What Makes a Great Acquisition?

The common wisdom is that most M&A goes south, with reported failure rates of up to 90%. How can CEOs tip the scales in their favor?

Brought to you by Masterworks

This painting sold for $8 million and everyday investors profited

When the painting by master Claude Monet (you may have heard of him) was bought for $6.8 million and sold for a cool $8 million just 631 days later, investors in shares of the offering received their share of the net proceeds.

All thanks to Masterworks, the award-winning platform for investing in blue-chip art. To date, every one of Masterworks’ 16 sales out of its portfolio has returned a profit to investors. With 3 recent sales, Masterworks investors realized net annualized returns of 17.6%, 21.5% and 35%.

I’ve been investing with Masterworks for years and have really enjoyed using the platform. My portfolio includes shares of paintings by world renowned artists like Picasso, Ruscha, and Rothko.

So how does it work? Masterworks does all of the heavy lifting like finding the painting, buying it, storing it, and eventually selling it. It files each offering with the SEC so that nearly anyone can invest in highly coveted artworks for just a fraction of the price of the entire piece.

Shares of every offering are limited, but The Generalist readers can skip the waitlist with this exclusive link.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about what makes a great acquisition.

Advantage, extroverts. Confident, outspoken chief executives tend to produce better acquisition outcomes than understated counterparts, according to one research study. The authors suggest that this performance bump stems from sociable CEOs’ broader networks and superior power of persuasion. Their abundant relationships deliver more M&A opportunities, while their gift of the gab can make even a mundane acquisition sound compelling.

Culture wars. Can an authoritarian incumbent effectively integrate a non-hierarchical startup? Can a fast-moving tech company successfully absorb an old-school shop that moves at the pace of the civil service? It will not surprise you that such marriages often end unhappily. Per one Academy of Management paper, the “congruence” of cultures is critical to an acquisition’s success. Matchmaking between firms requires more than merely complementary businesses.

