Asana in 1 minute

Asana is a task management and collaboration suite founded by Facebook's former CTO, Dustin Moskovitz. Unlike Moskovitz's alma mater, Asana is a business obsessed with mindfulness, transparency, and candor. Those values are at the forefront of the S-1, considered a source of defensibility by management. For Asana, culture is a moat.

Asana's challenge will be selling investors on such an intangible, though buyers may not need further incentive. Asana is a SaaS business growing +85% a year in a hot market. In 2020, revenues stood at $143M, with losses of $120M, and gross margins of 86%. Winners of the direct listing include Benchmark Capital, an iconic venture firm with ties to Facebook.

To learn about Asana's Buddhist principles, competition from Smartsheet, and the "metalayer" of work, keep reading.

If you enjoy this analysis, sign up for more S-1s here 👇

On Monday, September 21, at 6 pm ET, we'll walk through our research and answer questions. Join Alex Lieberman, Stew Bradley, Pranavi Cheemakurti, Nandu Anilal, and me. RSVP below.

Analysts

Introduction

It was not the beginning of the end, though perhaps it should have been. In justifying his company's new $20B valuation, Adam Neumann said that to understand WeWork, you couldn't look at the numbers.

"WeWork isn't...a real estate company. It's a state of consciousness," he argued.

He had said and done crazier things before — in 2017, he inexplicably spent $13.8M on Wavegarden, a maker of wave-pools — and would spend much of the following eighteen months outdoing himself. When you think back to WeWork's decline now, other, more lambent follies come to mind: vague plans to save the orphans and solve world hunger, "community-adjusted EBITDA," a frivolous school, and ambitions to ascend to the office of "president of the world."

Still, it was a phrase that drew titters at the time. In its egoism and vague appeal to religious ideas, it was classic Neumann — typical of an executive part Rasputin, part Caligula, both an absorbing conniver of Masayoshi's court and mad emperor of his own.

In demeanor and appearance, Dustin Moskovitz bears little resemblance to the WeWork impresario. He is five years younger and almost a foot shorter, and where Neumann dazzled with libertine brio, Moskovitz reads as earnest and humble and more than a little shy.

And yet, they make the same argument.

Though delivered with signature Neumann top-spin, the "state of consciousness" argument was simple: corporate values are worth something. Culture can be a moat.

In Asana's S-1, that message is repeated throughout. Yes, the company is growing, and yes, the product is slick, well-designed, and improving. But the core of the filing's case is not based on any of these things. It is about culture, the ineffability of it, and its value.

Where WeWork combined the feel-good spiritualism of Eat Pray Love, the rigor of Goop, and the tonal resonance of a frat party, Asana gives the sense that they will stop at nothing less than enlightenment. Indeed, even the name "asana" is borrowed from a body posture associated with yoga.

By culture, we don't mean "beer on Fridays." We mean the practical and pervasive implementation of norms, best practices, and ideals. We empower people with what they need to do their best work and avoid micromanagement.

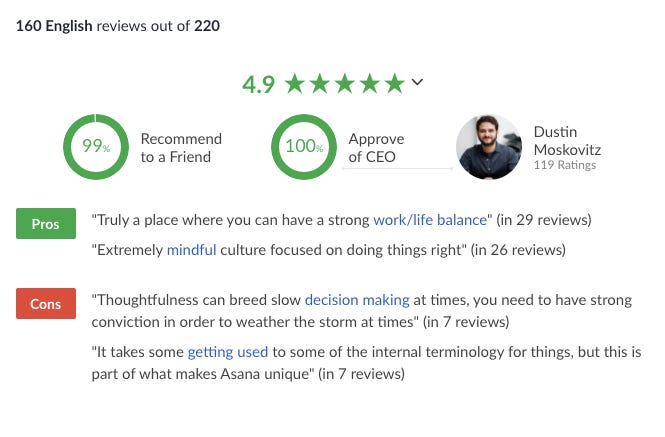

Tangibly speaking, Asana looks to bring mindfulness to office life. "No meeting Wednesdays" strive to provide flow for employees, while the S-1 emphasizes values like candor, inclusion, and trust. As proof of some success in creating corporate cohesion, Asana notes annual retention of 90%, "despite competition for talent." The firm's Glassdoor reviews are glowing.

An ostensibly happy work place, Glassdoor

What is all this worth?

Asana's rhetoric is persuasive but broad. How many companies have we seen — particularly this year — explain the importance of diversity and inclusion to their organization? What tech company doesn't preach the value of honesty and transparency? (Aside: possibly Palantir.)

Core values, Asana’s S-1 filing

This does not mean that Asana's culture is not defensible; it may mean our words, our methods of explanation, are insufficient.

Costco's founder, Jim Sinegal, once said, "Culture is not the most important thing in the world. It's the only thing…It is the thing that drives the business."

Despite Amazon entering grocery with its 2017 Whole Foods acquisition, Costco has continued to thrive, its stock doubling in that period. There are undoubtedly many reasons for Costco's continued success, but shouldn't we believe Sinegal in noting that culture drives such achievement?

If you believe culture matters, that it may be the thing that matters most, it's worth wondering who will be software's Costco. We imagine a business that treats its employees well, sticks to its values, and manages with the long-term in mind. A company that trades not on finances alone, but a state of consciousness.

In short, a company remarkably similar to Asana.

Asana’s history

Does the name Dustin Moskovitz ring a bell? If so, what comes to mind?

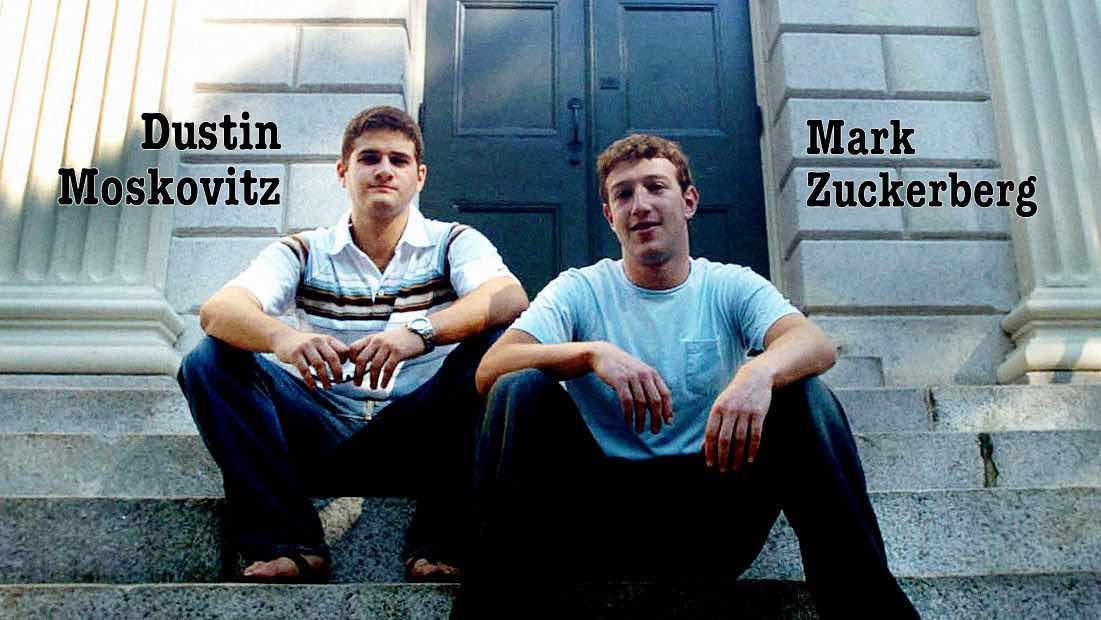

Likely, the answer involves some combination of Harvard, Zuck, and Facebook. And that makes sense. Dustin was Mark Zuckerberg's sophomore year roommate, a co-founder of Facebook, and its first CTO.

Facebook’s founders in the company’s early years, Fossbytes

But if we were to evaluate Moskovitz's entrepreneurial journey holistically, Facebook wouldn't get even half the air time. That's because the 36-year-old Gainsville-native departed the $760B social network just four years after launch to build a work organization and tracking tool with a fellow Facebook engineer.

That tool has evolved into Asana and that fellow Facebook engineer, Justin Rosenstein (or JR), is Dustin's co-founder. The two have been growing the now-700+-person SaaS business for the last 12 years.

