Actionable insights

If you only have a couple of minutes to spare, here’s what investors, operators, and founders can learn about Tiger Global.

We may be earlier than we thought. Tiger’s current private market thesis is simple: we are still in the opening stages of the digital revolution. For those who began evangelizing the “software opportunity” decades ago, that we have yet to reach maturation may come as a surprise. If Tiger’s right, we should expect many more unicorns to be minted and for returns to be larger than anticipated.

There are different ways to win in venture capital. Just as a16z did a decade ago, Tiger has disrupted the venture market, showing a new way to win. Its approach is predicated on rapid capital deployment, reducing founder friction, and accepting a lower return profile.

Outsourcing due diligence has benefits. How does Tiger invest across geographies at a rate of roughly a deal a day? By delegating elements of deal sourcing and evaluation to consultancies like Bain. By doing so, Tiger is able to move much faster with broader coverage. This maneuver also turns a fixed cost into a variable one.

Founders may be sick of “hands-on” investors. Part of Tiger’s pitch is that it will be an unobtrusive capital partner. That approach runs counter to industry norms as most firms compete to demonstrate a willingness to roll up their sleeves and help. The fact that so many founders find Tiger’s laissez-faire attitude attractive exemplifies the lack of trust many have in VC’s value propositions.

Hedge fund managers can bring novel perspectives to startups. Though perhaps less visionary than their venture capital counterparts, some founders find the detail and rigor of hedge fund managers’ thinking refreshing. That might make crossover funds like Tiger increasingly attractive partners.

Learn how the best businesses and investors win.Every Sunday, we send a free email that explains the business world’s most important innovations and the stories behind them. It’s high quality business analysis, delivered at no cost to you.

More than ever, venture capital is a game of speed.

Though private equity funders in previous eras had the luxury of establishing deep relationships and carefully selecting investments, as competition has increased, timelines have tightened. As a result, what once looked like a standard chess game — all careful strategy and deliberation — has quickened into blitz chess. That variation requires players to make their move in 10 minutes or less, favoring rapid decision-making and acting on instinct.

It is, in truth, a different game. Even one of the greatest players of all time, Hikaru Nakamura, has said "[Blitz] is just getting positions where you can move fast. I mean, it's not chess."

Tiger Global is the best blitz chess player in the world of venture capital today. The near-$100 billion crossover fund moves at a pace that no other firm can compete with, allocating around the world, on virtually a daily basis. To the casual observer, Tiger seems to run on a dark blend of hedge fund bravado, inflated valuations, and fast-twitch hunches. Perhaps that is why it's easy to imagine Nakamura's off-hand comment adjusted to apply to the fund:

Sure, Tiger invests in a lot of startups. But, I mean, it's not a venture firm.

This is a sentiment one often hears voiced about Tiger. As excellently encapsulated by investor Everett Randle, the inference of such gripes is that the fund is not playing the game the way one is supposed to, that it uses too much amygdala and not enough frontal lobe. Though narratively tempting, writing Tiger off in this way misses almost everything that makes it special. This is not some unthinking gavage-capitalist spamming the "buy" button, but a twenty-one-year-old fund with a distinctive culture, a storied partnership, roaring returns, and a history of adapting its mandate to fit the macroeconomic environment.

That Tiger can move faster and invest more than any other fund is not an accident, but the consequence of a thoughtful strategy put in motion. While Nakamura has his doubts, even blitz chess requires real cerebral power.

In today's piece, we'll enter the Tiger's cage and ask him how he earned his stripes. In particular, we'll outline:

Tiger's origins. The fund of today wouldn't exist without the famed "Wizard of Wall Street."

The fund's cultural influences. Tiger Global's leader, Chase Coleman, began professional life at a fund that prioritized flexible thinking and a meritocratic structure. Both influenced what came next.

The leadership of Coleman. As a 25-year old, Coleman saw opportunity in the tech sector. To capitalize on it, he had to adjust his fund's mandate multiple times over.

How Tiger wins. No other fund operates the same playbook as Tiger — perhaps because no one else can.

Let's get started.

Robertson's Prologue

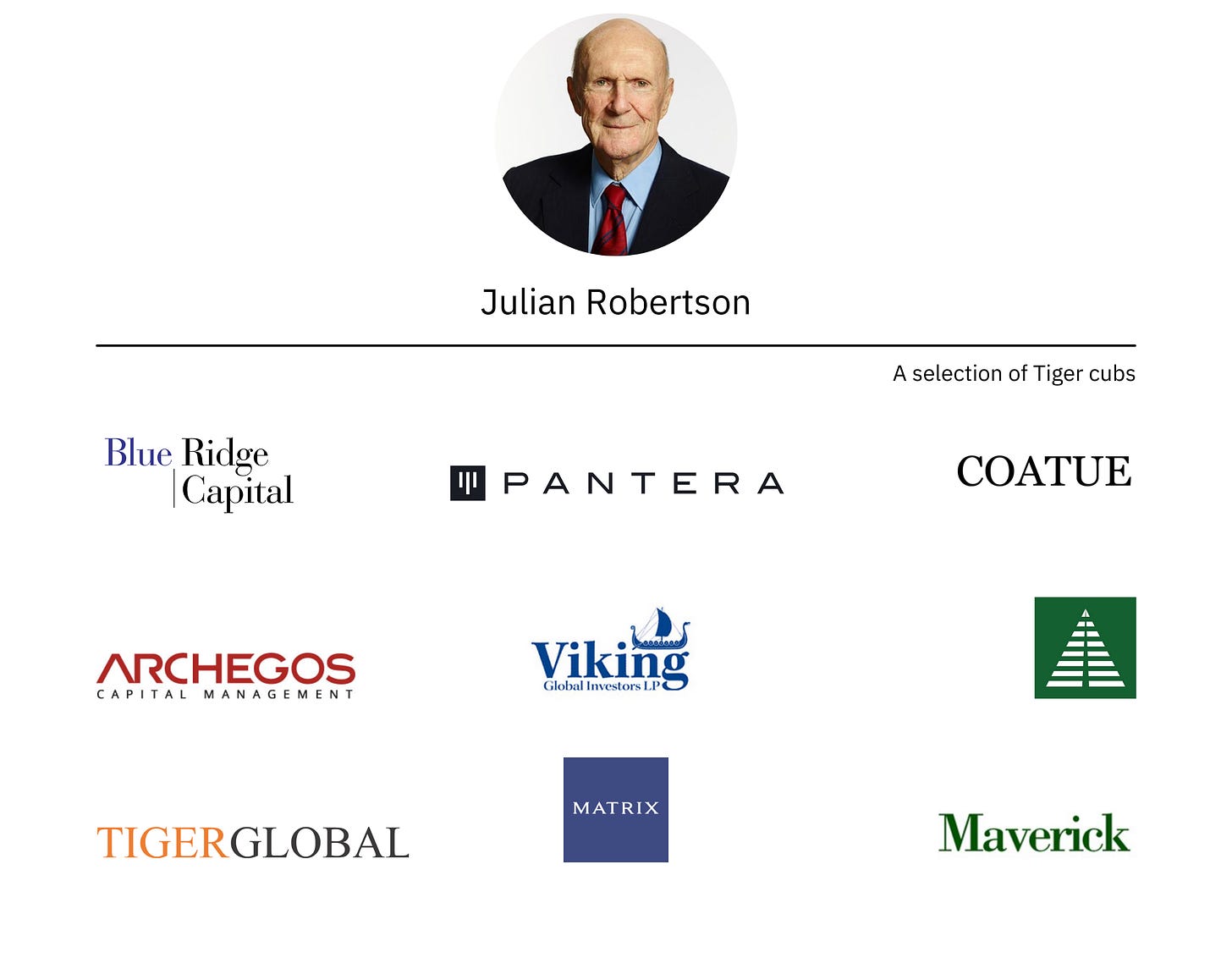

To understand Tiger Global, you first must understand its predecessor, Tiger Management. And to comprehend Tiger Management, we must start with its founder, Julian Robertson.

