Brex’s Second Act

The $12.3 billion fintech is hitting new heights and entering a new growth phase. It’s a dividend of the firm’s clear-eyed decision-making.

The Generalist delivers in-depth analysis and insights on the world's most successful companies, executives, and technologies. Join us to make sure you don’t miss our next briefing.

Brought to you by Brex

Brex is the all-in-one spend platform trusted by startups and fast-growing enterprises. Companies like DoorDash, Coinbase, Scale, and Airtable use Brex for their business accounts, expense management, corporate cards, bill pay, travel, and more. It’s a sophisticated, powerful, one-stop shop that saves time, streamlines compliance, and keeps teams on budget.

Even more impressively, Brex works around the world. The company’s global platform accommodates spending in over 100 currencies while considering domestic regulations and local corporate policies. No matter how distributed your team is, Brex is ready.

Please note: As always, this is not financial advice.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about Brex.

Brex is cooking. The all-in-one financial platform is in rare form. The firm is expected to hit $500 million in annualized revenue within the next twelve months. Crucially, one of its fastest-growing units is Empower – a high-margin software-as-a-service product for large enterprises.

Built different. Though customers might not notice it, one of Brex’s core advantages is its underlying architecture. From the beginning, founders Henrique Dubugras and Pedro Franceschi have preferred to build in-house, eschewing third-party offerings. The result is a powerful, modular structure capable of accommodating massive scale. According to Brex’s founders, it could prove a compounding advantage.

From point to platform. As its customers have grown, Brex has, too. While it started life offering credit cards to startups, it’s evolved into a comprehensive, multi-pronged platform offering expense management, bill pay, travel, business accounts, and much more. In undertaking this evolution, Brex has positioned itself to scale with tech’s fastest-growing business, winning customers like DoorDash, Coinbase, and Retool.

The dividends of hard decisions. Last summer, Brex announced one of its hardest decisions: it was offboarding small-business customers to focus on better serving venture-backed startups and enterprises. It was a move that attracted negative press and confused some customers. The decision has been vindicated. Brex has regained its mesmerizing shipping speed and improved its service.

Serving startups. During the Silicon Valley Bank crash, few businesses stepped up as much as Brex. As well as working around the clock to onboard new customers, founder Henrique Dubugras rushed to pull together a $1 billion emergency facility to assist entrepreneurs struggling to make payroll. While it ultimately wasn’t needed, thanks to the FDIC stepping in, it demonstrates the lengths Brex will go for the startup community. A coordinated new initiative aims to boost how the company serves startups further.

This piece was written as part of The Generalist’s partner program. You can read about the ethical guidelines I adhere to in the link above. I always note partnerships transparently, only share my genuine opinion, and commit to working with organizations I consider exceptional. Brex is one of them.

Dig through Jeff Bezos’ 1997 Annual Shareholders Letter for long enough, and you’ll find an ominous message. Buried in the footnotes is a warning of sorts, one that only makes sense with sufficient context. Alongside more perfunctory updates, Bezos uses this letter to outline his theory of decision-making. For the Amazon founder, there are only two types of decisions in the world.

“Type 1” decisions are significant and irreversible. In Bezos’ parlance, they are one-way doors: “If you walk through and don’t like what you see on the other side, you can’t get back to where you were before.” “Type 2” decisions operate differently. They are two-way doors – easily reversible and light on jeopardy. When it comes to Type 2 decisions, if you don’t like your choice, just walk it back and try again.

Bezos makes his concern clear in his letter: as Amazon scales, it cannot lose its nimbleness. Employees across the company must recognize when they are facing a “Type 2” decision – and move quickly. “As organizations get larger, there seems to be a tendency to use the heavy-weight Type 1 decision-making process on most decisions, including many Type 2 decisions,” he writes. “The end result of this is slowness, unthoughtful risk aversion, failure to experiment sufficiently, and consequently diminished invention.”

Bezos’ observation is astute, but the footnote attached carries a greater sense of foreboding – at least for startup founders. “The opposite scenario is less interesting,” the Amazon chief notes, “Any companies that habitually use the light-weight Type 2 decision-making process to make Type 1 decisions go extinct before they get large.”

It is easy to miss the significance of that message, clouded as it is with corporate speak and the CEO’s vernacular. In truth, Bezos is saying something simple: companies that make the wrong decisions when they matter die. If you move too quickly, think too little, and act without strategy, you will be overtaken. While big companies like Amazon might worry about maintaining their speed at scale, startups must know when to slow down and deliberate, to recognize when the stakes are high and the consequences of a misstep profound.

Not only do these moments determine whether your company continues to grow, they define its DNA. As former founder and venture capitalist Ben Horowitz writes in his book, The Hard Thing About Hard Things, “Every time you make the hard, correct decision, you become a bit more courageous, and every time you make the easy, wrong decision, you become a bit more cowardly. If you are CEO, these choices will lead to a courageous or cowardly company.”

In June 2022, Brex founders Henrique Dubugras and Pedro Franceschi announced one of the hardest decisions of their company’s life. From its inception in 2017, the fintech best known for its credit card offering had focused on startups. Its offering had proved compelling to customers and intoxicating to investors, catapulting the five-year-old business to a valuation north of $12 billion. However, as Brex grew and expanded its offering, it drew an increasingly diverse user base. Though built to serve venture-backed businesses managing millions of dollars in capital, Brex was soon relied upon by small businesses across the United States, from small agencies to local restaurants.

While Dubugras and Franceschi initially welcomed this new market, the difficulties of serving multiple stakeholders soon became clear. “We didn’t originally appreciate how different these customers were,” Franceschi remarked. Though SMBs liked Brex’s elegance and ease of use, they had fundamentally different needs than venture-backed startups. Trying to serve both customer bases created problems across the company, from product development to customer support. “It started pulling the company in two directions,” Franceschi said. Something had to change.

Brex’s founders faced a crossroads. Should they keep splitting their attention to serve SMBs, or refocus on tech-focused startups and high growth companies? It was a classic Type 1 decision with high stakes and little recourse. Make the wrong call, and Brex could find itself mired in operational complexities for years, permanently curbing its trajectory. Make the right one, and Brex could continue to build and thrive – but at the expense of part of its customer base.

In the end, Brex made the hard, correct decision – one that Franceschi calls “very principled” – and then communicated it clumsily. In June 2022, the company released a statement to inform SMBs that it would stop supporting them in the coming months. However, its ambiguous wording left a much larger portion of Brex’s customer base concerned about losing service.

Suddenly, startup CEOs wondered if they were about to be abandoned by the financial partner they’d helped hit remarkable heights. Even after quickly clarifying that its support for venture-backed startups remained undisturbed, many were left feeling disappointed and confused. “That was my worst moment,” Dubugras said. “You spend all this time asking customers to trust you and then to say, ‘Hey, you can’t use our product anymore’ – that doesn’t feel right. We had people hating us on Twitter, sending us nasty emails. All of it took a toll. But I don’t regret it because it was the correct decision for our business.”

What a difference a year makes. The past twelve and a half months have demonstrated the wisdom of Dubugras and Franceschi’s decision. Brex has operated at astonishing speed over the intervening period shipping a slew of updates and driving its core enterprise product to $100 million in annualized revenue. Those improvements have re-strengthened its grip on the startup market and proved its ability to serve larger customers like DoorDash, Coinbase, and Airbnb.

As well as showcasing the dividends of renowned focus, 2023 has also offered a chance at redemption. As Silicon Valley Bank disintegrated in March, few companies stepped into the vacuum as definitively as Brex. The firm worked around the clock to onboard new customers and moved quickly to pull together a bridge loan for startups facing shutdown. Its decisiveness and leadership did not go unnoticed, showcasing its connection to the startup ecosystem.

The overarching image of 2023 Brex is that of a company in the early innings of a new growth surge. If Dubugras and Franceschi’s firm can continue its impressive pace, the next five years could see it become one of the world’s most important businesses, a core piece of a corporation’s financial infrastructure. A compelling second act has begun.

Origins: Built for this

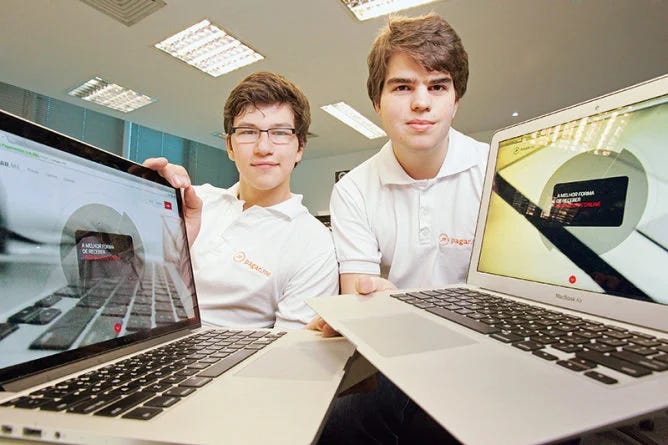

Given Silicon Valley’s worship of the wunderkind, it is something of a surprise to learn that the average age for a startup founder is 41.9. Henrique Dubugras and Pedro Franceschi are the sort of entrepreneurs who skew that data and reinforce the myth. By their early twenties, the California transplants had founded not one but two multi-million dollar companies. It is a story that begins on the internet; it could hardly have started anywhere else.

