The Six Stories of Mercado Libre

Latin America's largest e-commerce company is a Borgesian perplexity.

I would like to tell you six stories.

None are mine.

One belongs to Marcos Galperin. The other five, Jorge Luis Borges.

Perhaps one of these names means something to you; perhaps both; perhaps neither. Marcos Galperin is a businessman from Buenos Aires who is alive. Jorge Luis Borges is a writer from the same city who is dead.

(It is theoretically possible to write about Argentina without talking about Borges, just as it is possible to do so and not mention Messi. I shall fail twice.)

One is the story of a building company. The other five are stories of chance, time, dimension, possibility, delusion — which reveal something true about that company. We will meet monsters and labyrinths, enemies and ourselves.

Together, all create a larger story, the story of Mercado Libre, the largest e-commerce business in Latin America. In its scope and ambition, “Meli” is a Borgesian perplexity. It is both an e-commerce store with endless aisles and a bank, offering an intricate lacework of financial products. Though constrained geographically, it has found infinite opportunity by carving a fractal groove. And though others came to market first, Meli often leads the way, a late-mover that makes its own time.

Follow me.

History (or The Circular Ruins)

“He wanted to dream a man; he wanted to dream him with minute integrity and insert him into reality.” — Jorge Luis Borges

This is the first story.

In The Circular Ruins, Borges tells the tale of a wizard. The wizard arrives at an ancient temple with a goal: to dream a man into reality. After first conjuring a lifeless class of pupils, he changes his approach. Over two weeks, he succeeds in dreaming a man, piece by piece, into being.

The wizard raises the man as a son and then, as an act of compassion, erases his memory, so as to unburden him from the knowledge he is different from others.

A fire sweeps through the countryside. The wizard walks into the flames, realizing that though he is about to die, it does not matter, for he too was “an illusion, that someone was dreaming him.”

In its audacity and intimacy, creating a company resembles dreaming a human to life. In founding Meli, Marcos Galperin sought to not only manifest a new entity but change a continent.

Beginnings

Like all good founding stories, we begin in a garage.

In 1999, Galperin graduated from Stanford Business School and returned to his homeland of Argentina. It was not the first time he’d studied in the US, attending the University of Pennsylvania as an undergraduate, before working at YPF, a South American energy company.

This time was different. Rather than returning an employee, Galperin settled into space in sleepy Saavedra, a residential neighborhood of Buenos Aires, as a CEO.

Galperin had spent much of his time at Stanford obsessing over the nascent e-commerce revolution. In particular, he’d been fascinated by online auctioneer eBay, admiring the company’s impressive rise while simultaneously remarking on the absence of a similar player in Latin America.

Someone would build a regional player, he was sure. Why couldn’t it be him?

With a mop of dark hair and a gaze of childlike earnestness, Galperin could give off an air of credulity. That disguised the brilliant mind and fierce competitor that lay beneath. As a youth, he’d been obsessed with programming and chess before graduating to rugby, rising to Argentina’s youth team. (I could not figure out what position Galperin played. I picture him as a scheming fly-half in the mold of compatriot Hugo Porta, to whom he bears more than a passing resemblance.)

He had the education, the drive, and even the experience, in a manner of speaking. His family owned the globally-renowned leather company, Sadesa, and young Marcos had grown up surrounded by business discussions.

And, finally, he had the money. Galperin secured it memorably.

At Stanford GSB, Galperin had developed a particularly close relationship with a professor known to attract business celebrities to his class. The young Argentine learned to take full advantage of that exposure, though not after a miss he kicked himself for: he sat next to Warren Buffet for ten minutes without realizing who he was.

He would not allow a repeat of that oversight. When John Muse, founder of HM Capital Partners, visited, Galperin was ready. With the help of his professor, he wrangled the right to drive Muse to his private plane after the lecture. With Muse at his mercy, Galperin used the journey to pitch his idea to the tycoon, even taking a deliberate wrong turn to buy himself an extra twenty minutes.

Latin America needed its own eBay, a platform uniquely built to overcome local challenges and capitalize on regional buying patterns. Yes, Muse was right, internet penetration was low on the continent. And online buying? Practically non-existent. But it was only a matter of time, a matter of innovation, Galperin was sure of it.

Later, Galperin would recount the moment he secured his first check.

“He dropped his suitcase and said, ‘I would like to be an investor.’”

Muse was in; others soon followed.

With money in the bank, a new diploma to frame, and a CTO — his cousin Marcelo — Galperin sat at his garage desk and began.

Mercado Libre was off to the races.

Competition and survival

When Galperin pitched Muse, the timing for something like Meli could not have been better. Not only did Galperin have an open playing field with no meaningful competition, tech stocks were soaring.

But markets change quickly. In just its first year of operations, Meli would need to vanquish a foe and adapt to a radically different investment environment.

With penetrating hazel eyes and a sharp, fox-like grin, Alec Oxenford flaunted the intensity that Galperin seemed to disguise. A fellow Argentine, Oxenford navigated a similar path to Galperin, starting his career as a BCG consultant before attending Harvard’s Business School and starting a Latin American e-commerce company, DeRemate.

Just weeks after Meli’s August 2, 1999 launch in Argentina, DeRemate followed suit. Though chasing the same prize as Galperin, Oxenford and his ten other co-founders adhered to a radically different playbook.

Whereas Meli built a custom tech stack — leveraging state-of-the-art systems — DeRemate went off the rack. While Meli sought to win its own customers, DeRemate was happy to buy them, purchasing E-Bazar and its user base. And though Meli was far from short of cash, snagging $7.6 million seed funding from Muse, JP Morgan, and Flatiron Fund, DeRemate took it to a different level.

After a modest seed round, financed chiefly by its swarm of founders, DeRemate pulled in a $12 million Series A from Citigroup before landing a $45 million Series B from Terra, owned by Spanish telecom operator Telefonica. That valued Oxenford’s eight-month startup at $150 million, haring towards a multi-billion dollar IPO.

A year earlier, or just a few years later, and DeRemate’s high-speed, high-spend, blitzscale gambit might have worked. Then the bubble burst. In April 2000, affected by increased interest rates, the Japanese recession, and the aftermath of excessive speculation, tech companies plummeted. A door that had looked wide open to DeRemate was slammed shut. Though Oxenford would try to adapt the business’s strategy, DeRemate would never recover, eventually selling to Mercado Libre in 2005.

Amidst the noise and turbulence, Meli kept executing. Within three months of its launch, the company had attracted 15,000 users, completing transactions worth a cumulative $2 million. In a rare show of bravado, on New Year’s Eve in 1999, Galperin declared his company would become the largest in Latin America. Even after the dot-com collapse, Meli remained on track, expanding from Argentina to Brazil, Mexico, and Uruguay within a year. In a move that would pay dividends for years to come, Galperin recruited fellow Stanford MBA Stelleo Tolda to manage the critical Brazilian market.

Meli’s durability and perseverance positioned them perfectly to capture the attention and benevolence of the company they sought to emulate. In 2001, Meli acquired a subsidiary of iBazar, owned by eBay. Instead of taking an all-cash deal, eBay asked for equity, taking a 19.5% stake in Galperin’s company. As part of the deal, eBay agreed to share best practices and stay out of Latin America for five years. (The American firm would hold onto their stake until 2016.) By the end of 2001, Meli’s GMV had surpassed $20 million.

While the crash crippled many companies, Meli emerged with a growing customer base, a strengthened team, a lame-footed rival, and the backing of an internet giant.

Moving money

From the very beginning, Galperin wanted Meli to be more than just a place to match buyers and sellers. To change Latin American commerce, the company would need to manage payments.

In 2003, Meli took its first steps into fintech with the launch of “Mercado Pago,” an on-site solution that processed payments. It represented the start of a lengthy, still-evolving obsession with bringing financial services to the region.

Though Pago represented a significant addition to the platform, the challenges posed by Latin America’s unbanked population prevented it from being as widely used as it might have been in the US. Cash and checks reined; credit cards were a rarity. As Galperin had explained to Muse, though, his team understood the local market and would build enterprise value by tackling such issues head-on.

Pago’s first solution was to develop an escrow service that relied on a network of collections agents. Buyers on Meli would pay for their purchase with a local agent who would log its receipt, prompting the seller to release the goods. The seller would subsequently receive the cash from a pick-up point on their end.

Creative solutions like this proved vital, contributing to Pago’s rise. Within three years of its debut, Pago processed more than 8% of platform GMV, totaling close to $90 million in 2006. In the years that followed, Meli’s fintech division would proliferate into a range of products, including credit, point of sale systems, and consumer wallets that rival the initial e-commerce platform in importance.

It is a testament to Galperin that such efforts began so early.

Going public

On August 9, 2007, BNP Paribas froze $2.2 billion in assets. The French bank rationalized keeping investors from withdrawing capital by pointing to the "complete evaporation of liquidity" in the US market. It represented the kick-off to the credit crunch and the Global Financial Crisis that would subsume the world’s economies over the next two years.

It was also the day that Mercado Libre went public.

There was a certain symmetry to the date. It was, almost to the day, the eighth anniversary of Meli opening its doors. And it seemed almost fitting that Galperin’s company would mark yet another occasion, as it had in 2000, with a market meltdown.

Meli became the first Latin American company to list on the Nasdaq, and despite the day’s gloomy news, saw a surge in its share price, jumping from $18 to $36 for a market cap of $1.6 billion. As had been the case seven years earlier, there was much for Meli to celebrate even as storm clouds gathered.