Solving a nagging problem

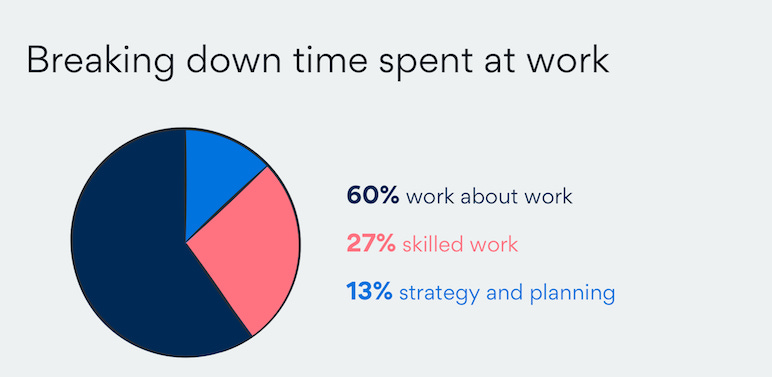

"Work about work" sucks. You may not recognize the phrase, but you've experienced the feeling.

Searching for information

Switching between apps

Managing shifting priorities

Checking up on the status of work

You know, all of the janitorial services revolving around effective work. As engineers at a nascent Facebook, Dustin and JR "grew frustrated by how difficult it was to coordinate everyone to get work done, and how much time they spent in meetings, sending emails, and searching for information."

“Work about work,” Asana’s blog

At the time, Dustin was leading Engineering under Zuckerberg, and JR was making a name for himself with a little feature called the "Like" button. Moskovitz began to notice the perils of "work about work," and JR volunteered to help. The two built an internal tool called "Tasks," which broke down projects into component parts and made workflows way easier to track. The initial response to "Tasks" was strong, according to Moskovitz:

The internal Tasks tool quickly took off within Facebook. Though we built it originally to solve a few use cases within engineering, it was adopted by teams all across the company and started being used for things we never anticipated, like meeting notes and agendas (which could then easily be turned into action items). Every time you walked through the office, you would see people interacting with this system on three out of four monitors; this reminded me a lot of the early days of the Facebook product, when walking through a campus computer lab meant seeing it up on all the displays.

Passion and the positive reception led Dustin and JR to re-organize their responsibilities and spend their time developing "Tasks" further.

Building with Buddhist values

The duo quickly discovered more similarities than just a shared love for smarter team collaboration. Both were students of Buddhist writings and saw the potential of building a company and culture entrenched in those ancient principles.

In December 2008, the Facebook alum left the social media giant to build for the world what they'd constructed for their co-workers. Asana was born as a team-based work management software company inspired by the Buddhist principles of ease, focus, and flow.

2008 - Present

It took a while for Asana to share their work publicly. Only in 2011 did the company emerge from closed beta, tying up a $1.2M seed round that spring. Investors included Silicon Valley legends Ron Conway and Mitch Kapor, along with some familiar faces from the pair's Facebook days: Peter Thiel and Sean Parker. Zuckerberg himself would invest in the company's $60M Series C in 2016.

Fast-forward to the present day, and what does Asana have to show for its transition from an internal tool to a venture-backed SaaS company?

Let's take it to the scoreboard, as of January 31, 2020.

Last valued at $1.5B

FY2020 revenue of $143M

Raised $413.2M in institutional capital

3.2M free activated accounts

75,000 paying customers (in 190 countries)

701 employees

With Moskovitz and Rosenstein still at the helm, Asana has become a major player in the expanding work management industry. In the process, the founding duo have reframed their history — moving away from the dopamine-hacking of Facebook towards the zen of Asana. In ten years, when we think of their names, Zuckerberg and his creation may not even enter the conversation.

Number of mentions in the S-1

Dustin Moskovitz or Moskovitz: 158

Culture: 36

Justin Rosenstein or Rosenstein: 33

Work about work: 22

Productivity: 21

Collaboration: 17

Facebook: 13

Market

Asana's industry is front and center in the age of COVID-19. The need for increased collaboration and structure around a knowledge worker's workflow has been expedited as a result of Zoom-centered workdays and the rollout of remote work.

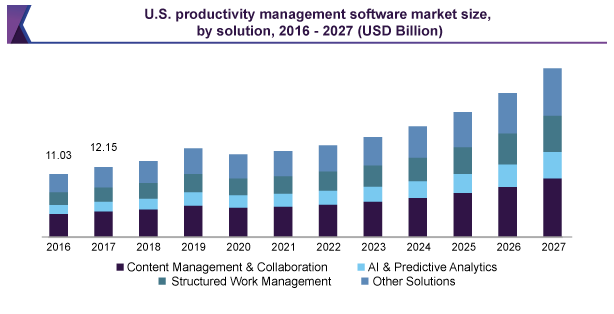

COVID-related tailwinds may have served the productivity and task management market. The global productivity management market is expected to reach $102.9B by 2027, up from $45.8B in 2019. That represents a CAGR of 13.4%. Enterprise spend is expected to be a significant driver of this growth.

Grandview Research

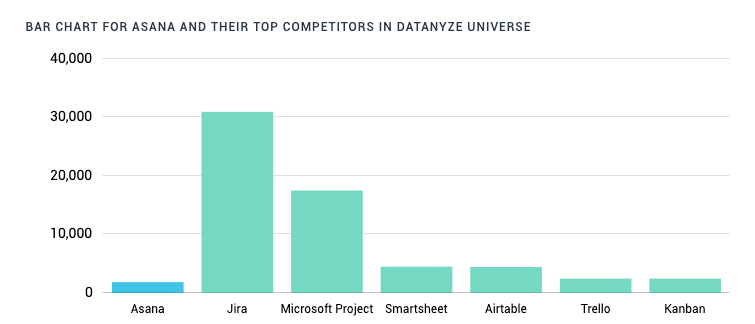

The space remains fractured. According to a Datanyze report, Asana has a market share of 2.12% compared to market leaders Jira (35.27%) and Microsoft Project (19.94%). Other notable players include Smartsheet (5.14%), Airtable (5.07%), Trello (2.8%), and Kanban (2.8%).

Jira dominating, Datanyze

In a space as splintered as this one, it's unsurprising to see that the industry leader has less than majority market share and several players enjoy less than 10%. We believe that this could be a reflection of user behavior — as work becomes more complicated, so does the productivity stack.

It's worth noting that many of the tools mentioned above sit as part of a larger organization. Jira is a part of the Atlassian empire, as is Trello, after a $425M acquisition. Project is, of course, part of Microsoft's 365. Smartsheet has gone public with a similar product, increasing 152% since IPO to reach a price of $47 per share.

Will Asana be able to succeed with a similarly narrow product?

The metalayer of work

What is work?

For Asana, work is the Google Doc, the Figma file, the spreadsheet. Work is output, novel contribution, something produced. The rest is, as mentioned, the dreaded "work about work." That phrase is mentioned in the filing with muted disgust, a dark incantation that summons drudgery and inefficiency, and all which Asana stands in defense against.

Email is not work, Slack is not work, meetings are (mostly) not work. For Asana, most of our days in the office are not spent in labor, but labor about labor, meta-work.

Much of the last few years of work tools have mined a similar theme — compressing feedback and production. Whereas you might once have created a product design, sent it to a colleague, garnered their feedback over email, then updated it, designers now jump into Figma. Feedback is hosted in the same place production occurs. (This subject is thoughtfully covered in Kevin Kwok's piece, "The Arc of Collaboration.")

In some instances, this has improved efficiency — Asana's ultimate goal. But the balkanization of tooling — companies balance GSuite, Notion, Figma, Coda, and others — has resulted in a proliferation of "inboxes. With feedback embedded across platforms, users must switch between them to complete a task.

The natural question is: what should be done? How do we deliver workers from this many-chambered hell?

The solution may be a "metalayer" sitting on top of platforms, serving both feedback and production, collaboration, and creation. Kwok discusses Slack and Dropbox's efforts to win this territory while Julian Lehr mentions Superhuman. With its aim to create a "corporate metaverse,” Zoom is in the mix, too.

Though last to enter the public markets, could Asana prove the best-positioned? We'll discuss the product in greater detail below, but at first blush, the company seems to allow for a degree of creation and communication. In some instances, project descriptions remove the need for docs, while dashboards substitute spreadsheets. Do those count as work, rather than just "work about work?"

As Asana expands its features and strengthens integrations, it may begin to resemble a true metalayer.

