A24: The Rise of a Cultural Conglomerate

The indie studio is behind some of Hollywood’s biggest hits and critical darlings. It has designs on becoming media’s answer to LVMH.

The Generalist delivers in-depth analysis and insights on the world's most successful companies, executives, and technologies. Join us to make sure you don’t miss our next briefing.

Brought to you by Mercury

Even with big ambitions, only a small percentage of startups make it. Mercury Raise is here to change that.

Introducing the comprehensive founder success platform built to remove roadblocks at every step of the startup journey.

Looking to fundraise? Get your pitch in front of hundreds of the right investors with Investor Connect.

Craving the company of people who get it? Join our Slack community of vetted founders for access to networking opportunities, moderated discussions, curated news, and AI-powered intros. Plus, participate in AMAs with renowned investors and industry experts.

Searching for answers to the questions you can’t Google? Step into Expert Sessions, the virtual offices of top investors, founders, and operators for personalized guidance and direction-setting insights.

With Mercury Raise, you don’t have to go it alone.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about A24.

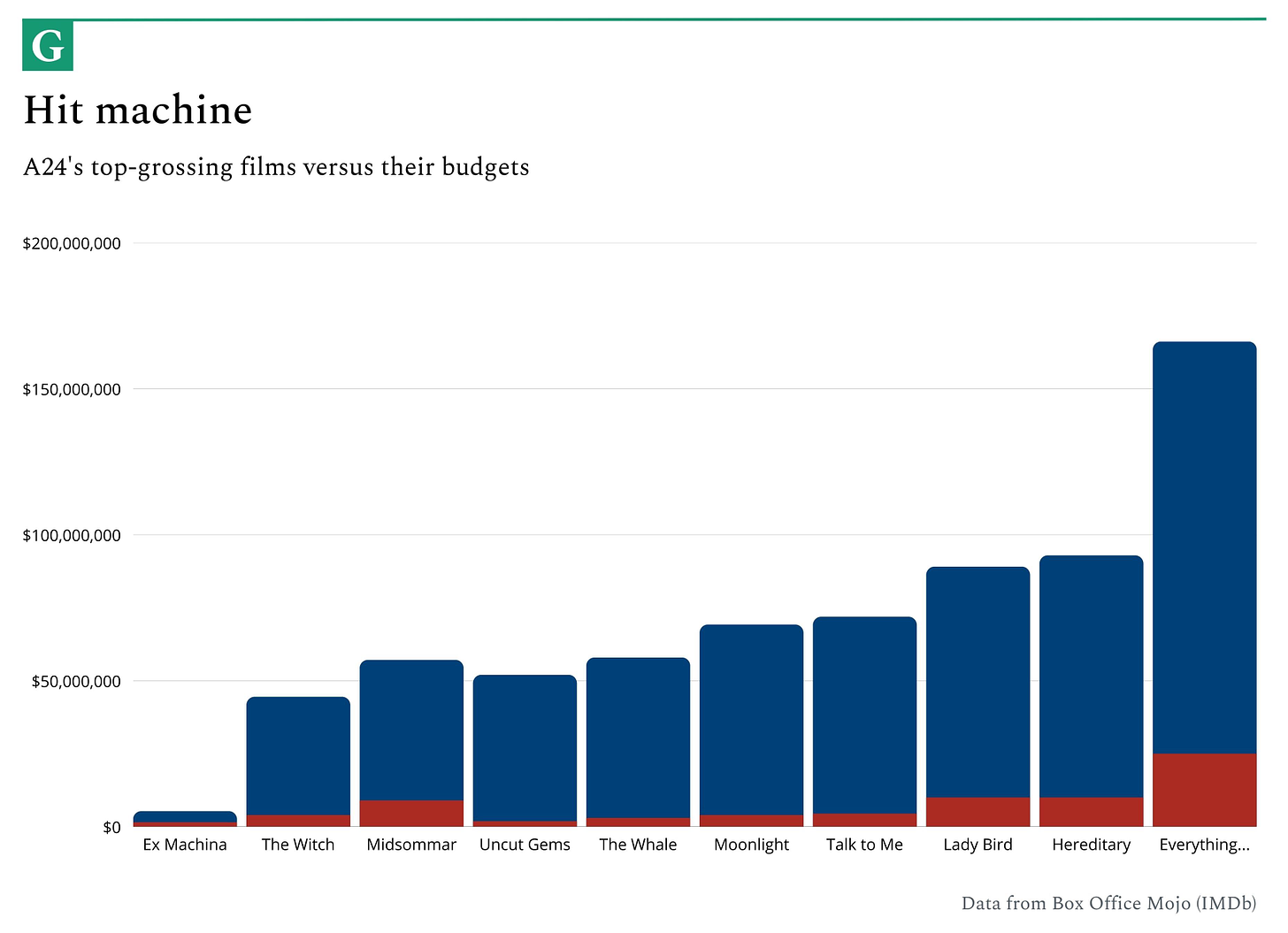

Indie no more. A24 may have started life as a small, indie shop, but the last eleven years have seen it morph into a cinematic powerhouse. At the last Academy Awards, A24’s Everything Everywhere All At Once picked up seven Oscars. It also grossed more than $140 million globally on just a $25 million investment.

The rat hole. Film studios don’t tend to make the best investment. Indeed, one Hollywood producer warned private equity investors that they were throwing money “down a rat hole.” The numbers tell a similar story: just 3.4% of independent films in the US make a profit, and 90% never get a theatrical deal. A24 is beating the odds.

Extremely online. How has A24 thrived in such a challenging industry? Its understanding of internet culture, fandom, and customer acquisition has been critical to its success. Like few other brands – let alone fellow studios – A24 has mastered social media distribution. This is a company that understands how to capture and capitalize on attention.