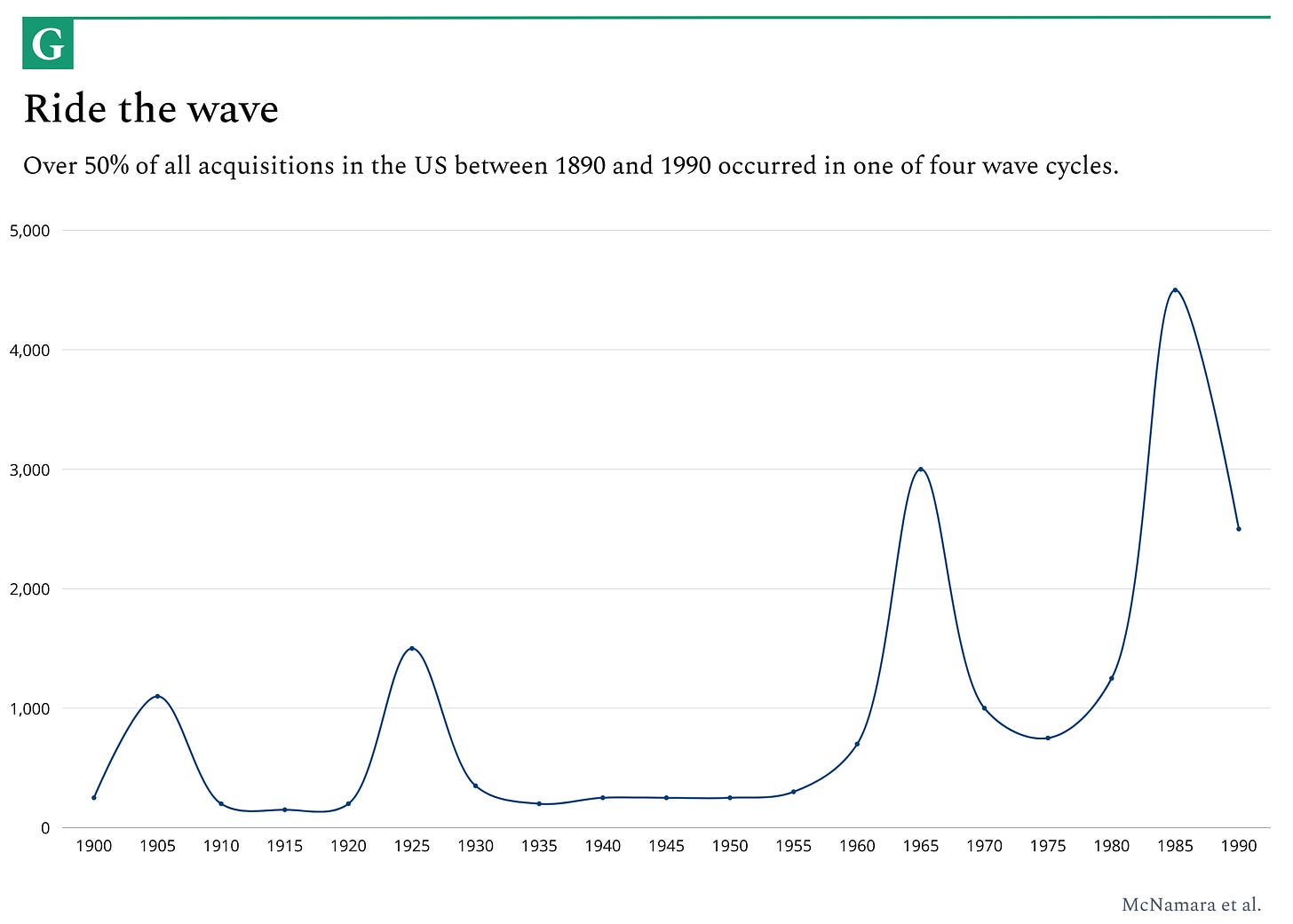

Need for speed. M&A tends to happen in distinct waves. Between 1890 and 1990, for example, 50% of all acquisitions in the United States occurred during four discrete periods. Depending on when in one of these cycles a company partakes in an acquisition, returns can vary significantly. Enterprises that act early tend to have better results, benefiting from lower prices and greater selection, while laggards are often left overpaying for slim pickings.

Practice, practice, practice. As the old joke goes, How do you get to Carnegie Hall? The answer: Practice, practice, practice. The road to the Fortune 500 follows a similar route. Research shows that companies that complete more acquisitions tend to become better at them. Not only do these businesses hone their processes, but they effectively average the price of their purchases – buying in both bull and bear markets.

Let’s begin with a true story. We can call it A Tale of Two Acquisitions.

It was the best of times, it was the worst of times. It was the year of the Eurozone crisis, it was the year of the Queen’s Diamond Jubilee, it was the epoch of Obama, it was the epoch of Putin, it was the season of Curiosity, it was the season of ignorance, it was the spring of Joseph Kony, it was the winter of Hurricane Sandy. In short, it was 2012 – a year of broad and roiling change, a year that included one of the most significant acquisitions of modern times.

That spring, two CEOs cast their eyes toward the same target: Instagram. In less than two years, the photo-sharing application founded by Kevin Systrom and Mike Krieger had become a viral sensation, amassing nearly 30 million users. Its avid user base, image-centric functionality, and mobile nativeness made it an appealing target for Twitter CEO Dick Costolo and Facebook’s Mark Zuckerberg.

Costolo made the first move. In March of that year, Twitter made overtures to purchase Instagram for $525 million, using a mix of cash and equity. Systrom and Krieger considered the offer – it was, after all, quite a windfall for less than 24 months’ work – before turning it down.

Shortly after, Instagram raised a $50 million Series B from Sequoia Capital, valuing the business at $500 million. For a brief interlude, that looked like the end of the drama – Systrom’s startup would stay independent, using its war chest to propel its growth. Then Zuckerberg called.

Just three weeks after breaking off its discussions with Twitter, Instagram announced it was joining Facebook for $1 billion. Once again, it involved a mix of cash and stock. According to reports, Costolo and company hadn’t been given a chance to counter; perhaps, if they had, they might have matched or surpassed Facebook’s three-comma concord.

