What Do Venture Capitalists Do?

A study from 1984 outlines the habits of Silicon Valley’s capital class. How have they changed?

The Generalist delivers in-depth analysis and insights on the world's most successful companies, executives, and technologies. Join us to make sure you don’t miss our next briefing.

Brought to you by Masterworks

Unlocking the $1.7 trillion art market for everyday investors

When incredibly rare and valuable assets come up for sale, it's often the wealthiest people that end up taking home an amazing investment. But not always.

One platform is buying up and securitizing some of history’s most prized blue-chip artworks, expanding access to everyday investors. In just the last few years, its clients have realized annualized net returns of 17.8%, 21.5%, 35% and more from these opportunities – despite macroeconomic turbulence.

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat, all of which are collectively owned by everyday investors. When Masterworks sells a painting – like the 16 it's already sold – investors reap their portion of the net proceeds.

It's easy to get started but offerings can sell out in minutes. Readers of The Generalist can skip the waitlist with this exclusive link.

Actionable insights

If you only have a few minutes to spare, here’s what investors, operators, and founders should know about what VCs do.

Return to 1984. That year, researchers Michael Gorman and William Sahlman published a paper titled “What do venture capitalists do?” It summarized the findings of an industry survey, illuminating the habits, priorities, and practices of a fast-growing but opaque asset class.

Not quite nine. Or 8.8, to be exact. That is the median number of portfolio companies VC partners reported monitoring, according to Gorman and Sahlman’s report. Additionally, this group averaged five board positions. In general, investors in this age seem to have focused their attention on a relatively small number of investments.

Eighty plus thirty. Investors spent considerable time with portfolio CEOs, with the average respondent estimating they passed 80 “on-site” hours with each company per year. They also spent about 30 hours per year on the phone with each investment. Though far from a day-to-day cadence, it illustrates how investors’ narrower focus translated into meaningful time commitments.

Thrice swings the ax. VCs of the 1980s were not afraid to leverage their position. Respondents estimated they had ousted 3 CEOs during their investing careers, at a rate of roughly one every 2.4 years. This was an age of active management in which investors retained power.

A 2023 rendition. What would a similar study unearth today? To try and answer that question, we’ve devised a short survey of our own. While very much an experiment, we hope it elucidates how modern venture investors communicate, network, and support founders. We’d love you to participate by following the instructions below.

If you’re a venture capitalist and would like to participate in a short survey, click here! Your answers will be kept completely anonymous. As mentioned, by participating, you’ll be contributing to an experiment we’re running designed to build a better understanding of the industry for founders and other stakeholders. (If you’re not a venture capitalist but are interested in seeing the survey’s results, enter your email here to receive a summary of our findings).

What do venture capitalists do?

It’s a question with a squint to it, a parenthetical “actually” hidden between the written words. If you are a venture investor, this is an inquiry you’ll have encountered dozens of times from well-intentioned family members, hair-touselling hedge funders, a college roommate operating in some tech-bereft sector, a professionally inquisitive mortgage broker, and even, perhaps, some of the entrepreneurs you have backed.

What counts as a “startup?” (A good question.)

Do you really invest just based on a slide deck? (Overstated.)

So it’s like Shark Tank? (Actually, yes.)

Will you make money from your investments? (Maybe in a decade.)

How many hours do you spend on Twitter? (Zero; I have a ghost-writer.)

All are branches of the same root question: what do you actually do every day? As it turns out, that’s an interrogation that has interested the broader business community for some time. Earlier this week, I came across a research paper published in the 1980s focused on this exact issue. “What do venture capitalists do?” is a charming, compelling artifact that illuminates how venture and its practice have changed. Reading it also triggered an intriguing thought: What would a similar study find today?

First, though, let’s turn our attention to the study in question. In 1984, Michael Gorman of McKinsey and William Sahlman of Harvard Business School mailed a three-page survey to 100 venture capital investors. As the paper’s introduction notes, they were doing so at a time of rapid growth in the venture industry:

Over the past five years, there has been an explosion in the level of activity in the venture capital market. In 1984, in excess of $4.5 billion of new capital was committed to the industry, an amount over six times greater than the amount committed in 1980. Over the same period, approximately 148 new venture capital partnerships were formed, while 303 new funds were created by existing venture capital firms.

