and Parler make the same arguments but on different grounds. While Mastodon and Post position themselves as more liberally-minded (their bugbear is the meddling, anti-woke billionaire), this trio does the same at the far-right end of the spectrum. For users of these platforms, Twitter is a product with an agenda, an agent of leftist censorship. In sum, both sets believe they are creating the platform for true free speech, but they look to find it in opposite directions.

Will these alternatives have staying power? Perhaps, on a smaller scale.

In the U.S., traditional media has increasingly pushed toward the poles. A Pew Research study from 2019 illustrates how partisan American news consumption is. Ninety-three percent of those who selected Fox as their main source of news identified as Republican, while 95% of those that chose MSNBC considered themselves Democrats. The information we consume reflects our political affiliations to an extreme extent.

The same fragmentation may occur across social media. Rather than assembling on a single unified platform like Twitter, users may increasingly fragment across several, each catering to a different worldview.

Though it might not look like it, this would be a marked difference from today. While we already live in social media echo chambers, the walls of these rooms do touch. For example, if you’re a right-wing conspiracy theorist, there’s a good chance your tweets will be met by opposition. In the Colosseum of Twitter, combat is partially the point. The emergence of implicit and explicit politicized alternatives could uncover whether this friction is a feature or a bug from a usage perspective.

As alluded to earlier, one of the primary questions about this next wave of companies is how they will make money. As consumers have become warier of ad-driven models, startups have experimented with other business models.

Gas is a good example. Since its launch last summer, the app reportedly pulled in $7 million in revenue. That arrived thanks to its subscription, “God Mode,” which allows users to see who voted for them in different polls. Yubo, a live-streaming network with 40 million users, also has a subscription product that management expects to produce $20 million in revenue in 2023.

Compared to the industry’s largest companies, these are tiny figures. But they demonstrate the potential to make money beyond advertising.

Subscriptions and in-app payments may better suit the hit-driven nature of social media companies. Like mobile games, it usually takes multiple attempts to land a winning product, and even when that does happen, success can be fleeting. Traditionally, social media companies have forgone early monetization so as not to inhibit growth, but it may be worth adding some degree of downside protection. Offering a paid product means that even if your app is little more than a summer fad, the exercise has not been fruitless, potentially producing millions in revenue.

Subscriptions and in-app payments are not the only options on the table. As TikTok has already shown, there’s an opportunity for social networks to act as the gateway to e-commerce. Turner Novak, founder of Banana Capital and writer of The Split, highlighted fashion-focused Teleport as a promising company from his portfolio. It is leveraging a revenue model that riffs on this theme. “It’s an app to post a video of your outfit each day,” Novak noted. “It’s incredibly simple to create a video, the content is centered around sharing outfit inspiration, and every video is shoppable. This leads to natural opportunities for Teleport to generate revenue by facilitating commerce.”

Alex Ma highlighted the possibility of monetizing Poparazzi’s brand. In his view, if a product is sufficiently well-loved, it could lend that affinity to monetizable products like concerts, music festivals, and merchandise. Perhaps the next Coachella will be built under the brand of Poparazzi or BeReal.

While that could produce a decent-sized business, it’s unlikely to make Meta sweat, a fact that Ma acknowledges. “You might not ever be as big as Facebook doing that,” he said, “But then there’s a moral question which is: Should a trillion dollar company even exist?”

The final strategy social media upstarts deploy is trying to win the next great use case. These companies look to be the first movers in promising but unproven categories.

Clubhouse is the best example from the past few years. The social audio platform recognized a shift in consumer behavior. Firstly, that aural content was undergoing a boom in popularity. Secondly, the introduction of AirPods meant we were primed to receive audio for much larger stretches of the day. When combined with a global lockdown, that produced a pandemic darling. Though Clubhouse hasn’t managed to sustain its early momentum, it recognized something true about the world that could provide the basis for future social networks.

Audio is one of many opportunities, of course. The last few years have seen many projects emerge at the intersection of crypto and social media, like Decentraland, Farcaster, Context, DSCVR, Geneva, Revel, t2, and many more. (As a note, Generalist Capital is an investor in Geneva and t2.)

These projects introduce new functionality and infrastructure, such as surfacing on-chain activity (NFT or token purchases), turning creators into tradable assets (social tokens), or leveraging a decentralized architecture to simplify building and protect against censorship. Of course, if crypto does take off in the manner many hope, the success of these projects is not guaranteed. But at the very least, these platforms will be well-positioned relative to web2 alternatives.

Next: Three trends

The writer Arthur C. Clarke described science fiction as “an escape into reality.” In Clarke’s estimation, unlike other art forms, his chosen genre was concerned with “real issues; the origin of man; our future.”

It’s time for us to attempt a Clarkian journey, looking into the future not as a form of distraction but as comprehension. Given our current knowledge of social media’s patterns and propensities, what will the next ten years bring? What trends can we identify and extrapolate? There are three in particular that I think are worth watching:

A relentless march towards richness.

