Destiny: Disrupting BlackRock

Serial founder Sohail Prasad has raised $100 million to build a public index of tech’s best private startups. Its ambitions could see it compete with the world’s biggest investment manager.

Brought to you by Destiny

Today’s piece is supported by Destiny.

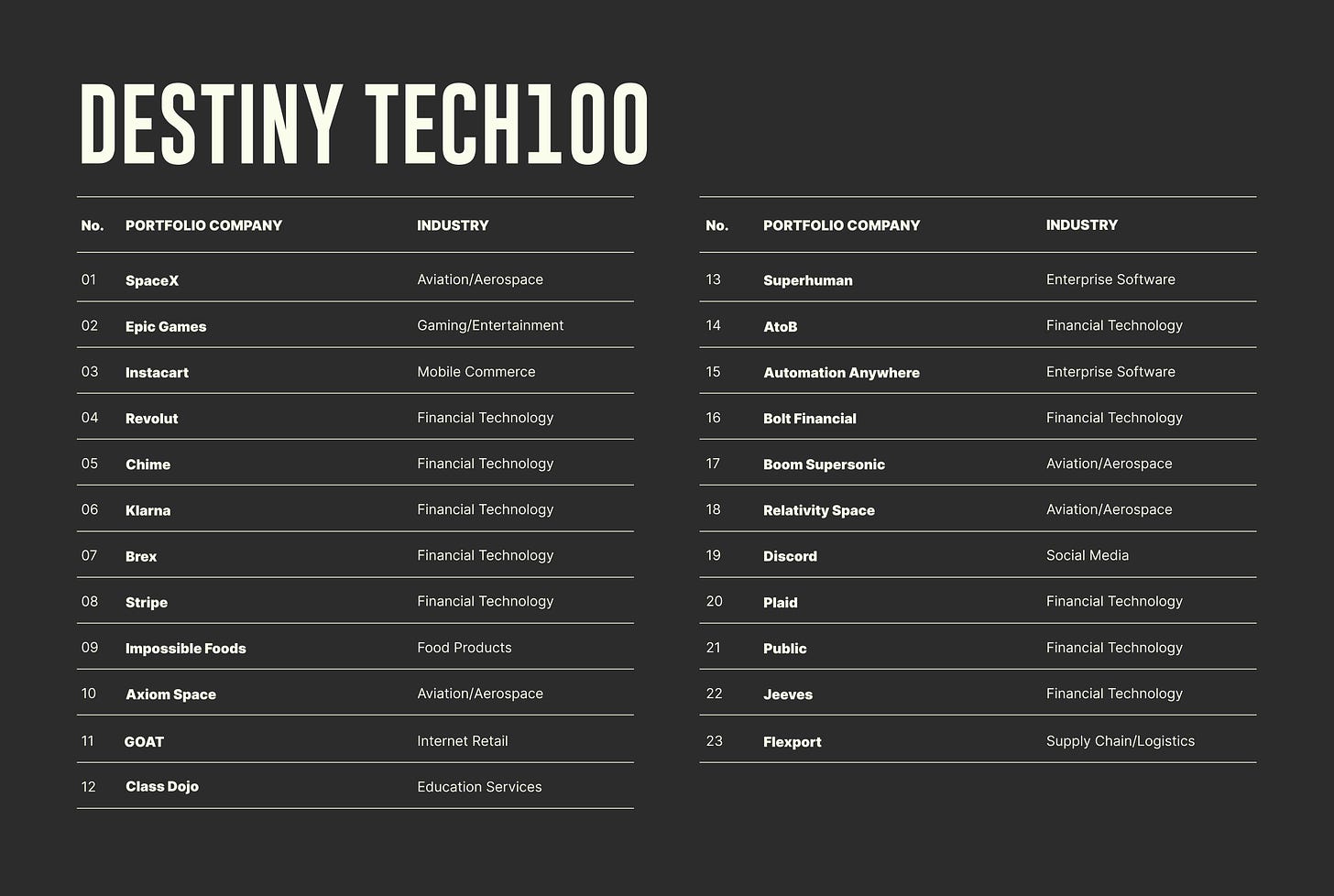

The modern investment management firm is building the “Tech100,” an index of 100 high-growth tech businesses. The ETF is expected to list on the NYSE later this year. You can think of it as a version of SPY or QQQ for the private markets.

When the Tech100 launches, every day investors will get access to a basket of leaders like Stripe, SpaceX, Plaid, Public, Instacart, AtoB, and many others.

If you want to be among the first to gain access to the Tech100, make sure to sign up on Destiny’s site.

Actionable Insights

If you only have a few minutes to spare, here's what investors, operators, and founders should know about Destiny.

A basket of the best. Destiny has built an index of tech’s most promising private companies. By buying shares in the “Tech100” ETF, investors get exposure to players like Stripe, SpaceX, and Epic Games. It’s the first time so many top-tier names have been so accessible to the mass market.