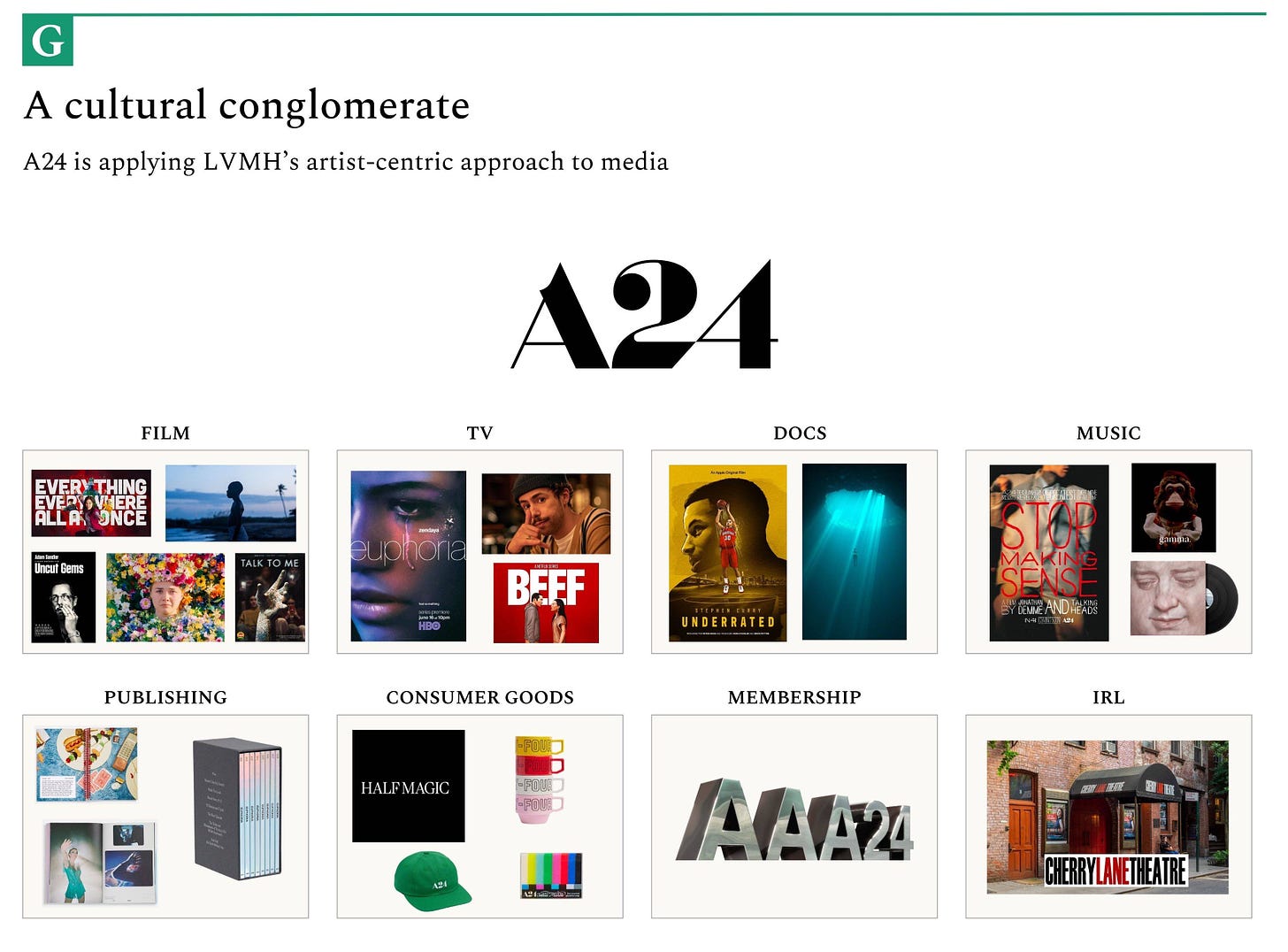

Moving beyond movies. While A24 is primarily a film studio, the last few years have seen them expand their reach. The maker of Moonlight and other filmic masterpieces is pushing into scripted television, sports documentaries, podcasting, publishing, music, and even cosmetics. It could be the makings of a prestige media conglomerate.

Talent in turmoil. Hollywood is in crisis. After more than two months of striking, the unions representing screenwriters and actors remain locked in a stand-off with the industry’s big studios. The use of artificial intelligence is just one of the issues at stake, but it casts a long shadow. Already, the technology shows signs of upending content creation as we know it. A24 and others will need to be awake to its disruptive power.

Stranded on a beach, a suicidal man finds a washed-up corpse (Daniel Radcliffe). Five minutes later, the man is riding the corpse like a jet ski, powered by the dead fellow’s flatulence. Swiss Army Man, the debut of directing duo Daniel Kwan and Daniel Scheinert, led to a series of walkouts at Sundance Film Festival, and, initially, only one underwhelming distribution offer from Netflix.

Then A24 appeared. According to Scheinert, A24 was so keen on the film that the firm’s Head of Acquisitions told the directors “he would jump out of a window” if they picked a different partner. While major studios were scared off by a movie about a farting corpse (played by Harry Potter), A24 knew that would be exactly what their core audience – terminally online, culturally-adventurous millennials – would love to watch.

Six years later, the same directing duo, known as “the Daniels,” released a film about a middle-aged, Chinese-American woman who runs a laundromat. On a budget of $25 million, Everything Everywhere All At Once surpassed $140 million at the box office, scooping up seven Academy Awards in the process. On its surface, Everything Everywhere seems antithetical to traditional Oscar fare: it’s a Marvelian-multiverse-sci-fi-comedy, starring an older Asian woman, with subplots involving animate rocks, an enchanted everything bagel, and hot-dog fingers.

The success of the film is a testament to the creators and cast. But it’s also a reflection of the strategy of the studio behind it. As a former studio executive remarked, “You get to an Everything Everywhere All at Once because A24 nurtured the Daniels.”

Since its founding in 2012, the New York-based firm has taken a contrarian path to cinematic success. While Hollywood’s major studios have spent the last decade pumping out superhero vehicles, A24 has embraced creative risk. Rather than looking to underwrite safe bets, founders David Fenkel and Daniel Katz look for true auteurs – then back them to the hilt. From one vantage, it’s an almost venture-like search for outliers; from another, it resembles LVMH’s designer-centric approach. As at Bernard Arnault’s luxury conglomerate, for A24, the artist is sovereign.

So far, it’s worked. Alongside the Daniels, A24 has backed the visionaries behind hits like Uncut Gems, Hereditary, Lady Bird, Midsommar, and Ex Machina. As well as delivering strong returns – and propelling the shop to a $2.5 billion valuation – A24’s filmography has earned critical respect and accumulated rare cultural power. It has become a brand unto itself, celebrated for its weirdness, distinctiveness, and craft. Though the titles mentioned differ in subject matter and style, they possess some shared DNA, an A24 allele, difficult to articulate but there nonetheless. That singular essence has spawned an unusual fandom: moviegoers are not only besotted with individual releases but the studio itself. Consumer devotion of this kind is unusual for those who stand behind the curtain. Though many may love the stories they tell, few would consider themselves Paramount obsessives, Columbia Pictures devotees, MGM ultras.

Like Disney before it, A24 is an exception to this rule. And like the House of Mouse, it has started extending its consumer relationship beyond the screen. Over the past few years, A24 has pushed the borders of its empire, moving into TV, music, publishing, physical experiences, and even cosmetics. It takes little imagination to see the contours A24 is following, to find a redux of Walt’s strategy designed for the 21st century.

A24’s modernity, especially from a tactical perspective, is an underrated aspect of its story. Yes, its success stems from its differentiated taste and unusual support for artists. But it is also a technology story. Social media smarts underpinned the firm’s rise, allowing it to acquire attention much more cost-effectively than its more backward-minded peers. So did its understanding of internet culture, memes, and viral mechanics. Over the past decade, no studio has more efficiently inserted itself into the online zeitgeist, seasoning our feeds with satanic goats and Oscar Isaac dance sequences.

A24’s tech-savvy may make it better placed to weather the existential seiche sweeping across Hollywood. Tensions between talent and the big studios reached a boiling point this summer, resulting in an industry-wide strike. Among these organizations’ demands is an appeal for safeguards around the use of artificial intelligence. Concerns around the misuse of actors’ likenesses are arriving not a moment too late as new models make creation and emulation increasingly life-like. It puts A24 in an interesting position: the champion of talent at a time when their value is in flux. Only time will tell if A24 is a beneficiary or casualty of such a seismic disruption.

To understand A24’s origins, rise, playbook, and future, we conducted deep research and interviewed several senior sources at the studio.

Origins: The making of A24

Autostrada 24 (A24) is a 103-mile highway linking Rome to Teramo. It’s largely the domain of Roman commuters and the occasional petrified tourist driver. It also happens to be where, in 2012, Daniel Katz came up with the idea for a company that would change the entertainment industry.

There was a haze over The Eternal City as Katz approached the outskirts of Rome, but his mind was clear. The Guggenheim Partners investor had always dreamt of starting a company – perhaps in the film industry, which he specialized in financing – but a fear of failure had halted his ambitions. Katz’s concerns were far from irrational: just 3.4% of independent films in the US make a profit and 90% never get a theatrical deal. Few would have been as aware of such unfavorable odds.

But as Katz motored down the autostrada, taking in the Italian air, he experienced an entrepreneurial epiphany:

I was with a bunch of friends, and we were in the south of Italy, and we were driving into Rome and I kind of had this moment of clarity. And it was on the A24 [motorway]. And in that moment I was like: Now it’s time to go do this.

It was only fitting that Katz would choose to name his company after the site of his inspiration.

An insipid status quo

Though admirable, Katz’s conviction and professional bonafides were no guarantee of success. If the financier shared his grand vision over a plate of cacio e pepe that evening, one could forgive any skepticism on the part of his traveling companions. After all, independent film is a graveyard of plucky, ambitious companies founded by capable people. It’s cost-intensive to start, and difficult to reap rewards. The fortunate ones struggle on until bought by one of the major studios. The late Jake Eberts – producer of classics like Chariots of Fire and Driving Miss Daisy – summarized the nonexistent returns indie films typically yielded, telling private equity investors they “might as well throw their money down a rat hole.”

To avoid lining the rodents’ residences, Katz teamed up with two other industry experts: David Fenkel and John Hodges. Both had led distinguished careers in film. In 2008, Fenkel had co-founded Oscilloscope Laboratories, the company behind We Need to Talk About Kevin, and an adaptation of Wuthering Heights. Hodges, meanwhile, had led development and production at Big Beach Films. Among the firm’s successes was 2006’s Little Miss Sunshine, a surprise indie smash that won two Academy Awards and grossed more than $100 million from an $8 million budget. Though experience was far from a guarantee of success, A24’s founding trio combined a strong blend of financial, operational, and acquisition experience.

