How to Win a Competitive Deal

You need more than sharp elbows. A tactical guide to winning your spot on the cap table.

🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor, founder, and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Become a member today.

Friends,

Venture capitalists, much like vampires, must be invited in. Though every private market financier wishes they could simply select the startups of their choosing (a sampler plate of SpaceX and Stripe, with a dab of Canva for flavor), they must enter only upon the permission of a founder.

Another way to put this: Even if you are the best picker in the world, capable of spotting the pearl gleaming from a mound of bitumen, you will deliver zero returns if you can’t convince an entrepreneur to let you invest.

The less you know about venture capital, the easier that sounds. Venture capitalists offer money. How difficult can it be to sell money? As the Irish dramatist Sean O’Casey put it, “Money doesn’t make you happy, but it does quiet the nerves.” What founder isn’t in the market for a gently tranquilizing bankroll?

It is not so simple. Over the past two decades, venture capital has swollen from a small holding to a factory farm, a phenomenon so frequently observed it is almost passé to mention. Once the province of a handful of patrician Silicon Valley partnerships, the United States is now home to nearly 2,500 firms competing with hundreds of others around the globe.

The result is that money, at least from venture capitalists, isn’t worth what it used to be. What was once a buyer’s market definitively tilted toward the sellers. Though the detonation of the 2021-2022 bubble has seen the scales waver, at tech’s top end, financiers still brawl for the best deals.

For all of venture’s outward friendliness, it remains a zero-sum game. There are only so many extraordinary companies founded each year and only so much money each can and will take. If your counterparts at rival firms greet you with a smile, it may be to show you their teeth.

Faced with formidable competition, how can you ensure you win allocation to the startups you want to invest in? What techniques should you deploy to transform yourself from “nice-to-have” to “must-make-room-for?”

This edition of the Investors Guide series offers answers. We’ve interviewed some of the world’s best investors and asked them to share how they outcompete their peers and gain access to legendary companies. This group includes multiple Midas winners and the backers of grand slams like Figma, Discord, DoorDash, Faire, Nubank, Abnormal Security, Coda, Cockroach Labs, and many more.

If you’re just joining us, our 10-part Investors Guide series is a detailed exploration of the strategies and tactics of exceptional investors – delivered right to your inbox. Here are our previous two editions:

We’ll publish seven more editions over the coming weeks and months – plus one bonus edition. For $22/month, you’ll unlock access to the full series and much more. Here are three reasons you should join today:

Learn from investing legends. Hear the wisdom of legendary venture capitalists in their own words. You’ll discover the mistakes they’ve made, how they’ve honed their practice, and where they see opportunity today.

Understand how exceptional businesses are built. Hear how some of the world’s best founders manage their companies. Then, bring those lessons back to your portfolio or your startup. It’s like unlocking a mini-advisory board.

Attain dangerous levels of competence. It is very possible that our premium newsletter may make you even more astute, insightful, and thoughtful than usual. Be prepared for flattery from colleagues and invitations to senior management meetings.

Brought to you by Mercury

If Jony Ive built a banking* experience…

I think it would look a lot like Mercury. The Generalist has been a Mercury customer for years, and I’m constantly awed by the platform’s beauty, thoughtfulness, and power. It’s become a core part of how we run our business and is probably the only banking product I find a genuine pleasure to use.

Mercury’s banking experience isn’t just loved by The Generalist. 200K other startups trust it to simplify their finances and power essential workflows, like paying bills or sending invoices. By using Mercury, customers save time, get granular visibility into their finances, and have finer-toothed control over money movement.

Apply in minutes today at mercury.com to simplify your finances and perform at your best.

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust®; Members FDIC.

How to Win a Competitive Deal

Strap on your helmet and get out the eye grease: it’s time to compete.

For venture capitalists, this part of the investing process – the time between discovering a desirable, competitive deal and making the investment is the arena. It’s the province of sharp elbows, late-night phone calls, speed reading data rooms, and dueling term sheets.

If handled well, this can be the making of the firm. With a small number of intelligent, farseeing decisions, you may find yourself the equity holder of a legendary business and the partner to a historic entrepreneur. But if managed poorly, you may find yourself sitting on an overheated pile of buzzy logos, not real businesses.