Product

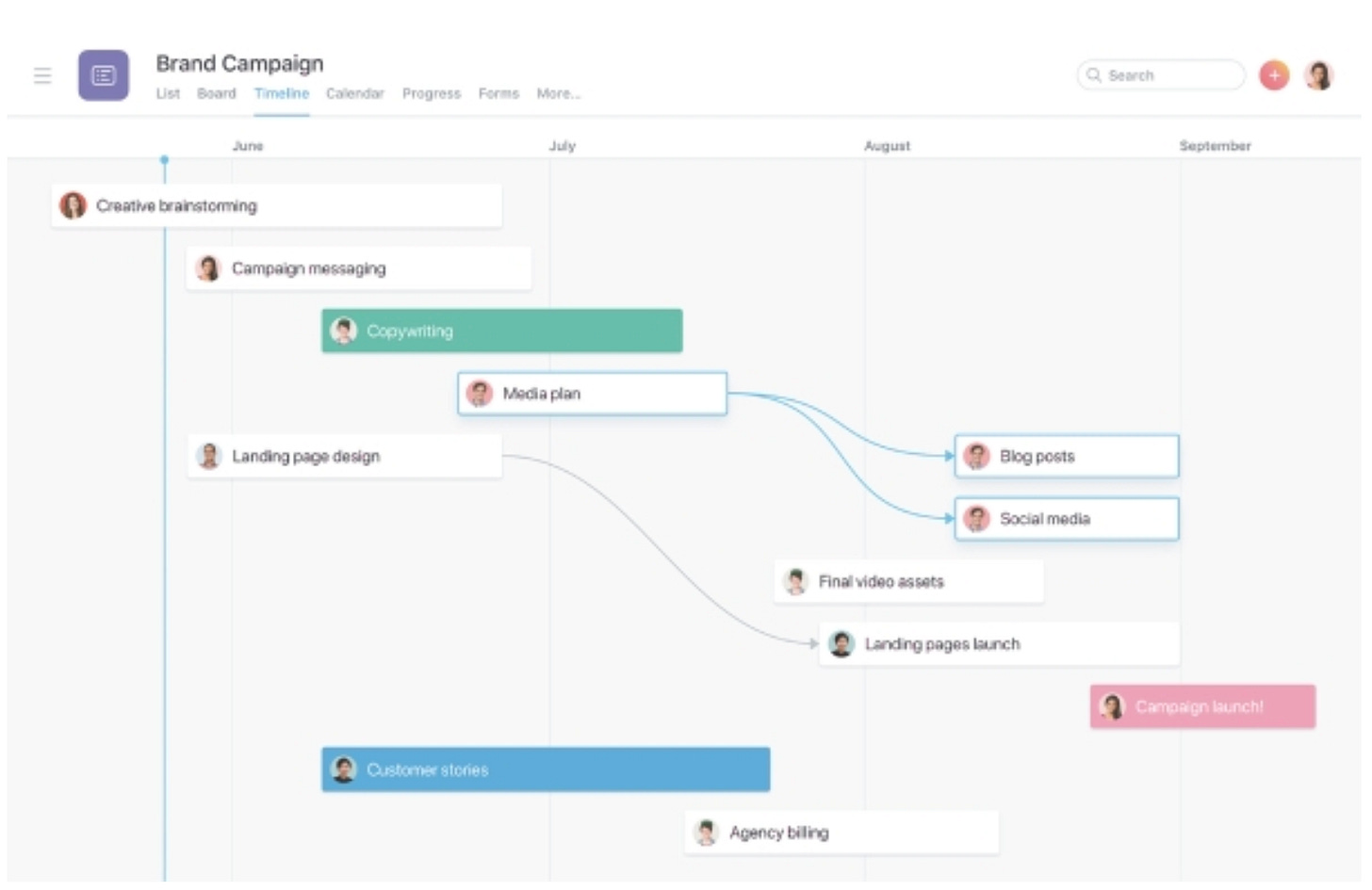

Asana allows teams to orchestrate their work across people and projects. As an orchestrator, Asana attempts to bring clarity and visibility to work processes.

Asana’s S-1 filing

Their fundamental insight is that the atomic unit of work is a "task." By capturing that unit of value, they hope to become the system-of-record. These tasks roll into projects, portfolios, and goals allowing for different levels of visibility. An individual contributor may spend most of their time managing their own tasks on Asana, but their manager gains the visibility to understand how the entire team is executing. Asana maps these relationships between people, tasks, and processes into a “Work Graph.”

Work Graph

The natural comparison is to the Social Graph, made famous by Facebook, the other Dustin Moskowitz company. Much like how your activity on Facebook gives the social network a rich understanding of people's relationships, your activity on Asana provides a rich understanding of how work is done within an organization. Facebook monetizes their graph by serving extremely relevant ads, while Asana uses its graph to deliver useful reporting and project management features.

The Work Graph helps us understand what Asana's incentives are and how they build. Because Asana is a horizontal product, there is a temptation to suggest they will expand their product into adjacent horizontal markets and compete with the Slacks and GSuites of the world. The reality is that their Graph only becomes more robust if they acquire new information about how work is done. To date, they've relied far more heavily on integrations to capture this information rather than on expanding their product.

Asana’s S-1 filing

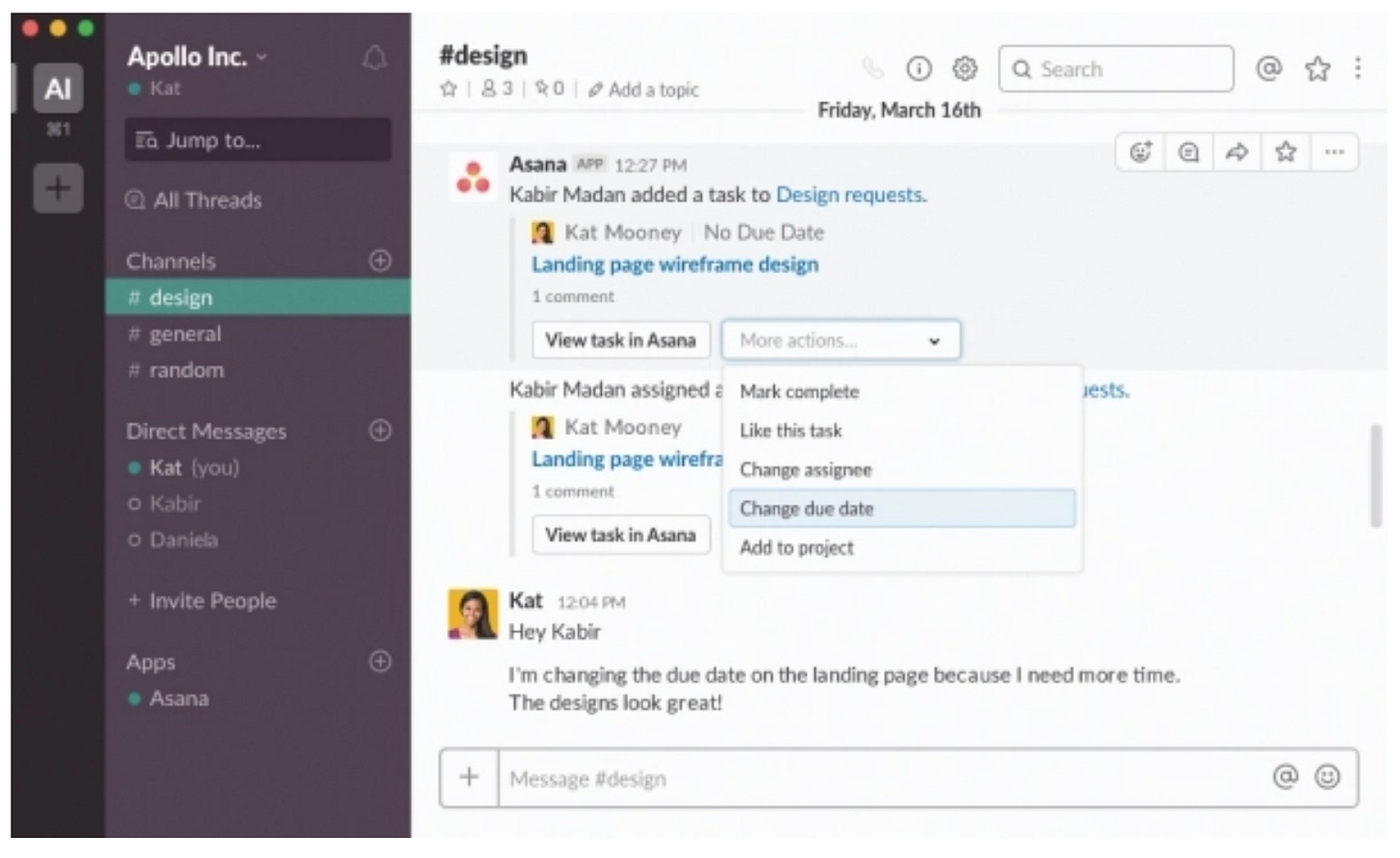

Integrations

There's more to work than managing tasks, of course, which is why Asana has invested in supporting 100+ third-party integrations with other major work applications. Covering everything from GSuite to Slack to GitHub, integrations allow Asana to meet users where they are. Additionally, it allows Asana to pull rich information into its work management product.