Those figures indicate just how far venture capital has come and how aggressively it has industrialized. Global venture capital investing hit $442 billion last year, spanning more than 30,000 deals. Just this year, we’ve seen multiple companies raise individual funding rounds that surpass the entirety of 1984’s volume, with Stripe pulling in $6.5 billion and OpenAI snagging $10 billion.

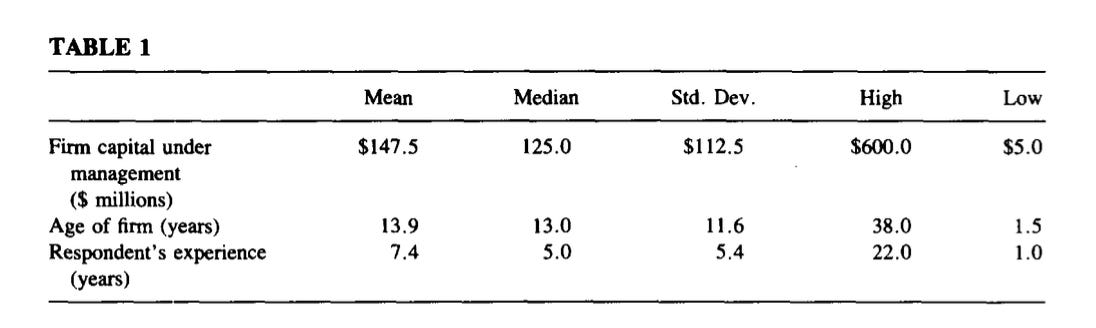

To return to 1984, Gorman and Sahlman received 49 responses to their outreach–a small sample size from one vantage but less pronounced given the industry’s incipiency. The authors note that “respondents represented firms that manage in aggregate $5.6 billion of venture capital or roughly 40% of the estimated industry resources.”

The findings portray a very different industry than the one we’re familiar with today. A smaller one, certainly, but also a more focused and cutthroat one. As you’ll learn, investors worked deeply with a relatively small number of companies, spending hours of time in person. These VCs also held the functional and social power to remove CEOs – which they did with some frequency.

As the venture capital industry shakes out the bone-cold of the last two years and looks toward the future, it’s worth contemplating how the asset class and its practice have changed. In doing so, we find a reflection of ourselves. Though the whole paper is worth reading, we’ve outlined seven primary takeaways below.

A non-hierarchical industry

Responses to the survey portray venture capital as a relatively flat industry. Of the 49 respondents, 31 reported having less than six years of experience. In spite of that, most entered as partners or had “brief apprenticeships” before ascending to that level.

Venture seems to have been an asset class that didn’t require participants to “pay their dues” within the industry. While you do see novice investors step into partnership roles today, they tend to do so after succeeding in an adjacent field – for example, founding a notable company. (This may have been the case in 1984, too; the authors do not elaborate.)

In general, it does seem more common to ascend through venture’s ranks in 2023. Major funds rely on a mix of analysts, associates, principals, junior partners, and general partners. Investors often begin in a lower-rank role and work their way up, moving between different firms in the process. As the industry has formalized, a more rigid hierarchy and career pathway appears to have emerged.

Is that a good thing? Do we want investors with more, linear training or those that arrive from other fields? I have heard plenty of arguments on both sides. Some point to the performance of legends like Fred Wilson, Mary Meeker, and Bill Gurley as evidence that a career in VC produces superior results. None needed storied operating backgrounds to identify outlier startups like Twitter, Uber, Spotify, Stitch Fix, Square, and Etsy. Alternatively, Vinod Khosla, Reid Hoffman, Peter Thiel, and many others had successful founding careers before finding success investing. (And, of course, Mike Moritz joined Sequoia Capital after working as a writer – an under-heralded pathway.)

Concentrated attention

In 1984, investment partners focused their attention on a relatively small number of businesses, monitoring 8.8 on average. Notably, this was much higher than the number associates were tasked with monitoring: just 3.6. As Gorman and Sahlman note, this “calls into question an allegation against venture capitalists commonly found in the press that they farm out their work to junior associates.” Associates clearly played a role, but partners bore the brunt of this task.

Notably, partners took a formal governance role in a large portion of the companies monitored, serving on an average of 5 boards. Some investors were considerably more hyperactive: one partner reported serving on 21 boards.