The firm’s S-1 shows a business in rude health. Meli was the largest e-commerce platform in Latin America, spanning twelve countries. In 2006, net revenues snowballed, up 85% year-over-year to reach $52.1 million. Pago contributed 14% of that sum, thanks to nearly 1 million transactions.

As financial behemoths staggered and shuttered the following year, Meli kept expanding. In 2008, the company purchased Classified Media Group, owner of sites tucarro.com and tuinmueble.com. By moving into the classifieds market, Galperin stepped into the arena with an old foe. Since docking DeRemate, Alec Oxenford had started a new company: OLX, a classified ads business for Latin America and beyond.

But Galperin had bigger things to worry about than competition. Though all seemed well on the surface, Galperin felt the need for a refresh. As he later told it, he was about to “bet the company.”

Opening the platform

“New World.”

That was the name given to Meli’s 2009 plan to renovate its technical stack. Though the company had shown admirable foresight in building its own platform off the bat, its systems began to show their age. That manifested in customer complaints.

To address the issue, Galperin moved “to a cubicle next to the CTO’s office, to learn the issues our technical team was dealing with first hand.” Over the next three years, Galperin and new-CTO Dani Rabinovich would undertake a massive renovation. “New World” was designed to position Meli to capture mobile traffic — rising since Apple’s introduction of the iPhone in 2007— and interface with external players. In short, Meli was transforming from application into platform.

It’s hard to overstate just how significant a move this was, though Galperin’s “bet the company” confession illustrates the jeopardy. If Meli had failed on this front, it might very well have failed to make the jump to mobile, leaving the door open for a competitor to leapfrog them in the process.

With a surefootedness that would become something of a calling card, Galperin stuck the landing. In 2012, Meli unveiled its revamped platform and APIs, encouraging engineers to interface with the company. They duly followed suit, developing a range of apps that increased Meli’s distribution and extended its functionality.

This technological shift came with an organizational one. To facilitate a more open-sourced system, Meli moved away from monolithic divisions to self-sufficient “cells,” which interfaced with each other. An example of Meli’s practice of cribbing best practices from competitors, the move strongly resembled Amazon’s reorganization. The following year’s 10-K described the shift:

Since 2010, we have been working on a deep technology overhaul that is allowing us to switch from a closed and monolithic system to an open and decoupled one. We are splitting MercadoLibre into many small “cells.” A cell is a functional unit with its own team, hardware, data and source code. Cells interact with each other using (Application Programming Interfaces, or APIs). All the Front-Ends are also being rewritten on top of these APIs.

In both infrastructure and organization, Meli had disrupted itself from within.

Investing in logistics

In the Generalist’s coverage of Coupang, we marveled at the company’s logistical strength while acknowledging that the concentration of South Korea’s population in Seoul made delivery comparatively straightforward.

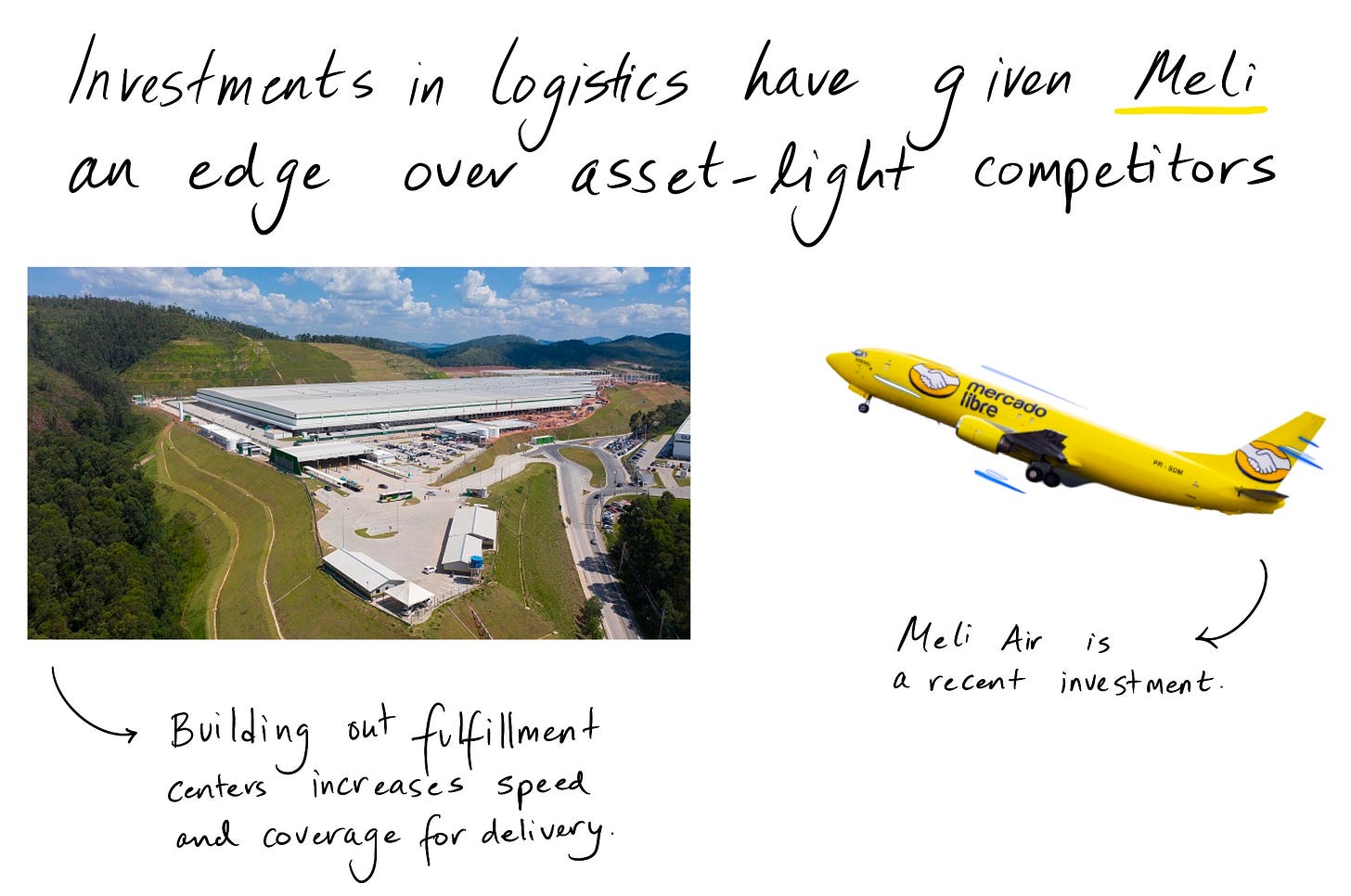

Meli had no such luxury. With operations across a region with patchy infrastructure and unreliable national postal services, Meli had to get creative. At first, that meant working with a patchwork of local providers — not unlike the methodology employed by Tokopedia for Indonesia’s archipelago — in addition to trialing unorthodox solutions like operating a fleet of motorcyclists to deliver packages. While ingenious, such hacks failed to address the problem sufficiently.

In 2013, Galperin set out to fortify Meli’s logistical capabilities, launching “Mercado Envíos.” Though Envíos began as little more than an ordering-tracking solution, it became an increasing focus for Galperin, drawing considerable internal investment. The company also turned to M&A, picking up Axado, a Brazilian logistical software business. By 2017, Meli could offer fulfillment services in Brazil, its biggest market.

That arrived not a moment too soon. In early 2018, Brazil’s national postal service, Correios, hiked its prices, with some deliveries costing an extra 50%. With much of Meli’s traffic in the country still managed via Correios, this represented a significant hit, crippling Meli’s bottom line. That encouraged some analysts to downgrade their ratings of the company.

But Galperin doesn’t do things by half-measure. When Meli’s finances were under fire, he doubled down on the initiative to secure the company’s future, building out fulfillment centers across the region and rolling out broader free-shipping coverage.

By 2019, despite negative earnings the year prior, Meli’s gambit had paid off. Envíos was handling more than 80 million packages a quarter across six countries. (In 2020, the company would unveil “Meli Air,” a fleet of planes to speed up deliveries and improve delivery speed.)

Coronavirus boost

Even Galperin couldn’t have known just how vital those investments in logistics would prove to be. As the world closed its doors to stop the spread of the coronavirus, Meli entered warp-drive as shopping moved online, en masse.