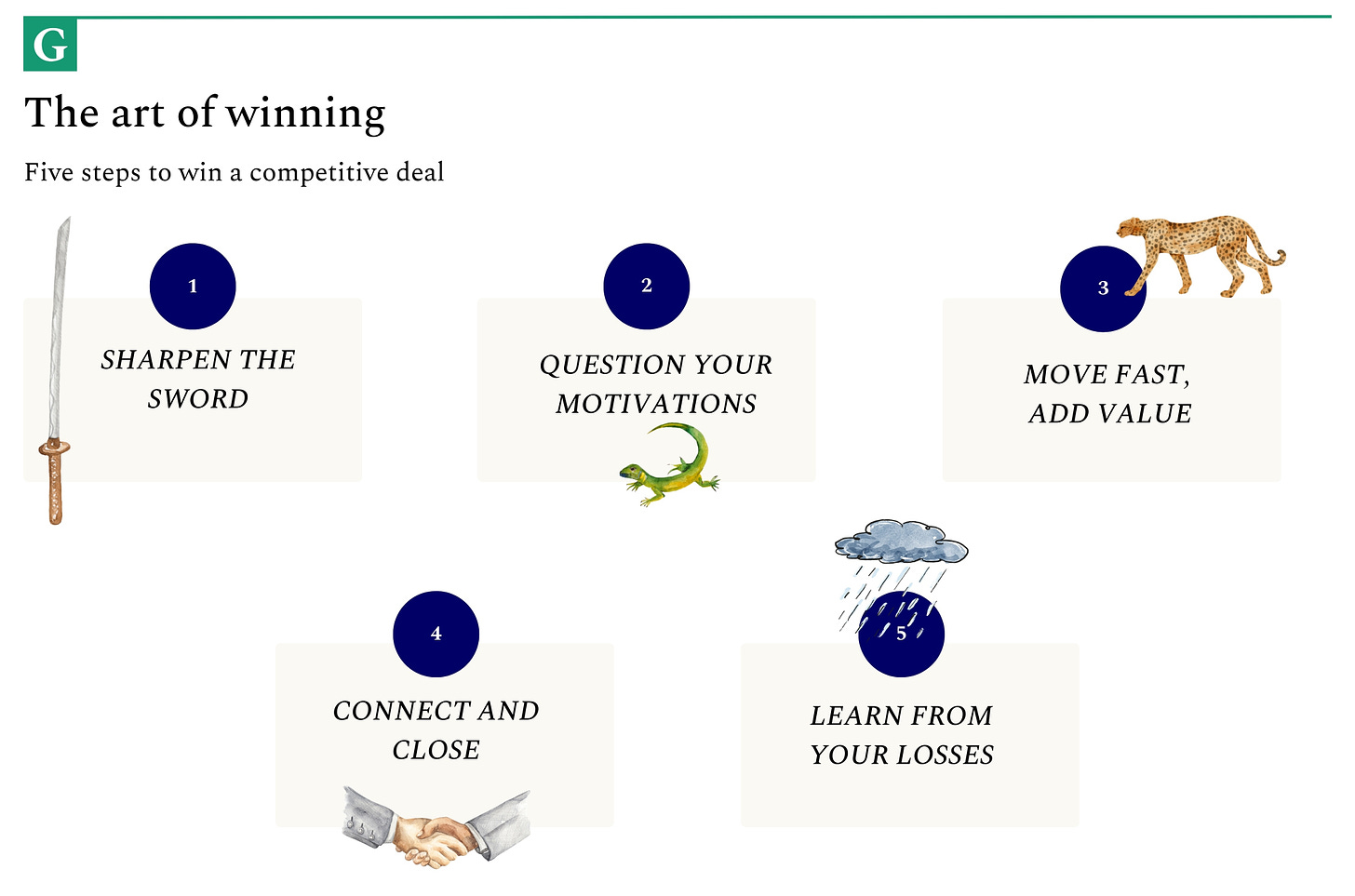

Based on the strategies of the exceptional investors we’ve interviewed, and our own research, we’ve devised a five step playbook to help you run a tight process, make shrewd decisions, and win allocation.

1. Sharpen the sword

Develop your network

Earn trust with promising founders

Build specialized knowledge

2. Question your motivations

Beware your reptile brain

Hot ≠ good

3. Move fast, add value

Arrive with a prepared mind

Move fast and be reliable

Add value (experience, knowledge, network, resources)

4. Connect and close

Understand the founder’s perspective

Build a personal connection

Show proof with references

Go big (in the right way)

5. Learn from your losses

Reasons for losing

Hold a post-mortem

Track your win rate

Thank you to Rebecca Kaden (USV), Saam Motamedi (Greylock), Sarah Guo (Conviction), Saar Gur (CRV), Alex Taussig (Lightspeed), Danny Rimer (Index), Hernan Kazah (Kaszek), and Kanyi Maqubela (Kindred) for sharing your wisdom.

Step 1: Sharpen the sword

The work to win an investment starts long before a missive pops up in your Twitter DMs. To give yourself a fighting chance of getting access to a hot round, consider these three preparatory steps:

Develop your networks

Earn trust with promising founders

Build specialized knowledge

Develop your networks

Unless you expect to be the first investor to discover every competitive deal (an impossible task), you’ll need to build a network that sends you opportunities with enough time to act on them.