More than 250 miles separate Rio de Janeiro from São Paulo. For many, it feels farther. In the popular imagination, Brazil’s two most populous cities embody different philosophies and disparate ways of living. Rio is the coastal libertine, insouciant and life-giving, less a formal city than a dance of sand, sea, and sun expressed through the medium of urban planning. Sao Paulo is the metropolis in purer, fiercer form. Its charms require greater work, sprouting as they do at the edges of a ferruginous commercial powerhouse. They are nonetheless there. This is a city of life, too, just one rendered in steel and concrete. However nuanced, their differences result in an ineluctable debate: which is better? A person can love both, but they cannot love both equally. (The French writer Stendhal may have penned a famous book about Rome, but only Florence’s crushing beauty drove him to faint.)

In 2012, two Brazilian teenagers found themselves locked in a different kind of debate: Vim or Emacs? Over Twitter, Rio-based Pedro Franceschi sparred with Paulista Henrique Dubugras. The duo didn’t know each other, but each coded enough to have an opinion on the superior text editor. Franceschi was a fan of Emacs’ power and configurability, while Dubugras favored Vim’s speed and portability.

Enjoying the sparring match and perhaps sensing a kindred spirit, the pair moved their debate from Twitter to a Skype call. Franceschi quickly conceded: “I was wrong, Henrique convinced me to switch.” Whatever their differences in opinion, the conversation revealed the many interests the teenagers shared. “We realized we had so much in common,” Franceschi said. “We were both young engineers in Brazil at a time when not many people our age were coding. That bonded us.”

The conversations continued over the following months, with the pair trading startup ideas. Despite their youth, both Dubugras and Franceschi brought previous work experience to the table. A few years earlier, frustrated by the exorbitant costs of the Korean video game Ragnarok, a favorite of his, Dubugras had created an alternative with a different business model. Consumers could buy one-off in-game items rather than paying a subscription fee. That episode allowed him to observe the complexities of processing online payments. It also attracted legal ire. A wave of cease and desist letters arrived at his home in Sao Paulo, concerning his mother. “I didn’t know what they meant, but she was pretty upset,” he recalled with a chuckle.

Franceschi had been similarly busy. The Rio resident started coding at nine, spending his free time developing apps and jailbreaking iPhones. When he and Dubugras met, Franceschi had already parlayed his abilities into three software engineering jobs. His most recent gig had been at M4U, a payments business. Both of them had witnessed the shoddy state of affairs in online payments first-hand. “We saw how bad it was,” Franceschi said, “We just said to ourselves, ‘Let’s build something better. And let’s focus the product on developers.” Dubugras and Franceschi decided to become business partners. They still had yet to meet in person.

“We had no idea what we were doing.”

In 2013, the teenagers formally launched Pagar.me, an online payments processor. Though they weren’t familiar with the Collisons’ company when they started, Pagar.me was functionally and philosophically aligned with Stripe, albeit with a different geographical focus. In the years to come, the press frequently referred to it as the “Stripe of Brazil.”

Simply starting a company at an age when most are sweating their college applications demonstrated impressive precocity. Beyond their solid sectoral experience, Franceschi attributes that boldness to the follies of youth. “We had no idea what we were doing. The level of ignorance we had about what it takes to build a company probably helped.”

Pagar.me was a success. Over the next three years, Dubugras and Franceschi scaled their business to more than 150 employees, $1 billion in annual transaction volume, and millions in revenue – all while balancing the demands of high school. At around the same time Pagar.me’s founders negotiated term sheets with megafunds like DST Global, they applied to college. Both Dubugras and Franceschi agreed on their dream school: Stanford. Ever since discovering the protagonist of his favorite TV show Chuck had attended the Palo Alto campus, Dubugras had dreamt of attending. That childhood ambition was bolstered by its position at the epicenter of innovation. Franceschi shared that passion: “We wanted to be at the bleeding edge of technology.”

In early 2016, the young entrepreneurs traded Brazil’s metropolises for California. While they initially fretted about the cost of tuition, they need not have worried. In August of that year, Pagar.me was acquired by Stone, a publicly-traded Brazilian fintech. While details of the deal have never been disclosed, it was more than enough to cover an education at Stanford and life in a new country.

In the end, Franceschi and Dubugras’ stint at Stanford was brief. “We only stayed six months,” Dubugras recalled. “Then we came up with a new idea for a company and dropped out.” The buzz and charm of college life couldn’t compete with the rush of building.

“What would you build if you could build anything?”

Twenty-sixteen was not only the year of Pagar.me’s acquisition. It was also “the year of VR,” according to many heraldic reports. While hindsight tells us that the technology was still years away from even minor consumer adoption, the debut headsets from Facebook, Microsoft, and HTC caused a stir. After an Oculus demo at the Palo Alto Mall left them “amazed,” Dubugras and Franceschi started working on “Veyond,” a VR company designed to bring the technology to the mass market. They joined Y Combinator’s winter batch to try and bring that vision to fruition.

To the founders’ credit, they did not let enthusiasm cloud their commercial instincts. Though inspired by VR’s potential, at YC, Franceschi and Dubugras began to question the timing of their company and whether they were the right people to run it. Though they hadn’t let a lack of knowledge dissuade them from building Pagar.me, it felt different this time. Not only were they still green entrepreneurs, but nearly every aspect of Veyond felt unfamiliar. There wasn’t a strong founder-market fit,” Franceschi said. “We didn’t know anything about hardware, for example. It was hard to think of how we would be successful.”

A conversation with YC Managing Director Michael Seibel prompted a rethink. “I remember he asked us, ‘What would you build if you could build anything?’” Dubugras said. “I answered, ‘A business bank.’” While building Pagar.me, its founders had hoped to someday expand into banking, but the company’s acquisition ended such ambitions. “I felt like there was still part of the story that we needed to see through,” Dubugras remarked.

A mixture of advice and observation clarified their approach. Dalton Caldwell, another YC partner, advised the young Brazilians to start by launching a point solution. Aspiring to build a full-service bank was all very good, but you had to start somewhere. “No one was going to trust two young guys with all their banking needs,” Dubugras said.

In watching their batchmates’ operational challenges, Franceschi and Dubugras found their opportunity. Despite receiving investment from YC, startups struggled to secure a corporate credit card. Traditional banks not only moved slowly, favoring in-person manual processes or turbid digital interfaces, they didn’t understand how to underwrite early-stage businesses with no credit history. Anu Hariharan, formerly of the YC Continuity Fund, recalled the unfavorable odds founders faced. “Getting an American Express card was fifty-fifty,” she said. “Even if you did get it, you’d have a $300 to $500 credit limit.” To add insult to injury, when traditional banks did deign to issue a card, it typically made the founder personally liable.

David Hsu, CEO of internal tooling platform Retool, remembered such struggles well. Part of the same batch as Franceschi and Dubugras, Hsu recalled striking out with traditional financial institutions. “We were rejected a few times. Most banks didn’t seem to understand startups, even those that were based in Silicon Valley and San Francisco.”

Veyond’s founders had faced the same kinds of challenges. Indeed, they were made even harder thanks to their international status. To Dubugras and Franceschi, it was as infuriating as it was illogical. After all, they and their contemporaries were building some of the most promising startups in the world. Even more importantly, they were sitting on hundreds of thousands – if not millions – of dollars in venture funding. Why didn’t that factor into the process? And why did it take so long?

Rather than deliberating over a new company name, they turned to an online generator and found one that felt right: Brex.

“The card cannot fail.”

The duo swiftly set to work. They focused on two core tasks: developing a robust product and securing capital.

Franceschi took the lead, engineering Brex’s platform. From the outset, he and Dubugras set an ambitious goal for their product. “We said to ourselves: ‘The card cannot fail. It has to work 100% of the time,” Franceschi recalled. Given the relative immaturity of fintech in 2017, achieving that reliability would be no small feat. Off-the-shelf products like Stripe Issuing didn’t yet exist, meaning that if the company wanted to issue a card, it would need to do so itself. Over the following months, Franceschi constructed Brex’s back end from scratch, coding the core card processor, KYC functionality, underwriting engine, and connective tissue to Visa and Mastercard. In the end, Brex would deliver its first cards to customers in four months.

As Franceschi wrangled convoluted banking rails, Dubugras sought capital. Brex needed venture funding to survive and credit to supply to customers. Given their pedigree, it’s perhaps unsurprising that equity investors came more easily.

Ribbit Capital’s Micky Malka had known Dubugras and Franceschi for years. As a fellow Latin American hailing from Venezuela, he’d taken a keen interest in Brazil’s prodigies. While Malka wasn’t interested in Veyond, the new direction was compelling. In early 2017, weeks before YC’s Demo Day, Ribbit led a $7 million Series A into the company.

Finagling debt and credit lines took longer, though a shrewd hire accelerated the process. After stints in banking and private equity, Michael Tannenbaum had joined lending company SoFi as a VP of Finance. Over three years, he became the firm’s Chief Revenue Officer. During this spell at SoFi, he’d had the chance to manage its corporate card program, seeing many of its complexities first-hand. When Tannenbaum was introduced to Dubugras in the spring of 2017, he immediately understood the potential of what the young Brazilian was building. “I thought it was really compelling,” Tannenbaum said. “I started working with them on the weekends, and then, when it became more serious, I jumped aboard.”