A decade in the making. Founders Sohail Prasad and Samvit Ramadurgam have been obsessed with expanding access to private tech since 2013. Before they founded Destiny, the pair built Forge, one of the world’s largest marketplaces for secondary shares. In 2021, Forge debuted on the NYSE.

The era of ETFs. Over the past couple of decades, passive strategies have taken over from more active approaches. The world’s largest asset manager, BlackRock, exemplifies this transition. Though Larry Fink’s shop started by leveraging active strategies, it has become the king of passive ETFs.

Execution is everything. Building a winning index isn’t as easy as simply picking the companies you want to invest in. Destiny’s job isn’t just to identify valuable startups – it’s to gain access to them at advantaged prices. That requires a deep understanding of venture capital and the secondary markets.

Rising competition. For now, Destiny’s index appears unique. It is unlikely to remain so uncontested. Startups like Titan and Carta have demonstrated an interest in the space, while investment managers like BlackRock could leverage their experience to tackle this new asset class. Destiny will need to stay one step ahead and look to turn potential rivals into partners.

This piece was written as part of The Generalist's partner program. You can read about the ethical guidelines I adhere to in the link above. I always note partnerships transparently, only share my genuine opinion, and commit to working with organizations I consider exceptional. Destiny is one of them.

In 1986, Larry Fink was on a losing streak. His securities unit had logged $100 million in losses, threatening to derail a gilded career. Though scarcely in his mid-thirties, Fink was a known entity in finance — First Boston’s youngest-ever managing director and respected for his pioneering work on the mortgage-backed bond market. By some estimates, Fink had added $1 billion to the institute he had joined fresh from UCLA’s business school. But Wall Street’s memory can be short. Despite his historical performance, Fink was pushed out.

It proved to be the making of him. Two years after his departure, Fink raised $5 million to start the investment firm that would come to be known as BlackRock. The shop, which began in a tiny rented office on Bear Stearns’ trading floor, would become the world’s largest asset manager.

Today, BlackRock manages nearly $8 trillion in capital. Before the drawdown in 2022, its AUM crested an astonishing $10 trillion.

Ten trillion. Ten trillion. It’s a number so large that it ceases to be comprehensible. Humans struggle to visualize discrete units beyond five and fail terribly at comparing figures several orders of magnitude apart.

Ten trillion is 80 Tiger Globals stacked on top of each other.

Ten trillion is 179 Ubers placed end-to-end.

Ten trillion is 1,042 Coinbases bundled into a burlap sack.

Ten trillion is unfathomable, impossible, almost funny in its absurdity. It is the kind of figure that makes you question what money is, in the same way repeating a word makes you wonder what it means; a figure that doesn’t bring to mind a moat so much as a towering wall of cash. This is the BlackRock imperium, the vast fortress of Fink, a man who responded to the loss of $100 million by amassing 100,000 as much.

What would it take to disrupt it?

It is a provocative question, and Sohail Prasad believes he has the answer. His company, Destiny, has created a publicly tradable index of the top 100 high-growth startups, featuring names like SpaceX, Stripe, Epic Games, Revolut, Impossible Foods, Plaid, Public, and Instacart. For the first time, everyday retail investors will be able to capitalize on the growth of tech’s best-performing private companies. Though revolutionary in its own right, Destiny has no plans to stop there. Prasad aims to build a modern investing giant that rivals the industry’s biggest players, a “BlackRock for the private markets.” It’s a vision a long time in the making.

Prehistory: Forge and rationalizing secondary markets

In 2019, Sohail Prasad was coming off a win. In truth, he was still partway through one. Forge, the startup he’d founded six years earlier, had grown to become the largest marketplace for secondary shares. Thousands of investors and operators used the platform to buy and sell stakes in startups like Stripe, Anduril, Databricks, Rippling, OpenAI, and others. Better still, it was pulling in mid-eight-figure revenue and growing quickly.

It had not been easy to reach that point. When Prasad and his co-founder Samvit Ramadurgam started in 2013, few believed they could overhaul a market that had recently demonstrated its unreliability and opacity.

Just three years earlier, the Valley had worked itself into a froth over a social media company called Facebook. Zuckerberg’s machine passed 500 million users in July of 2010 and even showed it could make money; by the end of that year, it neared $2 billion in revenue. With an I.P.O. expected within the next couple of years, external investors wanted a way in.

A platform existed to sate this interest, at least in theory. Today, Barry Silbert is best known as the founder of Digital Currency Group; in 2010, he was the C.E.O. of SecondMarket, a platform to buy and sell stakes in private companies. Data from that year shows that alongside Facebook, investors could express interest in Twitter, LinkedIn, Zynga, Yelp, Digg, and Etsy.

SecondMarket did process transactions. In Q3 of 2010, for example, the company managed approximately $75 million in volume. But it was few investors’ idea of a good time. Sellers reneged, buyers changed their offers at the last minute, transactions moved offline, forgoing protections, and intermediaries insinuated their way into the process to chisel out unnecessary fees. A transaction might take months to put together and moments to fall apart.