Building a reputation and network that delivers on that front is a prerequisite for competing for the most sought-after deals. It’s also an ongoing task. Sarah Guo argues that more than 80% of winning a deal happens in advance of the round:

Conviction

Eighty-plus percent of winning a deal is decided before you show up to an investment.

The reason I believe that is that the first piece of winning is access, right? Do you know about the founders? Has someone introduced you? In venture, proprietary deal flow rarely exists but time advantage does.

A big piece is also the work you’ve already done. This is more relevant for experienced investors but is also true for operators or people just starting out. A lot is on your references, your credibility, and your reputation. Who is going to call the entrepreneur and make the case for you?

All of that comes from work you do over a long period of time.

– Sarah Guo

If you’re just starting, it’s worth reflecting on the networks you’re already a part of that you can lean into. For example, if you attended an elite college with a history of producing strong founders, that’s a great starting point.

So, too, is time spent working at a company with a high talent density. You never know which former roommate or co-worker could become the founder of a trendy startup. Saar Gur of CRV explains just how influential those past bonds can be:

CRV

If I just met you, and your college buddy is a VC that’s known you forever, or if you worked together for ten years and now they’re a VC, it’s sort of a house deal. That’s very hard to break in there. It’s hard to build a strong bond and develop trust.

– Saar Gur

One academic study published in the Journal of Corporate Finance has observed a version of this phenomenon in private equity. Namely, PE investors tend to source and win more deals when the target CEO attended the same university as them. All of which is to say that you might have a great starting point, even if you haven’t fully realized it.

Attending a prestigious institution or holding a swanky job may be helpful, but it is far from necessary. Plenty of Silicon Valley’s denizens have constructed sprawling, influential relationships without such ties. Sarah Guo shares her advice for bootstrapping a network:

Conviction

Go meet people who are the best people you can in an area and try to be useful to them. What can you do as an investor that other people can’t? You can give them a broad view, or you can help them with a career thing, a recruiting thing, a customer thing.

This seems like relatively generic advice, but let’s say I was interested in email security. If you get really deep and say, “I’m going to meet every engineer, executive, and founder working on this,” suddenly you know a lot. You know what you think is going to happen in the space, you know everyone in the space, and if you have done well by them – or those people just think you understand the market – they will call you.

I’ve spent my time being directed toward areas I have interest in, and I think that translates to access.

– Sarah Guo

For more information about building a network, check out the first two editions of the Investors Guide:

Earn trust with promising founders

Building a reputation and network is the work of a lifetime. A more direct tactic is proactively building relationships with promising and future founders.

Doing so allows you to build trust outside of a deal window over a much longer timeline. Lightspeed’s Alex Taussig tends to get to know founders for over a year before investing:

Lightspeed

I actually think a lot of the work to win a deal happens outside the deal context.

For example, you cannot replicate cycles with a human being over a long period of time when it comes to earning the trust needed to be a board member or partner for the next decade. That is really hard to replicate. In fact, I think it’s the hardest thing to replicate.

I would say that every investment of mine that I’m really proud of is the result of getting to know the founders over at least a year.

There’s one exception, which was done over a weekend, but in that case, one of our scouts had invested in the pre-seed and had years of runtime with the CEO, and it was an area in which I had developed a strong point of view.

– Alex Taussig

Over time, you’ll get to see how these founders perform. Even if their first business doesn’t succeed, they may go on to start another company with greater potential. In those cases, knowing their abilities gives you an advantage over other investors, allowing you to act faster.

Saar Gur explains how that played out with Ring, the smart doorbell eventually acquired by Amazon for approximately $1 billion:

CRV

I had known Jamie Siminoff in his first company, PhoneTag, and then I had backed him with his next company, Unsubscribe. He called me one day and said, “You know, I think I want to raise venture money for this idea that I have.”

He told me on a Friday, I flew down on a Sunday to meet his co-founder. I brought him in on Monday. My thesis was that I actually hated the idea. But if I can buy 20% of Jamie Siminoff for $1.6 million, I’ll do that all day long.

Now, most people, if they hadn’t known Jamie for years, they wouldn’t know how special he was.

– Saar Gur

Even if you miss a deal initially, there may be an opportunity to build a relationship in preparation for future rounds.

For example, Alex Taussig built a productive long-term relationship with Faire’s Max Rhodes. It helped him win the right to invest.

Lightspeed

I met Max when he presented at YC at the seed. The whole founding team had worked at Square, directly with Keith [Rabois], so there was no chance anyone else was going to be able to access the company at that point.

But it was also very clear that Max was a special person, and it was a market that I had written about for a few years. I had written a blog post called, “The retail apocalypse is not evenly distributed” unpacking a bunch of data around store closures. What it showed was that while there were certainly categories shutting down, other “jobs to be done” in retail were working really well. One of those was local gift stores and home goods stores that provided a level of curation and service that you couldn’t get from Bed Bath and Beyond.