Later that same year, stung by Systrom’s rejection, Twitter purchased another upstart social media business. That October, Costolo’s firm paid a mere $30 million to take ownership of video platform Vine.

There’s no doubt which proved better value for money. Within four years, Twitter had shuttered Vine. Meanwhile, Facebook had swelled from a $104 billion IPO-debutant to a $330 billion democracy-fraying superbeast. Such frightening, rapid growth could never have occurred without Instagram, with Zuckerberg’s $1 billion outlay looking like a rounding error. Indeed, in 2018, it was estimated that Instagram would be valued at $100 billion as a standalone company. Since that assessment, the app has doubled its monthly active users to over 2 billion.

One moral of the story is this: the right acquisition can change everything. A purchaser who finds the perfect business at the ideal time can unlock new markets, establish new moats, stave off decline, and accelerate growth. Think Google snagging YouTube, eBay grabbing PayPal, or Disney devouring Marvel.

Another equally true moral: picking the right acquisition is extremely difficult. It requires a mix of vision, operational acuity, financial discipline, cultural awareness, market storytelling, and timing. There’s a reason that management theorist Roger Martin referred to M&A as a “mug’s game in which 70% to 90% of acquisitions are abysmal failures.” While one might quibble with Martin’s methodology or characterization, there’s little doubt that the odds are not in your favor.

So, as a CEO driven to forge a generational business, how can you tip the scales in your direction? How can you maximize the possibility of finding the next Instagram while minimizing the chances of selecting the next Vine? (This is a little harsh on Vine! Oh, well.) What should you consider or question when the M&A bankers come calling? In short, what makes a great acquisition?

To answer this fundamental question, we’ve reviewed dozens of academic papers on the often murky world of dealmaking, distilling the most interesting findings. Some will confirm your beliefs, while others may defy them. While not a comprehensive literature review by any means, we hope our summations serve as compelling food for thought.

Unlock The Generalist’s Premium Newsletter

If you haven’t done so already, now is the perfect time to join our premium newsletter Generalist+. For just $22/month, you’ll unlock a collection of new series designed to make you a better investor and technologist.

This week, we launched one of those series, “Letters to a Young Investor.” It features a correspondence between me and the legendary Reid Hoffman on the craft of investing. To hear Reid’s stories about backing Airbnb at the seed stage, missing out on Stripe, and developing a “theory of the game” for venture capital – join us today.

1. Extroverted CEOs

You may not have heard of Bud Tribble, but you know his work. In 1980, Tribble joined a small upstart company called Apple Computer, jumping aboard their fledgling Macintosh development team. As well as being one of the on-the-ground architects of the personal computer revolution, Tribble is also the author of one of Silicon Valley’s favorite terms of art: the “reality distortion field” or “RDF.” Tribble coined the phrase to describe boss Steve Jobs’ startling capacity to convince others. As another early Apple employee remarked:

“The reality distortion field was a confounding melange of a charismatic rhetorical style, an indomitable will, and an eagerness to bend any fact to fit the purpose at hand. If one line of argument failed to persuade, he would deftly switch to another. Sometimes, he would throw you off balance by suddenly adopting your position as his own, without acknowledging that he ever thought differently.”

While possessing the capacity to manifest RDF is not always a good thing (See: Neumann, Adam), some of its underlying ingredients may be useful when making successful acquisitions.

In 2017, academics from the University of Waterloo and Erasmus University Rotterdam set about assessing the impact of CEO personality on M&A activity. Specifically, researcher Shavin Malhotra and his colleagues studied the effect an extroverted executive had on acquisitiveness. To make this assessment, the authors set about trying to identify “extroversion.” To do so, they used specialized linguistics software to review the earnings calls of 2,381 CEOs over a ten-year period. Extroversion was determined by analyzing things like word count, word repetition, concreteness, visual language, and references to family and friends. This was subsequently compared to each firm’s M&A activity over the same period.

