If you would like to support The Generalist, the #1 thing you can do is share this email with someone you think might like it. Thank you. ❤️

🐰 Overheard

(Quotes from clever people)

There will be some pain at SoftBank, but they’re all billionaires. They’ll be fine. It’s embarrassing for Masayoshi Son, but big deal. MBS’s Saudi Arabia investment fund? Couldn’t happen to a nicer group of people.

Vindicated WeWork bear Scott Galloway discusses the company’s demise in a recent NY Mag interview. A few other companies he believes are poised for turbulent times ahead: Peloton, Uber, Wag and Compass. Hard to exaggerate what a brutal markdown Softbank’s portfolio has taken in 2019.

🍸 Monitoring: Modern Moonshine

(One space worth keeping an eye on)

The problem: millennials are putting down the bottle. They’re also not crazy about cigarettes, cocaine, or weed either, particularly when compared to Baby Boomers.* That’s hitting traditional purveyors of hooch in the pocket with stumbling beer sales, and slowed growth for wine and spirits.

The solution: Just Say Yes. Only this time to a substance that may be better branded, better for you, or simply novel. Both traditional beverage brands — including Heineken with their 0.0 line and Coca-Cola with Bar None — and insurgents are bringing new formulations to market. A few segments to watch below.

Female-focused brands. Apart from Skinny Girl Margarita, few brands cater to women. Companies like Bev, and Babe, are targeting a young female demographic, offering canned wine. The latter producer, founded by IG ‘celebrity’ The Fat Jewish, sold outright to Anheuser-Busch this summer. Bev, meanwhile, picked up $7MM from Founders Fund.

Non-alcoholic beer. While traditional beer grew an average of 0.2% over the past 5 years, alcohol-free suds have risen 3.9% annually. That makes it the fastest growing segment, with insurgents like Athletic Brewing taking advantage. Beyond beer, Seedlip has established themselves as an early front-runner in the alcohol-free spirits space. Diageo holds a minority stake.

Cannabis. Perhaps the noisiest entrant to the space is CBD, with THC-infused drinks cutting a slightly lower profile. Recess, the vaporware-inspired canned drink is near-ubiquitous in NYC stores, competing against brands like Cann, Dram, Bimble, Sprig, Oh Hi, Two Roots, Hempd and dozens of others.

New formulations. Kin is giving “euphorics” a place behind the bar, combining nootropics, adaptogens, and “replenishing botanicals” to bring a new kind of high to coastal millennials. Moon Juice appears to offer a similar concoction.

What’s next? While I’m most excited by companies like Kin that bring novel substances to market, successful brands will be built in each category. Given the size and acquisitiveness of incumbents, it is unlikely these companies stay independent for long. The best investment outcomes will come from backing capital-efficient brands at valuations that allow for strong returns on a < $100MM acquisition. ‘Sober bars,’ though an intriguing phenomenon, may be a harder place for VCs to play.

One final area to watch? Digital drugs. Or rather, digital experiences that replicate some of the cognitive effects of narcotics. While we are all well-acquainted with the dopamine-hijacking of social media and certain game mechanics, more interesting effects may be possible through augmented and virtual reality. The Museum of Future Experience, a recent YC graduate, has come to market with a VR journey that in some respects mirrors the free-associative logic of dreams or a trip.

—

*Worryingly, painkiller usage is on the rise.

🖼️ 1000 words

(Something to look at)

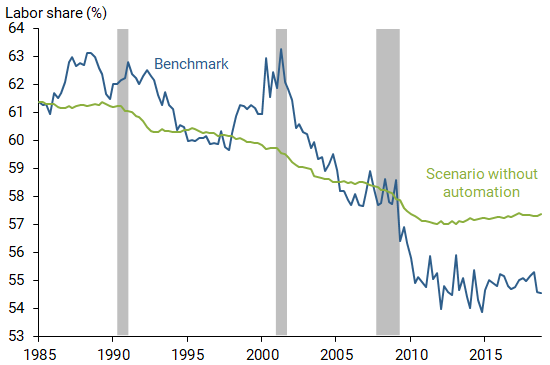

Robots are making us poorer. Despite a blundering president’s best efforts, the economy remains strong, with low unemployment. Nevertheless, automation is resulting in a decline in “labor share,” the amount of national income that goes to workers. It has fallen from 63% in 2000 to 56% in 2018. As businesses have more ability to automate work, employees have decreasing leverage in salary negotiations.