It’s unusual for a startup’s first hire to be its CFO. But in Tannenbaum, Brex found someone capable of building a best-in-class capital markets function and filling several other roles. “The title didn’t matter,” Tannenbaum said, “The earlier the company is, the more you’re doing a bit of everything.”

Long-time Brex investor Anu Hariharan called out Tannenbaum’s hiring as a masterstroke. For one thing, it demonstrated that Dubugras and Franceschi understood their business’s unique challenges. Just as critically, it set the firm up for years to come. “From a capital markets perspective, Brex operates at the proficiency of JPMorgan. I’m not even joking. You can’t do that without Michael.”

By July 2017, Brex had recruited a stellar executive, closed a Series A, and gotten a card into the hands of its first customers. Franceschi and Dubugras were just getting started.

Evolution: Managing change

Scalding product-market fit, the kind that creates markets and spawns competitors almost instantaneously, is rare. Perhaps because of that, companies that find it often seem to find themselves unsure of how to manage the opportunity. Mesmerized by the strength of demand, some simply stay put, riding the wave for as long as it will last, even as rivals creep behind them. Others become giddy from it, driving their business in ten different directions simultaneously, convoluting the value they found to begin with.

Though Brex is not perfect, it has done an uncommonly good job of turning initial, robust product-market fit into coherent momentum. Naturally, there have been missteps. But viewed holistically, Dubugras and Franceschi have done an outstanding job of evolving their business, pushing into new directions while successfully enhancing its value. In large part, that’s thanks to Brex’s understanding of its market and long-term vision. When it came to raising its Series B, the company demonstrated both.

“Let me show you my model.”

In early 2018, approximately nine months after giving his Demo Day pitch, Henrique Dubugras returned to Y Combinator. He was, once again, preparing to fundraise, albeit at a different order of magnitude.

A great deal had changed since Brex’s graduation, though much of it occurred behind the scenes. Virtually as soon as alpha users received their cards, it was clear the company had product-market fit. Franceschi recalled that Brex’s MVP worked via a command-line interface. If you wanted to log expenses, review your card number, or add team members, you had to do so via a terminal. It spoke to both the tech-savvy of its user base and their appreciation for Brex’s core value that such inadequacies hardly seemed to bother them. “I remember wondering, ‘Why are they using it when it’s so shitty?’” Franceschi said. “It was because there was such a big problem. That was an interesting early signal.”

It didn’t hurt that Brex’s product was simply better than alternatives. Those willing to look past the absence of a proper front-end got rapid access to a credit card with higher limits and no personal liability. Using technology, Brex could approve customers in just 24 hours – no manual paperwork or in-person visits required. By underwriting companies based on their capital, Brex could safely increase credit limits 10-20x beyond those proffered by a traditional bank. Critically, the newcomer didn’t put founders on the hook from a liability perspective. It was, in short, a credit product built for startups like them.

Retool was one of the first companies to jump aboard. As David Hsu recalled, it was a radically improved experience compared to dealing with old-school banks. “I was shocked at how quickly we could get a card. I was like, ‘That’s it? We just press a few buttons, enter a few text fields, and then we get to spend money? That’s nuts!’ I just thought, ‘Wow. This is how banking should work.’”

Despite strong demand for its services, Brex restricted itself to those within its small circle. Through early-2018, the company focused on building out its solution, bolstering its reliability, strengthening ties to credit providers, and positioning itself for a strong Series B. By the time Dubugras met with YC Continuity’s Anu Hariharan about their upcoming round, Brex had a strong offering, but fewer than 100 customers.

Hariharan didn’t take long to recognize that Dubugras was a special founder. “I remember early in the conversation he pulled out his laptop and said, ‘Let me show you my model.’” With the screen in front of them, Dubugras explained how Brex would become a billion-dollar business – or bigger. “He’d pulled data from Pitchbook and calculated the number of startups and total payment volume in the ecosystem. He used that to show that Brex only needed to win a few thousand companies to get to $100 million in net revenue.” Hariharan was dazzled. “He understood the math of this kind of business really well and was so thoughtful. For someone that age, it was doubly impressive.”

Still, she was not about to rush. After all, Brex was a company with few customers and a run rate of just $10,000 in net revenue. Hariharan assessed the opportunity in the following weeks, examining the total addressable market from scratch, vetting the solution with founders, and getting into the weeds with Brex’s product. The more diligence conducted, the more Hariharan appreciated the business’s attributes. She was particularly impressed by Brex’s financial savvy, strong infrastructure, and audacious vision.

Thanks to their experience building Pagar.me, Dubugras and Franceschi understood how to scale a financial services business. “There are a lot of companies that do software well but if you’re a fintech, you need to do finance well, too,” Hariharan said. Brex was the rare startup that understood this and had constructed itself accordingly.

Franceschi’s work building out Brex’s back end also caught Hariharan’s attention. To understand how the company’s core technology had been built, she’d deployed members of Stripe’s early engineering teams to take a look. The reports she received back fortified her conviction. “If you’re a fintech that relies too much on third parties, your margins get compressed,” she said. “Brex had been built down to the rails. Only Stripe had done that.”

Finally, in Dubugras, she sensed a visionary. In their first conversation, he’d not only explained the potential for Brex’s credit card service, he’d outlined half a dozen other products he wanted to build. As we’ll discuss, some of Brex’s most crucial launches stemmed from this list.

In March 2018, Hariharan made up her mind. The Continuity Fund led Brex’s Series B, investing $30 million of a $60 million round. The mooted valuation was $220 million. For all that she admired about the business, the Managing Director understood she was taking a risk. “It could have been a disaster,” she said.

“Do we want to be mediocre for everyone?”

Hariharan need not have worried. After closing its Series B, Brex officially opened the door to the public – and was met with a flood of new users. While a testament to the pent-up demand for Brex’s product, it was also the consequence of a savvy marketing campaign.

Starting that summer, Brex began blanketing Silicon Valley’s billboards as part of a coordinated strategy. Recognizing that most of their customer base was concentrated in a small geographical area, Brex believed outdoor advertising could be effective. Then-CRO Sam Blond worked with Michael Tannenbaum to vet the opportunity, contacting Clear Channel about a potential sponsorship. While boards placed along Highway 101 were expensive, those positioned in San Francisco proper were comparatively cheap, especially units located at bus stops. Though these received fewer impressions, the time a person stood in front of them was longer. Blond and Tannenbaum struck a deal with Clear Channel: the majority of downtown inventory for three months for $150,000.

It was a hit. Blond, now a partner at Founders Fund, referred to it as “the most successful billboard campaign of any tech startup in history,” producing “near 100% brand awareness” in the Silicon Valley area. Within three months of closing its Series B, Brex had scaled from approximately 85 customers to more than 2,000.