In the beginning…

It was time for something new, Robertson thought. Over the past twenty years, the North Carolina native had built a good if unremarkable career on Wall Street as a stockbroker. He'd made decent money at Kidder, Peabody & Co. but not enough to elevate him into the upper echelons of New York's financial scene.

Still, he'd risen through the ranks to become the head of the firm's asset management division, an achievement that would have surprised many of his college professors. Though Robertson always had a head for numbers, he'd been an average, unenthusiastic student at Chapel Hill.

At the age of 47, it was time to take a break. Robertson left New York and headed to New Zealand, relocating his wife and two young children in the process. He would later recall the choice as a somewhat strange one:

[W]e just picked up and went down there...I shouldn't have been stupid enough to go. We couldn't afford it or anything.

Over his antipodal sabbatical, Robertson worked on a novel. Its plot would have been familiar to anyone that knew him: a young Southerner moves to Manhattan to make his fortune and secure his future.

Life takes narrative liberties that even the most daring of authors cannot, which is to say that whatever gleaming triumphs Robertson might have considered for his protagonist, they certainly paled in comparison to what came to pass.

Though a year in New Zealand taught Robertson he was "not a novelist by any stretch of the imagination," it afforded him the time and space to cook up his next act.

In 1980, he returned to New York City and opened the doors of Tiger Management. He began with a simple plan: to operate a fundamentals-driven long-short hedge fund. Robertson's style would later be succinctly depicted as simply buying the best companies and shorting the worst.

Tiger also began with a modest sum of money: $8.8 million. That came from Robertson's savings, as well as from friends and family.

Over the next two decades, Robertson would grow Tiger's assets under management to a high of $21 billion, increasing 259,000%. Tiger beat the market 14 of its twenty years, delivering an annual average return of 25%, net of fees, to its limited partners (LPs).

To understand how such sustained brilliance came to pass, we must first outline Robertson's particular genius.

Robertson's genius

In researching this piece, I had the chance to speak with several investors and founders who interacted with Tiger Management and its filial organizations. Among those was Erez Kalir. Kalir previously worked at Tiger Management under Robertson's mentorship, started a "Tiger cub," Sabretooth Capital Management, and served as both CIO and CEO of Stansberry Asset Management. During our conversation, Kalir unpacked some of the factors that made Robertson such an exceptional fund manager. That includes:

A gift for spotting talent

A meritocratic approach

Superior pattern recognition

A flexible investing mandate

Robertson's skill in spotting gifted investors may well define his legacy. As Kalir noted, "Julian is deservedly famous for hiring young talent."

That seems to have been a natural gift for Robertson, though his intuition was codified into a rigorous hiring structure as Tiger grew. Starting in the 1990s, Tiger required applicants to complete a 450-question test that took over three hours to complete. It was designed to assess aptitude alongside desirable character traits including competitiveness, intellectual openness, teamwork, and integrity. A former employee recalled one of the test’s questions:

Is it more important to get on well with your team or to challenge them? Would you prefer to be intellectually right but lose money or to be intellectually wrong but save the trade?

Influential in designing that test was Dr. Aaron Stern, a psychoanalyst who operated as a consigliere to Robertson. Stern also served as Chief Operating Officer at some points in Tiger's life.

(Now deceased, the good doctor seems to have been an intriguing, complicated character — author of Me: The Narcissistic American, as well the former head of Hollywood's rating agency where he was notorious for editing scripts and prudishly snipping sexually explicit scenes.)

Though unorthodox, particularly at the time, Stern's presence illuminated the importance Robertson placed on talent assessment and his desire to go beyond the pat lines of a curriculum vitae.

Tiger's success on this front is easy to see. As we'll discuss shortly, Robertson would later seed many of his former employees, putting them into business as fund managers. The remarkable performance of so many indicates what a powerhouse team the "Wizard of Wall Street" assembled.

This knack of Robertson's was coupled with a deep desire to create a truly meritocratic environment. In speaking of this quality, Kalir referenced famed University of North Carolina (UNC) college basketball coach Dean Smith's relationship with Michael Jordan.

In particular, he highlighted the 1982 NCAA championship game. In a heated battle against Patrick Ewing's Georgetown, UNC trailed by one point. With just 32 seconds on the clock, Smith drew up a play that put the ball in Michael Jordan's hands. He was only a freshman at the time.

As Jordan recalled in ESPN's documentary, The Last Dance, Smith said, "If you get the shot, take the shot." He got the shot and made it.

Robertson, coincidentally a UNC alum, adhered to similar principles. While the rest of Wall Street operated according to an almost militaristic hierarchy, Robertson gave talent opportunities to score, irrespective of their age or experience. From Kalir:

He didn't give a shit how old you were, he didn't give a shit if you'd paid your dues, he didn't give a shit how long you'd worked for him...he threw you the ball.

Those with the hot hand were richly rewarded, too. If you were capable of producing the goods, Robertson had no qualms paying you for it. "He would pay twenty-somethings eight-figure money if they put points on the board," Kalir said.

None of this would have mattered if Robertson, and those around him, had not been shrewd analysts, skilled at pattern matching. Decades in the business had honed the Tiger founder's instincts such that he could assess the macroeconomic environment and the particulars of a specific business better than almost anyone. In particular, Robertson seemed to have a nearly numinous grasp of each investment's financial figures and their effect on the firm's performance.

A controversial article by BusinessWeek — subject to a $1 billion defamation suit from Robertson before a settlement in which the publisher admitted no wrongdoing — articulated this ability:

It used to happen every day until 1993, when Robertson moved from the trading desk to his own office. On the screen were the prices of the stocks in Tiger's portfolios--all 100 of them. Just the prices, and the changes for each stock. Tiger might own a million shares of one, 2 million of another. But that's not on the screen. Only the stock symbols, their prices, and the change during the day.

Robertson would call out a figure. He had calculated, in his head, the total change in his entire equity portfolio, down to a fraction of a point. Inevitably he'd be right.

One Tiger employee said of Robertson, "He can look at a long list of numbers in a financial statement he'd never seen before and say, `This one is wrong.' And he'd be right." Such acuity originates from natural talent but only flourishes with sufficient experience.

Though it stemmed from Robertson, swift pattern recognition became a hallmark of the entire Tiger organization.

A keen understanding of business fundamentals seems to have contributed to Tiger's flexibility as an investor. Robertson made significant winning bets in equities, commodities, and currency exchanges during the fund's epic run. He adapted to the market environment, finding new ways to win.

As Kalir said, "Julian has made money in every different way."

Given this agnosticism, it's perhaps surprising that Tiger's eventual demise arose from intransigence. In 2000, Tiger closed its doors.

Passing the torch

Three months into the new millennium, Tiger released a letter announcing its closure. Though unsigned, the explanation was pure Robertson:

As you have heard me say on many occasions, the key to Tiger's success over the years has been a steady commitment to buying the best stocks and shorting the worst. In a rational environment, this strategy functions well. But in an irrational market, where earnings and price considerations take a back seat to mouse clicks and momentum, such logic, as we have learned, does not count for much.

The current technology, Internet and telecom craze, fueled by the performance desires of investors, money managers, and even financial buyers, is unwittingly creating a Ponzi pyramid destined for collapse. The tragedy is, however, that the only way to generate short-term performance in the current environment is to buy these stocks. That makes the process self-perpetuating until the pyramid eventually collapses under its own excess.

The previous two years had seen Tiger's performance suffer as he refused to adapt to the tech sector's hyperventilating valuations.