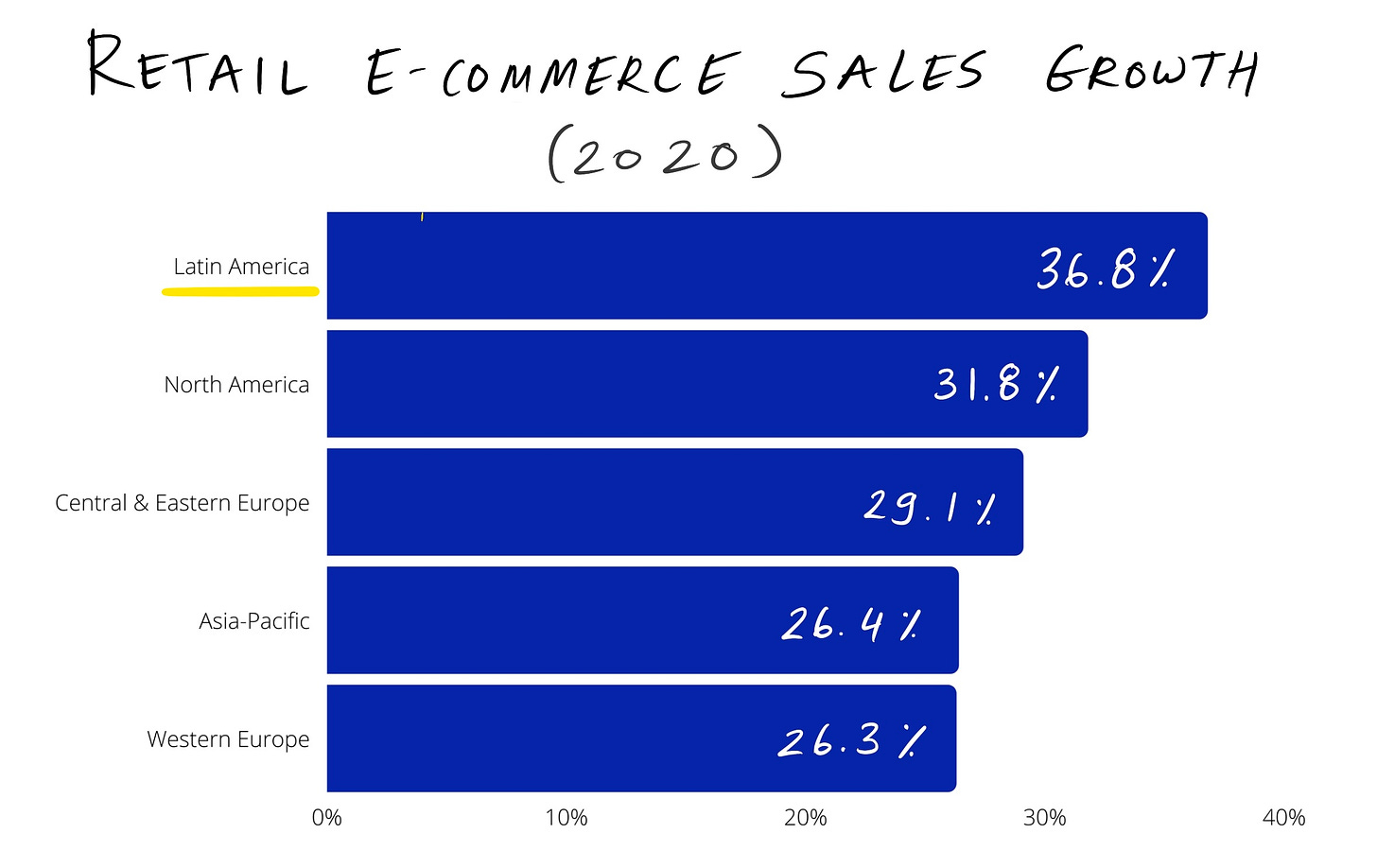

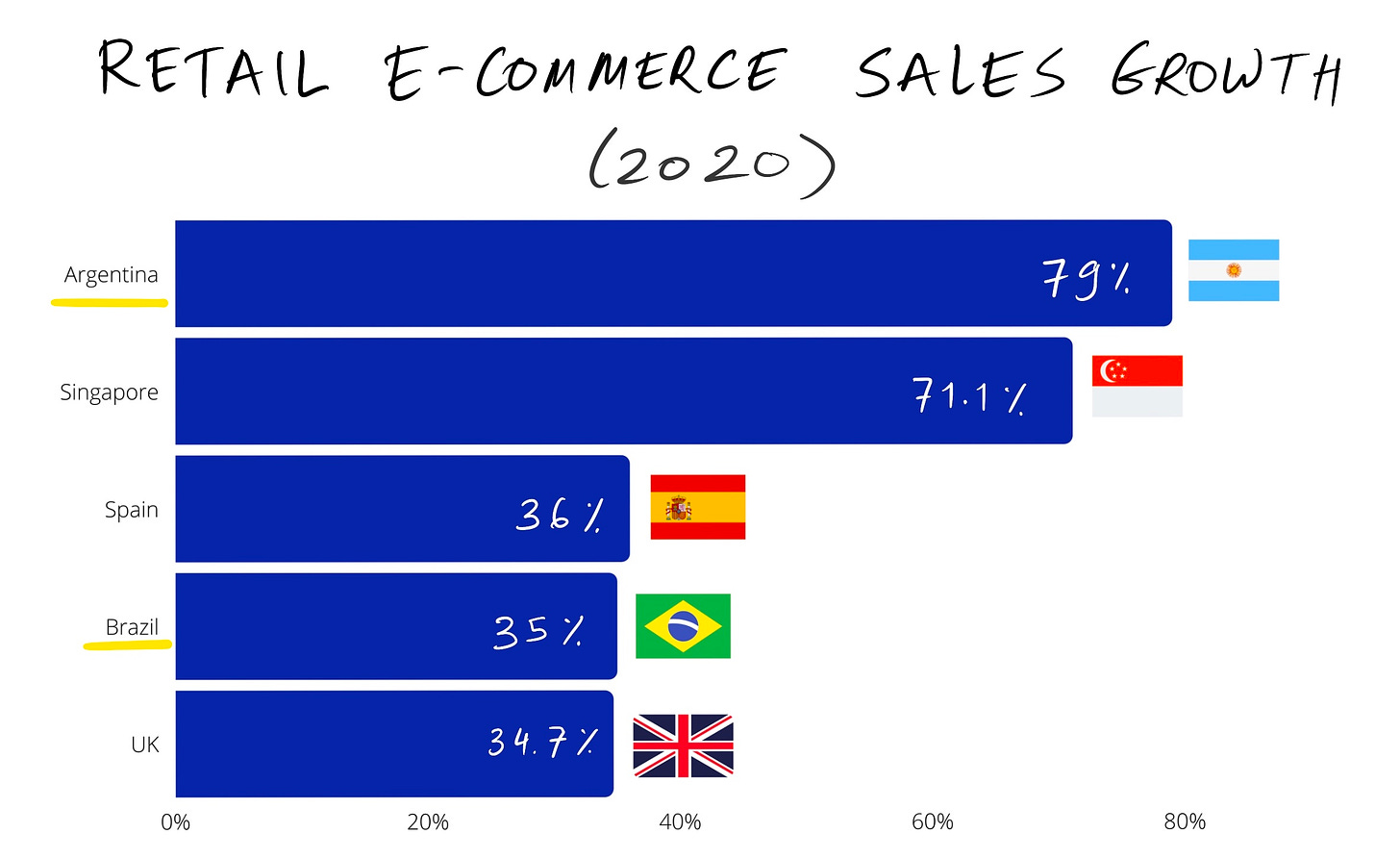

While other businesses wilted, e-commerce received the covid blessing, pulling forward adoption by several years. Even within that lucky sector, Latin American companies received a particular benediction. The geography was the fastest-growing region for e-commerce sales growth in 2020, hitting 36.8%. That outstripped North America (31.8%) and Asia-Pacific (26.4%). Notably, APAC had held the top spot for the ten years prior.

Of the five most strongly affected countries, two were critical territories for Meli. Argentina expanded most in 2020, with a 79% increase, while Brazil rose 35%.

In reflection of that fact, Meli’s stock began the year at $600 before skyrocketing to over $2000. That was a manifestation of the boggling volume — both in packages and payments — moving through the Meli platform. In 2020, active users reached 132.5 million (+79% YoY), net revenues swelled to $3.9 billion (+74%), number of items shipped approached 650 million (+ 111%), and total payment volume stopped just short of $50 billion (+75%).

Those figures revealed the scale of what Galperin had achieved. Starting in the Saavedra garage more than twenty years earlier, Meli’s founder had set out to build eBay for Latin America. In the process, he had created so much more — an e-commerce marketplace, classifieds business, advertising arm, payments goliath, and logistical marvel.

The soft-spoken computer geek from Buenos Aires had even surpassed the vision he’d pitched to Muse all those years before. The dream had come to life.

Modern Meli (or The Secret Miracle)

“Grant me those days, Thou who art the centuries and time itself.” — Jorge Luis Borges

Let me tell you the second story, the tale of “the secret miracle.”

Jaromir is a writer, imprisoned for his faith. In the days leading up to his execution by a firing squad, he laments how little time he has had to finish all the great works he hoped to compose. On the day of his death, Jaromir is brought out into a courtyard to be killed. As a gun is fired, Jaromir makes a wish for more time.

Though he braces himself for death, the bullet doesn't arrive. Jaromir soon learns that a miracle has occurred — Time now stands still. As the rest of the world is paused, Jaromir writes his magnum opus in his head.

Once it is finished, Time unfreezes, and the bullet continues its trajectory. Jaromir is killed, grateful to have completed his work.

Though Meli deals with nothing so serious as life or death, this is a company with a unique relationship with time, one that often seems to have benefited from the same miracle as Jaromir.

Meli was a comparatively late-mover to the e-commerce space, arriving five years after Amazon, four after eBay, one after JD.com, and four months after Alibaba. Often, the company leverages this position to its advantage, using the activities of its more mature competitors to inform its next steps. That might suggest Meli is the consummate mimic, a role filled by several companies operating in emerging markets.

But it’s not as simple as that. Yes, Meli came to market after other global giants, but it never seems to lag them. Rather, the company gives the impression of having the ability to unfurl time as it chooses — allowing others to make the first move so that it might observe the outcome, then pressing pause to catch up.

(The other Argentine genius with this superpower? Messi. For the first five minutes of every game, the greatest footballer of all time (come at me) barely moves. He walks the pitch and watches. Why? To see what’s happening — where opposition is positioned, how the ball is being moved. Once he has “solved” the game in his mind, he begins. And somehow, he influences the match as if no time passed. Which — don’t be fooled by the clock — it hasn’t, of course. Messi has simply unleashed the secret miracle and put us all on pause.)