Around the same time that SecondMarket was inundated with interest in Facebook shares, Sohail Prasad was beginning his career in tech. After briefly attending Carnegie Mellon, an eighteen-year-old Prasad began interning at Google. The following year, he was accepted into Y Combinator’s 2012 summer class. It was during his stint at the accelerator that Prasad met Ramadurgam and developed an easy friendship. Though they were working on different startups at the time, it wouldn’t take long for them to team up.

The impetus arrived the next year. For several years, Prasad had held valuable shares in a private company. Up until then, he’d been happy to hang onto them in the hopes they would continue to appreciate. That changed when Prasad began to angel invest. Though he didn’t know it at the time, he got off to a hot start, backing Zenefits and Coinbase. But when Prasad met Robinhood, he realized he didn’t have the liquidity to participate. To keep backing the impressive founders he was encountering, Prasad needed some way to offload his private shares.

As he searched for a solution, Prasad came face-to-face with the space’s inefficiencies. “It was astounding the process I went through to try and sell some shares,” he recalled. “I called a guy, who knew a guy, who knew a guy. Pretty soon, five people were involved, each trying to take 5-10% of the transaction. And no one had the money.”

The more Prasad learned about the ecosystem, the more he realized that his experience was par for the course. While platforms like SecondMarket had proven helpful in capturing buying and selling intent, they did little to facilitate the transactions themselves. Negotiations might go on for months, and even once terms were settled, plenty could go wrong. Lawyers might take as long as six months to agree on terms, treating each case as entirely novel, even though similar transactions had occurred in the past. That was usually enough time for a startup’s fortunes to change materially – if the company was doing better than expected, the seller pulled out; if it was doing worse, the buyer did.

It was particularly galling for Prasad to see some of his better-connected friends avoid these frustrations. If you knew a buyer or seller directly and had sufficient financial and social capital, transactions could get resolved rapidly. Investors like Lowercase Capital leveraged this power masterfully, building up significant positions in Twitter through secondary transactions.

To Prasad, it amounted to a dual-class system. Either you were an insider and could expect preferable treatment, or you were forced to endure a gauntlet of brokers, often to no end. That was not just unfair; it was an opportunity for something better to emerge.

By the fall of that year, Prasad was ready to start his next business. He brought aboard Samvit Ramadurgam and tech lawyer Gil Silberman as co-founders. Unlike SecondMarket, Prasad’s company would do more than connect people. It would standardize the transactions, making them faster and simpler to complete. In the process, they’d create a more trustworthy, transparent marketplace that allowed everyone to invest in tech’s most promising startups. They called it Equidate, later rebranding it as Forge. (For simplicity’s sake, we’ll refer to it as Forge going forward.)

They struggled to raise money. Along with the feeling that SecondMarket had already tried to address the problem with chequered results, there must have also been doubt about Prasad and Ramadurgam. No doubt they were impressive, especially for their age, and companies like Facebook had shown the precocious talent of teenagers. But was that the right profile for this problem? Was a 20-year-old equipped to disrupt a complex, idiosyncratic market full of entrenched interests?

There was something else bubbling beneath the surface, too. “There was a philosophical resistance to it,” Prasad said. “People worried that if founders or employees could cash out, they wouldn’t be motivated anymore. That didn’t make sense to me. Public companies give stock compensation but they’re still able to grow. Why if someone wants to pay $100,000 in debt is that suddenly going to distract them?”

That perspective – and a desire to maintain control – had led some startups to ban or aggressively dissuade secondary sales.

With little in the way of capital, Prasad set about trying to raise his startup’s profile. By early 2014, he’d attracted TechCrunch, VentureBeat, and even the New York Times to cover Forge’s launch. The Times’ coy profile remarked that the company had “no real track record” and “may well fail.” Nevertheless, it did the job. Though Forge had nothing more than a landing page, hundreds of would-be buyers and sellers reached out to express their interest. “Over the next five months, we talked to every single one of them,” Prasad remembered.

Venture capitalists started to show interest, too. Ullas Naik was the first to back the company. The founder and general partner (GP) of Streamlined Ventures had met both Prasad and Ramadurgam during their spell at Y Combinator.

In hearing the pair discuss their vision for Forge, Naik appreciated its audacity and noticed how deeply Prasad and Ramadurgam understood the market. “The sophistication with which they were talking about asset classes and capital formation was extremely impressive,” Naik said.

Prasad convinced several others, including Scott and Cyan Banister, Adeyemi Ajao, Quora co-founder Charlie Cheever, and Adroll founder Jared Kopf. In total, Forge pulled in $500,000, a slim sum for a business operating in a legally-complex space. “That was all we had to get through the regulatory process,” Prasad said.

From the beginning, Prasad and Ramadurgam understood that they couldn’t build Forge like their last startups. As Ullas Naik remarked, regulated financial services is not a market in which you can “move fast and break things.” To succeed, Forge would need to balance speed and creativity with compliance.