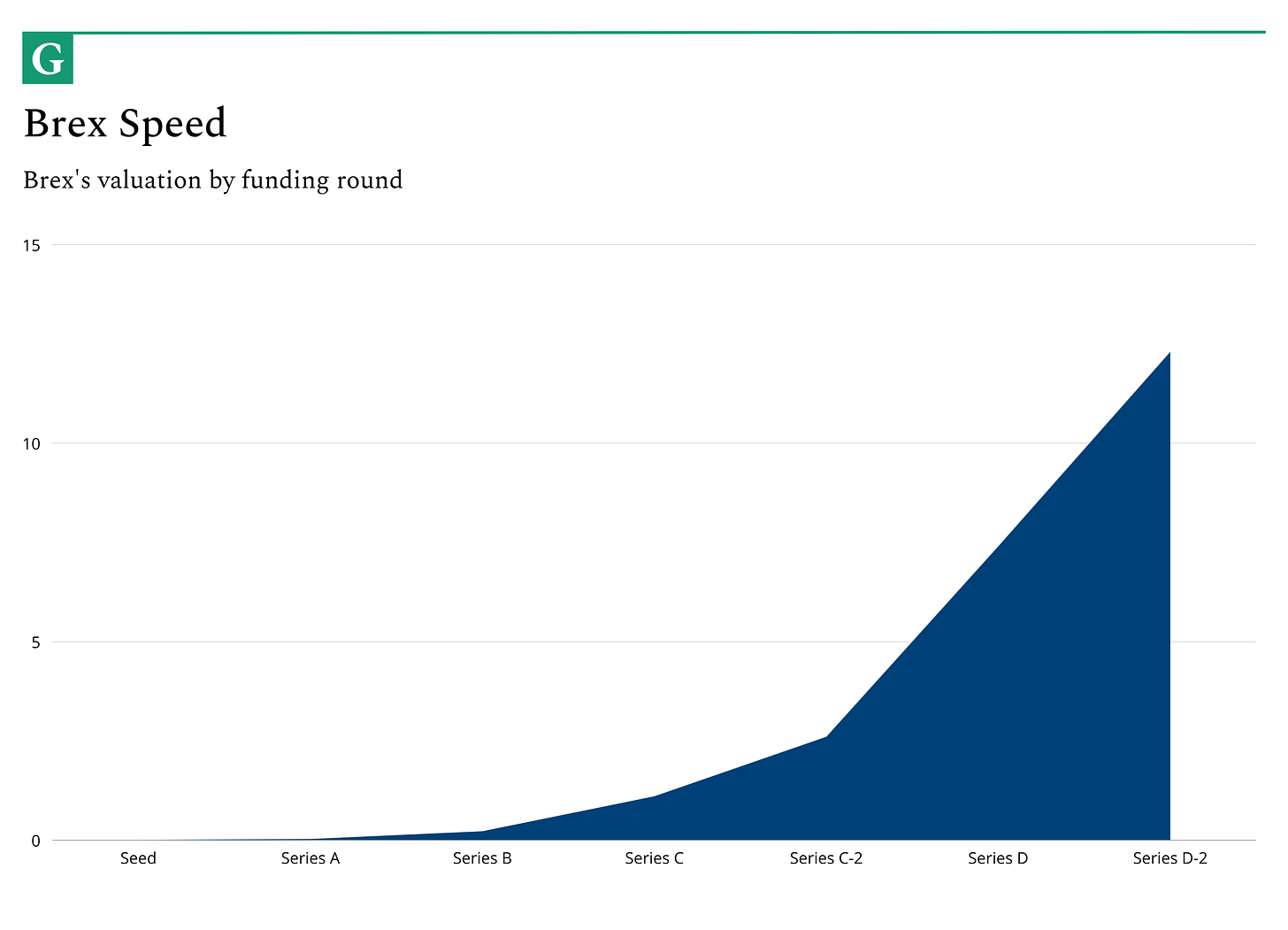

Over the next three years, Brex sketched a torrid trajectory. By the beginning of 2022 , the company had onboarded hundreds of thousands of customers, raised $1.5 billion in equity from investors like Kleiner Perkins, and hit a valuation of $12.3 billion. It had also greatly expanded its product suite, shipping a comprehensive rewards program, a business account, and expense management features. Even in an industry of superlatives and hyperbole, the speed at which Brex amassed value and expanded its reach was genuinely jaw-dropping. Dubugras had been wrong when he’d said Brex could be a $1 billion business; the opportunity was much, much bigger.

Buried in that relentless rise was a mistake dressed as an opportunity. Starting in 2020, Brex began to serve small businesses. From one vantage, it seemed like a neat fit. Brex had built a powerful engine capable of underwriting credit-seekers quickly and effectively; SMBs valued the platform’s simplicity and speed. Why couldn’t Brex service them?

The decision slowly started to gum up the wheels and slow Brex’s momentum. Lucas Fox, the former head of Brex’s startup unit, laid out the company’s problem in plain terms. “When you put it into numbers, you realize the issue. There are roughly 50,000 venture-backed startups in the US today. Meanwhile, there are around 7 million SMBs. When you decide to serve them, everything you do needs to become fundamentally different. The size of your support team, fraud prevention, monetization – all of those change.”

At the same time that more SMBs joined the platform, many of Brex’s early startup customers began to ask for new features. Early customers like Retool and Scale had grown rapidly in the intervening years, their needs changing along with their size. If Brex wanted to keep these high-potential businesses, it had to mature and meet their needs. Brex found itself in an increasingly difficult situation, pulled between the desires of two stakeholders.

In early 2022, Brex’s leadership began contemplating a change. “We had to ask ourselves, ‘Do we want to be mediocre for everyone? Or do we want to be the best quality service for venture-backed startups and enterprises?’” Franceschi said.

The answer was clear from a financial and strategic perspective, though that didn’t make it easy. “We knew it would be hard,” Franceschi said of the choice. “In some way, though, that gives meaning to your decisions as a founder. What are you willing to do to double down on the parts of the business that really matter?”

In June 2022, Brex announced it would be offboarding SMBs. As mentioned, the message stung small businesses and briefly left startups wondering whether they would be out of service, too. A speedy clarification helped, but Brex had created a sense of doubt that would take time to assuage. In the following months, the company diligently worked to help customers offboard and transition to a new service. “It was painful,” Franceschi said.

“Everyone practically bends time here.”

It was a decision that paid dividends. Thanks to its renewed focus, Brex doubled down on serving venture-backed startups and fast-growing enterprises.

Shortly after the SMB offboard, Brex created an official “startup” division. This unit was founded to ensure Brex didn’t lose sight of its core customer base again. “It’s a part of the company that obsesses over startups and how we can create the best product for founders. We want to improve constantly.” The establishment of the startups division was strategic as well as mission-driven. Without keeping its grip on early-stage businesses, Brex could find itself disrupted from below.

As part of that push, Brex started offering every client on its platform a dedicated support person they can reach over email or text. No matter the startup’s size, they were offered the attention typically reserved for a private bank. It was the kind of service that revealed the freedom Brex now had; it couldn’t have feasibly provided such a service to hundreds of thousands of SMBs.

At the same time that Brex cemented its relationship with startups, it accelerated its move upmarket. In 2022, Brex released “Empower,” a software platform designed to help larger companies better manage their finances. It represented a major launch – one that Dubugras had foretold as part of his Series B pitch to Hariharan. Empower positioned Brex to scale with its customers like never before. Though Empower launched a few months before the SMB offboarding, it hit its stride in the aftermath. By focusing on this platform and the segment it served, Brex grew it to $100 million in annualized revenue in little more than a year. The company strengthened its enterprise offering by launching a focused travel product earlier this year.

This speed was particularly remarkable for Chief Product Officer Karandeep Anand, who joined from Meta in January 2022. “Everyone practically bends time here.” While that seems to be part of Brex’s core DNA in some respects, it’s also a result of the company’s difficult decision – and the space it unlocked. Franceschi concurred. “The momentum we were able to build on the enterprise side would not have been possible if we had still been spread so thin.” If Brex hadn’t made that choice, there’s good reason to believe it would be in worse shape today.

If much of 2022 was spent regenerating Brex’s momentum, 2023 offered the chance to regain trust. In March, reports of instability at Silicon Valley Bank began to proliferate. As a long-time customer of the company, Brex was concerned, but not unduly. After speaking to several banking experts, the team considered a fallout unlikely. As a precaution, the company moved some of its capital out of the bank, expecting to reverse the wire within a few days or weeks.

Shortly after, all hell broke loose. In a matter of days, SVB went from under pressure to teetering to enthralled in a full-blown bank run. As it collapsed, the startup ecosystem panicked. Founders and venture firms that held funds with the bank appeared on the brink of dissolution.

Dubugras and Franceschi couldn’t have imagined such a meltdown; they took it as a call to action. As chaos reigned, Brex worked. Its team operated late through the night to onboard thousands of worried customers. Camilla Morais, Brex’s SVP of Operations, recalled the intensity of that period. “In terms of customer support, we had 400% of our previous highest volume day for a week straight. We had to move money faster than ever – there was way more money coming in, more transactions, more complexity. And we had many, many more customers applying.” From an operational perspective, Brex was stress-tested like never before.

As well as bringing new customers aboard, Brex sought to keep them alive. With SVB’s funds imperiled, founders across the industry worried about making payroll. To help, Dubugras started pulling together a $1 billion emergency bridge loan using Brex’s lending contacts. The goal wasn’t to make money but to create a lifeline for the industry.

In the end, the emergency capital wasn’t needed. On Sunday, March 12, the FDIC announced its commitment to backstop SVB’s reserves. Funds were safe. For Dubugras, it was a relief. “I was never so happy to waste work in my life,” he told the San Francisco Examiner. After logging a 100-hour week to manage the crisis, Brex’s co-CEO slept for two days straight.

In the days that followed, Brex continued stepping up, taking a leading role in Silicon Valley’s reconstruction. It released higher levels of FDIC insurance to protect customers better. It moved $200 million of its own money into the new SVB entity as a sign of its trust. And it continued to bring thousands of customers and billions of dollars aboard. In just the week of SVB’s crash alone, Brex brought 4,000 new businesses and $2 billion in deposits aboard.

Brex’s actions in mid-March earned respect from the industry. For Jason Mok, who had spent 16 years of his career at SVB and a further two-and-a-half at Andreessen Horowitz, Brex’s actions prompted him to seek employment at the company. “A lot of people stepped up, but Brex stepped up in a different way. Henrique and Pedro were coming out saying ‘We’re going to do a bridge financing to support payroll. And we believe in the system, we believe in the safety and the soundness of the US government.’ I was waiting for a way to step in and be a part of the solution. This felt like the way to do it.” In June, Mok was announced as Brex’s new Head of Startups.

Just as importantly, its decisiveness meant a great deal to Brex’s broader team. Virtually everyone we spoke with referred to the company’s response as a high point. It exemplified Brex’s commitment to the startup ecosystem, demonstrating the lengths it will go to defend and serve its customer base. For Dubugras, Franceschi, and their team, it felt like a kind of redemption.

Product: From the ground up

Brex boasts a very different product than the one with which it started. As the company’s evolution demonstrates, it has successfully undergone the journey from point solution to product suite. Today, Brex offers the closest thing to an all-in-one financial platform for startups and tech-first enterprises. We’ll explore its different features, the philosophy behind it, and its customer impact.

Products

Brex has been built from the ground up. As we’ve mentioned, from the company’s earliest days, it has constructed its architecture in-house. The result is a system that works in synchronicity. Undergirding individual products like corporate cards, travel, and expense management is a coherent platform called “Empower.” We’ll walk through Brex’s structure, highlighting the different components.

Empower is the base layer upon which all Brex products sit. It results from an initiative the company kicked off in late 2021. As Brex looked to serve larger companies, leadership realized they needed to fundamentally reimagine the business from bottom to top. Small startups were happy with credit cards and a simple interface, but their financial needs expanded with them as they grew. Larger businesses needed a sophisticated way to manage spending across thousands of employees worldwide. At the time, Brex wasn’t well-equipped to meet that need.