Asana’s S-1 filing

Like many horizontal productivity tools, Asana has also launched workflow automation features. As Asana understands the work that needs to be done, they can automate the repetitive, boring work. With more integrations and more automation, Asana's ideal state may require users to spend less time in the product while getting more value.

Remote work

The question of "what is my team working on?" is increasingly relevant with a distributed workforce. With fewer daily touchpoints, it can be challenging for managers to keep track of who is working on what and how things are progressing. It can be more challenging for individuals to understand how their work rolls up into the company's goals and strategy. Asana's product is built to solve both these problems. We may see that reflected in increased customer adoption and engagement going forward.

While we don't expect Asana to build a Zoom-competitor any time soon, one way they might capitalize on the increase of remote meetings is by building deeper integrations with Zoom or GCal. One example of how this could work: with calendar access, Asana could see that you'd just completed a meeting and suggest adjustments to relevant tasks or assignments.

Business Model

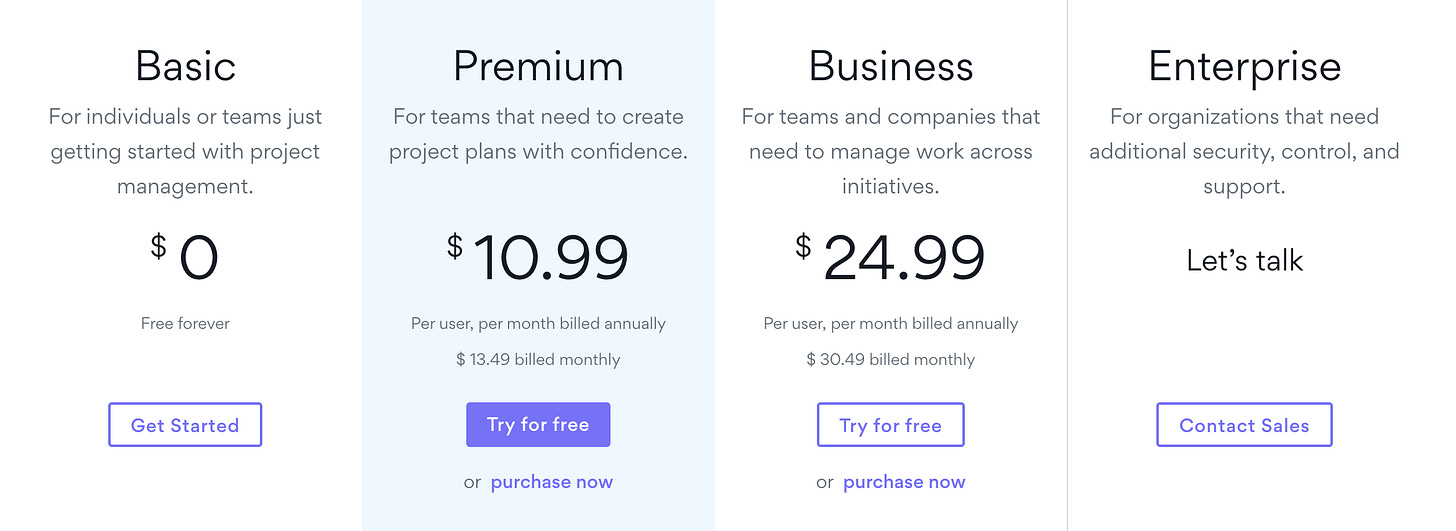

Asana has a single product but offers three levels of paid subscriptions: Premium, Business, Enterprise. Each level unlocks additional features and functionalities. Asana also offers a Basic plan, a free tier providing core — but limited — features for teams up to 15 people.

A self-serve model, Asana’s website

Customers pay monthly or annually, with the majority of Business and Enterprise customers on annual plans. Pricing is based on the number of users and subscription level. Asana has primarily kept new features behind the paywall, and recent increases in Business and Enterprise subscription revenue indicates this strategy has worked well. More on this below.

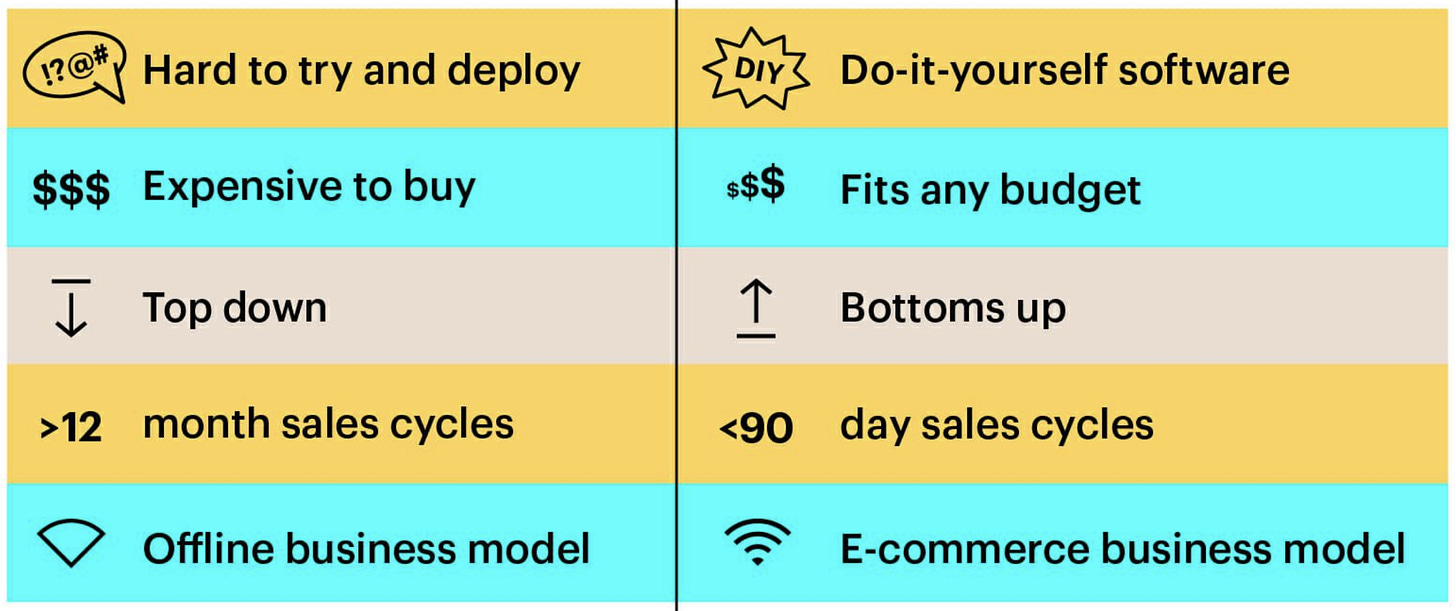

Go-to-market discussions often lead to eyes glazing over, but in Asana's case, it is one of the more exciting aspects of the story. Asana is part of a growing cohort of software companies using a bottom-up go-to-market. By selling directly to individuals and teams, bottom-up sales help end-users supplant C-suite executives as the primary curators and purchasers of software. User experience has long sat at the bottom of the priority list when it comes to business software development — open any prevalent ERP solution and this becomes glaringly obvious. But in the bottom-up model, the product is king. Because end-users are the same people making the purchasing decision, user experience is one of the most critical determinants of a product's success. Founded in 2008, Asana is an OG among companies selling bottom-up, and it's clean and intuitive user interface reflects an understanding of this dynamic.

In the bottom-up model, customers find the product via word of mouth, inbound marketing, or partnerships. Initial purchasing or trial sign-up is completed self-service, and company-wide agreements are pursued selectively, once usage in an organization is stable and pervasive.

Selling directly to users provides some compelling benefits; cost savings from fewer sales reps, flexibility around where savings are reinvested, and, most importantly, a tight feedback loop with users. Top-down sales efforts are slow, adoption requires long and cumbersome integrations, and added layers can limit visibility into user behavior. By selling bottom-up, Asana can provision in seconds, tracking purchasing and usage patterns to develop a data-supported understanding of customers. This visibility informs product development and targeted investment decisions to increase user value, improve conversion, deepen engagement, and fuel expansion across organizations.