In the end, Robertson was proven right. Just three days after Tiger published its farewell, Microsoft was found guilty of monopolistic behavior, precipitating a 15% drop in its stock price and heralding the start of the dot-com crash in earnest. Within seven months, Pets.com was out of business, and the tech sector had declined as much as 75%.

It was too late for Tiger then, and even had it happened a year earlier, it may not have mattered. Significant capital had already flowed out of the fund, and Robertson was now, at 69, a much older man. It was the right time for something new to emerge.

While Robertson had already secured his legend, arguably his most enduring legacy arrived after he stopped managing Tiger. With his team effectively out of work, Robertson ensured the most talented received seed capital to open their own funds.

Kalir summarized it, noting that Robertson effectively said, "You can't work for me anymore, but I'm willing to put you into business."

The list of Tiger cubs is now an essential part of hedge fund lore. Many of the most influential firms of the last twenty years trace their roots back to Tiger and Robertson. (As a note, some refer to the funds that received financial backing as “Tiger seeds,” used to differentiate them from those run by alums of the firm that did not receive their mentor’s money.)

Descendant vehicles include Viking, Coatue, Lone Pine, Maveric, Blue Ridge, and dozens of others. Not all have been successful — Archegos, founded by alumnus Bill Hwang, attracted attention for its spectacular fallout and the $10 billion it incinerated for banks. But taken together, Robertson's proteges (and the proteges of those proteges) have had a major impact on the financial world.

None have had a bigger impact than Tiger Global Management and Chase Coleman III.

A New Tiger

What's in a name?

If America has an aristocracy, Chase Coleman III is undoubtedly in it. A descendant of Peter Stuyvesant, director-general of New York during its stint as a Dutch colony, Coleman was born into wealth. On Long Island's North Shore, Coleman befriended Spencer Robertson, son of Tiger's famed manager.

After attending Williams College, where he captained the lacrosse team, Coleman joined pater Robertson's firm in 1997. Over the succeeding four years — Coleman managed Robertson's personal capital for a year after the closure of Tiger Management — the Economics and Spanish graduate impressed, becoming a partner.

When it came time to move on, Robertson supplied the funding. With $25 million under management, Coleman launched Tiger Tech. He was just 25 years old.

Stylistically, Tiger Tech was both a continuation and a repudiation of Robertson's approach. The new vehicle harkened back to Tiger as a long-short hedge fund, focused on fundamentals. But whereas his mentor had famously rejected tech stocks, Coleman embraced them. The whole purpose of the fund was to invest in the budding sector.

While Coleman sought returns in a different sector, his philosophy was quintessential Robertson. According to Kalir, "Chase is, in many respects, Julian's most successful flagbearer."

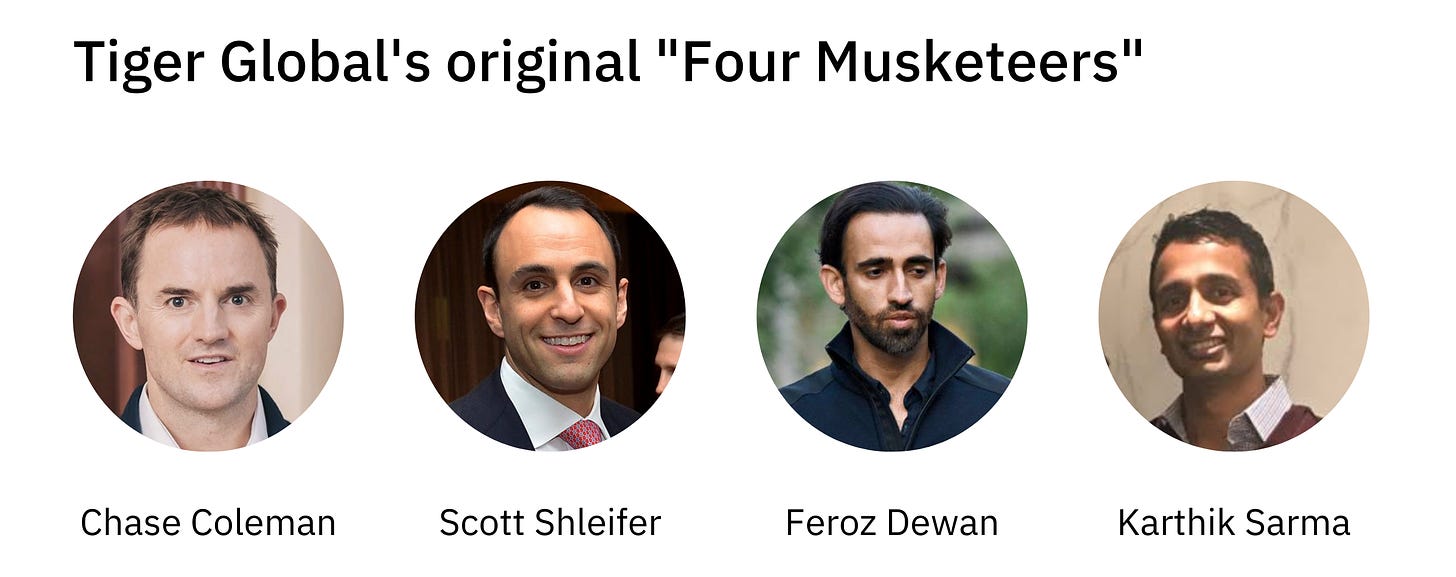

Chief among the similarities was a nose for talent.

The first investors Coleman hired at the new fund were Scott Shleifer, Feroz Dewan, and Karthik Sarma. All three have carved out extraordinarily successful careers in the years since. Shleifer heads Tiger's private equity team and is worth a reported $5 billion. Dewan spent 15 years at Tiger, taking over day-to-day management for a time before starting his own fund, Arena Holdings. Sarma left after five years to start SRS Investment Management; just last week, the Financial Times reported that the vehicle was sitting on up to $5 billion in unrealized gains thanks to a well-timed bet on Avis.

Coleman coupled this with Robertson's meritocratic governance. Kalir noted that Tiger Tech's founder had "the good sense" to give such "superstars" room to roam and compensated them appropriately.

"There's no 'Fuck you, I'm Chase, I'm the man'" Kalir noted. "He signals to these people, 'If you stick with me, all of us are going to become billionaires.'"

That seems to have been borne out, though it required flexibility that would make Robertson proud. Since its debut, Coleman's fund has seemingly gone through three discrete mandate changes.

Shift 1: Going global

When Tiger Tech started, it limited itself to public tech companies in the US. That didn't last long.

Tasked with finding long-short opportunities in the telecom industry, Dewan quickly discovered opportunities outside the United States. In particular, he recognized the potential of Orascom Telecom, now called Global Telecom Holding.

Traded on the Egyptian stock exchange, Dewan felt Orascom was more compelling than domestic players in the sector. It had the potential to be a big winner. He was sure of it.

To accommodate that bet, Tiger altered its approach. Rather than being limited to the US, it would play globally. Eventually, its name would reflect this broader aperture when "Tiger Tech" became "Tiger Global."

Dewan was right. According to Kalir, the Orascom bet was a "grand slam home run," returning roughly 25x. Early in its life, Tiger recognized the potential of technology to create big winners worldwide and would build much of its reputation on backing companies in China, India, Latin America, and beyond.

Shift 2: Potential in privates

Just as Dewan's research would shift Tiger's geographic strategy, Shleifer's work opened a different kind of frontier.

Like Robertson's fund, Coleman & Co. were expert pattern-matchers. According to Kalir, Tiger Global had a knack for identifying businesses with an advantageous set of characteristics. Once they'd done so, grasping the shape of the entity in question, they'd look for companies with similar complexions in different markets.

Dewan's work in telecom informed the kind of companies Tiger sought in the tech sector. But as Shleifer began to dig into the space, he found that many of the most exciting businesses had yet to hit the public market.