Chief Product Officer Karandeep Anand joined to support Brex as it evolved from a pure fintech into a fintech-enterprise-SaaS hybrid. The shift required Brex to make operational changes, hire more software-focused talent, and adjust its culture. The most critical shift, however, was to build a new core platform, Empower. Rather than working from existing code, Brex opted to start from scratch. “Instead of trying to retrofit our existing stack for scale, we wrote all new stuff,” Anand said. It was a bold choice.

In December 2021, Brex began writing the first lines of code for its new platform. Anand expected the transformation to take two years to complete – and that was optimistic. In the end, Brex shipped its first version of Empower in April 2022, opening full access by October. Once again, the team managed to bend time in its favor. Today, Empower is trusted by tens of thousands of employees at companies like DoorDash, Indeed, Lemonade, Airbnb, and Flexport.

At its core, Empower makes it easy for large enterprises to manage how employees spend money wherever they are. Users can set specific policies by category and geography, making it simple for an office manager in Rio or a designer in Tel Aviv to access the tools they need while adhering to their employer’s guidelines. It automatically generates receipts, streamlining compliance, and syncs up with external tools like NetSuite, Slack, and Deel. CFOs and other leadership can track spend in real-time, avoiding any end of month hassle. From a business perspective, Empower essentially removes graduation risk; high-growth players like Retool don’t need to switch to SAP Concur or Coupa – they simply grow with Brex. As we’ll discuss, this has proven a winning and highly-lucrative formula.

Empower’s engine underpins Brex’s other products, including corporate cards. This is, of course, the revitalized version of the company’s beachhead product. It remains exceptionally convenient and has grown more powerful in the intervening years- cards can now be issued in more than 20 currencies It also offers perks tailored to the tech community, with Brex card points redeemable for an array of founder-friendly tools and resources.

Expense management is another key feature. Brex has built a software product designed to automate compliance and save time. Expenses within a company’s stated policy are auto-approved, reducing fruitless monitoring. Meanwhile, those that sit outside of the guidelines are flagged for review. Brex also leverages AI to improve this product, relying on it to populate receipts automatically.

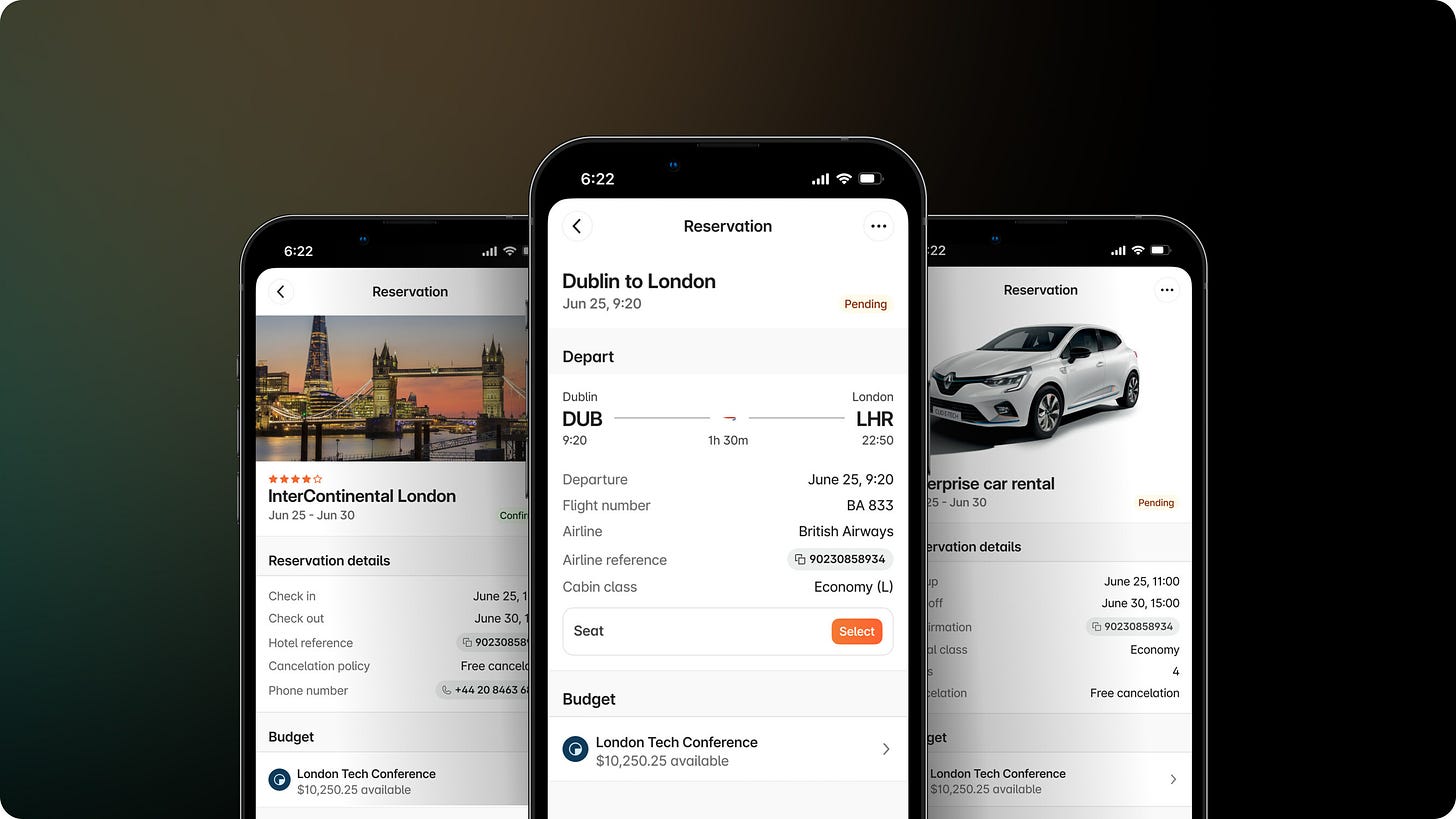

Travel is the rare example of something the company did not build itself. Instead, Brex partnered with Spotnana, a “travel-as-a-service” platform that has raised $116 million in venture funding. As Anand explains, that decision was made given the “operationally heavy” nature of the sector; Brex wants to manage travel spend but isn’t trying to build a modern booking agency.

In March, Brex launched its travel solution. While powered by Spotnana, it has been designed in deep partnership to feel and operate like a native product. Customers can quickly find and book flights and hotels through the Brex platform, often at a discount. They can make unlimited itinerary changes and have access to Spotnana’s experienced roster of travel agents 24/7.

In 2019, Brex launched what was then called “Brex cash.” Today, it is simply referred to as the Brex business account. It does what you want it to do, giving customers a flexible account with the choice of allocating across a money market fund (currently with a 4.7% interest rate) and FDIC insured cash (up to $6.5M). In the wake of SVB’s demise, Brex introduced FDIC insurance of up to $6.5 million, thanks to its networked approach to bank partnerships. From a strategic perspective, business accounts are critical to the company. The first financial product startups look for is typically a place to park their cash. With its business account, Brex has ensured it cannot be easily upstreamed. Equally, it’s a solution that grows with customers, acting as an operating account for mid-market and enterprise users.

Customers can handle invoicing, payments, and reconciliation through bill pay. Again, it’s a strong, straightforward product that benefits from connecting to the rest of Brex’s unified suite. For example, the same OCR tech that helps ingest physical receipts populates invoicing information shared via email. Users can process one-time or recurring payments, with money flowing directly from their Brex business account logged in via their expense management.

Beyond the five offshoots shown above, one other feature is noteworthy. In April 2022, Brex acquired Pry Financials – a software platform designed to visualize growth, cash flow, and runway – for $90 million. It has become the crux of the company’s financial planning product. Venture-backed businesses of all sizes benefit from clear financial planning and forecasting, and given Brex’s position as the source of truth, it can populate most, if not all, of the relevant data.

Philosophy

Brex is operating in a competitive space but has made very different decisions than some of its contemporaries. From a product perspective, it appears to have three critical priorities that contribute to a distinctive philosophy: scalability, modularity, and universality.