Ethan Silver provided critical assistance on this front. Silver had started his career prosecuting securities fraudsters as an enforcement attorney at the New Jersey Attorney General’s office. He’d gone on to work for financial firms and brokerages before a lightbulb went off around 2010. Helping a software developer friend get a broker-dealer license for his stock trading app made Silver wonder whether tech or “fintech” – a word that didn’t exist at that point – might represent a fruitful area of focus. Not long after, Silver was introduced to the founders of Robinhood; he would go on to serve as the company’s primary outside counsel for the next seven years.

In addition to guiding that brokerage, Silver assisted companies like Brex, Titan, Mercury, Alpaca, and Forge. He met Prasad and Ramadurgam in the company’s early days (“I’m not even sure they could drink,” he recalled), helping them navigate the different regulatory hurdles.

Forge’s introduction of forward contracts was an example of how innovation had to go hand-in-hand with legal considerations. Traditional finance often relies on forward contracts, especially in currency and commodities trading, but they hadn’t been used in the private markets before.

Prasad felt they were an ideal antidote to many of its blights. Transactions often failed when a discussion of voting rights was reached. Would the buyer get the same power as the seller? Could they suddenly influence the direction of a company they had no established connection to? Part of the reason startups blocked secondary sales was to prevent precisely this outcome; an interloper with influence.

Forward contracts smoothed over this issue. Rather than transferring shares immediately (along with their associated rights), a forward contract did so only once a particular event had occurred. Forge could standardize its documents such that control transferred only after a startup had exited, selling or reaching the public markets. “It allowed an investor to benefit from the economic effects without all the bullshit that comes with it.”

It also radically reduced the time it took to hammer out an agreement. “You can take this months-long process and make it almost instant,” Prasad explained. This, in turn, prevented the slow decay that scuppered so many deals. A company’s changing fortunes have little impact on the viability of a deal when it concludes in hours or days.

Though forward contracts solved one problem, they introduced another. When a company finally exited, and the agreement went into effect, what if one of the parties failed to uphold their side of the bargain?

It’s easy to imagine a scenario in which it might be logical, if unethical, to do so. In 2014, for example, an employee of Airbnb might have agreed to a forward contract in which they sold a 0.1% stake for $10 million at an implied valuation of $10 billion. They would receive the payment immediately but hold onto the shares until a liquidity event occurred. Six years later, that day would arrive. In 2020, Airbnb made its public debut and swiftly pushed past a $100 billion valuation. Suddenly, the employee realizes that their stake is worth $100 million, not $10 million – and technically, they still have it under their control. (For this example, we can ignore dilution and lock-up periods, which would impact the actual value of shares).

Wouldn’t it make sense to try and wriggle your way out? Even if you expect it might invite legal action, with $90 million at stake, that might be a risk worth taking.

Prasad understood that if Forge was to become the best place to buy and sell secondaries, it needed to protect against such scenarios. To do so, the company partnered with Munich Re in 2016 to offer transaction insurance. It was not an easy product to get off the ground, especially for so young a business. During the courting process, Prasad recalled that European executives arrived in San Francisco, asking to see Forge’s offices. At the time, that was Prasad’s living room. Without a better option, Prasad invited the German managers to a conference room in his apartment complex – a passable solution.

Munich Re’s involvement marked the beginning of a mutually productive relationship. The German company’s name lent credibility to the startup, and the introduction of transaction insurance made Forge the safest place to conduct secondary sales. Munich Re’s engagement with Forge paved the way for greater involvement in Silicon Valley. In the years that followed, the insurer built a team in San Francisco and kicked off a program for startups. It would also become one of Forge’s largest investors.

In those days, though, Forge was far from moneyed. With just half a million to work with, Prasad and Ramadurgam set about getting their startup to “default alive.” They kept burn to a minimum, spending only on “servers, lawyers, and Chipotle burritos,” according to Prasad. Eventually, a small office replaced Prasad’s kitchen table.

It began to work. From 2014 to 2018, Forge tripled its revenue annually, moving from $300,000 to $1 million to $3 million to $9 million. That growth, combined with Prasad and Ramadurgam’s frugality, convinced two new angels to invest: Tim Draper and Peter Thiel. After seeing the chaos around Facebook equity sales on SecondMarket, Thiel needed little convincing of the demand for such an idea but wondered about its effect on the market. Prasad brought him aboard by “explaining how it was positive and scalable.”

If the involvement of two of Silicon Valley’s best-known investors suggested a broader change in sentiment, it didn’t feel that way to Prasad: “What we were doing was still far from accepted,” he said. “To invest in Forge, you had to have a different view of where the world was going.”