In general, investors during this era seem to have favored having fewer, closer relationships. It suggests a kind of “Dunbar’s number” for this kind of relationship; perhaps venture capitalist’s social capacities fray beyond a dozen such ties.

Anecdotally, that no longer seems to be the case today. The modern VC appears to be an increasingly networked creature, juggling dozens of different relationships. Though the bear market has re-introduced some calm, the last decade has been defined by sharp competitive pressures, curtailed timelines, and quick decisions. When deals can open and close within days or weeks (if not, on rare occasions, hours), investors need to be constantly plugged in, maintaining a vast network both within and outside of their portfolios.

Varied deployment speed

Venture firms deployed at very different speeds, according to Gorman and Sahlman’s report. New investments per year ranged from 4 to 30, with a mean of 11.2. Investors planned on holding their positions for under 6 years, with a high of 10 years.

Interestingly, smaller firms tended to be more active than medium and large-sized ones. Bigger firms made “surprisingly few” investments, according to the authors. Without clear data, it’s hard to gauge whether this pattern holds today. There are certainly small funds that take an indexed approach, investing in dozens of companies. But large firms also play this game at times – famously, Tiger Global deployed at a never-before-seen pace despite its magnitude.

More interesting is the extent to which the tail-end of the spectrum has shifted. Industrialized incubators like Y Combinator have been able to viably invest in hundreds of companies a year – 490 over the past two batches. That’s a far cry from the high of 30 that the study reports. I would expect this to be the most pronounced change to investment velocity since 1984, with the ceiling jumping an order of magnitude.

Dedicated time

Investors in 1984 dedicated considerable time to their portfolio companies. On a per-company basis, the average VC reported spending 80 hours of time “on-site” and 30 hours on the phone per year. This suggests that investors devoted nearly three weeks of full-time work to each of their companies, assuming a 40-hour workweek. Notably, these estimates do not include work an investor might do outside of an in-office visit or phone discussion, such as reviewing reports.

As you might expect, investors spent much more time with a company when they were the lead. An early-stage business, for example, typically received 2 hours per week from its lead investor but just 45 minutes per week from non-leads. In sum, the majority of responding VCs reported spending more than 60% of their time per year either “assisting or monitoring” the companies they had backed.

Given this study is based on self-reporting, it’s fair to question the integrity of these figures. Did investors either consciously or unconsciously inflate their efforts? It’s certainly possible. Nevertheless, a less rabid deal-making environment likely allowed for greater focus and more hands-on exertions.

How would today’s investors compare? I would imagine that the modern venture capitalist is spread much thinner and distributes help in short, ad-hoc bursts. Need to get eyes on new sales collateral? I’ll check it out on my Uber ride. Trying to recruit a VP from a rival company? Let me shoot over a text.

The growth and formalization of the asset class may also impact how much focused time investors can give their portfolio companies. Many of today’s leading firms have hundreds of employees. According to their website (and painstaking counting of their team photos), a16z has over 500 employees split across a variety of functions: investing, marketing, research, finance, go-to-market, legal, and so forth. Naturally, larger headcounts increase managerial duties, requiring partners to divide time between internal operations and investing activities. Many of the world’s best-regarded investors may spend much of their time acting as CEOs of their own firms.

Focused on raising the next round

What kind of work did venture capitalists perform on behalf of their companies? Above all, raising money. Respondents identified “obtaining additional financing” as the most frequent form of help they gave companies – and the most important.

Helping with fundraising remains a key activity for today’s investors, though it likely differs in kind from 1984. Capital availability hit all-time highs in the last bull run, meaning that for many founders, the question was less “Can I raise?” and instead “How much and from whom?” A trustworthy investing partner can help guide those decisions.

Beyond fundraising, investors reported helping with “strategic planning,” “management recruitment,” “operational planning,” “introductions to potential customers and suppliers, and “resolv[ing] compensation issues.”

Again, all of these are within the purview of today’s venture firms, though they are often managed by in-house portfolio support teams. Though today’s CEOs can depend on the advice of a senior GP, they may also tap a slew of firm-supplied marketers, operators, and recruiters for assistance.