As it turned out, extroverted CEOs acted distinctly to their less gregarious colleagues. Not only did they engage in more frequent M&A activity, they also tended to make larger acquisitions. An increase in CEO extroversion from one standard deviation below the mean to one standard deviation above the mean increases the odds of making an acquisition by 11.2%, increases the frequency of acquisitions by 13%, and increases the size of targets by 6.7%.

While these statistics might suggest extroverted CEOs simply have low-impulse control, the study also indicated that more outgoing executives are more successful buyers. Namely, Malhotra et al. found a positive correlation between a CEO’s “extroversion score” and the short-term movement of the acquiring company’s stock price. (The latter is often referred to as the “cumulative abnormal return” or CAR.) More concretely, a one-standard-deviation bump in extroversion increases the abnormal stock returns upon acquisition announcements by 0.2%. Though that might not sound like much, it translated into an average gain of $14.7 million for companies in their sample.

Such results beg the question: what makes extroverted CEOs better dealmakers? Is it simply a case of a reality distortion field at work? That may be part of the equation; charisma on earnings calls can certainly assist stock price performance. However, it’s not the only factor at play. Extroverted CEOs also benefit from broader social networks. For example, they are more likely to serve on the boards of other companies, giving them greater insight into adjacent industries and potential acquisition targets.

Verdict: Have an extroverted CEO with a powerful public-speaking presence and a strategic smattering of board seats in other companies.

2. Congruent cultures

Ten days into the new millennium, two media giants announced their merger. On January 10, 2000, AOL and Time Warner joined forces to create a new $350 billion behemoth. Within months, it was already being referred to as “the worst merger in history.”

While technological shifts contributed to the ill-fated marriage of AOL-Time Warner, the firm’s differing cultures may have been even more damaging. Richard Parsons described his struggles annealing the disparate entities. “It was beyond certainly my abilities to figure out how to blend the old media and the new media culture,” the Time Warner President remarked. “They were like different species, and in fact, they were species that were inherently at war.”

While AOL-Time Warner may be the canonical example of a culture clash, it's far from the only one. In their paper, “The Role of Culture Compatibility in Successful Organizational Marriage,” researchers Susan Cartwright and Cary Cooper assessed the importance of cultural fit in brokering an acquisition.

To make their analysis, the authors interviewed employees at both acquired and acquiring companies over a three-year period. They gathered data via surveys. In particular, Cartwright and Cooper (a duo that sounds like they should be headlining a procedural drama on TNT) used these methods to capture measurements of organizational commitment, job satisfaction, employee stress, and mental well-being. They also examined behavioral indicators like employee turnover, sickness, and absentee data. Taken together, these findings revealed the cultural style of different organizations and their effectiveness at integrating with another firm.

Before turning to Cartwright and Cooper’s findings, it’s worth discussing the point of cultural styles. They are critical to understanding the study’s results. They also happen to be fascinating. The authors divided companies into four cultural categories, borrowing terminology coined by Roger Harrison, an expert in organizational development.

Zeus culture. This type of organization is fundamentally “power-based.” An autocratic figure – and a select group of managers – control the business with little interference. This kind of culture was common during the rigid Industrial Revolution, though we can see a contemporary version of it in Elon Musk’s forceful management of Twitter.

Apollo culture. Though your local DMV might not immediately remind you of the gorgeous Greco-Roman sun god, it bears his namesake from an organization's vantage. Apollonian cultures are “role-based.” Employees stay within the explicit confines of their jobs. Bureaucracy and procedure matter a great deal in these organizations, commonly found in the civil service.

Dionysius culture. These organizations emphasize the individual. They are known as “person-based” cultures and tend towards flat, egalitarian structures in which employees are given greater freedom. Communities and non-profit organizations may embrace this methodology. In the business world, Zappos’ Holacracy may be a rare example.

Athens culture. This “task-based” culture is mission-focused, valuing knowledge and competency. Employees act in the way they consider suitable for the task. Stripe may be an example, as prior employees have suggested without using the same terminology.

With our categories set, let’s turn to the results. What did Cartwright and Cooper discover? As you might expect, our crime-fighting duo discovered that culture mattered a great deal in the success of a merger or acquisition. While every marriage is unique, Cartwright and Cooper argue that some cultural combinations are likelier to work out than others.