Beyond their expertise, Katz, Fenkel, and Hodges shared a similar view on the state of the movie industry – one warped by the dynamics of the large movie studios. There’s a saying in venture capital: “your size is your strategy.” The idea is that the amount of money you manage determines the playbook you can run. A bespoke fund with $10 million under management can operate a very different strategy to Coatue with its colossal stack – and vice-versa. For the smaller shop, an investment of $1 million that appreciates 10x makes a huge difference, returning the fund. For a megafund, it would barely make a dent. To deliver a meaningful return, these larger vehicles have to put more money to work and swing for bigger returns.

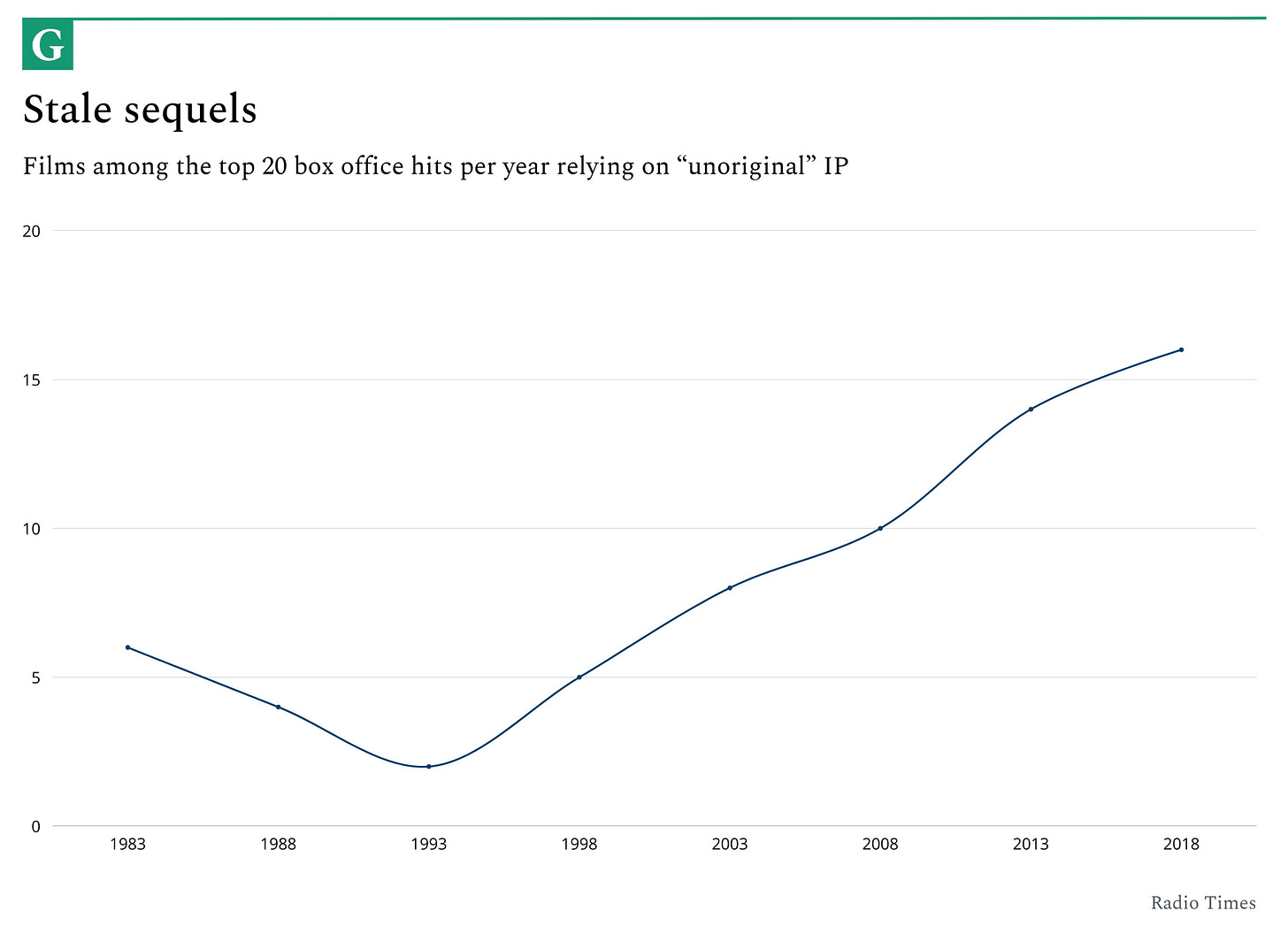

Similar dynamics play out in the film industry. The big studios preside over large war chests that must be deployed. Because of their size, it makes little strategic sense for players like Paramount, Columbia, or Warner Bros. to invest $5 million into a small, speculative project that might pull in $30 million. This is why they focus their efforts on high-budget vehicles that have the potential to gross billions globally. To minimize the risk of this outlay, major studios have gravitated towards safe bets like sequels and reboots. Why bet on an unproven indie concept when you can disgorge another iteration of Fast and Furious?

The impact these incentives have had on film production is clear. Over the past thirty years, prequels, sequels, reboots, and spin-offs have come to dominate box office charts. The direction of travel was readily apparent by 2012. Nine years earlier, in 1993, just two of the twenty top-grossing films were derived from “unoriginal” IP. By 2008, that figure had climbed to ten; by 2013, fourteen.

A24’s founders had noticed this decay. Rather than bemoaning it, however, they spotted an opening. Just because big studios didn’t want to make opinionated indie films anymore didn’t mean that audiences didn’t want to watch them. On the contrary, amidst an increasingly homogeneous cultural landscape, projects with a genuine point of view could have an outsized impact. “Films didn’t seem as exciting to us as when we started our careers,” Katz noted. “And that signaled an opportunity.”

The disruptive distributor

For such a colorful industry, much of the nomenclature Hollywood uses can be rather drab. What role in the creative process does the producer play? What exactly does a distributor do? To those with an understanding of the industry, such questions are as basic as asking what part a product manager or UX designer plays at a startup, but for those uninitiated, it's worth distinguishing.

In simple terms, producers bring a creative project to life. They are manager and orchestrator, coordinating between stakeholders from pre-production through to a film’s release. In addition to being the party that finds a script and secures financing, they help hire behind-the-camera talent, keep the shooting process on the rails, play a role in editing, and position the project to become a box office hit. It’s not uncommon for multiple production companies to collaborate on a given project.

Distributors play a much more limited role. They arrive once a film is finished and work to release it as successfully as possible. That involves striking deals with theater chains, implementing a marketing strategy, and negotiating overseas circulation. Though a distributor’s job is fundamentally consumer-facing – their goal is to sell tickets – they tend to operate subtly. They are, in a sense, the infrastructure software of the film world. They’re fundamental, but if they’re doing their job right, you’ll barely notice them. Indeed, many cinemagoers scarcely realize there’s a whole industry that just buys finished films and puts together all the trailers, posters, and, occasionally, life-size Barbie boxes.

A24 began its life as a distributor. Its team frequented film festivals, acquired the rights to promising pictures, and set about marketing them. It was a pragmatic starting point, grounded in the reality of the firm’s size. Rather than risk vast sums taking a project from script to screen, A24 concentrated its capital on finished projects that at least had a shot of delivering a return. “When we started, it was last money in, first money out,” one executive noted.

If that was A24’s sole strategy, they would not have become the innovative company they are today. In addition to sitting in a de-risked part of the stack, A24 made four critical decisions that became a core part of the firm’s strategy:

Operate like a startup.

Make small bets.

Find outlier auteurs.

Embrace the internet.

A24’s differentiated strategy starts with its distinctive culture. In many respects, it’s a firm inspired by Silicon Valley rather than Hollywood. “We’ve been very influenced by how technology companies think about the world,” one executive remarked. Another affirmed that position, referring to A24 as “more akin to a tech company than a classic studio.”

Employees receive equity in the business, and the company operates with a flat organizational structure. Indeed, the firm’s headquarters in New York has been specifically designed to accommodate this approach. “No one has an office; everyone sits out on an open-plan floor,” one source remarked. This atmosphere is designed to encourage team members to share ideas, regardless of their position in the organization. Above all, A24’s management seems to want to provide the freedom to ideate and experiment. “I felt like there was a huge opportunity to create something where the talented people could be talented,” Katz said. That is more than just talk – A24 has purchased projects recommended by employees outside its core acquisition team.