I kept showing up with Max. We’d get together at their office every few months and talk about what was going on. He’d say, “What do you want to talk about?” And I say, “I don’t know. Why don’t we talk about what your biggest questions are in the business right now and pretend we’re working together?”

Max would very transparently show me the entire data dashboard for how he ran the company. We’d sit there and talk about what we were seeing in the data. He showed me all the good and the bad stuff.

We did that for a year. When it got to the point where I had enough conviction that they'd figured out the business model and the growth loop, we decided to preempt what was eventually the Series B, three to four months before it happened.

In total, we’ve invested six times in Faire.

– Alex Taussig

Not all of the relationships you build will lead to an investment. Indeed, if you want a genuine friendship with someone, it’s best not to think in such transactional terms, as Alex Taussig explains:

Lightspeed

Sometimes, the time you spend with a company doesn’t translate into an opportunity. Sometimes, you invest a lot of time and energy into a relationship, and the company doesn’t really go anywhere, but that’s ok. There’s some element of this job that’s pay-it-forward.

– Alex Taussig

Build specialized knowledge

When a deal drops, you need to be ready to race. One final tip to make sure you don’t start cold? Build valuable specialized knowledge. If you can turn yourself into an expert – or at least a good sparring partner – in a particular area, you’ll be a much more attractive option for founders. Greylock’s Saam Motamedi has done this by becoming an AI specialist:

Greylock

If you’re a founder raising your first institutional round, which is when we’d love to intersect with you, you deserve a partner who understands what you’re doing really deeply.

I try to view myself as being a sector specialist. The argument I would make is I don’t know a lot about everything, but there are some things I know really, really well. It’s not just that I have the understanding, but I have networks on the customer side and talent side and can really accelerate you in those areas. For me, those three areas would be cybersecurity, AI applications, and AI and data infrastructure.

The first part of winning is having a brand and a track record of being involved with great companies in a narrow set of domains.

– Saam Motamedi

Generalists needn’t fear. Even if you don’t want to limit yourself to a certain sector, you can still develop theses and accumulate relevant knowledge. The goal is simply to give yourself an informational advantage over your peers, and make yourself a more compelling partner to founders.

Writing is a particularly useful way of achieving these ends. It forces you to articulate your thinking, encourages feedback, and attracts founders. Even if it doesn’t pay off in the near term, it may come in handy down the line. Rebecca Kaden of USV discusses the value of writing and shares a recent example:

USV

We lean a lot on our thesis and on our writing. We think it’s really different to go to a founder and say, “Hey, you have a perspective on this category, and we have a perspective on this category. Let’s have a conversation about it. Are we aligned? Where do we agree?” Compare that to saying, “Hey, pitch me your company and tell me what you’re doing.”

My partner Brad recently led investment. He basically said to the team, “I’ve been thinking and writing about the category you’re working on for 15 years. Here are some examples of that, and I think it’s just becoming investable right now. But the themes you’re working on, I’ve been focused on for decades.”

That’s an extreme. But we have been working on creating easier ways to leverage all our past writing so that we can find it when we meet with a founder and easily say, “Here are the things we’ve written that are relevant to what you’re doing and reflect our perspectives.”

– Rebecca Kaden

If words don’t come easily to you, there are other ways of developing a track record of your thinking and establishing credibility.

Saar Gur highlights how having research calls can accelerate your conviction and deliver an advantage:

CRV

As a young person, you have a lot of advantages over folks like me. You have time to build a thesis, do a market map, or meet fifty companies in a certain sector.

Speed is the number one advantage for a young person. And yet, it’s very nerve-wracking to invest in early-stage venture. All of these startups are early and ugly. And often, the best investments are going to be non-consensus, where other people think you’re stupid or don’t see what you see.

So the core of it is: How do you build your own conviction faster than someone else and then move very quickly?

If you’ve met 50 founders building food delivery apps and then you meet Tony from DoorDash, you’re like, “I’ve been looking for you! You’re the one! You understand that you’re building a local logistics company. You’ve got an understanding of your ICP.” Then you can move quickly and speak the same language.

It’s also a very different interaction than a founder will have with most investors who are very doubting and critical.

– Saar Gur

Step 2: Question your motivations

An email pops up in your Superhuman account. It’s your friend at a collaborative VC introducing you to the CEO of a startup. The team comes from Anduril, OpenAI, and Stripe. They’re building at the intersection of AI and American infrastructure but with SaaS margins. They have term sheets from Founders Fund, Khosla, Sequoia, and USV. Whoever they pick, they’re leaving some allocation open for other aligned investors.