For example, a buyer with an Apollo or “role-based” culture may have success integrating an acquisition operating under a Zeus or “power-based” culture. While incoming employees may experience a culture shock, they will likely appreciate the perceived “fairness” of their new home. The reverse composition has a much bleaker outlook – when a “power-based” culture takes over a “role-based” business (or indeed, any of the other categories), the results are “potentially disastrous,” according to the authors. Incoming employees may react poorly to their new strictures, resulting in increased turnover and “culture collisions.” The cost of these collisions can be extremely high, reducing the performance of the acquired company by 25-30%.

Verdict: A task-based culture of the acquirer – in which there’s an emphasis on team commitment and a belief in the mission, where tasks are assigned based on its requirements rather than politicking or favors – is most likely to result in a smooth acquisition of the acquired company.

3. Moving first

“The first mover advantage is a myth,” the organizational psychologist Adam Grant once proclaimed in a TED talk. To back up his position, he drew on data that showed 47% of “first mover” companies failed in their early years compared to just 8% of late-arriving “improvers.”

While the Think Again author may have a point when it comes to building a business, it doesn’t apply to the buying process.

A 2008 paper published in The Academy of Management Journal outlines this dynamic. Authors Gerry McNamara, Jerayr Haleblian, and Bernadine Johnson Dykes begin by describing the cyclical nature of M&A activity. Between 1890 and 1990, the US witnessed four distinct waves that accounted for 50% of all acquisitions. These periods of frenzy saw thousands of companies snapped up over a matter of years, followed by a steep decline.

By studying 3,194 acquisitions across a twenty-year period, the researchers noted an intriguing relationship: acquirers that moved early in a market cycle found greater success than firms that jumped on the M&A bandwagon later. As shown in the chart below, companies that move in the first 5% of a new wave see positive abnormal returns of 4.2%. By contrast, those who make an acquisition at the height of a wave (roughly 65% through) see an abnormal return of -3%. As a wave heads towards its culmination, returns gradually improve, charting a U-shaped curve.

What explains this pattern? Why do first-movers see positive returns, but those in the middle of the pack don’t? A few dynamics are at play.

For one thing, first movers may be acting on asymmetric information – they know something that the rest of the market doesn’t yet. Because of this, they may be able to secure a deal at a reasonable price compared to those that follow. Additionally, they have their pick of available firms with little to no competition.

As more companies begin to partake in M&A, the environment shifts. Now, potential acquirers face significant competition, driving up prices, limiting selection, and forcing fast decision-making. The result is a string of hasty, costly, and ill-conceived marriages that only let up when the market cools.

Verdict: If you possess asymmetric information indicative of a technological or market trend, you should move early. If you don’t, hold off – and be careful not to copy a competitor blindly.

4. Practice makes perfect

Over their lifetimes, Apple, Amazon, and Facebook have all made more than 100 acquisitions each. Google has made more than 250. Such volume is no accident. The best companies understand that to find game-changing deals, you have to make M&A a habit.