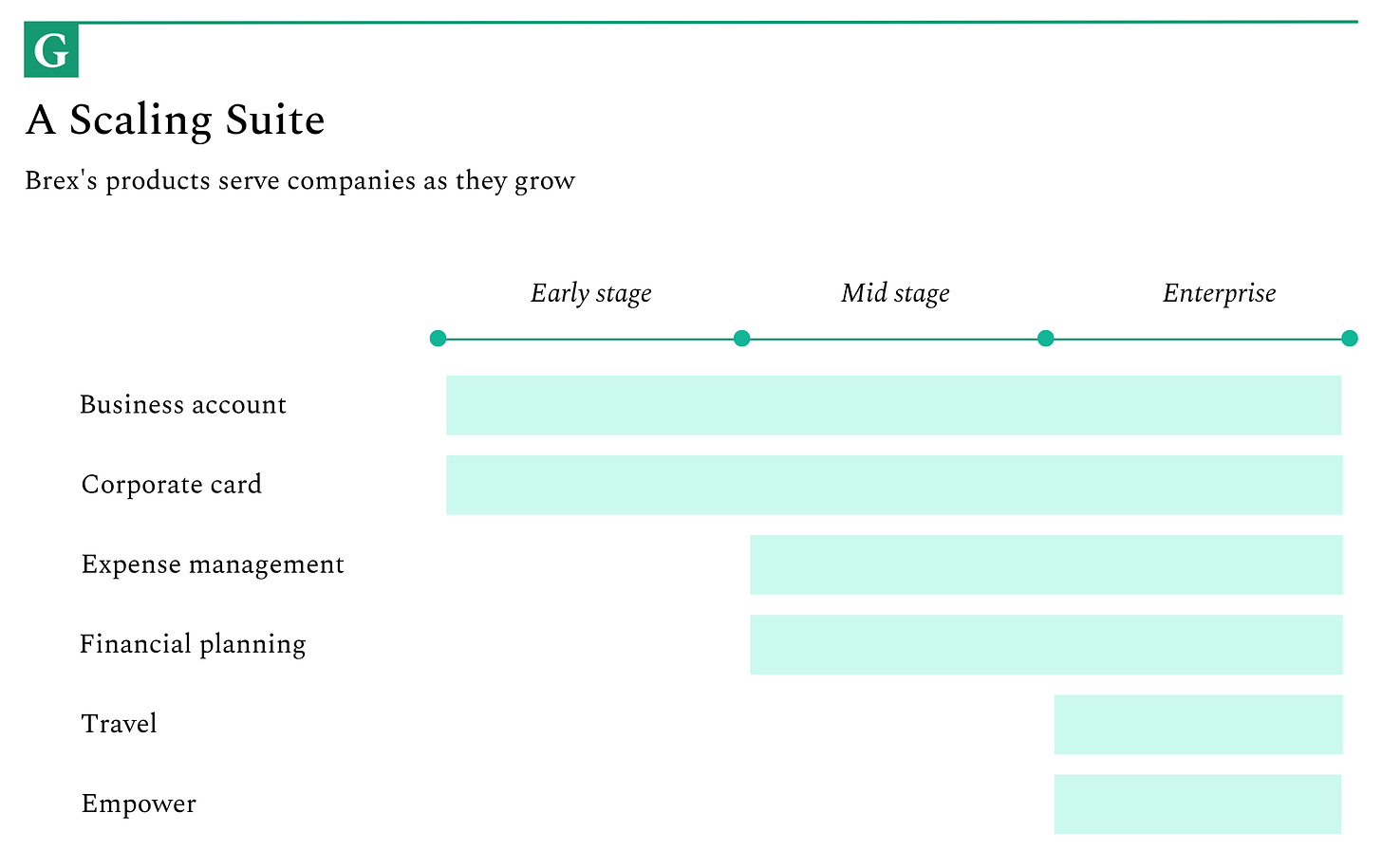

Scalability is at the heart of Brex’s product. The company is designed to grow alongside its customers from “MVP to IPO and beyond.” A venture-backed startup with only a few employees can use Brex’s business account and cards to manage their finances. A mid-stage firm can leverage fine-toothed financial planning, expense management, and integrated bill pay. Finally, a large enterprise can lean on Empower’s global reach and sophisticated feature set to manage spend for thousands of employees worldwide; it can use Brex’s travel product to orchestrate movement between them.

Equally critical is Brex’s modularity. The dividend of building down to the rails is that each element can seamlessly communicate, improving its functionality. “One thing people underestimate about Brex is the resources we spent building the architecture and infrastructure the right way,” Dubugras said. “That compounds over time.” We can see this happening today with many different products intersecting. “It’s been built modularly,” Karandeep Anand said. “Each product is individually compelling, but collectively, they’re awesome.”

This approach is even more intriguing when considering the future. Brex should be able to ship improvements and wholesale business lines faster than some of its competitors because of how it has been built. As an example, Dubugras pointed to Brex’s budgeting architecture as an impactful primitive that could unlock new functionality. “People haven’t seen the full potential of it yet,” he said. “We’re building a lot of stuff on top of it. My guess is that two years from now, a competitor will look at it and realize that it’s going to be very hard to copy what we’ve done. That’s because we’ve built our architecture the right way.”

Finally, Brex decided to build a truly global architecture when shipping Empower. This desire for universality is a core part of Brex’s product and culture. Customers must have an American presence to use Brex, but the platform’s features work worldwide. Given Dubugras and Franceschi’s upbringing, it’s unsurprising that they’re just as keen to level up non-US businesses as domestic ones.

It’s proven to be a strong selling point. Over 50% of customers using Empower are international, with offices and operations across geographies. By choosing to be global by default, Brex positioned itself to win these businesses and capture ever-larger percentages of their spend.

Impact

It’s hard to overstate what an integral part of the startup ecosystem Brex has become in just six years. A few statistics shared by the company demonstrate its penetration:

25% of US startups use Brex.

33% of the top 50 venture firms’ portfolios use Brex.

80% of Y Combinator companies use Brex.

When it comes to venture-backed startups, Brex is, quite simply, the standard. It appears to have an especially strong hold among the most promising companies in this market, and it’s done an exceptionally good job leveraging its connection with Y Combinator. (It is attempting a similar feat by partnering up with Techstars.) These levels of market share wouldn’t be possible if it weren’t for the fact that companies seem to love Brex.

Retool CEO David Hsu outlined the utility of Brex to his company. “We really use Brex as a platform, so we use it for almost everything,” he said. “All ‘Retools’ have Brex cards which means that all spending that’s under $10,000 is basically done on Brex. If someone is having dinner with a customer – that’s on Brex. If someone’s buying a piece of software – that’s on Brex.” Expense management, business accounts, bill pay – Retool controls all these things via Brex. Since opening a London headquarters, such functionality has become even more impactful, seamlessly stretching across the Atlantic. Its importance to Retool puts it in rare company. “The two companies we’ve standardized around are Brex and Stripe.”

Brex doesn’t just excel at the big things; it delights with little details, too. Hsu highlighted the way Brex distills the complexities of finance to its essentials. “It’s kind of incredible how they’ve managed to simplify these things down to the basics. It’s like ‘Hey, you want to send money? What’s their name, account and routing number? And by the way if you’ve sent money to them before, then it’s probably not fraud [and we don’t have to block it.]’ That’s the kind of product thinking that’s really unbelievable.” Especially when compared to the financial providers of the past, Brex offers a step-change improvement down to even the smallest interactions. There’s a reason why so many startups still favor the firm.

Model: Twin engines

Brex not only boasts a beloved product but a booming business. As the firm has matured, it has discovered increasing ways to grow and diversify its revenue. We’ll talk through its business model and evaluate Brex’s current scale.

Model

In broad strokes, Brex has two ways of generating revenue. First, it earns money through financial operations. That includes merchant interchange fees from card transactions, like any other credit card. It can also monetize via foreign exchange and interest on deposited funds. These sources of income are extremely valuable, giving Brex a way to monetize customers without charging them directly. Brex can offer card and cash management strategies to startups for “free” while capitalizing on their usage. As these startups grow and reach higher transaction volumes, Brex’s revenue increases, too.

The introduction of Empower gave Brex a second source of revenue: selling software-as-a-service. It’s worth noting that building a revenue-spinning enterprise SaaS unit has required Brex to build new muscles, especially with regard to sales and go-to-market. “Pre-2022, the thing that customers bought from us was a credit card and a business account,” Dubugras said. “The process for that was to win them over really early when they were starting out. It’s fast, it’s easy. It’s a quick sales motion with a product that’s simple to explain.” Empower altered that dynamic. “When you’re selling software, everything changes. Now, what people are buying is this integration between software and financial services. It’s a lot of different components: expense management, travel, global capabilities, and so on. They’re often replacing another product like Concur or Expensify and so it becomes a much more complicated sale where they need to think about switching costs and different configurations. Really, everything is different.”

Chief People Officer Angela Crossman joined Brex from weight-loss platform Noom in October 2022. In tandem with CRO Doug Adamic, Crossman has helped Brex reconfigure itself to meet this opportunity. “We’ve retooled our sales, implementation and customer success teams and brought in additional sellers. We have truly different functions now that we’re at a different stage, and so it’s been about building that go-to-market machine.” That machine already seems to be purring.

Scale

It’s hard enough to create one business that reaches $100 million in annualized revenue. Brex has built two.

Earlier this year, Brex announced that business accounts and Empower had reached that milestone. Together, they exemplify the diversity of Brex’s revenue: a mix of financial services and SaaS. Empower’s rapid rise is especially eye-catching: it hit the $100 million mark in approximately a year of full operation. As startup customers mature into large enterprises and enterprises expand further, this division could become an incredibly lucrative money-spinner.

Excitingly, Brex appears to have other promising business lines bubbling beneath these. Travel, for example, is already seeing a strong uptick. According to Brex, it increased its wallet share among customers from 0% to 20% in under four months. Some customers have already shifted 100% of their travel spend to Brex. In years to come, we should expect more Brex business units to hit nine figures. In total, Brex is on track to hit $500 million in annualized revenue within the next 12 months.

Culture: Live the values

As companies age, the connection to their core values can sometimes atrophy. Brex is an example of the inverse case – a business that treasures its culture as it evolves. In conversation, employees and leadership frequently reference the firm’s central tenets and how different decisions or leaders have embodied them. The result is a business that feels integrated, authentic, and humble, even as it strives for great things. These values begin at the top.