While ownership, openness, and a meritocracy of ideas are standard in the startup world, they are aberrations in the more rigid, old-fashioned entertainment business.

A24’s culture may be progressive, but its financial strategy is on the conservative side. When it comes to investing in a project, A24 makes purposefully small investments. It does so to spread the risk around and ensure that a couple of bad bets don’t jeopardize the viability of the enterprise itself. This was particularly important in the firm’s early days when it operated with a more constrained budget, though it remains true today. “We specifically size films so that they’re not massive swings,” one executive remarked.

Such fiscal prudence gave A24 the confidence to take risks elsewhere – namely, on the creative side. From the very beginning, Fenkel, Katz, and Hodges made the decision to seek outlier auteurs, those with bold, original visions. Their thesis was that gifted creators with a distinct point of view would appeal to younger audiences seeking an antidote to Hollywood’s stale sequel machine. While other distributors and producers often tried to subdue directors’ stranger creative instincts, A24 took the opposite approach, leaning in. “Every project they do is ride or die,” one streaming executive said of A24. “And they make creators feel that way. It’s their superpower.”

Beginning life as a no-name upstart, A24 took particular pains to emphasize its creator-centricity. In 2012, for example, the distribution rights for Harmony Korine’s Spring Breakers became available. It was a pitch made for Katz: A hazy fever dream set in a swampy demi-monde, directed by one of the most interesting experimental filmmakers alive. He wasn’t about to let it get away.

To woo the film’s producers, Katz’s team sprang into action. Head of Acquisitions Noah Sacco recalled the episode. “I woke up one morning to an email from Daniel that was sent at three in the morning: “Can you go to Pittsburgh?” I come into the office, and there are interns running around like in some crazy factory.”

An ordinary gift basket wouldn't suffice for the team behind Spring Breakers. To stand out from the chasing pack, Katz had tasked his staff to commission a custom set of gun-shaped glass bongs, engraved with the film’s logo. If anything showed A24’s understanding of Korine’s world, surely, this was it.

The bongs did the trick. Spring Breakers became A24’s first big win, turning a $5 million budget into $32 million at the box office.

In addition to validating demand for the types of films A24 wanted to showcase, Spring Breakers showcased the startup’s distribution chops. In particular, it illustrated the fruits of embracing the internet as a marketing channel.

In 2012, few studios or distributors had learned how to leverage the web’s disruptive power. Incumbents had yet to truly understand social media dynamics, memetic content, and online culture. In their defense, although the internet and social media were far from novel by then, they had yet to become as ubiquitous as they are today. It had only been five years since Steve Jobs debuted the iPhone, bringing handheld internet access to the mainstream; the same year that A24 launched, Instagram sold to Facebook for $1 billion.

As geriatric studios tried to figure out how to connect to the WiFi, A24 made a virtue of its youth. The early 2010s were an era of Manifest Destiny in social media marketing, a time before advertising dollars had flooded in and when content was shifting from text to image-based. Between your uncle’s daily bible quote and a friend’s relationship update lay acres of barren news feeds, waiting to be claimed. A24 moved to colonize all of them, setting up accounts on Facebook, Instagram, Twitter, Tumblr, Snapchat, and Pinterest. The firm reaped the benefits of low competition and seems to have continued to do so. According to one executive, A24’s marketing spend is “many multiples” better than other studios.

Its promotion of Spring Breakers demonstrated the firm’s ability to titillate, court the right amount of controversy, and capture attention online. Since the film starred Disney Channel favorites Vannessa Hudgens and Selena Gomez, much of A24’s marketing materials played up the fallen woman narrative; innocence, corrupted. To stir up excitement about James Franco’s against-type performance as a cornrowed hustler, A24 published a rendition of the Last Supper, with Franco’s character as Jesus. It quickly went viral on Facebook.

In the years that followed, A24 kept pushing boundaries in online marketing. In 2015, the firm purchased the distribution rights to Alex Garland’s sci-fi drama Ex Machina. The film explores the emergence of artificial general intelligence, represented in the figure of Ava, a humanoid robot portrayed by Alicia Vikander. To build buzz around the film, A24 created a Tinder bot in Ava’s image, releasing it at South by Southwest. It was a clever stunt, earning a score of articles from mainstream publications.

It helped deliver another significant win – both commercially and critically. Ex Machina grossed $36 million at the box office from a $15 million budget. It earned widespread acclaim, receiving Oscar nominations in the “Original Screenplay” and “Visual Effects” categories, winning in the latter. Writer and director Alex Garland did not mince words when discussing A24’s impact. “I would say that if Ex Machina had been distributed by a big studio, the film would not have been remotely as well received or successful as it was.”

In just three years, A24 had built a promising financial track record and even landed an Academy Award. Within two more, it would have a Best Picture winner on its hands.

The means of production

In 2016, A24 decided it was time to level up. If it wanted to be a true entertainment power player, it needed to do more than simply distribute films. It was time to play the role of producer. Whether beginner’s luck or another vindication of A24’s taste and strategy, the firm could not have picked a better first film to co-produce.

That year, A24 reviewed an adaptation of Tarell Alvin McCraney’s play, In Moonlight Black Boys Look Blue. It had been written by McCraney and Barry Jenkins, a 37-year-old filmmaker with a largely undistinguished background. Jenkins had built a career as a director and writer without breaking into Hollywood circles. He’d directed a few short films, written for HBO’s The Leftovers, and worked as a carpenter to make ends meet. By Jenkins’ own admission, he and Moonlight represented an unorthodox choice for the new production house.

"If I told you I was opening a Hollywood studio and the first film I was going to put my money into was going to be a triptych film about a gay black boy whose mom was addicted to drugs, made by a filmmaker who's only made one film for $15,000, would you say, 'Yes, that sounds like an awesome idea?' Probably not," Jenkins said. “But these people did.”

Critically, Jenkins was as excited about teaming up with the studio as they were with him. “The biggest thing that stood out to me – and why I was so ready to make Moonlight – was that I always felt you could feel the filmmakers’ voices in their films.”

To call the partnership between Jenkins and A24 a success would be an understatement. Moonlight debuted to rave reviews and widespread critical acclaim. As well as scoring more than $65 million from its $4 million budget, Jenkins’ picture earned eight Oscar nominations. Its trip to the Academy Awards provided a publicity stunt even marketing masters A24 couldn’t have devised.

The first Academy Awards ceremony was held in May 1929 at The Hollywood Roosevelt Hotel. Fifteen statuettes were awarded, and the ceremony ran for fifteen minutes. The 89th Academy Awards took place in February 2017. In attendance: Lady Gaga sporting a feather boa, a mustachioed Bill Murray, A24 founders Katz and Fenkel, and Barry Jenkins. As the evening headed towards its close, the Moonlight team had much to be happy about. Already, they’d received awards for Best Supporting Actor and Best Adapted Screenplay — good going for any studio, let alone an indie on their first production.

It was the presentation of the Best Picture award that brought the night to its crescendo. After a few quintessential banalities about the transformative power of film and the relationship between art and politics, they announced the winner: La La Land. The music started, and the La La Land team ambled down from their seats and up onto the stage. People embraced each other, statuettes were presented, and the speech started. But something wasn’t right. Fenkel and Katz recounted what happened next:

Fenkel: I stare straight ahead. I don’t even look at him. I say, “Don’t go there.” Because what happened was, someone ran out with a red envelope. We saw the red envelope. And when you’re a loser, you think for a split second, Maybe they got it wrong.

Katz: By the way, a thousand times out of a thousand, you’re wrong. You lost.

Fenkel: And then I started saying, “No way. No way.”

Katz: It was just like, “Wait. Did Moonlight just win Best Picture?”

When the mistake was realized, La La Land producer Jordan Horowitz strode to the podium and announced there had been an error: Moonlight had, in fact, won the Oscar. Cue: pandemonium, confusion, and celebration.

Fenkel: You don’t know how to control yourself. I think we lost control. But you’re in a tuxedo and everyone around you is older and they’re quiet…

Jenkins: It sucks, man, because of how it happened, none of us thanked them! But I do remember finally looking over, because I didn’t know where they were sitting, and I spotted Dan Katz and Dave Fenkel, and, man, the smile on their faces! I just raised the Oscar at them. I was like, “Fuck yeah!”