It became increasingly difficult to deny Prasad’s vision. As tech’s unicorn stampede picked up speed in the late 2010s, demand grew on both sides of Forge’s marketplace. Millionaires on paper sought to diversify their wealth while hungry investors fought for a piece of the new boom. Forge began to pull ahead of older competitors like SharesPost and SecondMarket (the latter now operating under Nasdaq’s ownership). In 2018, Forge jumped straight from its Thiel-Draper seed to an $85 million Series B.

That year marked the beginning of a new era for the business. Forge was no longer a small, scrappy startup but a well-financed business, becoming an industry leader. Around this time, Prasad met Kelly Rodriques. The former C.E.O. of PENSCO Trust, Rodriques had built a long career at the intersection of tech, financial services, and alternative assets. He understood the business Prasad and Ramadurgam were building; in fact, he’d even served on the board of their rival, SharesPost.

At first, Prasad thought Rodriques would make a good investor. As he spent more time with him, often meeting multiple times a week, he began to feel Rodriques could play a bigger role at Forge. Maybe he could become a board member? Or perhaps the head of the company’s institutional division?

Over months of conversations, they reached an agreement neither man had planned for going in: Rodriques would become Forge’s C.E.O. “That was an…interesting move at the time,” Prasad said. “And definitely controversial. The last time people had heard of a founder giving up their role was in the dotcom era.”

Though an unusual move, Prasad was sure it was the right one. In Rodriques, he’d found a tenured leader that shared his vision – and was better suited to guide Forge in the coming years. For early investor Ullas Naik, it was another indication that Prasad and Ramagurdam possessed acumen beyond their years. “They were balanced enough to say, ‘Let’s bring the best talent in.’ That was very prescient on their part. It showed me they had that maturity.”

With Rodriques at the helm, Forge matured as a business. Rodriques drove two major acquisitions, including of rival platform, SharesPost. The company grew from 30 people to more than 250. And in 2021, Forge merged with Motive Capital’s SPAC and hit the public markets.

Prasad and Ramadurgam played vital roles in many of these events, staying with Forge through 2020 and staying on the board until it made its public debut. But toward the end of that year, a new idea began to gnaw at Prasad. Back in Texas for the holidays, he walked the corridors of his childhood home, thinking it over. “I couldn’t get the idea out of my head.”

Origins: Destiny manifests

There are more than a few commonalities between Larry Fink circa 1986 and Sohail Prasad circa 2019.

Both achieved professional success quickly, rising to the top of their respective industries.

Both were vital in formalizing new markets, Fink with mortgage-backed bonds and Prasad with secondary shares.

Both were outsiders that had made their way into the inner circle. Fink lamented Wall Street’s treatment of Jewish and Italian traders in describing his early years in the industry, but by the time he left First Boston, he was a consummate insider. Prasad started Forge after realizing how difficult it was to buy and sell shares of high-quality startups before building a network of relationships that rivaled an elite venture firm.

And both were about to take the biggest swing of their career.

Prasad’s father had been the one to get him thinking. In the garage of his Dallas home, Prasad pater asked his son a simple question: “What should I invest in?” Despite running the world’s largest marketplace for secondary shares, Prasad realized he didn’t have a good answer. He could point his father towards plenty of promising startups on Forge, but minimum investments tended to be in the tens of thousands, if not more. The high death rate of startups also meant that individual investments were more likely than not to go to zero. What you really wanted was an index – something that spread around the risk and allowed investors like his dad to benefit from private tech’s strong returns.

The more Prasad thought about his father’s question, the more he felt like the problem he’d founded Forge to address had only been partially solved. Yes, it was now easy and safe for investors and employees to transact in the private markets, but the buy-side was restricted to accredited investors. To meet that threshold, investors needed to make $200,000 a year for the last two years (or $300,000 between spouses) or possess a net worth north of $1 million. A 2016 S.E.C. report suggested that just 13% of the U.S. population qualified as accredited.

Was this the problem Prasad had wanted to solve? To streamline access for a small group of the population while the rest were left in the cold?

“As much as we’d built with Forge, most people hadn’t been touched by it,” Prasad said, “My Dad, my Mom, my friends – they had no way to participate.”

By the turn of the decade, it had become abundantly clear that missing out on the tech revolution meant missing out on one of the world’s greatest vehicles for wealth creation. A 2020 Startup Genome study pegged the value of the ecosystem at $3 trillion, “on par with a G7 economy,” and seven of the ten largest companies operate in the tech sector. Estimates from the World Bank suggest the sector’s importance will continue to grow, with 70% of global value deriving from “digital business models” over the next ten years. Yet, few have been able to capitalize on this colossal, ongoing upswing fully.

Others had tried to address the issue with which Prasad became obsessed. Though the Initial Coin Offering (I.C.O.) craze turned out to be one of crypto’s many casinos, its theoretical goal was to democratize startup investing, side-stepping accreditation rules.

Crowdfunding was another solution. New regulations opened the door for companies like Republic and WeFunder to accept investments into startups via their platform. Investors didn’t need to meet accreditation standards and could deploy small checks, sometimes as low as $50.