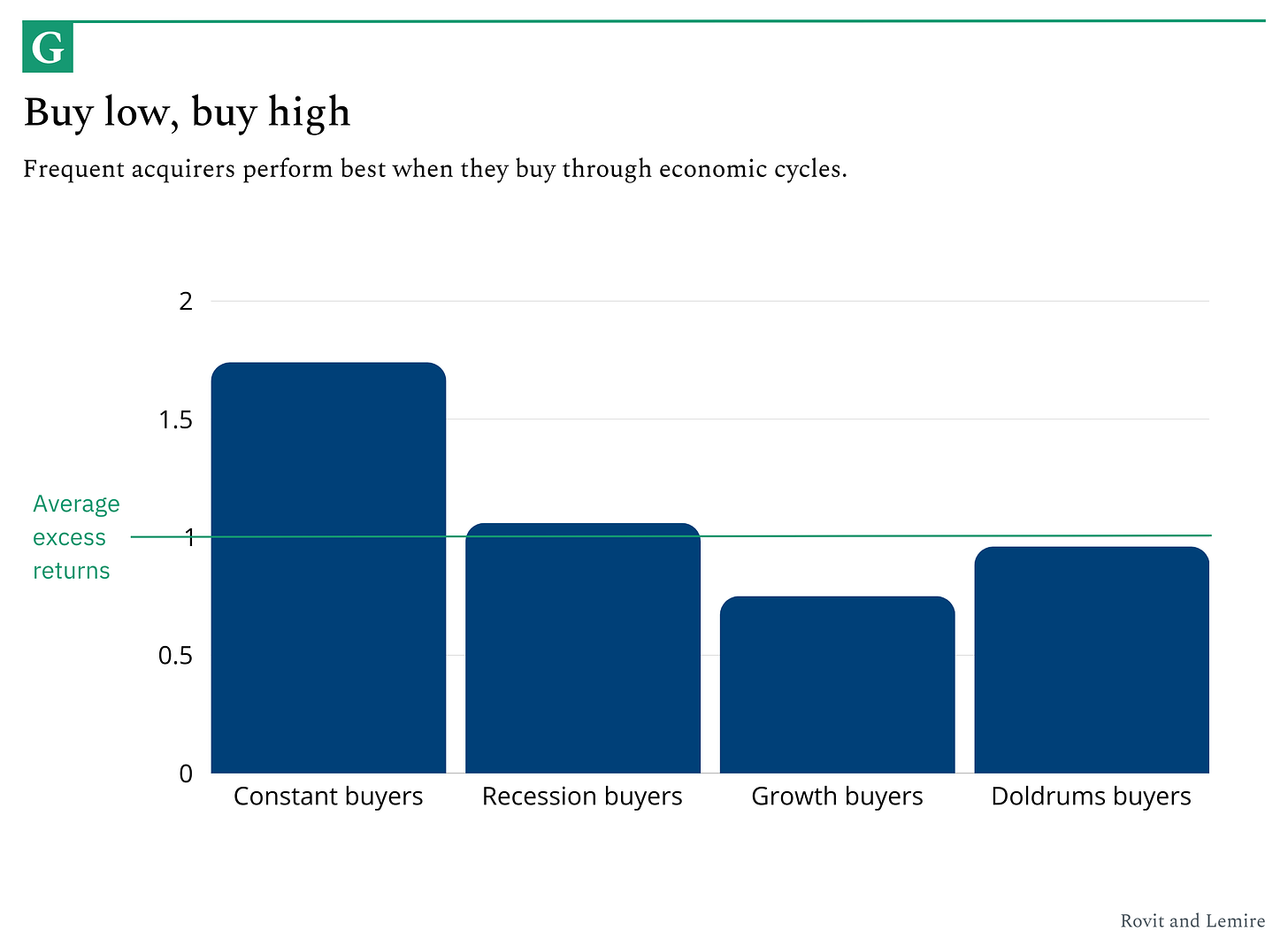

Research from Sam Rovit and Catherine Lemire bolsters this position. The duo analyzed 725 American companies with revenues over $500 million. In looking at this sample, the authors focused on the 7,475 acquisitions made between 1986 and 2001 and the excess returns they delivered to shareholders. The authors defined “excess returns” as “the total return to shareholders, including dividends, minus the cost of equity, or the investor’s expected return.” They then set the average excess returns at 1.

Rovit and Lemire split the frequent buyers into four groups:

“Constant buyers” bought consistently through economic cycles.

“Recession buyers” increased their buying in recessionary periods.

“Growth buyers” primarily bought in periods of economic growth.

“Doldrums buyers” tended to buy in stable or slightly uncertain periods.

As it happened, “constant buyers” proved the most successful by some distance. Not only did they outperform “doldrums buyers” by 1.8x, they surpassed “growth buyers” by 2.3x. “Recession buyers” had the second-best results, outperforming their growth-focused counterparts by 1.4x.