In their freshman year, A24 won the biggest prize in filmmaking.

Jenkins’ masterpiece cemented A24’s arrival in earnest. It also accelerated its run of critical and commercial successes. The year after Moonlight’s release, Greta Gerwig’s directorial debut Lady Bird earned five Oscar nominations and won two Golden Globes. It also grossed over $78 million globally, a then-record for A24. That record was broken the following year with Ari Aster’s Hereditary. Uncut Gems, released in 2019, didn’t receive quite the same level of box-office success but was critically lauded. As The Hollywood Reporter noted: “Many will agree that [Uncut Gems] is Sandler's best performance, and the Safdies will finally move from the fringes of the commercial film scene to somewhere closer to the center.”

A24 reached new heights in 2022, its ten-year anniversary. Everything Everywhere All at Once delivered the firm’s biggest hit yet, grossing over $140 million globally on a $25 million budget and winning seven Academy Awards. It was a sign of how far the studio had come that The Whale, which grossed $50 million and won Brendan Fraser an Academy Award, ended the year second-best. A decade after its inception, A24 had reached a new height, better capitalized and critically-acclaimed than ever. Where would the studio turn next?

Evolution: A cultural conglomerate

“They have very good taste in movies,” film critic Alison Willmore said of A24. “They’re good at picking directors to work with, at buying movies when they buy movies. But they, more than anything else, are an incredible triumph of branding.”

Like few other studios, A24 has built a unique identity for itself, a singular voice. Though its filmography crosses genres, ranging from “psychological thrillers set in 1890s lighthouses to slapstick romps about intergenerational trauma,” there’s an unmistakable throughline. A24 products have a level of craft, personality, and specificity that stands apart. It’s this final quality that’s particularly notable. As one commenter noted, “The studio doesn’t just make a ‘high-school movie,’ it makes a ‘Catholic school in Sacramento in the spring of 2003 movie.’”

The strength of A24’s brand and its connection to consumers has empowered its latest evolution. Over the past two years, leadership has overseen a radical expansion in scope, pushing into television, documentaries, music, publishing, cosmetics, digital memberships, and physical experiences. Though many of these initiatives are unproven, they contribute to the sense that A24 is less a film business and more an emerging cultural conglomerate. Though operating at a very different scale, A24’s obsession with craft and elevation of the artist evokes LVMH. It seems obvious that Fenkel, Katz, and Company have drawn at least as much inspiration from Bernard Arnault as Walt Disney; this is a luxury playbook applied to modern media.

As one A24 executive remarked, the company’s goal is to build “a singular brand in the media space.” To understand how it seeks to do so, one must grasp the different pieces in play.

Television

Starting in 2015, A24 began experimenting with television production. It was a typically farsighted move. Though streaming was already popular, it had yet to reach today’s heights. For the first four years of its operations in that category, A24 acted cautiously. It released some stand-up specials and comedy series as it built out its film arm.

Twenty-nineteen marked a turning point. That year, A24 landed two hits: Ramy, a soulful comedy on Hulu, and Euphoria, a drug-addled teenage drama on HBO. The latter series has proved a particular success, snagging a score of Emmys and huge ratings. Euphoria’s second season averaged 20 million viewers, making it HBO’s second-most-watched show since 1994, behind Game of Thrones. Less tangibly, the Zendaya vehicle has become the zeitgeisty hit studios dream of. Over the next couple of years, A24 seems to have a full slate of promising projects and partnerships with all of the major streaming services.

Not all of A24’s productions have been hits, of course. The novelty of seeing The Weeknd play a deranged svengali couldn’t save The Idol from low ratings and public ridicule. The nature of the business means that other fizzles are inevitable. But given A24’s exceptional selection in the film world, it seems a safe bet to imagine the firm will more than make up for its misses.

Documentaries

In 2021, A24 released Val, a look at the life of Val Kilmer, drawing from the 800 hours of home videos the actor had recorded over the years. Though far from being a smash, it was a significant moment for A24, marking the studio’s step into the world of documentaries.

Though this part of A24’s business remains immature – it has released just four documentaries in total – insiders see it as a promising initiative. In particular, sources pointed to Underrated, a documentary about NBA legend Steph Curry, as a sign of things to come. As this executive remarked, sports have natural narrative arcs, but those arcs are often relayed with little creativity. A24 will believe it can bring its quintessential freshness, perspective, and personality to the genre. In doing so, it will step on the toes of ESPN Films, the firm behind the popular 30 For 30 anthology and Chicago Bulls series The Last Dance. Box to Box, the house behind Formula 1 favorite Drive to Survive is another notable, growing force with big ambitions in the sporting arena.

Beyond the storytelling opportunities sports afford, the chance to cozy up to another category of “creator” may be an enticement for A24. Athletes are increasingly recognized as content creators, owners of their personal IP. Michael Jordan is the canonical example of an athlete who recognizes this power, turning court abilities into a fashion empire, feature film appearances, and – decades later – a hit documentary about it all.

While Jordan has effectively leveraged the narrative power of his story, scores of other exceptional athletes have not. Where are the miniseries about Messi, Federer, Biles, and Bolt? Increasingly, A24 will hope it can be the narrator for these superstars, turning their accomplishments into winning content.

Music

In 1958, Jack Warner launched a music business. The Warner Bros. executive did so less in keeping with a considered strategy, more in a pique of jealousy. The year prior, one of the studio’s actors, Tab Hunter, had released the song “Young Love.” The record quickly climbed to the top of the Billboard charts and would go on to sell more than two million copies. The only problem? Hunter’s song had been produced by Dot Records, a subsidiary of rival studio, Paramount. To ensure his firm profited from Hunter’s next album, and the musical creations the rest of its talent pool might produce, Warner Music was created. Over the intervening six-and-a-half decades, it has grown to become the third-largest label in the world.

Warner Music’s origin story illustrates the strategic impulses behind A24’s own forays into the sector. From Hollywood’s early days, talent has drifted between cinematic and musical pursuits, making money in both. It is only logical that studios should wish to leverage their relationship with talent to capture a piece of such exploits. Fundamentally, these firms seek an unequal relationship – asking for monogamy from their creative clients while managing multiple liaisons of their own.

Though A24 may not think of the matter in such Machiavellian terms, they are shrewd enough to recognize the value a music division can deliver. So far, “A24 Music” is in its early stages. It has its own e-commerce store for fans to purchase the vinyl soundtracks of favorite films and associated merch. It’s joined by a sparse YouTube channel.

A24’s restoration and re-release of Stop Making Sense is its most significant music-driven project to date. The recording of a 1984 performance by Talking Heads is considered by some to be “the greatest concert movie of all time.”

It’s intriguing to consider how A24 might develop its musical ambitions. Will it look to apply its formidable talent-spotting skill to find up-and-coming bands? Its cinematic distribution gives it an advantage over standalone indie labels. As seen with Netflix’s Stranger Things, popular shows can be kingmakers in the charts. The placement of Kate Bush’s “Running Up That Hill” in the show gave Bush her first UK number one in 44 years and first ever US Top 10 hit, 37 years after the song’s debut. Young artists looking to make their mark could do worse than snagging a spot in an episode of Euphoria.

The more obvious play would be for A24 to lean into more projects like Stop Making Sense. As with athletes, musicians are IP creators – both in the literal and more abstract sense. In addition to interest in their songs and performances, audiences are intrigued by their life stories. While Taylor Swift chose Tremolo Productions for her Netflix-distributed documentary Miss Americana, A24 will hope her next film bears its name.

Beyond its own music initiatives, A24 has taken an interest in others. The company invested in Gamma, a startup founded by Larry Jackson, former global creative director of Apple. Details are vague for now. In its own words: “Gamma is not a label. It is not a management company. It is connective tissue, bridging the gap between enigmatic genius and everyday life.” So far, the firm has signed Usher and Rick Ross; it reportedly has its eyes on snagging Dr. Dre’s discography, too.

Publishing

A24’s publishing efforts are at a similarly early stage. Visit the company’s website, and you’ll find a mix of books, screenplays, and zines available for purchase. Most directly riff on existing intellectual property – scripts of popular A24 films, or lookbooks showcasing particular shots with director commentary.