Tiger Global made its second adjustment. Coleman raised a new fund to go after the private markets, with Shleifer at the helm.

Like Dewan, the Wharton alum was drawn to businesses outside the US. Not only were valuations more reasonable, but competition was significantly scarcer. Among those early bets was Yandex.

Shleifer led a $5.3 million Series A into the Russian search engine in 2000, with additional capital injections throughout the company's life. Yandex went public in 2011 at more than an $11 billion valuation; today, its market cap sits at $30 billion.

Yandex was followed by investments in Mail.Ru (acquired), Maktoob (acquired), DangDang (IPOed at a $1 billion valuation), eLong (IPOed then merged with Tongcheng), Mercado Libre (IPOed, now valued at $78 billion), and Despegar (IPOed, now valued at $850 million).

This is a mind-boggling run worthy of comparison to any venture fund hot streak. Over the next ten years, through 2010, Tiger would succeed in picking many other winners, including Zynga (Series B), LinkedIn (via secondaries), Flipkart (Series B), Facebook (via secondaries), and Trendyol (Series B).

Tidy picks in the public markets bolstered this venture performance. Shleifer is credited for Tiger's investments in China's "Yahoos" — businesses like NetEase and Sina Corp that picked up serious gains between 2002 and 2003.

It's interesting to note that within the fund's first years of operations, it was already receiving criticism that would become familiar in the coming decades. The primary gripe was that Tiger overpaid for deals, beating out other investors in the process.

Hindsight suggests Tiger was right to pay above the market rate; the valuation of tech companies has only gone up, of course.

Kalir recalled one particular anecdote in which Tiger outbid Yahoo by 2-3x to snag a deal. To many at the time, that might have looked ridiculous. But within a handful of years, Yahoo came back to buy out Tiger's stake at a 20x premium. Shleifer and the rest of the private market team may have struck deals that looked rich but often proved savvy.

Shift 3: Indexing the top 10%

We are living through Tiger's third mandate shift.

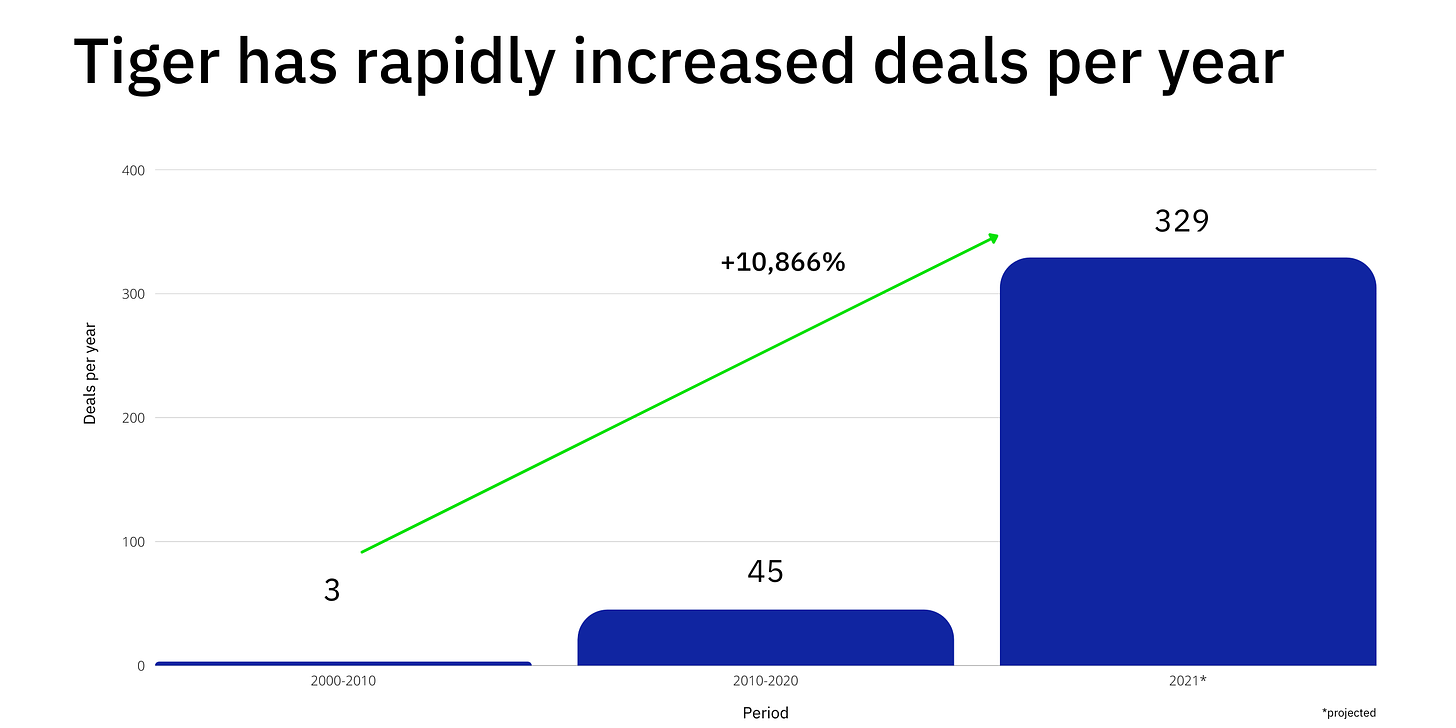

For much of its early private markets' history, Tiger moved relatively conservatively. Between 2000 and 2010, for example, the firm participated in just 30 venture financing events, an average of three per year. That data, taken from Crunchbase, includes secondary purchases and multiple investments into the same entity.

Tiger accelerated its deployment in the following decade: participation in financing events rocketed up to 449, or roughly 45 per year.

While that represented a pretty nippy pace, Tiger's 2021 makes it look positively lethargic. So far this year, the company has invested 286 rounds. At its current rate, the firm should comfortably clear 300 by year's end.

So, what has changed? How can we explain a 100x increase in velocity from Tiger's first ten years and a 6.6x jump from its next decade?

The fund's adjustment seems to be less anecdotal and more systemic. It may, in part, have something to do with a change in personnel, as well.

Lee Fixel joined Tiger in 2006 as a young economics graduate from Washington University in St. Louis. Over thirteen years, he attained near-legendary status as a venture investor, named to the Midas List eight times.

As part of Shleifer's team, Fixel backed Peloton, Stripe, Spotify, Warby Parker, and Juul. He also built an especially dazzling reputation in the Indian market, backing Flipkart, Ola, Myntra, Quikr, and others.

Flipkart's CEO spoke of the Tiger investor's influence on the ecosystem, describing him as "the pioneer who single-handedly put the Indian startup scene on the global map."

While Fixel moved quickly, he seemed to favor a more surreptitious, understated method of investing. A manager of a leading venture fund described Fixel's approach as "shadowy and surgical"; you would hear nothing of his movements only to come across his name on the cap table.

Fixel's departure in 2019 seems to have coincided with a shift in approach. Rather than striking covertly and selectively, Tiger began papering a vast swath of the market.

The manager mentioned above remembered hearing about Tiger's interest in a software company around the time of Fixel's departure. He was surprised; it was a solid business but not an obvious breakout performer. When he asked another investor what Tiger saw in the company, his counterpart replied that Tiger had told them they had a "software thesis" and believed "value in the software asset class [was] mispriced."

That statement is bland but revealing. While the venture ecosystem has long seen the potential of software and has evangelized the sector's potential to external parties, Tiger effectively said to these investors: You are still thinking too small. We are earlier than you realize, and winners will be orders of magnitude larger than we currently believe.

This seems to be the most fundamental reason behind Tiger's latest update. Though consistently bullish about the tech sector, Coleman and Shleifer seem to have upwardly recalibrated to their expectations. It's natural, particularly given the size of Tiger's assets under management (AUM), that such a revision would precipitate both higher prices and greater activity.