The authors subsequently honed in on what they termed “frequent buyers” – companies from any of the four categories that had completed more than 20 deals over the fifteen-year period studied. In simple terms, the authors effectively found that the more deals a company made, the more value it could deliver to shareholders. “Frequent buyers” delivered 2x excess returns compared to “nonbuyers” – companies that made no purchases during that stint.

Are Rovit and Lemire’s results an invitation to spray and pray? Should every company stampede to their nearest investment banker’s office?

Not quite. As it turns out, the most successful “frequent buyers” tended to follow a set of implicit guidelines:

Calculated bets. They started with small deals, institutionalized processes, and created feedback systems.

A prepared mind. They continually reviewed targets and kept lists of potential acquisitions they considered attractive should they become available at the right price.

A team of specialists. They built a standing acquisition team, allowing the company to strike quickly and effectively when the right deal arose.

Buy in from above. They involved management early in due diligence and devised clear guidelines for integrating acquired firms.

Verdict: Buying at the right price is an essential factor when reviewing a singular acquisition. Over time, however, if a company is making many acquisitions, a dollar-cost average approach will work better than trying to time the market.

5. True synergy

Few words evoke as disgusted a reaction as “synergy.” It is among the most-hated business buzzwords on the planet – a synecdoche for corporate mundanity, fluorescent meeting rooms, and brainless PowerPoint presentations. Yet, in its truest sense (liberated from its cultural baggage), it is the ultimate M&A achievement.

How can one achieve it? And what does synergy actually look like?

The great Clayton Christensen offers a persuasive depiction. In his paper, “The New M&A Playbook,” the late Harvard theoretician posits that, for a great acquisition, the acquirer needs to look at the critical acquired resources, as well as customer behavior. In a word, synergy.

Christensen and his co-authors provide a charming, seasonal example to illustrate the point:

“Many New England homes are heated with oil in the winter. Oil retailers typically make monthly deliveries. Suppose one retailer buys a competitor that operates in the same neighborhood. In that case, the parent buys the competitor’s customers and can eliminate the duplicate fixed costs of two trucks serving neighboring customers. Here, the critical acquired resource is not the trucks or drivers, which the company does not need to serve the new customers; it is the customers themselves, and they are plug-compatible with the parent’s resources, processes, and profit formula. That’s why the deal will lower the acquirer’s costs.”

Compare that with a situation where the retailer purchased a similar firm in a different city. In that case, the purchased company would replicate the parent’s cost position in a new geographic area rather than reducing it. There might be some overhead efficiencies, but the acquirer would save less money as the oil retailer would need the acquired company’s trucks to service its new customers.

Another temptation would be to try and cross-sell the oil retailer’s customers. They already buy oil from us, so why not sell them something else? Christensen warns that acquisitions whose rationale is to sell a variety of products to new customers will only succeed if customers need to buy those products simultaneously and in the same place. Again, “The New M&A Playbook” elegantly lays out its argument:

Let’s say Clayton Christensen is a typical shopper, who buys both consumer electronics and hardware. Wouldn’t Walmart, which carries both product categories, have a better chance of winning his business than Best Buy, which sells only consumer electronics, or Home Depot, which sells only hardware? In a word, no. That’s because Clay needs to buy electronics just before birthdays and holidays, whereas he needs to buy hardware on Saturday mornings, when he intends to repair something at home. Because these two jobs-to-be-done arise at different times, the fact that Walmart can sell him both kinds of products does not give it an advantage over the specialists. Typical shopper Clay does, however, buy gasoline and junk food at the same time—when he’s on a road trip. Hence, we have seen a convergence of convenience stores and gas stations.

Verdict: Consider acquisitions that contain critical acquired resources (trucks in the neighborhood) or true customer behavior (crossover in purchasing patterns.) Ideally, both!

Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance masterworks.com/cd

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Great post. Having sat on both sides of the M&A table multiple times this really resonated.

Particularly when you combine it all together e.g. Apple tends to buy very early stage companies with breakthrough tech but whose size and culture is easily assimilated into its own. Google has generally been less disciplined in this regard and some of the bigger players have struggled e.g. Nest, Waze etc...