Perhaps that explains how Meli has succeeded in growing so many business lines, each with relatively mature offerings.

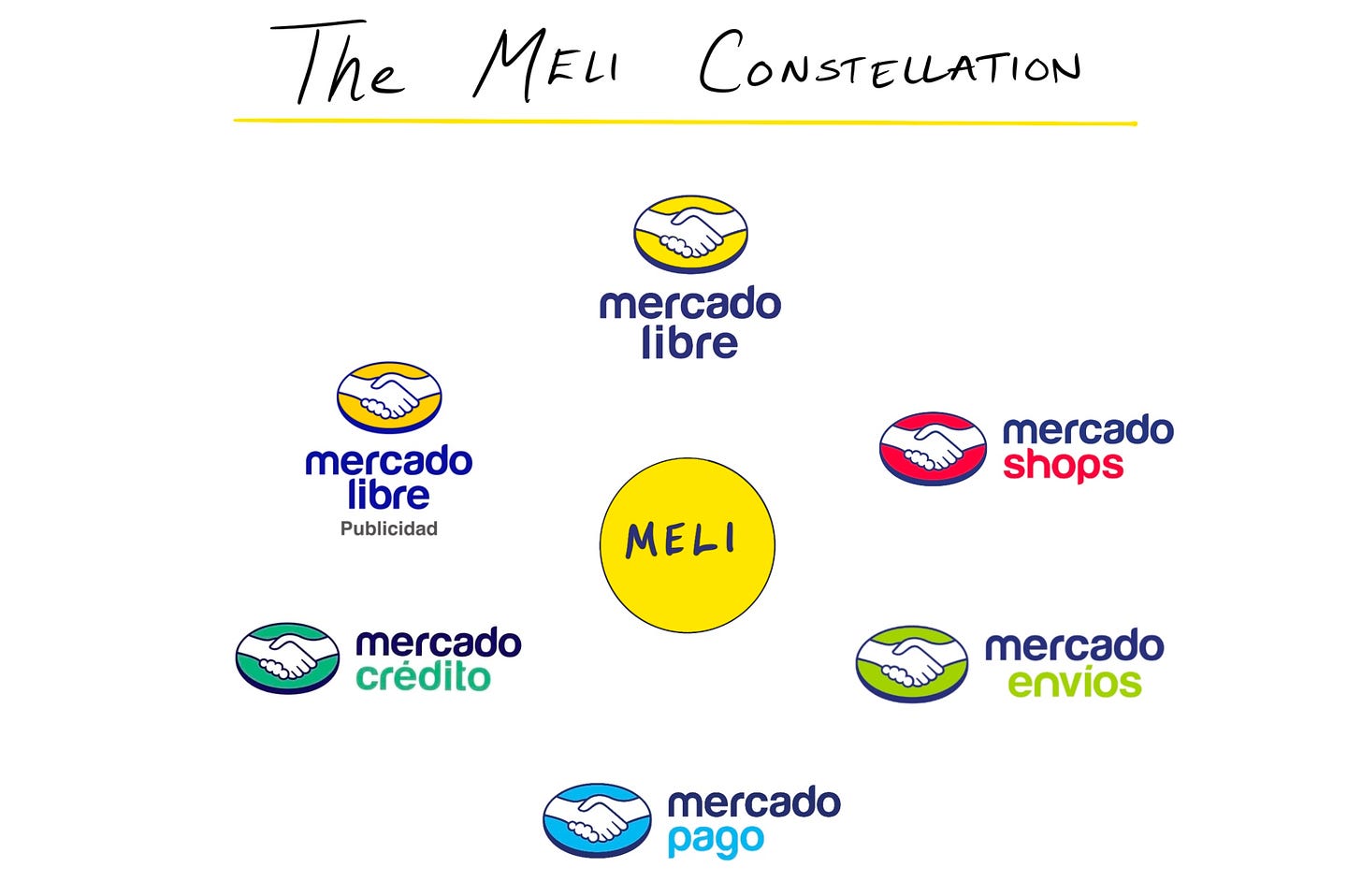

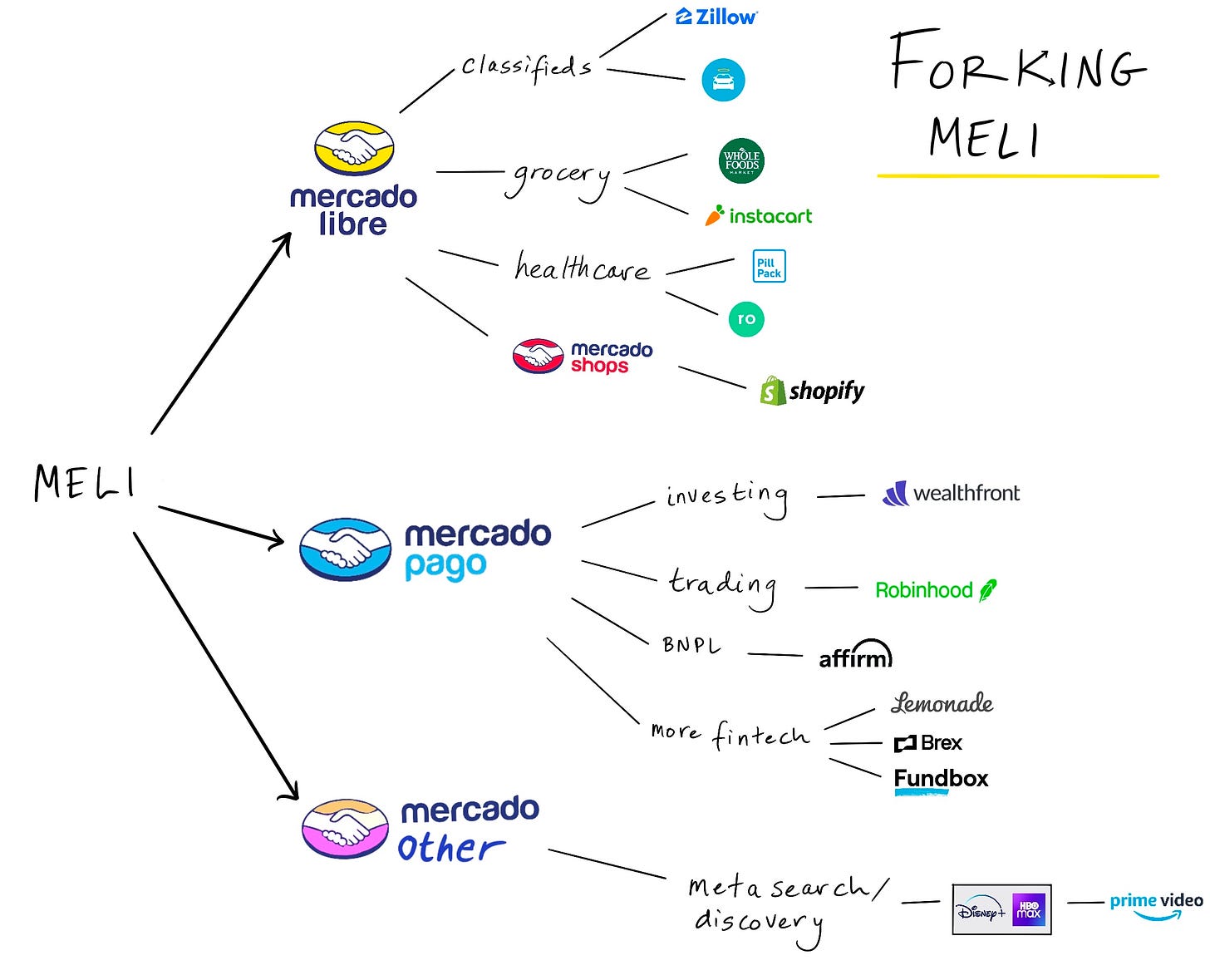

Meli describes itself as a composition of six core units: Libre (marketplace), Shops (storefronts), Envíos (shipping), Pago (payments), Crédito (credit), and Publicidad (advertising).

Though not illustrated in this framework, Meli also operates a Classifieds program, lead-gen for OTT platforms like Disney+ and HBO, and a venture arm. While each of the six mentioned and these ancillary divisions are worthy of discussion, we’ll focus on Libre, Envíos, Pago, and Crédito.

Libre

Still the core of Meli’s platform, Libre has evolved from an eBay replica into a full-scale e-commerce provider with a loyalty program, free shipping, and sleek UX. In Q1 of this year, Meli reported handling $6 billion of GMV via the platform, thanks to interactions between 36 million buyers and 4 million sellers. Critically, Libre appears healthy from a compositional standpoint: 67% of GMV goes to small-to-medium sellers, indicating that Meli has attracted a long-tail of viable merchants. Twenty percent of GMV comes from large brands that run customizable pages on the platform.

While the Libre offering is already mature, there is certainly plenty of room for expansion, particularly from an advertising perspective. Though Meli doesn’t break out how much it makes from advertising on platform (regulatory filings are hilariously curt, with revenue bifurcated into “Commerce” or “Fintech”), Amazon has shown the potential for returns. The American company is expected to pull in over $26 billion in revenue from ads in 2021, projected to rise to $85 billion by 2026.