Though a valuable addition to the ecosystem, Prasad wasn’t convinced by these alternatives. “There’s a huge adverse selection problem,” he explained. “The best companies don’t need to go to one of these platforms.” Because power laws govern venture capital, Prasad knew that unless consumers had the chance to invest in the top 1% of startups, they’d miss out on most of the returns.

One of Forge’s shrewdest moves had been to borrow the notion of forward contracts from traditional finance. Prasad thought a similar maneuver might be possible here. Just as Silicon Valley changed rapidly during the 2010s, Wall Street underwent its own machinations. BlackRock was at the heart of one of its most notable shifts. In the firm’s early days, it had succeeded by offering active strategies: funds in which individual managers sought to beat market benchmarks. In 2009, that changed. BlackRock acquired Barclays Global Investors (B.G.I.) for $15.2 billion. The British bank’s exchange-traded fund division included iShares, a fast-growing sub-unit. The deal proved to be a masterstroke and defined BlackRock’s last decade. The firm has catalyzed and capitalized on the growing popularity of ETFs, with the iShares division a particular beneficiary. At one point in 2021, the firm’s ETF business pulled in $1 billion a day. Today, the majority of BlackRock’s assets under management are in passive strategies.

This was what the private market needed, Prasad thought. An index. A basket of the best the tech sector had to offer, publicly traded and available to everyone. “I just became convinced that this was a product that needs to exist. Needs to.”

Fortunately, Ramadurgam was just as bullish as Prasad on the idea. It leveraged the expertise they’d developed while building Forge and pushed their fundamental mission even further. They chose a name that reflected the sense of autonomy and control they wanted their customers to have over their financial future: Destiny.

Prasad knew that, once again, he had picked an idea with a heavy regulatory lift. It was little surprise then that one of his first calls was to Ethan Silver, the prosecutor that had found his way into fintech. Though he’d historically rejected full-time offers in favor of building his own legal practice, he needed little convincing to hop aboard as C.O.O. of Destiny. “This product has an incredible amount of potential to change the way people invest,” he said of his decision. “And there’s probably nobody better situated to launch it than Sohail and Samvit. I dare you to show me someone better.”

The success of Forge meant raising money for Destiny was easier, though it was more complicated. This time, Prasad and Ramadurgam needed to raise two separate rounds: one for Destiny the organization, the second to purchase stakes for its first index, the “Destiny Tech100.”

In the summer of 2021, Destiny announced it had raised $5 million in venture funding. Once again, Ullas Naik was among those that invested. He saw the company as a natural extension of the founding pair’s expertise and a clear opportunity. “It leveraged all of the learnings they had made in the private markets. I think it was a very smart leap for them to make.”

Tashi Nakanishi shared Naik’s view. The founder of Dreamers V.C. had gotten to know Prasad during his time at Forge. He needed little convincing about this newest venture. “It immediately made sense to me that late-stage investments could become ETFs,” Nakanishi remarked. It was a “no brainer” with massive upside in the venture investor’s estimation. “This could be the next BlackRock,” Nakanishi said. “The BlackRock of the private markets.”

With enough capital to run Destiny the business, Prasad set about raising funds for the Tech100. He would need more than $5 million to assemble a collection of the industry’s highest-value companies. He and Ramadurgam landed on $100 million as a target.

The easiest way to get that kind of capital would have been to pitch institutions, but that didn’t feel right to Destiny’s founders. The whole goal of their product was to equalize access to the world’s highest-growth companies – how could they remain true to that mission if sovereign wealth funds or large institutional investors got preferential treatment?

Though securities laws meant they couldn’t solicit the general public, at the very least, they could bring a large pool of aligned individual investors aboard. Prasad took an unusual step to maximize the number of people they could include. Instead of setting a minimum investment size, he did the reverse. Investors in the Tech100 could invest as little as they wanted, but only up to a certain amount. “Most people do it the other way,” he said. “But I wanted as mission-aligned participants as possible.”

In October 2021, Destiny announced it had raised $100 million to build its index. Backers included the founders of Coinbase, Plaid, Mercury, Superhuman, Quora, and many others. Partners from Sequoia, Greylock, and Y Combinator participated as individuals. Operators from Silicon Valley’s most influential companies, like Google, Meta, Stripe, and Apple also participated. For a company that’s success rests on accessing shares in highly-sought after businesses, Tech100’s investor base demonstrated the strength of its network.

Prasad had built his war chest. Next, he would need to figure out how to deploy it.

Product and operations: How to make an index

Those that understand the private markets know there is a right and a wrong time to invest in Discord. The difference between those moments is not down to a fundamental change in the chat application’s fortunes but an administrative quirk. Discord approves secondary sales at its quarterly board meeting. If an employee wishes to sell part of their stake in the business, they must wait for it to be ratified via this forum.

Knowing this impacts the price a buyer can secure. As the quarterly meeting approaches, the pressured seller may be willing to reduce their demands. The engineer hoping to make a down payment on a house or the product manager sending her child to college may not want to wait another quarter for liquidity – getting a deal over the line may be worth accepting a lower valuation.