The benefits of Atlassian’s bottoms-up model, Intercom blog

While the listed benefits look good on paper, bottom-up sales are not a panacea. Many products aren't a good fit (i.e., FP&A software), and for those that are, the learning curve is steep. Low-friction sales can quickly turn into low-friction churn. Building a healthy and growing self-serve customer base requires managing user behavior typically associated with consumer-social apps. It's likely the consumer-social experience the founding team brought with them from Facebook was a boon on this front. Metrics like engagement, reach, and conversion are the life-blood of a product sold bottom-up. Asana is on solid footing here, particularly with large customers. Net-revenue retention rates are healthy and expanding (120% for all customers) but are significantly higher for the largest customers (140% for customers who pay over $50k a year).

An oft-cited selling point of the bottom-up approach is that the product effectively "sells itself." Implying a truly self-serve product — where a user experiences the entire product journey, from initial sign-up and feature activation to upgrades and cancellation, without needing to interact with another person — can create a self-sustaining flywheel that fuels growth. Atlassian has been the poster-child of this narrative due to its lack of a formal sales team and impressive growth story. But even Atlassian acknowledges that their sales process requires human interaction when it comes to larger clients, using customer success reps as a quasi-direct sales team for enterprise. So while this product-led approach can significantly lower the cost associated with selling, it's a miscategorization to say these products are selling themselves.

Asana describes its go-to-market approach as a hybrid of the bottom-up and top-down strategies. And while all bottom-up strategies have some direct sales elements, Asana takes a more overt approach to blending these approaches. When a customer purchases Asana's Business or Premium plan, they do so entirely self-serve, but they must contact the sales team if they want an Enterprise plan. Self-serve isn't even an option.

Once individuals and teams within organizations adopt our platform, our direct sales team follows up with an opportunity to strategically expand our offerings across the organization. We are at the early stages of building our direct sales force to focus on the significant expansion opportunity we see within our customer base.

Interestingly, Asana adopting this incarnation of a hybrid strategy seems recent. At the beginning of 2019, only 11% of revenue came from Business and Enterprise accounts. Today, those accounts represent 54% of revenue. Over that same time frame, Asana more than doubled its direct sales team and improved the free-to-paid conversion rate by 33%, taking it from 3.6% to 4.8%. Asana has improved its ability to monetize and upsell its user base over time, indicating it may have found an impressive balance with its go-to-market strategy. With over 25M downloads, 3.2M active accounts, 1.2M paid users, and 75K customers, there is an attractive opportunity among their existing user base if these improvements continue.

It's worth noting that while Asana has found a balance—and an attractive growth rate—with its current hybrid strategy, the fact that it had to tweak its go-to-market strategy in the first place is telling. Growth has not come as easily as hoped. A reasonable hypothesis is that the free Basic plan was serving users' needs and hurting free-to-paid conversion, but there's not enough user data in the S-1 to know. As detailed in the "Financial highlights" section, Asana's revenue growth is in line with other product-led fast-growth SaaS companies, while Sales & Marketing (S&M) and Research & Development (R&D) is well above peers. Notably, both S&M and R&D expenses are growing faster than revenue. Whether this dynamic is a short-term phenomenon as they implement a new GTM strategy or more structural due to mounting competition and market saturation will be essential to watch.

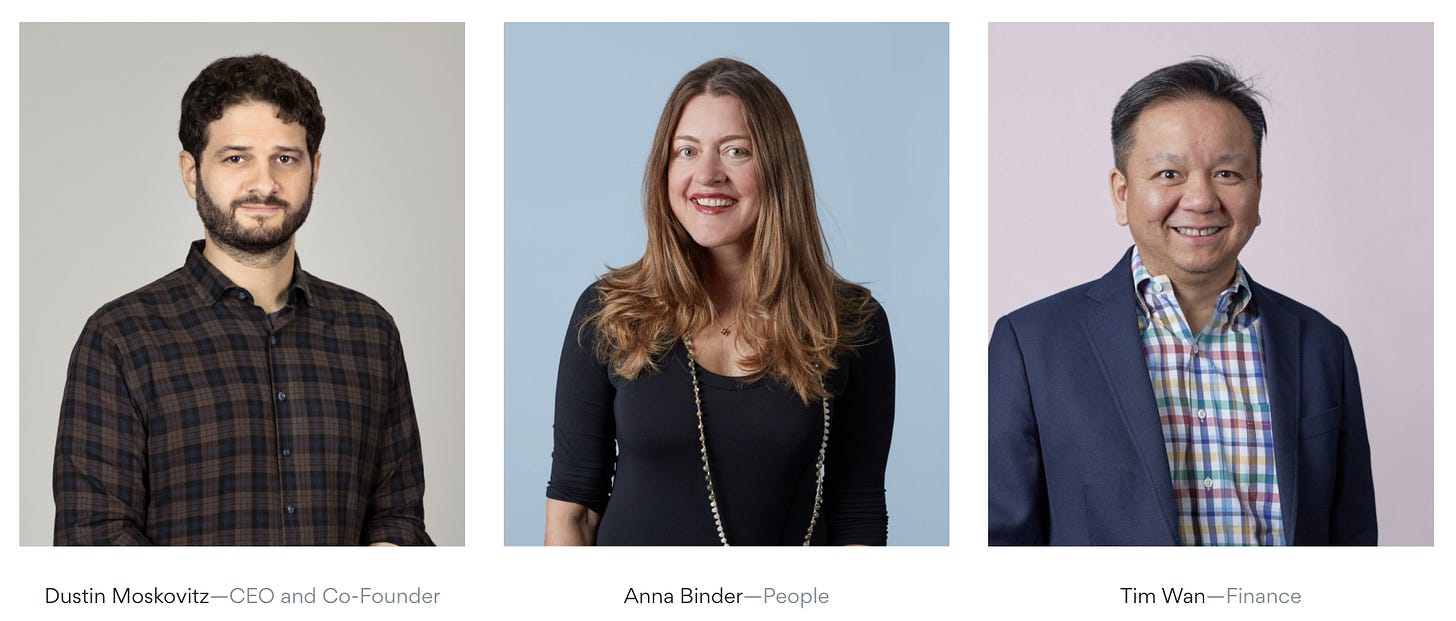

Management team

As mentioned above, the two co-founders of Asana were early Facebook employees. Moskovitz was a co-founder and the first CTO, while Rosenstein was a key engineering lead.

The success of their former employer has allowed the pair to be uncommonly altruistic when it comes to Asana. Both Moskovitz and Rosenstein "pledge to use 100% of the value of our Asana equity for philanthropic purposes," as stated in the Letter from the Co-Founders in the S-1. The founders believe that Asana is part of a broader mission to help people work together, "from curing diseases and developing clean energy to building local schools and creating global movements, progress depends on teamwork."

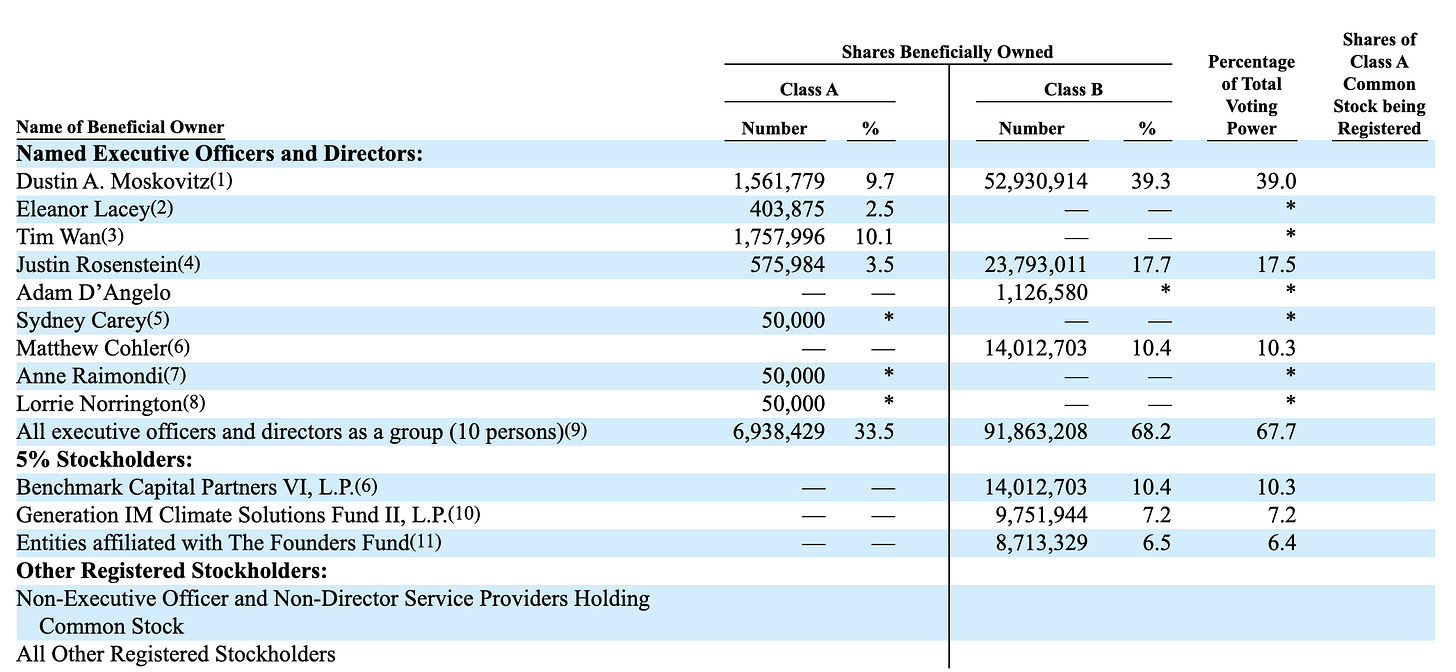

That beneficience doesn’t extend to control of the company. Asana has a dual-class structure, meaning that Moskovitz holds the reins with voting power equivalent to 10 votes per share. Companies like Facebook, Google, and Shopify have all utilized this structure.

