How to Spot a Supertrend

A definitive guide to seeing into the future and capitalizing on it.

🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor, founder, and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Become a member today.

Friends,

As a hedge fund investor at D.E. Shaw, thirty-year-old Jeff Bezos encountered a staggering statistic: the World Wide Web was growing at 2,300% per year.

At first, Bezos wasn’t sure what to do with that information. He came up with the concept of selling books online but still wondered whether he should leave his well-paid investing job, especially before bonus season.

Ultimately, he decided to go for it, leaving D.E. Shaw and founding Amazon. “I wanted not to have regrets. I knew for a fact, I have this idea, and if I don’t try, I’m going to regret having never tried,” he said of his decision. Today, Amazon sits in the trillion-dollar club, with a market cap of $1.77 trillion at the time of writing. Bezos’s net worth is estimated at $187.1 billion.

Such is the transformative power of a supertrend. Though it would be wrong to solely attribute Bezos’s success to spotting that one startling statistic, it was a necessary condition. If the future Amazon CEO had not stumbled across it or done so a few years later, with the hinges on his golden handcuffs a little tighter, perhaps he would not have had the courage to leave high finance. Less than we care to admit, life hinges on such moments: the bet not made, the unasked question, and the road untaken.

More than any other species of investor, it is the job of the venture capitalist to spot the kind of supertrend upon which Bezos built his wealth. While others may focus on mitigating risk or exploiting fleeting arbitrages, the VC locates the wave gathering miles offshore and prepares to catch it.

Part of the reason the art of trendspotting is such a difficult one is that every winning bet appears obvious in hindsight. The internet? Of course it was slated to change the world. Mobile? Only a fool doubted its potential.

And yet, there does seem to be a knack to it. Luck plays its role, but a subset of investors seem to get lucky again and again. How?

We’ve spent several months researching this topic and interviewing investors who have demonstrated impressive foresight. Along with our own insights, you’ll find wisdom from venture capitalists who were years early to the opportunities in artificial intelligence, crypto, computational biology, digital commerce, emerging geographies like Latin America, and more. We’ve spent time with each of them to determine how they identify possible supertrends, the process they use to test these ideas, and how they invest against them.

If you’re an investor seeking to capitalize on exponential trends or a founder looking for the next wave to catch, this Investors Guide offers over 12,000 words of strategies, frameworks, and hard-earned experience to guide your journey.

What you’ll get in this guide

A +12,000 word guide detailing how to spot a supertrend, featuring insights and direct quotes from leading venture capitalists.

15 strategies to level up your information diet, generate promising investment ideas, test your theses, and invest against them.

20 books recommended by great venture capitalists that will expand your mind and help you make new mental connections.

8 data sources to help you spot emerging trends and understand them better.

+15 investors’ insights and strategies garnered from in-depth one-on-one interviews. A month of fascinating coffees condensed into a single document.

6 new technologies to play with to better understand where the future is headed and which companies might win.

4 “fringe” movements that might spawn the next supertrend.

You can unlock all of these benefits and the rest of our premium membership for just $22/month.

Brought to you by Mercury

You’ve zeroed in on the industries and focus areas you’re looking to invest in. Now, it’s just a matter of filtering through hundreds of emails, reviewing dozens of pitch decks, and scheduling hours of calls...or is it?

Investor Connect by Mercury Raise offers a monthly opportunity to invest in top startups— minus the manual work. Simply provide your investment criteria and sit back as a fresh, curated list of startups arrives in your inbox each month.

How to Spot a Supertrend

When a journalist asked Don Valentine to explain his investing success, he needed no more than two sentences. “That’s easy,” the founder of Sequoia Capital said. “I just follow Moore's Law and make a few guesses about its consequences.”

Though Valentine’s quote undersells his acuity, it is a testament to the importance of finding and investing against the right supertrend. It may mark the difference between a lucrative career and one spent scrabbling for meager gains, battling against the tide of a dying sector.

To position yourself to capture the next big thing, we’ll explore the three key stages of identifying a supertrend and more than 15 strategies designed to make you a better investor.

1. Find great ideas

Strategy 1: Build a better information diet

Strategy 2: Look at the data

Strategy 3: Go to the fringes

Strategy 4: Notice problems

Strategy 5: Search for new primitives

Strategy 6: Give yourself novel inputs

Strategy 7: Study the frontrunners

Strategy 8: Swim against the current

Strategy 9: Live in the future

2. Test their potential

Strategy 1: Debate with peers

Strategy 2: Interview stakeholders

Strategy 3: Consider the timing

Strategy 4: Think in public

Strategy 5: Meet founders

Strategy 6: Throw out the losers

3. Invest in the best

Tip 1: Be patient

Tip 2: Find the right founder

Tip 3: Have conviction

Thank you to Danny Rimer (Index Ventures), Firat Ileri (Hummingbird), Jesse Walden (Variant Fund), Kirsten Green (Forerunner), Kyle Samani (Multicoin), Nathan Benaich (Air Street), Rebecca Kaden (USV), Rex Woodbury (Daybreak), Sarah Guo (Conviction), Scott Sobel (Valor), Tomasz Tunguz (Theory), Zavain Dar (Dimension), Zoe Weinberg (Ex/ante) for sharing your wisdom.