Leadership

Henrique Dubugras and Pedro Franceschi have operated as co-CEOs for over a decade, starting at Pagar.me. It’s an arrangement that speaks to their trust and connection. “There’s a fair amount of telepathy that happens,” Franceschi said. SVP Camilla Morais seconded that sentiment. “It’s crazy – there are two of them, but they think like one. It’s to the point where I don’t have to prep them. Wherever the last one left off, the other naturally picks up from there.”

Perhaps their greatest shared trait is an ability to focus on what matters most at a given moment. Independently, both Franceschi and Dubugras commended the other for this trait. “He’s really good at figuring out what the most important thing we need to do right now is,” Dubugras said of his co-founder. “The biggest thing is that he has this ability to see where we are now and figure out what the big needle-movers are that we’re not paying enough attention to,” Franceschi said. Having two CEOs that instinctively zero in on the highest-impact problems has served Brex well.

While they have characteristics in common, Brex’s founders also seem to counterbalance one another nicely.

Dubugras exemplifies Brex’s cultural commitment to “dream big.” “Henrique is a visionary,” Morais said. “When you work with him, it’s never about today. He’s always talking about six or twelve months from now. Some of the things you hear him talk about, at first, you think are impossible. But because I’ve been here for a while, I know they’re going to happen. He doesn’t take no for an answer.” Investor Anu Hariharan noted that Dubugras’s big picture often impacts those outside Brex’s orbit. “He pushes everybody to live up to ‘dreaming big.’ There are founders that have told me they’re building a much bigger company because of him,” she said. As Hariharan’s anecdote suggests, Dubugras is also the more external-facing of Brex’s CEOs, drawing on an impressive network to score partnerships and attract senior talent.

Franceschi is minded toward the big-picture, too, but in a different manner. Dubugras describes his partner as an excellent “systems thinker” gifted at orienting a group in the right direction. “He’s very good at figuring out how to set OKRs, set goals, and set the culture in such a way that it drives outcomes,” Dubugras. “He really thinks of himself as an operator.”

The Rio native is also the more granular of the pair. “He’s an extremely detail-oriented guy,” Morais said. “Everything we do and build, he wants to make it perfect. During the SVB run, he would be on calls until 2 AM finalizing the communication we were sending to customers. He’s that kind of person, the one that’s extra careful about what we’re creating and building.”

Franceschi’s defining feature is arguably his “growth mindset.” As well as being one of Brex’s values, it’s a core part of the co-CEO’s makeup. Anu Hariharan had the chance to witness this trait shortly after the Series B investment. One of the risks she’d flagged during diligence was the self-awareness of Brex’s CEOs. “Are these founders that will recognize when they made a mistake?” she asked herself. A month later, she got her answer. Franceschi called to inform her that their newly-appointed Head of Product had just resigned. “He told me he was really stressed because he’d messed up and wanted to learn from it.” To correct his error, Franceschi asked the departed employee to sit down with him and provide unvarnished feedback on his missteps – the blunter, the better. “For me, that was A+++.”

Outside its CEOs, Brex looks like a company preparing for an IPO. Though Dubugras has expressed a desire to wait for profitability, he and Franceschi moved to recruit strong talent over the past few years. Recent additions include:

Karandeep Anand, Chief Product Officer. As mentioned, Anand joined Brex in early 2022, helping the firm build its enterprise software bonafides. Before joining, Anand worked for six years at Meta and fifteen at Microsoft. An industry group recently named him one of the top 20 CPOs in the world.

Angela Crossman, Chief People Officer. Crossman joined Brex in October 2022 after a year and a half as Noom’s Head of People. That followed nearly six years at Bain & Company as an EVP focused on talent and global operations.

Doug Adamic, Chief Revenue Officer. It’s hard to imagine a better profile for Brex’s CRO role than Adamic. Before hopping aboard in May 2022, he worked at SAP Concur for sixteen years, rising to the role of CRO.

However, not all of Brex’s C-Suite is filled due to the high bar the company holds. Franceschi noted that he had been looking for a CMO for over ten months but refused to compromise. “We could have hired someone suboptimal, but these are the moments where the culture gets set,” he said. That culture, and the values behind it, are key to understanding the business.

Culture

Beyond the values alluded to in the section above, there are two other critical aspects of Brex’s culture.

First and foremost is the company’s care for its customers. Part of the reason the SMB offboarding caught many by surprise is because it represented the rare case where Brex seemed out of sync with its customer base. It was, in a sense, the exception that proved the rule.

In large and small details, Brex creates a culture of genuine customer obsession. For example, as part of onboarding, every new hire can participate in customer support conversations, hearing from users first-hand. Brex also promotes many customer support agents to different parts of the business. “We have folks that started in customer support in almost every single division of Brex,” Camilla Morais said. “In sales, risk, recruiting – you name it, and someone that started in customer support works there. I’m very proud of it. And it says something about our culture.” Not only does it encourage every employee to have the kind of “growth mindset” Franceschi embodies, but it also introduces frontline, customer-facing DNA to virtually every team.

Brex’s global approach is another notable characteristic. The company has architected itself to accept talent from all over. Chief People Officer Angela Crossman has played a key role over the last year, fortifying the firm’s overseas recruiting muscle and strengthening the bonds between different geographical teams. “We’ve really accelerated our ability to hire outside the US,” Crossman said. “We believe so strongly in the idea that value can be created from anywhere and we want to live that, internally. We spent a lot of time building our talent pipeline internationally and making sure that our employees have equally terrific experiences, no matter where they’re located.”

While Brex was one of the first to embrace a remote-first approach during the pandemic, it has matured into what Crossman calls “flexible-first.” “There are a lot of people who go into offices, which is great, but it’s fine not to. We’ve invested pretty strongly in creating a flexible and distributed team.” To bolster that structure, Brex has increased its number of offsites and is doubling down on regional “hubs.” Because of Dubugras and Franceschi’s origins, Brazil has emerged as a natural Latin American base – one with room to scale in Crossman’s eyes. Brex’s $50 million acquisition of commerce API platform Weav established a foothold in Israel. A Tel-Aviv team now acts as a kind of Brex R&D.

In sum, Brex has created a highly effective organization with a distinct personality and clear mission. It has built a culture respected by its peers. “I’m always really excited to interview someone who used to work at Brex,” Retool’s Hsu said. “The reason for that is they’ve built a culture that says, ‘We care about you but we also care about the work, and winning together.’ It’s a culture of empathy and real leadership.”

Risks: Maintaining focus

“The graveyards are full of indispensable men,” the French general Charles de Gaulle is supposed to have remarked. The same could be said of companies. As the death of SVB shows, no business is too large or too important to meet its end.

Barring an unforeseen catastrophe, however, Brex does not face any immediate existential threats. As discussed, this firm is on ostensibly strong footing, with multiple money-spinning divisions growing rapidly.

That isn’t to say, of course, that it doesn’t face real risks. In particular, Franceschi and Dubugras must ensure their business avoids future PR missteps, proves its valuation, and stays ahead of the competition.

Public opinion

Brex made the right decision last summer. But they delivered it poorly. The firm’s messaging faux-pas proved costly, introducing doubt among their core constituency of startups. While it seems to have won that trust back and boasts impressive customer satisfaction figures, the debacle creates a vulnerability. Another significant PR misstep, particularly one that made customers feel unwanted or unsupported, could begin to feel like a pattern. Though that might not cause a huge outflow of customers – switching financial partners is hard, after all – it could undermine industry trust and give rivals a chance to counterposition. Over time and with enough savvy, competitors could establish themselves as the “friendly” alternative to a Brex depicted as calculated and overly pragmatic. The concern here would not be that this was the case – Brex’s commitment to its value is very clear – but that it might appear that way for too long.

Ultimately, Brex seems to have learned from its mistakes, and its leaders are keen not to repeat them. With a more streamlined user base, the company should be well-placed to keep customers happy.

Valuation

In 2022, Brex’s $300 million Series D valued the business at $12.3 billion. Since then, the venture market has shifted radically, forcing many high-flying enterprises to re-capitalize at lower valuations. What price could Brex snag in today’s market?

Dubugras has previously said he expects the company to hit $500 million in revenue within 12 months. Holding valuation constant, that indicates a revenue multiple of 24.6x. Public competitor Bill.com trades at approximately a 14x multiple with roughly $1 billion in revenue. (Admittedly, it’s more SMB-focused than Brex.) However, Brex appears a higher potential business. Despite Bill.com’s network effects, the younger company has a much more compelling, robust suite of products.

Brex’s valuation doesn’t look particularly out of sync. That said, it’s hard to be entirely sure with our available information. Crucially, we don’t know the composition of its revenue, though given Empower is tracking at $100 million ARR, we would expect most earnings to come from lower-margin financial operations. Nevertheless, depending on how each unit tracks, the picture could look very different in a year, with Brex’s revenue profile more closely resembling an enterprise SaaS business.

Brex is unlikely to be overly concerned at the moment. In an October 2022 blog post, Franceschi reported the firm had “many years” of runway left. With profitability ostensibly within striking distance, Brex will get to decide when it and if it wants to raise again from private investors or take the plunge into the public markets.

Competition

“The Game of Fintechs” is afoot. As we’ve written previously, the contest to become a business’s financial provider of choice is a heated one. Brex can count high-performance players like Ramp, Mercury, Stripe, Rippling, Rho, Navan, Novo, and many others as direct or indirect competitors. While each has a slightly different approach and strategy, they are vying to capture corporate spending.