Envíos

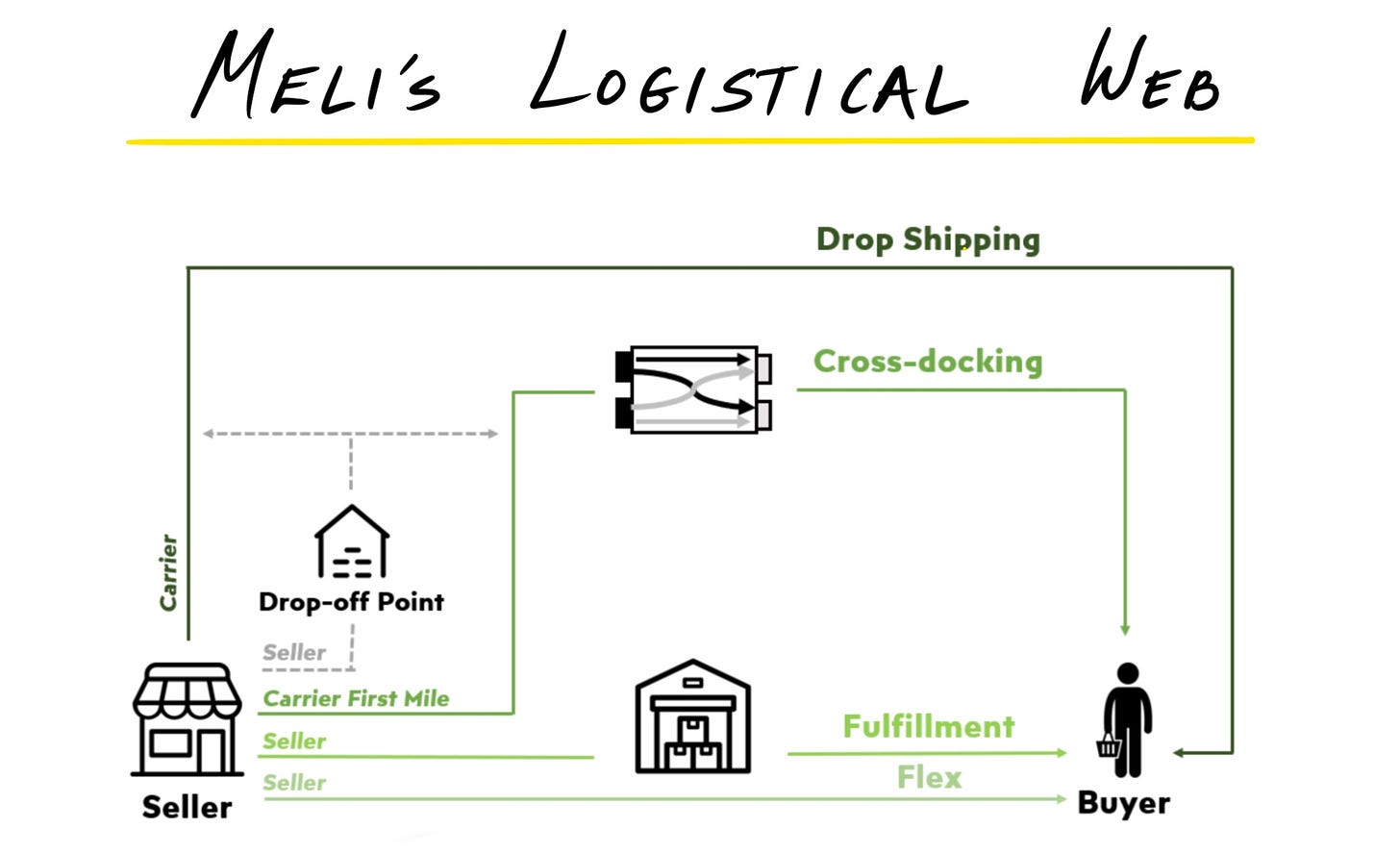

Having invested billions into logistics, Meli can now boast the best set up on the continent by some distance. Though Envíos is only available in six of Meli’s 18 markets, the scale of those geographies means the penetration is still impressive. A Q1 presentation from Meli noted that 97% of the 208 million orders shipped within the period were handled via Envíos.

That “handling” can take different forms, with Meli facilitating a mix of drop shipping, cross-docking, check-points, fulfillment, and “flex.” The latter is similar to Amazon’s own Flex program, allowing merchants to leverage their own or third-party drivers, with tech-enablement and subsidization from Meli.

Pago

Perhaps the most intriguing spoke of the Meli wheel is Pago. Under this umbrella, Meli operates a range of financial products, including POS systems (including QR checkout), prepaid cards, credit cards, gift cards, merchant services, and investment accounts (Mercado Fondo).

In speaking to experts about this piece, more than one described Meli’s financial platform as the “PayPal of Latam.” That’s because the company facilities payments both on and off-platform, driving volume. The same Q1 presentation referenced earlier noted conducting 630 million transactions from 57 million payers for a total of $15 billion.

Just as impressive as the volume of Pago is its tentacular breadth. With more than a passing nod to Alibaba’s strategy with Ant Financial, Meli has succeeded in constructing a suite suited to serve almost every basic financial need. As with other efforts, this has been driven by desire and necessity, with many lacking essential banking services.

For example, 63% of Mexico’s population is unbanked, as is more than half of Argentina. By comparison, just 20% of the Chinese population is unbanked, 4% of the US, and 1% of the UK or Canada.

Though this paucity undoubtedly made it harder for Meli to scale, it also presented a rare opportunity for the company to own the necessary infrastructure. Galperin and his team have the product to bring that goal to fruition.

Crédito

In 2017, Meli ran a survey among its merchants. Among its questions, the company asked sellers whether they required financing and if they had access to it through traditional channels. The results hammered home the need for a Meli to move into the credit space: 75% of sellers said they needed financing assistance, but only 18% qualified for bank loans.

Crédito solved the problem. Relying on alternative data sources, Meli was able to underwrite customers that couldn’t access traditional funding sources. In the process, it helped sellers grow, bringing more products to the platform. Just as importantly, offering credit more closely entwined merchants with Meli’s other financial products, particularly POS.

In time, Meli rolled out credit for buyers, too. Given the low number of credit cardholders in Latin America, consumers also suffered from insufficient options to finance a larger purchase.

Today, merchant and buyer credit is available across three markets. In Q1, Meli’s credit portfolio stood at $576 million, with 18 million disbursements made.

Somehow, in its totality, Meli manages to be both complicated and coherent. Though the company operates Matryoshka-style business lines, there’s an unmistakable logic and lucidity in its construction.

Much of that is down to exceptional management.

Management (or The Disk)

“‘It is the disk of Odin,’” the old man said in a patient voice, as though he were speaking to a child. “‘It has but one side. There is not another thing on earth that has but one side. So long as I hold it in my hand I shall be king.’” — Jorge Luis Borges

The Disk is one of Borges’s shortest stories.

An old man visits a woodcutter and asks to stay the night. As the two converse, the decrepit elder claims to be an ancient king, granted his rule by a special Disk, given by the god Odin.

The old man opens his hand to show an empty palm. He explains that the Disk is the only object in the world with only one side. Though the woodcutter initially considers the old man mad, when he reaches out to the empty palm, he feels “something cold” and sees a “quick gleam.”

Desiring to possess the Disk, the woodcutter kills the old man with his ax, then disposes of his body by the river. When he returns to his home to claim the Disk, he cannot find it. He searches for it for many years, without luck.

In discussion with those that study Meli, one thing became abundantly clear: management is special. Though perhaps not quite as rare as a celestial, one-sided object, Galperin and his team possess a rare combination of humility, creativity, focus, and decisiveness.