The graph above shows the current decline in blue, along with a projection of what the labor share might have looked like without automation in green.

😱 Signs of the apocalypse

(Look on my Works, ye Mighty, and despair!)

Super babies. Three CRISPR babies may have been born already. He Jiankui, a Chinese biophysicist, previously edited the DNA of twins, making them immune to HIV. About 9 months ago, he confirmed he’d worked on another fetus.

The cause of coyotes. Nextdoor, the neighborhood social media platform, has become ground zero for a certain kind of boogey-man: the homeless. Often without evidence, neighborhoods coalesce in blaming itinerant locals for theft, drug use, and even coyotes. Particularly tricky given that those without a physical address cannot join the platform.

🐒 Long tail

(Best of the rest)

Paypal buys its way into China. The company’s acquisition of GoPay looks like a savvy way to break into the market. Interesting relative to the Niall Ferguson article discussed last week.

“Alexa, how do I get these motherf*ckin snakes, off this motherf**kin plane?” You can now replace Alexa’s default voice with Samuel L. Jackson’s. Part of a broader trend of voice assistants turning to celebrities to spice up their offering.

Pioneer’s founder wants to identify ‘lost Einsteins.’ In the process, he’s created an addictive, complicated game that seeks to quantify productivity.

More consumers are paying with installments. Companies like Affirm, Quadpay and Afterpay have normalized the practice, especially among the young. Worrying.

Wag is in the doghouse. $300MM from Softbank hasn’t been able to stop layoffs and unrest.

Meow Wolf is worth 9 figures. What started as a ragtag art collective in Sante Fe, may be the psychedelic future of the ‘experiential-economy.’

Michelle Phan was once the face of Beauty on YouTube. After an extended hiatus, the social media star is back…and she loves Bitcoin.

Mark Zuckerberg is ready to “go to the mat.” In leaked tapes, Facebook’s founder shares his willingness to combat attempts to break-up the company. He also discusses the threat of TikTok, and Libra’s regulatory trouble.

Spencer Dinwiddie tried to IPO himself. The NBA player wanted to turn his contract into shares, available for public investment. The league said no.

Derek Amato smashed his head on the side of a pool. He regained consciousness with an ability to play the piano. The connection between head trauma and genius is more common than you might imagine.

This robot can make 300 pizzas an hour. Picnic Robotics has raised $8.7MM from Vulcan Capital and Draper Associates. The company is joined by other robotic pizzaioli including Zume and Domino’s.

The Democratic Republic of Congo’s minerals trade is being cleaned up. Barcodes are replacing paper tags as proof of provenance. The latter were particularly vulnerable to fraud. Hopefully, this results in fewer buyers unintentionally propping up mines that use child labor.

Hereticon is here. Peter Thiel’s Founders Fund is hosting a conference for ‘ideological outcasts.’ Predictably, the great man’s acolytes are incredibly pleased with their own sense of daring. At the very least, you have to applaud the mental gymnastics it must have taken this mostly white, mostly male, very wealthy group to cast themselves as outsiders.

🧩 Puzzler

(A question, conundrum, or riddle to mull over)

A precious stone, as clear as diamond.

Seek it out while sun's near the horizon.

Though you can walk on water with its power,

Try to keep it, and it will vanish within the hour.

The answer to last week’s riddle was “pencil lead.” Hmm. Looking forward to hearing people’s guesses this week. Finding them often much cleverer than the actual answers.

💸 Something Extra

[Subscribers of The Generalist received an exclusive offer.]

It looks like a sleepy day in NYC. Hope that those of you in the city and beyond enjoy a gentle, leisurely Sunday. 💙