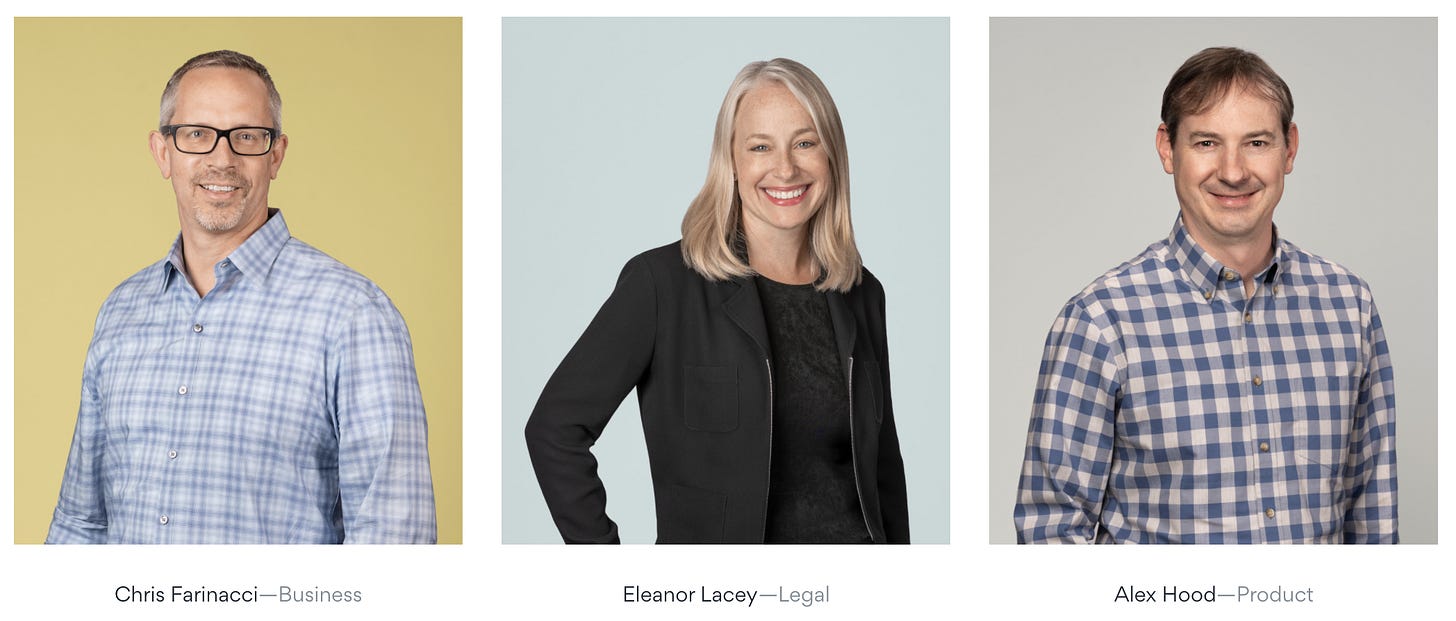

Beyond Moskovitz and Rosenstein, Asana has assembled senior management withBig Tech experience. COO Chris Farinacci previously served as a Senior Director of Marketing at Google, while Head of Sales and Business Development, Oliver Jay, ran Dropbox's operations in APAC and LATAM.

Tim Wan, CFO, joined in 2017 from Apigee Corporation, while Eleanor Lacey, General Counsel, came aboard last year from Sophos, a cybersecurity company. Anna Binder, Head of People — a critical role given Asana's focus on culture — previously served at MuleForce as VP of People.

Leadership, Asana’s website

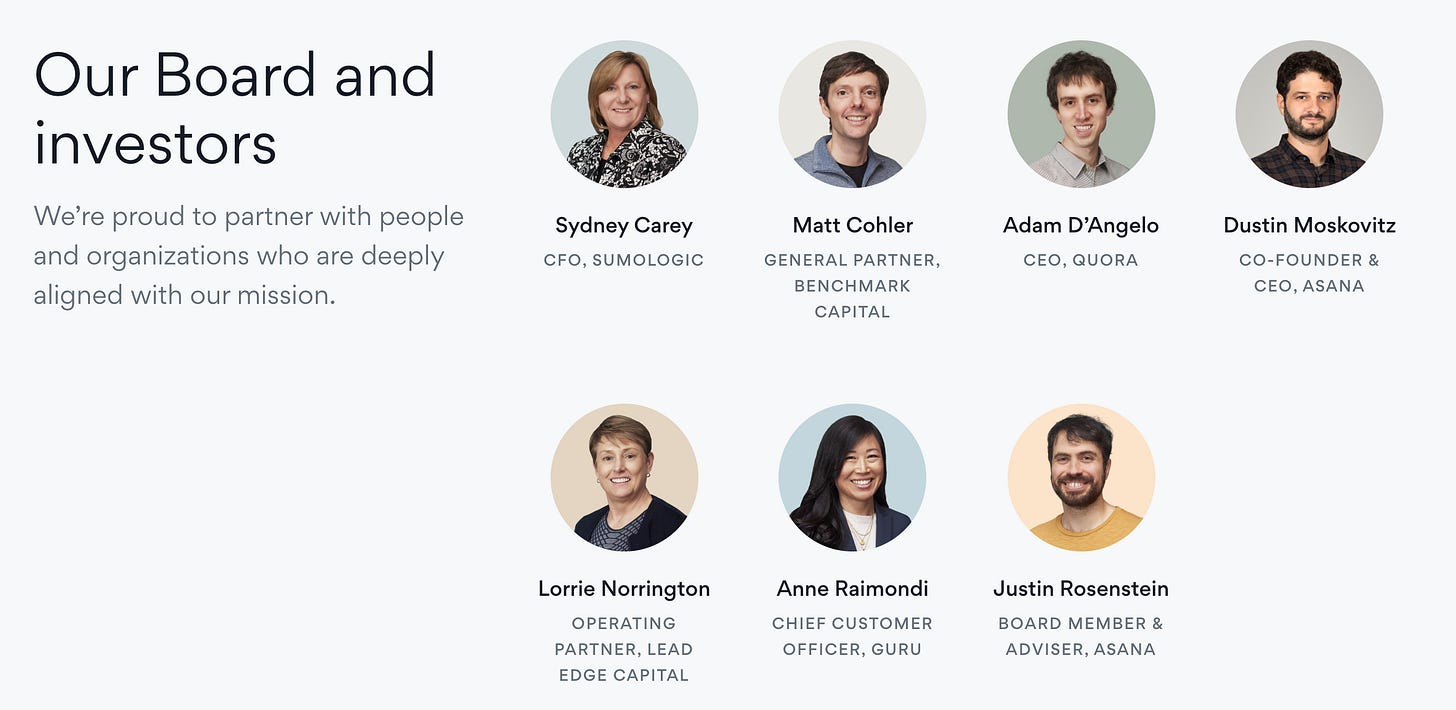

Non-employee directors include a couple of Facebook alums, notably Matt Cohler, a partner at Benchmark, and Adam D'Angelo, founder of Quora.

Asana’s website

Investors

In aggregate, Asana has raised ~$220M of equity financing and $200M of debt.

The investors poised to gain from Asana's IPO include some familiar names of Silicon Valley. Benchmark led the $9M Series A and owns over 10% of the shares outstanding. Founders Fund led a $28M Series B, with Peter Thiel joining the board, and holds 6%. Y Combinator led the $50M Series C, and the Series D and E were led by Generation IM, which owns just over 7%.