As we noted earlier, Tiger has gone from 3 to 300 deals per year. Inevitably, when such a shift occurs, the relative quality bar must decline. The venture manager I spoke to said that it looked like Tiger went from investing in the top 2% of tech companies to the top 10%.

Kalir echoed this, describing contemporary Tiger as an attempt to "try and own the top decile" of tech companies. In that respect, it looks something like an index strategy or a bet on a particular asset class.

While this explains what Tiger is doing, it doesn't tell us how the fund is pulling it off. Even with tens of billions under management, how can a 200 person team invest in a company nearly every day?

It's time to dig into Tiger's playbook.

Don't miss our next briefing. Join 53,000 readers and get powerful business analysis delivered straight to your inbox each Sunday. Unsubscribe anytime.

The Playbook

When split into its component parts, venture capital is a simple game. Funds are tasked with four primary responsibilities:

Sourcing deals. You can't invest if you don't see any deals. To start deploying capital effectively, you need to find ways to attract opportunities. Those might come directly from entrepreneurs or other investors.

Evaluating businesses. Every investor — even Tiger — sees more deals than they could possibly invest in. To choose wisely, you need to conduct diligence and assess a business's potential.

Winning the deal. The best startups are usually able to choose from multiple capital partners. If you want to invest, you'll need to prove your worth and outbid or outmaneuver competitors.

Supporting the company. Once you've invested, it's time to get to work helping your portfolio. Your goal is to improve the company's chances of success and build a positive reputation.

(You might argue that there's a fifth — exiting an investment. While some VCs might be active on this front, either matchmaking an acquisition or setting up a SPAC, many aren't. This topic also fits reasonably neatly under the concept of "support.”)

Traditional wisdom is that to be a great VC, you need to be good at all of these and great at one or more.

Benchmark, for example, has earned its reputation by being exceptional at step #2. Though they are undoubtedly excellent at each task, they're known as superior evaluators, better than almost anyone else at determining winners.

Compare that to Andreessen Horowitz (a16z). Again, while talented across this stack, a16z's rise to prominence came from dominating #4. Fund founders Marc Andreessen and Ben Horowitz were happy to take lower salaries to build out a portfolio services team able to support founders with marketing, product, finances, and just about everything else.

Each task connects to others, of course, but it helps to be considered exceptional at something to stand out.

This is Tiger's calling card: it is the best fund in the world at winning deals.

While other funds might be better sourcers, evaluators, or supporters, no one is willing to go to the lengths of Shleifer and his team when it comes to getting the ball over the line.

Tiger's singular skill here is not simply down to superior hustle, though that may play a role. It's a product of the fund doing things differently at each step in the venture process. The ability to win starts with a distinct mandate.

Mandate: Lowering the threshold

While not part of the four critical functions outlined, we should begin with Tiger's mandate. The fund's strategy is only possible because it seeks a fundamentally different return profile than traditional venture funds.

As we mentioned above, Tiger's current approach is to invest in the top decile of tech startups. If the tech sector continues to grow and the fund picks reasonably well, Tiger's returns should be strong — but it's less likely to drive the radically anomalous performance that traditional venture funds are seeking.

Classic VCs are often looking to clear a 30% internal rate of return (IRR) on investments; Tiger is likely hoping for something closer to 20%. A prospectus for Tiger XV, an upcoming $10 billion vehicle shared by a private source, revealed that the fund is outperforming this threshold. IRR across 14 private entities is 34% gross and 27% net of fees.

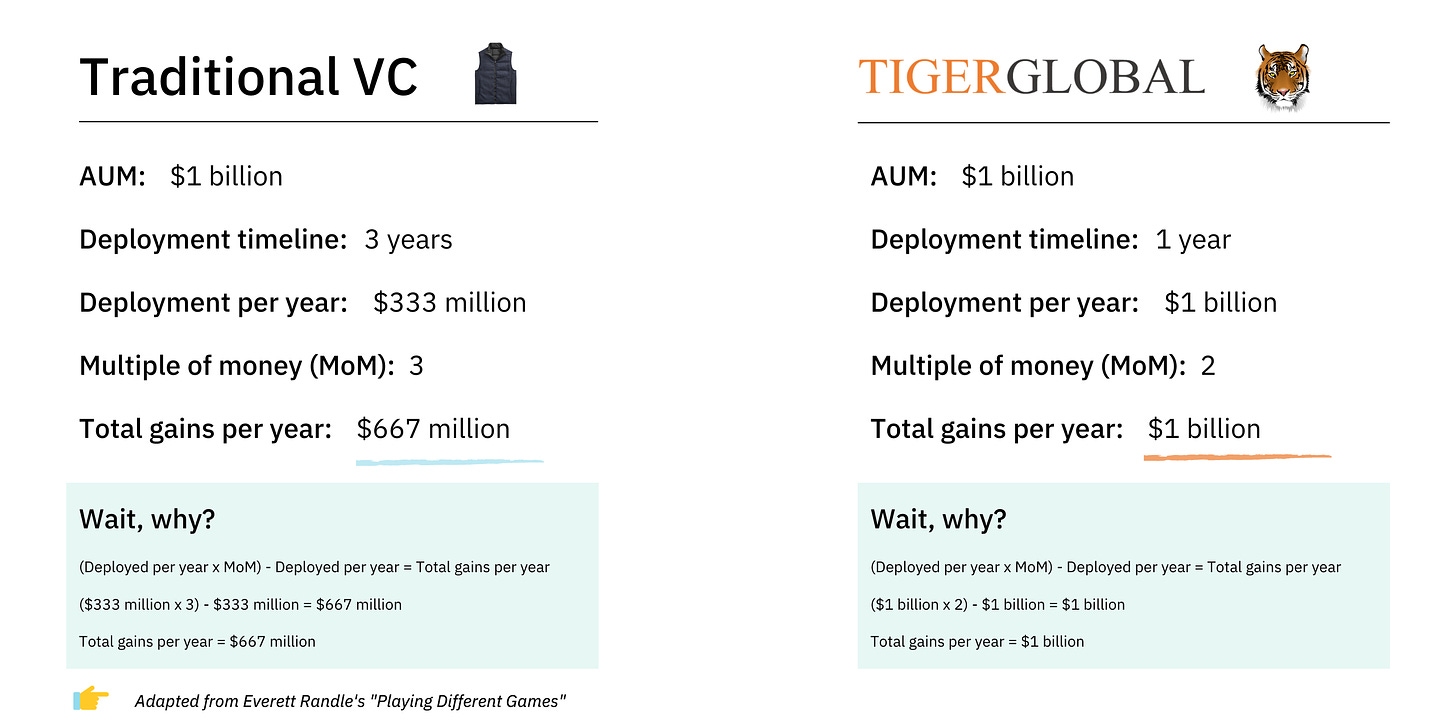

In his piece, "Playing Different Games," Everett Randle articulates the difference of approach:

Normal Fund: I'm going to deploy this fund I raised over the next ~3 years because that's what funds are supposed to do and that's what I told my LPs we're going to do. Over these 3 years, I'll just try to do the very best deals I can and maximize MoM [multiple of money] / IRR.

Tiger: I'm going to deploy as much capital as I physically can at an 18% IRR hurdle rate.

In essence, traditional venture capitalists are looking to get the best return possible within a specific time frame. Meanwhile, Tiger is looking to put as much money to work as possible at a reasonable IRR.

Why would any limited partner (LP) want to invest in Tiger if other venture firms offer the chance to secure a higher IRR?

It comes down to the speed of deployment. While a traditional VC might take two or three years to deploy $1 billion in funding, Tiger invests the same amount in a year or less. If Tiger can keep returns high enough, over time, that approach might produce bigger net gains.