Step 1: Find great ideas

Spend enough time in Silicon Valley, and someone will utter the phrase, “Ideas are cheap; execution is what matters.” For a sector defined by its innovation, this is a puzzling sentiment and one that couldn’t be further from the truth. While a great idea is insufficient to make a fund-returning investment or build a legendary company, it is necessary. “Neither man nor nation can exist without a sublime idea,” Fyodor Dostoevsky wrote. The same is true of every significant company.

For an investor, the question should not be “Do ideas matter?” but “Where can I discover the most promising ones?” It begins with curiosity, especially when it comes to things that may appear odd or unusual.

Hummingbird

You have to be innately curious in this business. You need to be able to spot anomalies.

– Firat Ileri

Forerunner

Be interested and be curious. No one has a secret line telling them what’s coming next.

– Kirsten Green

Strategy 1: Build a better information diet

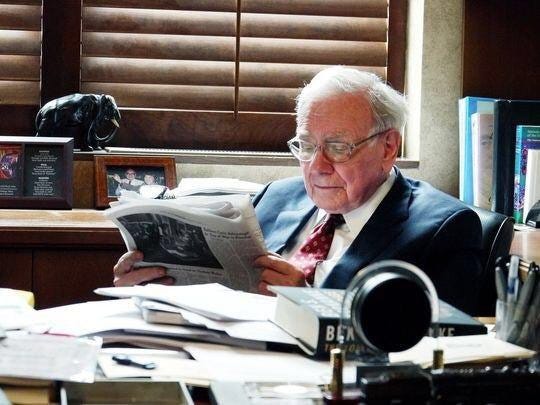

In the early days of Warren Buffet’s career, the young investor would read up to 1,000 pages a day. Even after all of his success, the steward of Berkshire Hathaway spends 80% of his working days poring over a book, study, or financial filing.

“Read 500 pages…every day,” Buffet said. “That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.”

To find great ideas, you must become an information machine, consuming high-quality information at a high volume. Both parts of this equation require consistent effort.

High-quality

Stripped to core components, an investor is a machine in which information goes in one end and capital allocation decisions come out the other. Venture capitalists who do not take care of their inputs place themselves at a disadvantage when it comes to their outputs.

The best investors focus on feeding themselves a regular diet of differentiated, high-quality information. Books and other sources of thoughtfully crafted writing are essential. Podcasts, YouTube, and social media posts can all hold valuable information. But there is a reason, beyond age alone, that so many of the world’s best thinkers are bibliophiles. Listen to Reid Hoffman, Warren Buffett, Charlie Munger, Peter Thiel, Vinod Khosla, Josh Wolfe, Michael Moritz, or Marc Andreessen speak, and you will hear someone extraordinarily well-read, with wide-ranging tastes spanning fiction, philosophy, economics, history, anthropology, media theory, linguistics, mathematics, zoology, and beyond.

Daybreak Ventures

I do consume a lot of information. I listen to a lot of podcasts, I read a lot of books, and I read a lot of articles. There is no substitute for learning that is better than reading.

– Rex Woodbury

It is often assumed that this eclectic knowledge is a coincidence, marking intriguing way stations on an individual’s journey to becoming an investor. The reality is that such knowledge both forms and sharpens an investor, giving them a unique, ever-widening, greater-fidelity worldview. It does not seem a fluke, for example, that Peter Thiel was the first outside investor to recognize the potential of Facebook. Perhaps only a dedicated adherent of René Girard could have understood the power of a platform so driven by mimesis and status games.

In his “Modern Meditations” interview, Josh Wolfe explicitly outlined how his scientific interests influence his style of investing:

Lux

I am endlessly fascinated by the process by which order emerges from disorder. How can that happen? How does something spontaneously come from nothing?

The work of Nobel laureate Ilya Priogine beautifully explained how dissipative structures (think whirlpools in a bathtub or a hurricane) share common characteristics. They have observable, stable forms that dynamically evolve in response to unequal distributions of energy or pressure. A similar pattern plays out in finance. Talent, financial resources, and technological know-how often cluster, creating discrete pockets of abundance and scarcity. Companies form to degrade and diffuse these asymmetries, creating new opportunities. Founders might not realize that’s what they’re doing, but from a structural perspective, their work draws on these dynamics to create something like an entrepreneurial hurricane.

– Josh Wolfe

Focus your time on consuming high-quality information with enduring wisdom. This may mean spending a great deal of time reading old books. Though you may not find as much immediately actionable information, the lessons they provide will last longer and prove more broadly applicable. Through years of interviewing investors and reviewing other sources, I have collected a list of recommended books. Do not try to tie these too directly to the tactical aspects of investing – some amount of obliqueness is a feature, not a bug.

A selection, including some of my suggestions: