Inside the Secret School for the World’s Best Founders

Avra, run by former Y Combinator investors, keeps a low profile. It’s quickly becoming a critical partner for elite entrepreneurs.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about Avra.

The school for scale. Founded in 2023, Avra runs a selective program for the world’s best growth-stage entrepreneurs. It helps the leaders of breakout businesses learn how to build an executive team, maintain shipping speed, and plan for the future. It’s a kind of doctoral program for startup CEOs, albeit one with a well-guarded curriculum and a venture fund on the back end.

Learning from Y Combinator. Avra’s team previously worked together at YC Continuity, the growth practice of the famed accelerator. When YC suddenly shuttered that division in March 2023, Avra founder Anu Hariharan put her plans for a new growth program into high gear, bringing colleagues with her.

A missing piece. Though YC is still recognized as the best launchpad for early-stage startups, it has competition from dozens of other incubators and accelerators. Avra is the first of its kind: a high-quality standalone program for post-Series A companies. As a result, the fund has the opportunity to establish itself as a standard bearer for later stage startups.

Tactical masterclasses. Avra’s program is taught by some of the startup ecosystem’s most impressive and successful founders. Sessions cover choosing the right metrics, hiring executives, scaling engineering, leveling up financial planning, and preparing for future fundraises. Each one is a tactical masterclass full of detail.

Reordering VC. Though Avra’s principal mission is to assist founders through targeted education, it monetizes as a venture firm. It is raising a reported $350 million to invest in a small fraction of the startups that pass through its program. It’s a clever strategy that reorders the traditional sequence venture capital follows. Rather than winning a deal and then adding value, Avra does the work upfront, proving its impact and building rapport ahead of a future round.

Benedict Evans, analyst and erstwhile investor, once referred to Andreessen Horowitz as “a media company that monetizes through VC.” It was a pithy description of his former employer that got to the heart of the firm’s forceful brand building strategy.

Avra Capital is a trade school that monetizes through VC.

In almost all of its core functionality, Avra appears to be a small-batch institution of higher learning. It runs bi-annual cohorts, holds classes, doles out required reading, and assigns homework. What distinguishes Avra from other vocational programs is the trade that it teaches, and the student body it admits.

Avra is not focused on nursing, HVAC repair, or aeronautics but on the craft of company building. Its student body is made up of many of this generation’s most promising founders—the people behind some of the world’s hottest startups, vying to become tech’s next big winner.

All matriculate to learn directly from founders who have overcome the obstacles they currently face. Walk the imagined hallways of Avra Academy, and you’ll pass the bronze nameplates of its luminary educators: Professor Parker Conrad of Compound Software, Visiting Scholar Greg Schott of Enterprise Sales, and Dean Tony Xu, Head of Urban Scanning.

Avra’s top-tier instructors and effective playbook owe a great deal to the experience of its founder, Anu Hariharan. Starting in 2016, Hariharan ran Y Combinator’s Growth team, backing companies like Brex, Monzo, Gusto, Zepto, Groww, Rappi and Faire. As part of that role, she and co-head Ali Rowghani managed the accelerator’s post-Series A program, designed to help breakout companies manage the next phase of their growth. When YC President Garry Tan abruptly shut down the division in March 2023, Hariharan and several colleagues used seven years of lessons to found Avra.

Given Hariharan’s bonafides and the quality of Avra’s instruction, it’s little wonder that attaining entrance to the fund’s program has grown increasingly competitive in just its first year of operation. The chance to attend small, tactical sessions with legendary entrepreneurs is attractive to many – not least when delivered in the vulnerable, off-the-record style that Avra encourages. It wants its students not simply to understand how DoorDash’s CEO recruits his C-Suite, for example, but to hear the mistakes and lessons learned along the way.

That frankness is why Avra guards the content of its curriculum so closely. It is one thing to ask a founder to regale an audience of junior peers with a parade of mistakes, quite another to make those battle scars visible to the public.

Perhaps because of its combination of secrecy and cache, Avra (and YC Growth before it) represents a tantalizing prospect for outsiders. Visit its site, and you’ll find glowing testimonials from alumni but little in the way of tangible detail. How do great CEOs scale their engineering teams? What quirks enable tech companies to maintain a rapid shipping speed? In short, what does a school for super-scalers actually look like from the inside? What do exceptional founders know that the rest of us don’t?

Over the past nine months, The Generalist has been given unprecedented access to Avra’s program, experiencing it as a student might. That includes accessing its classes, program material, and alumni resources.

It proved an illuminating process, giving me insight into Avra’s unusual advantages in the venture landscape and a fiercer appreciation for the grit, guile, intensity, and consistency it takes to build a generational business.

The making of a VC

Anu Hariharan made her decision. After much deliberation and research, she’d elected to choose three promising growth-stage companies: online grocery delivery provider Instacart, travel marketplace GetYourGuide, and on-demand storage player MakeSpace.

It represented an unusual sort of investment decision—freighted by high stakes but with no money on the line. It was part of the interview process with a New York City hedge fund interested in venture investing—“you can probably easily guess who,” she says—and Hariharan had been tasked with pitching a trio of compelling Series B startups.

It was a tricky task for a former Qualcomm engineer and Boston Consulting Group principal with no venture capital experience and little familiarity with the tech landscape. “I didn’t even know what Series B was,” Hariharan recalled. “I didn’t know anything about startups. I didn’t even read TechCrunch.”

Eleven years later, we know that Hariharan picked well. Instacart was valued at $25.4 million in its 2013 Series A; today, it trades at $9.5 billion. The Berlin-based GetYourGuide raised $194 million in debt and equity in 2023 at a $2 billion valuation; it had raised approximately $20 million at the time Hariharan assessed it. Only MakeSpace can be considered a miss, merging with rival firm Clutter, which subsequently sold at a steep discount last year.

Unsure of her selections and eager for a more experienced opinion, Hariharan reached out to seasoned investors, asking for their advice. That act summarized Hariharan’s direct, unflappable approach to problem solving, and changed the course of her career.

“I sent cold emails to four VCs saying, “I’m interviewing at this fund, and I would love any feedback on the three companies I’ve picked to pitch,’” Hariharan recalled. “One of the people I emailed happened to be Jeff Jordan.”

As it turned out, Jordan was the perfect recipient for Hariharan’s message. Not only had he spent time at BCG before rising through the ranks at Disney, stepping in as President of PayPal, co-founding OpenTable and Wealthfront, and arriving at Andreessen Horowitz (a16z), but he was also actively researching Instacart.

“I didn’t realize that he was diligencing them for the Series B,” Hariharan said. “He thought my diligence was pretty good and pretty interesting, so we started going back and forth on emails. And then he said, “Whenever you’re in San Francisco next, I’d love to meet you.”

Rather than leave the encounter to fate, Hariharan said she’d be in town the next week and booked a ticket. When she arrived at a16z’s office, Jordan surprised her with a few additions to her agenda. “I thought I was meeting just him, but he’d arranged eight meetings for me with everyone else at the firm,” Hariharan said.

Shortly after, Hariharan was offered a job on a16z’s investment team. It marked the beginning of her venture career and the start of a breakneck education in a new kind of investing.

Though Hariharan had spent much of her time at BCG in the firm’s private equity practice, conducting detailed due diligence on potential investments, VC required her to adjust her perspective. “I had to recalibrate my thought process from PE to VC. After every pitch meeting, Jeff would ask me to articulate my point of view within five minutes. He also helped me focus on how to identify founders because so much of venture is about picking the right person.”

In addition to paying closer attention to entrepreneurs, Hariharan had to learn to let go of some of the conservatism her private equity experience had inculcated in her. A lunch meeting with firm co-founder Marc Andreessen encouraged her to focus more on a company’s potential than its risks.

“It was sometime around my nine-month mark at a16z,” Hariharan recalled. “He told me that usually, when he onboards someone, he has to teach them not to say yes to too many investments. But for me, he was going to have to teach me to say yes to one of them.”

Andreessen told her that a VC’s biggest mistakes were ones of omission – the great companies that you should have invested in but didn’t. He urged Hariharan to apply her analytical brain to investigating a startup’s upside, developing the conviction to take a swing.

Hariharan cites Chris Dixon and Ben Horowitz as additional influences during this stage of her venture schooling. “Ben is exceptional at B2B SaaS – I learned a lot from how he dug into whether a sales team was working and the go-to-market metrics. Chris is just one of the most intelligent thesis-based investors I’ve ever seen.” Hariharan took lessons from both of them.

Although Hariharan may have been a greenhorn when it came to the venture asset class, she entered the industry with technical expertise, strategic experience, and a natural nose for investing. She tells the story of her entry into venture capital with deep humility – casting herself as a learner, above all else – but Hariharan’s fast rise is a testament to her talents. Spend even a few minutes with her, and you cannot help but notice her striking but unflashy intellect, a direct, genial speaking style, and substance. Her long-time colleague Nic Dardenne summarized Hariharan’s gifts eloquently. “There are two things: one, she works insanely hard. She’s an incredibly successful person but is also the hardest-working person I know, both for the team and the founders she works with. Two, she does right by founders. She has this superpower of telling people what they need to hear, not what they want to hear, but doing so in a way that endears herself to them and makes them trust her even more.”

Not long into her second year at a16z and another Silicon Valley institution had started noticing her talents.

Sam Altman, then President of Y Combinator, had decided to launch a growth practice designed to double down on the accelerator’s best-performing businesses. He sought two general partners to run “YC Continuity,” with existing Managing Director Ali Rowghani—the former CFO and COO of Twitter—slated to step into one of those roles.

Despite her relatively short tenure in venture, Hariharan had already made an impact on the YC community, developing a relationship with several of the ecosystem’s startups. “We worked with a lot of YC founders at Andreessen Horowitz,” she said. “One of YC’s partners pinged me and said they’d heard my name a lot and asked if I’d be open to having a conversation about the growth fund they were planning to launch.”

She was. Though Hariharan enjoyed her time at a16z, there was no path to a partner at the time – significant for someone who had been on the partner track at BCG. After she completed a two-year stint, she planned to step into an operating role at one of the firm’s portfolio companies. “I was on the path to be the CFO of one of the startups we’d invested in,” Hariharan reflected. “I never felt like I needed to be an investor. My goal is always around learning and impact. I thought, ‘Maybe I can go to a portfolio company and do that for four or five years.’”

Altman’s interest forced her to reconsider that plan. “YC is such an amazing place and a very differentiated platform,” Hariharan said. “I think it’s unlike any other VC. It’s not really a VC fund.” Over a few months, Hariharan got to know the team better, and by August 2016, she’d decided to join as YC Continuity’s second managing director.

Continuity

Though Hariharan intended to stay four years at Y Combinator, she lasted seven. That duration is a consequence of the compelling power of YC’s platform, the value the Continuity practice created, and the abruptness with which it was shuttered.

But we should not rush ahead. When Hariharan joined Ali Rowghani in 2016, the pair were tasked with building out a new practice under the auspices of Y Combinator. In addition to functioning as a growth-stage investor, Continuity was expected to build a curriculum and operate a program of its own.

Much of that mission aligned with Y Combinator’s roots, of course. Ever since its founding in 2005, it had operated a de-facto “founder school,” teaching unseasoned founders how to build startups. Its syllabus – devised by Paul Graham and honed by countless partners and practitioners – accelerated the trajectories of companies like Reddit, Airbnb, Stripe, and Flexport.

Continuity would do the same, albeit for a different audience and with some critical tweaks. Rather than assisting scarcely-formed projects, it would work with established startups, rapidly scaling revenue and headcount. That contrasting focus necessitated changes to YC’s classic syllabus and the program's structure.

Instead of serving 50, 100, or even 400 startups a batch, Continuity worked with 8-12. Rather than focusing on finding product-market fit, Hariharan and Rowghani counseled founders on scaling as CEOs, hiring executives, maintaining shipping speed, plowing through plateauing growth, and raising later-stage rounds. And because those topics require detailed tactical knowledge and emotional credibility, Continuity primarily relied on active founders – those still “in the arena” – to teach its courses. Plaid’s Zach Perret and Webflow’s Vlad Magalin both taught for Hariharan’s program.

It is perhaps unsurprising that Continuity proved a hit, with founders across YC’s ecosystem jockeying for entrance. It didn’t hurt that the growth program stood alone in the competitive landscape. Although myriad accelerators like Techstars and 500 Startups had cropped up to vie for early-stage founders, no dominant program existed for scalers. “I don’t think anyone runs something similar,” Hariharan said. “Even now that I’m on the outside and have spent all this time learning about founder programs, I still haven’t found anyone who does it – at least not as well.”

In part, that’s because of the network and wisdom Continuity was able to glean from its parent company. “I think we learned the art of doing it well because we got to see how well YC did it for the early stage,” Hariharan reasoned. “It’s not easy to do without that.”

Though Continuity saw itself principally as an educator, it monetized like YC – via investments. Once again, it did so with a twist. While YC makes investment a requirement to participate – you cannot attend the program without accepting its “Standard Deal” – Continuity operated opportunistically, investing in a select number of companies only when the right moment arrived. Not only was this a logical reflection of later-stage funding rounds, but it also meant that companies that matriculated to Continuity did so with no strings attached. The vast majority of graduates never received capital from Hariharan and Rowghani; of the approximately 180 that went through the program, Continuity backed just a fraction of them.

As she had at a16z, Hariharan continued to learn from those around her, not least future OpenAI’s supreme leader, Sam Altman. In particular, Altman exhorted Hariharan to test her conviction and size bets aggressively. “Sam had this characteristic of asking, ‘Are you betting the house?’” Hariharan recalled. “It was his way of understanding if you had high conviction on an investment. Either you have full conviction, or you don’t. If you’re on the fence, why are you doing this? And if you have full conviction, why aren’t you doing more? It’s a simplistic framework, but I appreciate how much clarity it brings to investment decisions. That’s the biggest thing I learned from Sam.”

According to Hariharan, Altman’s heuristic made a noticeable difference on Continuity’s investing style over time. In its first fund, the growth team approached capital-intensive businesses cautiously, even if a large addressable market might have justified a bolder strategy. By its last fund, Continuity had learned to lean in. “We were a little gun shy when the risk was higher, but then by the third fund, we were more aggressive. When we saw Zepto, which is a 10-minute quick commerce player in India, we bet the house. It wasn’t clear it was going to be a breakout, but it is today.”

Hariharan and Rowghani were not alone in making these investment decisions. Their growth practice grew to include Nic Dardenne, a former Morgan Stanley investment banker, and Tiffany Kosolcharoen, who conducted market intelligence at Meta.

Dardenne operated as a traditional growth investor, albeit one with a particular gift for grasping a company’s financials. A colleague likened his role to that of a “mini CFO” for some of the companies he works with, helping to retool their models from the ground up.

Kosolcharoen served in a slightly different capacity. At Meta, she built out the market intelligence systems and conducted research for a portfolio of products. At YC Continuity, she was brought on as Head of Investment Research, tasked with monitoring the accelerator’s many companies and spotting candidates for additional capital. Through this process, Continuity quickly spotted the steep trajectory of startups like Deel and Zip before they raised Series A rounds. That allowed the Continuity team to build a relationship and lead later investments.

Over Continuity’s seven-year run, it pulled together a promising portfolio, many of which have repaid its investment many times over. Hariharan and Rowghani’s prominent bets include Stripe, Coinbase, Faire, Monzo, Groww, Vanta, Segment, Rappi, Gusto, and Brex. Naturally, not all have been hits – in October 2023, trucking firm Convoy, a Continuity investment, shut down operations after consuming over $1 billion in capital. Nevertheless, on balance, Hariharan’s team seems to have done remarkably well. “My hope is that in time, we’ll show that we had one of the best growth track records during that period,” Tiffany Kosolcharoen said.

Brex represented a particularly significant investment for Hariharan. Not only did she preempt a pricey Series B round for a company that had little revenue in 2018 – a decision that was spectacularly vindicated in the following years—but she also found a future colleague.

Serving on Brex’s board introduced her to Lucas Fox, an early employee who would go on to manage its startup business unit. The pair became frequent collaborators, with Fox struck by the intensity with which Hariharan was willing to graft on behalf of the company. “She was almost like an exec at Brex. We worked really closely together – we’d go on three-to-five-day work binges when we were trying to solve a problem together.” Sometimes, when Fox was tackling a particularly thorny issue, he’d stay at Hariharan’s family home for days at a time.

That level of commitment, combined with the value of its programming, forged an unusually strong bond between Continuity’s principals and the startups it served. One founder who went through the course described it as “one of the most valuable things I’ve done as a CEO.” Overall, YC’s growth program earned an NPS of 70+ from founders, an illustration of the esteem in which it was held.

All of which made its sudden demise even more startling.

The last job

If there was one source of friction between Anu Hariharan and Y Combinator, one wasp at the picnic, this was it. The accelerator wanted Continuity to invest only in startups that had gone through its early-stage program. Its mission was to prepare YC alumni for the next phase of growth and build greater ownership in their businesses, not accelerate the best growth founders, no matter what their provenance.

It marked a philosophical difference between Hariharan and her employer. Though she understood that accepting non-YC companies presented a challenge – risking upsetting legacy founders in favor of newcomers, she considered it a surmountable one. “I actually told YC that maybe the program should include companies from the outside. Just like when you look at universities, there are two main entry points: undergraduate and graduate,” said Hariharan.

YC dabbled with the idea, allowing Continuity to back two external startups: British neobank Monzo and the ill-fated logistics company Convoy. Ultimately, though, it declined to continue the experiment, preferring to exclusively serve alumni.

Long before Hariharan joined Continuity or even a16z, she’d known that, at some point, she wanted to build a business of her own. “I’ve always had the itch to be an entrepreneur. I didn’t know whether I would start a company or a fund, but I knew that my last job could never be part of any platform.” The limitations on Continuity’s operations, added to the fact that she’d stayed at YC much longer than she’d anticipated, caused Hariharan to consider building something of her own.

By the end of 2022, she’d written a “strategy letter” outlining the fund she planned to start. It would be a firm influenced by the impact of YC Continuity but available to all founders. “I thought that what we built at YC was awesome, and I really wanted to continue that work,” Hariharan explained. “Barring a few, growth investing on the outside is done so poorly. It’s done lazily. Everyone thinks, “Oh, these companies have their Series A, that’s enough. They have $5-15 million in revenue; they don’t need support.’ That’s absolutely not true. I felt there was an opportunity to do this really well, inspired by all the YC principles I learned, but to do it differently.”

There’s a long-standing joke in the Hariharan family: every financial recession comes for Anu. She graduated college in the wake of the dotcom crash, then received her MBA amidst the wreckage of the global financial crisis. But as America flirted with another downturn at the start of 2023 and Silicon Valley weathered a banking crisis, the Hariharans were uncommonly sanguine. “My family thought, ‘Oh, in 2023, Anu is safe; she has so many years of experience,’” Hariharan says with a chuckle. “And then, of everyone in the family, I was the only one without a job.”

The defenestration of Hariharan, Rowghani, and the rest of the Continuity team was swift. On March 13, 2023, The Information reported that new YC president Garry Tan had decided to close the firm’s growth practice as part of a push to refocus the accelerator. “Late-stage investing turned out to be so different from early-stage investing that we found it to be a distraction from our core mission,” Tan told The Information at the time.

It came as a jolt to Hariharan. Though she’d laid the groundwork for a new fund, she hadn’t expected to take the jump until 2024 at the earliest. Now, the transition had been thrust upon her. “It was hard, she said. “We had to take care of the whole team. It was a huge shock to them.” At the time of Tan’s announcement, Continuity still had $500 million in capital left to invest.

It caught many prominent alumni off-guard, too, with at least ten startups expressing in a letter to YC that they were “surprised and deeply disappointed” by a decision that impacted the composition of their boards. Signatories included the founders of Brex, Deel, Rappi, Zepto, Convoy, and Monzo.

Though undoubtedly a blow to Hariharan and her team, it also presented an opportunity. “I had assumed I wasn’t going to take anyone with me from YC, which is why I’d started conversations with Lucas [Fox] ahead of time,” Hariharan said of the recently departed Brex employee. “Now, I could also get Nic [Dardenne] and Tiffany [Kosolcharoen] from day one, which meant there were many steps I could eliminate, and we could spring into action very quickly.”

By September 2023, seven months after Continuity’s closure, Avra Capital ran its first batch.

The Avra academy

Almost exactly a year after Avra launched its program, welcoming eleven companies into its cohort, it is wrapping up its third batch. In the intervening 12 months, Avra is reportedly honing in on $350 million in capital, according to TechCrunch (Hariharan declined to comment on the matter). Andrew Davis, Managing Partner of Socium Ventures, shared his rationale for backing Avra’s debut vehicle:

The easiest way to gain conviction in Anu’s track record was by seeing how many of the founders and partners she worked with chose to be investors in [Avra]. I have partnered with Anu for many years, and she is one of the most impactful and ethical investors I’ve ever worked with. We couldn’t say ‘yes’ fast enough when she asked us.

As well as winning over limited partners like Davis, Avra has also honed its curriculum, built intriguing in-house software, and impressed some of the world’s most coveted growth-stage founders. Entrants include European OpenAI challenger Mistral, creative platform Runway ML, GPU orchestration system Foundry, gaming device Backbone, and many others.

In devising Avra, Hariharan chose to build around a few key pillars – some inspired by YC Continuity, others in direct opposition:

Open to all. Since Avra is not part of an existing platform, it is free to accept any business it chooses without having to give preferential treatment to YC alumni. Places are given to the growth-stage firms Avra considers most promising.

Founder taught. Like YC Growth, Avra’s programs are taught by expert practitioners, typically tenured CEOs or VPs with domain expertise. These people have gone through the same challenges as Avra’s students and can speak with experience and authority.

Off-the-record. Many venture firms produce first-rate content for founders. However, when this information features advice from other entrepreneurs, it is inherently “on-the-record.” By keeping all of Avra’s sessions confidential, instructors are able to speak with greater vulnerability, specificity, and candor.

Education-first. Avra sees itself as an educational offering first and a fund second. This is more than just marketing. The majority of the team’s time and focus is spent on improving its programming and associated offerings. The idea is that investment opportunities will naturally follow.

Personalized curriculum. Though growth companies face the same set of challenges – scaling executive teams and maintaining high throughput – they do not all experience them at the same time. Avra tries to ensure its sessions directly attack founders’ most pressing problems, as well as prepare them for the future.

No strings attached. Admittance to the program is not predicated on Avra investing, either implicitly or explicitly. Founders understand that Avra monetizes as a venture firm but are not pressured to solicit them for future rounds. Hariharan’s team believes it will earn the opportunity by delivering value, not by making demands.

These principles have guided the creation of the Avra apparatus, a machine that ingests thousands of startups but serves a select few. It is neither the slow, precious, boutique venture capital of the traditionalists nor does it adhere to Y Combinator’s industrialized model. It is something new, something in between – a processed, productized approach to small-batch brewing.

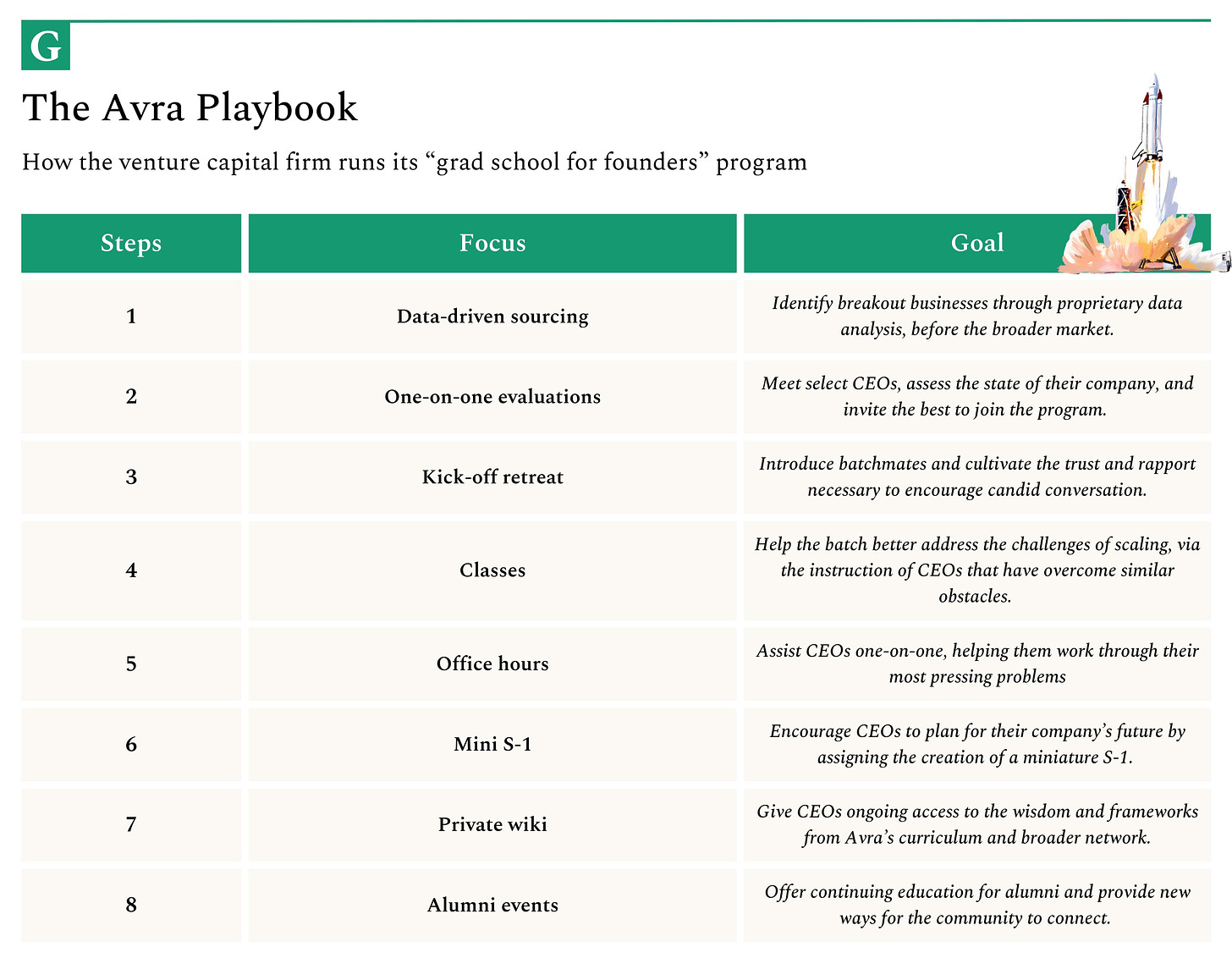

Before exploring its curriculum, it’s important to understand how it sits within Avra’s broader structure and sequencing. In total, its methodology is comprised of 8 critical steps:

Step 1: Data-driven sourcing

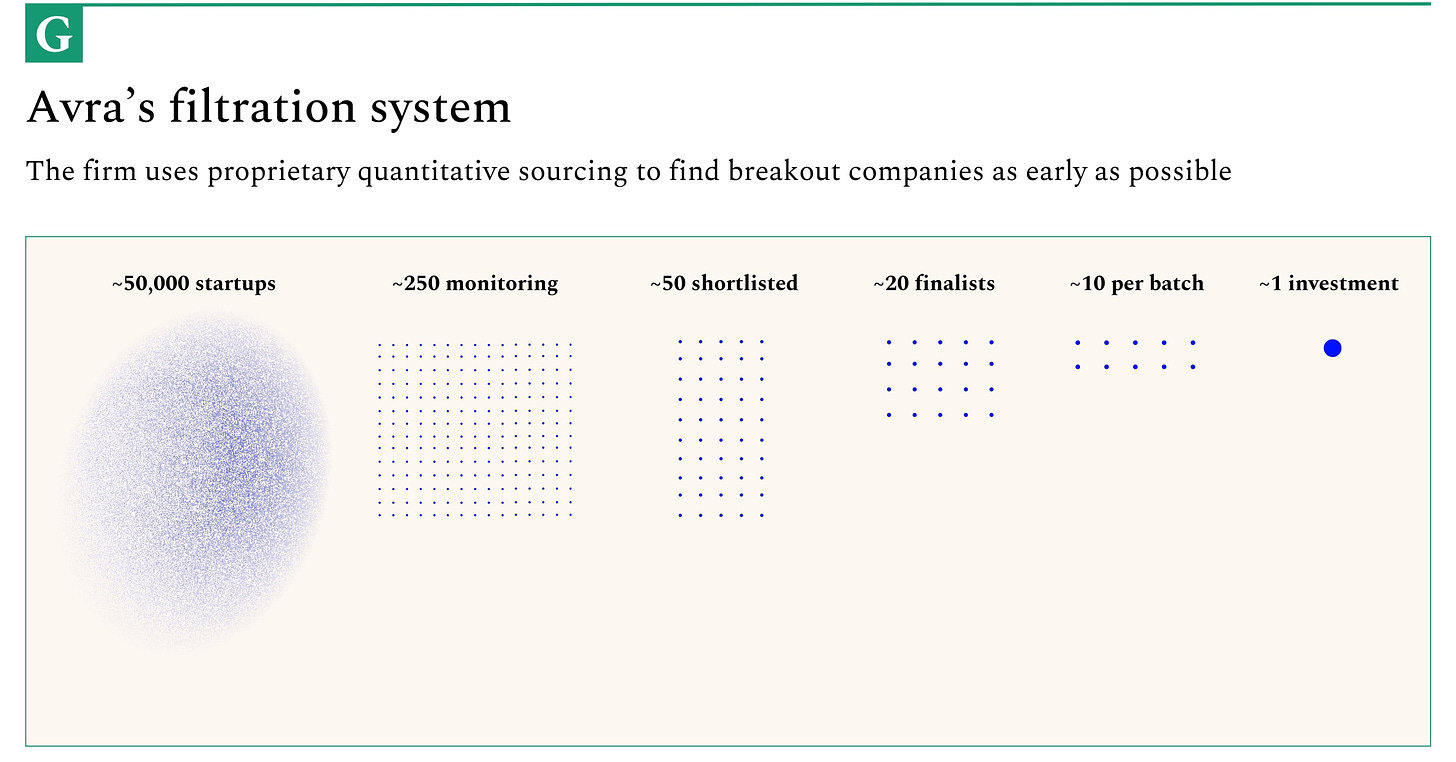

Avra scans tens of thousands of startups around the world through a bespoke early-detection system devised by Tiffany Kosolcharoen. Though it has a similar goal to the product Kosolocharoen built at YC Continuity – identifying breakout startups – it is being architected in a new technological era. “We get to reimagine it in the age of AI,” Kosolcharoen said. “The stack is being reinvented.”

The early-detection system tracks approximately 50,000 global startups between pre-seed and Series A, excluding Chinese businesses and those in sectors Avra feels unsuited to advise. Though the fund is generalist in approach, it steers clear of a few highly technical, specialized pockets like biotech.

Kosolcharoen and the broader team are tight-lipped about how exactly the system works but did share some of its key principles and a few example data sources. “There’s this large alternative data industry where hedge funds spend millions of dollars a year to acquire data sets. Through my past experiences, we’ve learned how to do it differently where we’re not spending that amount of money. We’re really looking at which metrics are leading versus lagging in breakout businesses,” Kosolcharoen explained. “For example, revenue might be a lagging indicator because it’s not necessarily the first metric that helps you identify a breakout business. The same is true of job openings – only after a company achieves a certain round of funding are they able to open up new positions.”

So, what data sources are actually leading? Lucas Fox highlighted the importance of tracking Github repositories and stars, Twitter trends, and engagement via platforms like Discord or other open-source communities. Avra’s system tracks the social activity of certain influential people – noting the new companies or entrepreneurs they follow. It also incorporates app traffic, web traffic, Hacker News upvotes, backlinks growth, and consumer credit card data. The system integrates qualitative signals, too, assessing the perceived quality of a founding team and the caliber of the company’s known cap table. In total, it tracks more than 50 custom sources to develop a sense of the current market.

Through this process, Avra filters 50,000 startups to a shortlist of a few hundred that it continuously monitors. Further screening relies on manual intervention and nuanced judgment. Kosolcharoen creates “competitive sets” for different industries as part of this process. The idea here is to parse the dynamics within a certain industry to allow for cleaner comparisons between players. “It’s a really controversial, contentious topic because every single person at a company defines their competitive set differently,” Kosolcharoen noted. “It’s about identifying the peer sets today and then going through the game theory to see who might be in that peer set in the future.”

The ultimate goal is to use this information to pick potential market winners. “There’s often a human angle to it, some product strategy, to identifying a category leader. You need to figure out which companies might converge onto each other,” Kosolcharoen clarified. “That’s a challenge if you anchor only on alternative data. The product roadmap and product strategy of a company doesn’t exist in a data format. You need a combination of looking at the data and the strategy to identify which companies may be inflecting among their peer set.”

For example, an analysis of the neobanking space would not only compare Nubank, Revolut, Chime, Monzo, and dozens of other consumer offerings. It would have highlighted the potential for neobrokers like Robinhood and Public to make a play for the space, for B2B offerings like Mercury and Brex to try and win over consumers, for rent rewards-focused cards like Bilt to extend outward, and for stablecoin-based products like DolarApp to win with new rails.

According to attendees of Avra's program, Kosolcharoen has a gift for this process. “She’s extremely talented at understanding business models,” Joseph Nelson, CEO of Roboflow, said. “When you have tactical questions around positioning, or what’s going on in your space, she can not only talk about it in terms of what makes sense strategically but also what’s playing out in the sector and how you should think about it as a result.”

Looking at the 37 companies that have attended the program so far, it’s evident that Avra’s system has identified non-obvious candidates alongside some of the buzzy names previously mentioned.

Anu Hariharan cited Clerk.dev as an example of Avra’s quantitative sourcing at work. Its system flagged the user management platform’s spiking sign-ups and encouraged Avra to reach out. In its second batch, Hariharan estimates that Kosolcharoen’s system helped select approximately 60% of the companies. Avra has also invited companies headquartered in Mexico, the United Kingdom, Saudi Arabia, Singapore, France, and Sweden – not entrepreneurial backwaters, but some way behind the USA.

Before it gets to the invitation stage, Avra conducts further filtering. It cannot reasonably meet with hundreds of companies; instead, it watches them over time and looks for inflection points followed by consistent growth. “We do week-over-week monitoring. That’s how we know which ones are taking off,” Hariharan said. “The key is to measure it dynamically. Pretty easily, you get to a top 50 because not everyone is growing week-over-week.”

Finally, Avra does external diligence to cut its top 50 down to 20 finalists. It conducts further research, speaks to customers, assesses the logos they’ve succeeded in signing up, and asks its community of founders for comment. “Our alums often say, ‘Talk to these people, don’t talk to those ones.’ They help us narrow down the list and also add founders we might have missed,’” Hariharan said. “They’ll say, ‘Hey, this company might not be on your radar because they just raised a seed and haven’t announced it, but they need to be on your list.’”

These referrals are a critical part of Avra’s sourcing process. Founders are often excellent judges of talent and early adopters of new, disruptive technologies.

According to Nic Dardenne, Avra is already benefiting from this process. “For our second batch, we were able to get 20-30 recommendations from founders that went through the first batch or had previous relationships with,” he said.

Hariharan noted that Anyscale (Avra Batch 2), an AI compute platform, had been referred by RunwayML’s CEO, Cris Valenzuela (Avra Batch 1). Similarly, Clair (Avra Batch 2), the provider of earned wage access solutions, came thanks to a recommendation from Plaid’s Zach Perret (YC Growth). “Clair actually hadn’t come up on our radar because they were just breaking out,” Hariharan said. “Zach said that we should really talk to them.”

Step 2: One-on-one evaluations

Once Avra has identified 20 finalists, it contacts them for a meeting. Before getting to the meetings themselves and what the fund is looking for, it’s worth highlighting an advantage Avra has in this outreach compared to traditional venture firms.

Hot companies are constantly warding off investors; garlic, crucifix, and terse email responses at the ready. Any startup the market sees as a potential breakout receives a steady drip of inbound interest, requests for casual coffee chats, and suggestions of pre-emptive financing. Though the first such offers may be flattering, they quickly become distracting, which is why so many CEOs shut them down with a simple: “heads down building, will circle back when we raise next.”

Because Avra offers a specific, differentiated product, it is able to sidestep this tripwire. When a member of the investment team reaches out to a startup CEO, it is not asking to invest; it is offering something of value. Especially when this pitch comes via a founder who enjoyed the program, it’s a powerful sell.

During its meetings with founders, Avra seeks to better understand the stage of the company and the capabilities of the founder. Three characteristics are particularly important:

Revenue threshold. Avra’s program is explicitly designed for growth-stage companies. If a company hasn’t achieved meaningful revenue, it may be better for them to wait for a later batch. “If you haven’t gotten to $2 million in annual revenue, it doesn’t make sense to do the program because it is not a good use of their time,” Hariharan said.

Scaling speed. As well as surpassing a certain threshold, Avra also looks to ensure a startup is growing rapidly. Much of Avra’s program focuses on building large, performant teams at hyper-speed, something a more modestly growing company may not need. “If you’re not scaling really fast in terms of revenue growth, you shouldnt be scaling your team,” Hariharan added.

A self-aware CEO. “I’ve had the privilege of working with a lot of really good founders, and they’re very self-aware,” Hariharan explained. “It’s almost a signal we’re testing for because we don’t want founders who feel like they know everything. It won’t work for us, and over the long term, we have learned it does not work well for the company.” Avra looks for CEOs that understand their strengths and weaknesses.

Is it difficult to gauge self-awareness? Avra seems to find it straightforward, asking a series of questions that force introspection. A few examples:

What’s energizing about your job? What’s draining?

What are three things you’re good at? What are three things you suck at?

What are the strengths of your leadership team?

How well do you think you’ve hired?

These questions, and others like them, provide a window into how founders have solved problems and their current assessment of the business.

Avra can’t invite every founder it meets with, cutting its 20 finalists down to a 10-12 company batch. So far, almost every company Hariharan has invited has accepted despite the commitment it requires. “The take-up is very high,” Hariharan said. According to Avra’s founder, only one company chose not to attend Batch 1 for timing reasons.

Step 3: Kick-off retreat

To create an environment in which founders feel comfortable sharing their challenges and failures, Avra kicks off each batch with an in-person retreat in Santa Rosa, California. This is a time for attendees to get to know one another and build context on each other’s businesses.

“It’s exceptionally helpful in setting the stage,” Roboflow’s Nelson said. “People share what’s working and not working inside their companies.” Vojta Drmota, CEO of Momence, shared a similar opinion: “You get to know the other founders on a personal level. There is no substitute for understanding who founders are and learning about their journey. That bond is really important for the rest of the program.”

Avra works to build rapport through structured exercises. “It feels kind of like a summer-camp-manufactured-fun kind of vibe,” Joseph Nelson said. “But it actually kind of works and makes you feel more relaxed with your peers. It establishes trust and candor amongst people in the program.”

Much of the retreat’s value occurs outside these team-building activities. “A big piece of it is just bringing people together,” Nic Dardenne explained. “It gives them a space away from their companies, away from their day-to-day, away from their laptop. It’s just free time to be able to connect.”

Step 4: Classes

The reason Avra invests in creating rapport between batchmates is because it wants its classes to be discussion groups, not lectures. “A lot of the value comes from founders sharing their problems, not just from the instructors,” Nic Dardenne remarked. “You need it not to be a one-to-many lecture. People have to feel comfortable sharing and being more vulnerable.”

Avra’s core curriculum is composed of 7 classes. Hariharan has asked that we not name the instructors so that we can share their takeaways while respecting the off-the-record nature of the sessions. These are Avra’s classes, in sequence:

Executive hiring and management (taught by two CEOs)

Mission, strategy, and metrics (taught by two CEOs)

Leading leaders (taught by public market CEO)

Operating cadence (taught by a CEO)

Scaling engineering (taught by two CTOs)

Scaling people management (taught by a CEO and former VP of People)

Financial Planning and fundraising (taught by a CFO)

Before each session, students are tasked with “pre-reading,” which usually takes a couple of hours to consume. They may also be prompted to reflect on the topic and tell the Avra team what they’re particularly keen to learn about, creating a more tailored program. Lucas Fox gave an example of how this works. “Ahead of our ‘Leading leaders’ session in Batch 2, we spent five minutes with each founder ahead of time really understanding the number one bottlenecks each of them had as it relates to people management. Out of 12 CEOs, we got 12 pressing problems. And then, on the call with the instructor, we just went one by one, asking, ‘How would you tackle this? How would you think about this?’ It’s very tactical. It’s not a general talk.”

The sessions themselves last approximately 90 minutes. Hariharan plays the role of interlocutor for instructors, prompting them to talk about certain experiences, share certain frameworks, or respond to questions. Her expertise is obvious in this role. It’s clear not only that she knows the stories of the instructors’ companies intimately, able to perfectly poke and prod, but that she also understands what is likely to be most valuable to growth-stage startups. As teachers share their experiences, students frequently chime in with questions or comments of their own. Magical moments occur when multiple CEOs – both those in the program and those teaching it – weigh in on a given subject, explaining how their company handles executive compensation or engineering structure.

Paul Copplestone, CEO of Supabase, highlighted the value of the discussions. “It’s super useful. And Anu is very good at prodding the instructors further. ‘What were the mistakes you made at this stage? Who did you hire? How many hours did you spend with executive recruits? What was your process?’ Anu’s constantly pulling them back to our stage – and maybe one step ahead. These topics are pretty timeless. There are all sorts of little tricks that founders have learned over the years. This is a way for them to pass that knowledge along.”

For RunwayML’s Cris Valenzuela, the value of the sessions was less in picking up specific tips and more in hearing the thinking process of exceptional CEOs. “I’m less a fan of instructions and recipes and rules that you can follow,” he said. “I’m more interested in intuition and how people make decisions. You can learn a lot by hearing how successful companies have been built and the decisions people took along the way. That’s the exposure I wanted. It wasn’t about getting something particular out of it, more of a way of thinking about how to tackle specific problems.”

Going through the experience together is another critical part of its value. “The reason the CEO job feels so lonely is because you’re grappling with things you’ve never dealt with before,” Hex founder Barry McCardel explained. “One of the few salves for it is knowing that the problems you’re facing are very common. When you go through a program like this, you get to talk to folks who are a few phases ahead and went through the same things you’re going through. You get to talk to other founders who have the same thoughts as you do. And they reaffirm for you that, yes, it is hard. And no, you’re not an idiot for struggling with it. It’s really helpful. It gets you out of your head and lets you zero in on the task at hand.”

Step 5: Office hours

In tandem with classes, Avra offers weekly office hours. These are an opportunity for founders to reflect on recent sessions and talk through their particular problems in greater detail.

“They’re super useful,” Paul Copplestone said, citing their impact on leveling up Supabase’s financials as part of Avra’s push for the company to create a “mini S-1” (more in a moment). “The mini S-1 project makes you think a lot and forces you to ask a lot of questions. Without the office hours, I would have been floundering a bit, especially around knowing how to write up our financials. The Avra team literally built spreadsheets for us, which I now use for our investors.”

Momence CEO Vojta Drmota also found the added attention of office hours valuable. “In between sessions we would meet with Anu and her team. It supplemented the sessions very well because it was more pointed toward where Momence is now and what we need to focus on.”

For Avra as an investor, office hours are another chance to diligence companies close up. Founders openly talk about their thorniest problems and discuss how they’re thinking about solving them. Avra then gets to observe how quickly and effectively they test different solutions and land on the correct answer. Though most growth VCs get to know potential investments over a long period of time (at least six months and usually a year) to create a longitudinal view of their progress, Avra gets to witness it up close and unvarnished.

Hariharan highlighted how valuable it is to see founders address problems in real time. “How fast you move is very important. How long is a founder sitting on a certain decision? Do they have tight feedback loops, and are they course-correcting quickly? What frameworks are they using? Do they get stuck by brick walls, or do they know how to run through them?”

Step 6: Mini S-1

Avra’s batch culminates with an exercise: writing a “mini” S-1 filing. The goal is for founders to understand how their business fits into the broader corporate landscape, learn how public market investors value comparable companies, reflect on the core drivers of their current success, and sketch a blueprint for life as a public business.

Vojta Drmota outlined the process and its value. “It teaches you to present your business in a structured fashion. That’s something you don’t do as a private company on a regular basis. You write investor updates, but this is a much more detailed format. That’s very helpful, in and of itself,” he said. “Another key part of it is that in the S-1, you have to explain to an investor the $10 billion, $50 billion, or $100 billion outcome. You have to indicate where the company can go to impress upon investors that it’s a worthy investment. That’s not something you really think about as a founder. You think about, ‘How do I get to the $15 million revenue mark? How do I get to the $25 million mark?’ You rarely think about how you get to $5 billion or $10 billion.”

Thinking in those terms forces a level of bottom-up analysis that many startups don’t prioritize early in their lives. “You have to articulate what the best case scenario for your TAM is, what your market share has to look like, and what ACVs have to look like,” Drmota said. “It forces you to think not just about your mission but how it can be materialized.”

Founders rely on help from Avra and feedback from their batchmates to craft their S-1, which they eventually present in front of prominent public market investors. “It’s definitely an interesting process,” Cris Valenzuela said. “You learn a lot just by doing it, but you also get a lot because you speak with other people about it and get feedback. It helps you understand the future things you should be thinking about. I’d never done it before.”

Anu Hariharan consistently and earnestly emphasizes that office hours and the mini S-1 exercise are done to serve founders. There is no doubting the sincerity of that suggestion. The pragmatists among you cannot help but notice the advantages these exercises grant Avra the investor. From that vantage, the S-1 exercise asks founders to diligence themselves, presenting their findings and future growth for review. In essence, they are creating a pitch – stuffed with detail, risks, and opportunities. This exercise would not work if founders didn’t find it valuable; a happy byproduct is that it doubles as investment research.

Step 7: Private wiki

If a YC alum needs a question answered, there’s a good chance they’ll post on Bookface. That’s the name for the accelerator’s private site featuring a discussion forum, investor ratings, a library of resources, and various perks.

Avra is building its own version of that resource, designed for growth-stage entrepreneurs. For now, the private wiki is barebones but already intriguing. It features a directory of the 42 founders who have attended Avra’s program, access to a private off-the-record podcast, and a wiki that documents key lessons from across the curriculum. Visit the page for “Leading leaders,” for example, and you’ll find well-structured notes gleaned from the associated session. Over time, Avra plans to add to these pages, creating a repository of high-quality information that helps founders during the program and beyond.

It’s exciting to envision what form this might take. As well as incorporating expertise from multiple CEOs over time in a given page, Avra could also collect collateral from different entrepreneurs. Sometimes, simply seeing how a founder lays out their hiring process on the page, or builds their board deck, can make a tangible difference.

Roboflow’s Nelson hopes Avra facilitates more of this resource sharing. “I think there are probably ways to grease the wheels and make sharing resources more commonplace. For example, making companies more comfortable walking through recent board decks and trading ideas. You can only do that when you have a close relationship.”

As the trusted connection between its instructors and students, Avra is positioned to act as the hub for this information. In time, growth-stage founders may want to join Hariharan’s community as much to access this library as to attend its course.

Step 8: Alumni sessions

Though Avra’s program culminates with the mini S-1 exercise, the firm’s relationship with founders continues beyond it. As well as continually adding new resources to its wiki, Avra holds alumni sessions and an off-the-record podcast.

There is no real difference between these two products. Both feature Hariharan holding a conversation with a prominent founder, operator, or technologist, using her expert prodding to deftly direct the discussion. Past sessions have given founders an opportunity to learn about AI from a long-time expert, hear about a remarkable public market turnaround, and discover how an external CEO rescued a flagging unicorn from collapse. The idea of the podcast is to inspire founders during their most difficult times.

Alumni sessions are an effective way for Avra to augment founders’ education and address transient issues. For example, had Avra existed during the Silicon Valley Bank catastrophe, it would have been well-positioned to put together a rapid response session, pulling in experts from relevant fields. As funding ebbs and flows and disruptive technologies like AI change the game on the field, this ongoing education is extremely valuable.

Class is in session

The hours I spent with Avra’s curriculum were among my highest-leverage of the year. In the course of a cumulative 12 hours, I learned how some of the world’s best CEOs manage their recruiting, financials, engineering teams, and fundraises. I heard of common mistakes, near-death experiences, and miraculous turnarounds.

All of which is why I’m extremely excited that Avra has allowed The Generalist to share takeaways from the program. To be clear, these are just the tip of the iceberg. Each session is packed with fascinating insights – some obvious in their value, others more subtle.

When Hariharan pitches the program to founders, she tells them they will receive direction in three areas:

Executive hiring and management

Shipping fast as you scale

Execution and clarity of thought

Rather than walk through all seven sessions, we’ve distilled impactful pieces of advice from the entire curriculum that fit those categories.

Naturally, to respect the confidentiality of the instructors, we’ve kept them anonymous and stayed clear of identifying information. We’ve highlighted universal takeaways that stand alone and that we believe will be of greatest use to other founders.

Focus 1: Executive hiring and management

To scale your company, you must learn to hire exceptional people with capabilities that surpass your own in at least one dimension. Though founders are used to pinch-hitting across functions in a startup’s early days, winning in the growth phase necessitates finding and converting executives who can take your company to the next step.

Executive hiring success rate. A surprisingly large number of executive hires do not work out. Hex founder Barry McCardel cited this as particularly valuable information. “People will tell you that a good success rate for leadership hires is 60-70%. In reality, it’s closer to 50% for most companies, which is insane when you think about it. Hearing from other CEOs who are further along in their journey [was really helpful.]” Great executives surpass these levels. One CEO said that their last 15 executive hires had all worked out, an “exceptional” record.

Don’t skip the references. It’s easy to skip out on referring executive hires earlier in your company’s life. Often, you might think you have enough information to make the call yourself. Don’t take this shortcut. One instructor said that 30% of the team references revealed a piece of critical information about a recruit. When you conduct references, ask the reference to score the person out of 10. Anything below a ‘9’ should be considered a poor score.

Take a “breadth-first” approach to the executive search. A common cause of a failed hire is not knowing the profile of the person you’re recruiting for. To prevent that from happening, conduct a “breadth-first” search in which you speak to different “flavors” of the role you’re hiring for. For example, if you’re recruiting a CFO, talk to one with more of an accounting background, one that’s more FP&A oriented, and one that focuses on strategic finance to see which feels like the best fit. When you find the right person, be aggressive in winning them. “Elite founders don’t lose candidates,” was one CEO’s mantra.

Invest heavily in executive onboarding. When you succeed in hiring an executive, give them the tools to succeed. Align on the expectations for the role, and have them devise a plan for their first 30, 60, 90 days. (This is a place where you should lean on their functional expertise.) For the first 30-60 days, encourage them to spend as much time as possible simply learning about the organization rather than managing direct reports or producing work. For example, one incoming CEO conducted 80 one-on-ones and 20 group meetings before officially taking the reins. This is time well spent.

Proactively give raises to retain talent. Employees who scale alongside a startup often drastically increase their importance in a short amount of time. To avoid losing these people, give “out of band” pay increases when you notice their salary lags behind their impact. This will prevent them from feeling undervalued and looking for a new role. Additionally, one CEO recommends conducting stock refresher grants around the 2.5-year mark of an employee’s tenure as many consider their next move after about three years.

Focus 2: Shipping fast as you scale

Founders often think their organization will accelerate as headcount increases. After all, can’t you achieve more with more people? It’s more common for the opposite to occur, at least in the short term. As your company scales, old processes break, the quality of new hires degrades, and coordination costs grow. Shipping fast as you scale requires an uncompromising mindset, intense work ethic, and sound strategy.

Don’t accept “CEO in a box” trade-offs. Internal leaders will often come to you with either/or decisions: you can either have a product built fast or with quality; which do you want? One executive calls these “CEO in a box” trade-offs that should not be accepted. Why can’t a product be delivered quickly and with exceptional quality? It is almost always possible to avoid these false compromises.

When troubleshooting, look for anecdotal evidence, not data. When a part of the organization is not working, it’s more useful to dig into transcripts or Slack messages than review high-level numbers. If the support team is lagging, read the last 25 tickets. If sales is underperforming, read the last 25 Gong recordings. You’ll spot patterns and get much deeper context than a dashboard can provide.

Commit to crazy. While attending an accelerator like YC, founders are pushed to their limits and operate at a frenzied pace. According to one CEO, when the program ends, most people revert to a much slower cadence. To build a legendary business, you cannot allow yourself to do this. Instead, you should be part of the few “crazy motherfuckers” that maintain that relentless speed. Working 20% more doesn’t yield a 20% productivity increase, according to this CEO; it delivers “way, way more.”

Go slow to go fast. To build engineering teams that ship quickly, spend time upfront on two key areas: data modeling and core technology decisions. Both of these are difficult to change down the line, so think it through before committing. On a related note, consider introducing code reviews and tests from day one or close to it. Both will save you time in the long run and ensure you have strong engineering foundations.

Break your engineering team into pods. As your company scales, you’ll need to manage an increasing number of engineers. Splitting people into arbitrary teams can drastically increase communication and coordination costs, slowing down shipping. One CTO outlines the approach his company uses, organizing itself into small 8-10 person “pods.” Pods are composed of 5-7 engineers, a PM, a designer, and a data scientist. Pods are given the context and resources they need to achieve their goals but are empowered to set their own strategy and to act as “small startups.”

Focus 3: Execution and clarity of thought

In preparation for your Series B, take the time to look toward the future and build the systems you need to achieve your ultimate goals. Startups are constantly faced with urgent issues that require attention. You must proactively make time for non-urgent but still important subjects. In particular, make the effort to define your metrics, hone your messaging, and prepare for future raises.

Separate input and output metrics. Companies are used to focusing on “output” metrics like revenue or monthly active users (MAUs). Though this information is useful, especially for investors, it’s insufficiently actionable. What do you have to do exactly to grow MAUs? “Input” metrics are KPIs that help drive your output metrics and are more directly within your control. For example, to increase revenue as a food delivery company, you might set input metrics of order frequency and customer retention, as these could make an impact on your topline. Picking the right input metrics will require data analysis and deep consideration, but once you identify them, it’s much easier to direct your team’s efforts effectively.

Repeat your message consistently and frequently. Creating alignment across the organization requires you to restate your company’s mission, metrics, and strategy much more than you might expect. At least every week, you should re-communicate this to the company, using consistent language. Though it may seem like overkill, it’s critical to maintaining a common goal, refocusing different teams, and getting new hires up to speed.

Financial planning by confidence interval. As your company matures, building out a strategic financial department becomes essential. You will need a Head of Finance and, eventually, a CFO who can help you set realistic projections and plan for the future. Though setting goals often begins top-down, with a CEO outlining their ambitions, it should gradually become more bottom-up as the team scales and your processes become more predictable. Nevertheless, making perfect projections can be difficult for an organization that develops rapidly. One strategy is to plan for whatever period you have 70% confidence you can accurately forecast. This might be three months, six months, or a year. While this shouldn’t replace your annual planning, it ensures your forecasts don’t drift too out of line.

Lay the groundwork with investors. Growth-stage investors are writing larger checks, typically in the $20-100 million range. As a result, their process is longer and more detailed. To ensure you fundraise from a position of strength, identify 5-10 investors you believe would be suited to lead your next round and begin building relationships with them 6-12 months ahead of when you plan to raise. This gives VCs the opportunity to get to know you better, learn more about your model and market, and arrive to the fundraise with a prepared mind. It also allows you to vet potential partners.

Running a tight fundraise. If poorly managed, raising capital can take months or longer. You should drive investors to follow a 1-4 week diligence process. For that to happen, you must arrive prepared and equipped with a well-stocked data room. Once the process has begun, you should focus your attention on “high-signal investors” – namely, those that actually seem interested in your business. A good rule of thumb: “An interested investor tries to speed you up rather than slow you down.” When possible, use the momentum of other VCs to drive peers through the process.

Aberrant venture

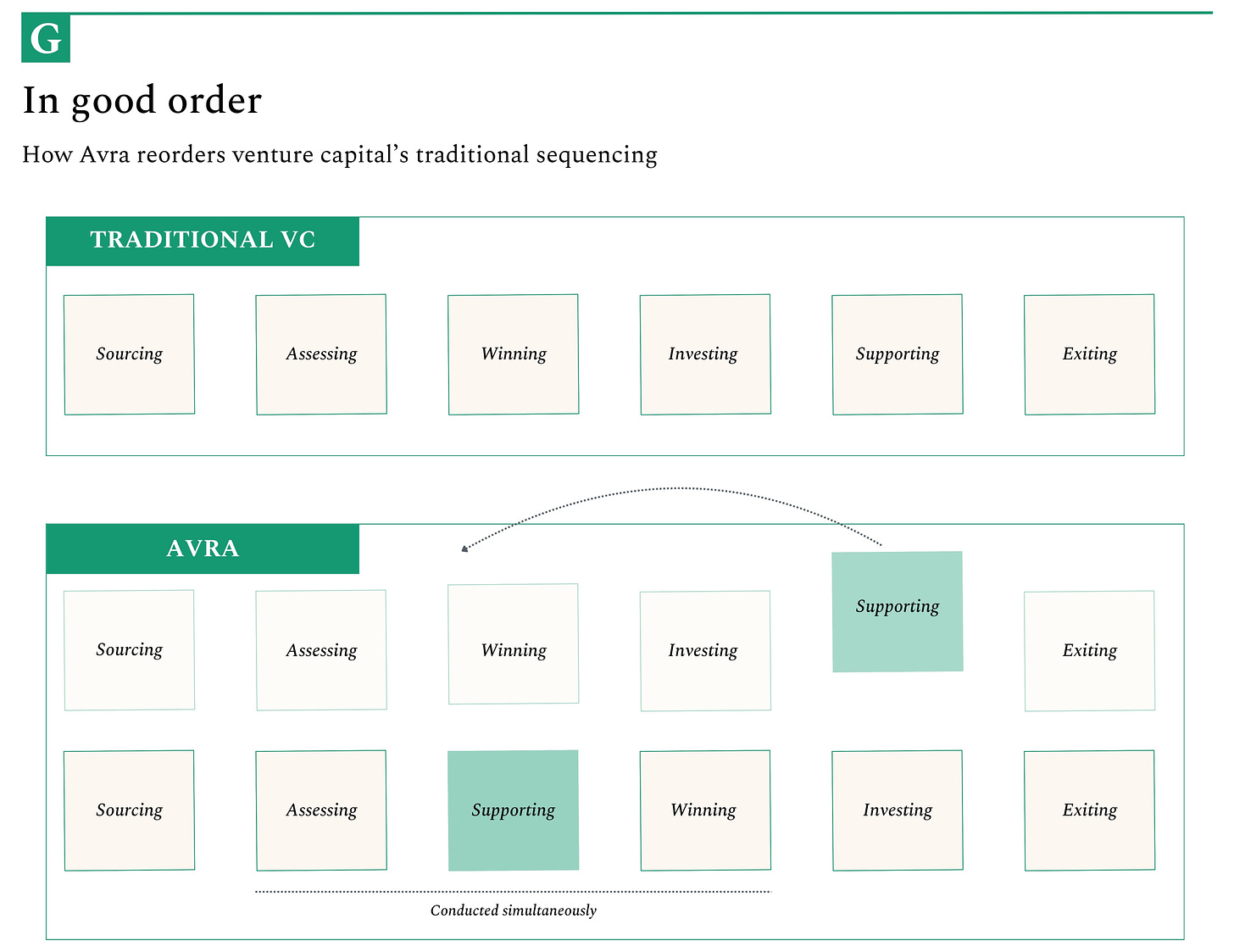

Venture capital, all of its theater and competition, can be condensed into six essential tasks:

Sourcing. To invest in a legendary company, you must find it first. Sourcing is the art of discovering as many high-quality opportunities as possible, ideally before your rivals.

Assessing. Once you’ve identified a potential investment, you must spend time diligencing it. At the growth stage, this often occurs over months or years of conversations and formal research.

Winning. Just because you have conviction in a startup does not mean you get to invest in it. Venture capitalists have to convince founders to let them buy shares, often over competitors.

Investing. Though usually winning a deal results in an investment being made, they are theoretically distinct steps. Because of Avra’s model, and its quirks, it’s worth separating them.

Supporting. Not all VC firms want to help their portfolio companies, with some believing it to be a folly. Most do, however, assist with hiring, business development, future financing, and much more. This is the “adding value” phase that VCs market to the point of parody.

Exiting. To realize a return on an investment, VCs have to exit their position at some point. This may occur as a company enters the public markets, via an M&A event, or through secondary sales.

Not only do these six tasks neatly summarize the work of a venture capitalist, but they also describe the sequence in which this style of investing occurs. Though there’s frequent overlap between them, each more or less operates as a distinct step in the process: you find a business, evaluate it, win it, “work” it, and sell it. It’s chronological and sequential.

One of the most interesting aspects of Avra’s model is that it rearranges these steps to its own benefit. Though Avra starts by sourcing companies, it follows that stage by assessing, winning, and supporting a startup all at the same time. Its program compresses these three steps into one: Avra assesses a company as it adds value and, in doing so, preemptively wins the right to invest. Avra follows this process with all of its companies, including many it will not invest in. Only later on does it actually circle back and deploy capital.

It’s a meaningful twist on the venture model. Though investors and founders spend time getting to know one another and learning about each other’s businesses, there’s an unavoidable leap of faith made when entering into a partnership. A blustering dealmaker may spend months telling a CEO how they’ll win them customers, drive candidates to their doors, and broker introductions, only to disappear once the ink has dried. Another financier may extoll the virtues of an expansive in-house team and sophisticated software stack, open only to portfolio companies, and leave the entrepreneur with ineffectual help and vaporware.

Because Avra proactively frontloads its value-add, founders don’t have to worry about a bait-and-switch. Hariharan’s firm does not tell you how it can help; it shows you in vivid detail. When it comes to partnering, the leap of faith has been shortened into a puddle jump.

Several of the founders we spoke with expressed their interest in taking money from Avra despite the fact they were not actively fundraising. This is especially notable given that Hariharan’s firm works with many of the ecosystem’s hottest startups who have an abundance of funding options. “If we end up doing a round, I’ll definitely reach out to them,” Supabase’s Paul Copplestone said. “The most helpful and best investor in terms of helpfulness is definitely YC. I’d put Avra right next to them,” he added. “We’re not in a fundraising situation right now, so it’s hard to say, but I don’t see a reason why we wouldn’t reach out to them,” said Vojta Drmota. “I think it would be a strong yes.”

No venture investor can win every deal they want, of course, and though Avra has unique weapons, it also has weaknesses. “There are upsides and downsides of a new fund,” Joseph Nelson said. “One of the downsides is that a lot of the value for a fund is driving market awareness, whether that’s companies or candidates. That’s something I’m sure Avra is aware of. It’s just like a startup – you just have to offer to ensure you win a customer’s business.”

The early indications suggest that Avra’s product is doing a good job of winning founders’ business. So far, Hariharan has backed two companies, Zepto and Supabase, which did circle back to Avra a few months after our interview. Interestingly, Zepto is not a graduate of Avra’s program but a breakout business that YC Continuity previously backed. The fact that Avra participated in the grocery delivery company’s $665 million Series F round illustrates its ability to be flexible and pragmatic, investing in the best opportunities for which it has a prepared mind.

It also hints at a remaining opportunity Hariharan and her team intend to address: pre-IPO businesses. Just as growth-stage founders need dedicated help, Avra is convinced that CEOs heading for the public markets could benefit from tailored tutelage.

“The culmination of a great journey is becoming a public company,” Lucas Fox said. “There’s a reason the vast majority of the Fortune 500 is public – it comes with operational rigor, and there’s a lot of beauty and elegance in being a high-performing public business. We want to be able to partner with founders from the moment they start scaling through to the public markets.”

It would be a shrewd addition. For even exceptional startup founders, entering the public markets is a learning moment. It requires education and preparation, as well as the embrace of new rules and norms. Fox outlined what this program might look like: “We’ll invite companies that are 1-2 years from being public, and invite them to do a smaller program, probably on the weekends. We have alumni from the program that have already taken their companies public who can teach. We’ll separate it into certain modules, just like the current Avra program designed to help founders avoid common mistakes. It might talk about how to pick the right investment bank, structure your audited financials, or tell your story.”

By assisting founders at this stage, Avra would once again get a front-row seat to analyze them and could win the opportunity to invest ahead of a public debut. It’s an intriguing position in the capital stack, as there’s relatively little risk, often notable upside, and a much shorter path to liquidity.

Crucially, it also strengthens Avra’s existing machine. At the moment, much of the fund’s success depends on its goodwill with talented founders willing to teach its sessions. Without these exceptional instructors, it might struggle to attract high-quality growth-stage entrepreneurs to attend its program. Though Hariharan can relay stories and frameworks second-hand, it is more powerful for CEOs to learn directly from one another. By introducing a pre-IPO program, Avra could expressly “reward” those who teach its growth-stage program. Though these are not purely transactional relationships, having a tangible way of returning the favor and deepening the connection between Avra and this critical stakeholder fortifies its approach. “It would tie into the whole ecosystem,” Fox said. “We want to find a way to add value to our teachers as well. We do that one-off right now by introducing them to key people, but we want a systematic playbook to funnel these guests into so that they feel like they’re part of the program, too.”

Running a high-growth startup is a job for which there is no real training. It might help if you’ve already built a career for yourself, but it can just as easily work against you. It’s a bonus if you can code, but certainly not a prerequisite. Have you finished your module on self-reliance? How about your symposium on irrational hubris and unhealthy tenacity? From which institution did you receive your Master’s in resourcefulness? Which PhD program granted your doctorate in pain tolerance?

To build a business is a lonely, bruising job; to do so while having your foot glued to the gas pedal ratchets up the stress and risk to the mix.

Since the closure of YC Continuity, Avra has emerged as the only serious school for the tiny subset of people building rapidly scaling businesses. Its existence is a benefit to the startup ecosystem and an illustration of the innovation still possible in venture capital. Amongst predictions of a great culling in the asset class’s ranks, Avra shows that new funds are viable, and new approaches can – with enough originality and distinctive value – become increasingly essential. The secret may be to operate as little like a venture firm as possible.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

Mario - congratulations. Your articles keep getting better and better. Tbh, even calling them ‘articles’ feels slightly likely I’m doing you a disservice considering the amount of research you clearly put into them. I’m looking forward to the next one.

Fantastic story. Well done Mario.