Again, Randle's work is exceptional here. He outlines a scenario in which a traditional VC and Tiger are each given a $1 billion fund. The conventional VC deploys over three years and produces a 3x return or multiple of money (MoM). Tiger deploys over one year and produces a 2x MoM.

Here's what that means in terms of net gains, adapted from Randle:

While the traditional VC might secure a bigger MoM, Tiger spits off more cash annually. This is particularly advantageous to large LPs — think massive endowments and sovereign wealth, because they can keep reinvesting, putting more and more of their capital to work.

Imagine you're the head of Duke's endowment, for example. To access higher returns, you invest $1 billion into a traditional venture fund. Since it is deployed over three years, you're effectively putting $333 million into venture capital per year.

Now, if you put $1 billion into Tiger, it gets deployed within twelve months. Since Tiger wants to keep investing, that means you have the chance to deploy another $1 billion next year, and the year after, and so on.

After ten years, you might have only gotten to allocate $3.3 billion to the venture asset class with a traditional fund versus $10 billion with Tiger.

The real numbers are much crazier than this. That prospectus mentioned earlier notes that Tiger plans to put the full $10 billion from fund XV to work within 12-18 months.

Now, reasonably, you might say, well, why not just invest more money into traditional venture funds?

Usually, the answer is that it is not possible to do so. While venture funds have grown, the way they approach sourcing, diligence, and support (discussed in a moment) means there is a cap on the amount of capital they can put to work.

Though an emerging manager may struggle to build an LP base, prestige firms must turn many institutions away or significantly reduce the capital they can take.

In a discussion about Tiger, one investor described how potential LPs frequently propositioned his firm, particularly sovereign wealth funds. Because of their size, these parties want to put hundreds of millions to work. Though attractive in the abstract, the manager noted that it's impossible to accommodate — the fund cannot productively put so much additional capital to work, and doing so would skew the composition of their LP base.

These are precisely the kind of clients Tiger can serve.

Want to put $200 million to work in tech? No problem.

In total, Tiger boasts $83 billion in AUM, not including the $10 billion being raised as of August 2021. In all likelihood, it's already approaching $100 billion. You might not get Sequoia-level returns, but there's a higher upside than sticking your cash in bonds or treasuries.

Though finding a complete list of a fund's LPs is almost always impossible, we have a sense of Tiger's base. It's exactly the kind of list you'd expect, replete with charitable entities, college endowments, and retirement funds.

Notable names include retirement plans for JPMorgan, 3M, Duke university; foundations from the Pritzker, Rockefeller, and Lasker families; and insurance companies like American General Life Insurance Company, Variable Annuity Life Insurance Company, and Western National Life Insurance Company.

This LP base is extremely stable. According to the prospectus, 85% of outside capital comes from investors with whom Tiger has a 5+ year relationship. On Tiger's last fund, 89% came from existing LPs.

Such solidity is further bolstered by the fact that Tiger's largest LP is its own employees. Not only does this mean Tiger has real skin in the game, but a significant portion of its money comes from people that, a priori, buy into the fund's strategy.

Sourcing: Buy leads

Like other prominent funds, Tiger benefits from significant demand. One founder I spoke to outlined how he had targeted Tiger for his seed round, knowing about their deep pockets and hands-off approach — an attractive combination to an experienced founder.

Outside of reputationally-driven inbound, Tiger takes two specific steps to bolster its sourcing:

Seeding other funds.

Hiring consultants.

To make sure it sees more deals, Tiger cozies up to seed funds. One investor with knowledge of this practice explained that Shleifer's team often looks to invest ~$25 million into emerging early-stage funds. The goal here is to become a new manager's largest LP and keep Tiger abreast of portfolio companies' future funding rounds.

The source I spoke to noted that Tiger essentially asks these managers, "How do we become the only partner you bring Series As to?"

Alongside money, Tiger has plenty of perks with which to woo managers, offering trips on private jets and swanky tickets to the hottest sporting events.

It's unclear at this point how many times this strategy has been executed, but given Tiger's size, the fund certainly has the clout and capital to roll this out at a reasonable scale.

Tiger's friendliness extends to Series A funds. An investor that focuses on that stage remarked that though Tiger hadn't made overtures to invest, a partner had expressed the desire to mark up their entire portfolio in future rounds.

As you might expect, Tiger seems less interested in cultivating relationships with growth stage colleagues. These are, after all, competitors looking to maximize their allocation in hot rounds. The manager of a renowned fund said of John Curtius, one of Shleifer's most prominent lieutenants, "John has made no effort to build a relationship with me...no one from Tiger has."

Beyond seeding funds, Tiger discovers opportunities through research and outreach. While other funds do this in-house, relying on analysts and associates, Tiger takes a different approach.

As we'll discuss in a moment, much of Tiger's model leans on the work of consultants. Tiger is Bain's largest customer, though the fund also relies on the work of Ernst & Young and likely others.

These consulting shops are tasked with researching specific markets and surfacing prospects. Tiger's history of superior pattern matching plays a vital role here — once Shleifer's team has reached conviction on an area and approach, they invest in multiple players across geographies.

For example, from looking at Tiger's bets, it becomes evident that grocery delivery is one focus. The fund has backed businesses across the stack, including Getir, Jokr, Nuro, Favo, Grofers, Wolt, and Telio.

These companies span continents, and in some cases, are competitive with each other. That's an unusual practice in venture capital — most consider it poor form and anti-founder to do so. That Tiger has managed to skirt criticism on this front is down to the firm's hands-off approach, discussed below.

Another clear area of interest is the "democratization of investing," both in traditional equities and cryptocurrencies. Tiger's has invested in Groww, FTX, Public, CoinSwitch, Coinbase, Falcon X, and Robinhood.

It's easy to pull other themes from the portfolio — digital business banking, restaurant tech, and SMB operations are all prominently featured. If these focus areas sound a little bland, a little general, well, that's kind of the point. While firms like Union Square Ventures (USV) have been surgical in defining and executing thoughtful, detailed theses, Tiger is happy to say "Tech = good" and run with it. The fact that it's working is a testament to the correctness of Tiger's read on the macro environment and sign, perhaps, that during times like this, venture can be played simply.

Evaluating: "Cloud" diligence

Tiger's use of consultants moves into high gear when it comes to evaluating companies.

Let's recap Tiger's approach briefly:

It's betting on private tech as an asset class.

It will deploy as much as $10 billion a year into this market.

It will participate at any stage, from seed to pre-IPO (and beyond).

It will invest anywhere on the planet.

How does any fund do this?

How can you tangibly assess companies across dozens and dozens of complex, changing geographies in a sector with high complexity, that can shift on a dime?

How do you staff this strategy? How many people do you need to run it?