Other offerings come from the minds of A24’s stable of creators or riff on the industry in general: A children’s book written by Daniel Kwan (one half of the Daniels directing duo), a cookbook with recipes from famous films, a movie-themed crossword set.

In its current iteration, this isn’t particularly interesting, but it's intriguing to consider what a full-fledged publishing arm could mean for A24. Though books attract much less mainstream attention than films or television shows, they remain the best source of new intellectual property. Our favorite movies and series often begin life as novels, biographies, or comic books.

If A24 wanted to, it could begin to publish original written work, vertically integrating IP production. If done correctly, it could turn its most popular books and graphic novels into films, spin-off TV shows, and finally immersive experiences. Given the rundown state of the publishing industry, A24 would arguably be able to compete relatively quickly and could do so from an advantaged financial position given its success elsewhere. The possibility of having one’s work turned into a movie would likely be attractive to many authors, particularly when the studio in question has demonstrated its respect for an artist’s vision.

At present, publishing doesn’t seem to be one of A24’s focus areas. But building a roster of latent IP, waiting to be adapted, could be a farsighted move.

Consumer goods

The crystallization of A24’s cultural significance and creator-centricity came in the formation of Half Magic, a Europhia-inspired beauty brand.

The show features a distinctive makeup look that has been called “the biggest trend beauty has seen since contouring.” The hashtag #euphoriamakeup on TikTok has 2.5 billion views and averages over 100,000 online searches monthly. As the “Euphoria look” skyrocketed in popularity, makeup artist Donni Davy found herself inundated by beauty brands looking to forge a partnership.

A24 had given Davy her first big break in the entertainment industry. She had been working odd jobs around Los Angeles when she landed the role of makeup department head for Moonlight, going on to helm Euphoria. That history contributed to a shared trust. And so when Davy received commercial interest in her artistry, she approached A24 for advice. To the studio’s credit, they recognized the opportunity before them. Why encourage an exceptional talent to collaborate with another company when the studio had the resources it needed in-house? Though A24 might not have launched a makeup brand before, it had proven its marketing mastery and succeeded in building a thriving e-commerce presence of its own. Its in-house merch line – featuring frequent collaborations with other brands – tended to sell out instantly. Could it use those talents to co-launch a brand new venture?

In 2022, Davy founded Half Magic, a cosmetics company backed by A24. Though it may seem like a divagation from the company’s entertainment focus, executives see it as part of the same high-level strategy: find outstanding artists and give them the freedom to thrive. As one source remarked, the company's goal is to “provide a platform for great storytellers,” whether those stories are told through film, song, or chromemaddiction matte eye paint.

Involvement from outside investors has affirmed the potential A24 sees in Half Magic. A January press release revealed that Alliance Consumer Growth (ACG) had led an investment into the startup. “Some of the most successful brands in beauty over the past couple of decades and beyond have been practitioner-led artistry brands,” said Julianne Kur, principal at ACG. “When we think of Half Magic, we really think they’re creating the artistry brand for Gen Z, with Donni really being that credible artist.” ACG has previously backed successful consumer brands such as Harry’s, Shake Shack, and Skims.

While the creation of Half Magic was opportunistic, it’s unlikely to be the last of A24’s joint ventures in the consumer goods world. COO Matthew Bires said as much, noting that the company is working to create a “platform for all types [of creators] to create consumer products.”

Just as LVMH has benefitted from partnering with Rihanna on Fenty Beauty, A24 will believe it can do similarly, helping its artists build empires in fashion, skincare, jewelry, alcohol, and other brand-heavy ventures suited to celebrity involvement. Your next favorite reposado may arrive courtesy of Harmony Korine.

Digital membership

One of the reasons film production and distribution is such an unforgiving business is that revenue is unreliable. It arrives in lumps – as a film attracts viewers – and those lumps are of varying, unpredictable magnitudes. Promising projects can flounder at the box office while disastrous productions may find a cult following.

A24’s membership is an attempt to secure a reliable source of revenue, albeit at a small scale. For $5 per month, subscribers to “A24 All Access” (AAA24) receive a quarterly zine, the occasional free movie ticket, early access to merch drops, and entry into the brand’s “close friends” circle on Instagram. Though A24 has yet to make membership figures public, the “close friends” circle numbers north of 16,800. If that represented the sum total of A24’s membership base, it would be pulling in approximately $1 million in recurring revenue. Given that many AAA24 subscribers might not join the Instagram circle, the true numbers could be meaningfully higher.

A24’s subscription revenue is unlikely to have Netflix or HBO peering over its shoulder. But that’s not really the point. While A24 will be glad for the extra earnings, the real goal is to build a more direct and deeper relationship with its audience. Both of these elements are key and worth discussing.

Firstly, AAA24 gives the firm a more direct relationship with consumers. While A24’s early success rested on its top-drawer social media smarts, insiders recognize the risk of being beholden to an algorithm. Rather than trying to sell movie tickets by shipping memes on Instagram, AAA24 offers a way for the studio to communicate without an intermediary. As one source remarked, the company wants to “control [its] own destiny.” The launch of an exclusive app for members makes this even easier.

This more direct connection opens the aperture for A24 to engage with its audience in new and exciting ways. For example, its new app offers sneak peeks of upcoming projects and shares exclusive content. That might be an interview with a director or a discussion between cast members on a recently released film. As one executive noted, this is “just the beginning.”

Ultimately, A24 is betting that its efforts in this sphere will increase adoption of its core products while building brand affinity and securing a recurring revenue kicker.

Physical experiences

A24 has spent the last decade innovating online, but its next innovation may be in the physical world. The studio recently purchased the storied Manhattan venue Cherry Lane Theatre. According to a company source, A24 sees itself as stewards of the theater for the next generation. They want it to be a home for creators – Adam Sandler and Ari Aster have already done events there.

A24 has been an internet-first business geared towards digital natives, so it may sound odd to suggest its next big move might be into the real world. But the clues have been there all along. A24 has excelled at transmuting their taste into physical objects – whether it’s glass bongs or their much-hyped merch drops – so it seems like a natural extension to transform that taste into immersive experiences.