Not all companies operate as Discord does, which is the point. To operate effectively in the private markets, a buyer needs to know the intricate workings of different companies worldwide.

Christine Healey has built a career mastering these unusual dynamics. After working as an investment banker at Credit Suisse and Jefferies, she joined Forge. One of her core responsibilities was to help the company crack international markets. Though Forge had good access to U.S. companies and counterparties, it needed to build it elsewhere. That became an increasing priority as demand for high-growth startups like Gojek, Nubank, Rappi, Kavak, and others expanded.

Healey discovered how differently each market operated. In Asia, for example, secondary purchases were much larger. “The sizes are huge,” Healey said, “there are some deals where a seller won’t even talk to you for less than $10 million. If you wanted a $20 million block of ByteDance, for example, you’d get laughed out of the door.” In the U.S., it was possible to work with much smaller check sizes, sometimes in the tens of thousands.

Different markets also prioritized different companies. For example, Healey noted that Instacart was actively traded in Asian markets, perhaps because local companies had shown the model’s potential.

Across her time at Forge, Healey learned how intricate and idiosyncratic the private markets are. That was especially true when acting as a purchaser of primary and secondary shares. “You have to understand which structures and which counterparties are going to be reliable and lucrative,” she explained. “If you can understand every part of the deal, you’ll see places to optimize.”

Prasad ensured Destiny would benefit from Healey’s expertise by bringing her aboard as Head of Private Markets. She and her team are tasked with creating the highest quality index of private tech companies. How is that managed in practice? What does it take to effectively invest $100 million in the sector’s highest-quality companies? How is Destiny constructing the Tech100?

First, Destiny has to find the best companies to invest in. You might think that’s relatively easy. After all, shouldn’t the Tech100 be a basket of the most highly valued private startups? It’s not quite that simple. As Prasad explained, if Destiny adhered to that rule, it would become both a forced buyer and seller. Anytime a company dropped out of the top 100, Destiny would have to sell, regardless of whether it was attractive to do so. The same principle exists on the selling side. “We want to be a passive fund, but we also aren’t going to get run over on the execution side,” Prasad said.

Destiny is taking a page from the S&P500 in creating its basket. That popular ETF selects public companies to include in its index according to rigorous criteria. To be included in Destiny’s Tech100, a startup must first meet the following five standards:

It has been vetted by professional investors. Specifically, Destiny looks at companies that have received more than $50 million in capital from U.S. institutional investors.

It has a healthy capital stack. The company should have a healthy liquidation preference ratio relative to its valuation.

It is in a strong financial position. Namely, the company should not have heavy debts to pay.

It does not rely on foreign legal structures. For example, the company shouldn’t rely on layers of Cayman Islands entities.

It does not have cultural red flags. Turnover is within a normal range, and there do not appear to be major outstanding managerial or cultural issues.

These minimum requirements are designed to filter out poorly constructed or badly managed entities. Destiny may occasionally make exceptions if it believes a strong company fails to meet one of these standards.

Beyond this checklist, Destiny evaluates startups based on their potential upside. Just like a venture firm conducting comprehensive diligence, Prasad’s firm assesses the size and growth of the addressable market, financial traction, cultural power, and managerial abilities. Factors like a startup’s commitment to E.S.G. goals and team diversity are also included.

Once Destiny has conviction in a startup, it tries to purchase shares at a price it finds attractive. This is where Healey’s expertise – and that of Prasad and Ramadurgam – becomes most powerful. Because of the team’s years in the space, it has the context and connections to see the best opportunities first.

Destiny is adaptable in how it puts deals together. In some cases, it joins a primary transaction, participating in a round like another venture firm. In other instances, it works with employees or early investors to buy secondary stakes. These transactions could be as small as $20,000 or as large as $15 million. “It’s about being flexible,” Healey said. “We say to brokers, ‘Show us everything.’”

So far, this approach is working well. As part of the S.E.C. registration process for the Tech100 (it is still being reviewed), Destiny disclosed the startups it invested in. It’s too soon to say whether these will be good investments. The valuation at which Destiny made its investments is not included, for example. However, at first blush, it makes for impressive reading. Prasad’s firm has amassed stakes in many of tech’s most sought-after companies, including SpaceX, Stripe, Flexport, and Public. In total, the firm has deployed approximately $81 million of its investable capital in the following businesses:

In the coming decades, the companies Destiny has assembled may determine how to communicate, learn, travel, eat, move goods, and transact. If they succeed in doing so, they should amass significant value. When the Tech100 finally lists – likely in mid-2023 – that value will be accessible to non-accredited retail investors for the first time.

You might be wondering what it costs consumers to invest in the Tech100. For Prasad and Ramadurgam, getting the business model right was essential – they wanted to ensure they offered a fair product to customers that didn’t clip upside. As a result, Destiny will charge a 2.5% management fee but 0% carry.