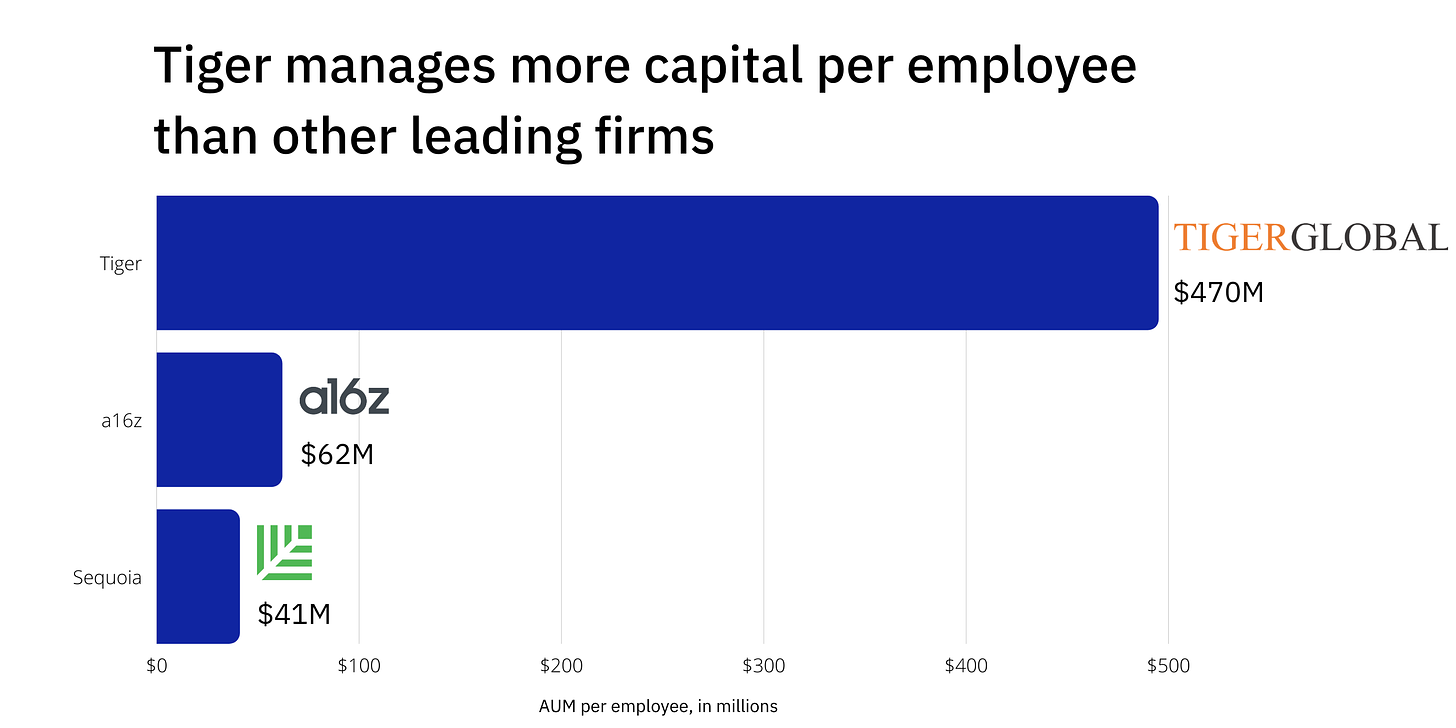

If you were to look at Tiger's numbers alone, you would assume the answer to be about 200 people. LinkedIn tells us 188 people work at the fund, effectively managing $93 billion. That comes out to almost $500 million in assets per employee. Other leading venture funds can't come near this kind of efficiency:

As one investor described it, "[Tiger] is the most leveraged business model of all time."

What is the secret, then? Is every Tiger investor just magically faster than their counterparts at Sequoia or a16z?

No. Of course not.

The difference is that traditional funds conduct their diligence in-house, whereas Tiger outsources it. The fund reportedly spends hundreds of millions on Bain's services every year, with much of that dedicated to company evaluation. Given Tiger is earning between $1.5 billion and $2 billion a year in management fees, the fund can certainly afford it.

This approach has other benefits, too. Specifically, Tiger can add new areas of coverage as it needs, not unlike a startup spinning up new servers via AWS. Suppose Shleifer suddenly decides he wants to finance startups in Pakistan's food delivery market. He doesn't need to set up a dedicated local office and hire experts in the industry — he can call someone at Bain. With offices around the world and diverse talent, the consulting shop can staff a team overnight.

The same goes for diligencing an active deal. If Tiger is looking at a business banking startup in Egypt, it doesn't need to make its investors go through rigorous surveying and backchanneling; it can have Bain conduct dozens and then report back with the results.

Niftily, by working in this way, Tiger effectively turns a fixed cost (employee salaries) into a variable one (consulting as needed).

Venture investors have seen this approach play out first-hand. One manager recalled how a Tiger investor had shown up to a portfolio company with hundreds of pages of customer calls, clearly produced by a consulting firm. Amazingly, Tiger paid for all of this research in advance of the company raising a round.

That practice of pre-emption is part of the reason Tiger has become venture capital's winning machine.

Winning: Move faster and pay more

Tiger's zone of genius is the space between discovering an opportunity and agreeing on a term sheet. It is a fund that thrives in competition, and that will do anything to win.

The primary lever Shleifer pulls is price. Tiger is willing to pay more than anyone else to get a deal across the line.

How much more?

It depends on who you ask. Some of my sources estimated Tiger's premium to be somewhere around 25-50%, while others suggested the fund was willing to pay multiples of competitors.

One investor recounted a situation in which Tiger approached a company courted by several other Tier 1 funds and proposed a valuation 25% higher than the bid on the table. When the company CEO said they'd have to think about it, Tiger countered by asking what price it would take for the process to close. When the CEO said another $100 million, Tiger immediately agreed. The deal was theirs.

One source summarized Tiger's approach to valuation, "I honestly think [they pay] what it takes to get the job done, in a lot of cases."

Does this mean that Tiger overpays for its deals?

Possibly, though it's also feasible venture investors have simply underpriced private tech companies for the last few decades. In either case, it may not matter; Tiger's different return profile means it can afford to pay up for winners.

Related to this is that entrepreneurs know Tiger will continue to deploy more into their company over time. One entrepreneur noted that it was almost a "duty" to ask for more capital from the fund. Part of the reason he was sold on partnering with them was that he'd seen Tiger stick with business round after round, often through difficult circumstances. "I look[ed] at the consistency of their participation, round after round, in the ups and downs," he said.

Tiger has other arrows in its quiver outside of deep pockets. Arguably the biggest is its willingness to make decisions in the time it takes most firms to schedule an introductory call. Entrepreneurs I spoke to explained that processes with Tiger closed in a matter of days, while other VCs took weeks to make a decision.

A founder that went on to take funding from Tiger commented on this speed, remarking that once you start the process with the fund, you know it will take just a handful of days before you receive a definitive decision. “The process was so fucking delightful,” he added.

For entrepreneurs focused on moving quickly, this is a godsend. Rather than allocating multiple months to fundraising, they can simply partner with Tiger and shortcut the process, allowing them to return to business building.

That Tiger can do this is, again, only possible because of its model. It has the latitude to invest more frequently at a lower return threshold and has usually received outsourced diligence before the process has formally kicked off. The entrepreneur remarked that in his first call with Tiger's team, it was so clear they "know exactly what they want."

Sometimes this speed can be a mirage. While Tiger is usually happy to wire funds within days for smaller checks, large investments may go through a longer process. Tiger gets around this by committing to a deal fast but then making the investment contingent on further diligence. This lagging research is often conducted by Ernst & Young. In at least one instance, Tiger has reportedly backed out from a deal after verbally committing.

Shleifer will need to be careful here; there are few things as ruinous to a VC's reputation as reneging on a deal.

Tiger's final weapon to win is a cultural one: aggression. Because of its origins, Tiger feels more like a hedge fund than a venture firm — it's a place where extreme hustle, quantitative dexterity, and fierce competitiveness are expected and prized.

Though still combative, venture capital has the decorum of a gentleman's boxing match; the hedge fund world is a bare-knuckled brawl.

For some founders, that ethos is attractive. Given the intensity it takes to run a startup, many entrepreneurs seem to find Tiger's relentlessness kindred; while venture investors stereotypically clock in at 10 am, take a couple of coffee meetings, then bounce mid-afternoon, Tiger is seen as a place that requires grit and endurance. That's bolstered by the team's willingness to bid whatever it takes to close a deal or hop on a flight to turn around a lost cause.

Part of the reason Tiger wins so much is that they’re willing to go the extra mile.

Supporting: Lean on the network

For the last decade, the venture market has been reacting to a16z's game, defined by its commitment to portfolio support.

To try to catch up, other funds have expanded their teams and the services they offer. The idea here is that by being the most "founder friendly," "hands-on," and "value additive" firm out there, they should be able to win the most competitive deals.