From one vantage, this seems like an obvious improvement – a way to scale time and attention beyond an individual practitioner. A founder that opted in to receive this kind of help from a well-staffed firm could probably receive hundreds of hours of “free” assistance per year – far exceeding the 110 hours VCs gave each company in 1984. That many founders don’t seem to maximize this benefit speaks to the other side of the equation. Are these services desirable to founders? Do they trust outsiders – even outsiders with a stake in their company – to handle core responsibilities? Do free or heavily discounted services naturally seem less valuable?

Failures of leadership

In addition to asking about VC’s schedules, Gorman and Sahlman also dug into the anatomy of startup failure – from the perspective of investors. The authors asked subjects to “consider companies with which you have been associated that have fallen seriously short of their objectives, so far short as to endanger the company’s continued independent existence.” In particular, respondents were asked to try and rationalize the company’s failure. Did the firm fail to find product-market fit? Were there quality control issues? Were they outmaneuvered by a competitor?

In 94% of cases, investors cited company management as a “contributing factor”; 65% of the time, it was identified as the “most important contributing factor.” Though market issues, manufacturing performance, and other matters played their part in various startup collapses, investors found most fault with leadership.

Would it be quite so clear-cut today? Has the nature of entrepreneurship – and thus entrepreneurial failure – changed in decisive ways? And, if not, would today’s investors be as willing to criticize founders, even when anonymous?

Active management

Venture investors were ready and willing to replace CEOs in the 1980s. That’s unsurprising, given the results mentioned in the previous section. On average, VCs replaced 3 CEOs during their career, an average of 1 firing per 2.4 years of experience. The report contextualizes the frequency of this occurrence:

Given that a venture capitalist typically monitors only nine companies at a time, and expects to hold each investment five to seven years, this represents a noticeably high incidence of what is for all parties a traumatic experience.

Founders have considerably more power today. Often, this is codified in a company’s voting structure, but even if it isn’t, the reputational damage of ousting a founder makes VCs loathe to do so. In broad strokes, these results back up the notion that venture was once a more “active” asset class in this respect.

Taken together, these results provoke a desire for comparison. How would today’s venture capitalists compare to their 1984 counterparts? How do they spend their time and attention? What does the split look like between existing investments and prospective ones? What kinds of portfolio support do they focus on? How do they collaborate with colleagues, rivals, and entrepreneurs?

To answer these questions, we’ve decided to run an experiment. Specifically, we tried our hand at creating a survey designed to capture the behavior of the modern venture investor. Will this work? I’m genuinely not sure. We may get too few results, or perhaps the findings will be less interesting than hoped. What I can say is that I think it’s an experiment worth running to better understand our industry. If you’re a venture capitalist and would like to contribute to that goal, I’d be grateful if you’d take a couple of minutes and take the survey here. Your responses will be kept entirely anonymous.

As a note, though this survey takes inspiration from Gorman and Sahlman’s work, it isn’t meant to be a replication. For one thing, this is obviously not a formal academic study – but rather an informal collaboration. For another, we’ve created a different set of questions designed to elicit interesting insights from the modern investor. The industry has changed a lot since 1984, so it seems natural that the questions should too. The Motorola DynaTAC-wielding dealmakers at Warburg Pincus didn’t have to think about things like social media or video conferencing. We think these questions will produce more interesting findings, but it does mean there won’t be an exact comparison.

Why does any of this matter? It’s a reasonable question. Is there a benefit to knowing how capitalizers of innovation spend their time? Interestingly, Gorman and Sahlman are relatively quiet on this front – the growth and magnitude of the burgeoning venture capital sector are deemed motivation enough for inquiry. Given the ballooning the last four decades have overseen, these drivers remain potent.

Still, we can put a finer point on the issue. It is manifestly useful for VCs to understand how their effort and attention compare to the broader industry. Where do they spike versus others? Is their focus more concentrated or diffuse? Each individual may have a sense of such things, but it is an imperfect measure.

More importantly, answering these questions is valuable for founders. Especially for novice entrepreneurs, VC can seem opaque. What exactly is happening in those nestled offices along Sand Hill Road? What do these people I want to meet do each day? Experienced CEOs may benefit from contextualizing how the broader industry assists its portfolio companies – better grasping which of its requests are most likely to yield fruit.

In short, this is a question worth asking – just as it was in 1984. Now is the right moment for fresh answers.

If you’re a VC, please participate in the survey here. It will take just a few minutes and should be quite fun.

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.