🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor, founder, and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Become a member today.

Friends,

Welcome to the latest edition of The Investors Guide – a new Generalist series exploring the essential challenges of raising, running, and succeeding as a venture capitalist. We do that by conducting detailed interviews with some of the world’s best established and insurgent investors, and compiling their advice, tactics, and strategies into an actionable guide.

It was fantastic to learn how many of you enjoyed the first edition and hear the stories behind your funds. I hope you’ll find today’s guide just as valuable, if not more so. I loved how investor and Generalist subscriber Sajith Pai summarized the value of The Investors Guide series: “Up until now, info / content like this could only be unlocked via 1:1 convos (and only for privileged insiders).”

Using Sajith’s framing, I can comfortably say that today’s edition, “How to Find a Unicorn,” is the equivalent of at least 20 coffee meetings – compressed into an 11,500-word guide. This guide is the result of dozens of hours of interviewing, research, and writing.

Below, you’ll find a detailed discussion of the inbound and outbound strategies global investors use to find legendary startups. Throughout their careers, this group (or the firms they run) have backed many of the most consequential companies across the asset class including Nubank, Jet, Coupang, Runway, Faire, Kavak, Lyft, Stone, Canva, Peak Games, Chime, Ledger, Cockroach DB, Upstart, The Graph, Coinbase, Dataiku, Circle, Zoox, The Farmer’s Dog, ClassDojo, and Kraken.

Cumulatively, they have assessed tens of thousands of companies, spoken to countless entrepreneurs, and identified some of the best to back. Though all run elite, well-regarded firms today, none started with the benefit of a historic brand name. Rather than relying on their firm’s reputation, these investors have won through savvy, intelligence, intense hustle, and a little bit of luck.

To access all of their wisdom, subscribe as a premium member today:

By doing so, you’ll ensure you receive the entirety of The Investors Guide’s ten editions. Here’s what we’ll be covering:

How to find your first unicorn (Today!)

How to win a competitive deal

How to spot a super trend

How to be a top 1% angel

How to get your first institutional investor

How to size your investments

How to actually add value

How to build a unique voice in the ecosystem

How to win at secondaries

**Secret bonus edition 🤫**

You won’t want to miss it:

Brought to you by Mercury

If only discovering your next investment opportunity was as easy as checking your inbox. Well, now it is.

Investor Connect by Mercury Raise is a data-powered platform that puts ambitious founders in front of active investors like you. It’s simple: Join the investor pool, submit your investment criteria, and receive a fresh, curated drop of top startups vetted by a panel of VCs each month. Then, get connected with a single click.

How to Find a Unicorn

Firms live and die on the deals they find. It is perfectly possible to raise a fund from LPs, spend four years sourcing opportunities, meeting with founders, diligencing diligently, and writing checks without ever encountering a true unicorn. Without meeting the kind of reality-bending founder capable of building a generational business.

A shrewd manager may be able to salvage such a vintage. You could land some base hits, secure some savvy secondary sales, and minimize losses. All of these can stanch the bleeding, but they are not the basis for eyebrow-raising DPI. Nor are they the basis for the establishment of a new franchise.

All of which is to say that if you don’t see great companies, you cannot build a great fund. It really is that simple and that difficult.

Valor

Sourcing and origination – I think that’s probably the biggest driver of alpha. Alpha is really doing things that other people aren’t doing. That could be focusing on a particular geography, sector, or disruptive technology.

Great performance comes from a relatively small number of companies, and you want to be in those companies early.

– Scott Sobel

While the crowd jostles for space along the shoreline, casting their lines in the same direction, you may find opportunity standing alone among the reeds, using a fly you have fashioned yourself.

Whatever your strategy, however you choose to play the game, the imperative is the same: you must find your unicorn.

What do we mean by a “unicorn?”

It deserves some clarification. The term typically denotes a startup valued at or above $1 billion. However, too many companies have achieved billion-dollar status over the past few years based on little more than market exuberance. We’re using the word a little differently here, in a manner truer to its initial spirit. A unicorn is simply that company. The startup on the far right tail, a skewer of returns – a fund returner and reputation-maker.

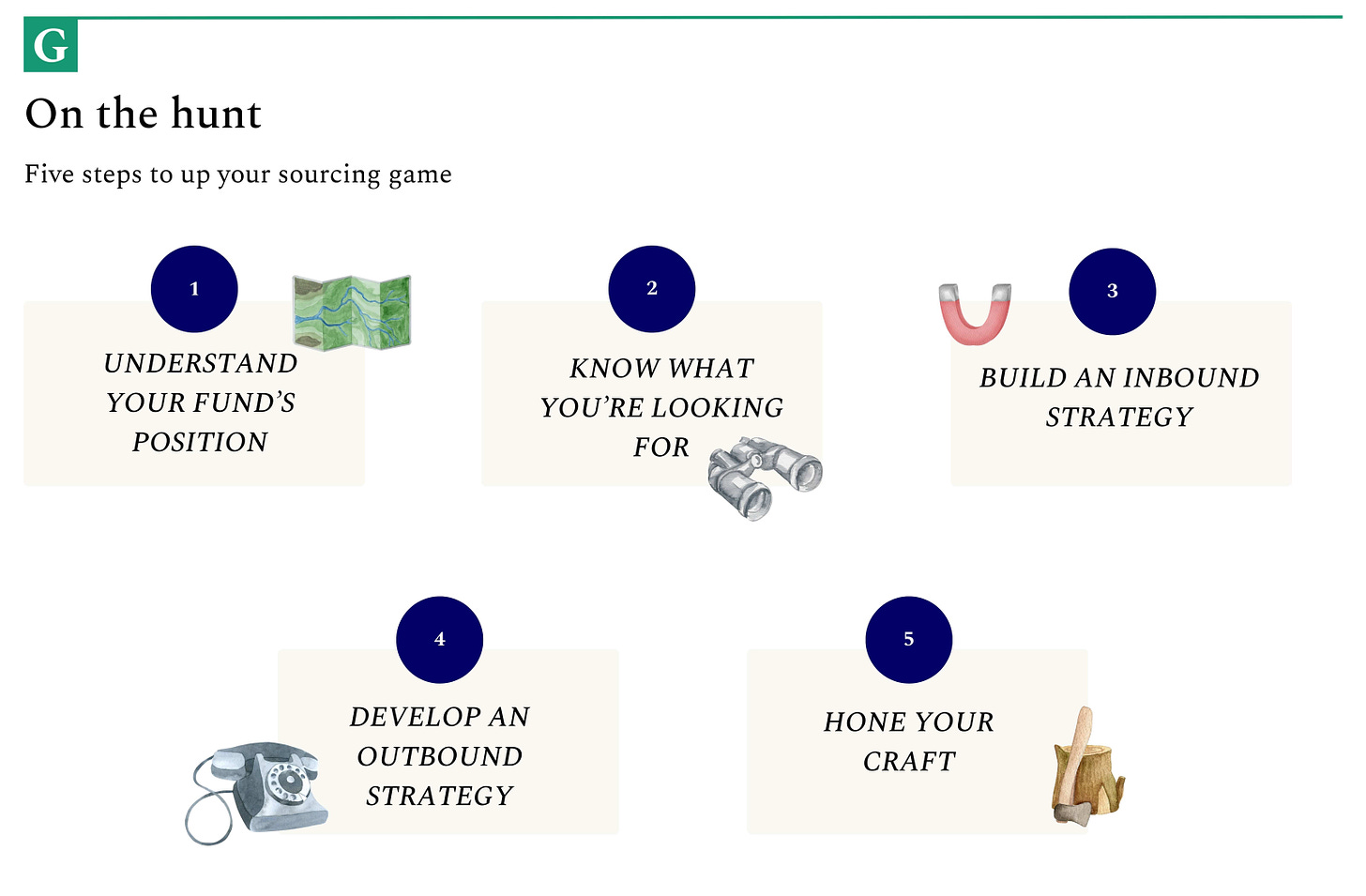

The advice below reflects how to find these rarest of startups. Here’s what we’ll cover:

Know your game

Recognize your fund’s position

Understand your magnetism

Assess your circles of competence and incompetence

Know what you’re looking for

Build a founder profile

Constrain your focus

Calibrate by stage

Develop an inbound strategy

Increase your surface area for serendipity

Share your thinking

Make “upstream” friends

Invest in your network

Pay attention to referrals from founders

Build your outbound strategy

Chase your curiosity

Look for “adjacent greatness”

Trace the idea pipeline

Map, then infiltrate

Lean on scouts

Hone the craft

Get the reps in

Build a process (but don’t over-engineer)

Improve your picking

Forge a reputation

Thank you to Ann Miura-Ko (Floodgate), Scott Sobel (Valor), Kanyi Maqubela (Kindred), Kirsten Green (Forerunner), Ben Sun (Primary), Nikhil Basu Trivedi (Footwork), Matt Turck (FirstMark), Niki Scevak (Blackbird), Firat Ileri (Hummingbird), Hernan Kazah (Kaszek), Michael Dempsey (Compound), and Nathan Benaich (Air Street) for sharing their insights for this issue of the Investors Guide series.