Economies replacing advertising.

The rise of synthetic kinship.

One of my favorite interpreters of social media is Rex Woodbury, writer of the Digital Native newsletter and partner at Index Ventures. In our exchange, Woodbury highlighted a key dynamic in the space: the “march toward richer media formats.” Text was replaced by photos which were usurped by video.

What follows video?

“Immersive worlds feel like a natural next step,” Woodbury said, highlighting Minecraft and Roblox as models for future experiences. While the Index partner notes these could take place in the browser, they could eventually become fully-fledged VR or AR ecosystems.

Poparazzi’s Alex Ma also pointed to gaming worlds as potentially predictive. “Fortnite is by far the most social experience you can have online right now,” he said, referring to the battle royale game, which has also hosted virtual concerts.

Will the social experiences of tomorrow look more like Roblox or Fortnite than Facebook? That is, of course, the view of Facebook’s creator Mark Zuckerberg. As discussed last week, Snap is making a similar bet on AR.

All of which is to say that if social advances according to this historical pattern, both Meta and Snap’s high-level theses will be proven correct. However, the wisdom of their investments in VR and AR will come down to the manner and timing in which immersive worlds manifest for the mainstream.

“I’m skeptical in the short-term,” Ma said of the metaverse. “But in the long-term I think that’s where the world is trending.”

Social media may also take inspiration from immersive games on the business model side. Platforms like Roblox have demonstrated the power of running in-world economies. Rather than leveraging ads, Roblox monetizes via avatar accessories, game upgrades, or other special experiences. Users must buy Robux, the company’s in-game currency, to access these items. One of the advantages of this dynamic is that Roblox essentially gets an interest-free loan from its consumers: it receives money for Robux, which is often only spent later. It is, in effect, a very strange neobank, denominated in a fantasy currency. (For other “secret neobanks,” see Starbucks.)

It’s easy to imagine how these mechanics could be leveraged within a social media app. Users might pay to boost their visibility, style their profile, unlock information, or purchase real and digital items. As mentioned, we see this behavior already in apps like Gas and Yubo. It’s also common in the adjacent world of dating. Apps like Tinder and Bumble earn hundreds of millions in revenue from users paying for kindred features.

Woodbury notes that this monetization style is common outside the U.S. “In China, many large players stitch together subscriptions, gifts, ticketing, and other revenue streams,” he explained. “Business models are much less monolithic than here in the U.S. (Snap and Facebook are 90% ads-driven), and we may see more multi-pronged approaches over the coming years.” The next generation of social media giants may not obsess over capturing attention. Instead, they’ll focus on creating functional, multifaceted economies.

AI could be responsible for the most profound change in social media. That is likely to be true in banal and radical ways. It takes little imagination to envision how generative AI could be used to create content for social networks. ChatGPT can write decent tweets, and DALLE-2 can craft more compelling images than most Instagrammers. Captivating videos will soon be within its grasp.

AI may not simply change the content we post; it could remove the need for social media altogether. Fundamentally, we seek out those platforms to connect. Humans crave kinship, a sense of belonging with a larger group. Right now, that can only be sated by interacting with other humans. Very soon, though, that may no longer be true.

Already, AI has matured to a point where it is possible to have a meaningful relationship with it. One of The Generalist’s first-ever pieces outlined how dating was “scaling beyond the human.” Romantic chatbots like those offered by Replika are more than simple time-fillers; they are synthetic partners that people form genuine attachments to.

Though this behavior remains niche, it fits William Gibson’s classic adage: “The future is here — it’s just not evenly distributed.” As the technology improves and social mores change, we should expect to see more people seek connection from artificial partners and friends. Though dystopian, it seems eminently plausible that humans may have dozens of synthetic friends and loved ones in future decades. We will talk and play and share with these creations as we do today.

Will we rely on a network or platform to organize these relationships? Maybe. In some respects, it feels like a logical extension of social media’s dynamics. We are increasingly splintered into echo chambers. We may eventually retreat into the ultimate echo chamber: a room with us alone, surrounded by hundreds of thousands of fabricated friends. Instead of connecting with one another (or pretending to), we might live in private versions of The Truman Show, with AI playing the other characters.

Less despairingly, AI could be used to bootstrap new social experiences. The founders of future platforms may solve the cold start problem by generating billions of synthetic personalities to interact with human participants. Even a network with a few hundred “real” users could be made to feel active in this way; the lines between human and artificial people will become increasingly blurry.

“What I value is the naked contact of a mind,” Virginia Woolf wrote. Woolf was not alone in that desire. Indeed, humans crave connection; social media was our generation’s attempt to deliver it.

We have seen enough to know it is not the right answer. Not only does it not satisfy that desire for community, it often works directly against it. In the process, it introduces various other problems that have proven difficult to shift.

Can we find better alternatives? Though the newest crop of social competitors has a long way to go to prove they can be similarly successful businesses, they are introducing new variables that could prove valuable.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.