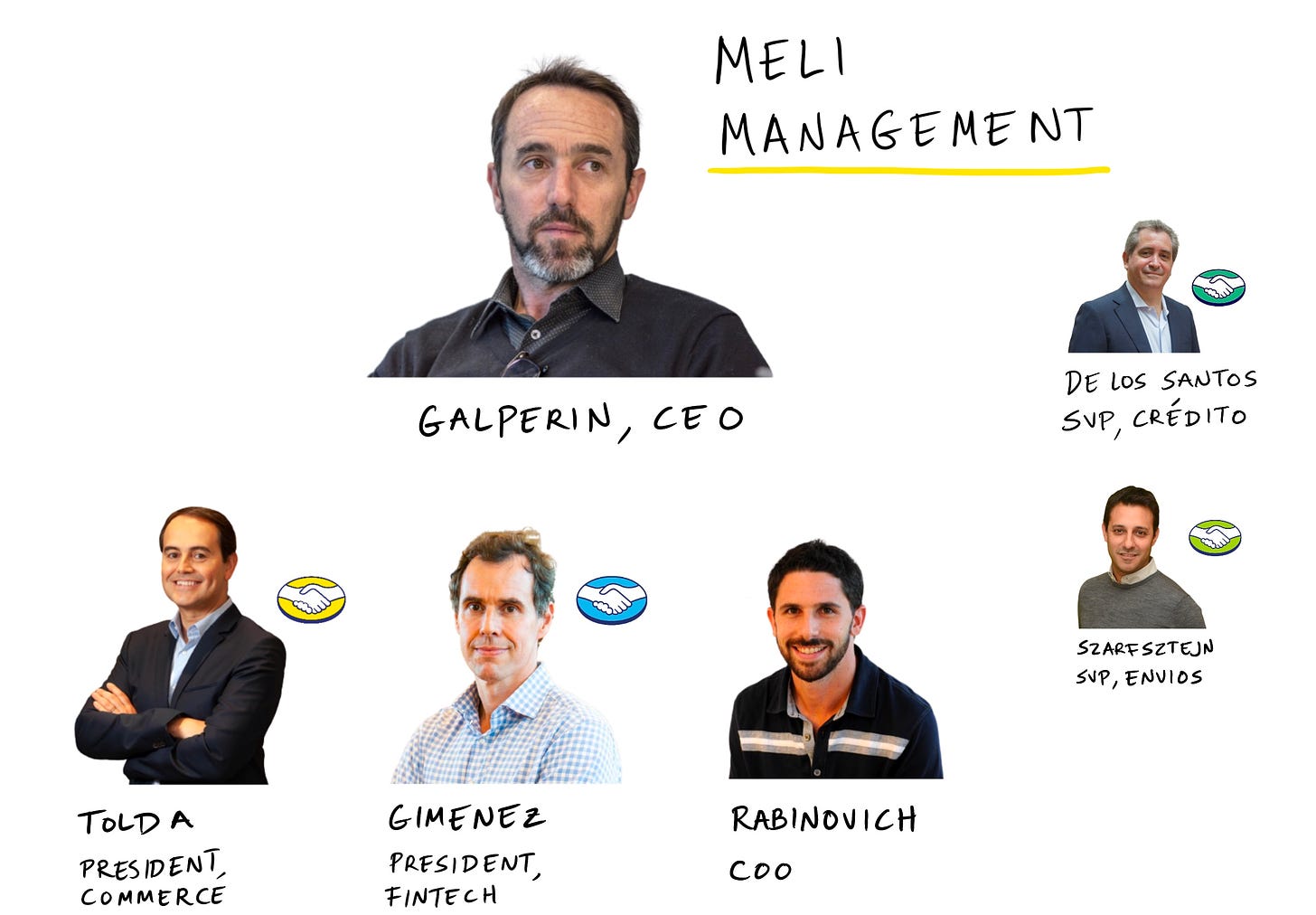

Beyond Galperin, key players include Dan Rabinovich (COO), Stelleo Tolda (President of Commerce), and Osvaldo Gimenez (President of Fintech). You might recall that Tolda began as GM of the Brazilian unit, rising through the ranks to COO and now, President of the company’s cornerstone division. Similarly, Rabinovich started as an engineer before taking over as CTO and leading the “New World” renovation.

In terms of organizational structure, Galperin seems to be once again following Amazon’s lead. By billing Tolda and Gimenez as “Presidents,” the suggestion is that both operate as quasi-CEOs of companies sitting beneath the Meli superstructure. That Ariel Szarfsztejn, SVP of Envíos, and Martin de los Santos, SVP of Crédito, are described differently is perhaps an indication that those units are not yet self-sufficient in the manner of Libre and Pago. As Envíos and Crédito expand, we might see the respective lieutenants promoted to positions that reflect fuller autonomy.

Though the experience and structure of the team have certainly contributed, Meli’s relative performance may be more decisively attributed to the values of management and the culture it has created.

In particular, Meli’s leadership seems to excel on four fronts:

Focusing on the long-term

Understanding the market

Knowing the enemy

Sensing when to gamble

From the beginning, Galperin gave the impression of a man on a mission, focused on the long term. He’s been vocal that he wants Meli to be a generational business rather than solely a vehicle for his fame or wealth.

I see many entrepreneurs who use their company as a platform to be famous," says Mr. Galperin. For us it's exactly the opposite, we want the company to be famous. The lower our personal profile, the better.

That mindset seems to have bled into the fabric of Meli. While rivals like DeRemate ran strategies around scaling to a fast exit, Galperin’s revolves around solving hard problems that increase Meli’s long-term enterprise value. Rather than buying software off the shelf, Meli built it in-house. Rather than acquiring a user base, Meli drew its own.

Though such maneuvers have required patience, it has been rewarded. Meli has been built to last.

Far from entering blind, Galperin understood that in building Meli, he would have to overcome the idiosyncrasies of the Latin American market. This local knowledge has proven to be a differentiator, particularly as foreign players encroach on the region. From the start, Galperin and the founding team understood that each new country required a dedicated team, and the autonomy to respond to customer feedback. In launching Brazil, and all the other markets that followed, Meli developed iteratively, changing product and marketing to fit local circumstances. This is very different from the top-down approach many others have attempted.

This understanding has also emboldened Meli to be creative. The company rolled out novel, bespoke solutions specifically suited to the region. Examples include the innovative approach to managing cash payments in the early days of Pago and the deployment of motorcycles to manage urban deliveries.

Just as Meli grasps its milieu, management seems to have an almost preternatural beat on what competitors are doing around the world, head on a swivel. Leadership’s maneuvers indicate that they’ve spent considerable time studying the rise of Amazon, Alibaba, Ant Financial, JD.com, and others. In this respect, Meli has made the most of being a comparatively late-mover, watching what has worked and bringing it into its product. From org design to product rollouts, Galperin and Co. have been unafraid to observe and crib best practices.

If there’s one trait that describes Meli’s management, it’s that they know how to gamble. Galperin called the “New World” a “bet the company” moment, but the truth is there have been multiple. Pouring money into building a robust logistical infrastructure at a time when margins were already hit did not always look like the perspicacious move it proved to be; it could have easily backfired.

That Meli has pulled off these bets in an often challenging environment in which political and economic instability are commonplace speaks to management’s coolheadedness. Like the seasoned poker player, Galperin and his team seem especially gifted at surveying the risks, sizing the reward, and when the right moment arrives, going all-in.

Of course, management does have its weaknesses. Though they are few and far between, some sources we spoke to noted that though leadership are exceptional executors, that may come at the expense of imagination. Meli has so often had the chance to pick its next move by looking at competitors that it may have become more imitator than pioneer. While that might not prove an issue for the foreseeable future, too narrow an aperture may preclude Meli from unlocking a step-change in value.

Though we can understand the rationale of this perspective, the inventive solutions Meli has come up with in the past make it hard to take it too seriously. While Galperin is not a Jobsian visionary, he has proven he can examine difficult situations and propose ingenious answers.

Opportunities (or The Garden of Forking Paths)

“I leave to the various futures (not to all) my garden of forking paths.”

More than any other, Borges's The Garden of the Forking Paths speaks to something true and important about Meli.

Dr. Yu Tsun is a German spy on the run. He is tasked with discovering and relaying the location of Britain’s new artillery park. Complicating his mission is the pursuit of his English counterpart, Richard Madden.

Once in possession of the information, Tsun seeks to pass it on. In attempting to do so, he is directed to visit a man named Stephen Albert. Upon his arrival, Albert explains to Tsun that he is a student of Ts'ui Pen, a former Chinese governor, and one of Tsun's ancestors.

Pen’s lifelong goal had been to write a novel and create an impossible labyrinth. Though his descendants assumed he had failed at both, Albert explains that Pen actually succeeded. The convoluted manuscript Pen left was the labyrinth.

In his writing, Pen created a maze in which decisions made by a character do not close off other possibilities but open them. The result is that each route followed yields others, which open still more. Some paths circle back, connecting with one another, but the primary geometry is diluvian spread.

Soon after learning of Pen’s puzzle, Tsun realizes the English spy has found him. Realizing he cannot evade capture, Tsun kills Albert. In doing so, he passes on a message to the German government — the city of Albert, which shares the name with the deceased, is the location of the weapons stash.

In the scope of opportunity available to the company, Mercado Libre gives the impression of a business with almost endless, recursive possibility, a garden of forking paths. As shown by our mosey through the company’s product above, winning in one space opens up opportunities in others. (This is not always the case; victory can be a gilded but sealed chamber.) This is a Mandelbrot set masquerading as a multinational.

By placing Meli within this framework, we can best understand what the company could become.

fork(Libre);

As Meli’s paterfamilias, it is only fitting that Libre should spawn a host of offspring. Already, the company has done a solid job expanding the core product, birthing display ads, and classifieds. We’ve mentioned how ads might drive more revenue; classifieds allow us to paint with a looser hand.

Right now, this part of the platform caters to real estate and automobile listings. Over time, could Meli look to bring these sectors into orbit, serving as the hub for both discovery and transacting? While that would represent an adventurous move, it would allow Meli to take a run at building the Zillow and Carvana of Latin America.

Expanding grocery operations may be a more realistic option. Though Meli has a “Supermercado” section, it does not offer produce at any volume. This makes sense given the logistical challenges we’ve detailed above, but as Envíos increases its speed, product expansion might make sense. Some of the advisors we spoke with mentioned whispers that Meli was considering a Whole Foods-style acquisition to facilitate this play, bringing onboard a network of suppliers along with well-located physical locations.

Knowing how well Galperin observes the landscape, it’s impossible not to imagine Meli is not considering a pharmaceutical delivery play. Alibaba began offering medication delivery via Taobao starting in 2018, while Amazon bought into the space via its $753 million acquisition of PillPack the following year. Though Colombian on-demand unicorn, Rappi, teamed up with Sanofi to offer delivery for some medications, this is an immature market in Latin America. Meli has the chance to own this space.

Rather than expanding into new verticals, the best fork of Libre may arrive by leaning into Storefronts. This product allows merchants to build out their web presence with the help of Meli’s tools and services. There’s a sense among some commentators that Storefront has yet to achieve its full potential. With Shopify a comparative non-entity in Latin America, Meli has the chance to disrupt itself from within with Storefronts “arming the rebels” to fight big, bad...Meli? Though a convincing kayfabe is tricky to pull off, if Meli can own both sides of the battle, it should.

fork(Pago);

If you had to bet on one division defining the future of Meli, the smart money would choose Pago. Though Libre is the more mature product, Pago fizzes with possibilities.