Depending on how the valuation shakes out, Benchmark's stake in Asana is likely to be in the ~$500M range, which would single-handedly return the entire $425M fund from which the investment was made.

Asana’s S-1 filing

As alluded to previously, Asana is going public via a Direct Listing. Typically, one of the downsides of a Direct Listing is that no primary capital is raised, although the SEC recently approved a proposal to change that.

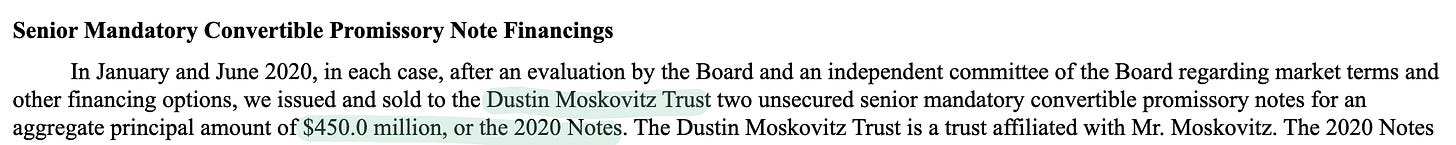

Regardless, Asana does not need capital at the moment. In January and June of 2020, Dustin Moskovitz's Trust put $450M into Asana via convertible notes with 3.5% interest rates.

Asana’s S-1 filing

Financial highlights

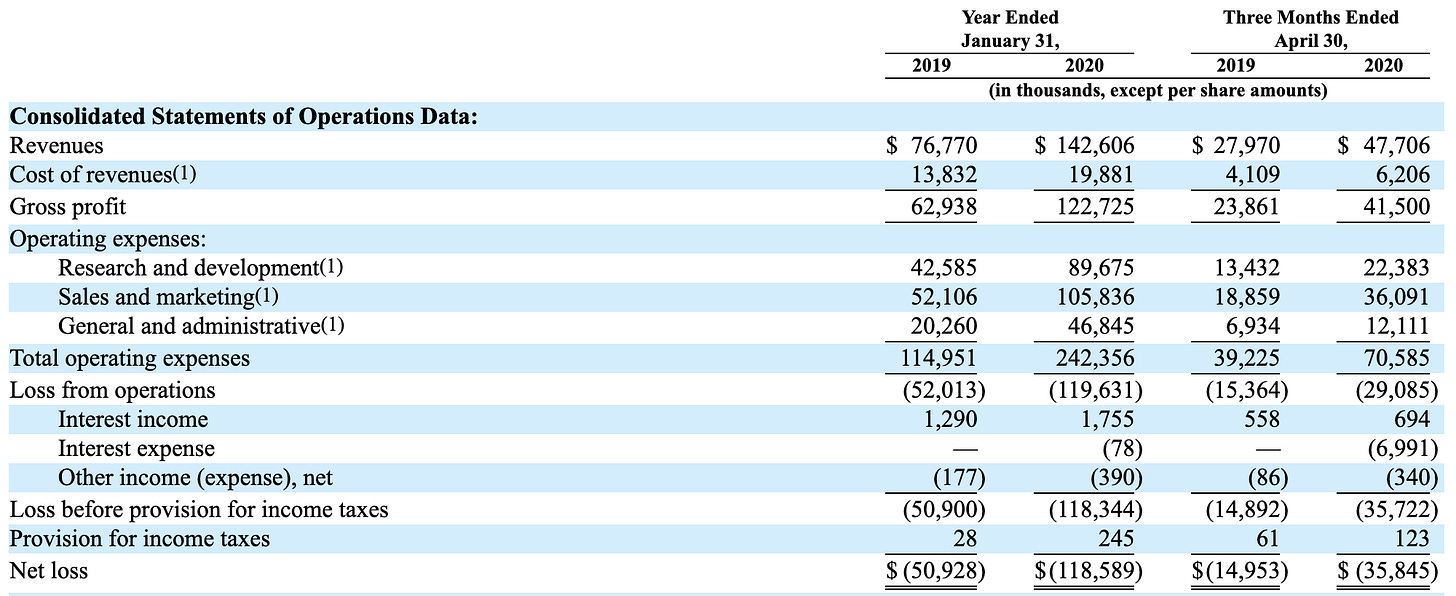

Asana is a prototypical bottoms-up, "Product-Led Growth company," and the filing's numbers reflect that. Compared to the broader universe of SaaS companies, Asana is growing faster, is more efficient, and boasts higher margins while commanding relatively strong retention. Let's dig in.

Growth

We start with growth, which is healthy. Thanks to a simple yet compelling go-to-market strategy, Asana generated $142M in 2020, an impressive +85% jump from 2019.

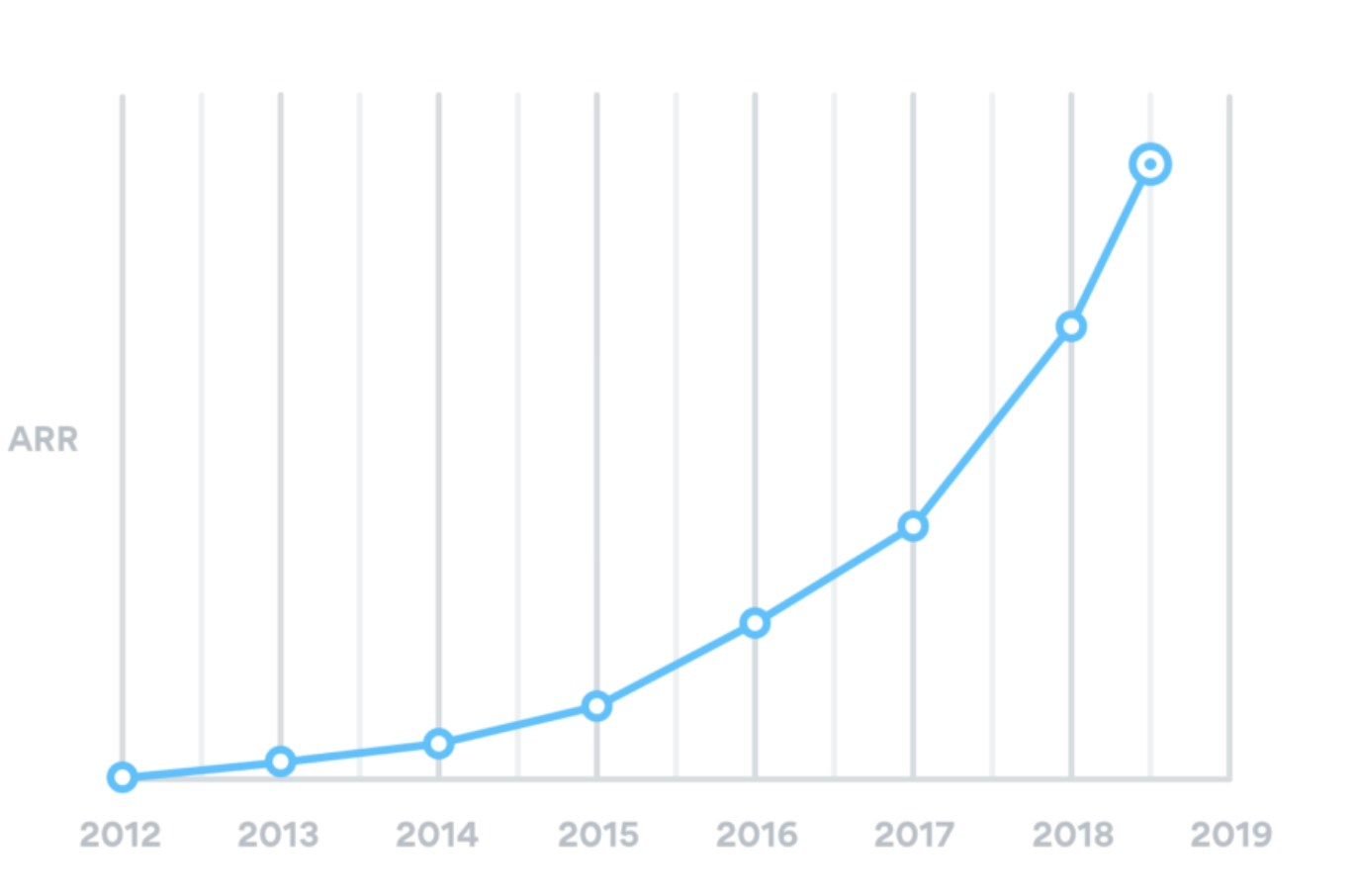

Asana’s blog

Asana’s S-1 filing

As the graph above shows (somewhat cryptically), revenue has been growing at around +90% year on year (YoY) since 2013. We think three fundamental levers are driving this growth.