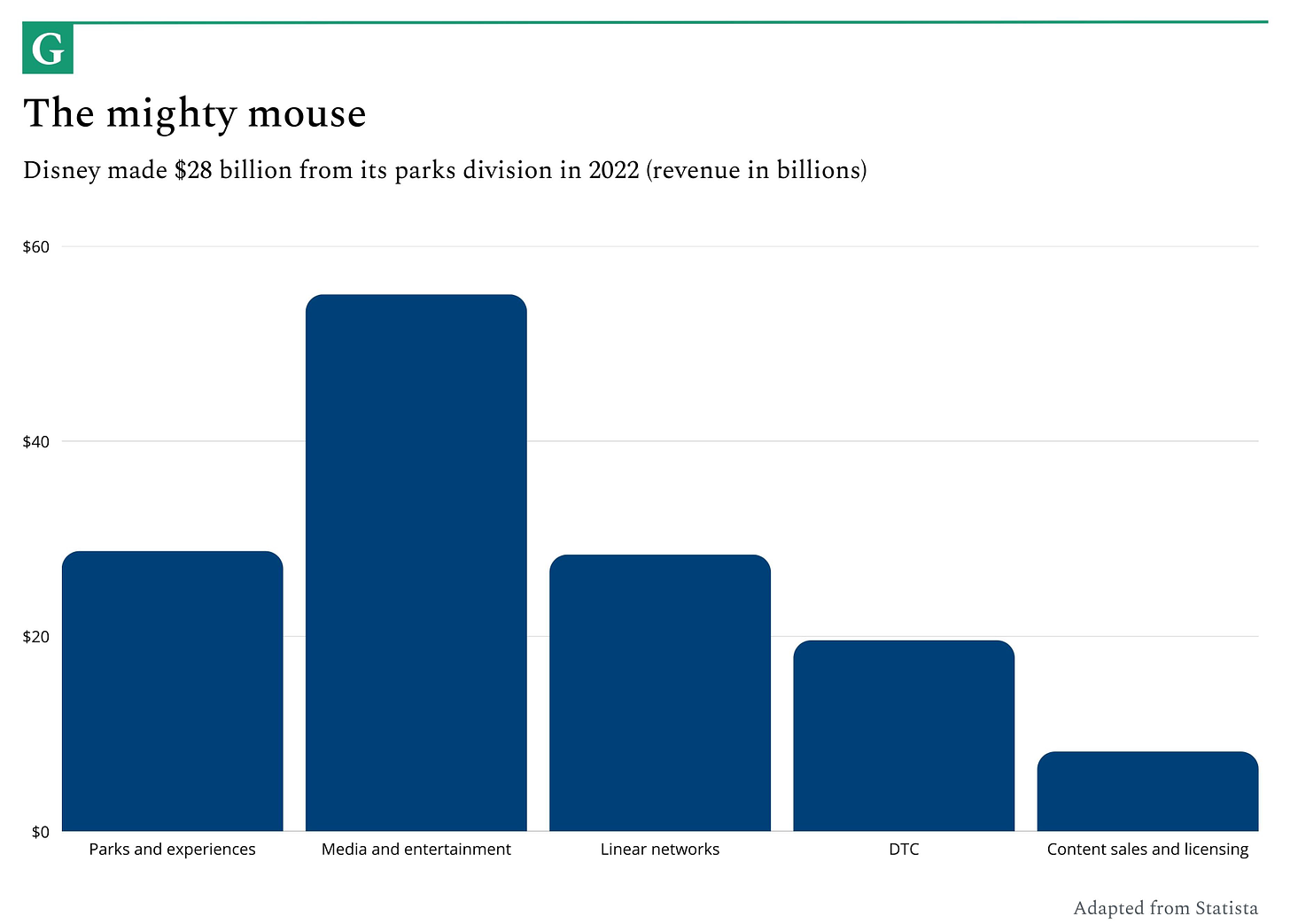

The elephant (or perhaps mouse) in the room is Disney. In 2022, the Walt Disney Corporation logged parks-related revenues of $28 billion.

As well as contributing 20% of total revenue, physical experiences have been key to Disney maintaining brand loyalty. Its properties are the places where lasting memories are made, favorite characters encountered, and merchandise acquired. “The Happiest Place on Earth” is also among the most lucrative.

Disney is not alone in executing this strategy. Universal boasts its own string of parks which delivered $7.5 billion in 2022. Even tech-first players like Netflix have recognized the financial and brand potential of this strategy. The streamer has used supernatural series Stranger Things as the inspiration for a globetrotting immersive experience and upcoming West End stage play. This follows Bridgerton balls and Knives Out escape rooms.

While A24 is far off from building a sprawling Floridian wonderland to rival Disney or Universal, its purchase of Cherry Lane and interest in potentially adding other properties to its portfolio demonstrates a willingness to reckon with the physical realm. What might make sense?

In the short term, it would be interesting to see A24 produce a show in a similar vein to Sleep No More. The sprawling, immersive rendition of Macbeth is played out across the floors of a hotel and designed for a mature audience. The show’s production company, Punchdrunk, earns a reported $25 million annually. While that’s no Magic Kingdom, it would certainly be a start.

If A24 wanted to go even more high-brow, it could do worse than taking notes from “The Museum of Innocence,” in Istanbul. Created in conjunction with Nobel Prize-winning author Orhan Pamuk, the museum serves as an exploration of 1960s Turkey and one of Pamuk’s novels brought to life. It’s the kind of visionary, artist-led project A24 prides itself on, albeit with a more literary lens.

In the long term, it’s not impossible to imagine A24 taking a bigger swing. If it were to do so, the firm would benefit from looking at Ghibli Park. Based in Nagakute, Japan, the park takes inspiration from Studio Ghibli classics like My Neighbor Totoro, Howl's Moving Castle, and Ponyo. It is the encapsulation of a singular world and style, rendered in bricks and buildings. A24 will have a similar goal for any such efforts.

Future: A world in flux

In 2022, A24 announced a new round of funding. Stripes, a New York-based growth fund, had led a $225 million investment into the company, with participation from Neuberger Berman. The round valued A24 at a cool $2.5 billion.

That sum was a reminder of how far A24 had come and how far it had yet to climb. Though the studio has influenced the zeitgeist, won Oscars, killed it at the box office, and grown to oversee an increasingly dizzying portfolio of different projects, it remains a minnow compared to Hollywood’s giants. Disney’s market cap sits at $151 billion, for example, even after the beatdown the stock has taken over the past couple of years. While A24 has a couple of hundred employees, Disney has more than 200,000.

While expecting A24 to cross that chasm anytime soon is unreasonable given the 89-year-head start Disney has, the question remains: how big a business can A24 become? If it hopes to reach the decacorn club, it will need to navigate tempting acquisition offers, rising industry tensions, technological disruption, and the perils of success. Distilled, A24’s checklist for the next decade might look something like this:

Fend off interest from above (while staying ahead of the pack.)

Stay on the side of talent (while experimenting with AI).

Embrace mainstream IP (while retaining our core DNA).

It’s a challenging agenda full of conflicting dynamics and complex incentives.

Fend off interest from above

Even the world’s biggest studios tend to get swallowed by a larger fish. Columbia Pictures is owned by Sony. Universal Pictures is owned by NBCUniversal which is, in turn, under the auspices of Comcast. Warner Bros. has been part of coalitions with Time, AT&T, and now, Discovery. Assets are bundled and unbundled, divisions kneaded together and pulled apart.

A24 has already courted acquisition interest. The firm was rumored to be considering a sale in 2021, with a mooted price range of $2.5 billion to $3 billion. Apple was purportedly among the interested parties, although a deal never materialized.

Though A24’s price tag was vindicated by their subsequent growth round, some commentators have suggested it scared off the likes of Apple. If that is the case, it’s surprising. Apple is making a much-vaunted push into streaming and has released a slate of well-received vehicles like CODA, Ted Lasso, and The Morning Show. Tim Cook has apparently committed to spend $1 billion a year to produce more of its own films.

While Apple has created works of real quality, its projects have struggled to capture attention. A Vulture piece titled “Apple TV+ Is Doing Better Than You Think” summarized the initiative’s status as a rather unheralded success. Apple’s weakness in this endeavor is arguably A24’s greatest strength. As we’ve discussed, Katz and Fenkel are masters of marketing and building hype around their projects. What kind of force multiplier might they be able to create on Apple’s investments? How might their catalog elevate Apple’s relatively thin library?

Other firms have recognized the value of these media assets and moved aggressively to secure them. In August 2021, Blackstone bought a majority interest in Reese Witherspoon’s production house Hello Sunshine for $900 million. Early the following year, Amazon announced its $8.45 billion purchase of MGM.

Would A24 be able to resist a sweetheart deal from this kind of acquirer? Its willingness to engage in M&A discussion suggests at least some ambivalence about remaining an independent firm.

If A24 is to stay independent, it will need to maintain its lead over other insurgent studios. The company’s success has galvanized smaller players.

Neon is arguably A24’s most direct competitor. The company was founded in 2017 by Tom Quinn, an experienced indie film executive, and the CEO of the Alamo Drafthouse cinema chain, Tim League. Quinn expressed Neon's intent to release titles that appeal to audiences who “skew under 45, that have no aversion to violence, no aversion to foreign language and to non-fiction.” That description would apply well to A24’s audience, too.

Like A24, Neon has shown a talent for identifying promising films and winning over creators. It successfully obtained the distribution rights to the last four Palme d'Or winners at the Cannes Film Festival: Parasite (2019), Titane (2021), Triangle of Sadness (2022), and Anatomy of a Fall (2023). Parasite has been Neon's highest-grossing film to date, pulling in over $200 million at the box office and winning four Academy Awards, including Best Picture and Best Director.

Neon has also seen success with a social media-centric strategy. In August 2023, Neon cemented this similarity by hiring A24 alumni Alexandra Altschuler and Don Wilcox as vice presidents of Media and Marketing, respectively. While Quinn’s firm has yet to reach the levels of A24 fan obsession, they’re ones to watch – even recently launching their own merchandise line. Parasite family t-shirt, anyone?

Another competitor is Blumhouse Productions. While older than A24 – it was founded in 2000 – it has historically focused on horror. It brings a similar low-cost, high-concept approach to this narrower category. The proto-Blumhouse production was Paranormal Activity, which was made for $15,000 and grossed over $193 million worldwide. Another home run was Insidious, which grossed over $100 million on a budget of $1.5 million.