Already it has borne fruit, leading to the creation of Crédito. But there is room for much further innovation. Mercado Fondo is a step in the right direction for investing. Still, we should expect Meli to significantly bolster the product’s capabilities in the years to come, making it an attractive place to hold significant assets.

To bolster its capabilities, Meli might consider offering trading, a wildly popular consumer behavior in the US, but remains relatively analog in Latam. Earlier this year, Accel led a $12 million round into Flink, a mobile payment and investment app bringing brokerage services to Mexico City.

Given its integration across checkout sites, Meli is also well-positioned to build an Affirm or Klarna for the region, providing “buy now, pay later” services at the point of purchase. Though Crédito does offer consumer loans, distributed BNPL can capture a much larger customer base, providing a frictionless solution.

Meli could probably move a dozen other directions should it wish to, selling mobile insurance, leaning into SMB banking, or going after big-ticket invoice financing.

fork(Other);

Though we could engage in a similarly bewildering spin through Envíos's feasible incarnations, it’s arguably more intriguing to turn to a less-discussed part of Meli’s business: media.

In its Q1 earnings call, management commented on the success of the company’s content-arm, which provides access to OTT services Disney+, Deezer, and HBO. According to some sources, Meli is the largest distributor of Disney and HBO’s new streaming services, an auspicious position to hold. Already, engagement with media seems to be having a beneficial impact on buying habits, per CFO Pedro Arnt:

More importantly, we are seeing strong signs of incremental engagement from user cohorts that purchase content through our loyalty program. Building on this initial success will be a growing focus for us.

Suppose Meli can establish itself as a supra-streaming platform, sitting on top of different providers and offering discovery and metasearch. In that case, the company has the chance to radically increase its ad load and incentivize purchasing. Should the uptick in consumption and retention justify it, we might even see the company dabble in original content.

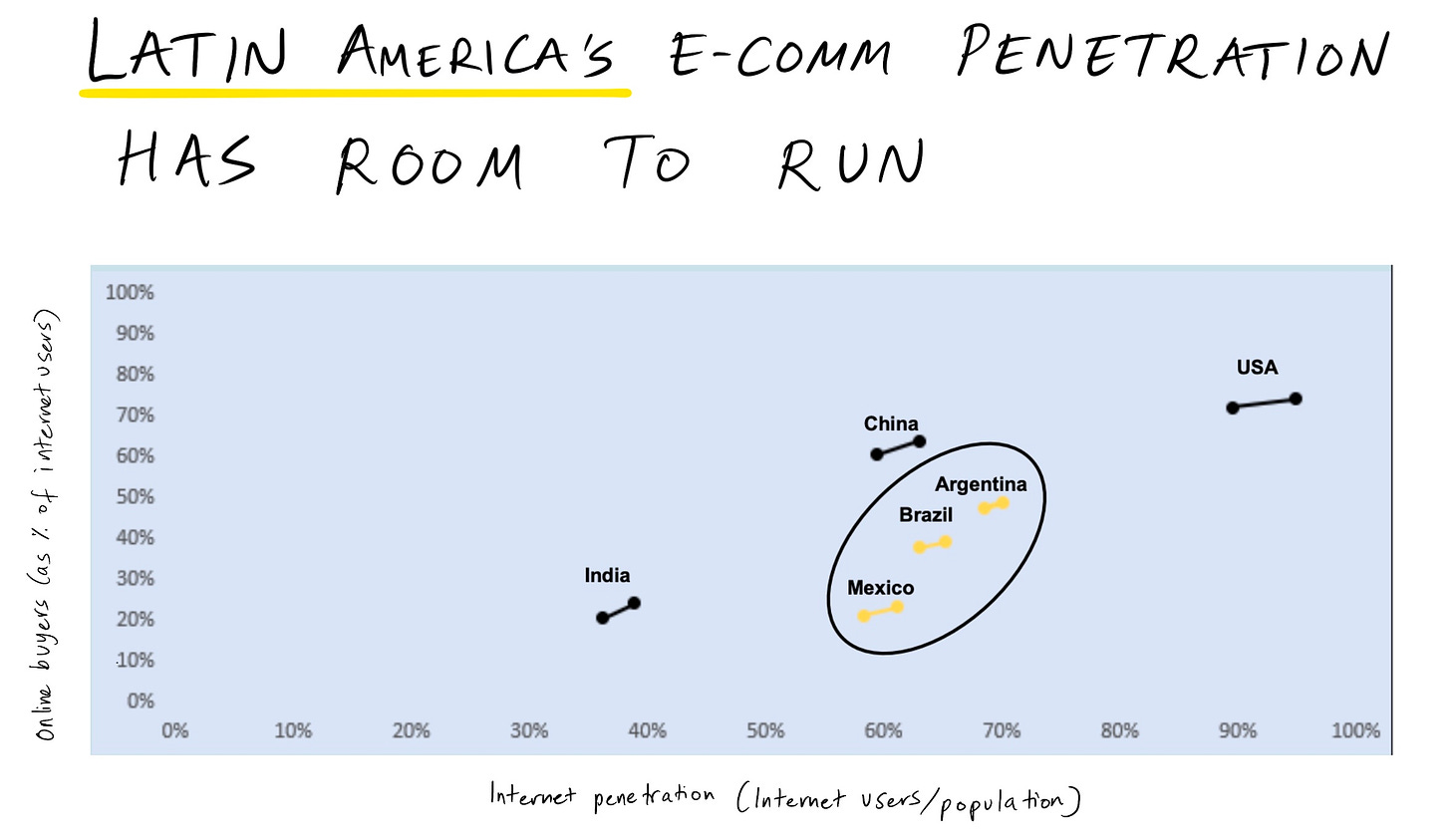

Putting Meli through a clefted funhouse mirror brings the company’s opportunities into sharp relief. But the truth is that Meli’s growth doesn’t rely on new products or feature expansion. Across the 18 countries in which it operates, Meli has the opportunity to win over the buying habits of a 682 million population. This translates into a combined GDP of $5.5 trillion, with Brazil ($1.8 trillion) and Mexico ($1.2 trillion) the largest markets.

One analyst provided an interesting point of comparison: China has a population of 1.4 billion with a GDP of $14.3 trillion. Without any further geographical expansion, Meli has a market 40% the size of China’s to win in terms of GDP. And yet, Meli sits at a $66 billion market cap while the pairing of Alibaba and Ant Financial — a combination that provides comparable services — comes in somewhere north of $750 billion. Net/net, Meli is valued at less than a tenth of the Chinese pair.

Yet, looking toward the future, Latin America looks like the growth market. While internet penetration levels in countries like Brazil and Argentina are similar to China’s 60-70%, online buying is much lower. Meli will believe it can close this gap, eventually reaching the levels of economies like the US.

To reap the ultimate rewards, the late-mover will have to show patience.

Competition (or The House of Asterion)

“‘Would you believe it, Ariadne?’ said Theseus. ‘The Minotaur scarcely defended itself.’” — Jorge Luis Borges

This is our final story.

Asterion lives in a house with no furniture, no doors, and no locks. Instead, it is a series of never-ending halls through which he runs. Every nine years, nine men come to kill Asterion; unsuccessfully, he dispatches them with ease.

Then one year, the “redeemer” arrives, and Asterion is slain. The last line of the story reveals that Asterion is the Cretan Minotaur and he has been trapped in a labyrinth. As in the Greek myth, he is killed by Theseus, who utters the line above.

During its twenty-two years of operations, Meli has managed to see off all comers to become the largest e-commerce company in Latin America. It has done so with almost consummate ease. But no beast, even the mighty Meli, is unslayable. As competition looks heats up, the company will need to avoid complacency and ensure no rival plays the role of “redeemer.”