Step 1: Know your game

An effective sourcing strategy begins by knowing the game you’re playing. That starts with two fundamental tasks:

Understanding your fund’s position

Knowing your strengths and limitations

Understand your fund’s position

Begin by understanding your fund’s position in the broader venture landscape. Those who are running a fund of their own should have deeply considered this question as part of the founding process, but to paraphrase the Prussian commander Helmuth von Moltke, “no plan survives contact with the market.” As you look for founders, hear pitches, and describe your value-add, you’ll quickly learn which parts of your product resonate and which do not.

Those joining an existing franchise will likely go through a similar process. You may have learned all about your new employer, but it will take experience on the ground to understand its nuances.

Michael Dempsey of Compound and Firat Ileri of Hummingbird highlighted how sourcing strategies will likely vary depending on where you’re situated.

Compound

You have to ask yourself: what is the place you’re doing this from? Are you doing this from a known brand firm or an unknown firm? Each necessitates a different type of framing.

– Michael Dempsey

Hummingbird

There are two types of firms – and plenty in between. There are probably 10-20 funds in the world where you can safely assume that even if you don’t hustle at all, you will come across amazing opportunities. That’s the first type.

The other type makes up 99% of the market. If you’re in that category and you don’t hustle, I fundamentally believe you’re going to be served what you get through your network, which is very constrained. It compounds over time, but given how global our world is and the sheer number of opportunities, you’re going to be disadvantaged.

– Firat Ileri

How strong is your fund’s brand equity? What deals does it see first and why? Are there sectors where it seems to spike? How would other investors describe it? Are you in the 1% or the 99%?

The answers to these questions, and others like them, may radically impact your approach to sourcing.

Know your strengths and limitations

It is as important to understand your personal skill set. What are your unique weapons? Who are you a magnet for? What experiences or abilities do you have that are rare and valuable? Who are your allies in the ecosystem?

It was thanks to Hernan Kazah’s experience building e-commerce giant Mercado Libre that his fund, Kaszek, found its first unicorn.

Kaszek

For MadeiraMadeira, I remember our first meeting was at a hotel in Palo Alto. Danny was obviously building an e-commerce business, so our Mercado Libre experience was very relevant to him, so somehow, we connected.

We spoke with him and immediately liked his character. He was a former competitive driver, Formula 3 or something like that. He had that interesting edge. You could tell he was really competitive, very dedicated and committed.

– Hernan Kazah

Use an understanding of your strengths to focus your work. Insurgent managers have dozens of competing priorities, as Forerunner’s Kirsten Green explains:

Forerunner

If you’re a team of one or two or three – you just can’t do everything. There are so many things to do in every dimension of the business: setting up your firm, managing it, deal sourcing, diligencing things, supporting your portfolio. So you’ve got to pick and choose what you’re going to be really good at and where you have outsized advantages.

– Kirsten Green

Floodgate’s Ann Miura-Ko recommends considering your weaknesses. What are your failure modes? Where do your worst decisions seem to stem from? What is your “circle of incompetence?”

It may take time for these to reveal themselves, but paying attention early could benefit future reflection.

Floodgate

Every quarter, we talk about our “circle of competence” within Floodgate. We reflect on the companies we’ve invested in that have done well – where our actual distributions have been great. What do the best companies that I’ve been involved with look like?

Then, we look at more recent examples. The younger startups that are doing well, where did they emerge?

That process reveals both “circles of competence” and “circles of incompetence.” Knowing your “circle of incompetence” is just as important. For me, a “circle of incompetence” is when I have a very strong thesis for what I’m looking for. I’ll talk about it with our team – I’m really passionate about finding a company in the space. Then, when I do, I fall in love pretty fast.

This is where my partnership has to really hold me accountable. Is this the one? Are the founders up to par? Have I fallen in love with the idea or the company that’s really in front of you?

When I’ve done poorly with an investment, it’s usually in this camp. It’s something I’ve been looking for. It’s so easy to paper over the risks at the early stage. I would encourage anyone who’s starting their investing to really think about where their “circles of incompetence” might be.

– Ann Miura-Ko

Step 2: Know what you’re looking for

According to a Crunchbase report, VCs participated in over 28,000 rounds in 2023. Naturally, this figure doesn’t include the thousands of startups that did not raise capital.

No manager can hope to diligence that many opportunities. If you want to find a unicorn, you have to pick your spots. That begins with knowing yourself, but it’s just as important to understand the kind of deal you’re looking for. Investors cited three tactics worth considering:

Build an investment profile

Constrain your focus

Keep an open mind

Build an investment profile

To start, decide what you think your type of investment looks like.