Recent years have seen it push into prestige drama, releasing Oscar nominees Whiplash, BlacKkKlansman, and Get Out. Blumhouse has shown a desire to push beyond films, too, launching TV, publishing, and video game initiatives. Blumhouse’s horror catalog – which is well-suited to gaming – makes the last of those particularly interesting.

Stay on the side of talent

Hollywood is in turmoil. On May 2, the Writers Guild of America (WGA) – representing 11,500 screenwriters – went on strike over an ongoing labor dispute with the Alliance of Motion Picture and Television Producers (AMPTP). A writers’ strike is a crisis but arguably a manageable one. For example, in the last writers’ strike of 2007-2008, movies like Quantum of Solace struggled on with re-writes done by the director and Daniel Craig.

Then, in July, the Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) – representing 160,000 members, joined the strike, grinding Hollywood to a halt. Not only could no new productions take place, any promotion of previously made movies also had to stop. As news of the strike came in, stars of Oppenheimer left the Leicester Square premiere after the red carpet promenade.

This is the first combined strike of both writers and actors since 1960, when future president Ronald Reagan served as president of the Screen Actors Guild. The issue at that time concerned a new disruptive technological marvel and associated residual payments. Residuals are payments made over the long term to actors, writers, and other workers when a show or film is rerun or aired after its original release.

In 1960, the disruptive technology was television. The strike today is a similar complaint regarding residuals on streaming platforms – as well as grappling with the specter of artificial intelligence. While AI is one of the more abstract issues on the table, with particular requests for writing rooms, wage floors, and residuals taking priority, an alignment on AI usage would be pivotal.

How should A24 navigate the current turbulence? Above all, it must make sure it remains firmly on the side of the talent. A24’s brand and core DNA is built on championing artists – any attempts to weaken that stance would be viewed especially critically in the current environment.

To its credit, A24 has shown no signs of changing its approach. And though it will hope a resolution is reached quickly, it has fared better than many larger studios, receiving permission from the unions to proceed with two of its features, subject to agreements.

(Neon was also approved to continue promotional activities for its films during the strike, most notably Michael Mann’s Ferrari. The film’s star, Adam Driver, publicly praised Neon at the Venice Biennale, contrasting them against the bigger studios: “Why is it that a smaller distribution company like Neon can meet the dream demands of what SAG is asking for, but a big company like Netflix and Amazon can’t?”)

A24 will still need to ensure the talent is on board with its release plan, but years of cultivating relationships should pay dividends here. As one executive said, the current strike is an unprecedented “market dislocation”; such radical shifts provide opportunities as well as challenges. A24 will hope that the reputation it has built allows it to emerge even stronger.

As artificial intelligence advances, remaining truly creator-aligned may become thornier in the years to come. AI can already create moderately good content in minutes at extremely low cost – tens or hundreds of dollars. This is particularly revolutionary in an industry where even small “indie” projects typically take years and multi-million-dollar budgets. One streaming writer sees the future as “like that second half of Wall-E” where all of us are “in those pods, constantly being fed content curated for us, but it’s all created by AI.” As we have written previously, we see humanity on the cusp of an era of endless media.

In the short term, this might be a boon for A24. As an executive reminded us, the firm has always been at the technological vanguard. “Social media marketing might seem quite 101,” they said, “but it’s fairly novel compared to the competition.” A24 is also used to working with lean budgets and taking risks. If any firm can find a way to leverage AI effectively, it’s likely to be the one that styles its culture on Silicon Valley’s darlings.

But there will come a point when AI experiments will turn from cute to existential. While it could be fun to have an Ari Aster bot tell you ghost stories, direct from A24’s app, how would that content be monetized? Who would profit? And what would other creators think of this kind of commercial abstraction?

Even this is a relatively innocuous example. What happens when it becomes possible to train a model on A24’s archive and produce the next Moonlight, automatically? Will the studio’s distinct tone and connection to creators still be an edge when AI can approximate both? These questions are not unique to A24, of course, but to the industry at large. Nevertheless, Katz and Fenkel’s company must continue to push the boundaries without alienating the talent on which it currently relies.

Embrace mainstream IP

At the time of writing, Greta Gerwig’s Barbie has grossed over $1.4 billion. It is just the fourteenth film in history to do so and the highest-grossing film helmed by a woman. Though the movie was neither produced nor distributed by A24, it’s a vindication of the studio’s model. On one level, Barbie is a glossy, hot-pink commercial for a doll. More fundamentally, though, it’s the expression of a unique artistic vision, a genuinely auteur-driven film. Without Gerwig’s humor, knowing wink, and subversion, Barbie would never have become a megahit. In less inspired hands, it would be an anodyne flop, a shameless corporate cash grab, another indication of Hollywood’s creative bankruptcy.

Increasingly, other studios and big IP holders are realizing what A24 has recognized all along: there is no substitute for true artistry, for a real sense of voice. The last decade of sterilized superhero fare has made this even more apparent and left audiences ever keener for something that feels different. It is now almost passé to play it straight, as shown by Amazon’s superhero show The Boys, Todd Phillips’ Joker, or Gerwig’s Barbie.

As IP holders look for a fresh spin on old material, A24 is the natural port of call. According to a company source, the studio has been receiving considerable interest to this effect, running the gamut of video games, novels, and comic books. While A24 will undoubtedly look to further develop its own IP (Everything Everywhere All at Once has endless spin-off possibilities by itself), it looks increasingly likely to get a chance to interpret old classics.

It may not be long before we see A24 bring its magic to Mattel IP. Even before Barbie’s release, the toy maker teed up a staggering list of 45 features in development: among them Hot Wheels and Thomas the Tank Engine. Can you imagine the absolute fever dream an A24 version of those films would be? A Banshees of Inisheerin-style tragedy about a breakdown between Thomas and Percy? Hot Wheels delivered in Yorgos Lanthimos’ halting dialogue? Polly Pocket rendered in the evocative palette and cinematography of The Green Knight?

Properties of this magnitude would give A24 the chance to 10x the $140 million Everything Everywhere grossed. But it would also present key challenges. Earlier in this piece, we outlined how size often determines strategy. The smaller operator has options available to it that the larger one does not. Can A24 be A24 at ten times the size? Can it retain its singular voice when shepherding some Mattel monolith or Hasbro confection?

Barbie is a triumph of vision, but it is not Moonlight. It is not Aftersun. It is not even the gassy cadaver of Swiss Army Man. As A24 expands, it risks becoming the type of studio it was founded in reaction against – a purveyor of sequels and spin-offs, a peddler of revivified IP. Though it might render these stories in different color, it would still no longer be a champion of original voices and original ideas. More than anything else, A24 must protect against becoming like everyone else.

A24 is constructing its own empire. Its combination of creative instincts and business acumen has helped it defy the odds and avoid the indie studio graveyard. It has found a winning formula in its core business. It’s diversifying across adjacent business lines, and building joint ventures for more ambitious voyages. While there are headwinds, most notably the looming AI gale, A24 has charted a steady course.

But there have been other star studios that have burned bright, yet later fallen. In 1919, Charlie Chaplin co-founded United Artists (UA). It launched with a novel, creator-friendly premise – allowing actors to control their own interests rather than depending upon commercial studios. After struggling for decades, UA broke out in the 1960s, securing a string of hits and establishing itself as a cultural powerhouse. Over a three-year spell, UA released the record-breaking West Side Story, introduced American audiences to the Beatles, and produced Dr. No, launching the James Bond film franchise. In the years that followed, Ian Fleming’s suave Secret Service agent would develop into an IP bonanza, generating over $7 billion to date.

UA did not survive as an independent company long enough to see it happen. By 1967, just four years after Dr. No’s debut, Transamerica Corporation purchased 98% of UA’s stock. Over the decades that followed, Chaplin’s creation was sold and re-sold, eventually ending up at MGM, a minor line item in Amazon’s acquisition.

As admirers of A24 and fans of their films, we inhabit a timeline in which the studio comes out on top. There’s every reason for optimism. A24’s films continue to define the culture and rake it in at the box office. It produces TV shows that trend on TikTok and is part-owner of a cosmetics brand built on those trends. It is a purveyor of merch that would make Supreme jealous, a compelling dark horse in the sports category, a film club with recurring revenue, and the landlord of legendary locations. A24 is, in a word, singular. We should all hope it remains that way.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Great read, I've been obsessed with A24 as well. And I agree, you can throw this & Disney into the bucket of production companies that have a brand moat.