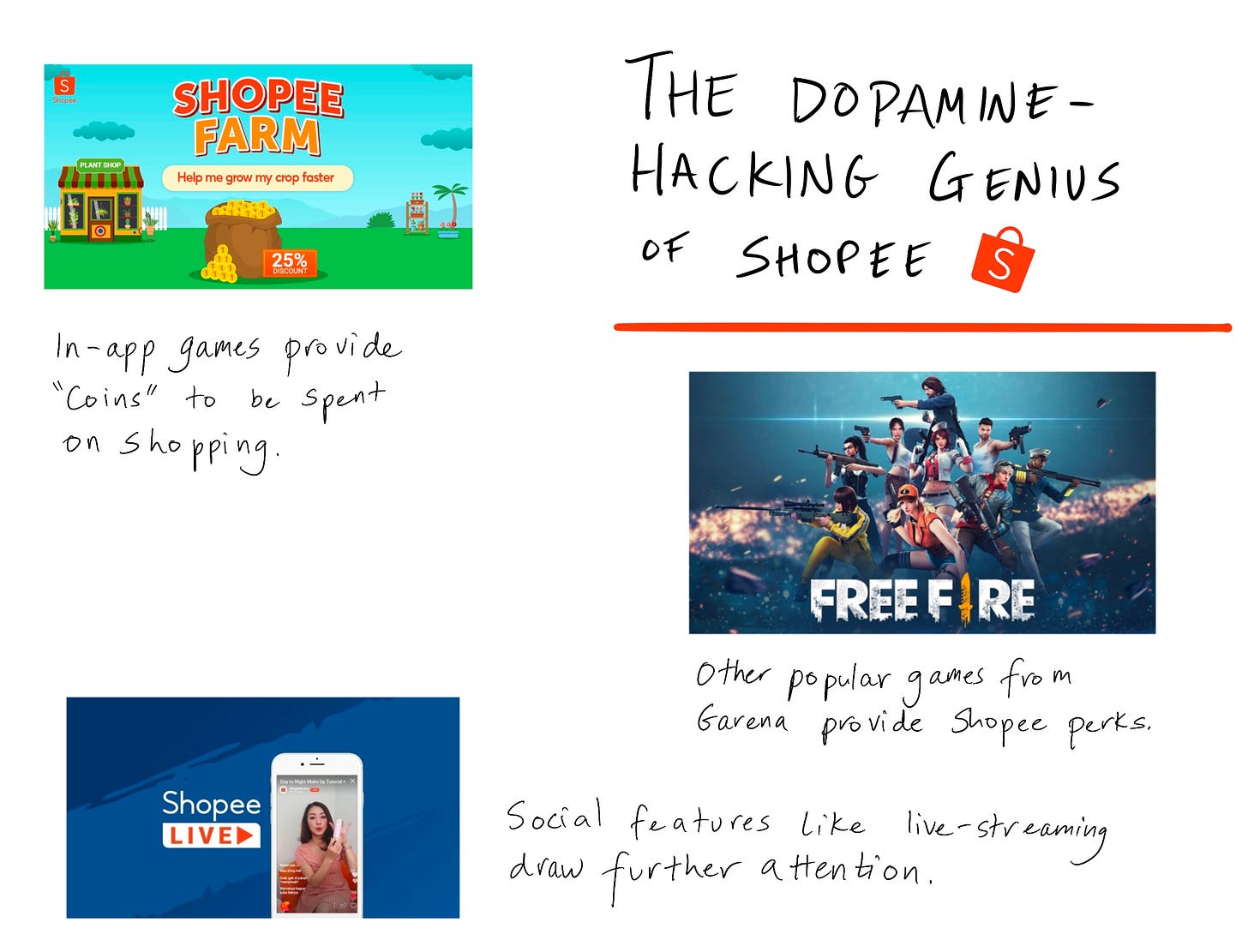

Though Amazon first landed in the continent in 2012 and Alibaba in 2015, the last 18 months suggest Shopee may be the most likely candidate.

Owned by Sea Group, Shopee represents a uniquely terrifying proposition: bankrolled by a money-spinning game conglomerate, thrilled to burn money to buy share, and engineered to within an inch of its life to draw attention and keep it.

As it has expanded, the Singaporean company has dialed in an effective playbook, one very different from Meli’s own. Mobile by default, Shopee attracts users through a mix of gaming and social features. For example, “Shopee Farm,” which rewards users with “Shopee Coins” to visit the app and tend to a virtual freehold, incentivizing multiple opens per day. Leveraging Sea’s gaming subsidiary, Garena, Shopee also offers rewards through vehicles like Free Fire, a popular game in Brazil. Livestreaming shopping events is another approach that brings its own appeal.

While Shopee positions itself as locally sensitive, in the mold of Meli, its model is predicated on a different approach. Rather than onboarding SMEs in Brazil, for example, Shopee advertises excess inventory for sale in Brazil. The outcome is that the platform doesn’t lift Latin American merchants but exposes Asian sellers to a new audience. Only after finding a foothold does Shopee court native merchants.

Where Shopee does tailor its approach is when it comes to marketing. The company hires local celebrities and influencers to promote its products. This is coupled with generous discounting and shipping subsidies.

It has worked. In a blink of an eye, Shopee has jumped to the 9th most downloaded app in Brazil, according to App Annie. Data from earlier this year suggests the company surpassed Amazon and Alibaba in terms of traffic in the country. Revealingly, Shopee’s local presence has expanded significantly, surpassing a 250-person headcount. The company has shuffled influential lieutenants from Asia to focus on the new market while also sniping talent from Meli. Earlier this year, Shopee announced the launch of its app in Mexico. True to form, it is beginning by offering only cross-border products.

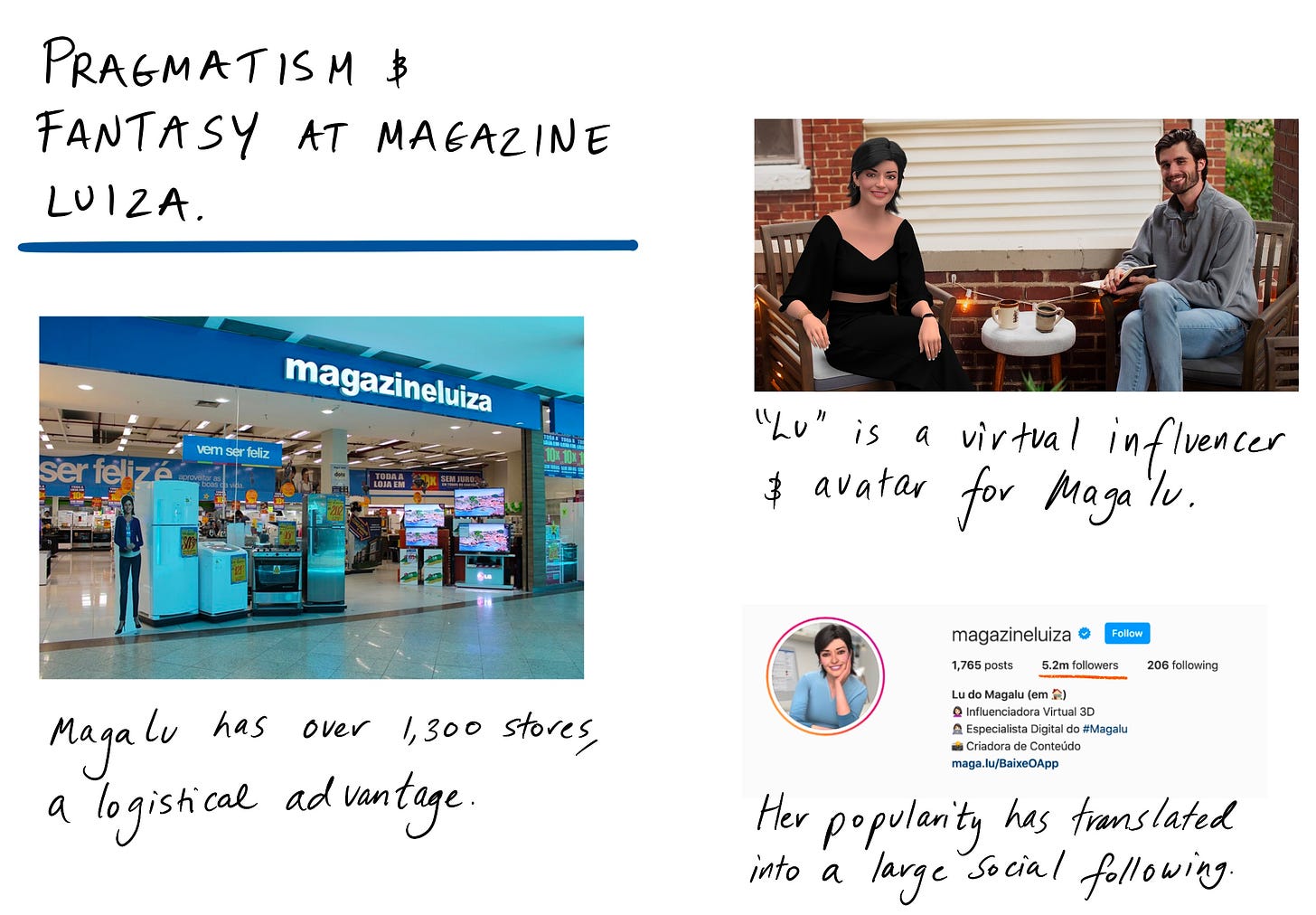

If Shopee is Brazil’s new kid on the block, Magazine Luiza is the old rival. Founded in 1957 as a chain of retail stores, “Magalu” successfully transitioned to an omnichannel strategy, adding online buying to its footprint. In some respects, Magalu and Meli have spent the last ten years moving in opposite directions, the former bolstering its virtual position as the latter strengthens its physical one. With $5.5 billion in 2020 net revenues, Magalu outstrips Meli, even if it operates with a more asset-heavy model. (Intriguingly, Magalu advertises with the help of virtual influencer “Lu,” the Lil’ Miquela of Brazilian e-commerce. That’s helped Luiza reach 5.2 million Instagram followers, while Mercado Libre’s local account has just 2.9 million.)

Other players pose a threat, including OLX and Americanas. And, of course, neither Amazon nor Alibaba should be counted out. In November of last year, Alibaba kicked off a partnership with Air Atlas designed to shorten the shipping time from Chinese sellers to Latin American buyers. Meanwhile, Amazon opened four new fulfillment centers in Brazil last year and rolled out local content on Prime Video.

Ultimately, Meli may be happy for the competition. The company has always been glad to maintain a low profile, and its ostensibly contested position has given Galperin the latitude to keep growing without anything like the regulatory scrutiny Amazon faces Stateside. If Meli keeps executing, it will not mind if others momentarily steal the limelight.

Borges once said, “the original is unfaithful to the translation.”

Recalling that Mercado Libre began life as an eBay clone is to evoke the same feeling; the sense that it is the translation, not the original, that is now the primary source. Though Galperin’s creation began life as a regional facsimile, it has morphed into one of the most generative companies on the planet, a colossus with the balance of a ballerina, able to move in any manner of directions.

And with Latin America entering a period of extraordinary technological flourishing, there is the sense that rather than just six ficciones, Meli will have many. The story is only just beginning.

____

Thank you to the many people that provided guidance and insights in writing this piece.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.