It should go without saying that there is room for multiple winners in the space and that all of these upstarts will predominantly be banking on taking share away from incumbents like SAP, American Express, and JPMorgan. Given the proliferation of players, there is likely to be consolidation. Still, as one of the larger and better-capitalized players, Brex is positioned to eat rather than be eaten.

That does not mean that Brex can rest easy. From a strategic perspective, Brex should be most concerned about getting upstreamed. Though Empower allows Brex to win large customers for the first time, converting them from other tools, the fundamental growth mechanism is to capture startups early and scale with them. Suppose Brex stops being a strong default for new venture-backed builders. In that case, it risks losing out on the next category-defining companies capable of delivering tens of millions in revenue or more.

As it moves upmarket, Brex must be careful not to overcomplicate its product or market itself too heavily to big companies. It is a fine balance to strike, but one the team is particularly aware of. There is a reason why the company created a dedicated “startups” division, struck a partnership with Techstars, and recruited operators like Jason Mok to the firm. It keenly understands that startups are the essential lifeblood of the business, and only by engaging and overserving them can it retain their business.

Future: The road ahead

It’s easy to forget that Brex is just a six-year-old company. What it has achieved in that time is remarkable, but there’s good reason to believe the best is yet to come. Its existing business units all have room to expand, even without the improvements Brex is sure to make. History tells us that Dubugras and Franceschi will not stop here, though. The company they have built has plenty of opportunities to explore – the trick will be in pursuing the right ones.

Devouring the stack

Since its founding in 2017, Brex has methodically devoured different parts of the financial stack. It has gone from a simple credit card provider to a comprehensive platform handling everything from financial planning to travel booking. In the years to come, it seems likely that Brex will look to pull even more functionality into its orbit.

Payroll would be an especially compelling addition. Fundamentally, Brex wants to maximize the share of business spending it manages, and few categories are as large as payroll. In the US alone, trillions of dollars are paid out every year. Though building a robust system would not be simple, Brex is strategically well-placed. It already manages its customers’ funds – handling employee payments is a plausible extension. If successful, it would give Brex an inroad into managing employee benefits, too.

Moving in this direction would put Brex in more direct competition with Rippling but further differentiate it from players like Ramp. Ultimately, it would be another step towards becoming a company’s all-in-one financial solution.

Embracing AI

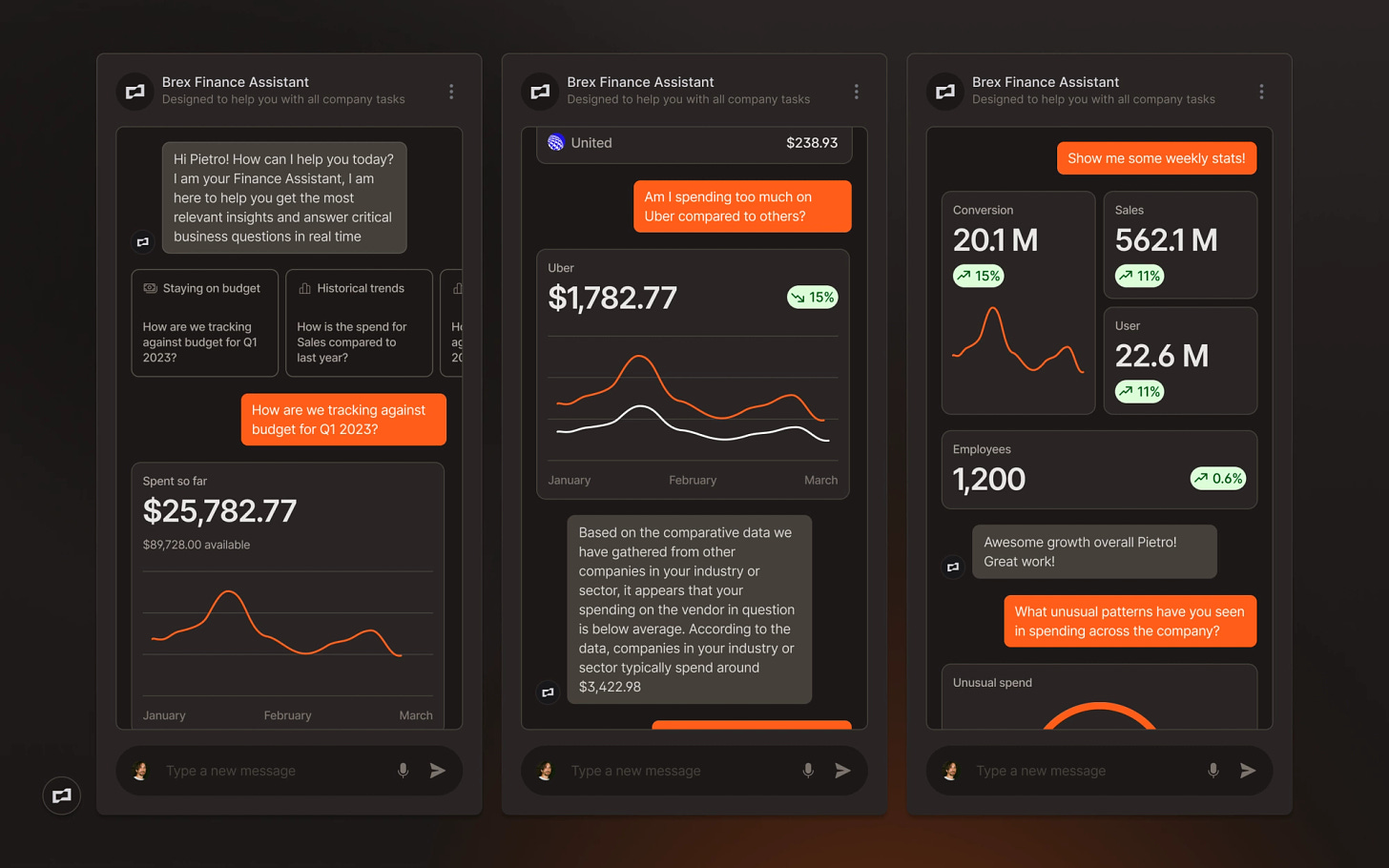

Henrique Dubugras expects artificial intelligence to play a disruptive role in fintech. “I do believe it will be transformational and a step-function change,” he told Bloomberg in May. Brex has relied on versions of the technology for some time, but it has accelerated adoption in 2023.

Earlier this year, it released a series of new tools in partnership with OpenAI and Scale, including a financial chatbot. Users can ask complex questions about their finances via a conversation interface and receive detailed, data-driven answers. Critically, these answers provide information about how a company compares to its peers. For example, if you ask how your firm’s travel spending stacks up against your competition, Brex’s chatbot can provide an answer.

Will synthetic CFOs be the wave of the future? We have been here before. For a period around 2016, tech fell in love with chatbots, mesmerized by their potential. After a flush of exuberance, the industry seemed to collectively remember that not all actions are best managed via question and answer – the many sophisticated interfaces companies have built often solve the problem better than a stop-start conversation. While today’s models are orders of magnitude more intelligent and, thus, more useful, we may see a similar spluttering.

Uncertainty over the most effective interface should not be confused with a criticism of the technology’s potential. It seems inevitable that AI will, indeed, transform fintech, though it may occur by subtler means. Soon, Brex could use AI to underwrite better, streamline travel booking, and automatically generate financial models. The goal for Brex should be less about finding the perfect implementation than experimenting and aggregating talent.

Creating connections

Brex doesn’t want to be the next Silicon Valley Bank. However, if Jason Mok achieves what he hopes to with the company, it will fill part of the vacuum SVB has left. “I’ve heard a lot of VCs and founders say that there’s something they’re missing, and that’s the people,” Brex’s Head of Startups said. “Even though we have this great product-first approach, the people still matter. Customers want to talk to a human being.”

While it can be difficult to quantify the value of relationships, cultivating these kinds of connections could prove to be one of Brex’s most important initiatives. To that end, Mok is launching a new “startup ambassadors” program focused on key hubs. “In San Francisco, New York, Boston, Los Angeles, and Miami, we’re going to have people in market so that founders have a senior point of contact,” Mok said. These “human routers” serve the startup community by offering financial advice, throwing events, and onboarding founders to Brex. In total, Brex has more than 150 startup events planned for 2023.

Over time, Mok hopes the program will create a consistent, personalized experience for builders and foster greater customer loyalty. In an increasingly competitive space, relationships matter. This kind of investment should deepen Brex’s startup roots even further.

“Hard things are hard because there are no easy answers or recipes,” Ben Horowitz writes in his book. “They are hard because your emotions are at odds with your logic. They are hard because you don’t know the answer and you cannot ask for help without showing weakness.”

In 2022, Brex faced down a hard thing, a battle between emotions and logic. A year later, it’s clear the firm is better for it. Brex looks like a company going from strength to strength: focused, generative, and dreaming big once again. With two $100 million ARR business units and a $500 million benchmark in sight, it looks set to regain the exceptional momentum that helped it reach this point. Just as importantly for a company that began life by serving startups, it has refocused itself on that community and invested in strengthening its service. For Henrique Dubugras and Pedro Franceschi, it must feel like vindication.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.