First, Asana is benefiting from a growing user base, both free and paid. Though the S-1 annoyingly doesn't break out user growth through the years, we can interpolate using a few online sources. At the end of 2018, Asana served +50K organizations, and 1M total paid users. Over the past two years, the company has grown these figures 50% and 20% to +75K and 1.2M. Well played.

Second, Asana is more effectively converting free users to paid users, as mentioned. In January 2018, Asana reported a conversion rate of 3.6%. This has now grown to 4.8%. According to consensus (Quora), average SaaS conversion rates typically hover in the 3-5% range. So, at 4.8%, Asana is performing well and creeping towards better than average.

Third, and perhaps most importantly, Asana continues to gain enterprise traction. Mentioned in the "Business model" section, the figures are worth repeating here. Net-revenue retention stands at 120% for 2020 (not too shabby), rising to 140% for organizations spending >$50k per year (not too shabby at all).

We should also mention international expansion as another strong growth driver. Given the nature of the distribution model, Asana has developed a significant portion of its business outside the United States (41%). This is impressive given the limited investment needed to support the expansion. Asana now serves customers across 196 countries.

But while the company's distribution model aligns closely with product-led growth norms (for example, most paying customers initially adopting the platform through self-service and free trials), Asana differs from the competition in significant ways.

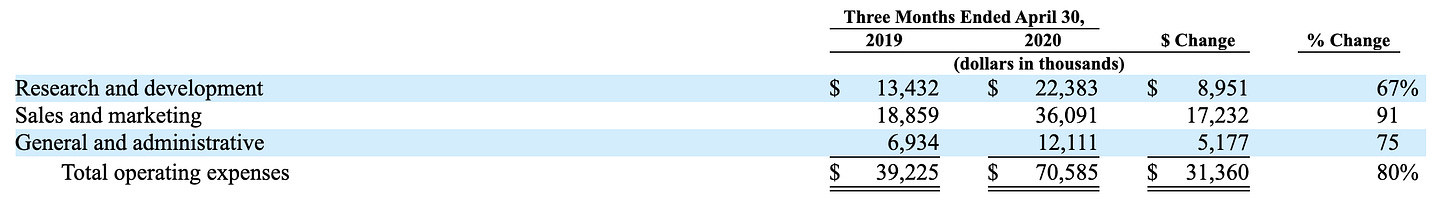

Product spend

The most notable divergence relates to how much the company spends on S&M and R&D. That contributes to an elevated burn rate for a company of Asana's profile.

Median product-led growth companies spend 48.6% of revenue on S&M, and 30.8% on R&D. Asana clocks in at 74% on the former, 63% on the latter. Among its publicly traded peers, no other company spends as much on S&M while only Slack outpaces Asana in R&D spend.

Product innovation created through R&D spend leads to a better experience for users adopting Asana via free trials and self-service. What's more, investment in a robust S&M organization drives increased conversion and the ability to expand reach within a customer's organization more effectively. To date, these investments are paying off. We've already highlighted the strong conversion trends above.

Product-related spend reflects the strength of Asana's flywheel and its long-term founder-led vision. However, these trending expenses also raise questions about whether the company will reach a more sustainable trajectory in the face of mounting competition.

It should be noted that gross margins are high, as you’d expect from a product in this category. In 2019, Asana achieved 82% gross margins, rising to 86% in 2020.

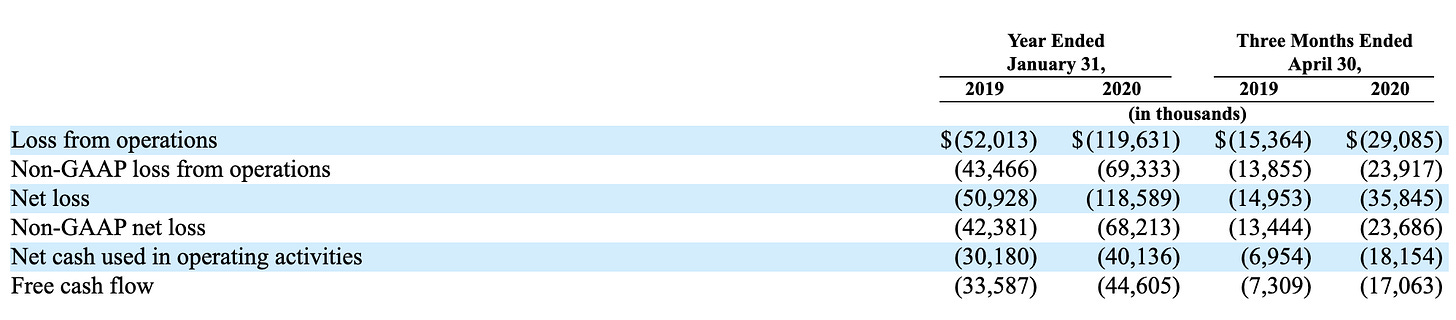

Mounting losses

While S&M and R&D spend is driving product-led growth, it is also contributing to a negative bottom line. Annual loss more than doubled in 2020 to -$120M from -$52M. However, net cash flow only decreased by $13M. What gives?

Asana’s S-1 filing

The bulk of Asana's GAAP-reported loss stems from non-cash share-based compensation, which tallied $48.8M in 2020 (up from only $8M in 2019). Many companies issue share-based payments to employees and executives to decrease cash burn and properly incentivize staff. While this has the benefit of improving a company's underlying cash position, this comes at the cost of shareholder dilution. In essence, Asana is partially shifting the cost of growth from the company itself to existing shareholders.

Though share-based comp is standard across all sized companies, Asana's total share-based comp equates to 34% of revenue, which is steep. However, as a percent of revenue, this will ideally come down as executives face the discerning hammer of public investors.

Competition

The confluence of SaaS business models and bottoms-up customer adoption has led to a very competitive landscape for work and productivity solutions. There have been various approaches that startups and incumbents have taken to capture this market, but let's take a look at the three groups that Asana breaks out in its S-1.

Work management solutions

Asana fits into this category most directly, as do its two main rivals: Smartsheet and Monday.com. With public and private valuations of $5.6B and $2.7B, these two rivals have helped evangelize the category. Over time, the three companies have converged on similar feature sets (adding automation and integrations) and similar pricing structures. Consequently, if there is to be a winner in the category, it may come down to who can most quickly and efficiently spread within an organization. By the time hundreds of users are using Asana, the switching costs become more difficult to take on.

Productivity suites

If we look more broadly at the productivity space, we can see how Asana overlaps with giants like Google and Microsoft. Their suite of products includes spreadsheets, calendars, email, and more. On a given workday, these applications are among the most used by knowledge workers around the world. As they have built out broad portfolios that touch various workflows, they similarly can build a metalayer that provides visibility into how work is done. Asana would probably disagree with this assessment because, despite the amount of time people spend on these productivity applications, they do not capture task-level information.

Vertical solutions

We've seen vertical SaaS explode over the past decade, with everyone from sales to engineering garnering the budget and authority to purchase software to augment their workflows. While Asana's approach has been to go broad across the organization with one product, others have chosen to go deep in specific verticals. Atlassian has adopted this strategy, building out a portfolio of vertical solutions. They launched Jira in 2002 for development teams to plan, track, and ship software. Since then, they've expanded with a Jira IT Service Desk product that caters to the IT professional. Even a company like Gong, focused on generating insights from sales calls, has the opportunity to undercut the need for Asana. Why track your issues in Asana when Gong is already capturing your tasks automatically? When it comes to vertical solutions, Asana needs to find a way to integrate into existing workflows or risk competing with too many solutions.

Why now?

The fact that three other venture-backed cloud companies — Snowflake, SumoLogic, and JFrog — filed S-1s on the same day as Asana tells you almost everything you need to know about why the company chose to go public when it did.

The public market investor appetite for high-growth cloud companies has never been higher. A Zoom-led halo effect around companies powering the future of work has pushed demand into the stratosphere (Slack's recent challenges notwithstanding).

Going public now creates a timely PR opportunity for a company looking to own a piece of the future of work narrative and gain mindshare amidst the noise of an increasingly competitive market.

As Moskovitz noted in a recent Forbes profile, the Asana "snowball" — built patiently over the years — is picking up speed, aligning with a market opportunity that creates an ideal window to cash in on the company's deliberate growth.

If you enjoyed our analysis, we’d very much appreciate you sharing with a friend. We’d also love to have you join us for Monday’s event.