That’s very different from traditional venture firms, which typically charge 2% management fees and 20% carry. For some of Destiny’s backers, this disruption may be the company’s most exciting aspect. Over the past decade, growth funds have swollen in size. They have often done so without demonstrating exceptionally strong picking ability. Instead, they’ve benefitted from tailwinds that have propelled the entire tech industry forward. The era of the undifferentiated growth investor may end, at least in Tashi Nakanishi’s view. “This is going to fundamentally change venture capital,” he said. “Funds that charge 2-and-20 for access to late-stage deals are going to disappear. To get paid, you’ll have to generate real value.”

Future and risks: Building the benchmark

BlackRock’s iShares division boasts more than $2.5 trillion in assets under management, spread across 1,250 different ETFs. If Prasad wants to hang with the world’s largest investment firms, Destiny cannot stop at the Tech100.

It’s not hard to imagine how the offering might expand. Destiny could offer indexes for different sectors in the private markets. In a few years, investors might be able to allocate to the Bio100, Fintech100, or Space100. Each of those ETFs would carry stakes of the most valuable vertical startups. Other indexes might also make sense: a YCombinator100 or UnionSquareVentures50 for those that want to back businesses that have received funding from respected capital partners.

To reach that junction, Prasad knows that Destiny will need to grow its presence and distinguish itself from competitors. While there isn’t a directly analogous product on the market, others are playing in this space. In September 2022, investment platform Titan announced a partnership with ARK Invest. Titan members can now invest in a selection of companies selected by Cathy Wood’s fund. While most of “ARK Venture’s” holdings are public companies like Coinbase, UiPath, and Roblox, it has also snagged shares in private businesses like Twitter, Chipper Cash, and Epic Games. Though they’ve yet to declare an interest in creating a publicly-traded index, private market platforms like Carta and AngelList could conceivably enter the space, too.

Bigger players may also decide they want a slice of the pie. That includes massive managers and financial institutions like BlackRock, Vanguard, State Street, and Goldman Sachs. Will Destiny have the chance to disrupt these players?

Sohail Prasad doesn’t see these firms as rivals but as potential partners. While at Forge, Prasad developed close relationships with management at these organizations and has kept them abreast of his newest venture. “There’s somebody very senior at every firm that’s very excited about what we’re doing,” Prasad said. “How can we take that excitement and turn it into a cohesive part of their business strategy?” In the future, we may see Destiny and J.P. Morgan collaborate to create a JPM-AI-100 index, for example. Prasad’s firm would take care of the selection and execution while relying on a partner organization for distribution.

Destiny must remain aware of the competition, but it has a greater risk to manage: timing. Though 2023 has shown flickers of life, tech remains in a colder period. Valuations in private and public markets have fallen sharply from where they sat in 2020 and 2021. In this more conservative environment, will retail investors want to own an index of higher-risk startups?

Ullas Naik highlighted this as one of Destiny’s core risks. Fundamentally, however, the Streamlined Ventures G.P. sees it as manageable. “Eventually, public assets will inflate again and investors will seek private market assets.” Naik added that on a relative basis, it would take very little volume for the Tech100 to grow in size. “If even 1-2% of ETF allocations went to the private markets, that would be a massive allocation. Not for one company, but ten.” Destiny will believe there is more than sufficient demand for its product, regardless of the market’s current mood.

“Building a portfolio around index funds isn’t really settling for the average,” Fortune and Vanity Fair journalist Bethany McLean once wrote. “It’s just refusing to believe in magic.”

The past few decades on Wall Street have illustrated the efficiency of passive strategies and helped propel firms like BlackRock to trillions in assets under management.

When the Tech100 lists, likely later this year, it may bring a similar revolution to the private markets. Venture capital’s rent-collecting growth investors may see their position challenged. Customers will have a chance to invest in the companies defining our future – for most, it will be the first time they have been able to do so. And Sohail Prasad will see the fulfillment of a decade-long dream to increase the accessibility of the private markets, to open it up so that people like his father, mother, and friends can benefit from the economy’s most dynamic sector.

It is a dream held so long, worked for so fervently, that it has begun to feel like destiny. There is something quite magical in that.

The financial information on the Tech100 cited in this briefing is based upon publicly available material, including regulatory filings available as of date of publication.

N.B. on broad usage of terms of art within this briefing:

ETF is used in a broad sense to mean an exchange traded product or fund (in Destiny’s case, a closed-end fund).

Index is used to mean a portfolio composed of a selection of investments, in Destiny Tech100’s case it is the portfolio of companies that it has identified to invest in. For some funds, an index is used as reference to track the performance of a group of assets or a basket of securities, such as a list of publicly traded companies and their stock prices.

Basket is used to mean a selection of investments that make up an investment portfolio that may form an investment fund. For some funds, baskets of securities may be part of the way shares are created and redeemed, however this is not the case for the Tech100.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.