The fact that such phrases require quotations at all illustrates the skepticism that most of these claims elicit. While some VCs can meaningfully change a company's trajectory with their involvement, many provide little more than a Rolodex and the occasional unedifying phone call. Because of this perception of over-promising and under-delivering, many entrepreneurs view such promises with skepticism.

Tiger capitalizes on this zeitgeist and zags in the opposite direction. Instead of trying to prove its bonafides as a SuperNiceCapitalistHelper, it explicitly advertises a lack of involvement. Tiger's partners do not want to be the first number on your speed dial or the person you loop into your team's two-day offsite. They do not want to sit on your board of directors, though they occasionally do. They are money — smart money, yes, but still money.

When executed poorly, this approach can reflect badly on the firm. An investor that serves on a board with a Tiger partner noted that during meetings, the investor "didn't really pay attention. I'm not sure why he was there...he would just look at his phone and fuck around."

While that kind of behavior is a turn-off to founders, this lack of involvement can be attractive when managed thoughtfully. One experienced founder explained the appeal of Tiger's unobtrusiveness, "I know what I need to do. I don't need babysitting."

Now, this isn't to say that Tiger adds no value after investment, only that once again, it relies on others to deliver support. Perks come in the form of spending credits and access to an elite network.

Once you're a part of Tiger's portfolio, you get access to Bain's consulting services for free. One founder playfully referred to this as "Tiger Vouchers," available to be spent at your discretion.

Another emphasized just how valuable this was to him, particularly when it comes to big decisions, like choosing his business's next market. "That's a $10 million decision...The fact that you can get this resource [Bain]...is freaking insane."

Though less frequently discussed, a similar arrangement exists with elite recruiting firm Heidrick & Struggles. When it comes time to find their next executive, portfolio companies can tap the search firm, gratis.

The final perk is Tiger's network. While most established funds offer significant access, Tiger's is rather different from most venture firms. Specifically, Shleifer's team can connect entrepreneurs to public market investors with deep expertise in relevant industries.

This can be hugely valuable. A founder I spoke with noted how much he had learned from conversations with hedge fund managers that cover his industry. Not only did he get a better sense of his market, he gained insight into what later-stage investors might look for:

By being surrounded by extremely financially savvy investors...you get such a good sense of how the public markets view your company.

He also noted the difference in thinking between venture capitalists and hedge funders, stressing how quantitatively rigorous the latter seemed to be:

I can't speak highly enough about these guys. I would love to work with hedge fund investors for the rest of time...You become way more razor-sharp.

Tiger is not afraid to do things differently. Across each of venture's core functions, the fund makes unusual choices, all designed to improve the odds of winning.

Move and countermove

One of the most intriguing parts of Tiger's strategy is that it is exceedingly hard for traditional venture funds to emulate. By increasing the speed of the game, Tiger effectively sacrifices precision. It accepts a higher error rate to deploy more capital, faster.

Copying Tiger breaks a traditional venture fund. If they choose to move quicker, they increase their error rate; if they want to outbid competitors, they reduce their return profile. Tiger is built to absorb these hits — the mandate explicitly dictates this approach, and the size of AUM makes it viable. But a traditional venture fund has a different, finely balanced risk and reward profile, not to mention a culture that tends towards the ponderous.

Good competitors always find ways to adapt to novel strategies, though. Tiger is not the end game of the venture market, though it does feel like the logical conclusion to a blitz chess strategy.

Others have suggested that Tiger catalyzes a bifurcation in the venture market, a split between the prestigious old-guard and fast-moving insurgents. In his piece, Randle suggests we are moving towards a world where "luxury retailers" like Sequoia and Benchmark compete with "low-cost vendors" like Tiger.

A senior VC I spoke with made a similar inference, suggesting some founders prefer traditional, hands-on firms while others will go for the ease and laissez-faire ethos of Tiger:

Ultimately, if the founder is making a decision between the two of us [Tiger and the individual's firm], one of us is probably in the wrong room.

While brand and reputation always have power, classifying Tiger as a radically different, implicitly lower-end product seems like a misjudgment. None of the founders I spoke to seemed to feel Tiger had a negative brand; on the contrary, they appeared proud of their affiliation with the firm. Equally, all were unusually enthusiastic, more so than many founders I've spoken to that raise from traditional funds. Even though Tiger explicitly doesn't meddle, the firm seemed to have added meaningful, tangible value to its portfolio founders while also giving them favorable valuations and saving them from arduous fundraising processes.

Will founders wait for a Tier 1 traditionalist when Tiger offers better terms, faster?

Sometimes, but perhaps not as often as one might think. To ensure they win competitive deals, traditional firms will have to accelerate their decision-making process but somehow not radically raise their error rate. They will also need to make their unique benefits much more tangible. To casually browse VC websites is to drown in a sea of platitudes about believing, helping, thought-partnering, caring, loving, understanding, supporting, being in awe of, being inspired by, being in service to, seeing the future, acting first, pushing the world forward, and any number of other well-meant banalities. Only an exceptional few truly spell out how these promises are kept and the difference they make. Broadly, venture firms will need to better surface their genuine expertise and translate its impact for founders during fundraising.

The choice may also not be a binary one. Increasingly, we might see founders choose both Tiger and a traditional firm. In many respects, this is the best of both worlds. Since Tiger's structural advantages will almost always allow it to move faster, founders can use the fund as leverage, forcing traditional firms to speed up and pay up. The company unlocks access to a bucketload of "Tiger vouchers" and the fund's network while also receiving the attention of traditional investors that have articulated and demonstrated the tangible value they can bring to the table.

Of course, if the market migrates towards a "Tiger + 1" default, competition for the accompanying slot will increase, forcing traditional funds to more directly maneuver against each other.

Though Tiger has the tools to dominate in the current market, there is always the risk of failure. While the firm's reputation seems solid at present, that could change. Tiger will need to be careful about dodging verbal agreements or overtly investing in competitors. It must also ensure it’s aggressive capitalization strategy doesn’t lead to high-profile blowouts of the ilk Softbank endured with WeWork. Any of these could taint Tiger’s low-key allure. Similarly, if Tiger's hands-off approach encourages bad outcomes, with startups receiving insufficient advice and governance, founders may sour. Some venture investors are already sounding the alarm on this front, arguing that too many companies are operating with insufficient oversight and strategic planning.

Of course, for many, this is an incentivized position; to believe anything else would be to invite cognitive dissonance. That doesn’t mean the argument is without merit. Certainly, there will be startups that suffer from a lack of governance, just as others suffer from its abundance. Tiger will need to make sure it does not become the poster-child for failures of the first kind.

The most significant risk to Tiger is macroeconomic. Right now, the fund is happy to pay high prices, knowing that public market investors are hot on tech. Should the sector experience a sharp downturn, Tiger could find itself in a situation in which its portfolio is significantly marked-down. Because of its broader strategy, it is perhaps likelier to have more losing bets than traditionally selective firms.

Equally, a tech winter could reduce the number of startups being created, making it much harder for the fund to efficiently allocate the seismic sums under management.

Tiger will be well aware of these risks, of course. And if the past is any indication, they will be prepared to adapt to a change in circumstances.

Bobby Fischer once said, "Blitz chess kills your ideas." For Fischer, the rapidity of the game handicapped one's ability to generate sophisticated, novel stratagems.

It's tempting to think of today's venture market and Tiger's role in it, along the same lines. This is a spray-and-pray business now, this line of thinking goes, and Tiger's got the biggest hose.

While it's true that Tiger might not have the most conceptually adventurous of investment theses, there is plenty of thought in its approach. By adjusting its mandate, shifting its resource allocation, and mapping the ecosystem, it has developed a fund capable of executing around the world, around the clock, ceaselessly and sleeplessly.

For now, at least, it is the closest thing venture capital has to a winning machine.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.